Beruflich Dokumente

Kultur Dokumente

Construction Spending Aug 2011

Hochgeladen von

Jessica Kister-LombardoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Construction Spending Aug 2011

Hochgeladen von

Jessica Kister-LombardoCopyright:

Verfügbare Formate

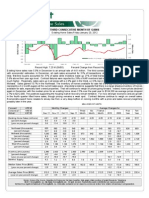

SURPRISING GAIN LED BY NONRESIDENTIAL SURGE

Construction Spending Monday August 1, 2011

3 2 1 Monthly % Change 0 -1 -2 -3 -4 -5 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11

Monthly % Change Year-on-Year % Change

12 8 4 Yearly % Change 0 -4 -8 -12 -16 -20

Construction spending rose 0.2% in June which was better than expectations for no change. Moreover, upward revisions in the previous two months resulted in moderate gains as opposed to the originally reported declines. Nevertheless, construction spending remains 4.7% below its year ago level and is 36.3% lower than its March 2006 peak. The level of spending remains weak but at least the rate of decline has slowed by more than half over the past year. Residential construction spending is persistently weak, falling by 0.3% in June; down 2.1% from its year ago level and only 3.2% above its cyclical nadir of July 2009. A rebound will be depend ent on reduction of the current large inventory of existing homes. Nonresidential construction spending rose 1.8% in June amid broad based gains. Although nonresidential construction is down 1.3% over the last year and trending lower overall, the pace of decline has slowed substantially. Public construction expenditures fell 0.7% in June and are now off 3.0% on the year. Fading stimulus dollars and difficult budget positions for many state and local governments significantly downgrade the outlook for public spending going forward. Given the current state of the housing market, slower economic conditions and the fiscal crisis in Washington, recovery in any of the three categories of construction spending is still down the road.

Forecast: Consensus**: Actual: 0.0% 0.0% 0.2% Monthly % Change Relative Weight* Jun-11 100.0% 0.2 May-11 0.3 -0.6 0.2 -0.8 1.2 2.2 4.6 -0.4 -1.7 -0.5 0.4 -1.0 1.3 0.6 Apr-11 0.7 -0.6 2.4 4.9 0.1 2.5 -1.0 -1.9 -0.4 0.6 -2.0 -1.5 -3.4 -1.4 PERCENT CHANGE Annual Rates of % Change for Three Six Twelve Five Month Month Month 2010 2009 Year 5.2 -2.7 -4.7 -6.0 -16.2 -8

Ten Year -0.4

Construction Spending Previous estimate Private Construction Residential Nonresidential Commercial Power Office Health Care All Other Public Construction Education Highways & Streets All Others

63.9% 30.5% 33.4% 5.2% 9.4% 2.8% 3.7% 12.3% 36.1% 8.6% 9.7% 17.9%

0.8 -0.3 1.8 3.1 0.6 0.5 2.3 2.3 -0.7 -4.1 -1.6 1.5

14.3 15.8 13.0 36.0 18.0 -6.8 0.7 9.7 -8.8 -23.7 -13.8 2.9

1.8 5.1 -1.0 26.8 -11.2 -12.4 -9.1 3.3 -10.0 -8.4 -18.1 -5.8

-1.7 -2.1 -1.3 2.3 13.0 -10.1 -3.0 -9.0 -9.6 -13.0 -10.4 -7.5

-8.1 -6.3 -9.7 -14.3 11.1 -19.4 -1.8 -20.1 -2.1 -10.6 5.1 -1.5

-21.9 -15.0 -27.0 -40.6 -5.2 -43.5 -21.9 -27.1 -3.7 -10.3 -3.0 -0.2

-12.2 -19.1 -1.0 -13.2 19.4 -9.7 0.7 -1.6 4.0 -0.5 4.5 6.3

-2.4 -4.0 -0.8 -5.7 10.6 -8.9 4.2 -1.8 4.7 #N/A #N/A #N/A

Source: Bureau of the Census, Department of Commerce via Haver Analytics. Data, graph & table courtesy of Insight Economics, LLC. **Bloomberg 2011 HousingMatrix, Inc. | http://www.HousingMatrix.com | All rights reserved. Reproduction and/or redistribution are expressly prohibited. Hot Sheet is a registered trademark of HousingMatrix, Inc. Information herein is based on sources we believe to be reliable, but its accuracy is not guaranteed.

