Beruflich Dokumente

Kultur Dokumente

Notes Chapter 1 FA 3

Hochgeladen von

Vasant SriudomOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Notes Chapter 1 FA 3

Hochgeladen von

Vasant SriudomCopyright:

Verfügbare Formate

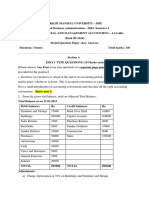

1.

0 FINANCIAL STATEMENT FOR THE YEAR A limited company especially a public limited company needs to prepare two sets of final accounts one for internal use and another for external use. For internal use are for presentation to the companys management (BOD) and those for external use are for filling the Registry of Companies and publication. The Companies Act requires the audited financial statements of the company to be prepared every calendar year, at intervals of not more than fifteen months and to lay before the company at its Annual General Meeting financial statements made up to a date not more than six months before the date of the meeting. Final accounts for both internal and external use consist to the following: a. Trading, Profit and Loss and Appropriation Account; b. Balance Sheet; and c. Cash Flow Statement. (Chapter 4) Section 169 of the Companies Act 1965 lists out Ninth Schedule the information to be disclosed in these two statements. The Ninth Schedule of the Companies Act 1965 and the various Financial Reporting Standards specify the minimum information to be disclosed in the annual financial statements of companies presented to external users. The financial statements that are prepared and presented have to comply with the accounting standards that are in force in Malaysia. The Malaysia Accounting Standards Board (MASB) is now responsible for issuing the standards. At present, the MASB has issued a number of accounting standards called Financial Reporting Standards (FRSs) which are similar to the International Financial Reporting Standards (IFRs) and some of the Malaysia Standards. FRSs are for public entities. Private entities may apply FRSs or Private Entity Reporting Standards (PERs).

1.1 Trading, Profit and Loss and Appropriation Account Financial Reporting Standard 101 - Presentation of Financial Statements deal with the presentation of general purpose financial statement. There is no specific standard format to be adopted for financial report. But it is advisable to adapt to the standard format for external use as set by the Accounting Standards and Companies Act, so that later it can easily be converted into the format for external use. The suggested format is given below:

a. T Format Company Name Trading and Profit and Loss Account for the year ended ____ Notes Opening stock Purchase - Return Outward Carriage inward - Closing stock COGS Gross Profit RM xxx xxx (xxx) xxx xx_ xxx xxx (xx) xxx xxx xxx === Notes Sales - Return Inward RM xxx xx

Less : Expenses eg : Depreciation Salary Discount allowed Carriage outward Utility Loan Interest Debenture Interest Bad Debt Nett profit xx xx xx xx xx xx xx xx xx xxx === xx xx xxx ===

Gross Profit Add : Revenue Receivable Rental xx Receivable discount xx Investment Interest xx

xxx === xxx

Tax Profit after tax

Nett profit

xxx === xx ___ xxx ===

Company Name Profit and Loss Appropriation Account for the year ended ____ Appropriation: Interim dividend - Ordinary share - Preferred share Propose dividend - Ordinary share - Preferred share Reserve transferred Written off good will Retained earning (c/d) Profit after tax Retained earning (b/d) xx xx xx xx xx xx xx xxx === xx xx

___ xxx ===

Balance Sheet As At _____________ Notes RM Fixed Asset Building Vehicle Machine xx xx xx Notes Authorized Share Capital Ordinary Share Preferred Share Issued and Paid Up Capital Investment Goodwill Current Asset Debtors Bank Cash Utility Prepayment xx xx xx xx xx xx Ordinary Share Ordinary Share Share Premium Retained Earning (c/d) General Reserve Current Liability Creditors Accrued Salary Long Term Liability Loan Debenture ___ xxx === xx xx ___ xxx === xx xx xx xx xx xx xx xx xx == RM

b. Statement Format Company Name Income Statement and Appropriation for the year ended ____ Notes Sales - Return Inward RM RM RM xxx xx xxx

