Beruflich Dokumente

Kultur Dokumente

Credit Bureau Understanding Your Credit Report

Hochgeladen von

surfnewsOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Credit Bureau Understanding Your Credit Report

Hochgeladen von

surfnewsCopyright:

Verfügbare Formate

UNDERSTANDING YOUR CREDIT REPORT

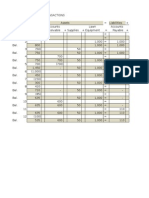

Data Provided Shows the required input from individuals as well as members when obtaining a report. This information is required for the matching of data held in CBS as well as to track all access to the report. Summary Displays a quick summary of the report by indicating how many previous enquiries have been made as well as how many account status(inclusive of closed accounts), payment default and bankruptcy information have been loaded on the individual. A debt management flag is also available to indicate if individual is under a debt management program with Credit Counselling Singapore. Personal Details / Additional Identification Basic personal details and additional identification details are used for verification of information from the applicant. Account Status History This information is displayed on a rolling 12 months basis (with the most current cycle on the left) while closed accounts will have the last 12 months payment status history as at the date of closure displayed for 3 years. First Row - Promptness of payments by monthly cycles versus the respective due dates. The status of the account is indicated by the following symbols: A - Payments were current to 29 days past due B - 30 59 days overdue C - 60 89 days overdue D - 90 days or more past due E - Closed with no outstanding balance F - Closed with outstanding balance * - Facility not used or zero balance G - Voluntary closure with outstanding / surrender of security with outstanding balance H - Involuntary closure with outstanding / surrender of security with outstanding balance R - Closed, restructured loan S - Closed, negotiated settlement prior to charge off W - Coded as default record by Member M - Account status not available#

# The M account status may represent account status that are not available for the particular month or account status before 1st July 2002, as account status data before 1st July 2002 are not collected by CBS. Second Row - Cash advance status / Balance transfer indicator (Only applicable to Credit Card facilities) Y - Yes. Indicates that there is cash advance / balance transfer activity or balance. N - No. Indicates that there is no cash advance / balance transfer activity or balance. - Data on cash advance / balance transfer are not available as the credit facility was not in use. Third Row - Full payment status (Only applicable to Credit Card facilities) Y - Yes. Indicates that full payment has been made for that month N - No. Indicates that full payment was not made for that month - Data on full payment is not available as the credit facility was not in use. Overdue Balance - The value loaded may include overdue balances that are a variable number of days overdue. If minimum amount is not paid before the due date, overdue balance will be shown in the credit report. Please note that only values of $200.00 or more will be displayed. Previous Enquiries Contains a record of all enquiries made on the individuals report. This information will be retained in the report for 2 years from the date of enquiry. Default Payments Indicates payment default as reported by Members. Default records with the status of Negotiated Settlement or Full Settlement will be displayed for 3 years from date of settlement. For default records with the status of Outstanding and Partial Payment, the records will be displayed indefinitely on the report. Bankruptcy Proceedings Displays bankruptcy records from public source. This information will be retained in the report for 5 years from the date of bankruptcy discharge. Narrative Provides any comments that members, individuals or third parties may have on the reports contents. How to contact Us If you have any queries on your report, you may contact our Hotline 65656363, fax your enquiry to 65384326 or email to : Consumer_services@creditbureau.com.sg to seek clarification.

Das könnte Ihnen auch gefallen

- Jim's LawncareDokument18 SeitenJim's LawncareJakeDickersonNoch keine Bewertungen

- RewardsCardBooklet Feb2019Dokument18 SeitenRewardsCardBooklet Feb2019Debbie Jamielyn Ong0% (1)

- Index ViewsDokument4 SeitenIndex ViewspallikachopraNoch keine Bewertungen

- CT1 Assignment Chapter 14Dokument5 SeitenCT1 Assignment Chapter 14Gaurav satraNoch keine Bewertungen

- Credit Reports and Scores Note Taking Guide 2 6 1 l1Dokument4 SeitenCredit Reports and Scores Note Taking Guide 2 6 1 l1api-26818659550% (2)

- Credit Card Statement: Syed Ali Hyder ZaidiDokument1 SeiteCredit Card Statement: Syed Ali Hyder ZaidiAli Hyder ZaidiNoch keine Bewertungen

