Beruflich Dokumente

Kultur Dokumente

SAP Auto Saved)

Hochgeladen von

Moeed Ahmed BaigOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SAP Auto Saved)

Hochgeladen von

Moeed Ahmed BaigCopyright:

Verfügbare Formate

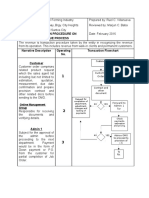

Daily Processing -AS IS Process-Document Parking & Posting Process involves Jounalizing of Vendor invoice.

Process steps S. NO. 1 ( Description ) (Office Manager (OM) receives documents in mail. ) ( Reviews the same & forwards it to Responsible Person ) ((RP) for approval ) (RP reviews the document (Inv/DN) for validity of price, ) (quantity, product service recd. Returns it to OM. ) (OM forwards the document to Accounts Dept (A/C) for ) (payment approval & payment. ) (A/C approves payment & posts document (Inv/DN) ) Responsible OM

RP

OM

4 5

A/C

(A/C dept prepares/posts cheque/bank trf for invoices due for ) A/C (payment. Alternatively, pays invoice online & forwards ) (cheque/bk trf to OM for signature & paid invoice for ) (authorization. ) (OM authorizes online payment/signs cheque & returns it ) (to A/C for posting & dispatch to vendor/ filing. ) (A/C posts online payment & files the invoice. ) OM

A/C

Input Document 1 2 (Vendor invoice ) (Debit note )

Output Document 1 2 3 Report (Journal ) (Updated vendor a/c ) (Approved vendor invoice )

1 2

(Trial Balance ) (General Ledger )

Expectation 1 Posting should be allowed after invoice is duly approved by person receiving product/service (System should intimate due dates )

Bank Name & Address

ROYAL BANK OF CANADA 260 EAST BEAVER CREEK ROAD HWY 404 & HWY 7 BRANCH RICHMOND HILL, ONT. L4B 3M3 CANADA

6032 400431 3 A/C NO.

USD CHEQUING 2 Bank Name & Address ROYAL BANK OF CANADA 260 EAST BEAVER CREEK ROAD HWY 404 & HWY 7 BRANCH RICHMOND HILL, ONT. L4B 3M3 CANADA

A/C NO. 6032 100 282 3 CDN CHEQUING

Bank Name

Bank Address 260 East Beaver Creek Road 260 East Beaver Creek CANADA Road Richmond Hill, ONT. L4B 3M3 Canada 260 East Beaver Creek Road 260 East Beaver Creek CANADA Road Richmond Hill, ONT. L4B 3M3 Canada

Account No

Currency

ROYAL BANK OF

6032 400431 3

USD

ROYAL BANK OF

6032 100 282 3

CDN

TRAVEL FUNDS ADVANCED TO SALES STAFF - AS IS

Process :

Sales staff requests the Acct to provide the travel funds. Acct initiates the request by entering details on Travel software which is internally designed to control the travel funds & trip details. It generates the trip no. & converts the currency to CDN $ at weighted average rates based on previous purchase of foreign currency.

Acct prepares trip voucher on excel indicating details of funds/ currency/exchange rate/ Trip No.& coversion to CDN $ amount in duplicate. One copy is given to Sales staff & other is retained by Acct duly signed by Sales staff for funds advanced On return from trip sales staff gives account of funds expensed with supporting cash expense vouchers to Acct Acct then updates the relevent trip no. item in the travel software & updates it by posting amount returned. Acct then updates the relevent excel voucher by entering the details of funds spent/returned Acct posts the transaction by making journal entry to expense the trip cost in the accounting software. Expectation The system should allow for the above process to be completed with in the system in a more efficient & simple way.

h is internally

ncy/exchange rate/ n to Sales staff &

updates it by posting

p cost in the accounting

d with in the

Input tax code is HST Input tax rate Payment terms

This is included in vendor invoice & added to the total cost Currently is 13 %. Normal payment terms from Vendors are 30 days, 45 days, 60 days & 90 days

DEPRECIATION - PLEASE SEE ATTACHED SCHEDULE.

