Beruflich Dokumente

Kultur Dokumente

Objection of New Jersey Department of Treasury

Hochgeladen von

DealBookOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Objection of New Jersey Department of Treasury

Hochgeladen von

DealBookCopyright:

Verfügbare Formate

ZUCKERMAN SPAEDER LLP Laura E.

Neish 1540 Broadway, Suite 1604 New York, NY 10036 (212) 704-9600 -andNelson C. Cohen Virginia Whitehill Guldi 1800 M Street, N.W., Suite 1000 Washington, DC 20036 (202) 778-1800

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ) ) ) ) ) ) ) Chapter 11 Case No. 08-13555 (JMP) Jointly Administered

In re LEHMAN BROTHERS HOLDINGS INC. et al., Debtors.

OBJECTION OF THE STATE OF NEW JERSEY, DEPARTMENT OF TREASURY, DIVISION OF INVESTMENT TO MOTION, PURSUANT TO SECTION 362 OF THE BANKRUPTCY CODE AND RULE 4001 OF THE FEDERAL RULES OF BANKRUPTCY PROCEDURE, FOR AN ORDER MODIFYING THE AUTOMATIC STAY TO ALLOW PAYMENT OF A JUDGMENT UNDER THE DIRECTORS AND OFFICERS INSURANCE POLICIES ISSUED TO THE DEBTORS

The State of New Jersey, Department of Treasury, Division of Investment (NJ DOI), by its undersigned counsel, hereby objects to the Motion of Roland Hansalik, George Barclay Perry and Joseph Arena Pursuant to Section 362 of the Bankruptcy Code, for an Order Modifying the Automatic Stay to Allow Payment Under Directors and Officers Insurance Policies Issued to the Debtors (the Motion). In support of this objection, NJ DOI states as follows:

2155846.1

BACKGROUND 1. NJ DOI is the plaintiff in a litigation pending before the United States District

Court for the Southern District of New York (the NY District Court) Docket No. 10-CV05201-LAK, against Ernst & Young LLP and various individuals (collectively, the Defendants), some of whom are former officers and directors of Lehman Brothers Holdings Inc. and certain of its affiliated debtors (collectively the Debtors). Although none of the Defendants in the litigation are Debtors, the NJ DOI litigation has been stayed by Order of the NY District Court apparently so as to provide an orderly and fair resolution of the claims of all parties thereto.1 2. As a result of the stay imposed by the NY District Court, NJ DOI is prevented

from reducing its claims against the Defendants to a judgment. Without a judgment, NJ DOI can not make a claim on the insurance policies which are the subject of the current motion. 3. NJ DOI is aware of numerous, similar litigation claims pending before other

courts around the country. The damage awards in these litigations likely will exceed the policy limits on the Debtors insurance policies. NJ DOI is concerned that, although the insurance policies provide substantial coverage, they will not be sufficient to fully satisfy all of the litigation claims. As a result, the individuals and entities who serendipitously reach a final judgment before other claimants will receive the full benefit of the insurance policies while other plaintiffs are left with nothing.2

Although the Debtors are not Defendants in the SDNY Litigation, NJ DOI has independent standing in this matter pursuant to section 1109 of the Bankruptcy Code. In addition to its unliquidated claims against the Debtors insurance policies from the SDNY Litigation, NJ DOI has asserted separate and distinct claims against the Debtors for which proofs of claim were timely filed.

NJ DOI acknowledges that other claims previously have received payment from the Debtors insurance policies. See Order Granting Debtors Motion Pursuant To Section 362 Of The Bankruptcy Code, For An Order Modifying The Automatic Stay To Allow Settlement Payment Under Directors and Officers Insurance Policies

2

2155846.1

ARGUMENT The Bankruptcy Code was designed to facilitate equality of distribution among similarly situated creditors. Musso v. Ostashko, 468 F.2d 99, 104 (2d Cir. 2006) (quoting 5 Collier on Bankruptcy 541.01 (15th ed. Rev. 2005)). The automatic stay is a critical part of this policy because it prevents creditors from dismantling the estate in a piecemeal fashion. Granting relief from the automatic stay in order to allow this group of alleged creditors to reach the insurance proceeds at this time will undercut this overarching policy. Courts agree that insurance policies are generally considered property of the estate. There is, however, disagreement among courts regarding whether the proceeds of those policies are property of the estate. 3 Generally, the determination of whether the proceeds are property of the estate must be analyzed in light of the facts of each case. In re Brunswick Baptist Church, Dist. Ct. Case. No. 1:05-CV-1085, slip op. (N.D.N.Y. Jan. 16, 2007) (citing Ochs v. Lipson, 99 CV-6730 (TCP) (E.D.N.Y. Mar. 2, 2000)); see also, In re Sfuzzi, Inc., 191 B.R. 664, 668 (Bankr. N.D. Tex. 1996); In re CyberMedica, Inc., 280 B.R. 12, 17 (Bankr. D. Mass. 2002). Courts have expressed particular concern about insurance proceeds where it appears that the claims will be