- Earnings Statement: Non NegotiableDokument1 SeiteEarnings Statement: Non NegotiableKang KimNoch keine Bewertungen

- Check Acceptance Procedure - RevisedDokument4 SeitenCheck Acceptance Procedure - RevisedJoe EskenaziNoch keine Bewertungen

- Jessica LaplaceDokument2 SeitenJessica Laplacejtm3323Noch keine Bewertungen

- Bank Statement Template 1 - TemplateLabDokument3 SeitenBank Statement Template 1 - TemplateLabHasanNoch keine Bewertungen

- Class Action v. Capital One and AmazonDokument36 SeitenClass Action v. Capital One and AmazonNat LevyNoch keine Bewertungen

- Yes Private Credit Card MITC PDFDokument8 SeitenYes Private Credit Card MITC PDFkiran saiNoch keine Bewertungen

- Platinum Ser GuideDokument97 SeitenPlatinum Ser GuideRohit RoyNoch keine Bewertungen

- PaypalDokument24 SeitenPaypalMarine EssenceNoch keine Bewertungen

- Walmart Sams Club Identity Theft Victims AffidavitDokument3 SeitenWalmart Sams Club Identity Theft Victims AffidavitJeffPack-BluefinmanNoch keine Bewertungen

- LCC LawsuitDokument43 SeitenLCC LawsuitdaneNoch keine Bewertungen

- Background Investigation FormDokument5 SeitenBackground Investigation FormWDAScribdNoch keine Bewertungen

- Personal - ChexSystems Identity Theft AffidavitDokument4 SeitenPersonal - ChexSystems Identity Theft AffidavitEmpresarioNoch keine Bewertungen

- InvDokument1 SeiteInvAnonymous 0wPNBG0% (1)

- Consumer Investigations IRE 2019Dokument15 SeitenConsumer Investigations IRE 2019ABC News PoliticsNoch keine Bewertungen

- Jumpstart Credit Card Processing (Version 1)Dokument15 SeitenJumpstart Credit Card Processing (Version 1)Oleksiy KovyrinNoch keine Bewertungen

- Client Manual Consumer Banking - CitibankDokument29 SeitenClient Manual Consumer Banking - CitibankNGUYEN HUU THUNoch keine Bewertungen

- Cash Rewards Credit Card Agreement and DisclosureDokument11 SeitenCash Rewards Credit Card Agreement and DisclosureMacrobiM Reklam AjansıNoch keine Bewertungen

- MPR Grant Application - FinalDokument3 SeitenMPR Grant Application - FinalWest Central TribuneNoch keine Bewertungen

- Credit CardsDokument24 SeitenCredit Cardsramking509Noch keine Bewertungen

- Checks ManagementDokument3 SeitenChecks ManagementnorthepirNoch keine Bewertungen

- DocuSign PDFDokument7 SeitenDocuSign PDFLourdesNoch keine Bewertungen

- Prepaid Cards For Transit Agencies 20110212Dokument38 SeitenPrepaid Cards For Transit Agencies 20110212amolnatuNoch keine Bewertungen

- Credit Dispute LetterDokument2 SeitenCredit Dispute Lettermglc8327440% (1)

- The Ray Reynolds Plan: Printing Turn Key ClassDokument13 SeitenThe Ray Reynolds Plan: Printing Turn Key Classmjacu999100% (1)

- Wells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Dokument24 SeitenWells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Frank GregoireNoch keine Bewertungen

- Talent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027Dokument9 SeitenTalent6 5419 Hollywood Blvd. Suite C727 Hollywood, CA 90027bambini84Noch keine Bewertungen

- MD02A - Bank Account Master Data UploadDokument21 SeitenMD02A - Bank Account Master Data UploadSagar Garg (IN)Noch keine Bewertungen

- Bank Fraud: Kes College of Arts & Commerce Fraud in BankDokument49 SeitenBank Fraud: Kes College of Arts & Commerce Fraud in BankNehal ShahNoch keine Bewertungen

- Welcome To The Second Edition of The MS & Reward Program Spreadsheet!Dokument12 SeitenWelcome To The Second Edition of The MS & Reward Program Spreadsheet!BrianNoch keine Bewertungen

