Beruflich Dokumente

Kultur Dokumente

Bajaj

Hochgeladen von

Ravindra AndhaleOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bajaj

Hochgeladen von

Ravindra AndhaleCopyright:

Verfügbare Formate

Bajaj Auto Ltd.

Company Profile

Publication Date: 25 Feb 2011

www.datamonitor.com

Europe, Middle East & Africa 119 Farringdon Road London EC1R 3DA United Kingdom t: +44 20 7551 9000 f: +44 20 7551 9090 e: euroinfo@datamonitor.com Americas 245 5th Avenue 4th Floor New York, NY 10016 USA t: +1 212 686 7400 f: +1 212 686 2626 e: usinfo@datamonitor.com Asia Pacific Level 46 2 Park Street Sydney, NSW 2000 Australia t: +61 2 8705 6900 f: +61 2 8088 7405 e: apinfo@datamonitor.com

Bajaj Auto Ltd.

ABOUT DATAMONITOR

Datamonitor is a leading business information company specializing in industry analysis. Through its proprietary databases and wealth of expertise, Datamonitor provides clients with unbiased expert analysis and in depth forecasts for six industry sectors: Healthcare, Technology, Automotive, Energy, Consumer Markets, and Financial Services. The company also advises clients on the impact that new technology and eCommerce will have on their businesses. Datamonitor maintains its headquarters in London, and regional offices in New York, Frankfurt, and Hong Kong. The company serves the world's largest 5000 companies. Datamonitor's premium reports are based on primary research with industry panels and consumers. We gather information on market segmentation, market growth and pricing, competitors and products. Our experts then interpret this data to produce detailed forecasts and actionable recommendations, helping you create new business opportunities and ideas. Our series of company, industry and country profiles complements our premium products, providing top-level information on 10,000 companies, 2,500 industries and 50 countries. While they do not contain the highly detailed breakdowns found in premium reports, profiles give you the most important qualitative and quantitative summary information you need - including predictions and forecasts.

All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Datamonitor plc. The facts of this profile are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Datamonitor delivers will be based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such Datamonitor can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect.

Bajaj Auto Ltd. Datamonitor

Page 2

Bajaj Auto Ltd.

TABLE OF CONTENTS

TABLE OF CONTENTS

Company Overview..............................................................................................4 Key Facts...............................................................................................................4 Business Description...........................................................................................5 History...................................................................................................................6 Key Employees.....................................................................................................8 Key Employee Biographies..................................................................................9 Major Products and Services............................................................................17 Revenue Analysis...............................................................................................18 SWOT Analysis...................................................................................................19 Top Competitors.................................................................................................25 Company View.....................................................................................................26 Locations and Subsidiaries...............................................................................28

Bajaj Auto Ltd. Datamonitor

Page 3

Bajaj Auto Ltd.

Company Overview

COMPANY OVERVIEW

Bajaj Auto, an India-based company, is a manufacturer and marketer of two and three wheeled vehicles which include scooters, motorcycles, passenger carriers and goods carriers. The company operates in India and is headquartered in Pune, India. The company recorded revenues of INR115,431.6 million ($2,539.5 million) in the financial year ended March 2010 (FY2010), an increase of 36.7% over FY2009.The operating profit of the company was INR25,566.3 million ($562.5 million) in FY2010, compared to an operating profit of INR11,012 million ($242.2 million) in FY2009.The net profit was INR15,972.2 million ($351.4 million) in FY2010, compared to a net profit of INR5,357.9 million ($117.9 million) in FY2009.

KEY FACTS

Head Office Bajaj Auto Ltd. Akurdi Pune 411 035 IND 91 20 2747 2851

Phone Fax Web Address

http://www.bajajauto.com

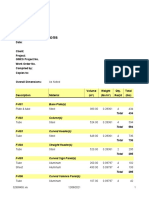

Revenue / turnover 120,966.5 (INR Mn) Financial Year End Bombay Stock Exchange Ticker National Stock Exchange of India Ticker March 532977 BAJAJ-AUTO

Bajaj Auto Ltd. Datamonitor

Page 4

Bajaj Auto Ltd.

