Beruflich Dokumente

Kultur Dokumente

ETF Technical Analysis and Forex Technical Analysis Chart Book For August 01 2011

Hochgeladen von

Alan Posner0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten4 SeitenOur focus over the last two weeks has been the persistent weakness of economic numbers and the markets conclusion that a rebound in the second half may not be coming. While the media has been squarely focused on the debt ceiling debate our commentary has been more concerned over economic growth and employment. As this commentary is written the

congress is coming together to make a deal on the debt ceiling. Regardless of the benefit of this deal stocks have now reached the bottom of their respective channels. Stocks are ready to bounce not because of optimism but rather because the short term pessimism is excessive. The negative overhang is in place and now is a time for equities to bounce in the short term. The analysis is for educational purposes only and not a solicitation to buy or sell any security at any time. The

comments are made in the context of ETF position trading and Forex position trading. Visit my technical analysis blog for more information at http://www.sealionllc.com

Originaltitel

ETF Technical Analysis and Forex Technical Analysis Chart Book for August 01 2011

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenOur focus over the last two weeks has been the persistent weakness of economic numbers and the markets conclusion that a rebound in the second half may not be coming. While the media has been squarely focused on the debt ceiling debate our commentary has been more concerned over economic growth and employment. As this commentary is written the

congress is coming together to make a deal on the debt ceiling. Regardless of the benefit of this deal stocks have now reached the bottom of their respective channels. Stocks are ready to bounce not because of optimism but rather because the short term pessimism is excessive. The negative overhang is in place and now is a time for equities to bounce in the short term. The analysis is for educational purposes only and not a solicitation to buy or sell any security at any time. The

comments are made in the context of ETF position trading and Forex position trading. Visit my technical analysis blog for more information at http://www.sealionllc.com

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For August 01 2011

Hochgeladen von

Alan PosnerOur focus over the last two weeks has been the persistent weakness of economic numbers and the markets conclusion that a rebound in the second half may not be coming. While the media has been squarely focused on the debt ceiling debate our commentary has been more concerned over economic growth and employment. As this commentary is written the

congress is coming together to make a deal on the debt ceiling. Regardless of the benefit of this deal stocks have now reached the bottom of their respective channels. Stocks are ready to bounce not because of optimism but rather because the short term pessimism is excessive. The negative overhang is in place and now is a time for equities to bounce in the short term. The analysis is for educational purposes only and not a solicitation to buy or sell any security at any time. The

comments are made in the context of ETF position trading and Forex position trading. Visit my technical analysis blog for more information at http://www.sealionllc.com

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Our focus over the last two weeks has been the persistent weakness of economic numbers and

the markets conclusion that

a rebound in the second half may not be coming. While the media has been squarely focused on the debt ceiling debate

our commentary has been more concerned over economic growth and employment. As this commentary is written the

congress is coming together to make a deal on the debt ceiling. Regardless of the benefit of this deal stocks have now

reached the bottom of their respective channels. Stocks are ready to bounce not because of optimism but rather because

the short term pessimism is excessive. The negative overhang is in place and now is a time for equities to bounce in the

short term. The analysis is for educational purposes only and not a solicitation to buy or sell any security at any time. The

comments are made in the context of ETF position trading and Forex position trading. Visit my technical analysis blog for

more information at http://www.sealionllc.com

Economic concerns trump debt deal

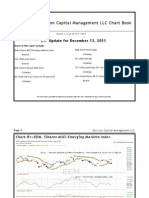

Chart #1SPY, SPDR S&P 500

Please support us by choosing services from our partners. The offers are free and help support this

chart book, our video analysis on YouTube, and other great services. Your support is greatly appreci-

ated. Visit our website www.sealionllc.com for more ETF technical analysis, Forex technical analysis

and thoughts on ETF position trading and Forex position trading. We maintain a technical analysis

blog and demonstrate ETF expertise and Forex expertise. You can get more information on our part-

ners there as well.

This chart book is for educational purposes only and not a solicitation to buy or sell any security.

08/01/2011 Volume 1, Issue 16

Sea Lion Capital Management LLC

Chart Book

Chart Notes

3. Possible lower high with shooting star

candle

4. Prices are now above the median line of

the bullish channel and have found short

-term resistance.

5. Prices rally through resistance and out

of the channel. A consolidation will be

required before the next move up.

6. No consolidation yet as prices are rising

along channel resistance.

7. Prices retreat to prior resistance now

support for consolidation

8. Prices testing lower channel support and

need to reverse quickly to maintain the

rally

9. Prices could be back testing setting up a

move lower but more likely the channel

needs to be redrawn or this is a

temporary noisy overshoot.