Das könnte Ihnen auch gefallen

- Construction Spending Oct. 2011Dokument1 SeiteConstruction Spending Oct. 2011Jessica Kister-LombardoNoch keine Bewertungen

- November Construction SpendingDokument1 SeiteNovember Construction SpendingJessica Kister-LombardoNoch keine Bewertungen

- Constructionspending 9-1-11Dokument1 SeiteConstructionspending 9-1-11Jessica Kister-LombardoNoch keine Bewertungen

- Construction Spending June 1stDokument1 SeiteConstruction Spending June 1stJessica Kister-LombardoNoch keine Bewertungen

- Construction Spending December 2011Dokument1 SeiteConstruction Spending December 2011Jessica Kister-LombardoNoch keine Bewertungen

- Construction Costs Report October 2011Dokument2 SeitenConstruction Costs Report October 2011William HarrisNoch keine Bewertungen

- Local Market Reports 2013 q1 NYBuffaloDokument7 SeitenLocal Market Reports 2013 q1 NYBuffaloFevi AbejeNoch keine Bewertungen

- 3 Chapter 2Dokument26 Seiten3 Chapter 2Raphael MorenzNoch keine Bewertungen

- Economic Highlights - Industrial Production Slowed Down Markedly in July, Pointing To Further Deceleration in Economic Growth in The 3Q - 09/09/2010Dokument3 SeitenEconomic Highlights - Industrial Production Slowed Down Markedly in July, Pointing To Further Deceleration in Economic Growth in The 3Q - 09/09/2010Rhb InvestNoch keine Bewertungen

- San Mateo County Market Update - Septemebr 2011Dokument4 SeitenSan Mateo County Market Update - Septemebr 2011Gwen WangNoch keine Bewertungen

- Economic Highlights - Vietnam: Real GDP Grew at A Faster Pace in January-September 2010 - 29/09/2010Dokument3 SeitenEconomic Highlights - Vietnam: Real GDP Grew at A Faster Pace in January-September 2010 - 29/09/2010Rhb InvestNoch keine Bewertungen

- Local Market Trends: The Real Estate ReportDokument4 SeitenLocal Market Trends: The Real Estate Reportsusan5458Noch keine Bewertungen

- Local Market Trends: The Real Estate ReportDokument4 SeitenLocal Market Trends: The Real Estate ReportSusan StrouseNoch keine Bewertungen

- Q4 Fy21 GDPDokument7 SeitenQ4 Fy21 GDPsksaha1976Noch keine Bewertungen

- MFM Jul 15 2011Dokument13 SeitenMFM Jul 15 2011timurrsNoch keine Bewertungen

- Country Economic Forecasts - ThailandDokument10 SeitenCountry Economic Forecasts - Thailandthanhphong17vnNoch keine Bewertungen

- Today's Market : Houston-Baytown-Sugar Land Area Local Market Report, Third Quarter 2011Dokument7 SeitenToday's Market : Houston-Baytown-Sugar Land Area Local Market Report, Third Quarter 2011Kevin ReadNoch keine Bewertungen

- Gary Shilling Review and Forecast: Low Interest RatesDokument22 SeitenGary Shilling Review and Forecast: Low Interest Ratesrichardck61Noch keine Bewertungen

- Economic Highlights: Vietnam: Real GDP Picked Up in The 1Q, Economic Outlook Remains Bright-01/04/2010Dokument3 SeitenEconomic Highlights: Vietnam: Real GDP Picked Up in The 1Q, Economic Outlook Remains Bright-01/04/2010Rhb InvestNoch keine Bewertungen

- Local Market Trends: The Real Estate ReportDokument4 SeitenLocal Market Trends: The Real Estate ReportSusan StrouseNoch keine Bewertungen

- QLD NAsDokument1 SeiteQLD NAseconomicdelusionNoch keine Bewertungen

- Economic Highlights - Vietnam: Economic Data Showing Signs of Weakness in July - 30/07/2010Dokument4 SeitenEconomic Highlights - Vietnam: Economic Data Showing Signs of Weakness in July - 30/07/2010Rhb InvestNoch keine Bewertungen

- Local Market Reports 2012 q4 ALMobileDokument7 SeitenLocal Market Reports 2012 q4 ALMobileFevi AbejeNoch keine Bewertungen

- India's Economic Growth Projected at 8.2% for 2011-12Dokument5 SeitenIndia's Economic Growth Projected at 8.2% for 2011-12Ishaan GoelNoch keine Bewertungen

- Event: IIP Data AlertDokument5 SeitenEvent: IIP Data AlertSagar MoradiyaNoch keine Bewertungen

- State Economic, Revenue, and Budget Update: Presented To The Senate Appropriations CommitteeDokument18 SeitenState Economic, Revenue, and Budget Update: Presented To The Senate Appropriations CommitteeFrank A. Cusumano, Jr.Noch keine Bewertungen

