Beruflich Dokumente

Kultur Dokumente

Indian Bank Performance Ranking

Hochgeladen von

Parikshit Vilas LokeOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indian Bank Performance Ranking

Hochgeladen von

Parikshit Vilas LokeCopyright:

Verfügbare Formate

Ranking of Indian Banks

April 2010

Personalized | Reliable | Innovative

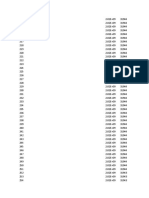

Performance of a bank is judged based on a number of parameters including growth, quality of assets, size etc. Consequently, we have ranked a list of banks with respect to the following parameters assigning appropriate weight to each of the parameter. Credit growth Net Interest Margin Net NPA Efficiency Ratio Fees Income to Total Income Return on Asset Balance Sheet Size

Personalized | Reliable | Innovative

Performance based ranking of Indian banks

Banks (9m 2010)

List of Banks Score CMP

(INR)

P/E

P/BV

Mcap

(INR crores)

Yes Bank Axis Bank PNB HDFC Bank Andhra Bank Allahabad Bank Indian Bank Corporation Bank Federal Bank Bank of Baroda South Indian Bank Jammu and Kashmir Bank Ltd SBI Canara Bank IndusInd Bank Union Bank of India Oriental Bank of Commerece State Bank of Travancore ICICI Bank of India IDBI Bank UCO Bank ING Vysya Bank Vijaya Bank DCB

Personalized | Reliable | Innovative

7.51 5.44 5.12 5.11 5.08 5.03 5.01 4.99 4.91 4.63 4.62 4.56 4.49 4.48 4.41 4.24 4.00 3.74 3.61 3.59 3.14 3.09 2.96 2.54 1.48

251 1,192 1,003 1,965 101 147 171 458 264 637 171 662 2,094 411 180 291 318 596 953 326 116 57 275 48 33

20.44 27.49 10.26 41.38 8.13 8.50 6.17 7.55 9.89 10.02 7.88 8.11 10.69 8.26 24.43 7.54 7.86 4.52 31.55 5.68 11.65 4.44 18.07 5.41 NA

5.02 3.56 2.25 4.81 1.34 1.09 1.31 1.33 1.05 1.76 1.51 1.22 1.84 1.67 3.88 2.08 1.23 1.32 2.27 1.43 1.11 1.12 1.64 1.34 1.05

8,539 48,282 31,629 89,944 4,886 6,555 7,345 6,566 4,519 23,365 1,935 3,210 132,972 16,853 7,400 14,676 7,962 2,980 106,232 17,123 8,405 3,142 3,301 2,068 650

3

Performance based ranking of Indian bank Private Banks

List of Banks

Score

CMP

(INR)

P/E

P/BV

Mcap

(INR crores)

Yes Bank Axis Bank HDFC Bank Federal Bank South Indian Bank Jammu and Kashmir Bank Ltd IndusInd Bank ICICI ING Vysya Bank DCB

Personalized | Reliable | Innovative

7.51 5.44 5.11 4.91 4.62 4.56 4.41 3.61 2.96 1.48

251 1,192 1,965 264 171 662 180 953 275 33

20.44 27.49 41.38 9.89 7.88 8.11 24.43 31.55 18.07 NA

5.02 3.56 4.81 1.05 1.51 1.22 3.88 2.27 1.64 1.05

8,539 48,282 89,944 4,519 1,935 3,210 7,400 106,232 3,301 650

Performance based ranking of Indian banks Public Banks

List of Banks Score CMP

(INR)

P/E

P/BV

Mcap

(INR crores)

PNB Andhra Bank Allahabad Bank Indian Bank Corporation Bank Bank of Baroda SBI Canara Bank Union Bank of India Oriental Bank of Commerece State Bank of Travancore Bank of India IDBI Bank UCO Bank Vijaya Bank

5.12 5.08 5.03 5.01 4.99 4.63 4.49 4.48 4.24 4.00 3.74 3.59 3.14 3.09 2.54

1,003 101 147 171 458 637 2,094 411 291 318 596 326 116 57 48

10.26 8.13 8.50 6.17 7.55 10.02 10.69 8.26 7.54 7.86 4.52 5.68 11.65 4.44 5.41

2.25 1.34 1.09 1.31 1.33 1.76 1.84 1.67 2.08 1.23 1.32 1.43 1.11 1.12 1.34

31,629 4,886 6,555 7,345 6,566 23,365 132,972 16,853 14,676 7,962 2,980 17,123 8,405 3,142 2,068

