Beruflich Dokumente

Kultur Dokumente

Portfolio Management of CNX NIFTY by Abhishek Biswas 2010-2012

Hochgeladen von

abhi2018Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Portfolio Management of CNX NIFTY by Abhishek Biswas 2010-2012

Hochgeladen von

abhi2018Copyright:

Verfügbare Formate

INSTITUTE FOR TECHNOLOGY AND MANAGEMENT

PGDM (FM) 2010-12

Summer Project Report on

Portfolio Management

While Summer Placement at: Religare Securities ltd 400/1A, Prince Anwar Shah Road 4th floor, Opposite South City Mall, Kolkata -700045 In the partial fulfillment of PGDM FM 2010-2012 programme By Name: Abhishek Biswas Roll No.: 61 PGDM Financial Markets Under the Guidance of Mr Abhishek Saha

ITM Institute of Financial Markets BSEL Tech Park, Vashi

2 |Page

CERTIFICATE

Project entitled: Portfolio Management of S & P CNX Nifty companies at Religare Securities Ltd. This is to certify that the project work entitled Portfolio management of CNX Midcap Companies at Religare securities ltd has been carried out by Abhishek Biswas of the Institute for Technology and Management, Navi Mumbai doing the Post Graduate Diploma in Management Financial Markets 20102012, during his / her summer placement with our organization between 1st June 2011 to 31st July 2011. Submitted by: Abhishek Biswas in partial fulfillment of the Post Graduate Diploma in Management Financial Markets 2010-2012, course. Signature of Company Guide: Mr Abhishek Saha (Company Seal)

Signature of Faculty Guide: Mr Manohar Lal

Signature of Academic Coordinator: Academic Coordinator (Seal of ITM)

ITM Institute of Financial Markets

3 |Page

Acknowledgement I take this opportunity to express my deep sense of gratitude to all those who have contributed significantly by sharing their knowledge and experience in the completion of this project work. I am greatly obliged to Dr. K. S. Murthy, Director, ITM IFM for providing me the right kind of opportunity and facilities to complete this venture. My first word of gratitude is due to Mr. Abhishek Saha , my corporate guide, for his kind help and support and for his valuable guidance throughout the project. I am thankful to him for providing me with necessary insights and helping me out at every single step. My heartfelt thanks to my respected Faculty Guide namely Mr. Manohar Lal Without his continuous help the project would not have been materialized in the present form. His valuable suggestions helped me at every step. Finally, I would also like to thank all my dear friends for their kind cooperation, advice and encouragement during the long and arduous task of preparing this report and carrying out the project.

(Sign ature of the Student)

Name: Abhishek Biswas Roll No.: 61 PGDM FM (2010-12) ITM Institute of Financial Markets

ITM Institute of Financial Markets

4 |Page

Vashi, Navi Mumbai.

ITM Institute of Financial Markets

5 |Page

DECLARATION FORM

I hereby declare that the Project work entitled, Portfolio

management of CNX Midcap companies at Religare Securities ltd Kolkata, submitted by me for the partial fulfillment of the Post Graduate Diploma in Management (PGDM) to ITM Institute for Financial Markets, is my own original work and has not been submitted earlier either to ITM IFM or to any other Institution for the fulfillment of the requirement for any course of study. I also declare that no chapter of this manuscript in whole or in part is lifted and incorporated in this report from any earlier / other work done by me or others.

Place

: Kolkata

Date : 27 July 2012

Signature of Student Name of Student: Abhishek Biswas Address: 1174 Purbo Sinthee Road Dum Dum Kolkata 700030

ITM Institute of Financial Markets

6 |Page

Executive Summary

This project report on Portfolio management of CNX Nifty at Religare Securities ltd Kolkata is based on understanding of portfolio management which is taking place in the stock market, under the project I have done marketing of Trading and demat account so this helps in understanding how practically the market works.

Under the project firstly I found out 3 portfolios, according to the different age groups which has made technical breakout in CNX Nifty index. Company selection is based on return and risk of that security also. On the basis of returns given by the securities for the last 6 months I have found out individual risk and return of a stock as well as for the portfolios. Then I compared the portfolio with the market index and at last I have compared the risk and return of the 3 portfolios together. Hence according to the risk appetite I found the suitable portfolios for them.

