Beruflich Dokumente

Kultur Dokumente

Forward Market: Greg Mackinnon Finance 676 Sobey School of Business Saint Mary'S University

Hochgeladen von

Mamoon RashidOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Forward Market: Greg Mackinnon Finance 676 Sobey School of Business Saint Mary'S University

Hochgeladen von

Mamoon RashidCopyright:

Verfügbare Formate

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

Forward Market Definition: A forward contract is simply an agreement between two parties to exchange two different currencies at some fixed date in the future. The exchange rate between the two currencies is fixed at the time the contact is signed. Example: A bank and its client sign a forward contract. the client will give the bank 1,600,000 DM in 90 days and get $1,000,000 U.S. in return. No matter what the spot exchange rate is in 90 days, the contract is the same. The forward rate here is 1.6 DM/$US. Forwards are generally used to hedge exchange rate risk. To hedge is to eliminate (or greatly reduce) risk. Example: (all figures as of Feb. 7, 1997) A Canadian firm is going to receive a $1,000,000 US payment in 30 days. Currently, e0 = 1.3492 $Can/$US Thus, the payment is worth $1,349,200 Can. If, however, the $US depreciates before the payment is made, its value in $Can terms will decrease. Say that: e1 = 1.3300 then the payment is worth only $1,330,000 Can. The firm has lost because of its exposure to exchange rate risk. The value of the foreign currency payment decreased before it could be collected. In this example, the firm has a long position in $US (it will receive them), therefore to hedge its risk it can take a short position in $US with a forward contract that offsets it. Sign forward contract with bank. The 30 day forward rate is 1.3468 $Can/$US. Therefore, the firm promises to deliver $1,000,000 US in 30 days (when it gets its payment) in exchange for $1,346,800 Can. Because the rate at which the firm will exchange its $US is now fixed, there is no exchange rate risk Note: By fixing the exchange rate, the firm is also giving up any potential gains that would occur if the $US appreciated before the payment was made. Note: Forwards are contracts negotiated with the bank. They can therefore be tailored to the customers needs. That is, the amount of currency to be exchanged can be exactly the amount the client wants to hedge, and the maturity date of the forward can be set to exactly the time the client wants it. Thus, forwards can provide a perfect hedge. They can eliminate all exchange rate risk.

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

Note: Historically, forward contracts were reserved for a banks largest customers. Hence, small and medium sized businesses had no opportunity to use forward contracts to hedge. In the last few years, because of competition in the banking sector, forwards have moved down-market. Common forwards, such as $US for $Can contracts, are now available to many smaller businesses in Canada (for example, revenues of around $10,000,000 per year or more). However, other less common contracts (such as very long maturity, an unusual (not commonly traded)maturity, or for a less common currency) are still generally only available to the largest and best customers of a bank and are negotiated directly between the client and the bank. Forward Rate Quotations Like spot foreign exchange, there exists a large inter-bank market for forward contracts. It is here that banks will offset the contracts that they sign with customers. For instance, if a client of a bank wants to be long forward Swiss francs, the bank will take a forward short position in the contract. This exposes the bank to risk (i.e. the client firm has hedged itself by essentially transferring the exchange rate risk to the bank) because if the Swiss franc appreciates the bank will lose money on its position. In order to offset this, immediately after signing the contract the bank will go to the inter-bank forward market and enter a contract on the long side. Together, the two contracts mean that the bank is no longer exposed to any exchange rate risk. If banks generally offset all forward contracts that they sign, how do they profit? Again, the market for forward foreign exchange works in much the same way as for spot; the forward market works on a bid-ask basis, with banks collecting the spread each time they can sell a currency long and the sell it short to offset. Another thing to note about quotes of forward rates is that in the interbank market they are usually given in terms of forward points (also known as the swap points). A point is simply the last decimal in an exchange rate quote. For instance, most currencies are quoted to four decimal places, for those currencies a point is 0.0001. If a currency is quoted to only two decimal places (like the yen or lira) then a point is 0.01 for those currencies. The number of decimals to which a particular currency is quoted is simply a matter of convention. A forward quote in terms of forward points is not an actual exchange rate, but rather the difference between the forward rate and the spot rate. If the spot Canadian dollar rate is 1.3492 and the 30 day forward rate is 1.3468, then a forward forex trader would quote the forward price as 0.0024 forward points (=1.3492 - 1.3468 ). Please note that for simplicity, we are ignoring the fact that both bid and ask prices would be quoted. Note: Forward rate generally expressed as (units of currency)/$US if forward rate < spot rate - currency is at a forward premium if forward rate > spot rate