Personalized | Reliable | Innovative

Performance of Indian Banks

Based on above mentioned seven parameters, we have identified banks trading at higher multiple backed by high score based on the first nine months performance of FY 2010;

Axis Bank has the highest score among big private players which is been accounted in terms of higher multiple assigned to the stock Yes Bank is trading at a higher multiple backed by its highest score in the industry HDFC Bank is trading at the highest P/B multiple. This is justified on account of the banks performance as well as unlocked value in its subsidiaries which operate into various financial business PNB being the highest scorer among the public sector banks enjoys a higher P/B multiple which looks adequately fair based on its performance

Personalized | Reliable | Innovative

Performance of Indian Banks

With respect to the seven parameters, we have identified banks trading at lower multiple on account of lower score based on the first nine months performance of FY 2010;

Development Credit Bank has the lowest score among the peers. Consequently, it is been trading at a lower P/B multiple which seems justified Among public banks, IDBI, UCO Bank, and Oriental Bank of Commerce are trading at a lower multiple which is justified by their lower performance scores compared to peers

Personalized | Reliable | Innovative

Performance of Indian Banks

Here with, we have identified banks trading at higher multiple in spite of lower score or vice versa based on the first nine months performance of FY 2010;

Indian Bank is valued at a lower multiple in spite of a higher score among the peers. Allahabad Bank is valued at a very low multiple among public banks. However, it has a good score which places it on third position among the public banks. Federal Bank is valued at a lower multiple compared to other private players being on fourth position among the private players in the list IndusInd Bank and ING Vysya Bank are valued at a higher multiple in spite of having a low score among peers

Personalized | Reliable | Innovative

Thank You

Disclaimer: This product is distributed for information purposes only. The information in this report does not constitute an offer to sell or a solicitation of an offer to buy any of the securities mentioned in the report. The readers may note that neither the company, its Directors, Officers or employees take any responsibility, financial or otherwise, due to any transaction undertaken or any action based on the information contained herein. The Company, its Directors, Officers or Employees may have a position or may otherwise be interested in the investment referred to in this document.

Personalized | Reliable | Innovative

Das könnte Ihnen auch gefallen

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- Sbi Vs Icici Redo FinaleDokument22 SeitenSbi Vs Icici Redo FinaleYuvraj BhatnagarNoch keine Bewertungen

- Analysis of Banking Industry On The Basis of 7Ps and S.W.O.TDokument28 SeitenAnalysis of Banking Industry On The Basis of 7Ps and S.W.O.Tpatelkinnar1991Noch keine Bewertungen

- A) Brief Relevance of The Topic and The Organization.: GrowthDokument38 SeitenA) Brief Relevance of The Topic and The Organization.: GrowthShree CyberiaNoch keine Bewertungen

- Summer Training Report OF Bank of India (Relation Ship Beyond Banking)Dokument20 SeitenSummer Training Report OF Bank of India (Relation Ship Beyond Banking)Varsha NakraNoch keine Bewertungen

- Presentation On: of Top 5 Private BanksDokument23 SeitenPresentation On: of Top 5 Private BanksTarunveerNoch keine Bewertungen

- Corporate Finance ProjectDokument14 SeitenCorporate Finance ProjectAspiring StudentNoch keine Bewertungen

- Abn Ambro Bank Final 19-09-2007Dokument85 SeitenAbn Ambro Bank Final 19-09-2007Gaurav NathaniNoch keine Bewertungen

- Jasrae Issue 2 Vol 12 45133Dokument8 SeitenJasrae Issue 2 Vol 12 45133Bhavya GambhirNoch keine Bewertungen

- INTRODUCTION - keshavIMP (1) Keshav123Dokument26 SeitenINTRODUCTION - keshavIMP (1) Keshav123JATIN TomarNoch keine Bewertungen

- Banking ComparisonDokument21 SeitenBanking Comparisonhatimezzy523492Noch keine Bewertungen