ITM Institute of Financial Markets

7 |Page

TABLE OF CONTENTS

CHAPTER: 1 Company Details....9

1.1 Activities of RELIGARE10 1.2 A Brief about RELIGARE SECURITIES:11 CHAPTER: 2 Facts & findings..18

2.1 Theories of portfolio...19 2.2 Formulae used in this project..23 2.3 Portfolio:1..24 2.4 Portfolio:2..31 2.5 Portfolio:3..37 CHAPTER: 3 Analysis..43 CHAPTER: 4 Limitations of the project..44 CHAPTER:5 CHAPTER:6 Conclusion & suggestions....45 Bibliography..45

ITM Institute of Financial Markets

8 |Page

INTODUCTION

COMPANY DETAILS Religare is a global financial services group with a presence across Asia, Africa, Middle East, Europe and the Americas. Religare is promoted by the promoters of Ranbaxy pharmaceuticals Limited. In India, Religares largest market, the group offers a wide array of products and services ranging from insurance, asset management, broking and lending solutions to investment banking and wealth management. The group has also pioneered the concept of investments in alternative asset classes such as arts and films. With over 10,000 employees across multiple geographies, Religare serves over a million clients, including corporate and institutions, high net worth families and individuals, and retail investors. Religare operate from six regional offices and 25 sub-regional offices and have a presence in 330 cities and towns controlling 979 locations which are managed either directly by Religare or by our Business Associates all over India, the company have a representative office in London. While the majority of Religare offices provide the full complement of its services yet it has dedicated offices for investment banking, institutional brokerage, portfolio management services and priority client services. As on date the Company is empanelled with UTI, IDBI, IFCI, SBI, BOI-MF, Punjab National Bank, PNB-MF, Oriental Insurance, GIC, UTI-Offshore, ICICI Can bank MF, Punjab & Sind Bank, Pioneer ITI, SUN F&C, IDBI Principal, Prudential ICICI, ING Baring and J M Mutual Fund. RELIGARE was founded with the vision of providing integrated financial care driven by the relationship of trust. The bouquet of services offered by RELIGARE includes Broking (Stocks and

ITM Institute of Financial Markets

9 |Page

Commodities), Depository Participant Service, Advisory on Mutual Fund Investments and Portfolio Management Services.

RELIGARE is a pioneer in the concept of partnership to reach multiple locations in order to effectively service its large base of individual clients. Besides the reach of RELIGARE, the clients of the company greatly benefit by its strong research capability, which encompasses fundamentals as well as technical knowledge.

Activities of Religare Enterprises Limited 1. Religare Securities Limited Equity Broking Online Investment Portal Portfolio Management Services Depository Services 2. Religare Finvest Limited Lending and Distribution business Proposed Custodial business 3. Religare Commodities Limited Commodity Broking 4. Religare Insurance Broking Limited Life Insurance General Insurance Reinsurance 5. Religare Capital Markets Limited

ITM Institute of Financial Markets

10 | P a g e

Investment Banking Proposed Institutional Broking 6. Religare Arts Initiative Limited Business of Art Gallery launched - arts-i 7. Religare Realty Limited In house Real Estate Management Company 8. Religare Venture Capital Limited Private Equity and Investment Manager 9. Religare Hichens Harrison Corporate Broking Institutional Broking Derivatives Sales Corporate Finance 10. Religare Asset Management NAME: Religare is a Latin word that translates as 'to bind together'. This name has been chosen to reflect the integrated nature of the financial services the company offers Symbol: The Religare name is paired with the symbol of a four-leaf clover. Traditionally, it is considered good fortune to find a four-leaf clover as there is only one four-leaf clover for every 10,000 threeleaf clovers found.

ITM Institute of Financial Markets

11 | P a g e

For us, each leaf of the clover has a special meaning. It is a symbol of Hope. Trust, Care and Good Fortune. For the world, it is the symbol of Religare.