Business Description

BUSINESS DESCRIPTION

Bajaj Auto is a manufacturer of two-wheelers and three-wheelers scooters. The company manufactures and markets scooters, motorcycles, passenger carriers and goods carriers. It also trades spare parts and accessories. The company has a network of more than 600 dealers and over 1,100 authorized service centers spread across India. The Bajaj brand is well-known across several countries in Latin America, Africa, Middle East, South and South East Asia. The company operates through two business segments: automotive and investment. The company focuses on two-wheelers and three-wheelers in automotive segment. In two-wheelers, the company manufactures motorcycles and scooters. Bajaj Auto classifies motorcycles into three segments: entry segment, executive segment, and performance segment.The company manufactures motorcycles such as the Pulsar range (150 cc, 180 cc, 200 cc and the recently launched 220 cc), the 220 cc Avenger DTS-i (Digital Twin Spark) and a 250 cc Kawasaki Ninja 250R (in collaboration with Kawasaki Heavy Industries) under the performance segment. Under the executive segment, the company manufactures 125 cc motorcycles including Discover DTS-i 135 and the XCD 125 DTS-Si (Swirl Induction); and under the entry level segment, the 100 cc Platina motorcycles. Bajaj Auto manufactures scooters under the brand, Kristal. The company has three manufacturing plants in India including Pantnagar in Uttarakhand (manufactures Platina, Platina 125, Discover and Pulsar 135), Chakan in Pune (Pulsar, Avenger and Discover) and Waluj in Aurangabad (manufactures Boxer, Platina, Discover and three-wheelers). In three-wheelers, Bajaj Auto manufactures goods carrier and passenger carrier three-wheelers. The company manufactures a range of passenger carriers which include: 2-stroke (2S), 4-stroke (4S), 4S compressed natural gas type, 4S liquefied petroleum gas type and 4S diesel type vehicles. The companys goods carrier brands include GC Max Diesel, GC Max CNG and RE 600. Its passenger carrier brands include Mega Max, RE 25, RE 45, RE Diesel and RE GDI. In FY2010, the company sold over 2.5 million motorcycles worldwide including 1.8 million units in India. In the same year, the company sold 340,937 three-wheelers including 331,707 passenger carriers and 9,230 goods carriers. Further, the company exported a total of 891,002 units in FY2010 including 726,115 units of two wheelers and 164,887 units of three wheelers. The company has a technical tie-up with Kawasaki Heavy Industries, Japan to produce a range of two-wheelers in India. Since the tie-up, Bajaj Auto launched KB100, KB RTZ, KB125, 4S, 4S Champion, Boxer, Caliber, Caliber115, Wind125 and Kawasaki Bajaj Eliminator. The company's subsidiaries include: Bajaj Auto International Holdings, a 100% Netherlands based subsidiary; and PT Bajaj Indonesia which assembles and markets Pulsars in Indonesia.

Bajaj Auto Ltd. Datamonitor

Page 5

Bajaj Auto Ltd.

History

HISTORY

Bajaj Auto was established as M/s Bachraj Trading in 1945. In 1948, the company's started importing two and three wheelers in India. Bajaj Auto obtained license from the Government of India to manufacture two and three wheelers, in 1959. Bajaj Auto became a public limited company in 1960. The company introduced three-wheeler goods carrier, in 1971. In the following year, it introduced Bajaj Chetak. The company formed a joint venture with Maharashtra Scooters in 1975. Bajaj Auto established the Waluj production plant in Aurangabad, in 1985. In the following year, the company entered into the technical tie-up with Kawasaki Heavy Industries, Japan to produce a range of two-wheelers in India. In 1995, the company signed agreements with Kubota, Japan for the development of diesel engines for three-wheelers, and with Tokyo Research and Development for gearless Scooter and moped development. In 1999, Bajaj Auto commenced the production at Chakan plant. The company introduced Bajaj Saffire in 2000. In the following year, Bajaj Auto launched Eliminator and Pulsar bikes. Bajaj Auto launched Bajaj Wind 125, Pulsar 150cc and 180cc sports styled bikes, in 2003. In the following year, Bajaj Auto launched Bajaj CT100 and Bajaj Discover DTS-i. It launched Bajaj Discover, Bajaj Avenger DTS-i, and Bajaj Wave DTS-i, in 2005. In the following year, it launched Bajaj Platina. Bajaj Auto launched 200 cc Pulsar DTS-i, and Bajaj Kristal DTS-i in 2007. In the same year, the company started a new plant at Pantnagar, Uttarakhand. In addition, the company demerged to form three separate entities: Bajaj Auto (automobiles); Bajaj Holdings and Investment (an investment company); and Bajaj Finserv (wind power and financial services company). Subsequently, Bajaj Auto launched its 'XCD 125 DTS-Si', a 125cc motor bike. In 2008, Bajaj Auto, Renault and Nissan formed a joint-venture company to develop, manufacture and market the car code-named ULC (ultra low cost) with wholesale price range starting from $2,500. The joint-venture company was 50% owned by Bajaj Auto, 25% by Renault and 25% by Nissan. Bajaj Auto acquired its first stake in Austrian power bike maker KTM Power Sports in 2009. In the same year, the company started the production of its bikes in China for exports to Nigeria. Later in the year, Bajaj Auto received patent for its invention multi-spring vehicle shock absorber used in its motorcycles.

Bajaj Auto Ltd. Datamonitor

Page 6

Bajaj Auto Ltd.