Opening stock Purchase - Return Outward Carriage inward - Closing stock COGS Gross Profit Add : Revenue Receivable Rental Receivable discount Investment Interest Less : Expenses eg : Depreciation Salary Discount allowed Carriage outward Utility Loan Interest Debenture Interest Bad Debt Nett profit Tax Profit after tax Retained earning (b/d) Appropriation: Interim dividend - Ordinary share - Preferred share Propose dividend - Ordinary share - Preferred share Reserve transferred Written off good will Retained earning (c/d)

xxx xxx (xxx) xxx xx_ xxx xxx (xx) xxx xxx xx xx xx xxx xx xx xx xx xx xx xx xx_

(xxx) xxx (xx) xx xx xxx

xx xx xx xx xx xx

(xx) xxx ===

Balance Sheet As At _______________ Notes Fixed Asset Building Vehicle Machine Investment Goodwill Current Asset Debtors Bank Cash Utility Prepayment Current Liability Creditors Accrued Salary Working Capital RM RM RM xx xx xx xx xx xxx xx xx xx xx xxx xx xx

xx xx xxx ===

Authorized Share Capital Ordinary Share Preferred Share

xx xx ===

Issued and Paid Up Capital Ordinary Share Ordinary Share Share Premium Retained Earning (c/d) General Reserve Long Term Liability Loan Debenture

xx xx xx xx xx

xx

xx xx xxx ===

Das könnte Ihnen auch gefallen

- Final AccountsDokument9 SeitenFinal AccountsJack Martin100% (1)

- Alwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsDokument14 SeitenAlwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsFarrukhsgNoch keine Bewertungen

- Week 9: Interpretation of Financial StatementsDokument47 SeitenWeek 9: Interpretation of Financial StatementsUmair AshrafNoch keine Bewertungen

- Pfa0064 - Topic 9Dokument18 SeitenPfa0064 - Topic 9Jeyaletchumy Nava RatinamNoch keine Bewertungen

- FS TypesDokument23 SeitenFS TypesAnamika VermaNoch keine Bewertungen

- ComplianceDokument6 SeitenCompliancementinfusionNoch keine Bewertungen

- Understanding Financial ReportsDokument40 SeitenUnderstanding Financial ReportshitekshaNoch keine Bewertungen

- Understanding of Accounting StandardsDokument42 SeitenUnderstanding of Accounting StandardsIndu MalikNoch keine Bewertungen

- Taxguru - In-How To Prepare Directors Report As Per Companies Act 2013Dokument9 SeitenTaxguru - In-How To Prepare Directors Report As Per Companies Act 2013g26agarwalNoch keine Bewertungen

- Final Accounts - Principles of AccountingDokument9 SeitenFinal Accounts - Principles of AccountingAbdulla MaseehNoch keine Bewertungen

- Unit V: Financial AccountingDokument31 SeitenUnit V: Financial AccountingAbhishek Bose100% (2)

- Finance For Non FinanceDokument56 SeitenFinance For Non Financeamitiiit31100% (3)

- DOW ACCOUNTING Jan 11,2021Dokument8 SeitenDOW ACCOUNTING Jan 11,2021Hira SialNoch keine Bewertungen

- Tax Incentives For Malaysia As A Regional Hub and For Research and DevelopmentDokument12 SeitenTax Incentives For Malaysia As A Regional Hub and For Research and DevelopmentAfeef ArifNoch keine Bewertungen

- Fabm ReviewerDokument7 SeitenFabm Reviewersab lightningNoch keine Bewertungen

- Financial StatementsDokument20 SeitenFinancial StatementsOmnath BihariNoch keine Bewertungen

- Financing Forecasting and PlanningDokument12 SeitenFinancing Forecasting and PlanningCarl JovianNoch keine Bewertungen

- Statement of Change in Financial Position-5Dokument32 SeitenStatement of Change in Financial Position-5Amit SinghNoch keine Bewertungen

- Financial Accounting Libby 7th Edition Solutions ManualDokument5 SeitenFinancial Accounting Libby 7th Edition Solutions Manualstephaniehornxsoiceygfp100% (44)

- Ias Updated CompletedDokument92 SeitenIas Updated CompletedTahir_Sartaj_1148Noch keine Bewertungen

- IAS-7 S C F: Tatement of ASH LowsDokument11 SeitenIAS-7 S C F: Tatement of ASH LowsLauren WebbNoch keine Bewertungen