[DKT. No. 6297] (authorizing payment of $1,675,000); Order Granting Debtors Motion Pursuant To Section 362 Of The Bankruptcy Code, For An Order Modifying The Automatic Stay To Allow Settlement Payment Under Directors and Officers Insurance Policies [DKT. No. 12895] (authorizing payment of $10,000,000); Order Granting Debtors Motion Pursuant To Section 362 Of The Bankruptcy Code, For An Order Modifying The Automatic Stay To Allow Settlement Payment Under Directors and Officers Insurance Policies [DKT. No. 13929] (authorizing payment of $975,000). The present motion seeks authority to pay another $15,000,000. This piecemeal consumption of the insurance policies puts all litigation creditors at risk that funds will not be available to pay their claims when they are finally permitted to liquidate them. NJ DOI believes that the legal morass created by severing the ownership of an insurance policy from the actual proceeds is but a red herring because section 362(a) (3) enjoins all efforts to obtain possession of property from the estate. 11 U.S.C. 362(a) (3). Even if the proceeds of the insurance policies are not property of the estate they are the proceeds of estate property - the insurance policies. Therefore, the right to payment from the insurance policies is property from the estate to which the automatic stay applies.

3

3

2155846.1

competing for a limited pool of assets. In fact, the present situation is more akin to a case involving mass tort claims than the typical case involving director and officer liability.4 [T]he decisions by several courts to include the proceeds as property of the estate appear to be motivated by a concern that the court would not otherwise be able to prevent a free-for-all against the insurer outside the bankruptcy proceeding. There was also a threat that, unless the policy proceeds were marshalled in the bankruptcy proceeding, they would not cover plaintiffs' claims and would expose the debtor's estate. In re Sfuzzi, Inc., 191 B.R. at 666-67. Because the District Court has stayed its litigation, NJ DOI is prevented from liquidating its claims against the Defendants, a necessary requisite for NJ DOI to apply for a share of the insurance proceeds. As a result, NJ DOI and other similar claimants are precluded from sharing in the insurance proceeds at this time. This result is inherently inequitable because the claimants have no control over the process by which the claims will be liquidated. Under section 105 of the Bankruptcy Code, this Court has the authority to fashion appropriate relief to protect the interest of all potential claimants. To do so, the proceeds of the insurance policies must be held until such time as the body of potential claims may be assessed and the claimants who have valid claims are allowed to ratably share those limited proceeds.5

Typically, the cases discussing the directors and officers insurance policy proceeds involve the estate competing with the insureds for coverage. Specifically, a debtor may typically object to payment of the insureds legal expenses because such payments would reduce the amount available for recovery in the event the estate ultimately prevailed on claims it has. These cases are simply inapposite to the present situation where many claimants may not have the benefit of the insurance proceeds without intervention by this Court. In the cases cited in the Debtors motion, the estate itself was competing with the creditors for the application of insurance proceeds. In those instances, the courts had the opportunity to equalize later distributions in the event claims exceeded the policy limits. See In re Boston Regional Medical Center, Inc., 285 B.R. 87, 97 n.11 (Bankr. D. Mass. 2002). This case is different because the various claimants are distinct entities. Presumably after payment of the insurance claims there will be no way for the Court to equalize the distributions among these claimants at a later date.