- Protecting Your Credit Score ActDokument4 SeitenProtecting Your Credit Score ActLashon SpearsNoch keine Bewertungen

- List of Outstanding Springfield Property TaxesDokument3 SeitenList of Outstanding Springfield Property TaxesMassLive100% (1)

- Pandemic Relief Loans Received by ScientologyDokument4 SeitenPandemic Relief Loans Received by ScientologyThe Daily DotNoch keine Bewertungen

- Paystub 10:2014Dokument3 SeitenPaystub 10:2014ReyAyalaNoch keine Bewertungen

- Disclosure and Release Form-SignedDokument2 SeitenDisclosure and Release Form-SignedDalitsoChapemaNoch keine Bewertungen

- Internet Banking User Handbook (English) & Frequently Asked Questions (FAQ)Dokument18 SeitenInternet Banking User Handbook (English) & Frequently Asked Questions (FAQ)Zobi HossainNoch keine Bewertungen

- Consumer Authorization Background Check FormDokument2 SeitenConsumer Authorization Background Check Formapi-351412138Noch keine Bewertungen

- Opt Out InstructionsDokument1 SeiteOpt Out InstructionsKNOWLEDGE SOURCENoch keine Bewertungen

- Sonja Emery: Detention Hearing AppealDokument32 SeitenSonja Emery: Detention Hearing AppealHLMeditNoch keine Bewertungen

- Food Stamp Calculator Oct 2015 X LsDokument24 SeitenFood Stamp Calculator Oct 2015 X Lsjesi5445Noch keine Bewertungen

- Introduction To Accounting & Baiscs of JournalDokument227 SeitenIntroduction To Accounting & Baiscs of Journaldateraj100% (1)

- ATM Case Study, Part 1: Object-Oriented Design With The UMLDokument46 SeitenATM Case Study, Part 1: Object-Oriented Design With The UMLVaidehiBaporikarNoch keine Bewertungen

- Mobile BankingDokument17 SeitenMobile BankingSuchet SinghNoch keine Bewertungen

- Writ of Habeas Corpus To Ex Post Facto LawsDokument554 SeitenWrit of Habeas Corpus To Ex Post Facto LawsGillian Elliot AlbayNoch keine Bewertungen

- Credit Card Authorization Form: Thomas A. KeelerDokument1 SeiteCredit Card Authorization Form: Thomas A. KeelerThomas KeelerNoch keine Bewertungen

- Ds 11Dokument6 SeitenDs 11muhammad aliNoch keine Bewertungen

- VpopmailDokument21 SeitenVpopmaild14n4dNoch keine Bewertungen

- Cash App Cashapp Instagram Photos and VideosnbuzyrrvfiDokument2 SeitenCash App Cashapp Instagram Photos and Videosnbuzyrrvfifueljudge9Noch keine Bewertungen

- Judicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowDokument9 SeitenJudicial Foreclosures and Constitutional Challenges: What Every Estate Planning Attorney Needs To KnowElaine Diane EtingoffNoch keine Bewertungen

- Identity Theft in PennsylvaniaDokument2 SeitenIdentity Theft in PennsylvaniaJesse WhiteNoch keine Bewertungen

- Integrigy Oracle E-Business Suite Credit Cards PCI April 2016Dokument54 SeitenIntegrigy Oracle E-Business Suite Credit Cards PCI April 2016BhavaniNoch keine Bewertungen

- Momo Statement - 250783521544-1.pdf WENDokument27 SeitenMomo Statement - 250783521544-1.pdf WENJonathan HAKIZIMANA0% (1)

- Verification of AdvancesDokument12 SeitenVerification of AdvancesAvinash SinyalNoch keine Bewertungen

- Nueces County Game Room RegulationsDokument24 SeitenNueces County Game Room RegulationscallertimesNoch keine Bewertungen

- Internet Download Manager A Complete Guide - 2019 EditionVon EverandInternet Download Manager A Complete Guide - 2019 EditionNoch keine Bewertungen

- Himalayan Bank LTD Nepal Introduction (Essay)Dokument2 SeitenHimalayan Bank LTD Nepal Introduction (Essay)Chiran KandelNoch keine Bewertungen

