Beruflich Dokumente

Kultur Dokumente

Final Sa Assgmnt

Hochgeladen von

saurabhtayal88Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Final Sa Assgmnt

Hochgeladen von

saurabhtayal88Copyright:

Verfügbare Formate

INTRODUCTION TO THE IPO

Godrej Properties came out with an IPO of 9,429,750 equity shares of Rs 10 each. The issue was opened for subscription on December 9 and closed on December 11, 2009. The issue constitute 13.5% of the post issue paid-up capital of the company. Godrej Industries, the parent company, at that time holds 80.26% of equity share capital in the company. The company is in the business of real estate development in India. It currently has real estate development projects in 10 cities in India, which are at various stages of development. The proceeds of the issue was used for acquisition of land development rights for forthcoming projects; construction of forthcoming project and repayment of loans. The equity shares were proposed to be listed on the BSE and NSE. For the year ended March 31, 2009, the company reported profit after tax of Rs 74.74 crore on total income of Rs 188.13 crore. As on June 30, 2009, it has debt of Rs 745.78 crore on its books. Global Co-ordinators and book running lead managers to the issue were ICICI Securities Limited, Kotak Mahindra Capital Company Limited, IDFC SSKI Limited and Nomura Financial Advisory and Securities (India) Private Limited. Karvy Computershare Private Limited was the registrar. We would not recommend investors to invest in this IPO. Watch out this blog for details on subscription, allotment and listing!

Minimum Subscription

If the Company does not receive the minimum subscription of 90% of the Issue, including devolvement of underwriters within 60 days from the Bid/Issue Closing Date, the Company shall forthwith refund the entire subscription amount received. If there is a delay beyond eight (8) days after the Company becomes liable to pay the amount, the Company shall pay interest prescribed under Section 73 of the Companies Act. If at least 60% of the Issue cannot be allocated to QIBs, then the entire application money will be refunded forthwith. Further, we shall ensure that the number of prospective allotees to whom Equity Shares will be allotted shall not be less than 1,000. The Equity Shares have not been and will not be registered, listed or otherwise qualified in any other jurisdiction outside India and may not be offered or sold, and Bids may not be made by persons in any such jurisdiction.

Restriction on transfer of shares

Except for lock-in of the pre-Issue Equity Shares and Promoters minimum contribution in the Issue as detailed in the section entitled Capital Structure on page 26 of this Draft Red Herring Prospectus, and except as provided in our Articles, there are no restrictions on transfers of Equity Shares. There are no restrictions on transfers of debentures except as provided in our Articles. There are no restrictions on transmission of shares/debentures and on their consolidation/ splitting except as provided in our Articles

TERMS OF THE ISSUE

The Equity Shares being issued are subject to the provisions of the Companies Act, our Memorandum and Articles, the terms of this Draft Red Herring Prospectus, the Red Herring Prospectus and the Prospectus, Bid cum Application Form, the Revision Form, the CAN and other terms and conditions as may be incorporated in the Allotment advices and other documents/ certificates that may be executed in respect of the Issue. The Equity Shares shall also be subject to laws, guidelines, notifications and regulations relating to the issue of capital and listing of securities issued from time to time by SEBI, the Government of India, Stock Exchanges, RoC, RBI and/or other authorities, as in force on the date of the Issue and to the extent applicable. Ranking of Equity Shares The Equity Shares being issued shall be subject to the provisions of our Memorandum and Articles of Association and shall rank pari-passu with the existing Equity Shares of the Company including rights in respect of dividend. The Allotees in receipt of Allotment of Equity Shares under this Issue will be entitled to dividends and other corporate benefits, if any, declared by the Company after the date of Allotment. For further details, please see Main Provisions of the Articles of Association on page 392 of this Draft Red Herring Prospectus. Mode of Payment of Dividend We shall pay dividends to our shareholders in accordance with the provisions of the Companies Act. Face Value and Issue Price The face value of the Equity Shares is Rs. 10 each and the Issue Price is Rs per Equity Share. The Anchor Investor Issue Price is Rs. 10 per Equity Share. At any given point of time there shall be only one denomination for the Equity Shares Category A B C D No. of Applications Retail Individual Bidders Non Institutional Bidders Qualified Institutional Bidders Anchors Total No. of Shares 18,300 50 57 4 18,411 No. of times subscription 1,025,235 343,837 29,503,552 2,686,528 33,559,152

0.36 0.36 7,45 1.58 3.56

Final Demand

The final demand at different bid prices is as under: Bid Price 490 491 492 493 494 495 496 497 498 499 500 501 No. of Shares 21,917,584 26 65 221 26 13 801,983 78 % to total 70.82 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2.59 0.00 Cumulative Total 30,948,996 9,031,412 9,031,386 9,031,321 9,031,321 9,031,321 9,031,100 9,031,074 9,031,074 9,031,061 9,031,061 8,229,078 Cumulative % of Total 100.00 29.18 29.18 29.18 29.18 29.18 29.18 29.18 29.18 29.18 29.18 26.59

502 503 504 505 506 507 508 509 510 511 512 513 514 515 516 517 518 519 520 521 522 523 524 525 526 527 528 529 530

65 117 13 13 41,171 91 13 221 26 1,170 819 13 39 13 8,185,216

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.13 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 26.45

8,229,000 8,228,935 8,228,935 8,228,935 8,228,818 8,228,805 8,228,805 8,228,792 8,228,792 8,187.621 8,187,621 8,187,530 8,187,517 8,187,517 8,187,296 8,187,296 8,187,296 8,187,270 8,187,270 8,186,100 8,186,100 8,186,100 8,186,100 8,186,100 8,185,281 8,185,281 8,185,268 8,185,229 8,185,216

26.59 26.59 26.59 26.59 26.59 26.59 26.59 26.59 26.59 26.46 26.46 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45 26.45

The Basis of Allocation was finalized in consultation with the Designated Stock Exchange, being the Bombay Stock Exchange Limited ("BSE") on December 23, 2009.