For us, each leaf of the clover has a special meaning. It is a symbol of Hope. Trust. Care. Good Fortune. For the world, it is the symbol of Religare. The first leaf of the clover represents Hope. The aspirations to succeed. The dream of becoming. Of new possibilities. It is the beginning of every step and the foundation on which a person reaches for the stars. The second leaf of the clover represents Trust. The ability to place ones own faith in another. To have a relationship as partners in a team. To accomplish a given goal with the balance that brings satisfaction to all, not in the binding, but in the bond that is built. The third leaf of the clover represents Care. The secret ingredient that is the cement in every relationship. The truth of feeling that underlines sincerity and the triumph of diligence in every aspect. From it springs true warmth of service and the ability to adapt to evolving environments with consideration to all. The fourth and final leaf of the clover represents Good Fortune. Signifying that rare ability to meld opportunity and planning with circumstance to generate those often looked for remunerative moments of success.

ITM Institute of Financial Markets

12 | P a g e

Hope. Trust. Care. Good Fortune. All elements perfectly combine in the emblematic and rare, four-leaf clover to visually symbolize the values that bind together and form the core of the Religare vision.

RELIGARE GROUP COMPANIES Religare Enterprises Limited group comprises of Religare Securities Limited, Religare Commodities Limited, Religare Finvest Limited and Religare Insurance Broking Limited which deal in equity, commodity and financial services business. 1. Religare Securities Limited RSL is one of the leading broking houses of India and are dealing into Equity Broking, Depository Services, Portfolio Management Services, Internet Trading, Institutional Equity Brokerage & Research, Investment Banking, Merchant Banking and Corporate Finance. To facilitate free and fare trading process Religare is a member of major financial institutions like, National Stock Exchange of India, Bombay Stock Exchange of India, Depository Participant with National Securities Depository Limited and Central Depository Services (I) Limited, and a SEBI approved Portfolio Manager. RSL serves a platform to all segments of investors to avail the opportunities offered by investing in Indian equities either on their own or through managed funds in Portfolio Management. 2. Religare Commodities Limited

ITM Institute of Financial Markets

13 | P a g e

Religare is a member of NCDEX and MCX and provides platform for trading in commodities, which is an online facility also. RCL provides platform to both agro and non-agro commodity traders to derive the actual price of the commodity and also to trade and hedge actively in the growing commodity trading market in India. With this realization, Religare Commodities is coming up with its branches at mandi locations. It is a flagship effort from our team which would be helpful in facilitating trade and speculating price of commodities in future.

3. Religare Finvest Religare Finvest Limited (RFL), a Non Banking Finance Company (NBFC) is aggressively making a name in the Indian corporate sector. Financial services arena in India. In a fast paced, constantly changing dynamic business environment, RFL has delivered the most competitive products and services. RFL is primarily engaged in the business of providing finance against securities in the secondary market. It also provides finance for application in Initial Public Offers to non-retail clients in the primary market. RFL is also planning to initiate personal loan portfolio as fund based activity and mutual fund distribution as fee based activities. Along with this, the company also undertakes non-fund based advisory operations in the field of Corporate Financing in the nature of Credit Syndication which includes inter alias, bills discounting, inter corporate deposit, working capital loan

ITM Institute of Financial Markets

14 | P a g e

syndication, placement of private equity and other structured products. 4. Religare Insurance Broking Ltd. Religare has been taking care of financial services for long but there was a missing link. Financial planning is incomplete without protective measure i.e. structured products to take care of event of things that may go wrong Religare Insurance Broking Limited. As composite insurance broker, deals in both insurance and reinsurance, providing our clients risk transfer solutions on life and non-life sides. This service will take benefit of Religares vast business empire spread throughout the country -- providing our valued clients insurance services across India. We aim to have a wide reach with our services literally! Thats why we are catering the insurance requirements of both retail and corporate segments with products of all the insurance companies on life and non-life Still, there is more in store. We also cater individuals with a complete suite of insurance solutions, both life and general to mitigate risks to life and assets through our existing network side. For corporate clients, we will be offering value based customized solutions to cover all risks, which their business is exposed to. Our clients will be supported by an operations team equipped with the best of technology support. Religare Insurance Broking aims to provide neutral, transparent and professional risk transfer advice to become the first choice of India. Why customer trade with Religare? 1. Personal Assistance Dedicated dealers for facilitating trading and post trade needs.