- 5 Year Forecast BCIS August 2008Dokument21 Seiten5 Year Forecast BCIS August 2008egglestonaNoch keine Bewertungen

- Big Rock Candy MountainDokument63 SeitenBig Rock Candy MountainrguyNoch keine Bewertungen

- Asia Cyclical Dashboard 130214Dokument5 SeitenAsia Cyclical Dashboard 130214Yew Toh TatNoch keine Bewertungen

- Economic Highlights - Vietnam: Real GDP Grew at A Stronger Pace in The 1H-01/07/2010Dokument3 SeitenEconomic Highlights - Vietnam: Real GDP Grew at A Stronger Pace in The 1H-01/07/2010Rhb InvestNoch keine Bewertungen

- Municipal Bond Market CommentaryDokument8 SeitenMunicipal Bond Market CommentaryAnonymous Ht0MIJNoch keine Bewertungen

- Cpi 10122023Dokument38 SeitenCpi 10122023Rafael BorgesNoch keine Bewertungen

- MSFL - Inflation Aug'11Dokument4 SeitenMSFL - Inflation Aug'11Himanshu KuriyalNoch keine Bewertungen

- MPS Feb 2013 CompendiumDokument32 SeitenMPS Feb 2013 CompendiumTufail MallickNoch keine Bewertungen

- December 2013 Construction at $930.5 Billion Annual RateDokument5 SeitenDecember 2013 Construction at $930.5 Billion Annual Rateapi-25887578Noch keine Bewertungen

- No More TimeDokument7 SeitenNo More TimeJorge Monzó BergéNoch keine Bewertungen

- Commercial Real Estate Outlook 2012 11Dokument8 SeitenCommercial Real Estate Outlook 2012 11National Association of REALTORS®Noch keine Bewertungen

- IBO Budget AnalysisDokument17 SeitenIBO Budget Analysishangman0000Noch keine Bewertungen

- Housing Data Wrap-Up: December 2012: Economics GroupDokument7 SeitenHousing Data Wrap-Up: December 2012: Economics GroupAaron MaslianskyNoch keine Bewertungen

- Siena Research Institute: Confidence Down in NY Consumer Recovery StallsDokument4 SeitenSiena Research Institute: Confidence Down in NY Consumer Recovery StallsElizabeth BenjaminNoch keine Bewertungen

- Analysis On 2014 BudgetDokument52 SeitenAnalysis On 2014 BudgetBlogWatchNoch keine Bewertungen

- Jul 16 Erste Group Macro Markets UsaDokument6 SeitenJul 16 Erste Group Macro Markets UsaMiir ViirNoch keine Bewertungen

- B W 09032012Dokument28 SeitenB W 09032012Ray Anthony RodriguezNoch keine Bewertungen

- I Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For TodayDokument4 SeitenI Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For Todayapi-162199694Noch keine Bewertungen

- Country Strategy 2011-2014 RussiaDokument18 SeitenCountry Strategy 2011-2014 RussiaBeeHoofNoch keine Bewertungen

- FICCI Eco Survey 2011 12Dokument9 SeitenFICCI Eco Survey 2011 12Krunal KeniaNoch keine Bewertungen

- Vietnam - Economic Highlights - Stronger Economic Activities in May - 1/6/2010Dokument4 SeitenVietnam - Economic Highlights - Stronger Economic Activities in May - 1/6/2010Rhb InvestNoch keine Bewertungen

- 3 Eco Forecast LaymanDokument21 Seiten3 Eco Forecast LaymanVikas BhatterNoch keine Bewertungen

- The World Economy... - 15/7/2010Dokument3 SeitenThe World Economy... - 15/7/2010Rhb InvestNoch keine Bewertungen

- Residex Quarterly Report - Sep 2013Dokument13 SeitenResidex Quarterly Report - Sep 2013cclan05Noch keine Bewertungen

- Monthly Economic Outlook 06082011Dokument6 SeitenMonthly Economic Outlook 06082011jws_listNoch keine Bewertungen

- Http://kaplan - Diploma.s3.amazonaws - Com/kaplan - Singapore - Academic - Works - and - A PA - Guide - 2013 - v2 PDFDokument10 SeitenHttp://kaplan - Diploma.s3.amazonaws - Com/kaplan - Singapore - Academic - Works - and - A PA - Guide - 2013 - v2 PDFKo Tong AnNoch keine Bewertungen