ISSUE STRUCTURE

Issue of 9,429,750 Equity Shares for cash at a price of Rs. 10 per Equity Share (including share premium of Rs. 2 per Equity Share). The Issue will constitute 13.5% of the post-issue paid-up capital of the Company. The Company is considering a pre-IPO placement of up to 2,444,750 Equity Shares with certain investors (Pre-IPO Placement). The Pre-IPO Placement is at the discretion of the Company. The Company will complete the issuance, if any, of such Equity Shares prior to the filing of the Red Herring Prospectus with the ROC. If the Pre-IPO Placement is completed, then the Issue size offered to the public will be reduced to the extent of such Pre-IPO Placement, subject to a minimum Issue size of 10% of the post Issue capital being offered to the public

QIBs

Non-Institutional Bidders

Retail Individual Bidders

Number Shares

of

Equity At least 5,657,850 Equity Shares

Not less than 942,975 Equity Shares available for allocation or Issue less allocation to QIB Bidders and Retail Individual Bidders. Not less than 10% of Issue or the Issue less allocation to QIB Bidders and Retail Individual Bidders.

Percentage of Issue Size available for Allotment/allocation

Basis of Allotment/Allocation if respective category is oversubscribed

Minimum Bid

Maximum Bid

Mode of Allotment

At least 60% of the Issue Size being allocated. However, up to 5% of the QIB Portion (excluding the Anchor Investor Portion) shall be available for allocation proportionately to Mutual Funds only. Proportionate as follows: (a) 282,893 Equity Shares shall be allocated on a proportionate basis to Mutual Funds; and (b) 5,374,957 Equity Shares shall be allotted on a proportionate basis to all QIBs including Mutual Funds receiving allocation as per (a) above. Such number of Equity Shares that the Bid Amount exceeds Rs. 100,000 and in multiples of [] Equity Shares thereafter. Such number of Equity Shares not exceeding the Issue, subject to applicable limits. Compulsorily in dematerialised form

Not less than 2,828,925 Equity Shares available for allocation or Issue less allocation to QIB Bidders and NonInstitutional Bidders. Not less than 30% of the Issue or the Issue less allocation to QIB Bidders and NonInstitutional Bidders.

Proportionate

Proportionate

Such number of Equity Shares that the Bid Amount exceeds Rs. 100,000 and in multiples of [] Equity Shares thereafter. Such number of Equity Shares not exceeding the Issue subject to applicable limits. Compulsorily in dematerialised form.

Equity Shares

Such number of Equity Shares whereby the Bid Amount does not exceed Rs. 100,000. Compulsorily in dematerialised form.

Bid lot

Allotment Lot

Equity Shares and in multiples of [_] Equity Shares thereafter. Equity Shares and in multiples of 1 Equity Share thereafter One Equity Share

Equity Shares and in multiples of [_] Equity Shares thereafter. Equity Shares and in multiples of 1 Equity Share thereafter One Equity Share

Equity Shares and in multiples of [_] Equity Shares thereafter. Equity Shares and in multiples of 1 Equity Share thereafter One Equity Share

Trading Lot

Terms of Payment

Margin Amount

Margin Amount shall be payable at the time of submission of Bid cum Application Form to the Syndicate Members. Up to 10% of Bid Amount

Amount shall be Amount shall be payable payable at the time of at the time of submission submission of Bid cum of Bid cum Application Application Form. Form. Full Bid Amount on bidding Full Bid Amount on bidding

BASIS OF ALLOTMENT

A. For Retail Individual Bidders Bids received from the Retail Individual Bidders at or above the Issue Price shall be grouped together to determine the total demand under this category. The Allotment to all the successful Retail Individual Bidders will be made at the Issue Price. The Issue size less Allotment to Non-Institutional and QIB Bidders shall be available for Allotment to Retail Individual Bidders who have bid in the Issue at a price that is equal to or greater than the Issue Price. If the aggregate demand in this category is less than or equal to [_] Equity Shares at or above the Issue Price, full Allotment shall be made to the Retail Individual Bidders to the extent of their valid Bids. If the aggregate demand in this category is greater than [_] Equity Shares at or above the Issue Price, the Allotment shall be made on a proportionate basis up to a minimum of [] Equity Shares. The Basis of Allocation to the Retail Individual Bidders, who have bid at cut-off or at the Issue Price of Rs.490/- per Equity Share, was finalized in consultation with BSE. This category has been subscribed to the extent of 0.35 times. Hence full and firm allotments were made to all valid applicants in this category. The total number of Equity Shares allotted in Retail Individual Bidders category is 1,010,815 Equity Shares to 18,075 applicants. 4,932 applications for 247,728 Equity Shares were made under the ASBA process. 4,910 applications for 247,013 Equity Shares were found valid and they were considered for allotment.