ITM Institute of Financial Markets

15 | P a g e

Dedicated Relationship Managers for assisting multiple investments needs. 2. Research & Advisory Regular news and updates on market Research service over SMS to keep one Daily and weekly technical reports A complete information report on results and performance individual companies. Complete reports on various economic sectors and their performance along with analysis of few major companies in that sector Trading calls in Futures & Options Daily capsule of Market indices and index movement, national and international corporate news, and their performance along with forth coming IPO tracker.

3. Add-Ons Access to all your accounts through your Customer Relationship Number (CRN) Access your ledger balances and account information over internet, branch and call center Interest on Cash Margin

ITM Institute of Financial Markets

16 | P a g e

Even while you are waiting to make your next trade or online investment, your unutilized cash does not lie idle with us. You earn interest on your unutilized cash margin. 360 degree Investment Portal Invest online in Equities, Commodities, Currency, IPO and Mutual Funds in a single platform and maintain all your financial records at one place. Now, you can also file your tax and book air tickets, make hotel reservations and buy attractive holiday packages, all online. So get empowered, enrich your experience of investing online and open yourself to a whole new world of possibilities for Religare Online will become Your World Online, beyond investments! Exposure up to 20 times* on your margin Allowing you the freedom to trade without hassles throughout the day without having to worry about your cash margin. You can get exposure (on cash segment) as high as 20 times for intraday trades.

FACTS & FINDING

PORTFOLIO:

A set or combination of securities held by an investor. A portfolio comprising of different types of securities and assets.

ITM Institute of Financial Markets

17 | P a g e

Portfolio may consist different sets of assets of financial nature such as gold, silver, real estate, insurance policies, post office certificates [for e.g. NSC, KVP etc] etc for making a provision for future. The basket of all these investments or assets held by an individual or a corporate body or any economic unit is called a portfolio.

PORTFOLIO MANAGEMENT:

Each of the investment avenues has their own risk and return. Investor plans his investment as per this Risk Return Profile or his preferences while managing his portfolio efficiently so as to secure the highest return for lowest possible risk. This is in short the portfolio management. Portfolio management is a process of encompassing many activities of investment in assets and securities, which includes planning, supervision, timing, rationalism etc in selection of securities to meet investors objectives. It is the process of selecting a list of securities that will provide the investor a maximum yield constant with risk he wishes to assume.

OBJECTIVE OF PORTFOLIO MANAGEMENT:

ITM Institute of Financial Markets

18 | P a g e

The base objective of portfolio management is to maximize yield and minimize risk. The others ancillary objectives are as per the needs of the investors, namely regular income or stable return, Appreciation of capital, marketability and liquidity, safety of investment and minimizing of tax viability. Risk: Risk in the securities markets is associated with a number of uncertainties of possible outcomes. The realized returns may vary from the expected returns in direction as also in degree. The degree variance may be anything from zero to Infinity. The word risk and uncertainty are not the same in the strict sense. Risk is wider term and decision maker may know the possible consequences of his decision. The possibilities of outcomes may b known in some cases. But the burden of such possibilities has to be borne by him. In the case of uncertainties, the outcomes are not known or the possibilities cannot be predicted. Risk can be there under both certainty and uncertainty of outcome. Return: Investors are interested in an income from their investment either in form of interest, dividend or capital appreciation. This is called the return. It is the key variable, influencing the investment decision and is motivating force for people to save and invest. Returns are used the performance of assets, in which the investments are made.

ITM Institute of Financial Markets

19 | P a g e

In this context, two terms used namely realized and expected return have to be distinguished. Realized return is actually earned income of past, while the investment decision are made on the basis of expected returns. Thus, expected return is more important than the realized return although the latter is dependent on the former. Expected return is the return on investment anticipated by the investor. It is that level or amount that includes the investor to invest. This level or rate may not be realized, which leads to Risk in Investments.