5

4

2155846.1

WHEREFORE, the State of New Jersey, Department of Treasury, Division of Investment respectfully requests that the motion for relief from the automatic stay be denied and that the Court grant such other or further relief as is just and proper under the circumstances. Dated: Washington, D.C. July 13, 2011 ZUCKERMAN SPAEDER LLP s/ Laura E. Neish Laura E. Neish 1540 Broadway, Suite 1604 New York, NY 10036 (212) 704-9600 - and Nelson C. Cohen Virginia Whitehill Guldi 1800 M Street, Suite 1000 Washington, DC 20036 (202) 778-1800 Attorneys for State of New Jersey, Department of Treasury, Division of Investment Of Counsel: Merrill G. Davidoff, Esquire Lawrence J. Lederer, Esquire Robin Switzenbaum, Esquire Berger & Montague, P.C. 1622 Locust Street Philadelphia, PA 19103 Telephone: (215) 875-3000 Facsimile: (215) 875-4604 - and Peter S. Pearlman, Esquire Cohn Lifland Pearlman Herrmann & Knopf LLP Park 80 Plaza West-One Saddle Brook, NJ 07663 Telephone: (201) 845-9600 Facsimile: (201) 845-9423

5

2155846.1

Das könnte Ihnen auch gefallen

- United States of America On Behalf of Its Agency Internal Revenue Service v. William H. Norton, Carrie W. Norton, F/k/a Carrie A. Woodward, 717 F.2d 767, 3rd Cir. (1983)Dokument11 SeitenUnited States of America On Behalf of Its Agency Internal Revenue Service v. William H. Norton, Carrie W. Norton, F/k/a Carrie A. Woodward, 717 F.2d 767, 3rd Cir. (1983)Scribd Government DocsNoch keine Bewertungen

- Citibank (New York State), N.A. v. Interfirst Bank of Wichita Falls, N.A. F/k/a City National Bank in Wichita Falls, 784 F.2d 619, 1st Cir. (1986)Dokument6 SeitenCitibank (New York State), N.A. v. Interfirst Bank of Wichita Falls, N.A. F/k/a City National Bank in Wichita Falls, 784 F.2d 619, 1st Cir. (1986)Scribd Government DocsNoch keine Bewertungen

- United States v. Bell Credit Union, United States of America v. Golden Plains Credit Union, 860 F.2d 365, 10th Cir. (1988)Dokument12 SeitenUnited States v. Bell Credit Union, United States of America v. Golden Plains Credit Union, 860 F.2d 365, 10th Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- Luis and Margaret Vega, Individually and On Behalf of Others Similarly Situated v. First Federal Savings & Loan Association of Detroit, 622 F.2d 918, 1st Cir. (1980)Dokument13 SeitenLuis and Margaret Vega, Individually and On Behalf of Others Similarly Situated v. First Federal Savings & Loan Association of Detroit, 622 F.2d 918, 1st Cir. (1980)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument4 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Second CircuitDokument7 SeitenUnited States Court of Appeals, Second CircuitScribd Government DocsNoch keine Bewertungen

- 2015 Winter Handouts PDFDokument304 Seiten2015 Winter Handouts PDFMOHAN KUMARNoch keine Bewertungen

- United States Court of Appeals, Second Circuit.: No. 84, Docket 81-5017Dokument14 SeitenUnited States Court of Appeals, Second Circuit.: No. 84, Docket 81-5017Scribd Government DocsNoch keine Bewertungen

- HEARING DATE: June 7, 2011 HEARING TIME: 2:00 P.M.: Professional Fees ExpensesDokument8 SeitenHEARING DATE: June 7, 2011 HEARING TIME: 2:00 P.M.: Professional Fees ExpensesChapter 11 DocketsNoch keine Bewertungen

- New York Credit Men's Adjustment Bureau, Inc., As Trustee in Bankruptcy of Stanton Togs, Inc. v. Samuel Breiter & Co., Inc., in The Matter of Stanton Togs, Inc., Bankrupt, 253 F.2d 675, 2d Cir. (1958)Dokument8 SeitenNew York Credit Men's Adjustment Bureau, Inc., As Trustee in Bankruptcy of Stanton Togs, Inc. v. Samuel Breiter & Co., Inc., in The Matter of Stanton Togs, Inc., Bankrupt, 253 F.2d 675, 2d Cir. (1958)Scribd Government DocsNoch keine Bewertungen

- Diversified Mortgage Investors v. U. S. Life Title Insurance Company of New York, 544 F.2d 571, 2d Cir. (1976)Dokument10 SeitenDiversified Mortgage Investors v. U. S. Life Title Insurance Company of New York, 544 F.2d 571, 2d Cir. (1976)Scribd Government DocsNoch keine Bewertungen

