Beruflich Dokumente

Kultur Dokumente

The Financial Crisis of 2008 ADZU by Adrian Wee

Hochgeladen von

jake_weeOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Financial Crisis of 2008 ADZU by Adrian Wee

Hochgeladen von

jake_weeCopyright:

Verfügbare Formate

The Financial Crisis of 2008 Sept. 7 U.S. government seized control of Fannie Mae and Freddie Mae Sept.

14 Lehman Brothers filed for bankruptcy (assets of $639 billion)

Merill Lynch was taken over by the Bank of America for $50 billion U.S. government seized control of American International Group, Inc. (AIG) biggest insurer providing $85 billion emergency loan and owns 79.9% equity in the firm Sept. 28 Washington Mutual became the largest bank failure in U.S. history with assets valued at $328 billion Oct. 5 Spanish government established a $40 to $68 billion emergency fund to purchase assets held by Spanish banks Oct. 12 U.S. announced that it would commit $250 billion of the $700 billion rescue package to recapitalize the banking sector ($125 billion will be injected into some of the country s largest commercial banks.) South Korea announced $100 billion in credit guarantees for its banking sector What is Finance? Finance is the study of how individuals, institutions, government and businesses acquire, spend and manage money and other financial assets. All of us are involved in making important economic and financial decisions. Wise economic and financial decisions benefit the individual and the enterprise. What is the Financial Environment Financial System Institutions Markets Individuals that make the economy operate efficiently

Financial Institutions These are organizations or intermediaries like Banks Insurance companies Investment companies they engage in financial activities to aid the flow of funds from savers to borrowers or investors Financial Markets These are physical or electronic forums that facilitate the flow of funds among investors, businesses, and governments. Investments These also include the sale of marketing securities, the analysis of securities and the management of investment risk. Investors include savers and lenders as well as equity investors. Investors can be corporate of personal.

Financial Management This involves financial planning, asset management and fund-raising decisions to enhance the value of businesses. This involves decision-making relating to the efficient use of financial resources in the production and sale of goods and services. What is the goal of the financial manager in a business organization? To maximize owner s wealth

Three Areas of Finance Institutions and Markets . Financial Management. Investments . These areas don t operate alone. They operate and interact with each other. 1. Why Study Finance? understanding of financial management. Through an understanding of financial management, it is possible for aTo make informed economic and financial decisions. Every individual should attain basic understanding of economics and finance as it applies to the financial system. In so doing, an individual can become economically and financially literate. 2. To acquire a basic knowledge of investments for business and personal reasons. An understanding of investments will enable a person to better manage financial resources for his company and for himself. 3. To acquire basic n individual to seek a career in finance or related areas.

The evolution of the financial systems in the Philippines can be viewed along the major political milestone of the country; 1. The Spanish Period 2. The American Period 3. The Japanese Occupation 4. The Post War Independence Period 5. The New Society Period In 1851, what represented the first established organized institutions in the Philippines? Obras Pias The first bank in the Philippine economy and the Far East? Banco Espaol-Filipino de Isabel II 1869, Suez Canal opened and expanded Philippine-European trade. 1873, Chartered Bank of India, Australia, and China put up agency in the Philippines. 1875, Hong Kong and Shanghai Banking Corp. established a branch. Aug. 2, 1882, first savings bank was founded by Fr. Felix Huertas and named it Monte de Piedad y Caja de Ahorros de Manila. At the end of the Spanish regime in 1898, there were fours banks three commercial and one savingswere doing business in the Philippines. Branches of International Banking Corporation (later absorbed by and as a branch of the National City Bank of New York) and the Guarantee Trust Company came in. Other foreign and domestic banks opened included the American Bank in 1901 which operated for 4 years. Short lived institutions in 1902, Wai Hung Bank, the Abrue, Newberry and Reyes Bank. In 1906, the S. Misaka Bank opened to serve the local Japanese community. At the same year, the Postal Savings Bank was created to promote the habit of thrift among the people and the bring banking to the rural areas. 1908, government-owned Agricultural Bank was established with a capital of P1 million but failed to render effective service to the farmers due to small capital.