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

-currency is at a forward discount A forward premium would be reflected in positive forward points and a forward discount would be reflected in negative forward points. Forward rates may also be quoted in terms of a percentage discount or premium. If f1 is the forward rate in terms of foreign currency/$US, then the percentage forward premium/discount for the foreign currency is:

1 1 f1 e 0 1 e0 = e 0 f1 f1

This will usually be annualized based on an assumption that a year has 360 days (a 360 day year is a convention borrowed from the US bond markets). Thus,

e 0 f1 360 100 f1 n

annual percentage forward discount/premium =

where n is the number to maturity of the forward contract. Interest Rate Parity Interest rate parity is a condition that relates forward exchange rates and current interest rates. It also provides a way to calculate what the prevailing forward exchange rate should be. The interest rate parity condition must hold in the real world. If it did not, there would be a way for an investor to make a profit with no investment of their own money and no risk. Consider the following, fictitious scenario: Canadian interest rates = ican = 0.10 U.S. interest rates = ius = 0.08 spot rate = e0 = 1.3 $Can/$US forward rate = f1 = 1.35 $Can/$US

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

where f1 is the forward rate today at which you can contract to exchange $Can for $US in one year. You could undertake the following investment strategy: - borrow $1 Can. - use that to buy 1/1.3 = 0.77 $US - invest the $0.77 US in the United States at the U.S. interest rate - sign a forward contract to sell $US in one year at 1.35 $Can/$US Result: - After one year you have (0.77)(1.08) = $0.8316 US - you sell the $US through the forward contract and get: ($0.8316 US)(1.35 $Can/$US) = $1.12 Can - you owe ($1 Can)(1.10) = $1.10 Can on the loan you took out. - Pay back the loan and you are left with $0.02 Can in profits Note that the profits you earned above did not require any investment of your own money (you borrowed the money needed) and there was no risk involved (as all of the rates were locked in at the beginning). Any situation where you could earn riskless returns with no investment is referred to as an arbitrage opportunity. In particular, this type is referred to as covered interest arbitrage. Opportunities like this should not exist. If the numbers above were observed in the real world, investors would immediately jump to take advantage of the opportunity. They would want to buy $US spot and sell $US forward. Millions of dollars being moved into this investment would drive up the spot value of $US and drive down the forward value of $US. Thus, prices would change until the arbitrage opportunity disappeared. Example: If you invest 1 unit of domestic currency at home you will get: (1+id) units of currency in one year. This must be equal to what you would get if you invested the same unit of currency in a foreign country. - the domestic currency gives:

1 e0

units of foreign currency (where e is expressed as units of domestic/unit of foreign) - this grows to:

1 (1 + i f ) e0

after one year. - convert this back into:

1 (1 + i f ) f1 e0

units of domestic currency through a forward contract. To prevent arbitrage, it must be that:

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

1 + id =

1 (1 + i f ) f1 e0

Rearrange to get:

(1 + i d ) f1 = (1 + i f ) e 0 This relationship is Interest Rate Parity.

Interest Rate Parity basically says that countries with high interest rates should see their currencies selling at a forward discount (and vice versa) Example: If id > if , then it must be that f1>e0 -a forward discount for the domestic currency Interest rate parity, for the most part, actually does hold in the real world. Transaction costs may cause the equation to not hold exactly, but the two sides will be within a narrow range of each other. Countries who use capital controls (limits on how easily foreign capital can enter and leave the country) will find that interest rate parity will not hold very closely for them. Banks actually use this parity condition to determine the forward rates they quote for major currencies, i.e. 1 + id f1 = e 0 1 + i f The interest rates that would be plugged into the formula would be the Eurocurrency rates for those currencies (we will discuss Eurocurrency later). Profits and Losses on Forwards Firms typically use forwards to hedge risk and offset an exposure to a currency that has arisen from their business. Thus, hedging firms typically do not worry about profit or loss on a forward contract. Similarly, banks, with which hedging firms are entering forward contracts, often do not worry about profit or loss on forwards as they enter offsetting contracts. For example, say a customer (of a Canadian bank) enters a forward contract to give $US to the bank and receive $Can from the bank in 3 months. The Canadian bank is exposed to exchange rate risk as they will receive the $US in 3 months and the exchange rate at that time is unknown. The bank will most likely offset this exposure by entering an offsetting contract. The bank may have another customer, somewhere else in the world, which has the opposite hedging needs as the first customer. In other words, this customer enters a forward contract with the bank in which the customer will take $US from the bank and give $Can in 3 months. The two forward contracts offset each other from the banks point of view. In 3 months, the bank simply collects $US from one forward and then gives them away to fulfill the other contract. Because the two contracts offset (cancel each other out), the bank is not exposed to exchange rate risk. How does the bank make money on this? We have been ignoring an