- Comparing performance of SBI, ICICI & CITI Bank in IndiaDokument4 SeitenComparing performance of SBI, ICICI & CITI Bank in IndiaNaveen HemromNoch keine Bewertungen

- BANK INDUSTRY ANALYSIS (AutoRecovered)Dokument9 SeitenBANK INDUSTRY ANALYSIS (AutoRecovered)AntraNoch keine Bewertungen

- Bank Industry AnalysisDokument9 SeitenBank Industry AnalysisAntraNoch keine Bewertungen

- Nick Paulson-Ellis: MarketsDokument3 SeitenNick Paulson-Ellis: MarketsSumit ManchandaNoch keine Bewertungen

- Strategic Management Assignment Analysis of HDFC BankDokument28 SeitenStrategic Management Assignment Analysis of HDFC BankJoanne O'ConnorNoch keine Bewertungen

- Literature Review of Yes BankDokument5 SeitenLiterature Review of Yes Bankafdtorpqk100% (1)

- Public vs. Private BanksDokument20 SeitenPublic vs. Private BanksJunaidShahNoch keine Bewertungen

- Annual Report On SBI Habib - 65Dokument20 SeitenAnnual Report On SBI Habib - 65Shashikala RajwadeNoch keine Bewertungen

- Bank and NBFC Mehal PDFDokument38 SeitenBank and NBFC Mehal PDFPrasun AgarwalNoch keine Bewertungen

- Project On HDFC LoansDokument61 SeitenProject On HDFC LoansPallavi80% (15)

- SWOT Analysis of ICICI Bank Reveals Strengths and Growth OpportunitiesDokument6 SeitenSWOT Analysis of ICICI Bank Reveals Strengths and Growth Opportunitiessouvikrock12Noch keine Bewertungen

- Company Profile ING VysyaDokument10 SeitenCompany Profile ING VysyaPrince Satish ReddyNoch keine Bewertungen

- T&D in Banking Sector (Arpit Shukla 18301B0007)Dokument12 SeitenT&D in Banking Sector (Arpit Shukla 18301B0007)Arpit ShuklaNoch keine Bewertungen

- Loan & Advances of IFIC Bank LimitedDokument28 SeitenLoan & Advances of IFIC Bank LimitedAbubakkar SiddiqueNoch keine Bewertungen

- Internship Report ON "The Bank of Punjab"Dokument31 SeitenInternship Report ON "The Bank of Punjab"ZIA UL REHMANNoch keine Bewertungen

- Literature Review of Sbi BankDokument6 SeitenLiterature Review of Sbi Bankeowcnerke100% (1)

- Finance ProjectDokument50 SeitenFinance ProjectGOURAVNoch keine Bewertungen

- General Banking Activities of EXIM Bank LTDDokument18 SeitenGeneral Banking Activities of EXIM Bank LTDtarique al ziad100% (1)

- Study On Non Performing AssetsDokument6 SeitenStudy On Non Performing AssetsHarshal RavankarNoch keine Bewertungen

- Minor 3Dokument15 SeitenMinor 3Divesh ChauhanNoch keine Bewertungen

- Top Credit Rating Agencies of IndiaDokument14 SeitenTop Credit Rating Agencies of IndiaAkhil GuptaNoch keine Bewertungen

- Comparative Financial Performance of SBI and ICICI BankDokument44 SeitenComparative Financial Performance of SBI and ICICI Bankpinuel76% (17)

- Banking Industry Evolution and Axis Bank's Market PositioningDokument43 SeitenBanking Industry Evolution and Axis Bank's Market PositioningamolkhadseNoch keine Bewertungen

- Strategic Management State Bank of IndiaDokument12 SeitenStrategic Management State Bank of IndiaAbhishek JhaveriNoch keine Bewertungen

- Journal On PerformanceDokument5 SeitenJournal On PerformanceSonia GhulatiNoch keine Bewertungen

- Financial Performance of EXIM BankDokument52 SeitenFinancial Performance of EXIM BankMirtun Joy100% (2)

- Banking Sector AnalysisDokument5 SeitenBanking Sector AnalysisNitin BighaneNoch keine Bewertungen

- AXIS BANK Project Word FileDokument28 SeitenAXIS BANK Project Word Fileअक्षय गोयलNoch keine Bewertungen