- In Re John Douglas Hastie, Debtor. Federal Deposit Insurance Corporation, and Acquisition Management, Inc., Successor To The Claims of Fdic v. John Douglas Hastie, 2 F.3d 1042, 10th Cir. (1993)Dokument8 SeitenIn Re John Douglas Hastie, Debtor. Federal Deposit Insurance Corporation, and Acquisition Management, Inc., Successor To The Claims of Fdic v. John Douglas Hastie, 2 F.3d 1042, 10th Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Fourth CircuitDokument6 SeitenUnited States Court of Appeals, Fourth CircuitScribd Government DocsNoch keine Bewertungen

- Transouth Financial Corporation of Florida v. Ralph Jennings Johnson, Vera Johnson, 931 F.2d 1505, 11th Cir. (1991)Dokument24 SeitenTransouth Financial Corporation of Florida v. Ralph Jennings Johnson, Vera Johnson, 931 F.2d 1505, 11th Cir. (1991)Scribd Government DocsNoch keine Bewertungen

- Demorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Dokument11 SeitenDemorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Fifth CircuitDokument12 SeitenUnited States Court of Appeals, Fifth CircuitScribd Government DocsNoch keine Bewertungen

- New York State Debt Collection Laws: Mel S. Harris & Associates, LLCDokument10 SeitenNew York State Debt Collection Laws: Mel S. Harris & Associates, LLCjohnny bravoNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument9 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Goorin Bros. v. Schedule A - Order Denying Leave To File Under SealDokument3 SeitenGoorin Bros. v. Schedule A - Order Denying Leave To File Under SealSarah BursteinNoch keine Bewertungen

- United States v. Centennial Savings Bank FSB, 499 U.S. 573 (1991)Dokument10 SeitenUnited States v. Centennial Savings Bank FSB, 499 U.S. 573 (1991)Scribd Government DocsNoch keine Bewertungen

- PrecedentialDokument17 SeitenPrecedentialScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals Third CircuitDokument4 SeitenUnited States Court of Appeals Third CircuitScribd Government DocsNoch keine Bewertungen

- Rizal Commercial Banking Corporation vs. Court of Appeals: 292 Supreme Court Reports AnnotatedDokument18 SeitenRizal Commercial Banking Corporation vs. Court of Appeals: 292 Supreme Court Reports AnnotatedAlexiss Mace JuradoNoch keine Bewertungen

- Rizal Commercial Banking Corporation vs. Court of Appeals: 292 Supreme Court Reports AnnotatedDokument18 SeitenRizal Commercial Banking Corporation vs. Court of Appeals: 292 Supreme Court Reports AnnotatedAlexiss Mace JuradoNoch keine Bewertungen

- United States Court of Appeals, Seventh CircuitDokument6 SeitenUnited States Court of Appeals, Seventh CircuitScribd Government DocsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument5 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Ford Motor Credit Co. v. Milhollin, 444 U.S. 555 (1980)Dokument14 SeitenFord Motor Credit Co. v. Milhollin, 444 U.S. 555 (1980)Scribd Government DocsNoch keine Bewertungen

- Simplifying Medicare ComplianceDokument4 SeitenSimplifying Medicare ComplianceForge ConsultingNoch keine Bewertungen

- Set Off and RecoupmentDokument9 SeitenSet Off and RecoupmentARTHUR MILLER100% (2)

- Aardwoolf Corporation, Formerly Known As Spectrum Development Company, Inc. v. Nelson Capital Corporation, 861 F.2d 46, 2d Cir. (1988)Dokument5 SeitenAardwoolf Corporation, Formerly Known As Spectrum Development Company, Inc. v. Nelson Capital Corporation, 861 F.2d 46, 2d Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- In The Matter of A & B Heating & Air Conditioning, Debtor. United States of America v. A & B Heating & Air Conditioning, Inc., 823 F.2d 462, 11th Cir. (1987)Dokument7 SeitenIn The Matter of A & B Heating & Air Conditioning, Debtor. United States of America v. A & B Heating & Air Conditioning, Inc., 823 F.2d 462, 11th Cir. (1987)Scribd Government DocsNoch keine Bewertungen

- In Re Walter J. Giller, JR., M.D., Debtor. First National Bank of El Dorado v. Walter J. Giller, JR., M.D., P.A., 962 F.2d 796, 1st Cir. (1992)Dokument4 SeitenIn Re Walter J. Giller, JR., M.D., Debtor. First National Bank of El Dorado v. Walter J. Giller, JR., M.D., P.A., 962 F.2d 796, 1st Cir. (1992)Scribd Government DocsNoch keine Bewertungen