DEPRECIATION - CLASS & RATES

ASSET NAME Office Furniture & Equipment Computer/EDP -acqd before Mar 07 Computer/EDP -acqd after Mar 07 Automobile Building Parking Patents CLASS 8 45 50 10 3 1 44 DEPN RATE 20% 45% 55% 30% 5% 4% 25%

Das könnte Ihnen auch gefallen

- ACHC Implementation GuideDokument30 SeitenACHC Implementation GuidetderuvoNoch keine Bewertungen

- Sap Accounting EntriesDokument9 SeitenSap Accounting Entrieskarthik_140886Noch keine Bewertungen

- Ajith Nadesan Handover Note Oct-2021Dokument9 SeitenAjith Nadesan Handover Note Oct-2021Vamc KrishnaNoch keine Bewertungen

- Inventory Accounting EntriesDokument6 SeitenInventory Accounting EntriesHimanshu SinghNoch keine Bewertungen

- Account PostingDokument16 SeitenAccount Postinganiruddha_2012Noch keine Bewertungen

- SAP - Order To Cash - AR StepsDokument34 SeitenSAP - Order To Cash - AR Stepsmurthypsn3886Noch keine Bewertungen

- Purchase Vs Consumption Based Accounting Accounting Entries in SapDokument10 SeitenPurchase Vs Consumption Based Accounting Accounting Entries in SapAAPS ACGSNoch keine Bewertungen

- Expense ReportDokument8 SeitenExpense ReportAshvinkumar H Chaudhari100% (1)

- Transaction Procedure On Revenue Process: Online Management GroupDokument11 SeitenTransaction Procedure On Revenue Process: Online Management GroupRuel VillanuevaNoch keine Bewertungen

- BPR - COC Case StudyDokument17 SeitenBPR - COC Case StudyFaseeh MuhammadNoch keine Bewertungen

- ERPLO DeemedExport 200614 0653 1304Dokument4 SeitenERPLO DeemedExport 200614 0653 1304SivaprasadVasireddyNoch keine Bewertungen

- Sap Accounting EntriesDokument9 SeitenSap Accounting Entriesswayam100% (1)

- Fi ApDokument91 SeitenFi Aprohitmandhania100% (1)

- Hand Written: Sample Recap FormatDokument78 SeitenHand Written: Sample Recap FormatPrincess MurallaNoch keine Bewertungen

- SAP MM Inventory Accounting EntriesDokument17 SeitenSAP MM Inventory Accounting EntriesKrishna Akula100% (1)

- Accounting EntriesDokument5 SeitenAccounting Entriesshreya9962Noch keine Bewertungen

- Accounting EnteriesDokument9 SeitenAccounting Enterieskavita sihagNoch keine Bewertungen

- Account Procedure 3Dokument3 SeitenAccount Procedure 3Temtime DebereNoch keine Bewertungen

- DISBURSEMENT MODULE RevisedDokument7 SeitenDISBURSEMENT MODULE RevisedJames PeraterNoch keine Bewertungen

- APDokument4 SeitenAPnagkkkkkNoch keine Bewertungen

- Sap Fi Accounts PayableDokument91 SeitenSap Fi Accounts PayableAnonymous 2AYQKfPn5oNoch keine Bewertungen

- SAP-TO BE Process: New Allenberrry Works Fico Naw Finance and ControllingDokument15 SeitenSAP-TO BE Process: New Allenberrry Works Fico Naw Finance and ControllingsivasivasapNoch keine Bewertungen

- PAPER Bradmark CaseDokument3 SeitenPAPER Bradmark Casesaniastari0% (1)

- Accounts Receivable - CRPDokument35 SeitenAccounts Receivable - CRPmaddiboinaNoch keine Bewertungen

- Financial MNGT Sir BACAYDokument35 SeitenFinancial MNGT Sir BACAYBfp Car TublayNoch keine Bewertungen

- FIAPDokument87 SeitenFIAPAravind GangaiahNoch keine Bewertungen

- Ra Bill PayDokument2 SeitenRa Bill PayNitin ShahNoch keine Bewertungen

- CADM Inc - POST - 000074V4EW000000 - SBB2785459Dokument3 SeitenCADM Inc - POST - 000074V4EW000000 - SBB2785459HR RonNoch keine Bewertungen

- 10 Naw To Be Material AccountingDokument24 Seiten10 Naw To Be Material AccountingsivasivasapNoch keine Bewertungen

- Pay On ReceiptDokument13 SeitenPay On Receiptbreakinhrt6880100% (1)

- Shanchay Patra BB ReceiptDokument5 SeitenShanchay Patra BB Receiptkhan_sadiNoch keine Bewertungen