10. Prices have no violated the channel

support and are trying a back test. The

back looks weak in nature.

11. Prices have broken through the channel

and head lower gyrating around their

median line.

12. Prices have exceeded their channel but

consolidated and stopped under prior

channel support. This bull trap will

reverse shortly.

13. Prices under old support line from prior

channel and at resistance of redrawn

channel.

14. With resistance tested and in place

prices have moved lower and begin their

move to the bottom of the channel.

15. Prices move aggressively half way across

the channel and are driving toward

channel bottom.

16. Prices reached channel bottom and have

bounced. The hammer bottom should

hold and prices should rise from here.

17. Prices are gyrating sideways and

forming a base from which they can

bounce. The bounce may be short

lived.

Page 2

Sea Lion Capital Management LLC

Prices have bounced with a hammer bottom and moved higher. This will serve as the near term

low while the debt ceiling legislation comes together. Once the deal is done we anticipate a rever-

sal but will be watching price action to determine when.

Chart Notes:

3. Possible change in trend needs

confirmation with a new high.

4. Prices are now in the upper half of

the bullish channel and have more

room to run.

5. Prices have continued up and no

extend beyond the channel. Prices

will need to consolidate before the

next leg higher.

6. Prices rising along resistance.

7. A return to former resistance now

turned support. A mild consolida-

tion has begun.

8. Testing the median line. Price

often finds support here.

9. Prices found support at the median

line and are poised to move higher.

10. Prices are holding their channel

support and a bounce may occur.

11. Prices have broken channel support

and are falling around the median

line.

12. Price have stopped at channel

resistance but need to reverse to

maintain the downtrend channel.

13. Prices at the apex of old support

now resistance and the current

channel resistance. Prices will

reverse soon.

14. Prices failed to hold their afternoon

rally and are now moving lower.

15. Prices gapped lower and may now

challenge the lower portion of the

channel.

16. Having found the bottom of the

channel and bounced with a

hammer prices should rise from

here in the near term.

17. Prices are bouncing around support

and forming the base necessary to

move higher.

Chart #2IWM, iShares Russell 2000

Page 3

Volume 1, Issue 16

Prices broke lower today with a rise in Euro zone concerns and optimism over the US debt ceiling.

Chart# 3EUR/USD, Eurodollar

Chart Notes:

1. Markets bullish trend broken

with violation of prior swing low.

2. Markets bounces and reverses

but puts in a lower high.

3. Market retests $1.40 low and if it

holds a sideways channel is in

place.

4. Prices reverse on support in an

evening star reversal in a show

of strength and the markets

wiliness to be open to risk.

5. Prices have failed to advance the

reversal and are now below the

reversal high. A retest of lower

channel support looks likely.

6. Prices made a dead-cat

bounce and will head lower to

range support.

7. Prices have edged higher but are

still below the median line and

are poised to reverse.

8. Prices rallied just short of the

prior high and have begun to

possibly reverse. A reversal

would correlate with a downturn

in equities.

9. The Euro strengthens against a

weak dollar and mild concern

over the US debt ceiling crisis.

Prices will reverse shortly.

10. Prices reversed hard today and a

new downtrend has begun.

11. Prices paused in their move

down but this is temporary as

the next moves are lower.

12. Prices finished lower but have

not closed lower than the lows of

last week. A break of the

median line will accelerate the

selloff.

Why Sea Lion Capital Management?

Everyone needs help investing money. Whether for retirement or addi-

tional income everyone wants to benefit from our free market capitalist

system to increase their wealth. The problem is most individual investors

lose money. In every trade there is a winner and a loser and the global

marketplace moves so fast and is so complex the "Average Joe" investor

has no chance. Most individual investors end up losing money in misplaced

stocks and mutual funds. The psychological pain of watching hard earned

money be lost makes most individual investors "buy high and sell low".

More than half of all managed mutual funds cannot even keep up with the

market indexes. If you have invested in the past and are frustrated with

the lack of quality returns we can help.

The Difference

Sea Lion Capital is a unique approach to wealth management. While most

investment advisors require their clients to have hundreds of thousands of

dollars we can work with you with as little as $10,000. Most investment

advisors require you to use an expensive broker whereas Sea Lion Capital

is partners with one whose commission fees are some of the lowest in the

industry. We know everyone is concerned about wealth management but

few know what to do about it. The internet has revolutionized home mort-

gages, tax services, insurance, and other financial services - the time has

come for Investment Advisory services as well.

633 Normandy Vlg

Nanuet, NY 10954

Phone: 877-242-8880

Fax: 877-242-8880

E-mail: support@sealionllc.com

Sea Lion Capital

Management LLC

Coming Soon.

