Beruflich Dokumente

Kultur Dokumente

Strategic Management

Hochgeladen von

Sandhya MadhanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

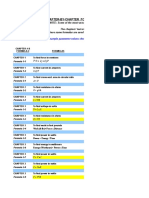

Strategic Management

Hochgeladen von

Sandhya MadhanCopyright:

Verfügbare Formate

Strategic management Strategy formulation: Nature of the formulation process: Formal and Informal. Simple and Complex.

Analytical and Qualitative. Involve many people or just a few. Three interlocking aspects of the strategy formulation process: Strategic Intent o Driver of the strategy formulation o Provides direction for strategy o Answer question, Where do we want to go? Strategic Choice o Provides relevant knowledge of strategic context o Anchors future strategies in reality o Answers question Where are we now? Strategic Assessment o If no choice- no strategy needed o The link to action o Answer questions How to get from where we are to where we want to be. Effective strategy formulation processes Customer awareness Supplier relationships Stakeholder influences Understanding of competence Awareness of technological change and innovation Mix of people involved in process Encouragement and understanding of top management Communication of results and reaction to feedback Sound logic and balance to the process Process design but not over-design Considered role of external support

Results from the strategy formulation process Goals that are simple, consistent and long term. Profound understanding of the competitive environment Objective appraisal of resources Effective implementation Business Level strategies for growth: Market penetration strategies Product development strategies Market development strategies Diversification strategies Product/Market Expansion: Scale Strategies Market Penetration Goal: increase market share Low risk/marginal returns Every business does this Market Development Goal: find new markets Marketing expertise Mature products/services Product Development Goal: develop & introduce new products/services Technical expertise Growth of products/services (Could Entail Related Diversification) Diversification Goal: develop & introduce products/services to new or emerging markets (Most likely Unrelated Diversification) When Does Diversification Make Sense? Single business strategies have a number of advantages but also a number of risks -- all ones eggs in one basket The logic: to spread corporate risk across multiple industries to enhance shareholder value: SYNERGY (i.e., 2 + 2 = 5)

Diversification Motives The risks of single business strategies are more severe for management than for shareholders of publicly traded firms. Diversification may be motivated by managements desire to reduce risk. Diversification only makes sense when it enhances shareholder value! Tests for Judging Diversification Attractiveness o Is the target industry attractive? (Use 5-forces model to assess industry attractiveness) o Does the diversification move fit with the grand strategy of the firm? Better-off o Does the diversification move produce opportunities for synergies? Will the company be better off after the diversification than it was before? How and why? Cost of entry o Is the cost of the diversification worth it? o Will the diversified firm create enough additional value to justify the cost? Methods for Diversification Acquisition of an existing business. Creation of a new business from within, e.g. a start-up. Joint venture with another firm or firms. Acquisition Most popular approach to diversification Quick market entry Avoids entry barriers: o Technology o Access to suppliers o Efficiency / economies of scale o Promotion o Distribution channels

Strategic Planning:

Strategic planning has taken on new importance in todays world of globalization, deregulation, advancing technology, and changing demographics, and lifestyles Grand Strategy General plan of major action to achieve long-term goals Falls into three general categories 1. Growth 2. Stability 3. Retrenchment Grand Strategy: Growth Growth can be promoted internally by investing in expansion or externally by acquiring additional business divisions Internal growth = can include development of new or changed products External growth = typically involves diversification businesses related to current product lines or into new areas

Grand Strategy: Stability Stability, sometimes called a pause strategy, means that the organization wants To remain the same size or to grow slowly and in a controlled fashion.