B. For Non-Institutional Bidders Bids received from Non-Institutional Bidders at or above the Issue Price shall be grouped together to determine the total demand under this category. The Allotment to all successful Non-Institutional Bidders will be made at the Issue Price. The Issue size less Allotment to QIBs and Retail Portion shall be available for Allotment to

Non-Institutional Bidders who have bid in the Issue at a price that is equal to or greater than the Issue Price. 372 If the aggregate demand in this category is less than or equal to [_] Equity Shares at or above the Issue Price, full Allotment shall be made to Non-Institutional Bidders to the extent of their demand. In case the aggregate demand in this category is greater than [_] Equity Shares at or above the Issue Price, Allotment shall be made on a proportionate basis up to a minimum of [] Equity Shares. For the method of proportionate basis of Allotment refer below.

The Basis of Allocation to the Non institutional Investors, who have bid at or above the Issue Price of Rs 490/- per Equity Share, was finalized in consultation with BSE. The category was subscribed 0.36 times. Hence full and firm allotments were made to all valid applicants in this category. The total number of shares allotted in this category is 342,186 Equity Shares to 48 applicants.

C. For QIBs Bids received from the QIB Bidders at or above the Issue Price shall be grouped together to determine the total demand under this portion. The Allotment to all the QIB Bidders will be made at the Issue Price. The QIB Portion shall be available for Allotment to QIB Bidders who have bid in the Issue at a price that is equal to or greater than the Issue Price. Allotment shall be undertaken in the following manner: A. In the first instance allocation to Mutual Funds for up to 5% of the QIB Portion (excluding Anchor Investor Portion) shall be determined as follows: (i). In the event that Mutual Fund Bids exceeds 5% of the QIB Portion (excluding Anchor Investor Portion), allocation to Mutual Funds shall be done on a proportionate basis for up to 5% of the QIB Portion (excluding Anchor Investor Portion). (ii) In the event that the aggregate demand from Mutual Funds is less than 5% of the QIB Portion (excluding Anchor Investor Portion) then all Mutual Funds shall get full Allotment to the extent of valid bids received above the Issue Price. (iii) Equity Shares remaining unsubscribed, if any, not allocated to Mutual Funds shall be available for Allotment to all QIB Bidders as set out in (b) below; B.) In the second instance Allotment to all QIBs shall be determined as follows: (i) In the event that the oversubscription in the QIB Portion, all QIB Bidders who have submitted Bids above the Issue Price shall be allotted Equity Shares on a proportionate basis for up to 95% of the QIB Portion. (ii) Mutual Funds, who have received allocation as per (a) above, for less than the number of Equity Shares Bid for by them, are eligible to receive Equity Shares on a proportionate basis along with other QIB Bidders. (iii) Under-subscription below 5% of the QIB Portion (excluding Anchor Investor Portion), if any, from Mutual Funds, would be included for allocation to the remaining QIB Bidders on a proportionate basis.

2,418,899 equity shares being the aggregate unsubscribed portion from Retail Individual Investors & Non Institutional Investors category were added to the QIB Category and hence the total number of shares allotted to QIBs were 8,076,749. Since, Anchor Investors were allotted 1,697,345 shares, the balance shares available for allotment to QIBs was arrived at 6,379,404. Allocation to QIBs have been done on a proportionate basis in consultation with the Bombay Stock Exchange Limited. As per the SEBI Regulations, Mutual Funds were initially allotted 5% of the quantum of shares available (318,970) and other QIBs and unsatisfied demands of Mutual Funds were allotted the remaining available shares (6,060,434) on proportionate basis. Mutual Funds were allotted 5% for QIB segment and other QIB applicants were allotted 55% of the shares for QIB segment.

Category No. of Shares

Fls/Banks 792,875

MFs 2,761,987

Flls 3,384,208

Insurance Companies 1,137,679

Total 8,076,749

D. For Anchor Investor Portion Allocation of Equity Shares to Anchor Investors at the Anchor Investor Issue Price will be at the discretion of the Company, in consultation with the GCBRLMs and the BRLMs, subject to compliance with the following requirements: o not more than 30% of the QIB Portion will be allocated to Anchor Investors; o one-third of the Anchor Investor Portion shall be reserved for domestic Mutual Funds, subject to valid Bids being received from domestic Mutual Funds at or above the price at which allocation is being done to Anchor Investors; o allocation to Anchor Investors shall be on a discretionary basis and subject to a minimum number of two Anchor Investors for allocation upto Rs. 2,500 million and minimum number of five Anchor Investors for allocation more than Rs. 2,500 million. The number of Equity Shares Allotted to Anchor Investors and the Anchor Investor Issue Price, shall be made available in the public domain by the GCBRLMs and the BRLMs before the Bid Opening Date by intimating the stock exchanges and uploading the said details on the websites of the BRLMs and on the terminals of the Syndicate Members. The Company allocated 1,697,345 Equity Shares to 4 Anchor Investors in consultation with the Global Co-ordinaters and Book Running Lead Managers and Book Running Lead Managers. This represents 30% of the QIB Portion.