- ICICI Bank Company ProfileDokument6 SeitenICICI Bank Company ProfilesumitpatraNoch keine Bewertungen

- Practical Assignment Group and Subject DetailsDokument15 SeitenPractical Assignment Group and Subject Detailsrohan amrutiyaNoch keine Bewertungen

- HDFCDokument18 SeitenHDFCMiral VadhanNoch keine Bewertungen

- Axis Bank Literature ReviewDokument8 SeitenAxis Bank Literature Reviewc5p0cd99100% (1)

- HDFC Bank Financial AnalysisDokument46 SeitenHDFC Bank Financial Analysiscorby24Noch keine Bewertungen

- HR Management at ICICI BankDokument10 SeitenHR Management at ICICI BanknavreenNoch keine Bewertungen

- Analysis On The Basis of 7 Ps and SwotDokument28 SeitenAnalysis On The Basis of 7 Ps and Swotvedanshjain100% (3)

- Presented by Lovely Jamwal MBA sem-IIIDokument33 SeitenPresented by Lovely Jamwal MBA sem-IIIAkhil SuriNoch keine Bewertungen

- Financial Analysis of HDFC BankDokument48 SeitenFinancial Analysis of HDFC BankAbhay JainNoch keine Bewertungen

- Working Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath NairdocDokument66 SeitenWorking Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath Nairdocsarathspark100% (5)

- Icici Bank Project Summer Internship Program 2020Dokument45 SeitenIcici Bank Project Summer Internship Program 2020Bhavna PatnaikNoch keine Bewertungen

- Axis Bank Report Nayak Oo007Dokument74 SeitenAxis Bank Report Nayak Oo007gajraj40Noch keine Bewertungen

- Security Analysis and Portfolio Management Analysis of Shares of Icici Bank LTDDokument15 SeitenSecurity Analysis and Portfolio Management Analysis of Shares of Icici Bank LTDjosephadayanNoch keine Bewertungen

- Mrutyunjaya Sangresakoppa - MB207683Dokument21 SeitenMrutyunjaya Sangresakoppa - MB207683Prashanth Y GNoch keine Bewertungen

- Thesis On Sbi BankDokument4 SeitenThesis On Sbi BankSomeoneToWriteMyPaperForMeEvansville100% (2)

- Financial Analysis of ICICI BankDokument28 SeitenFinancial Analysis of ICICI Bankaksharma5698Noch keine Bewertungen

- Indian Banking Industry: Rs 77 Trillion Market Dominated by Public BanksDokument23 SeitenIndian Banking Industry: Rs 77 Trillion Market Dominated by Public BanksSarah BellNoch keine Bewertungen

- Comparative Analysis Financial Performance of INDUSIND BANK With Other Four BanksDokument85 SeitenComparative Analysis Financial Performance of INDUSIND BANK With Other Four Bankskawalpreetyahoo0% (1)

- Scope of The Bank ManagementDokument5 SeitenScope of The Bank ManagementHari PrasadNoch keine Bewertungen

- State Bank of India Strategy AnalysisDokument25 SeitenState Bank of India Strategy AnalysisVineet Raj Goel85% (20)

- Au Small Finance BankDokument27 SeitenAu Small Finance BankRuhi Rana100% (2)

- Indian Banking Sector Towards The Next OrbitDokument17 SeitenIndian Banking Sector Towards The Next OrbitKalyan Raman VadlamaniNoch keine Bewertungen

- BasicsDokument2 SeitenBasicsdhwerdenNoch keine Bewertungen

- BA Session 4 28aug10Dokument52 SeitenBA Session 4 28aug10Parikshit Vilas LokeNoch keine Bewertungen

- Competitive Landscape: Market Structure ProtagonistsDokument5 SeitenCompetitive Landscape: Market Structure ProtagonistsParikshit Vilas LokeNoch keine Bewertungen

- TCS and Cloud ComputingDokument17 SeitenTCS and Cloud ComputingParikshit Vilas LokeNoch keine Bewertungen

- Account Statement: Melayani Dengan Setulus HatiDokument1 SeiteAccount Statement: Melayani Dengan Setulus HatiDonna FriskillaNoch keine Bewertungen