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

important fact, which is that the forward market works on a bid-ask basis just as the spot market does. Thus, the bank will actually sign the two forwards at slightly different rates that lock in a small profit without any risk. In fact, the bank is essentially acting as a middleman between the two customers (who have opposite hedging needs but do not know each other) and taking a fee (in the form of the bid-ask spread) for doing so. If the bank does not have another customer whose contract cancels out the first, the bank can simply go to the interbank market for forwards and enter an offsetting contract with another bank1. Occasionally, banks will not offset their forward contracts. This may be because they simply have not had time to offset yet, or, more likely, because their currency dealers are acting as speculators in the market and are attempting to earn extra profits through proprietary trading of forwards. As with many things, forwards are designed to hedge and reduce risk, but they can be used to speculate. Example: You go long one year forward against the $US at a rate f1 (in /$US) If the forward rate for delivery at that time increases (the depreciates in the forward market) you lose. If the forward rate decreases, you win. Remember that: 1 + i yen f1 = e 0 1 + i $ US so that changes in the forward rate, and therefore your profit/loss, depends on how the moves spot (e0) and also on how the interest rate differential between Japan and the US changes. Note that the term interest rate differential refers in the forward market refers to the ratio of the (1+i) terms, not to the difference between interest rates. However, the two numbers are normally approximately equal. Example: Say that the one year eurocurrency rates on Swiss francs and $US are: iSF = 5% i$US = 3% Assume that the spot rate is e0=4 SF/$US Consider a one year forward:

1.05 f1 = 4 1.03 SF = 4.078 $US

A speculator goes short SF 1,000,000 one year forward at 4.078. Say that the spot rate suddenly changes to 4.1 SF/$US. Now:

In actuality, the bank will not offset each contract individually, but rather will net all of its contracts (across the entire organization) out against each other and if there is ant balance left then it will go to the interbank market to offset.

1

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

1.05 f 1 = 4.1 1.03 SF = 4.180 $ US

If the speculator now goes long SF 1,000,000 one year forward at 4.180 then they have two offsetting contracts which will cancel each other out in one year. In one year they will get SF 1,000,000 from second contract give SF 1,000,000 on the first contract. Thus, in one year they will buy SF at 4.180 and sell at 4.078. Profit in one year =

1 1 ( SF1,000 ,000 ) = $5983 .79 US 4.078 4.180

However, those profits are earned in one year. The value of those profits today is calculated by taking the present value at the $US interest rate. The $US interest rate is used because the profit is in $US dollar terms. Value of profit today =

5983 .79 = $5809 .51 US 1.03

In other words, if you short SF1,000,000 at 4.078 and the forward price moves to 4.180, then you just made $5809.51 US. Note that it isnt necessary for you to actually have offset the contract (by entering the second forward) to say that you made this profit, because you know that you could do so and lock in that profit if you wanted to. Money Market Hedge From interest rate parity, it can be seen that the forward rate is related to the current spot rate and interest rates in the two currencies. Conceptually, one can think that it is possible to replicate a forward through the use of a spot transaction, and borrowing/depositing in the two currencies. In fact, this is true and the money markets (the markets for shorter term deposits and loans) can be used to create a synthetic forward. This means that a system can be set up that gives exactly the same effect as a forward, without the firm having to enter an actual forward contract. A firm which hedges exchange rate risk through the construction of a synthetic forward is using what is called a money market hedge. A money market hedge may be very useful to a firm wishing to hedge for a number of reasons. First if a bank is unwilling to enter the needed type of forward contract with the firm, it may still be possible to construct a money market hedge. Second, it is sometimes cheaper for the firm to use a money market hedge than it is to use an actual forward. Hence, a money market hedge may be a money saving devise for a hedging firm. The essence of a money market hedge is that to get rid of exchange rate risk the firm simply does all necessary currency conversions now, at the spot rate, rather than waiting until the future. That way the exchange rate that will be used is known. Currency that is not needed until the future can then be deposited to earn some interest until needed. If there is a need to obtain currency then it can be borrowed.