Method of Proportionate Basis of Allotment in the Issue

In the event of the Issue being over-subscribed, the Company shall finalise the basis of Allotment in consultation with the Designated Stock Exchange. The Executive Director (or any other senior official nominated by them) of the Designated Stock Exchange along with the GCBRLMs, the BRLMs and the Registrar to the Issue shall be responsible for ensuring that the basis of Allotment is finalised in a fair andproper manner. The Allotment shall be made in marketable lots, on a proportionate basis as explained below: a) Bidders will be categorised according to the number of Equity Shares applied for. b) The total number of Equity Shares to be allotted to each category as a whole shall be arrived at on a proportionate basis, which is the total number of Equity Shares applied for in that category (number of Bidders in the category multiplied by the number of Equity Shares applied for) multiplied by the inverse of the over-subscription ratio. c) Number of Equity Shares to be allotted to the successful Bidders will be arrived at on a proportionate basis, which is total number of Equity Shares applied for by each Bidder in that category multiplied by the inverse of the over-subscription ratio. d) In all Bids where the proportionate Allotment is less than [] Equity Shares per Bidder, the Allotment shall be made as follows: The successful Bidders out of the total Bidders for a category shall be determined by draw of lots in a manner such that the total number of Equity Shares allotted in that category is equal to the number of Equity Shares calculated in accordance with (b) above; and Each successful Bidder shall be allotted a minimum of [] Equity Shares. e) If the proportionate Allotment to a Bidder is a number that is more than [] but is not a multiple of 1(which is the marketable lot), the decimal would be rounded off to the higher whole number if that decimal is 0.5 or higher. If that number is lower than 0.5 it would be rounded off to the lower whole number. Allotment to all in such categories would be arrived at after such rounding off. f) If the Equity Shares allocated on a proportionate basis to any category are more than the Equity Shares allotted to the Bidders in that category, the remaining Equity Shares available for Allotment shall be first adjusted against any other category, where the allotted shares are not sufficient for proportionate Allotment to the successful Bidders in that category. The balance Equity Shares, if any, remaining after

such adjustment will be added to the category comprising Bidders applying for minimum number ofEquity Shares. g) Subject to valid Bids being received, allocation of Equity Shares to Anchor Investors shall be at the sole discretion of the Company, in consultation with the GCBRLMs and the BRLMs.

INFORMATION FROM PROSPECTUS

Full name of the coGODREJ PROPERTIES LIMITED

Registered and Corporate Office:

Godrej Bhavan, 4 Th, Floor, 4A, Home Street, Fort, Mumbai 400 001

Company Secretary and Compliance Officer:

Mr. Shodhan A. Kembhavi

Number and type of issue

9,429,750 Equity Shares of Rs. 10 ,

Face Value:

Rs. 10 Per Equity Share

Price bandRs. 490 - Rs. 530 Per Equity Share

Name of promoterGodrej & Boyce Manufacturing Company Limited and Godrej Industries Limited

Risk factor

This being the first public issue of Equity Shares of the Company, there has been no formal market for the Equity Shares of the Company. The face value of the Equity Shares is Rs. 10 per Equity Share. The Issue Price (as determined by the Company in consultation with the GCBRLMs and the BRLMs as stated under the section on Basis for Issue Price) should not be taken to be indicative of the market price of the Equity Shares after the Equity Shares are listed. No assurance can be given regarding an active and/or sustained trading in the Equity Shares of the Company or regarding the price at which the Equity Shares will be traded after listing. Investments in equity and equity-related securities involve a degree of risk and investors should not invest any funds in this Issue unless they can afford to take the risk of losing their investment. Investors are advised to read the Risk Factors carefully before taking an investment decision in this Issue. For taking an investment decision, investors must rely on their own examination of the Company and the Issue, including the risks involved. The Equity Shares offered in the Issue have not been recommended or approved by the Securities and Exchange Board of India (SEBI), nor does SEBI guarantee the accuracy or adequacy of this Draft Red Herring Prospectus. Specific attention of the investors is drawn to the section titled Risk Factors beginning on page xiv of this Draft Red Herring Prospect Dividend policy-The declaration and payment of dividends will be recommended by our board of directors and approved by our shareholders, in their discretion, and will depend on a number of factors, including but not limited to

our earnings, capital requirements and overall financial position. Our Company has no stated dividend policy. The dividend paid by the Company in the last five fiscals is as provided herein:

Fiscal 2005 Fiscal 2006 Face Value Per share 10.00 10.00 62.00 9.621 96.21%

Fiscal 2007 10.00 270.00 41.896 418.96%

Fiscal 2008 10.00 246.12 10.00 100.00%

Fiscal 2009 10.00 151.05 2.50 25%

Dividend (Rs. Million)* 25.50 Dividend per equity share 3.956 Dividend rate (% to paid up capital 39.56%

Method of Proportionate Basis of Allotment in the IssueIn the event of the Issue being over-subscribed, the Company shall finalise the basis of Allotment in consultation with the Designated Stock Exchange. The Executive Director (or any other senior official nominated by them) of the Designated Stock Exchange along with the GCBRLMs, the BRLMs and the Registrar to the Issue shall be responsible for ensuring that the basis of Allotment is finalised in a fair and proper manner. The Allotment shall be made in marketable lots, on a proportionate basis as explained below: a) Bidders will be categorized according to the number of Equity Shares applied for. b) The total number of Equity Shares to be allotted to each category as a whole shall be arrived at on a proportionate basis, which is the total number of Equity Shares applied for in that category (number of Bidders in the category multiplied by the number of Equity Shares applied for) multiplied by the inverse of the over-subscription ratio. c) Number of Equity Shares to be allotted to the successful Bidders will be arrived at on a proportionate basis, which is total number of Equity Shares applied for by each Bidder in that category multiplied by the inverse of the over-subscription ratio. d) In all Bids where the proportionate Allotment is less than [] Equity Shares per Bidder, the Allotment shall be made as follows: The successful Bidders out of the total Bidders for a category shall be determined by draw of lots in a manner such that the total number of Equity Shares allotted in that category is equal to the number of Equity Shares calculated in accordance with (b) above; and Each successful Bidder shall be allotted a minimum of [] Equity Shares. e) If the proportionate Allotment to a Bidder is a number that is more than [] but is not a multiple of 1 (which is the marketable lot), the decimal would be rounded off to the higher whole number if that decimal is 0.5 or higher. If that number is lower than 0.5 it would be rounded off to the lower whole number. Allotment to all in such categories would be arrived at after such rounding off. f) If the Equity Shares allocated on a proportionate basis to any category are more than the Equity Shares 374 allotted to the Bidders in that category, the remaining Equity Shares available for Allotment shall be first adjusted against any other category, where the allotted shares are not sufficient for proportionate Allotment to the successful Bidders in that category. The balance Equity Shares, if any, remaining after such adjustment will be added to the category comprising Bidders applying for minimum number of Equity Shares.