History

Further in 2009, the company launched the fastest bike made in India, the new Pulsar 220cc model. In the same year, Bajaj Auto launched 250cc motorcycle Kawasaki Ninja and the Pulsar 135 LS (light sport). Bajaj Auto introduced the new Platina 125, a heavy duty bike in March 2010. In the following month, Japan's Kawasaki Heavy Industries (KHI), set up its subsidiary named India Kawasaki Motors, in India. In the same month, KHI started a unit at its partner Bajaj Auto's Chakan plant in Pune, India, to assemble, import and sell its motorcycles in the country. In April 2010, Bajaj Auto increased its stake in European motorcycle manufacturer KTM Power Sports to 35.7%. In May 2010, Bajaj Auto unveiled its new range of 'RE' passenger vehicles. In June 2010, KTM Power Sports launched the serial production of motorcycles in the range of 125cc and 350cc in cooperation with Bajaj Auto.

Bajaj Auto Ltd. Datamonitor

Page 7

Bajaj Auto Ltd.

Key Employees

KEY EMPLOYEES

Name

Rahul Bajaj Madhur Bajaj Rajiv Bajaj Sanjiv Bajaj D.S. Mehta Kantikumar R. Podar Shekhar Bajaj D.J. Balaji Rao J.N. Godrej S.H. Khan Suman Kirloskar Naresh Chandra Nanoo Pamnani Manish Kejriwal P. Murari Niraj Bajaj Pradeep Shrivastava Abraham Joseph S. Sridhar R.C. Maheshwari Rakesh Sharma Eric Vas K. Srinivas Kevin P D'sa S. Ravikumar Amrut Rath N.H. Hingorani C.P. Tripathi

Job Title

Chairman and Chief Executive Officer Vice Chairman Managing Director Executive Director Director Director Director Director Director Director Director Director Director Director Director Director Chief Operating Officer President, Research and Development President, Motorcycle Business President, Commercial Vehicle Business President, International Business President, New Projects President, Retail Finance President, Finance Senior Vice President, Business Development and Assurance Vice President, Human Resources Vice President, Commercial Vice President, Corporate Social Responsibility

Board

Executive Board Executive Board Executive Board Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Non Executive Board Senior Management Senior Management Senior Management Senior Management Senior Management Senior Management Senior Management Senior Management Senior Management Senior Management Senior Management Senior Management

Compensation

61121055 INR 41595959 INR 34888610 INR 9363577 INR 350000 INR 350000 INR 320000 INR 910000 INR

910000 INR 350000 INR 910000 INR 630000 INR 350000 INR 280000 INR 350000 INR

Bajaj Auto Ltd. Datamonitor

Page 8

Bajaj Auto Ltd.

Key Employee Biographies

KEY EMPLOYEE BIOGRAPHIES

Rahul Bajaj

Board: Executive Board Job Title: Chairman and Chief Executive Officer Since: 1968 Age: 72 Mr. Bajaj is the Chairman at Bajaj Auto. He also serves as the Chairman at Bajaj Auto Finance, Bajaj Allianz General Insurance, Bajaj Allianz Life Insurance, Bajaj Holdings & Investment and Bajaj Finserv. Mr. Bajaj was the President of Confederation of Indian Industry from 1979 to 1980, and 1999 to 2000. He is also a former President at Mahratta Chamber of Commerce, Industry and Agriculture. Mr. Bajaj serves as a Member, Executive Board at Indian School of Business, and a Member at Harvard Business School's (India) Research Centre & India Advisory Board and the International Advisory Committee of NYSE Euronext.

Madhur Bajaj

Board: Executive Board Job Title: Vice Chairman Since: 2001 Age: 58 Mr. Bajaj is the Vice Chairman at Bajaj Auto. He served as the President at Society of Indian Automobile Manufacturers; and the Chairman at the Confederation of Indian Industry (Western Region). Mr. Bajaj is the Chairman at Maharashtra Scooters. He serves as a Director at Bajaj Holdings & Investment, Bajaj Finserv, Bajaj Auto Holdings, Bajaj Electricals and Bajaj Auto Finance.

Rajiv Bajaj

Board: Executive Board Job Title: Managing Director Since: 2005 Mr. Bajaj has been the Managing Director at Bajaj Auto since 2005. He was an Officer on Special Duty of the company from 1990 to 1993. From 1993 to 2000, Mr. Bajaj was the General Manager of Products and Vice President of Products at the company; and was the President and Joint Managing Director at the company from 2000 to 2005. He serves as a Director at Bajaj Auto Finance and Bajaj Auto Holdings.

Sanjiv Bajaj

Bajaj Auto Ltd. Datamonitor

Page 9

Bajaj Auto Ltd.

Key Employee Biographies

Board: Executive Board Job Title: Executive Director Since: 2004 Age: 41 Mr. Bajaj is an Executive Director at Bajaj Auto. He has been the Managing Director at Bajaj FinServ since 2008. Mr. Bajaj was the Head of International Business at Bajaj Auto from 2004 to 2007. He serves as a Director at Bajaj Allianz General Insurance, Bajaj Allianz Life Insurance, Bajaj Auto Finance and Maharashtra Scooters.