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

Example: 180 day eurocurrency rates are 7% in $US and 6% in $Can. Note: eurocurrency rates are quoted as annualized based on a 360 day year. Therefore, over 180 days, the rates are: $US 0.07

180 = 0.035 360 180 = 0.03 $Can 0.06 360

Assume that e0 = 1.3 $Can/$US. This means that the 180 day forward rate is:

1.03 f 180 days = 1.3 1.035 $Can = 1.2937 $ US

A Canadian firm is due to receive a $1,000,000 US payment from a customer in 180 days and wants to hedge its value. The firm could enter a forward contract to short $US at 1.2937. Or, the firm could use a money market hedge: Borrow $US now to repay in 180 days at US rates Convert to $Can at spot rate and deposit for 180 days at Canadian rates In 180 days the firm can use the $US payment from its customer to pay off the loan. At the same time its $Can deposit matures and the firm receives a fixed amount of $Can. Effectively, the firm receives a fixed amount of $Can for its $US. Thus, the effect is the same as that of a forward contract. By interest rate parity, a money market hedge and a hedge using an actual forward should be exactly the same if the borrowing and investing rates relevant to the firm are the same as the eurocurrency rates used by the banks to calculate forward rates. Since the eurocurrency market (see next set of notes) is in large part an interbank market, these rates are often not the same as the deposit/borrow rates available to a firm. Say the firm above can borrow $US at 8% and deposit $Can at 7.7%. Now the process of a money market hedge is: Borrow $US: want to pay off loan with the $1,000,000 US payment from customer, so borrow:

1000000 = $961 ,538 .46 US 180 1 + 0.08 360

Convert this into $Can to get $961,538.46 US(1.3 $Can/$US) = $1,250,000 Can. Deposit the $Can so that in 180 days you have:

Greg MacKinnon Finance 676 Sobey School of Business Saint Marys University

Using an actual forward to hedge would have locked in a payment of $1,000,000 US(1.2937 $Can/$US) = $1,293,700 Can, which is less than the guaranteed payment using a money market hedge. In this case, using the money market hedge would save you 1298125 1293700 = $4425 compared to hedging with a forward contract. One thing to note in the above example is that the 7.7% rate given as the deposit rate for $Can can be interpreted in a different way. Suppose that the firm regularly borrows money (perhaps by drawing on a line of credit) and that it normally pays 7.7% on borrowing. The money market hedge could be implemented by borrowing $US at 8% instead of the firms regular borrowing at 7.7%. Hence, 8% is the rate on the $US loan and 7.7% is the rate saved by not borrowing $Can (rather than the amount earned on deposit). This may be a more realistic interpretation in some cases.

180 1250000 1 + 0.077 = $1,298 ,125 Can 360

Das könnte Ihnen auch gefallen

- Chno7 International Arbitrage and Interest Rate ParityDokument19 SeitenChno7 International Arbitrage and Interest Rate ParitySaqib NiaziNoch keine Bewertungen

- Dozier Hedging AlternativesDokument2 SeitenDozier Hedging Alternativesacastillo1339Noch keine Bewertungen

- FINS 3616 Tutorial Questions-Week 4Dokument6 SeitenFINS 3616 Tutorial Questions-Week 4Alex WuNoch keine Bewertungen

- Economic ExposureDokument7 SeitenEconomic ExposureChi NguyenNoch keine Bewertungen

- Interest Rate Parity (IRP)Dokument13 SeitenInterest Rate Parity (IRP)Hiron Rafi100% (1)

- Forwards and FuturesDokument15 SeitenForwards and FuturesArpita ChristianNoch keine Bewertungen

- CHAPTER FOUR Golis University Foreign CurrencyDokument31 SeitenCHAPTER FOUR Golis University Foreign CurrencyCabdixakiim-Tiyari Cabdillaahi AadenNoch keine Bewertungen