Video Introduction to Sea Lion Capital Management LLC

Uncommon Wisdom for All

VI SI T OUR WEB S I TE AND OUR BLOG

WWW. SEALI ONLLC. COM

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Free ETF Technical Analysis and Forex Technical Analysis Chart Book Sample For November 4 2011Dokument6 SeitenFree ETF Technical Analysis and Forex Technical Analysis Chart Book Sample For November 4 2011Alan PosnerNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Sea Lion Capital ETF and Forex Update 03-19-2012Dokument1 SeiteSea Lion Capital ETF and Forex Update 03-19-2012Alan PosnerNoch keine Bewertungen

- Commoweath Bank Market Insight Weekly 11-20-2011Dokument5 SeitenCommoweath Bank Market Insight Weekly 11-20-2011Alan PosnerNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ETF Technical Analysis Chart Book For December 13 2011Dokument10 SeitenETF Technical Analysis Chart Book For December 13 2011Alan Posner100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- BMO Global Equity Weekly 11-18-2011Dokument4 SeitenBMO Global Equity Weekly 11-18-2011Alan PosnerNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- ETF Technical Analysis Chart Book For December 15 2011Dokument10 SeitenETF Technical Analysis Chart Book For December 15 2011Alan PosnerNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- KBC Morning Sunrise Market Commentary 09-012-2011Dokument7 SeitenKBC Morning Sunrise Market Commentary 09-012-2011Alan PosnerNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- KBC Banking Morning Sunrise Market Commentary 09-19-2011Dokument8 SeitenKBC Banking Morning Sunrise Market Commentary 09-19-2011Alan PosnerNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- KBC Morning Sunrise Market Commentary - 10!31!2011Dokument9 SeitenKBC Morning Sunrise Market Commentary - 10!31!2011Alan PosnerNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For September 16 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For September 16 2011Alan PosnerNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Commonweath Bank Global Market Research - Economics: PerspectiveDokument25 SeitenCommonweath Bank Global Market Research - Economics: PerspectiveAlan PosnerNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For August 03 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For August 03 2011Alan PosnerNoch keine Bewertungen

- The Many Dangers of Low-for-Long Interest RatesDokument15 SeitenThe Many Dangers of Low-for-Long Interest RatesAlan PosnerNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Commonwealth Bank Economics Daily Alert 09-13-2011Dokument11 SeitenCommonwealth Bank Economics Daily Alert 09-13-2011Alan PosnerNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For August 12 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For August 12 2011Alan PosnerNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- China Economic Daily - Beijing House Prices TumbleDokument4 SeitenChina Economic Daily - Beijing House Prices TumbleAlan PosnerNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For September 9 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For September 9 2011Alan PosnerNoch keine Bewertungen

- ETF Technical Analysis and Forex Technical Analysis Chart Book For August 15 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For August 15 2011Alan PosnerNoch keine Bewertungen

- Commonweath Bank Economics: Global Markets Research Daily Alert 08-31-2011Dokument9 SeitenCommonweath Bank Economics: Global Markets Research Daily Alert 08-31-2011Alan PosnerNoch keine Bewertungen

- KBC Morning Sunrise Market Commentary 09-02-2011Dokument10 SeitenKBC Morning Sunrise Market Commentary 09-02-2011Alan PosnerNoch keine Bewertungen

- Commonweath Bank Economics: Global Markets Research Daily AlertDokument8 SeitenCommonweath Bank Economics: Global Markets Research Daily AlertAlan PosnerNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For August 08 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For August 08 2011Alan PosnerNoch keine Bewertungen

- Danske Daily Investment Research - General Market Conditions 08-15-2011Dokument5 SeitenDanske Daily Investment Research - General Market Conditions 08-15-2011Alan PosnerNoch keine Bewertungen

- KBC Morning Sunrise Market Commentary 09-07-2011Dokument10 SeitenKBC Morning Sunrise Market Commentary 09-07-2011Alan PosnerNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For July 29 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For July 29 2011Alan PosnerNoch keine Bewertungen

- ETF Technical Analysis and Forex Technical Analysis Chart Book For July 27 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For July 27 2011Alan PosnerNoch keine Bewertungen

- ETF Technical Analysis and Forex Technical Analysis Chart Book For July 25 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For July 25 2011Alan Posner0% (1)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For July 20 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For July 20 2011Alan PosnerNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- ETF Technical Analysis and Forex Technical Analysis Chart Book For July 22 2011Dokument4 SeitenETF Technical Analysis and Forex Technical Analysis Chart Book For July 22 2011Alan PosnerNoch keine Bewertungen