g) Subject to valid Bids being received, allocation of Equity Shares to Anchor Investors shall be at the sole discretion of the Company, in consultation with the GCBRLMs and the BRLMs. bankers to the issueState Bank of India, IDBI Bank Limited book running lead managers-ICICI Securities Limited, Kotak Mahindra Capital Company Limited, IDFC SSKI Limited, Nomura Financial Advisory And Securities (India) Private Limited

IPO Details

GPL is coming out with an IPO (fresh issue of 0.94cr shares) in the price band of Rs490-530 a share. The company proposes to use the issue proceeds for acquisition of land development rights for upcoming projects, construction of upcoming projects, repayment of loans and to meet working capital requirements.

Objects of the Issue:

The objects of the Issue are to achieve the benefits of listing on the Stock Exchanges & to raise capital to: 1. Acquisition of land development rights for Forthcoming Projects; 2. Construction of their Forthcoming Project; 3. Repayment of loans; and 4. General Corporate Purposes.

Godrej Properties Ltd GPL IPO Grading / Rating

ICRA has assigned a 'ICRA IPO Grade 4' [Grade Four] to the proposed IPO issue of Godrej Properties Ltd (GPL). 'ICRA IPO Grade 4' indicates above average fundamentals. ICRA assigns IPO grades on a scale of Grade 5 to Grade 1, with Grade 5 indicating strong fundamentals and Grade 1 indicating pool fundamentals.

Issue Subscription Detail / Current Bidding Status

Number of Times Issue is Subscribed (BSE + NSE) Non Retail Qualified Institutional Individual As on Date & Time Institutional Total Investors Investors Buyers (QIBs) (NIIs) (RIIs) Shares Offered / Reserved 3,960,505 942,975 2,828,925 7,732,405 Day 1 - Dec 09, 2009 17:00 IST 2.3907 0.0074 0.0206 1.2300 Day 2 - Dec 10, 2009 17:00 IST 2.4261 0.0543 0.0833 1.2800 Day 3 - Dec 11, 2009 17:00 IST 7.4494 0.4090 0.3753 4.0000

Listing Day Trading Information

Issue Price: Open: Low: High: Last Trade: Volume:

BSE Rs. 490.00 Rs. 510.00 Rs. 500.00 Rs. 586.70 Rs. 534.55 5,260,628

NSE Rs. 490.00 Rs. 511.00 Rs. 502.15 Rs. 586.80 Rs. 537.25 8,707,481

ANALYSIS OF THE GODREJ PROPERTIES LIMITED AS A COMPANY

Unique business model: Godrej Properties Limited (GPL) intends to develop its projects through joint development agreements with land owners. Under this asset-light model, GPL will enter into revenue, profit or area-sharing agreements with land owners, instead of an outright purchase of the land. This model avoids direct land dealings for GPL and the locking-up of extensive capital in land. Around 80% of GPL's existing land bank will be executed through joint developments with partners. - Illustrious Parentage: The Godrej brand name has been associated with quality and strong corporate governance. Both of its existing listed entities, Godrej Consumer Products and Godrej Industries have given CAGR Returns of 48% and 77%, respectively, to investors since 2001. We believe that GPL could leverage its parentage brand (with respect to access to the land at Vikhroli and a strong customer preference towards it), assuring a timely delivery of execution. - Projects skewed towards long-gestation townships: More than 50% of GPL's existing land bank is exposed towards township projects and in one location (Ahmedabad), which will be executed over the next ten years. Any delay in this execution or a fall in property prices in Ahmedabad will impact our NAV estimates, as 50% of our NAV is derived from this project. - Too early to discount Vikhroli land: The Maharashtra government has repealed the ULCA (Urban Land Ceiling Act), with the intention of creating more, low cost housing. As per media reports, GPL could get access to a substantial portion of land parcels in the central suburbs of Mumbai. The management intends to create a model similar to the Bandra-Kurla Complex, once it has access to large tracts of land in the central suburbs. However, confusion over the repeal of the ULCA still prevails, as the BMC (Brihanmumbai Municipal Corporation) is yet to finalize a way to ensure whether the land belongs to the builder or the Government. This confusion would be ended once the ULCA provides the BMC with a list of its holdings. We believe that due to a lack of clarity, it is too early to discount access to land for GPL in our one-year forward NAV.

- Fairly Valued: Our fair NAV for GPL (based on its existing land bank) works out to Rs469/share.