- Chapter 6Dokument6 SeitenChapter 6TRINHNoch keine Bewertungen

- Task 3 Essential ReadingDokument5 SeitenTask 3 Essential Readingعهد الغلاNoch keine Bewertungen

- Session 2 - The Foreign Exchange MarketDokument12 SeitenSession 2 - The Foreign Exchange MarketVipin Kumar CNoch keine Bewertungen

- Done Motives For Using International Financial MarketsDokument6 SeitenDone Motives For Using International Financial Marketskingsley Bill Owusu NinepenceNoch keine Bewertungen

- 3-Forward ExchangeDokument6 Seiten3-Forward Exchangeyaseenjaved466Noch keine Bewertungen

- MD 5Dokument18 SeitenMD 5adityaraaviNoch keine Bewertungen

- Walt DisneyDokument6 SeitenWalt DisneyFlavia Angelina WitarsahNoch keine Bewertungen

- Covered Interest Rate ParityDokument4 SeitenCovered Interest Rate Parityrani0326Noch keine Bewertungen

- Currency SwapDokument5 SeitenCurrency SwapSachin RanadeNoch keine Bewertungen

- Module 5-Currency Derivatives-StudentDokument55 SeitenModule 5-Currency Derivatives-StudentAngela DucusinNoch keine Bewertungen

- Sept 2018Dokument7 SeitenSept 2018Elsa Tan XQNoch keine Bewertungen

- Interest Rate ParityDokument3 SeitenInterest Rate ParityPratik PatraNoch keine Bewertungen

- Hedge & SpeculDokument15 SeitenHedge & SpeculSambhav DassaniNoch keine Bewertungen

- Techniques of Asset/liability Management: Futures, Options, and SwapsDokument19 SeitenTechniques of Asset/liability Management: Futures, Options, and SwapsNishant Verma100% (1)

- Foreign ExchangeDokument6 SeitenForeign ExchangeAnthony MongeNoch keine Bewertungen

- Questions - Answers - Financial EngineeringDokument7 SeitenQuestions - Answers - Financial EngineeringSidharth ChoudharyNoch keine Bewertungen

- Currency Speculation: Carry TradeDokument5 SeitenCurrency Speculation: Carry Tradeafnan huqNoch keine Bewertungen

- Solution Problems 11 23Dokument8 SeitenSolution Problems 11 23jason.sevin02Noch keine Bewertungen

- Chapter Review International Arbitrage and Interest Rate Parity International ArbitrageDokument9 SeitenChapter Review International Arbitrage and Interest Rate Parity International ArbitrageWi SilalahiNoch keine Bewertungen

- Chapter 08 (International Short-Term Financing) NewDokument3 SeitenChapter 08 (International Short-Term Financing) NewKobir HossainNoch keine Bewertungen

- Practice Exercises AnswersDokument5 SeitenPractice Exercises AnswersShar100% (1)

- Dozier Hedging AlternativesDokument3 SeitenDozier Hedging AlternativesCcv PauliNoch keine Bewertungen

- Derivatives: Futures, Options and Swaps: Transfer Risk From One Person or Firm To AnotherDokument13 SeitenDerivatives: Futures, Options and Swaps: Transfer Risk From One Person or Firm To AnothershubhamNoch keine Bewertungen

- Techniques of Asset/liability Management: Futures, Options, and SwapsDokument43 SeitenTechniques of Asset/liability Management: Futures, Options, and SwapsSushmita BarlaNoch keine Bewertungen

- Valuing Bonds: Answers To Concept Review QuestionsDokument4 SeitenValuing Bonds: Answers To Concept Review QuestionsHuu DuyNoch keine Bewertungen

- Chap 6 ProblemsDokument5 SeitenChap 6 ProblemsCecilia Ooi Shu QingNoch keine Bewertungen

- Interest Rate ParityDokument14 SeitenInterest Rate ParityParul AsthanaNoch keine Bewertungen

- Derivative Counterparties Exchange Financial Instrument Bonds Coupon Cash Flows Accrued Floating Interest Rate Foreign Exchange RateDokument4 SeitenDerivative Counterparties Exchange Financial Instrument Bonds Coupon Cash Flows Accrued Floating Interest Rate Foreign Exchange RateIbtehaj MuasserNoch keine Bewertungen