- IATA Guide NewDokument6 SeitenIATA Guide NewFaizy_5starNoch keine Bewertungen

- Sap Fi Accounts PayableDokument87 SeitenSap Fi Accounts PayableMayford Desouza100% (5)

- AR AccountingDokument16 SeitenAR AccountingKingshuk100% (1)

- Administartion Format Close ChecklistDokument15 SeitenAdministartion Format Close ChecklistYogesh MisraNoch keine Bewertungen

- Chapter 3 - in Class Practice - Print-1Dokument2 SeitenChapter 3 - in Class Practice - Print-1nickNoch keine Bewertungen

- Accounting EntriesDokument16 SeitenAccounting EntriesphonraphatNoch keine Bewertungen

- Accounting & Finance For Bankers Module C: Presentation by S.D.Bargir Joint Director, IIBFDokument43 SeitenAccounting & Finance For Bankers Module C: Presentation by S.D.Bargir Joint Director, IIBFHarsh MehtaNoch keine Bewertungen

- R12 Payment Process RequestDokument9 SeitenR12 Payment Process RequestAmit ChauhanNoch keine Bewertungen

- C. Process DescriptionDokument5 SeitenC. Process Descriptionkhan_sadiNoch keine Bewertungen

- SAP TablesDokument25 SeitenSAP TablesFercho Canul CentenoNoch keine Bewertungen

- AccountingfinancebankersDokument43 SeitenAccountingfinancebankersPervez KhanNoch keine Bewertungen

- Hoja - Instrucciones CruceDokument5 SeitenHoja - Instrucciones CruceJavier MolinaNoch keine Bewertungen

- Exercise AC 518 2nd Sem 2016Dokument2 SeitenExercise AC 518 2nd Sem 2016RALLISONNoch keine Bewertungen

- Accounting Information System I SEMESTER I 2010/2011: Group AssignmentDokument9 SeitenAccounting Information System I SEMESTER I 2010/2011: Group AssignmentxaraprotocolNoch keine Bewertungen

- Account Payable InterviewDokument5 SeitenAccount Payable InterviewhanharinNoch keine Bewertungen

- New Vendor Request Form - ExternalDokument5 SeitenNew Vendor Request Form - ExternalArif M.ChalkooNoch keine Bewertungen

- SR Request Date: LocationDokument11 SeitenSR Request Date: Locationsaleem4uz1982Noch keine Bewertungen

- Napco Oracle Test CasesDokument110 SeitenNapco Oracle Test CasesThiru vengadamsudNoch keine Bewertungen

- MYOBDokument7 SeitenMYOBDaeng Wira KusumaNoch keine Bewertungen

- FI BankDokument34 SeitenFI BankoptymNoch keine Bewertungen

- Accounting & Finance For Bankers Module CDokument43 SeitenAccounting & Finance For Bankers Module CKarur KumarNoch keine Bewertungen

- 21St Century Computer Solutions: A Manual Accounting SimulationVon Everand21St Century Computer Solutions: A Manual Accounting SimulationNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionVon EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNoch keine Bewertungen

- CO Transactions For Controlling UsersDokument8 SeitenCO Transactions For Controlling UsersMoeed Ahmed BaigNoch keine Bewertungen

- Header Data: SymptomDokument2 SeitenHeader Data: SymptomMoeed Ahmed BaigNoch keine Bewertungen

- Hedge Management - Gopa Kumar S PDFDokument16 SeitenHedge Management - Gopa Kumar S PDFMoeed Ahmed BaigNoch keine Bewertungen

- S - ALR - 87012168 - Due Date Analysis For Open Items F.21 List of Customer Line Items (Aging) S - ALR - 87012178 Customer AgingDokument1 SeiteS - ALR - 87012168 - Due Date Analysis For Open Items F.21 List of Customer Line Items (Aging) S - ALR - 87012178 Customer AgingMoeed Ahmed BaigNoch keine Bewertungen

- Costing ScenarioDokument40 SeitenCosting ScenarioMoeed Ahmed BaigNoch keine Bewertungen

- Section 6 - Calling A Meeting and Setting An AgendaDokument5 SeitenSection 6 - Calling A Meeting and Setting An AgendaMoeed Ahmed BaigNoch keine Bewertungen

- RECRUITMENT AGENCIES IN U.A.E. (Here Is A List Containing 150+ Names)Dokument22 SeitenRECRUITMENT AGENCIES IN U.A.E. (Here Is A List Containing 150+ Names)raajc12380% (5)

- FranchisingDokument38 SeitenFranchisingprasadmahajan26100% (1)