Banking business in the Philippines during the period was dominated by foreign interests until the passage of Act No. 2612 in 1916, the establishment of the Philippine National Bank. PNB was organized to grant and extend long-term credit to agriculture and industry. After WWI, several foreign and domestic banks were also attracted to operate in Manila, including; Yokohama Specie Bank (1918), Asia Banking Corp. (1919), Chinese-American Bank of Commerce of Peking and the China Corp. (1920), People s Bank and Trust Co. and the Mercantile Bank of China (1926), National City Bank of New York (1930). 1935, the establishment of the Commonwealth. Bank of Taiwan opened a branch in 1937, Netherlands Indische Handles Bank opened branch in Manila. Before WWII, there were 17 banks operated in the country (11 domestic and 6 foreign) with 17 offices in Manila, 22 branches in the provinces and 54 provincial agencies. During this period that banks were regulated and supervised to provide safety to depositors and creditors. In Feb. 1929, the Bureau of Banking was created. Jan. 2, 1942. Japanese Imperial Forces entered Manila. All 17 banks were placed on a stand still for a day and resumed the next day to protect Japanese transactions, and are limited to Filipino-owned and Japanese banks. Other banks were considered enemies of Japan. Southern Development Bank (Nampo Kaihatsy Kindo) opened a branch in Manila, and acted as fiscal agent of the Japanese Government in the Philippines. It also served as the Central Bank, issuing military notes, supervising and regulating other banks operating. Executive Order No. 49 issued on June 6, 1945, rehabilitation of the banking system ravaged by the war. Reopening and emergence of banks, Rehabilitation Finance Corp. (RFC) which was organized primarily to provide financial aid in the rehabilitation of the country and to help in the broadening and the diversification of the Philippine economic structure. RFC charter was amended and gave way to a larger and expanded development banking institution, the Development Bank of the Philippines

Establishment of the Central Bank of the Philippines R.A. No. 265 created the Central Bank of the Philippines, was inaugurated in 1949 to administer both the monetary and the banking systems of the Republic. Its principal function is primarily to manage the country s currency system. Other functions: a. Control the economy s supply of money and credit b. Act as the country s sole bank of issue c. Depository and fiscal agent of the Philippine government and its instrumentalities It also sets policies on; 1. charges in rediscount rates 2. Variations on legal reserve requirements 3. Sales and purchases of the government securities 4. Selective credit and other regulations

1948, the General Banking Act (RA No. 337) was passed. It contained the first major rules and regulations governing the operation, particularly of commercial and savings and mortgage banks. 1952, the Rural Bank Act was approved. 1963, the Savings and Loans Association Act was approved, setting the stage for the development of another type of banking institution. At the end of 1969; a network of 38 commercial banks (with 542 branches and extension offices), 13 savings banks (with 38 branches), 29 private development banks complemented by 469 rural banks and 87 savings and loan associations (stock and non-stock) serviced the country on a national and regional scale.

The New Society (1970) needing complex economic environment. Society needs more sophisticated machinery. Banks need to go beyond traditional banking functions. Thus, statutory reforms in the financial system were initiated. Through P.D. No. 71, almost entirely amended R.A. No. 337 (General Banking Act) redefining basic banking terms, reclassifying financial intermediaries as bank and non-bank and their expanded functions as well as guidelines on their operations was made. It also raised Central Bank s responsibilities for the country s economic growth through internal and external monetary stability. The Banking Reforms of 1980 revised the Philippine Banking Structure with a new concept of banking introduced, the expanded commercial banking or universal banking. This type of banking involves a combination (full domestic and international banking) with the powers of an investment house. Also known as one-stop banking or department store banking , enables clients to avail of all banking services they need from only one bank. With the introduction of the universal banking concept, it is hoped that the financial system will contribute to the economic growth and development of the country. The introduction of electronic banking paves way to a more challenging and competitive banking in the Philippines. 1990: The New Central Bank June 14, 1993. Pres. Ramos signed into law R.A. 7653: the New Central Bank Act. Major Changes: 1. Change in the composition of the Monetary Board: Two members from the government and five full-time members from the private sector. The government representatives shall head the department and a cabinet member designated by the President. 2. The adoption of price stability, conducive to a balanced and sustained growth of the economy and the maintenance of monetary stability and the convertibility of the peso as its primary objectives. 3. Strengthening of the regulations and supervision framework for banks and quasi banks. 4. Abolition of two expense accounts, the Monetary Adjustment Accounts (MAA) and the Exchange Stabilization Adjustment Accounts (ESAA) in the balance sheet to which have been lodged expenses related to printing and minting of currency.