- SeatworkDokument3 SeitenSeatworkMs VampireNoch keine Bewertungen

- Investing for Interest 18: The Magic of Money Market Funds: Financial Freedom, #223Von EverandInvesting for Interest 18: The Magic of Money Market Funds: Financial Freedom, #223Noch keine Bewertungen

- Foreign Currency RiskDokument13 SeitenForeign Currency Riskkenedy simwingaNoch keine Bewertungen

- Uses of Financial Derivatives in Financial Markets With The Better Man of Financial Institutions and Other'sDokument13 SeitenUses of Financial Derivatives in Financial Markets With The Better Man of Financial Institutions and Other'sjalam160Noch keine Bewertungen

- International Finance - Update - STDokument9 SeitenInternational Finance - Update - STWorlex zakiNoch keine Bewertungen

- 5 FuturesDokument33 Seiten5 FuturesEbru ReisNoch keine Bewertungen

- CH - 10 (The Foreign Exchange Market)Dokument34 SeitenCH - 10 (The Foreign Exchange Market)AhanafNoch keine Bewertungen

- 123879525Dokument47 Seiten123879525omprakashNoch keine Bewertungen

- Chapter 2 MNCsDokument37 SeitenChapter 2 MNCsPhúc LêNoch keine Bewertungen

- Deal Contingent Transactions: Presented by Robert M. Lichten, JRDokument18 SeitenDeal Contingent Transactions: Presented by Robert M. Lichten, JRPrashantK100% (1)

- FINS3616 - TutorialWeek2 - SolutionsDokument6 SeitenFINS3616 - TutorialWeek2 - SolutionsNicole Wong100% (1)

- Chapter 6 - Hedging Foreign Exchange RiskDokument66 SeitenChapter 6 - Hedging Foreign Exchange RiskHay JirenyaaNoch keine Bewertungen

- 53338bos42717 cp12Dokument71 Seiten53338bos42717 cp12VarunNoch keine Bewertungen

- Understanding Exchange RatesDokument14 SeitenUnderstanding Exchange RatesJumoke FadareNoch keine Bewertungen

- Pricing of Future Contract and Currency FuturesDokument8 SeitenPricing of Future Contract and Currency FuturesVarun VermaNoch keine Bewertungen

- Mba 2 Semester (Finance Major) Chapter 5: Forward Exchange (Levi)Dokument11 SeitenMba 2 Semester (Finance Major) Chapter 5: Forward Exchange (Levi)SoloymanNoch keine Bewertungen

- Exercises For Revision With SolutionDokument4 SeitenExercises For Revision With SolutionThùy LinhhNoch keine Bewertungen

- Currency Derivative1Dokument47 SeitenCurrency Derivative1IubianNoch keine Bewertungen

- Problem Set 1Dokument5 SeitenProblem Set 1Kibet GibsonNoch keine Bewertungen

- L2 Money Market (v2)Dokument27 SeitenL2 Money Market (v2)Kruti BhattNoch keine Bewertungen

- M. SC and M. Phil Diaries: 1. Financial EconomicsDokument14 SeitenM. SC and M. Phil Diaries: 1. Financial EconomicsSumra KhanNoch keine Bewertungen

- Chapter 7 - CompleteDokument20 SeitenChapter 7 - Completemohsin razaNoch keine Bewertungen

- Arbitrade (I.F.M.) FinalDokument3 SeitenArbitrade (I.F.M.) Final0012 Shah Md. Arafat [C]Noch keine Bewertungen

- Mortgage-Backed Securities vs. Treasury Bonds: An Introduction to Mortgage REITs: Financial Freedom, #78Von EverandMortgage-Backed Securities vs. Treasury Bonds: An Introduction to Mortgage REITs: Financial Freedom, #78Noch keine Bewertungen

- Dividend Investing During Turbulent Times: Financial Freedom, #130Von EverandDividend Investing During Turbulent Times: Financial Freedom, #130Noch keine Bewertungen

- Leadership & Innovation BrochureDokument10 SeitenLeadership & Innovation BrochureFiona LiemNoch keine Bewertungen

- CH 07Dokument41 SeitenCH 07Mrk KhanNoch keine Bewertungen

- Talk About ImbalancesDokument1 SeiteTalk About ImbalancesforbesadminNoch keine Bewertungen