D.S. Mehta

Board: Non Executive Board Job Title: Director Since: 1998 Age: 74 Mr. Mehta has been a Director at Bajaj Auto since 1998. He has been associated with the Bajaj Group of Companies since 1966 and has more than 30 years experience in corporate law, taxation, finance and investment. Mr. Mehta is an Honorary Joint Director at the Bharatiya Vidya Bhavan; and Vice President at the Kasturba Health Society at Sewagram, Wardha, in Maharashtra. He is the Joint Managing Trustee at the Saurashtra Trust, which owns and publishes Gujarati language newspapers and magazines; and Vice Chairman at the Kasturba Gandhi National Memorial Trust at Indore, Madhya Pradesh. Mr. Mehta is a fellow Member at both the Institute of Chartered Accountants of India and the Institute of Company Secretaries of India.

Kantikumar R. Podar

Board: Non Executive Board Job Title: Director Since: 1983 Age: 75 Mr. Podar has been a Director at Bajaj Auto since 1983. He served as the Chairman and President at the Federation of Indian Chambers of Commerce and Industry; Economic and Scientific Research Foundation, New Delhi for three years; and The Indian Cotton Mills' Federation for two years. Mr. Podar also served as the Chairman and President at the Indian Merchants Chamber during its Platinum Jubilee Year; All India Organisation of Employers for two years; Indian Council of Arbitration for one year; Mumbai Textile Research Association for two years; and Member of the Senate of the University of Bombay for six years. He has been the President at the SAARC Chamber of Commerce and Industry with headquarters in Pakistan.

Shekhar Bajaj

Bajaj Auto Ltd. Datamonitor

Page 10

Bajaj Auto Ltd.

Key Employee Biographies

Board: Non Executive Board Job Title: Director Since: 1995 Age: 62 Mr. Bajaj has been a Director at Bajaj Auto since 1995. He started his career as Resident Director at Bajaj Sevashram, Udaipur in 1968. From 1969 to 1972, Mr. Bajaj was the Joint Managing Director at Bachhraj Factories, in Mumbai and was its CEO from 1974 to 1975. In 1975, he was appointed as part-time Managing Director at the Mumbai-based Bajaj International and later its whole-time Managing Director. Mr. Bajaj has been the Chairman and Managing Director at Bajaj Electricals since 1994. He served as the President at Associated Chamber of Commerce and Industry of India; the President and Member of Managing Committee at the Indian Merchants' Chamber; the President at Council for Fair Business Practices; a Member of governing body and the President at the Electric Lamp & Component Manufactures' Association of India; and a Member of the Executive Council at the Fan Makers Association of India.

D.J. Balaji Rao

Board: Non Executive Board Job Title: Director Since: 1993 Age: 71 Mr. Rao has been a Director at Bajaj Auto since 1993. He served as a Managing Director at the Infrastructure Development Finance; an Executive Director at ICICI, and Vice Chairman and Managing Director at SCICI. Mr. Rao was a Consultant to the National Development Bank of Sri Lanka in 1991; the CEO at the Industrial and Technical Consultancy Organisation of Tamil Nadu from 1981 to 1982; and Consultant to the Asian Development Bank from 1985 to 1986. He serves as a Director at 3M, Ashok Leyland, Graphite India, Jindal Iron & Steel, Prudential ICICI Trust, South East Asia Marine Engineering & Construction and Ennore Foundries.

J.N. Godrej

Board: Non Executive Board Job Title: Director Since: 1998 Age: 62 Mr. Godrej has been a Director at Bajaj Auto since 1998. He has been the Managing Director at Godrej & Boyce since 1991. Mr. Godrej has been associated with the Confederation of Indian Industry and was its President from 1993 to 1994. He is also the former President of the Indian Machine Tool Manufacturers' Association and is the President of the World Wide Fund for Nature, India. Mr. Godrej serves as a Director at 3D PLM Software Solutions, Godrej Agrovet, Godrej Consumer Products,

Bajaj Auto Ltd. Datamonitor

Page 11

Bajaj Auto Ltd.

Key Employee Biographies

Godrej Foods, Godrej Industries, Godrej Properties and Investments, Godrej Sara Lee, Godrej Tea and Godrej Upstream.

S.H. Khan

Board: Non Executive Board Job Title: Director Since: 1999 Age: 62 Mr. Khan has been a Director at Bajaj Auto since 1999. He joined the Reserve Bank of India as a Probationary Officer in 1961 from where, in 1966, he moved over to the Industrial Development Bank of India. Mr. Khan served with IDBI for over 30 years in various capacities, including as its Chairman and Managing Director for about five years until 1998. He serves as a Director at Infrastructure Development Finance, ITC Hotels, National Stock Exchange of India, Shipping Corporation of India and Birla Home Finance.

Suman Kirloskar

Board: Non Executive Board Job Title: Director Since: 2002 Age: 75 Ms. Kirloskar has been a Director at Bajaj Auto since 2002. She is associated with the Mahila Seva Mandal; and Empress Garden as the Chairperson. Ms. Kirloskar is also the Chairperson at Mahila Udyog. She is a Trustee at the Ravi Kirloskar Quality Prize Trust and the Sanjeevan Vidyalaya Trust.