Grand Strategy: Retrenchment Retrenchment = the organization goes through a period of forced decline by either shrinking current business units or selling off or liquidating entire businesses Liquidation = selling off a business unit for the cash value of the assets, thus terminating its existence Divestiture = involves selling off of businesses that no longer seem central to the corporation.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FlowCon General InstructionDokument4 SeitenFlowCon General InstructionGabriel Arriagada UsachNoch keine Bewertungen

- SPW3 Manual Rev 5Dokument713 SeitenSPW3 Manual Rev 5JPYadavNoch keine Bewertungen

- Understand Centrifugal CompressorDokument16 SeitenUnderstand Centrifugal Compressorramanathan72-1100% (2)

- Process Sizing CriteriaDokument91 SeitenProcess Sizing CriteriaMohammad BadakhshanNoch keine Bewertungen

- Study of Step Up & Step Down Transformer: Experiment 9Dokument3 SeitenStudy of Step Up & Step Down Transformer: Experiment 9Apna VeerNoch keine Bewertungen

- Milenium BypassDokument1 SeiteMilenium BypassdinotecNoch keine Bewertungen

- Suparco+ KRL Test Ques For Electrical EngrzDokument5 SeitenSuparco+ KRL Test Ques For Electrical Engrzمحمد فصیح آفتابNoch keine Bewertungen

- JupaCreations BWCGDokument203 SeitenJupaCreations BWCGsoudrack0% (1)

- Nazneen Wahab CVDokument5 SeitenNazneen Wahab CVRavi MittalNoch keine Bewertungen

- Reaction PaperDokument2 SeitenReaction PaperRonald CostalesNoch keine Bewertungen

- حل جميع المعادلات الكهربائيةDokument60 Seitenحل جميع المعادلات الكهربائيةGandhi HammoudNoch keine Bewertungen

- Ranking 4Dokument34 SeitenRanking 4Deepti BhatiaNoch keine Bewertungen

- Plotting in AutoCAD - A Complete GuideDokument30 SeitenPlotting in AutoCAD - A Complete GuideAdron LimNoch keine Bewertungen

- Oracle SCM TrainingDokument9 SeitenOracle SCM TrainingVishnu SajaiNoch keine Bewertungen

- Gpa 2145Dokument15 SeitenGpa 2145Sergio David Ruiz100% (1)

- HoltacDokument8 SeitenHoltacdargil66Noch keine Bewertungen

- The Next 20 Billion Digital MarketDokument4 SeitenThe Next 20 Billion Digital MarketakuabataNoch keine Bewertungen

- Rising Stem Ball ValveDokument6 SeitenRising Stem Ball ValveAnupam A. GandhewarNoch keine Bewertungen

- Scope of Work Project Sahastradhara Road (GYAN CONSTRUCTIONS)Dokument4 SeitenScope of Work Project Sahastradhara Road (GYAN CONSTRUCTIONS)Hotel Central palaceNoch keine Bewertungen

- Engineering Data, Summary of Productivity 2022Dokument2 SeitenEngineering Data, Summary of Productivity 2022Listya AnggrainiNoch keine Bewertungen

- Sample Style GuideDokument5 SeitenSample Style Guideapi-282547722Noch keine Bewertungen

- Hughes Brothers PDFDokument52 SeitenHughes Brothers PDFJavier MaldonadoNoch keine Bewertungen

- L04-L05 Parts 13-25-550 v05 42021Dokument84 SeitenL04-L05 Parts 13-25-550 v05 42021Brandi HillNoch keine Bewertungen

- GRC Fiori End User Guide Final - V2Dokument75 SeitenGRC Fiori End User Guide Final - V2Subhash BharmappaNoch keine Bewertungen

- Fuels and Heat Power: A Guide to Fuels, Furnaces, and FiringDokument101 SeitenFuels and Heat Power: A Guide to Fuels, Furnaces, and FiringAlyssa Clarizze MalaluanNoch keine Bewertungen

- PDF Saa6d140e 2 Seriespdf CompressDokument8 SeitenPDF Saa6d140e 2 Seriespdf CompressNathawatNoch keine Bewertungen

- CAT775GDokument32 SeitenCAT775GAndy Chan100% (1)

- Assign 1Dokument5 SeitenAssign 1Aubrey Camille Cabrera100% (1)

- Nord Motors Manual BookDokument70 SeitenNord Motors Manual Bookadh3ckNoch keine Bewertungen