- Virata V Wee To DigestDokument29 SeitenVirata V Wee To Digestanime loveNoch keine Bewertungen

- Lecture 4-Concrete WorksDokument24 SeitenLecture 4-Concrete WorksSyakir SulaimanNoch keine Bewertungen

- Flowchart of Raw Materials Purchasing FunctionDokument1 SeiteFlowchart of Raw Materials Purchasing Function05. Ariya ParendraNoch keine Bewertungen

- BSC Charting Proposal For Banglar JoyjatraDokument12 SeitenBSC Charting Proposal For Banglar Joyjatrarabi4457Noch keine Bewertungen

- SCADokument14 SeitenSCANITIN rajputNoch keine Bewertungen

- 5 Things You Can't Do in Hyperion Planning: (And How To Do Them - . .)Dokument23 Seiten5 Things You Can't Do in Hyperion Planning: (And How To Do Them - . .)sen2natNoch keine Bewertungen

- GADokument72 SeitenGABang OchimNoch keine Bewertungen

- Commonwealth Bank 2012 Annual ReportDokument346 SeitenCommonwealth Bank 2012 Annual ReportfebriaaaaNoch keine Bewertungen

- Finacle - CommandsDokument5 SeitenFinacle - CommandsvpsrnthNoch keine Bewertungen

- Dispute Form - Bilingual 2019Dokument2 SeitenDispute Form - Bilingual 2019Kxng MindCtrl OrevaNoch keine Bewertungen

- Chandelier Exit 26 Jun 2016Dokument4 SeitenChandelier Exit 26 Jun 2016Rajan ChaudhariNoch keine Bewertungen

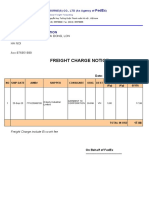

- Freight Charge Notice: To: Garment 10 CorporationDokument4 SeitenFreight Charge Notice: To: Garment 10 CorporationThuy HoangNoch keine Bewertungen

- Company Profile of Ncell Pvt. Ltd.Dokument22 SeitenCompany Profile of Ncell Pvt. Ltd.Ayush Man Tamrakar100% (1)

- GCC Placement List in MumbaiDokument14 SeitenGCC Placement List in MumbaifaradayzzzNoch keine Bewertungen

- Chapter 2 Management Accounting Hansen Mowen PDFDokument28 SeitenChapter 2 Management Accounting Hansen Mowen PDFidka100% (1)

- Customer Loyalty AttributesDokument25 SeitenCustomer Loyalty Attributesmr_gelda6183Noch keine Bewertungen

- Q4M1Dokument54 SeitenQ4M1Klyn AgananNoch keine Bewertungen

- MKT 460 CH 1 Seh Defining Marketing For The 21st CenturyDokument56 SeitenMKT 460 CH 1 Seh Defining Marketing For The 21st CenturyRifat ChowdhuryNoch keine Bewertungen

- Service Inventory & Service Supply RelationshipsDokument46 SeitenService Inventory & Service Supply RelationshipsSuraj JayNoch keine Bewertungen

- JollibeeDokument3 SeitenJollibeeArgel Linard Francisco Mabaga100% (1)

- Design Failure Mode and Effects Analysis: Design Information DFMEA InformationDokument11 SeitenDesign Failure Mode and Effects Analysis: Design Information DFMEA InformationMani Rathinam Rajamani0% (1)

- International Trade TheoriesDokument41 SeitenInternational Trade TheoriesShruti VadherNoch keine Bewertungen

- Generation Zombie Essays On The Living Dead in Modern Culture Zombies As Internal Fear or ThreatDokument9 SeitenGeneration Zombie Essays On The Living Dead in Modern Culture Zombies As Internal Fear or Threatamari_chanderiNoch keine Bewertungen

- Sales Flow Chart 2019Dokument2 SeitenSales Flow Chart 2019grace hutallaNoch keine Bewertungen

- Greening The Supply ChainDokument6 SeitenGreening The Supply ChainRajiv KhokherNoch keine Bewertungen

- Project On Max Life InsuranseDokument48 SeitenProject On Max Life InsuranseSumit PatelNoch keine Bewertungen

- Leave To Defend SinghalDokument6 SeitenLeave To Defend SinghalLavkesh Bhambhani50% (4)