Naresh Chandra

Board: Non Executive Board Job Title: Director Since: 2003 Age: 76 Mr. Chandra has been a Director at Bajaj Auto since 2003. He was an Ambassador of India to the US in 1996, Indian Co-Chairman at the US-Technology Group, and Member at the Indo-US Economic sub-committee. Mr. Chandra was the Senior Adviser to the Prime Minister of India in 1992; Governor of the State of Gujarat; and a Member at Indian Space Commission and the Indian Atomic Energy Commission from 1990 to 1992. He also served as the Cabinet Secretary in 1990; Secretary at Ministries of Water Resources, Defence, Interior and Justice from 1987 to 1990; Adviser to the Government of Jammu & Kashmir in 1986; Commonwealth Secretariat Adviser on Export Industrialisation and Policy in Colombo from 1981 to 1984; and Chief Secretary, Rajasthan.

Bajaj Auto Ltd. Datamonitor

Page 12

Bajaj Auto Ltd.

Key Employee Biographies

Mr. Chandra serves as a Director at Balrampur Chini Mills, Haldia Petrochemicals, Hindustan Motors, Lord Krishna Bank, Media Content & Communications Services, Associated Cement, Electrosteel Castings, Vedanta Resources (London), and Tata Consultancy Services.

Nanoo Pamnani

Board: Non Executive Board Job Title: Director Age: 65 Mr. Pamnani serves as a Director at Bajaj Auto. He is the Chairman at Citicorp Finance (India). Mr. Pamnani was appointed as the CEO and Global Head of consumer banking at Citibank, India, in 1995. He was also appointed as the Head of Operations and Technology for Citicorp's businesses in over 70 countries (based in London). Mr. Pamnani serves as a Director at Citicorp Brokerage (India), Citicorp Maruti Finance, Orbitech, and e-Serve International.

Manish Kejriwal

Board: Non Executive Board Job Title: Director Since: 2004 Age: 42 Mr. Kejriwal has been a Director at Bajaj Auto since 2004. He is the Managing Director at Temasek Holdings Advisors India. Prior to that, Mr. Kejriwal was a Partner at McKinsey. He was the hub Leader for McKinsey's Corporate Finance and Strategy practice in India. Mr. Kejriwal was also the Co-Leader of McKinsey's Business Process Outsourcing and Offshoring practice and was on the Global Leadership Team of the private equity practice. Prior to McKinsey, he had worked at the World Bank in Washington, DC and he had spent a short period with Goldman Sachs in Hong Kong.

P. Murari

Board: Non Executive Board Job Title: Director Since: 2006 Age: 76 Mr. Murari has been a Director at Bajaj Auto since 2006. He joined the Indian Administrative Service in which he served from 1957 to 1992. During his career as a Civil Servant, Mr. Murari held many distinguished positions, including: Sub-Divisional and District Magistrate, Sub-Collector, Deputy Director of Census Operations; and the Chairman, Managing Director and a Director in State undertakings of Government of Tamil Nadu. He also served as the Health Secretary, Commissioner for Commercial Taxes, Government of Tamil Nadu. Mr. Murari retired as Secretary to the President

Bajaj Auto Ltd. Datamonitor

Page 13

Bajaj Auto Ltd.

Key Employee Biographies

of India in 1992. He currently serves as an Adviser to the President, Federation of Indian Chambers of Commerce and Industry (FICCI).

Niraj Bajaj

Board: Non Executive Board Job Title: Director Since: 2006 Age: 56 Mr. Bajaj has been a Director at Bajaj Auto since 2006. He started his career with Bajaj Auto (two years) and Bajaj Electricals (six months) before joining Mukand in 1983 as Senior Marketing Manager. Since then, Mr. Bajaj held positions of General Manager (Marketing), Deputy CEO, and Executive Director. He served with several industry organizations, including as: the President at Alloy Steel Producers' Association of India; the President at the Indian Steel Development Association; and the Chairman at Indo-Russian Federation of joint business council. Mr. Bajaj currently serves as a Member of the Managing Committee of ASSOCHAM and Vice President of Indian Merchants' Chamber.

Abraham Joseph

Board: Senior Management Job Title: President, Research and Development Mr. Vas has been the President, New Projects at Bajaj Auto since 2009. He is a Mechanical Engineer from College of Engineering, Pune, & PGDM from Indian Institute of Management (IIM), Calcutta.

S. Sridhar

Board: Senior Management Job Title: President, Motorcycle Business Mr. Joseph has been the President, Research and Development at Bajaj Auto since 2007. He joined the company in 1989 and became General Manager of Research and Development in 2005. Mr. Joseph is a Mechanical Engineer from the National Institute of Technology, Bhopal.

R.C. Maheshwari

Board: Senior Management Job Title: President, Commercial Vehicle Business Since: 2007

Bajaj Auto Ltd. Datamonitor

Page 14

Bajaj Auto Ltd.