- Unit 4.7Dokument122 SeitenUnit 4.7nikita2802Noch keine Bewertungen

- RCBC V CADokument27 SeitenRCBC V CARaphael PangalanganNoch keine Bewertungen

- Commissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Dokument4 SeitenCommissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Scribd Government DocsNoch keine Bewertungen

- 28 RCBC vs. CADokument22 Seiten28 RCBC vs. CAMichelle Montenegro - AraujoNoch keine Bewertungen

- Nevada Reports 1966 (82 Nev.) PDFDokument397 SeitenNevada Reports 1966 (82 Nev.) PDFthadzigsNoch keine Bewertungen

- United States Court of Appeals, Ninth CircuitDokument5 SeitenUnited States Court of Appeals, Ninth CircuitScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument5 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- RCBC v. CADokument43 SeitenRCBC v. CABernadette Luces BeldadNoch keine Bewertungen

- Coastal Pacific v. Southern Rolling Mills (2006)Dokument19 SeitenCoastal Pacific v. Southern Rolling Mills (2006)springchicken88Noch keine Bewertungen

- Bank of Commerce V Spouses FloresDokument22 SeitenBank of Commerce V Spouses FloresAra Lorrea MarquezNoch keine Bewertungen

- United States Court of Appeals, Eighth CircuitDokument6 SeitenUnited States Court of Appeals, Eighth CircuitScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Eighth CircuitDokument3 SeitenUnited States Court of Appeals, Eighth CircuitScribd Government DocsNoch keine Bewertungen

- Glenn A. Souife v. First National Bank of Commerce, 628 F.2d 480, 1st Cir. (1980)Dokument12 SeitenGlenn A. Souife v. First National Bank of Commerce, 628 F.2d 480, 1st Cir. (1980)Scribd Government DocsNoch keine Bewertungen

- Shenzhen Yihong Lighting v. Schedule A - Order Denying Motion To SealDokument3 SeitenShenzhen Yihong Lighting v. Schedule A - Order Denying Motion To SealSarah BursteinNoch keine Bewertungen

- New Life Brokerage v. Cal-Surance, 334 F.3d 112, 1st Cir. (2003)Dokument4 SeitenNew Life Brokerage v. Cal-Surance, 334 F.3d 112, 1st Cir. (2003)Scribd Government DocsNoch keine Bewertungen

- 54 First Metro Investment V Este Del SolDokument15 Seiten54 First Metro Investment V Este Del Soljuan aldabaNoch keine Bewertungen

- Setoff, Recoupment, and BankruptcyDokument6 SeitenSetoff, Recoupment, and BankruptcyNikki Cofield100% (4)

- United States Court of Appeals, Fourth CircuitDokument5 SeitenUnited States Court of Appeals, Fourth CircuitScribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument5 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Ex Parte Motion For Order Shortening Notice Period andDokument9 SeitenEx Parte Motion For Order Shortening Notice Period andChapter 11 DocketsNoch keine Bewertungen

- United States Court of Appeals Tenth CircuitDokument5 SeitenUnited States Court of Appeals Tenth CircuitScribd Government DocsNoch keine Bewertungen

- Motion For Preliminary InjunctionDokument14 SeitenMotion For Preliminary InjunctionOSDocs2012Noch keine Bewertungen

- Capitol Indemnity Corporation v. Baljit S. Aulakh Pavitar P. Aulakh, and Superior Management Services, Incorporated, 313 F.3d 200, 4th Cir. (2002)Dokument6 SeitenCapitol Indemnity Corporation v. Baljit S. Aulakh Pavitar P. Aulakh, and Superior Management Services, Incorporated, 313 F.3d 200, 4th Cir. (2002)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals Fourth CircuitDokument7 SeitenUnited States Court of Appeals Fourth CircuitScribd Government DocsNoch keine Bewertungen

- Negotiable Instrument Case Digest (MidTerms)Dokument28 SeitenNegotiable Instrument Case Digest (MidTerms)brixphatesNoch keine Bewertungen

- Federal National v. Carvalho, 335 F.3d 45, 1st Cir. (2003)Dokument9 SeitenFederal National v. Carvalho, 335 F.3d 45, 1st Cir. (2003)Scribd Government DocsNoch keine Bewertungen

- California Supreme Court Petition: S173448 – Denied Without OpinionVon EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionBewertung: 4 von 5 Sternen4/5 (1)