5. The phase out of fiscal agency function, e.g. issuing and servicing of government securities, within a period of five years to allow Bangko Sentral to concentrate on monetary management. 6. The phase out of the regulatory functions over finance companies without quasi-banking functions within a period of 5 years, the same to be transferred to the Securities and Exchange Commission. 7. Additional mandatory reports to assure accountability. 8. Financial Restructuring of the Central Bank (CB). BSP will be provided with an initial capital of P10 billion and absorbing only certain assets from the old CB which will be increased to P50 billion within the next years. 9. The imposition of requirements on trust accounts by the Monetary Board as authorized by the new law. 10. The imposition of interest loans and advances made by the CB to any bank which has been placed under receivership, even after the bank is closed. Classification of the Financial System 1. The Banking Sector For purpsoses of uniformity, simplicity and equality of treatment, R.A. 765 entitled The New Central Bank Act classified banks institutions into the following categories; a. An expanded, commercial bank or universal bank and commercial bank; b. Thrift banks, composed of savings and mortgage banks, stocks savings and loan associations, cooperative banks, Islamic banks, microfinance banks; c. Private development banks; d. Regional unit banks, composed of rural banks.

Specialized unique government banks such as Development Bank of the Philippines and the Land Bank, are not covered by this classification but shall be subject to the supervision and regulation by the Central Bank pursuant to the provisions of section 25 of R.A. No. 265. Expanded Commercial Banks or Unibanks considered as one-stop com-bank performing com-banking functions and non-related banking activities. Commercial Banks offer the greatest variety of banking services among financial institutions such as; accepting demand, savings, time and foreign currency deposits, handling local foreign currency deposits, handling local and foreign fund remittances, money market transactions, and other services that makes them the department stores in finance. Rural Banks extend small loans for agricultural purposes as well as for retail traders. All rural banks are privately owned. Thrift Banks include savings and mortgage banks, private development banks and stock savings and loan associations. Offshore Banking Units (OBUs) are branches, subsidiaries or affiliates of foreign banks which are authorized to transport offshore banking business in the country. Offshore banking deals with banking transactions of foreign currencies involving the receipt of funds principally from external sources and the use of such funds, as provided for by Circular No. 1034.

Investment Houses constitute the largest group, in terms of resources, among the private non-bank financial intermediaries. They offer wide array of financial services such as planning and consultancy, portfolio management, raising of equity and loan capital and obtaining funds from external sources. Investment companies are primarily engaged in investing, reinvesting or trading in securities. Finance Companies are either partnership or corporations which are organized to extend credit lines to consumers and to industrial, commercial or agricultural enterprises by discounting and factoring commercial papers and account receivables or by buying or selling contracts, chatted mortgages, or other evidences of indebtedness, or by lending motor vehicles, heavy equipment and industrial machinery business and other machines, appliances and the like. The Securities Dealers are companies which buy and sell securities of others or which acquire securities to resell or offer them for sale to the public. Securities Brokers are those engaged in the business of effecting transactions in securities and earn their income from commissions received. Private Insurance companies are under the direct supervision and regulation of the Office of the Insurance Commissioner and are authorized to conduct life or non-life insurance business. Their assets consist of policy loans, real estate loans, stocks, mortgages, bonds, fixed deposits, and collateral loans. Pawnshops or Pawnbrokers are business establishments engaged in lending money on personal property delivered as security, pledge or collateral. Non-stock Savings and Loan Associations are associations which primarily provide short-term loan to members and whose main sources of income are savings and time deposits. They are organized for mutual self-help and the common interest of its members. Mutual and Building Loan Associations are mutually owned stock companies that specialize in extending long-term mortgage loans to members. These associations help members acquire their own house by mobilizing regular savings, capital stock proceeds from members, retained earnings and borrowings. Credit Unions are cooperatives composed of small producers and consumers who voluntarily join together to form their business enterprises which they themselves own, control and patronize. Trust and Pension Fund Managers are institutional and personal administrators of funds created or constituted for the benefit of others. Trust funds are created by trustors, or estates of absent persons, minors or by courts, thereby creating a trust relationship between the owner (trustor) of the fund or property and the manager (trustee) for the benefit of a third person called the beneficiary. Lending Investors pertain to individuals or entities engaged exclusively in the business of extending secured or unsecured direct loans to individuals and enterprise.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Security Agreement All Assets of Personal PropertyDokument17 SeitenSecurity Agreement All Assets of Personal PropertyJPF100% (6)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Complete List of Banking TermsDokument33 SeitenComplete List of Banking TermsTanya Hughes100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ABSTRACT OF TITLE PAID FOR IN FULL Discharging Mortgages 2Dokument1 SeiteABSTRACT OF TITLE PAID FOR IN FULL Discharging Mortgages 2jpesNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Do 54-2016 Cert. of Net Debt Service Ceiling..., BLGFDokument4 SeitenDo 54-2016 Cert. of Net Debt Service Ceiling..., BLGFvincent gianNoch keine Bewertungen