- Advanced Financial Accounting Chapter 6 - Cash Flow StatementsDokument16 SeitenAdvanced Financial Accounting Chapter 6 - Cash Flow StatementsSyed Sohaib AliNoch keine Bewertungen

- IAS-7 S C F: Tatement of ASH LowsDokument11 SeitenIAS-7 S C F: Tatement of ASH LowsAsim NazirNoch keine Bewertungen

- Finanancial Statements NotesDokument10 SeitenFinanancial Statements Notespetco95Noch keine Bewertungen

- 12.2 - Cash Flows From Operating Activities: Treatment of Interest ReceivedDokument9 Seiten12.2 - Cash Flows From Operating Activities: Treatment of Interest ReceivedSrikiran RajNoch keine Bewertungen

- Wa0013Dokument54 SeitenWa0013Maria AbrahamNoch keine Bewertungen

- Tut Solution FA - CombineDokument10 SeitenTut Solution FA - CombineSyazliana KasimNoch keine Bewertungen

- Financial Statements Guide for BusinessesDokument6 SeitenFinancial Statements Guide for BusinessesRaaghav SrinivasanNoch keine Bewertungen

- 2.0 Accounting Defined: The American Institute of Certified Public Accountant HasDokument31 Seiten2.0 Accounting Defined: The American Institute of Certified Public Accountant HashellenNoch keine Bewertungen

- Financial Analysis: Submitted byDokument18 SeitenFinancial Analysis: Submitted bybernie john bernabeNoch keine Bewertungen

- Cash Flow Statement: Position of A Firm. Cash and Relevant Terms As Per AS-3 (Revised)Dokument17 SeitenCash Flow Statement: Position of A Firm. Cash and Relevant Terms As Per AS-3 (Revised)Jebby VargheseNoch keine Bewertungen

- AccountsDokument21 SeitenAccountsakash lachhwani100% (1)

- V. Basic Interprestation and Use of Financial StatementsDokument12 SeitenV. Basic Interprestation and Use of Financial StatementsJHERICA SURELLNoch keine Bewertungen

- Arl Internship ReportDokument19 SeitenArl Internship ReportChaudhry RashidNoch keine Bewertungen

- Income Statement & Balance Sheet-1Dokument18 SeitenIncome Statement & Balance Sheet-1Shreyasi RanjanNoch keine Bewertungen

- Technical Accounting Interview QuestionsDokument14 SeitenTechnical Accounting Interview QuestionsRudra PatidarNoch keine Bewertungen

- Partnership Final Accounts GuideDokument6 SeitenPartnership Final Accounts Guideprabodhcms0% (1)

- Understanding Income StatementsDokument39 SeitenUnderstanding Income StatementsMarsh100% (1)

- 2.preparation of Financial StatementsDokument5 Seiten2.preparation of Financial StatementsAshutosh MhatreNoch keine Bewertungen

- Segment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)Dokument32 SeitenSegment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)AmolNoch keine Bewertungen

- Accounting EquationDokument36 SeitenAccounting EquationZainon Idris100% (1)

- CH 11Dokument13 SeitenCH 11Kashif AmmarNoch keine Bewertungen

- Chapter Seventeen: Mcgraw-Hill/IrwinDokument17 SeitenChapter Seventeen: Mcgraw-Hill/IrwinJohn ReyNoch keine Bewertungen

- IAS 7, Statement of Cash Flows - A Closer Look: ArticleDokument10 SeitenIAS 7, Statement of Cash Flows - A Closer Look: ArticlevcdsvcdsvsdfNoch keine Bewertungen

- VCE Summer Internship Program 2020: Smart Task Submission FormatDokument4 SeitenVCE Summer Internship Program 2020: Smart Task Submission FormatRevanth GupthaNoch keine Bewertungen

- MB0041 MQP Answer KeysDokument21 SeitenMB0041 MQP Answer Keysajeet100% (1)

- Financial Accounting Libby 7th Edition Solutions ManualDokument36 SeitenFinancial Accounting Libby 7th Edition Solutions Manualwalerfluster9egfh3100% (37)

- Cash Flow Statement Wit SumDokument27 SeitenCash Flow Statement Wit SumSunay KhaireNoch keine Bewertungen