- Tax Reviewer For MidtermDokument4 SeitenTax Reviewer For Midtermjury jasonNoch keine Bewertungen

- Chap 013Dokument141 SeitenChap 013theluckless77750% (2)

- Placement Report 2023Dokument9 SeitenPlacement Report 2023Star WhiteNoch keine Bewertungen

- The Seven Elements of CultureDokument2 SeitenThe Seven Elements of CultureДарья СухоборченкоNoch keine Bewertungen

- Macro Unit 2 WorksheetDokument5 SeitenMacro Unit 2 WorksheetSeth KillianNoch keine Bewertungen

- Its The Economy, Student! by Gloria Macapagal ArroyoDokument9 SeitenIts The Economy, Student! by Gloria Macapagal ArroyodabomeisterNoch keine Bewertungen

- Evaluasi Penerapan Perlakuan Akuntansi Psak 24 Pada PT Gudang Garam TBKDokument9 SeitenEvaluasi Penerapan Perlakuan Akuntansi Psak 24 Pada PT Gudang Garam TBKphoechoexNoch keine Bewertungen

- Certification of Residency - Form A - AccomplishedDokument2 SeitenCertification of Residency - Form A - AccomplishedjonbertNoch keine Bewertungen

- Report of The Third South Asian People's SummitDokument220 SeitenReport of The Third South Asian People's SummitMustafa Nazir Ahmad100% (1)

- From Resistance To Renewal: A 12 Step Program For The California Economy by Manuel Pastor and Chris BennerDokument118 SeitenFrom Resistance To Renewal: A 12 Step Program For The California Economy by Manuel Pastor and Chris BennerProgram for Environmental And Regional Equity / Center for the Study of Immigrant IntegrationNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Proposal Project AyamDokument14 SeitenProposal Project AyamIrvan PamungkasNoch keine Bewertungen

- Wilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Dokument2 SeitenWilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Alvin Ryan KipliNoch keine Bewertungen

- List of High, Middle and Low Income CountriesDokument4 SeitenList of High, Middle and Low Income CountriesMei-Lanny MancillaNoch keine Bewertungen

- India Road Network The Second Largest Road NetworkDokument19 SeitenIndia Road Network The Second Largest Road NetworkKushal rajNoch keine Bewertungen

- Bata FactsDokument3 SeitenBata FactsPrashant SantNoch keine Bewertungen

- Read The Article and Tick BedzedDokument1 SeiteRead The Article and Tick BedzedYaqueline Santamaria FerreñanNoch keine Bewertungen

- Project ProposalDokument7 SeitenProject Proposalrehmaniaaa100% (3)

- Paul Buchanan - Traffic in Towns and Transport in CitiesDokument20 SeitenPaul Buchanan - Traffic in Towns and Transport in CitiesRaffaeleNoch keine Bewertungen

- Nama Peserta BPPDokument53 SeitenNama Peserta BPPInge Syahla KearyNoch keine Bewertungen

- Buyer Questionnaire: General QuestionsDokument3 SeitenBuyer Questionnaire: General Questionsshweta meshramNoch keine Bewertungen

- International Marketing "Country Notebook" Export of Cardamom To Saudi ArabiaDokument28 SeitenInternational Marketing "Country Notebook" Export of Cardamom To Saudi ArabiaPurohit SagarNoch keine Bewertungen

- Asx S&P 200Dokument15 SeitenAsx S&P 200abcfactcheckNoch keine Bewertungen

- Indias Defence BudgetDokument1 SeiteIndias Defence BudgetNishkamyaNoch keine Bewertungen

- Accesorios Ape TheexzoneDokument64 SeitenAccesorios Ape TheexzoneLucas GomezNoch keine Bewertungen

- Chapter 6 - Product and Service StrategiesDokument32 SeitenChapter 6 - Product and Service StrategiesralphalonzoNoch keine Bewertungen

- Kanlaon Vs NLRCDokument3 SeitenKanlaon Vs NLRCJade Belen Zaragoza0% (2)

- Capacity Management in Service FirmsDokument10 SeitenCapacity Management in Service FirmsJussie BatistilNoch keine Bewertungen

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDokument2 SeitenAccount Statement: Date Value Date Description Cheque Deposit Withdrawal BalancesadhanaNoch keine Bewertungen

- CRN 7075614092Dokument3 SeitenCRN 7075614092Prasad BoniNoch keine Bewertungen

- Notice 11120 02 Apr 2024Dokument669 SeitenNotice 11120 02 Apr 2024bhattacharya.devangana2Noch keine Bewertungen