- What's Driving The U.S. Merchant Power Sector's Credit Outlook For 2012?Dokument13 SeitenWhat's Driving The U.S. Merchant Power Sector's Credit Outlook For 2012?bdmottlNoch keine Bewertungen

- Economics Group: Weekly Economic & Financial CommentaryDokument9 SeitenEconomics Group: Weekly Economic & Financial Commentaryamberyin92Noch keine Bewertungen

- JUNE 2009 Modest Growth, Higher Unemployment Predicted For Second Half of 2009Dokument10 SeitenJUNE 2009 Modest Growth, Higher Unemployment Predicted For Second Half of 2009rebeltradersNoch keine Bewertungen

- Governor Presentation UNFinancial Sector Developmentand Poverty ReductionDokument12 SeitenGovernor Presentation UNFinancial Sector Developmentand Poverty ReductionStellah Tembo ChitakwaNoch keine Bewertungen

- San Mateo County Market Update - November 2011Dokument4 SeitenSan Mateo County Market Update - November 2011Gwen WangNoch keine Bewertungen

- Economic Focus April 16 2012Dokument1 SeiteEconomic Focus April 16 2012Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus Feb. 20, 2012Dokument1 SeiteEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNoch keine Bewertungen

- New Home Sales January 2012Dokument1 SeiteNew Home Sales January 2012Jessica Kister-LombardoNoch keine Bewertungen

- January Existing Home SalesDokument1 SeiteJanuary Existing Home SalesJessica Kister-LombardoNoch keine Bewertungen

- New Home Sales November December) 2011Dokument1 SeiteNew Home Sales November December) 2011Jessica Kister-LombardoNoch keine Bewertungen

- Construction Spending 1-3-12Dokument2 SeitenConstruction Spending 1-3-12Jessica Kister-LombardoNoch keine Bewertungen

- Housing Starts December 2011Dokument1 SeiteHousing Starts December 2011Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus January 30, 2012Dokument1 SeiteEconomic Focus January 30, 2012Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 1-23-12Dokument1 SeiteEconomic Focus 1-23-12Jessica Kister-LombardoNoch keine Bewertungen

- January Housing StartsDokument1 SeiteJanuary Housing StartsJessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 12-12-11Dokument1 SeiteEconomic Focus 12-12-11Jessica Kister-LombardoNoch keine Bewertungen

- Construction Spending December 2011Dokument1 SeiteConstruction Spending December 2011Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 1-16-12Dokument1 SeiteEconomic Focus 1-16-12Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 12-19-11Dokument1 SeiteEconomic Focus 12-19-11Jessica Kister-LombardoNoch keine Bewertungen

- Existing Home SalesDokument1 SeiteExisting Home SalesJessica Kister-LombardoNoch keine Bewertungen

- Housing StartsDokument1 SeiteHousing StartsJessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 11-14-11Dokument1 SeiteEconomic Focus 11-14-11Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 12-5-11Dokument1 SeiteEconomic Focus 12-5-11Jessica Kister-LombardoNoch keine Bewertungen

- Existing Home SalesDokument1 SeiteExisting Home SalesJessica Kister-LombardoNoch keine Bewertungen

- Existing Home Sales October 2011Dokument1 SeiteExisting Home Sales October 2011Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus October 24, 2011Dokument1 SeiteEconomic Focus October 24, 2011Jessica Kister-LombardoNoch keine Bewertungen

- Housing Starts Oct 2011Dokument1 SeiteHousing Starts Oct 2011Jessica Kister-LombardoNoch keine Bewertungen

- Winter Wonderland 2011 - AttendeeDokument1 SeiteWinter Wonderland 2011 - AttendeeJessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 10-10-11Dokument1 SeiteEconomic Focus 10-10-11Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 10-17-11Dokument1 SeiteEconomic Focus 10-17-11Jessica Kister-LombardoNoch keine Bewertungen

- Housing Starts Oct 2011Dokument1 SeiteHousing Starts Oct 2011Jessica Kister-LombardoNoch keine Bewertungen

- New Home Sales September 2011Dokument1 SeiteNew Home Sales September 2011Jessica Kister-LombardoNoch keine Bewertungen

- Economic Focus 9-26-11Dokument1 SeiteEconomic Focus 9-26-11Jessica Kister-LombardoNoch keine Bewertungen

- Technical Data Sheet: Page 1 of 2 HCD-15208 (Rev. 9/4/2014 3:42:32 AM)Dokument2 SeitenTechnical Data Sheet: Page 1 of 2 HCD-15208 (Rev. 9/4/2014 3:42:32 AM)Akhtar AliNoch keine Bewertungen