Around 50% of the NAV is derived from its township project in Ahmedabad. We have factored in a 5% price escalation from FY2011E onwards in the construction and capital value for all its residential projects from the current levels, and a 5% correction in Rentals in FY2011E, but a 5% increase from FY2012E onwards for all its commercial and retail projects. We believe that the IPO is fairly priced and keep a Neutral view on it. However, investors can look at alternate, existing listed players like Anant Raj, which have a debt-free balance sheet, land at prime locations and is trading at a significant discount to our one-year forward NAV.

Land bank details So far, the company has developed a total of 23 projects, comprising of 16 residential and seven commercial projects, aggregating to an area of approximately 5.1mn sq ft. GPL's total land reserve currently stands at 391 acres, translating into a saleable area of 50.2mn sq ft. Around 50% of its saleable area is coming from the Ahmedabad township project, which will be executed over the next ten years. The outstanding land payments towards the acquisition of 391 acres currently stand at Rs293cr, which will be paid through the IPO proceeds. Mix of Land Reserves GPL is in the middle of a swift transition, in terms of the contribution of its land reserves to the overall product portfolio. A0s it began with a focus on residential sector, around 3.9mn sq ft of its completed project pipeline came from the residential sector. However, the contribution break-up of ongoing projects paints a different picture, as commercial projects comprise of around 11.4mn sq ft of the total 32.1mn sq ft. The forthcoming projects mark a substantial shift in GPL's portfolio, as nearly 11.4mn sq ft of the total 18.1mn sq ft shall be contributed by the commercial segment. Concrete Business Strategy The relatively established players in the Real Estate business possess an edge over GPL in terms of a larger acreage of land reserves (with the same being bought at relatively lower average acquisition costs over a period of time). In order to match the size of such players, GPL would have to commit a huge amount of capital to build up substantial land reserves, which would also involve a long pay-back period after development. However, to counter the same, GPL has devised a unique strategy, whereby it intends to develop its projects through joint development agreements with land owners. Under this asset-light model, GPL will enter into revenue, profit or area-sharing agreements with land owners, instead of an outright purchase of the land. This model avoids direct land dealings for GPL and the locking-up of extensive capital in land. Around 80% of GPL's existing land bank will be executed through joint developments with partners.

Return and capital gain of the company it now Return 5 jan2009 29july 2011 (762-537.5)/762*100 = 29.4619% Capital gain [(762-537.5)+4]/762*100=28.937%

Peer

Price

Change Rs. -0.15 0.8 0.4

Change % -0.06 2.61 0.17

EPS Rs. 7.4787 1.9496 5.1965

Companies Rs. DLF Unitech Oberoi Realty Jaypee Infratech HDIL Godrej Properties Ltd. Prestige Estate Proj Indiabulls Real Est. Phoenix Mills Sobha Developers Anant Inds Omaxe Peninsula Land Parsvnath Developers DB Realty Sunteck Realty Puravankara Projects MVL Mahindra Life. Dev. Ashoka Buildcon 135.05 767.6 230.75 31.5 236.3

TTM P/E 30.87 15.75 45.4

Dividend Yield 0.87 0.33 0.42

1YrReturn (%) -25.4 -62.03

47.1 143.95

0.15 1.45

0.32 1.02

10.3321 21.6002

4.54 6.6

2.66 0

-44.13 -45.27

-9.55

-1.23

12.9831

59.86

0.58

16.45

3.8

2.9

6.2044

21.15

0.91

100.05

0.45

0.45

1.1119

89.58

0.3

-39.84

213.55

0.95

6.3045

33.56

0.57

-4.9

260.3

0.55

0.21

18.6062

13.96

1.15

-21.71

Raj 81.4 137.95 51.75

-0.25 1.05 0

-0.31 0.77 0

5.6751 3.6012 6.205

14.39 38.02 8.34

0.73 0 3.29

-29.98 24.79 -25

47.15 74.75 293.55

0.6 -3.45 2.05

1.29 -4.41 0.7

1.7344 10.5112 0.9577

26.84 7.44 304.39

0 0 0.08

-27.24 -82.39 -53.55

75 24.25 356.65

-1.85 -0.1 3.6

-2.41 -0.41 1.02

3.9297 0.3703 25.8748

19.56 65.76 13.64

1.3 0.21 1.42

-32.13 -31.74 -24.75

273.4

3.5

1.3

16.0962

16.77

Das könnte Ihnen auch gefallen

- Jay Pee DraftDokument482 SeitenJay Pee DraftTara ChandNoch keine Bewertungen

- Max Flex & Imaging Systems Ltd.Dokument383 SeitenMax Flex & Imaging Systems Ltd.GaneshNoch keine Bewertungen

- GitanjaliDokument296 SeitenGitanjaliHarinder BhanguNoch keine Bewertungen

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKVon EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNoch keine Bewertungen

- DRHPDokument536 SeitenDRHPZalak ChavdaNoch keine Bewertungen

- Series 22 Exam Study Guide 2022 + Test BankVon EverandSeries 22 Exam Study Guide 2022 + Test BankNoch keine Bewertungen

- KabirdassDokument258 SeitenKabirdasssumitkishanpuriaNoch keine Bewertungen

- Series 6 Exam Study Guide 2022 + Test BankVon EverandSeries 6 Exam Study Guide 2022 + Test BankNoch keine Bewertungen