- Company AccountsDokument105 SeitenCompany AccountsKaustubh BasuNoch keine Bewertungen

- Revati Krishna CV (1) - 1Dokument2 SeitenRevati Krishna CV (1) - 1shivram.antallkoNoch keine Bewertungen

- Europass CV 110625 IanaDokument3 SeitenEuropass CV 110625 IanaDorina BalanNoch keine Bewertungen

- Sec Vs InterportDokument5 SeitenSec Vs InterportChase DaclanNoch keine Bewertungen

- Portfolio Monitoring TemplateDokument11 SeitenPortfolio Monitoring Templateseragaki88Noch keine Bewertungen

- The South African Economic Reconstruction and Recovery PlanDokument38 SeitenThe South African Economic Reconstruction and Recovery PlanMandla Lionel IsaacsNoch keine Bewertungen

- Money Crossword WordbankDokument1 SeiteMoney Crossword WordbankJoseph JenningsNoch keine Bewertungen

- Su001 1209en PDFDokument2 SeitenSu001 1209en PDFKimi RaikNoch keine Bewertungen

- Navigating GST 2.0 - Tax MantraDokument34 SeitenNavigating GST 2.0 - Tax MantraELP LawNoch keine Bewertungen

- PDS SMART Mortgage Flexi TawarruqDokument8 SeitenPDS SMART Mortgage Flexi TawarruqNUR AQILAH NUBAHARINoch keine Bewertungen

- Rental IncomeDokument2 SeitenRental IncomeAlex SirgiovanniNoch keine Bewertungen

- The Need For AdjustmentDokument5 SeitenThe Need For AdjustmentAnna CharlotteNoch keine Bewertungen

- Marketing Concepts For Bank ExamsDokument24 SeitenMarketing Concepts For Bank Examssunny_dear003Noch keine Bewertungen

- 14 PDFDokument6 Seiten14 PDFsrinu02062Noch keine Bewertungen

- SBS Instalment Plans at 0% Markup With No Processing Fee: LED Mi Band 2Dokument2 SeitenSBS Instalment Plans at 0% Markup With No Processing Fee: LED Mi Band 2James BondNoch keine Bewertungen

- The Hindu Review August 2021Dokument45 SeitenThe Hindu Review August 2021SHIKHA SHARMANoch keine Bewertungen

- SglawDokument61 SeitenSglawYuki CrossNoch keine Bewertungen

- Customer LoyaltyDokument16 SeitenCustomer LoyaltySiddharth TrivediNoch keine Bewertungen

- Our Ref: Cub/Hog/Oxd1/2018 Payment File: RBI/id1033/2016/2018Dokument2 SeitenOur Ref: Cub/Hog/Oxd1/2018 Payment File: RBI/id1033/2016/2018Vikas VidhurNoch keine Bewertungen

- Negotiable Instruments Law CasesDokument39 SeitenNegotiable Instruments Law CasesAgui S. AugusthineNoch keine Bewertungen

- FASE 1 Financial Accounting Manual 2021Dokument98 SeitenFASE 1 Financial Accounting Manual 2021erikatri366Noch keine Bewertungen

- A161 Tutorial 4 - Annual Report Fin AnalysisDokument10 SeitenA161 Tutorial 4 - Annual Report Fin AnalysisAmeer Al-asyraf MuhamadNoch keine Bewertungen

- Product Positioning (MbaDokument27 SeitenProduct Positioning (MbaDeepak Singh NegiNoch keine Bewertungen

- Payroll AccountinDokument2 SeitenPayroll AccountinIvy Veronica SandagonNoch keine Bewertungen

- Referralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrerDokument3 SeitenReferralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrermikeNoch keine Bewertungen

- Soft Copy ReportDokument3 SeitenSoft Copy ReportChristine Nathalie BalmesNoch keine Bewertungen

- Brain Drain Is The Emigration of Highly Trained or Intelligent People From A Particular CountryDokument3 SeitenBrain Drain Is The Emigration of Highly Trained or Intelligent People From A Particular CountrydivyanshNoch keine Bewertungen

- Modelo - Due DiligenceDokument17 SeitenModelo - Due DiligenceAdebayorMazuzeNoch keine Bewertungen