EVALUATION OF PORTFOLIO:

Investment analysts and Portfolio Managers continuously monitor and evaluate the results of their performance. The revision of portfolio investment is conducted on the basis of such monitoring and evaluation. The ability of Manager to outperform the market depends on their expertise and experience. The basic feature of the good Portfolio Manager are their ability to perceive the market trends correctly and make correct expectations and estimates regarding risk, return, ability to make proper diversifications, to reduce the company related risk and use proper Beta estimates for selection of securities to reduce the systematic risk. In such case, it is possible for an expert Portfolio Manager to show superior performance over the market. This performance also depends on the timing of investments and superior investment analysis and security selection. He has to have the acumen to

ITM Institute of Financial Markets

20 | P a g e

select the under valued shares under each risk class, for which a high degree of equity research is needed. The two major factors which influence his performance are the return achieved and the level of risk that the portfolio is exposed to. The Manager has to make proper diversification into different industries, asset classed and instruments so as to reduce the unsystematic risk to the minimum for a given level of return. Market returns being related positively to risk, evaluation has to take into account: 1. Rate of returns, or excess over risk free rate. 2. Level of Risk both Systematic (Beta) and Unsystematic and residual risks through proper diversification.

DIVERSIFICATION:

It is a technique of reducing the risk involved in investment and in portfolio. It is the process of conscious selection of assets instruments etc. in such a manner that the total risk (unsystematic risk) are brought down. There are many types of diversification like (i) types of asset [gold, real estate, corporate securities, government securities etc], (ii) financial instruments [bonds, stock, debentures etc](iii) Industries [chemical, cement, engineering, steel, fertilizers etc](iv)scrip of companies[new companies, growing companies , new product companies etc.]

INVESTMENT STRATEGY AT RELIGARE

ITM Institute of Financial Markets

21 | P a g e

The investment strategy at Religare is not to focus on the short term simulation competition gains but to utilize the long term potential growth of the portfolio. the portfolio selection criteria is based on the growth stocks that will outperform the market in a growing economic environment and speculative stocks that obtain great rewards. Their strategy of selecting stocks is consistent. In other words, we can define their investment style as aggressive by selecting most of the stocks from different sectors. Stock picking is done in such a way so that the risk can be diversified sector wise. To be more specific, the companies selected generally have a higher growth rate than the industry and a higher PE ratio.

ITM Institute of Financial Markets

22 | P a g e

FORMULAE USED IN THIS PROJECT:

Return on individual securities: Rx = todays closing price previous closing price * 100 Previous closing price Return on portfolio: Rp = Wx1*Rx1 + Wx2*Rx2 + + Wx n*Rx n Risk on individual securities: Variance (2) = risk. 2x = (x x`) n Risk on portfolio: Rp = Wx1* 2x1+ Wx2* 2x2 +.+ Wx * 2x n Where, Wx is weight of security x.(in %) Weightage of security x = Investment in security x (in rs) * 100

ITM Institute of Financial Markets

23 | P a g e

Total Investment Here, Investment in security x (in rs)= Purchase price of share * No of shares

PORTFOLIO 1:

Age group: 40-45 years. Objective: To get the maximum profit with minimum risk. This portfolio is highly diversified. Stock picking is done in such a way so that the risk can be diversified sector wise. To be more specific, the companies selected generally have a higher growth rate than the industry. The maximum investment is made in banking and finance sectoas its returns were found good enough

ITM Institute of Financial Markets

24 | P a g e

Diversification of stocks in various Sectors:

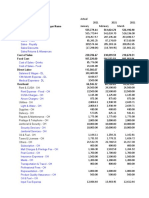

CALCULATION OF RETURN: Return on Individual Securities:

ITM Institute of Financial Markets

25 | P a g e

Return on Portfolio

ITM Institute of Financial Markets

26 | P a g e

Now, Return on Portfolio (Rp) =Wx1*Rx1+Wx2*Rx2 +Wx10*Rx10 Thus, Rp = 0.04591643

Where, Wx1 is the proportion invested in security 1 and so on. Rx1 is the Expected expected return (in %) from security and so on.

According to the return ,this portfolio is considered effective as it is given Expected return of 4.59 % whereas the market index has given a return of around 4%.so in this context return on portfolio is satisfactory enough as per the requirements of the investor.