- People/Occupancy Rules of Thumb: Bell - Ch10.indd 93 8/17/07 10:39:31 AMDokument8 SeitenPeople/Occupancy Rules of Thumb: Bell - Ch10.indd 93 8/17/07 10:39:31 AMPola OsamaNoch keine Bewertungen

- Java ProgramsDokument36 SeitenJava ProgramsPrashanth MohanNoch keine Bewertungen

- Fpga De0-Nano User Manual PDFDokument155 SeitenFpga De0-Nano User Manual PDFCesarNoch keine Bewertungen

- Circular Motion ProblemsDokument4 SeitenCircular Motion ProblemsGheline LexcieNoch keine Bewertungen

- 1.1 Cruz v. DENR PDFDokument7 Seiten1.1 Cruz v. DENR PDFBenBulacNoch keine Bewertungen

- Ad CVDokument2 SeitenAd CVzahid latifNoch keine Bewertungen

- Inkt Cables CabinetsDokument52 SeitenInkt Cables CabinetsvliegenkristofNoch keine Bewertungen

- TFTV3225 Service Manual 102010 Coby 26-32Dokument21 SeitenTFTV3225 Service Manual 102010 Coby 26-32bigbrother4275% (4)

- Group H Macroeconomics Germany InflationDokument13 SeitenGroup H Macroeconomics Germany Inflationmani kumarNoch keine Bewertungen

- Memorandum of AgreementDokument6 SeitenMemorandum of AgreementJomar JaymeNoch keine Bewertungen

- Part List SR-DVM70AG, SR-DVM70EUDokument28 SeitenPart List SR-DVM70AG, SR-DVM70EUAndrea BarbadoroNoch keine Bewertungen

- Model: The Most Accepted and Respected Engine-Driven Cooler in The Gas Compression IndustryDokument2 SeitenModel: The Most Accepted and Respected Engine-Driven Cooler in The Gas Compression IndustryparathasiNoch keine Bewertungen

- Schema Elctrica Placa Baza Toshiba A500-13wDokument49 SeitenSchema Elctrica Placa Baza Toshiba A500-13wnicmaxxusNoch keine Bewertungen

- Challan FormDokument2 SeitenChallan FormSingh KaramvirNoch keine Bewertungen

- Ein Extensive ListDokument60 SeitenEin Extensive ListRoberto Monterrosa100% (2)

- Beenet Conf ScriptDokument4 SeitenBeenet Conf ScriptRavali KambojiNoch keine Bewertungen

- Hortors Online ManualDokument11 SeitenHortors Online Manualtshepang4228Noch keine Bewertungen

- Genesis and Development of The Network Arch Consept - NYDokument15 SeitenGenesis and Development of The Network Arch Consept - NYVu Phi LongNoch keine Bewertungen

- Chapter 01Dokument26 SeitenChapter 01zwright172Noch keine Bewertungen

- Qrqs"1 Xl/Ijj1L Joi?Llt'Lll: Transport Bhawan, 1, Parliament Street New Delhi-110001Dokument2 SeitenQrqs"1 Xl/Ijj1L Joi?Llt'Lll: Transport Bhawan, 1, Parliament Street New Delhi-110001PrakashKommukuriNoch keine Bewertungen

- Low Cost CompaniesDokument9 SeitenLow Cost CompaniesIvan RodriguezNoch keine Bewertungen

- User Exits in Validations SubstitutionsDokument3 SeitenUser Exits in Validations SubstitutionssandeepNoch keine Bewertungen

- BPI vs. Posadas, G.R. No. L - 34583, 1931Dokument8 SeitenBPI vs. Posadas, G.R. No. L - 34583, 1931Nikko AlelojoNoch keine Bewertungen

- 5-Benefits at A GlanceDokument2 Seiten5-Benefits at A GlanceBlackBunny103Noch keine Bewertungen

- Eletrical InstallationDokument14 SeitenEletrical InstallationRenato C. LorillaNoch keine Bewertungen

- DSP Unit V ObjectiveDokument4 SeitenDSP Unit V Objectiveshashi dharNoch keine Bewertungen

- MushroomDokument8 SeitenMushroomAkshay AhlawatNoch keine Bewertungen

- Soal TKM B. Inggris Kls XII Des. 2013Dokument8 SeitenSoal TKM B. Inggris Kls XII Des. 2013Sinta SilviaNoch keine Bewertungen