- 16-08697 Notice of InterventionDokument9 Seiten16-08697 Notice of InterventionDealBookNoch keine Bewertungen

- Radioshack's Chapter 11 PetitionDokument22 SeitenRadioshack's Chapter 11 PetitionDealBookNoch keine Bewertungen

- Cerberus StatementDokument2 SeitenCerberus StatementDealBookNoch keine Bewertungen

- Corinthian Colleges Chapter 11 PetitionDokument19 SeitenCorinthian Colleges Chapter 11 PetitionDealBookNoch keine Bewertungen

- General Motors Ignition Switch Litigation Crime Fraud Memorandum July 9 2015Dokument48 SeitenGeneral Motors Ignition Switch Litigation Crime Fraud Memorandum July 9 2015DealBookNoch keine Bewertungen

- Judge's Decision Potentially Allowing Ackman To Vote in Allergan FightDokument30 SeitenJudge's Decision Potentially Allowing Ackman To Vote in Allergan FightDealBookNoch keine Bewertungen

- Robert Madsen Whistle-Blower CaseDokument220 SeitenRobert Madsen Whistle-Blower CaseDealBook100% (1)

- SEC V Syron Resolution April 14 2015Dokument13 SeitenSEC V Syron Resolution April 14 2015DealBookNoch keine Bewertungen

- EBITDA Used and Abused Nov-20141Dokument10 SeitenEBITDA Used and Abused Nov-20141DealBookNoch keine Bewertungen

- Inversiones Alsacia Disclosure StatementDokument648 SeitenInversiones Alsacia Disclosure StatementDealBookNoch keine Bewertungen

- FILED Motion To Intervenechallenge SettlementDokument12 SeitenFILED Motion To Intervenechallenge SettlementArik HesseldahlNoch keine Bewertungen

- Ken Griffin's Response To Divorce Proceeding Counter-PetitionDokument18 SeitenKen Griffin's Response To Divorce Proceeding Counter-PetitionDealBookNoch keine Bewertungen

- The IRR of NoDokument9 SeitenThe IRR of NoDealBookNoch keine Bewertungen

- Globalstar GSAT ReportDokument67 SeitenGlobalstar GSAT ReportDealBook100% (2)

- Ken Griffin's Further Response To Divorce ProceedingsDokument20 SeitenKen Griffin's Further Response To Divorce ProceedingsDealBookNoch keine Bewertungen

- Anne Griffin Request For Temporary Restraining Order in Divorce CaseDokument15 SeitenAnne Griffin Request For Temporary Restraining Order in Divorce CaseDealBookNoch keine Bewertungen

- United States Court of Appeals: Circuit JudgesDokument1 SeiteUnited States Court of Appeals: Circuit JudgesDealBookNoch keine Bewertungen

- Hedge Funds' Suit Against Bank of New York MellonDokument27 SeitenHedge Funds' Suit Against Bank of New York MellonDealBookNoch keine Bewertungen

- Motion To TransferDokument40 SeitenMotion To TransferDealBook100% (1)

- Mediator's Memorandum LightSquared CaseDokument22 SeitenMediator's Memorandum LightSquared CaseDealBookNoch keine Bewertungen

- New York v. Davis, Et AlDokument60 SeitenNew York v. Davis, Et AlDealBookNoch keine Bewertungen

- Search WarrantDokument16 SeitenSearch WarrantDealBookNoch keine Bewertungen

- Greene-v-MtGox Class Action LawsuitDokument32 SeitenGreene-v-MtGox Class Action LawsuitAndrew CoutsNoch keine Bewertungen

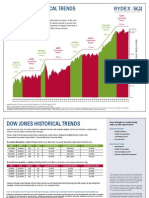

- Rydex Historical TrendsDokument2 SeitenRydex Historical TrendsVinayak PatilNoch keine Bewertungen

- Chapter C2 Formation of The Corporation Discussion QuestionsDokument16 SeitenChapter C2 Formation of The Corporation Discussion QuestionsPennyW0% (1)

- NHAI PPT EditedDokument16 SeitenNHAI PPT EditedArunjeet Singh100% (1)

- Efects of Globlization On SovereigntyDokument3 SeitenEfects of Globlization On SovereigntyirfanaliNoch keine Bewertungen

- Deed of Sale of Large CattleDokument3 SeitenDeed of Sale of Large CattleSean Arcilla100% (3)