CALCULATION OF RISK:

ITM Institute of Financial Markets

27 | P a g e

Risk on Individual Securities: Now, in order to find out Risk of each Security we need to calculate Standard Deviation or Variance of all the securities. Mean(x`) =x n = 52 11 = 5.2 where, n = 10

Variance (2) = (x x`)2 n

ITM Institute of Financial Markets

28 | P a g e

ITM Institute of Financial Markets

29 | P a g e

Total Risk on Portfolio (Vp) = Wx1*2 x1+Wx2*2 x2+Wx11*2x11 = 0.096391821

Where, Wx1 is the proportion invested in security 1 and so on. 2 x1 is the risk on security 1 and so on.

The risk level of this portfolio can be considered as appropriate because the market index has a beta of 1.

COMPARISION OF PORTFOLIO 1 WITH MARKET INDEX (NIFTY):

This portfolio can be said as an effective portfolio because this portfolio has given 4.59% of return whereas market index nifty has given a return of 4%.though the return of portfolio is so it is a good sign for the investor because excess loss are not to be borne. The overall risk of the portfolio in terms of its investment is also very less. And thus the objective of the investor is satisfied i.e. to get the maximum possible return with the minimum risk.

ITM Institute of Financial Markets

30 | P a g e

PORTFOLIO 2:

Age group: 35-40 years. Objective: To get the maximum profit with minimum risk. This portfolio is highly diversified. Stock picking is done in such a way so that the risk can be diversified sector wise. To be more specific, the companies selected generally have a higher growth rate than the industry. The maximum investment is made in banking and finance sector as its returns were found good enough.

ITM Institute of Financial Markets

31 | P a g e

ITM Institute of Financial Markets

32 | P a g e

CALCULATION OF RETURN: Return on Individual Securities:

ITM Institute of Financial Markets

33 | P a g e

Return on Portfolio:

ITM Institute of Financial Markets

34 | P a g e

Now,

Return

on

Portfolio

(Rp)

=Wx1*Rx1+Wx2*Rx2+Wx11*Rx9 Thus, Rp = 4.95%

Where, Wx1 is the proportion invested in security 1 and so on. Rx1 is the Expected expected return (in %) from security and so on.

According to the return, this portfolio is considered effective as it is given Expected return of 4.95% whereas the market index has given up to 4%.so in this context return on portfolio is good enough to fulfill the requirements of the investor. CALCULATION OF RISK: Risk on Individual Securities: Now, in order to find out Risk of each Security we need to calculate Standard Deviation or Variance of all the securities.

Mean(x`) =x n

where, n = 9

ITM Institute of Financial Markets

35 | P a g e

= 33 9 = 3.66 Variance (2) = (x x`)2 n

ITM Institute of Financial Markets

36 | P a g e

Risk on Portfolio:

ITM Institute of Financial Markets

37 | P a g e

Total Risk on Portfolio (Vp) = Wx1*2 x1+Wx2*2 x2+Wx11*2 x9 =0.22%

COMPARISION OF PORTFOLIO 2 WITH MARKET INDEX (NIFTY):

This portfolio can be said as an effective portfolio because this portfolio has given 4.95% of return whereas market index nifty has given 4% .Though the return of index is less but the return of portfolio is positive and high, so it is a good sign for the investor because excess return is expected. The overall risk of the portfolio in terms of its investment is normal. As there is famous saying NO RISK ,NO GAIN, the same concept works over here. But the investors objective was to get maximum return with

ITM Institute of Financial Markets

38 | P a g e

minimum risk and in this case the investor is getting high return but not with the minimum risk, the risk is comparatively very high. So it can be said that the objective of the investor is partially satisfied.

PORTFOLIO 3:

Age group: 30-35 years. Objective: To get the maximum possible return.

ITM Institute of Financial Markets

39 | P a g e This portfolio is not much diversified. The investment basically is made according to the requirements of the investor. The risk taking capability of the investor is very high and the returns wanted by him are also high so investment is made in only two sectors which have shown a good growth compared to other sectors.