Key Employee Biographies

Mr. Shrivastava has been the President, Engineering at Bajaj Auto since 2007. He joined the company in 1986. Mr. Shrivastava served as the Vice President, Engineering at Bajaj Auto in 2005. He received a degree in Mechanical Engineering from Indian Institute of Technology, Delhi. Mr. Shrivastava obtained a graduate diploma in Production and Finance from IIM Bangalore in 1986.

Rakesh Sharma

Board: Senior Management Job Title: President, International Business Since: 2007 Mr. Sridhar has been the Chief Executive Officer, Two Wheeler at Bajaj Auto since 2007. He joined the company in 2001 as the General Manager of Sales for Two Wheelers. Mr. Sridhar also served as the Vice President, Marketing and Sales of Two Wheelers in 2005. He holds an Engineering degree in Agriculture.

Eric Vas

Board: Senior Management Job Title: President, New Projects Since: 2009 Mr. Maheshwari has been the Chief Executive Officer, Commercial Vehicles at Bajaj Auto since 2007. He is a Mechanical engineer from BITS, Pilani.

K. Srinivas

Board: Senior Management Job Title: President, Retail Finance Since: 2009 Mr. Sharma has been the Chief Executive Officer, International Business at Bajaj Auto since 2007. He holds a Post Graduate Diploma in Management from IIM, Ahmedabad.

Kevin P D'sa

Board: Senior Management Job Title: President, Finance Mr. Tripathi has been the Vice President, Corporate at Bajaj Auto since 2007. He joined the company in 1996 as the Vice President (Waluj plant). Mr. Tripathi also served as the Vice President, Operations at Bajaj Auto in 2001. He is a Science graduate from Agra University, and holds a degree in Mechanical Engineering from the Indian Institute of Technology, Kharagpur.

Bajaj Auto Ltd. Datamonitor

Page 15

Bajaj Auto Ltd.

Key Employee Biographies

S. Ravikumar

Board: Senior Management Job Title: Senior Vice President, Business Development and Assurance Mr. Hingorani has been the Vice President, Commercial at Bajaj Auto since 2006. He joined the company in 1997 as the General Manager of Materials, and took over as the Vice President of Purchase in 1998. Mr. Hingorani holds a degree in Mechanical Engineering from the Malaviya Regional Engineering College, Jaipur.

Amrut Rath

Board: Senior Management Job Title: Vice President, Human Resources Since: 2009 Mr. D'sa serves as the Vice President, Finance at Bajaj Auto. He began his career with the company in 1978. Mr. D'sa holds a bachelor's degree in Commerce, completed his CA in 1978 and ICWA in 1981.

C.P. Tripathi

Board: Senior Management Job Title: Vice President, Corporate Social Responsibility Since: 2009 Mr. Sridhar has been the Company Secretary at Bajaj Auto since 2001. Prior to joining the company, he served as the Controller of Finance and Company Secretary, Maharashtra Scooters, a Bajaj Auto joint venture. Mr. Sridhar is a Graduate in Commerce and Law.

Bajaj Auto Ltd. Datamonitor

Page 16

Bajaj Auto Ltd.

Major Products and Services

MAJOR PRODUCTS AND SERVICES

Bajaj Auto, an India-based company, is a manufacturer and marketer of two and three wheeled vehicles which include scooters, motorcycles, passenger carriers and goods carriers. The company's key products include the following: Motorcycles: Avenger 200 DTS-i Pulsar 135 LS Pulsar 220 DTS-i Pulsar 180 DTS-i Pulsar 150 DTS-i Discover 150 Discover 135 DTS-i Discover DTS-Si Platina 125 Platina 100 CC Ninja 250R Goods Carriers: GC Max Diesel GC Max CNG RE600 Passenger Carriers: RE 2S RE 2S CNG RE 2S LPG RE 4S RE 4S CNG RE 4S LPG RE Diesel RE GDI Mega Max Automotive accessories and spare parts

Bajaj Auto Ltd. Datamonitor

Page 17

Bajaj Auto Ltd.

Revenue Analysis

REVENUE ANALYSIS

Overview Bajaj Auto recorded revenues of INR115,431.6 million ($2,539.5 million) in FY2010, an increase of 36.7% over FY2009. For FY2010, India, the company's largest geographic market, accounted for 72.7% of the total revenues. Bajaj Auto generates revenues through two business segments: automotive (99% of the total revenues in FY2010) and investments (1%). Revenue by segment In FY2010, the automotive segment recorded revenues of INR119,741.5 million ($2,634.3 million), an increase of 35.8% over FY2009. The investments segment recorded revenues of INR1,225 million ($27 million) in FY2010, an increase of 0.5% over FY2009. Note: The amount includes other income. Revenue by geography India, Bajaj Auto's largest geographical market, accounted for 72.7% of the total revenues in FY2010. Revenues from India reached INR87,947.5 million ($1,934.8 million) in FY2010, an increase of 39.9% over FY2009. Rest of the world accounted for 27.3% of the total revenues in FY2010. Revenues from rest of the world reached INR33,019 million ($726.4 million) in FY2010, an increase of 24.6% over FY2009.