- Working Capital Report - Finance Dept. DUDokument23 SeitenWorking Capital Report - Finance Dept. DUAhmed RezaNoch keine Bewertungen

- Accounting StandardsDokument45 SeitenAccounting Standardsjitesh_kumar_275% (4)

- Accounting Standards (Satyanath Mohapatra)Dokument39 SeitenAccounting Standards (Satyanath Mohapatra)smrutiranjan swain100% (1)

- AS-3 Cash Flow StatementDokument26 SeitenAS-3 Cash Flow StatementJonathan BarretoNoch keine Bewertungen

- FMGT 1321 Midterm 1 Review Questions: InstructionsDokument7 SeitenFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- F3 02 SCI and SCE HandoutsDokument7 SeitenF3 02 SCI and SCE HandoutsRichard de LeonNoch keine Bewertungen

- Damodaran On Valuation PDFDokument102 SeitenDamodaran On Valuation PDFmanishpawar11Noch keine Bewertungen

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.Von EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.Noch keine Bewertungen

- Statement of Cash Flows: Preparation, Presentation, and UseVon EverandStatement of Cash Flows: Preparation, Presentation, and UseNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Bod Suad 3Dokument1 SeiteBod Suad 3Vasant SriudomNoch keine Bewertungen

- CoverDokument1 SeiteCoverVasant SriudomNoch keine Bewertungen

- Bod Suad 4Dokument4 SeitenBod Suad 4Vasant Sriudom0% (1)

- Bod Suad 2Dokument7 SeitenBod Suad 2Vasant SriudomNoch keine Bewertungen

- Notes Chapter 1 FA 3Dokument5 SeitenNotes Chapter 1 FA 3Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q3Dokument2 SeitenFA 4 Chapter 3 - Q3Vasant SriudomNoch keine Bewertungen

- FA 3 Sem 5Dokument13 SeitenFA 3 Sem 5Vasant SriudomNoch keine Bewertungen

- Working Capital and Policy ManagementDokument20 SeitenWorking Capital and Policy ManagementVasant SriudomNoch keine Bewertungen

- Bod Suad 1Dokument17 SeitenBod Suad 1Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q1Dokument3 SeitenFA 4 Chapter 3 - Q1Vasant SriudomNoch keine Bewertungen

- Bod Suad 1Dokument17 SeitenBod Suad 1Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q4Dokument4 SeitenFA 4 Chapter 3 - Q4Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q3Dokument2 SeitenFA 4 Chapter 3 - Q3Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 6Dokument3 SeitenFA 4 Chapter 6Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 5 - AllDokument8 SeitenFA 4 Chapter 5 - AllVasant SriudomNoch keine Bewertungen

- FA 4 Chapter 4 - Q1Dokument4 SeitenFA 4 Chapter 4 - Q1Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q2Dokument3 SeitenFA 4 Chapter 3 - Q2Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 4 - Q2Dokument5 SeitenFA 4 Chapter 4 - Q2Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 4 - Q4Dokument4 SeitenFA 4 Chapter 4 - Q4Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 4 - Q3Dokument3 SeitenFA 4 Chapter 4 - Q3Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q4Dokument4 SeitenFA 4 Chapter 3 - Q4Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q2Dokument3 SeitenFA 4 Chapter 3 - Q2Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 2 - Q1 & Q2Dokument7 SeitenFA 4 Chapter 2 - Q1 & Q2Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 2 - Q4Dokument5 SeitenFA 4 Chapter 2 - Q4Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 3 - Q1Dokument3 SeitenFA 4 Chapter 3 - Q1Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 1 - AllDokument5 SeitenFA 4 Chapter 1 - AllVasant SriudomNoch keine Bewertungen

- Jawapan Assignment 4Dokument4 SeitenJawapan Assignment 4Vasant SriudomNoch keine Bewertungen

- FA 4 Chapter 2 - Q3Dokument5 SeitenFA 4 Chapter 2 - Q3Vasant SriudomNoch keine Bewertungen

- Soalan Assignment 4-8 Sem 6Dokument1 SeiteSoalan Assignment 4-8 Sem 6Vasant SriudomNoch keine Bewertungen

- Soalan Assignment 4-6 Sem 6Dokument1 SeiteSoalan Assignment 4-6 Sem 6Vasant SriudomNoch keine Bewertungen