- Writing A Scientific Research Report (IMRaD)Dokument5 SeitenWriting A Scientific Research Report (IMRaD)Lea B HobNoch keine Bewertungen

- Daniel 6:1-10 - LIARS, LAWS & LIONSDokument7 SeitenDaniel 6:1-10 - LIARS, LAWS & LIONSCalvary Tengah Bible-Presbyterian ChurchNoch keine Bewertungen

- The Lion of Judah PDFDokument19 SeitenThe Lion of Judah PDFMichael SympsonNoch keine Bewertungen

- ScriptDokument2 SeitenScriptKenneth FloresNoch keine Bewertungen

- Texto 2 - Donnelly - Human Rights - A New Standard of CivilizationDokument23 SeitenTexto 2 - Donnelly - Human Rights - A New Standard of CivilizationGabriel AzevedoNoch keine Bewertungen

- Case Digest 1Dokument16 SeitenCase Digest 1Laiza MayNoch keine Bewertungen

- Ang Alamat NG GubatDokument5 SeitenAng Alamat NG GubatJason SebastianNoch keine Bewertungen

- Mt. Carmel School of Siargao, Inc.: (Surigao Diocesan School System)Dokument1 SeiteMt. Carmel School of Siargao, Inc.: (Surigao Diocesan School System)EDMAR POLVOROZANoch keine Bewertungen

- It deters criminals from committing serious crimes. Common sense tells us that the most frightening thing for a human being is to lose their life; therefore, the death penalty is the best deterrent when it comes (1).pdfDokument3 SeitenIt deters criminals from committing serious crimes. Common sense tells us that the most frightening thing for a human being is to lose their life; therefore, the death penalty is the best deterrent when it comes (1).pdfJasmine AlbaNoch keine Bewertungen

- An English Settlement at JamestownDokument7 SeitenAn English Settlement at JamestownPatrick ThorntonNoch keine Bewertungen

- Australian/New Zealand StandardDokument10 SeitenAustralian/New Zealand StandardMatt Fizz0% (2)

- 9.1.1.7 Lab - Encrypting and Decrypting Data Using A Hacker Tool - OK PDFDokument6 Seiten9.1.1.7 Lab - Encrypting and Decrypting Data Using A Hacker Tool - OK PDFInteresting facts ChannelNoch keine Bewertungen

- Exercises of Analytical Exposition TextDokument2 SeitenExercises of Analytical Exposition TextSovie UnyilNoch keine Bewertungen

- Republic Act No. 11131Dokument12 SeitenRepublic Act No. 11131Nikko PedrozaNoch keine Bewertungen

- Jones v. Superior CourtDokument4 SeitenJones v. Superior CourtKerriganJamesRoiMaulitNoch keine Bewertungen

- TOPIC 2 - Topic 2 - Consolidated and Separate Financial StatementsDokument6 SeitenTOPIC 2 - Topic 2 - Consolidated and Separate Financial Statementsduguitjinky20.svcNoch keine Bewertungen

- Review of Utilization of ENR Revenues and Application of Media StrategiesDokument160 SeitenReview of Utilization of ENR Revenues and Application of Media StrategiesMark Lester Lee AureNoch keine Bewertungen

- Omnibus Sworn Statement For Emergency ProcurementDokument2 SeitenOmnibus Sworn Statement For Emergency ProcurementEduard FerrerNoch keine Bewertungen

- S.No Ward Zone License No License Validity Date Hawker Type Name Age Fathar/Husband NameDokument41 SeitenS.No Ward Zone License No License Validity Date Hawker Type Name Age Fathar/Husband NameSandeep DhimanNoch keine Bewertungen

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDokument29 SeitenPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceBowthen BoocNoch keine Bewertungen

- SFA HANDBOOK 201-280 Registration ProceduresDokument80 SeitenSFA HANDBOOK 201-280 Registration ProceduresGraeme NichollsNoch keine Bewertungen

- 4ATDokument3 Seiten4ATPaula Mae DacanayNoch keine Bewertungen

- Saran Blackbook FinalDokument78 SeitenSaran Blackbook FinalVishnuNadar100% (3)

- Gift DeedDokument9 SeitenGift DeedHarjot SinghNoch keine Bewertungen

- Judy Dench Case - Sindikat 2Dokument3 SeitenJudy Dench Case - Sindikat 2Bangtan RuniNoch keine Bewertungen