Bajaj Auto Ltd. Datamonitor

Page 18

Bajaj Auto Ltd.

SWOT Analysis

SWOT ANALYSIS

Bajaj Auto, an India-based company, is a manufacturer and marketer of two and three wheeled vehicles which include scooters, motorcycles, passenger carriers and goods carriers. The company is the world's fourth largest two and three wheeler manufacturer and the Bajaj brand is well-known across several countries in Latin America, Africa, Middle East, South and South East Asia. Strong market share enables the company to gain more business and increase the investor's confidence. However, intense competition from global and regional vehicle manufacturers, and industry consolidation could force the company to reduce prices, which could strain its margins. Strengths Strong market share Brand recognition Strong focus on research and development Robust financial performance Opportunities Growing Indian automobile market Global alliance with KTM and Kawasaki Introduction of new models to expand product offerings Weaknesses Lack of scale compared to peers

Threats Intense competition in the two wheeler market Extensive environmental regulations Rising raw material prices

Strengths

Strong market share Bajaj Auto is the world's fourth largest two and three wheeler manufacturer and the Bajaj brand is well-known across several countries in Latin America, Africa, Middle East, South and South East Asia. The company has a strong market share in India. In FY2010, Bajaj Auto has a market share of 24.3% and in the domestic motorcycle sales. The company increased its market share in entry segment in the recent past with the launch of Discover 100 cc in August 2009, which sold more than 500,000 units till date. In addition, the Discover 100 increased the company's market share to 24% in FY2010 hurting its primary competitor Hero Honda whose market share was down from 83% to 68% during the last 12 months. It also dominates the executive segment, with a domestic market share in excess of 45%. Moreover, it has 31% market share in the performance bike segment. Further, Bajaj Auto is Indias largest exporter of two and three-wheelers. During FY2010, the companys exports accounted 28% of its total revenues. The companys three wheeler exports accounted almost 50% of total three wheeler sales. In addition, Bajaj Auto is the leading three wheeler

Bajaj Auto Ltd. Datamonitor

Page 19

Bajaj Auto Ltd.

SWOT Analysis

player in India, with market share of 55.6%. In the passenger vehicle segment, it enjoys a market share of 63.5% and in goods carriers segment, it has a market share of 10.1%. Strong market share enables the company to gain more business and increase the investor's confidence. Brand recognition The company manufactures and markets scooters, motorcycles, passenger carriers and goods carriers. It focuses on motorcycles in the two-wheeler and three-wheeler segment. The company has well established brands in each of these vehicle segments. Bajaj Auto manufactures motorcycles such as the Pulsar range (150 cc, 180 cc, 200 cc and the new 220 cc) and the Avenger DTS-i (Digital Twin Spark) which are categorized under the performance segment; the executive segment which includes 125 cc motorcycles including Discover DTS-i 135 and the XCD 125 DTS-Si (Swirl Induction); and the entry level vehicle segment, the 100 cc Platina motorcycles. The company manufactures scooters under the brand, Kristal. Moreover, its adoption of a brand-centric strategy, focusing on the differentiation and positioning of the Discover and Pulsar brands has reflected on the company's robust volumes. The repositioning of its brands has helped the company cater to the segment between executive and premium bikes and also the entry and executive bikes. Moreover, bikes such as the Discover 100 and 150cc and the new Pulsar 135, 150, 180 and 220 cc have helped the company's domestic two-wheeler sales grow by a robust 45% for the nine months ended December 2010. The three-wheelers segment manufactures goods carrier and passenger carrier three-wheelers. Bajaj Auto manufactures a range of passenger carriers which include: 2-stroke (2S), 4-stroke (4S), 4S compressed natural gas type, 4S liquefied petroleum gas type and 4S diesel type.The company's extensive range of products and well established brands covering the diverse spectrum of the automotive market strengthens it's the reach and market position. Strong focus on research and development Bajaj Auto is one of the leaders in developing innovative technology and energy-efficient solutions to its products marketed worldwide. The company's research and development (R&D) efforts are directed at developing new products and processes and improving the capabilities of existing products. The company has made substantial investments in R&D facilities resulting in enhancement of its infrastructure for design, prototyping and testing. Bajaj Auto spent INR1,347.6 million ($29.6 million) on R&D in FY2010, which stood at 1.2% of the total sales. The company continues to focus on expanding its design & testing teams, which has enabled it to make the new generation products and technologies such as 4 valves DTS-i engine, twin plug ignition and swirl motion. R&D has enhanced its internal competencies by installing advanced machines in proto shop and introduction of special equipments in testing areas. Such focus on R&D has helped the company in incorporating newer features to its existing range of products and also in bringing out latest technologies in the varied areas. Many important products, which demonstrated the technical prowess of the company, were launched in FY2010 including Pulsar 220 F, Pulsar 180 UG, Pulsar 150 UG, Pulsar 135 LS and Discover DTS-si.