- Kalpataru Ltd.Dokument581 SeitenKalpataru Ltd.GaneshNoch keine Bewertungen

- In Do Solar DraftDokument284 SeitenIn Do Solar DraftSomraj DasguptaNoch keine Bewertungen

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementVon EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNoch keine Bewertungen

- KabirdassdraftDokument176 SeitenKabirdassdraftbenten140Noch keine Bewertungen

- REPCODokument361 SeitenREPCOcrapidomonasNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingVon EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNoch keine Bewertungen

- Just DialDokument392 SeitenJust DialakhilbhedaNoch keine Bewertungen

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionVon EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNoch keine Bewertungen

- ColurssssDokument198 SeitenColurssssKamlesh SoniwalNoch keine Bewertungen

- TrimaxdrhpDokument348 SeitenTrimaxdrhpArjun ArikeriNoch keine Bewertungen

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingVon EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNoch keine Bewertungen

- Mind Tree DraftDokument277 SeitenMind Tree DraftTony G MalayilNoch keine Bewertungen

- Muthoot DRHPDokument394 SeitenMuthoot DRHPTejas DalviNoch keine Bewertungen

- Jyoti CNC Automation Limited: History and Certain Corporate MattersDokument388 SeitenJyoti CNC Automation Limited: History and Certain Corporate MattersRAJAMANICKAMNoch keine Bewertungen

- Abhijeet Power - DRHPDokument538 SeitenAbhijeet Power - DRHPsheetal_incNoch keine Bewertungen

- GajradrhpDokument286 SeitenGajradrhpm_laddhaNoch keine Bewertungen

- Tech ProDokument574 SeitenTech ProMurali KrishnaNoch keine Bewertungen

- RushilDokument382 SeitenRushilReetika KashivNoch keine Bewertungen

- Austral CokeDokument218 SeitenAustral CokemanishkbaidNoch keine Bewertungen

- Net Alter Software LimitedDokument264 SeitenNet Alter Software LimitedGaneshNoch keine Bewertungen

- All Cargo DraftDokument346 SeitenAll Cargo DraftVasudevan NamboothiriNoch keine Bewertungen

- Indigo IPODokument592 SeitenIndigo IPOTarun SinghNoch keine Bewertungen

- MahindradrpDokument342 SeitenMahindradrpChaitanya KekreNoch keine Bewertungen

- L&T Finance ProspectusDokument667 SeitenL&T Finance Prospectusnyc007Noch keine Bewertungen

- SMETTLDokument6 SeitenSMETTLsatishbhattNoch keine Bewertungen

- Persistent SebiDokument315 SeitenPersistent Sebirahul_viswanathan_1Noch keine Bewertungen

- Mepidl - DRHP PDFDokument561 SeitenMepidl - DRHP PDFMarquis HowellNoch keine Bewertungen

- Madhya Baharat AgroDokument334 SeitenMadhya Baharat Agromanishkul-Noch keine Bewertungen

- Power GridDokument397 SeitenPower Gridrajesh.bhagiratiNoch keine Bewertungen

- Prataap SnacksDokument478 SeitenPrataap SnacksRicha P SinghalNoch keine Bewertungen

- IL&FS Preference Shares IssueDokument4 SeitenIL&FS Preference Shares Issuevish_dixitNoch keine Bewertungen

- Vks Projects LTDDokument263 SeitenVks Projects LTDAswathy NairNoch keine Bewertungen

- Stock Exchange Assignment-2 DB Realites Limited PermissionDokument3 SeitenStock Exchange Assignment-2 DB Realites Limited PermissionMadhav NemalikantiNoch keine Bewertungen

- Info EdgeDokument318 SeitenInfo Edgetheron96Noch keine Bewertungen

- Ipo RHP IrfcDokument413 SeitenIpo RHP IrfcNaresh GaurNoch keine Bewertungen

- Alkem Lab ReportDokument553 SeitenAlkem Lab Reportsumit kumarNoch keine Bewertungen

- Sbi Eqty 12 Combined Form MFDokument55 SeitenSbi Eqty 12 Combined Form MFanywheremechanical78Noch keine Bewertungen

- Apollo HealthDokument542 SeitenApollo HealthabulaskarNoch keine Bewertungen

- Capital Market Related Topics, Regulatory Insights and Exchange Related IssuesDokument43 SeitenCapital Market Related Topics, Regulatory Insights and Exchange Related IssuesmandarNoch keine Bewertungen

- Stock MarketDokument26 SeitenStock MarketBalajiNoch keine Bewertungen

- PCH Retail Prosectus June 2011Dokument309 SeitenPCH Retail Prosectus June 2011ankurmac1Noch keine Bewertungen

- Capital Market Regulatory Insight - P.S.rao & AssociatesDokument43 SeitenCapital Market Regulatory Insight - P.S.rao & AssociatesSharath Srinivas Budugunte100% (1)

- Original Prospectus of L&T Financial Holdings IPODokument547 SeitenOriginal Prospectus of L&T Financial Holdings IPO1106531Noch keine Bewertungen

- DraftRedHerringProspectus05122018 20181207121758Dokument316 SeitenDraftRedHerringProspectus05122018 20181207121758SubscriptionNoch keine Bewertungen

- CoalDokument687 SeitenCoalJaimin PanchalNoch keine Bewertungen

- Editor Attach 1327138073 1832Dokument59 SeitenEditor Attach 1327138073 1832Monther Al DebesNoch keine Bewertungen