- What Is Pledge and MortgageDokument35 SeitenWhat Is Pledge and MortgageLilibeth Dee GabuteroNoch keine Bewertungen

- Financial Discipline For AllDokument48 SeitenFinancial Discipline For AllMayur Mohanji GuptaNoch keine Bewertungen

- Credit Appraisal ProcessDokument43 SeitenCredit Appraisal ProcessAbhinav Singh100% (1)

- BFS Dumps 20100917Dokument23 SeitenBFS Dumps 20100917Muthu AmirthaRaj33% (3)

- Group 8 Ampongan and Abaño MCQS FinalsDokument15 SeitenGroup 8 Ampongan and Abaño MCQS FinalsCarlito B. Bancil100% (1)

- Gaju HumairaDokument431 SeitenGaju Humairagaju619Noch keine Bewertungen

- Banco-Espanol Filipino V Palanca GR No. L-11390 Street, JDokument2 SeitenBanco-Espanol Filipino V Palanca GR No. L-11390 Street, JAnna50% (2)

- Answers To Textbook QuestionsDokument86 SeitenAnswers To Textbook Questionsarsenal99266% (29)

- Asian Cathay Finance and Leasing Corp PDFDokument2 SeitenAsian Cathay Finance and Leasing Corp PDFNelia Mae S. VillenaNoch keine Bewertungen

- Civil Law - Special Forms of PaymentDokument1 SeiteCivil Law - Special Forms of PaymentJeff SarabusingNoch keine Bewertungen

- Chapter ThreeDokument25 SeitenChapter Threeshraddha amatyaNoch keine Bewertungen

- For Examiner's UseDokument13 SeitenFor Examiner's UseAung Zaw HtweNoch keine Bewertungen

- Company Profile - SSA AdvocatesDokument17 SeitenCompany Profile - SSA AdvocatesDianyndra Kusuma HardyNoch keine Bewertungen

- Pas 1Dokument5 SeitenPas 1Simon Marquis LUMBERANoch keine Bewertungen

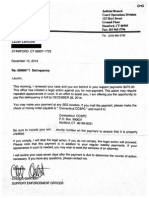

- Christmas Threat Letter From CT Child Support EnforcementDokument1 SeiteChristmas Threat Letter From CT Child Support EnforcementJournalistABCNoch keine Bewertungen

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDokument12 SeitenUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelDhoni KhanNoch keine Bewertungen

- PD Credit Card-IDokument30 SeitenPD Credit Card-IFAQIHAHNoch keine Bewertungen

- Fed z1 201912 PDFDokument198 SeitenFed z1 201912 PDFPoNoch keine Bewertungen

- Surya Padhi. CA, CPA - NRI Taxation and Tax PlanningDokument1 SeiteSurya Padhi. CA, CPA - NRI Taxation and Tax PlanningsuryaNoch keine Bewertungen

- A Study On Customer Prefernces Towards Credit Cards in HDFC BankDokument40 SeitenA Study On Customer Prefernces Towards Credit Cards in HDFC BankSharathNoch keine Bewertungen

- Law of Contract-Unit I With Case LawsDokument7 SeitenLaw of Contract-Unit I With Case LawsBharggav Shorthand ClassesNoch keine Bewertungen

- BA7026 Banking Financial Services ManagementDokument33 SeitenBA7026 Banking Financial Services ManagementrajamanipradeepNoch keine Bewertungen

- AIG - Background HistoryDokument5 SeitenAIG - Background HistoryKaren CalmaNoch keine Bewertungen

- Project Report On Consumer Preference Towards Debit Cards and Credit CardsDokument50 SeitenProject Report On Consumer Preference Towards Debit Cards and Credit CardsAnil BatraNoch keine Bewertungen

- CH11Dokument31 SeitenCH11Marwa HassanNoch keine Bewertungen

- Comp 18-19 PDFDokument2 SeitenComp 18-19 PDFFrench HubbNoch keine Bewertungen