Diversification of stocks in different sectors :

ITM Institute of Financial Markets

40 | P a g e

CALCULATION OF RETURN: Return on Individual Securities

ITM Institute of Financial Markets

41 | P a g e

Return on Portfolio:

Now, Return on Portfolio (Rp) =Wx1*Rx1+Wx2*Rx2+Wx6*Rx6

ITM Institute of Financial Markets

42 | P a g e

Thus, Rp Where,

= 9.4%

Wx1 is the proportion invested in security 1 and so on. Rx1 is the Expected expected return (in %) from security and so on.

CALCULATION OF RISK:

Risk on Individual Securities: Now, in order to find out Risk of each Security we need to calculate Standard Deviation or Variance of all the securities.

Mean(x`) =x n =38 6 = 6.33

where, n = 6

Variance (2) = (x x`)2 n

ITM Institute of Financial Markets

43 | P a g e

Risk on Portfolio:

ITM Institute of Financial Markets

44 | P a g e

Total Risk on Portfolio (Vp) = Wx1*2 x1+Wx2*2 x2+Wx6*2x6 = 0.6177394

Where, Wx1 is the proportion invested in security 1 and so on. 2 x1 is the risk on security 1 and so on.

ITM Institute of Financial Markets

45 | P a g e

COMPARISION OF PORTFOLIO 3 WITH MARKET INDEX (NIFTY):

This portfolio can be said as an effective portfolio because this portfolio has given 9.4% of return whereas market index nifty has given return up to 4%.though the return of index is less the portfolio has given a positive return so it is a good sign for the investor because excess return is got as required by the investor. The overall risk of the portfolio in terms of its investment is also very less. And thus the objective of the investor is satisfied i.e; to get the maximum possible return.

ITM Institute of Financial Markets

46 | P a g e

COMPARISON OF ALL THE EVALUATED PORTFOLIOS:

ITM Institute of Financial Markets

47 | P a g e

LIMITATIONS OF THE PROJECT:

Due to time constrain revision of portfolio is not done i.e; other securities are not analyzed.

The selected portfolios to be evaluated are provided by the company,so the data given can be bias.

The Expected return calculated is its expected value and not the actual return. (Return earned) because actual return can be calculated and known only after sale of security.

CONCLUSION & RECOMMENDATIONS:

RECOMMENDATIONS:

Company can evaluate their portfolios in this manner which will help the to know whether the portfolio is needed to be revised or not. Portfolio 2 should be revised as the objectives of the investor and the results got after evaluation doesnt matches. Portfolio should have been made by taking into consideration the risk taking capability of the investor which in this case is very low.

ITM Institute of Financial Markets

48 | P a g e

Optimum return on investment can be goy only after taking into consideration all these factors.

CONCLUSION:

Risk and return of each security and overall portfolio is found so as to evaluate them and know whether the objective of the investor is satisfied or not. Required recommendations are also made. There are many other ways also to find out risk and return and henceforth evaluate portfolio so that it can be known if there is need of its revision. and after evaluating three portfolios at IL&FS it can be seen that objective of two investors is completely satisfied whereas one investors complete objective is not satisfied and that portfolio needs to be revised.

ITM Institute of Financial Markets

49 | P a g e

BIBLIOGRAPHY

WEBSITES: www.ilfsindia.com www.investsmartindia.com www.indiabulls.com www.wikipedia.com www.bloomberg.com www.investopedia.com www.nseindia.com

BOOKS: Securities analysis and portfolio management. BY: V A Avadhani Himalaya Publishing House 8thdition(2006)

Investment management security analysis and portfolio management. BY:V K Bhalla 13th edition S Chand & Co. ltd

ITM Institute of Financial Markets

50 | P a g e

ITM Institute of Financial Markets

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Mystmt - 2022 11 09Dokument5 SeitenMystmt - 2022 11 09sylvia100% (2)

- Ford Fusion Engine 2 7l Ecoboost 238kw 324ps Repair ManualDokument22 SeitenFord Fusion Engine 2 7l Ecoboost 238kw 324ps Repair Manualkimberlyweaver020888cwq100% (58)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Crude Oil MethodologyDokument63 SeitenCrude Oil MethodologyKingsuk BurmanNoch keine Bewertungen

- 0106XXXXXX8428-01-04-21 - 31-03-2022Dokument27 Seiten0106XXXXXX8428-01-04-21 - 31-03-2022SabyasachiBanerjeeNoch keine Bewertungen