- Tropical Hut Employees' Union-Cgw vs. TROPICAL HUT FOOD MARKET, INC. G.R. No. L-43495-99, 20 January 1990Dokument2 SeitenTropical Hut Employees' Union-Cgw vs. TROPICAL HUT FOOD MARKET, INC. G.R. No. L-43495-99, 20 January 1990RyoNoch keine Bewertungen

- Briefing Form Perm (Telemarketing) - Bukit JelutongDokument1 SeiteBriefing Form Perm (Telemarketing) - Bukit JelutongThanes RawNoch keine Bewertungen

- Chap 21-2Dokument8 SeitenChap 21-2JackNoch keine Bewertungen

- Audit Report Cash SalesDokument30 SeitenAudit Report Cash SalesPlanco RosanaNoch keine Bewertungen

- Class Visit Iatmi SM Itb 2022Dokument45 SeitenClass Visit Iatmi SM Itb 2022entre Ipfest2022Noch keine Bewertungen

- Catalogo de Tuberías TenarisDokument134 SeitenCatalogo de Tuberías TenarisErwin Jeronimo GarciaNoch keine Bewertungen

- Profit and LossDokument9 SeitenProfit and Lossnganeshn1988Noch keine Bewertungen

- BIM Execution Plan ExampleDokument20 SeitenBIM Execution Plan ExampleDarell IvanderNoch keine Bewertungen

- Unit IDokument32 SeitenUnit Ithebrahyz0% (1)

- Administrative Secretary Job DescriptionDokument8 SeitenAdministrative Secretary Job DescriptionadministrativemanageNoch keine Bewertungen

- Week 12 Compulsory Quiz - Attempt Review 2ndDokument5 SeitenWeek 12 Compulsory Quiz - Attempt Review 2nd정은주Noch keine Bewertungen

- Principles of Marketing Lesson 1Dokument59 SeitenPrinciples of Marketing Lesson 1Lorraine Sambile Arroyo67% (3)

- Management Tri Nova CaseDokument4 SeitenManagement Tri Nova CaseAie Kah Dupal100% (2)

- MKT425 Ch4 Reference GroupsDokument29 SeitenMKT425 Ch4 Reference GroupsefritzgeraldNoch keine Bewertungen

- Radhakrishnan .P, Prasad .V, Gopalan .MDokument2 SeitenRadhakrishnan .P, Prasad .V, Gopalan .MPGDM IMSNoch keine Bewertungen

- Franchise & Consignment ProblemsDokument10 SeitenFranchise & Consignment ProblemsCeline Marie AntonioNoch keine Bewertungen

- Analyst Assessment Test - 1 (ANSWER)Dokument4 SeitenAnalyst Assessment Test - 1 (ANSWER)Christian CabadonggaNoch keine Bewertungen

- St. Peter's MBA Distance Education Regulations and SyllabiDokument73 SeitenSt. Peter's MBA Distance Education Regulations and SyllabiRaghavendra Pundaleek ChittaNoch keine Bewertungen

- Value Stream MappingDokument35 SeitenValue Stream MappingNevets NonnacNoch keine Bewertungen

- Maru Batting Center Case Study Excel Group YellowDokument26 SeitenMaru Batting Center Case Study Excel Group YellowAshish PatwardhanNoch keine Bewertungen

- SHE Organogram 013Dokument6 SeitenSHE Organogram 013Saif Mohammad KhanNoch keine Bewertungen

- VF Brands - Case Write Up - Group8Dokument6 SeitenVF Brands - Case Write Up - Group8maheshNoch keine Bewertungen

- Financial Ratios QuizDokument4 SeitenFinancial Ratios QuizHamieWave TVNoch keine Bewertungen

- Slime Blaster EN71 ReportDokument15 SeitenSlime Blaster EN71 ReportZimpli KidsNoch keine Bewertungen

- City, Corp liable for market injuryDokument6 SeitenCity, Corp liable for market injuryGeorge PandaNoch keine Bewertungen

- Project On Pepsico PerformanceDokument68 SeitenProject On Pepsico Performancerahul mehtaNoch keine Bewertungen

- Key Performance Indicators MST NDokument14 SeitenKey Performance Indicators MST NmscarreraNoch keine Bewertungen

- Date (Value Date) Narration Ref/Cheque No. Debit Credit BalanceDokument5 SeitenDate (Value Date) Narration Ref/Cheque No. Debit Credit BalanceanubhaNoch keine Bewertungen

- Audit Switching QuestionnaireDokument2 SeitenAudit Switching QuestionnaireAnvly Ho Yoke WeiNoch keine Bewertungen