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument33 SeitenDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceawadhNoch keine Bewertungen

- Master ProspectusDokument238 SeitenMaster ProspectusafkarputraNoch keine Bewertungen

- BanksDokument32 SeitenBanksPratyush ParanjapeNoch keine Bewertungen

- Bse E-Mandate ProcessDokument18 SeitenBse E-Mandate ProcessShakti ShivanandNoch keine Bewertungen

- METRO CITIES ATM LISTDokument88 SeitenMETRO CITIES ATM LISTArpit AgarwalNoch keine Bewertungen

- Banks in Country United KingdomDokument9 SeitenBanks in Country United KingdomGill ParamNoch keine Bewertungen

- Proof of Cash or Four Column ReconciliationDokument6 SeitenProof of Cash or Four Column ReconciliationMico Villegas BalbuenaNoch keine Bewertungen

- Structure and Functions of Commercial BanksDokument6 SeitenStructure and Functions of Commercial BanksAnurag VermaNoch keine Bewertungen

- PEI113 AwardsDokument22 SeitenPEI113 AwardsMarius RusNoch keine Bewertungen

- Fed ACHdirDokument1.043 SeitenFed ACHdirBala Janakiraman100% (3)

- Account STMT XX0862 01032024Dokument12 SeitenAccount STMT XX0862 01032024skhan49545Noch keine Bewertungen

- Hon'Ble Po: SL - No Case No. Applicant Vs Defendant Advocate RemarkDokument7 SeitenHon'Ble Po: SL - No Case No. Applicant Vs Defendant Advocate RemarkHarshvardhan MelantaNoch keine Bewertungen

- Ila IBAN Letter BH60 ABCO 5461 2669 1010 01Dokument1 SeiteIla IBAN Letter BH60 ABCO 5461 2669 1010 01masud alamNoch keine Bewertungen

- BIBM Written MathDokument241 SeitenBIBM Written MathIsmail HossainNoch keine Bewertungen

- Backup - GJ Januari 2024Dokument24 SeitenBackup - GJ Januari 2024Rosmina. S MagribNoch keine Bewertungen

- The Bombay Stock ExchangeDokument10 SeitenThe Bombay Stock ExchangeJ SmitNoch keine Bewertungen

- CISS FOR COLD STORAGE DATADokument14 SeitenCISS FOR COLD STORAGE DATAanahh ramakNoch keine Bewertungen

- Coding and Decoding QuestionsDokument28 SeitenCoding and Decoding QuestionsAbdulawwal IntisorNoch keine Bewertungen

- OYO AnnualReport FY22 1Dokument215 SeitenOYO AnnualReport FY22 1Harish N. ChaudhariNoch keine Bewertungen

- List of Beneficiary Bank Codes For Autopay ServicesDokument6 SeitenList of Beneficiary Bank Codes For Autopay ServicesEmail AlertNoch keine Bewertungen

- Swiftcode Bank Indonesia PDFDokument9 SeitenSwiftcode Bank Indonesia PDFtanjungulieNoch keine Bewertungen

- 09 05 23 StatementDokument1 Seite09 05 23 StatementZiyaur Rahman Iqbal AhmedNoch keine Bewertungen

- Axis Bank StatementDokument11 SeitenAxis Bank StatementKundan Kumar JaiswalNoch keine Bewertungen

- Bank Reconciliation Problems for Sassy, Beehive, Fabulous, and Bedlam CompaniesDokument4 SeitenBank Reconciliation Problems for Sassy, Beehive, Fabulous, and Bedlam CompaniesElizabethNoch keine Bewertungen

- Bank Account Details of Individuals in DelhiDokument189 SeitenBank Account Details of Individuals in DelhiPDRK BABIUNoch keine Bewertungen

- New 1Dokument36 SeitenNew 1Jane DyNoch keine Bewertungen

- Anexo 1. Homologacion Plan de CuentasDokument180 SeitenAnexo 1. Homologacion Plan de CuentasJesús FuentesNoch keine Bewertungen

- Safest Banks in The United StatesDokument4 SeitenSafest Banks in The United StatesweijeiNoch keine Bewertungen

- Greeting DiwaliDokument12 SeitenGreeting DiwaliAartiNoch keine Bewertungen