- Contemporary Case Studies On Fashion Production, Marketing and Operations PDFDokument245 SeitenContemporary Case Studies On Fashion Production, Marketing and Operations PDFKevin Sarmiento BarreraNoch keine Bewertungen

- Intro - S4HANA - Using - Global - Bike - Case - Study - PP - Fiori - en - v3.3 (Step 10)Dokument5 SeitenIntro - S4HANA - Using - Global - Bike - Case - Study - PP - Fiori - en - v3.3 (Step 10)Rodrigo Alonso Rios AlcantaraNoch keine Bewertungen

- LM Grade 9 HORTICULTURE PDFDokument113 SeitenLM Grade 9 HORTICULTURE PDFNenia J O. Sienes86% (21)

- Prosci-4-2 Methodology Process-V9 1 PDFDokument5 SeitenProsci-4-2 Methodology Process-V9 1 PDFMayowa OlatoyeNoch keine Bewertungen

- Indian OilDokument71 SeitenIndian OilArif Khan50% (2)

- Term:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaDokument50 SeitenTerm:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaMohit SainiNoch keine Bewertungen

- Overview of Employee Provident FundDokument8 SeitenOverview of Employee Provident FundReshma ManjunathNoch keine Bewertungen

- Financial Markets and Institutions: 13 EditionDokument35 SeitenFinancial Markets and Institutions: 13 EditionTherese Grace PostreroNoch keine Bewertungen

- Cash Flows and Accrual Accounting in Predicting Future Cash FlowsDokument210 SeitenCash Flows and Accrual Accounting in Predicting Future Cash FlowsNicolai AquinoNoch keine Bewertungen

- Articles of Organization: United StatesDokument2 SeitenArticles of Organization: United Stateshasan jamiNoch keine Bewertungen

- Unicredit International Bank (Luxembourg) S.ADokument126 SeitenUnicredit International Bank (Luxembourg) S.AViorel GhineaNoch keine Bewertungen

- Audit Planning NotesDokument30 SeitenAudit Planning NotesTinoManhangaNoch keine Bewertungen

- West Chemical Company Produces Three Products The Operating ResDokument1 SeiteWest Chemical Company Produces Three Products The Operating ResAmit PandeyNoch keine Bewertungen

- 2-Developing An Information SystemDokument7 Seiten2-Developing An Information SystemWorld of LoveNoch keine Bewertungen

- Banking Financial Institutions.Dokument18 SeitenBanking Financial Institutions.Jhonrey BragaisNoch keine Bewertungen

- The Bernie Madoff ScandalDokument42 SeitenThe Bernie Madoff ScandalShrutiNoch keine Bewertungen

- Pension Mathematics With Numerical Illustrations: Second EditionDokument13 SeitenPension Mathematics With Numerical Illustrations: Second EditionG.k. FlorentNoch keine Bewertungen

- ACCOUNTS (858) : Class XiDokument4 SeitenACCOUNTS (858) : Class XiYour Laptop GuideNoch keine Bewertungen

- CASE STUDY Contract Act AggrementDokument4 SeitenCASE STUDY Contract Act Aggrementpagal78Noch keine Bewertungen

- Awais Ahmed Awan BBA 6B 1711267 HRM Project On NestleDokument11 SeitenAwais Ahmed Awan BBA 6B 1711267 HRM Project On NestleQadirNoch keine Bewertungen

- RHED Financing Application Form 1Dokument2 SeitenRHED Financing Application Form 1Kenneth InuiNoch keine Bewertungen

- FranchiseDokument4 SeitenFranchiseJane DizonNoch keine Bewertungen

- Tender For DroneDokument34 SeitenTender For DroneSam SevenNoch keine Bewertungen

- ProjectreportonexploringexpresscargoDokument43 SeitenProjectreportonexploringexpresscargosanzitNoch keine Bewertungen

- Unit 7 - Outsourcing - R&WDokument5 SeitenUnit 7 - Outsourcing - R&WVăn ThànhNoch keine Bewertungen

- Case Study Project Income Statement BudgetingDokument186 SeitenCase Study Project Income Statement BudgetingKate ChuaNoch keine Bewertungen