- Black Hole Safety Brochure Trifold FinalDokument2 SeitenBlack Hole Safety Brochure Trifold Finalvixy1830Noch keine Bewertungen

- NOV23 Nomura Class 6Dokument54 SeitenNOV23 Nomura Class 6JAYA BHARATHA REDDYNoch keine Bewertungen

- Retail Operations ManualDokument44 SeitenRetail Operations ManualKamran Siddiqui100% (2)

- Course: Introduction To Geomatics (GLS411) Group Practical (2-3 Persons in A Group) Practical #3: Principle and Operation of A LevelDokument3 SeitenCourse: Introduction To Geomatics (GLS411) Group Practical (2-3 Persons in A Group) Practical #3: Principle and Operation of A LevelalyafarzanaNoch keine Bewertungen

- Analysis of MMDR Amendment ActDokument5 SeitenAnalysis of MMDR Amendment ActArunabh BhattacharyaNoch keine Bewertungen

- One and Half SindromeDokument4 SeitenOne and Half SindromeYulia DamayantiNoch keine Bewertungen

- Mini Project A-9-1Dokument12 SeitenMini Project A-9-1santhoshrao19Noch keine Bewertungen

- USTH Algorithm RecursionDokument73 SeitenUSTH Algorithm Recursionnhng2421Noch keine Bewertungen

- Jar Doc 06 Jjarus Sora Executive SummaryDokument3 SeitenJar Doc 06 Jjarus Sora Executive Summaryprasenjitdey786Noch keine Bewertungen

- Performance Evaluation of The KVM Hypervisor Running On Arm-Based Single-Board ComputersDokument18 SeitenPerformance Evaluation of The KVM Hypervisor Running On Arm-Based Single-Board ComputersAIRCC - IJCNCNoch keine Bewertungen

- Influence of Freezing and Pasteurization of The Physical Condition of The Plastik (PE, PP and HDPE) As Selar Fish Packaging (Selaroides Leptolepis) in Sendang Biru, Malang, East Java. IndonesiaDokument7 SeitenInfluence of Freezing and Pasteurization of The Physical Condition of The Plastik (PE, PP and HDPE) As Selar Fish Packaging (Selaroides Leptolepis) in Sendang Biru, Malang, East Java. IndonesiaInternational Network For Natural SciencesNoch keine Bewertungen

- Coc 1 ExamDokument7 SeitenCoc 1 ExamJelo BioNoch keine Bewertungen

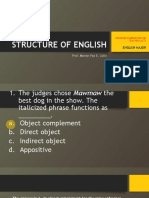

- LET-English-Structure of English-ExamDokument57 SeitenLET-English-Structure of English-ExamMarian Paz E Callo80% (5)

- PC Engines APU2 Series System BoardDokument11 SeitenPC Engines APU2 Series System Boardpdy2Noch keine Bewertungen

- Coefficient of Restitution - Center of MassDokument3 SeitenCoefficient of Restitution - Center of MassMannyCesNoch keine Bewertungen

- Model 900 Automated Viscometer: Drilling Fluids EquipmentDokument2 SeitenModel 900 Automated Viscometer: Drilling Fluids EquipmentJazminNoch keine Bewertungen

- Marine-Derived Biomaterials For Tissue Engineering ApplicationsDokument553 SeitenMarine-Derived Biomaterials For Tissue Engineering ApplicationsDobby ElfoNoch keine Bewertungen

- Salwico CS4000 Fire Detection System: Consilium Marine ABDokument38 SeitenSalwico CS4000 Fire Detection System: Consilium Marine ABJexean SañoNoch keine Bewertungen

- Different Principles Tools and Techniques in Creating A BusinessDokument5 SeitenDifferent Principles Tools and Techniques in Creating A BusinessLuna LedezmaNoch keine Bewertungen

- ABHIGYAN 2020 E-InvitationDokument2 SeitenABHIGYAN 2020 E-Invitationchirag sabhayaNoch keine Bewertungen

- Adding and Subtracting FractionsDokument4 SeitenAdding and Subtracting Fractionsapi-508898016Noch keine Bewertungen

- Ict's - 2022 - Mentorship - Summarized - Thread - by - Trader - Theory - Sep 22, 22 - From - RattibhaDokument11 SeitenIct's - 2022 - Mentorship - Summarized - Thread - by - Trader - Theory - Sep 22, 22 - From - RattibhaChristiana OnyinyeNoch keine Bewertungen

- 50 Law-Firms Details by Vaibhav SharmaDokument17 Seiten50 Law-Firms Details by Vaibhav SharmaApoorva NandiniNoch keine Bewertungen

- How To Make An Effective PowerPoint PresentationDokument12 SeitenHow To Make An Effective PowerPoint PresentationZach Hansen100% (1)

- 5G NR Essentials Guide From IntelefyDokument15 Seiten5G NR Essentials Guide From IntelefyUzair KhanNoch keine Bewertungen

- Necromunda CatalogDokument35 SeitenNecromunda Catalogzafnequin8494100% (1)

- IFSSO Newsletter Jul-Sep 2010Dokument2 SeitenIFSSO Newsletter Jul-Sep 2010rjotaduranNoch keine Bewertungen

- Case Study Managerial EconomicsDokument4 SeitenCase Study Managerial EconomicsZaza Afiza100% (1)

- Poka-Yoke or Mistake Proofing: Historical Evolution.Dokument5 SeitenPoka-Yoke or Mistake Proofing: Historical Evolution.Harris ChackoNoch keine Bewertungen