Bajaj Auto Ltd. Datamonitor

Page 20

Bajaj Auto Ltd.

SWOT Analysis

The company's strong focus on innovations has allowed it to uphold the technological leadership in most of its product segments. It has also enabled the company to develop innovative products, leading to strong sales. Robust financial performance Bajaj Auto has seen a significant increase in its financials over the previous year. For instance, the companys revenues increased more than 35% from INR89,367.1 million ($1,966.1 million) in FY2009 to INR120,966.5 million ($2,661.3 million) in FY2010. The increase was due to a significant rise in the unit sales of motorcycles. In FY2010, the company sold more than 2.5 million motorcycles worldwide, an increase of 31.4% compared to the previous year. In domestic market, the companys sales increased by 39.7% in FY2010. Similarly, the companys profits also increased in FY2010. The company recorded an operating profit of INR25,566.3 million ($562.5 million) in FY2010, compared to an operating profit of INR11,012 million ($242.2 million) in FY2009.The net profit was INR15,972.2 million ($351.4 million) in FY2010, compared to a net profit of INR5,357.9 million ($117.9 million) in FY2009. The growth was primarily due to higher unit sales. Further, the company had a robust cash position in FY2010. The company recorded INR34,370 million ($756.1 million) in FY2010 compared to INR7,338.3 million ($161.4 million). Moreover, the company has seen a significant increase in its return on operating capital. From 55% pre-tax return on operating capital employed in FY2009, the ratio increased to 253% for 2009-10. Robust financial performance increases the customer confidence in the companys products and helps it to increase its brand image in the market.

Weaknesses

Lack of scale compared to peers Although Bajaj Auto has a strong brand image, it lacks favorable scale of operations in comparison to its competitors. Many of its competitors, such as Yamaha Motor and Hero Honda Motors are much larger in size in terms of revenues. Hero Honda Motors recorded revenues of INR167,806.2 million ($3,691.7 million) in FY2010, significantly higher than Bajaj Auto. Similarly, Yamaha Motor recorded revenues of JPY1,153,642 million (approximately $12,344 million) for the year ended December 2009. Bajaj Auto, in contrast, recorded revenues of INR120,966.5 million ($2,661.3 million) in FY2010. The company's small scale of operations could turn out to be a disadvantage in the fiercely competitive market. Lack of scale also reduces the bargaining power of Bajaj Auto.

Opportunities

Bajaj Auto Ltd. Datamonitor

Page 21

Bajaj Auto Ltd.

SWOT Analysis

Growing Indian automobile market The Indian two wheeler market has witnessed a strong growth in the recent past and the trend is likely to continue in the future. According to Society of Indian Automobile Manufacturers (SIAM), fueled by government stimulus packages, better demand and lower loan interest rates, the country's automobile industry has reported a whopping 32.7% growth in sales in the year 2009-10 making FY2010 one of the best years for the sector. This encouraging trend in the industry has also made India the second fastest growing market in the world following China, which recorded a 42% growth. In the domestic market, the sales were driven by car and the two-wheelers.The two-wheelers market witnessed a 28.2% surge. The SIAM has forecasted 16-18% growth in two wheeler market and 30-32% for scooters market in India for 2010-11. The growing demand for two wheelers represents an opportunity for Bajaj to capitalize on this market and expand its revenues and profits. Global alliance with KTM and Kawasaki Bajaj Auto is planning a global alliance with KTM of Austria and Kawasaki Heavy Industries (KHI) of Japan. This global motorcycle alliance would combine the R&D and global distribution strengths of the three companies. The move will result in costeffective manufacturing processes for engines, platforms and components, as well as a global distribution and marketing programs. Bajaj Auto currently has a 38.1% stake in KTM, which specializes in manufacturing stylish street and off-road bikes. Bajaj Auto already uses KHI network in South East Asia, Latin America. In addition, the companys own brand-bikes are the market leaders in countries like Philippines and Colombia while being sold through the Japanese companys network. Further, KTM would implement the manufacturing cost structure model from KHI and Bajaj Auto would broaden its existing partnership with Kawasaki. In this context, in April 2010, KHI set up its subsidiary named India Kawasaki Motors, in India. In the same month, KHI started a unit at its partner Bajaj Auto's Chakan plant in Pune, India, to assemble, import and sell its motorcycles in the country. IKM released several supersport, sport and cruiser models primarily in the 250 cc class or greater in FY2010 and planned to sell around 1,000 units in 2010-11. Similarly, in June 2010, KTM Power Sports started the production of motorcycles in the range of 125cc and 350cc in cooperation with Bajaj Auto. The first of the co-developed products named KTM Duke 125 is expected to be launched in European markets by the first half of 2011. KTM also planned to launch its products in India during the second half of 2012. Hence, the alliance helps three companies to use developed platforms to create different products suitable to their strategy and brand. This enhances the product capability of Bajaj Auto products and helps it to serve its customers more efficiently. Introduction of new models to expand product offerings Bajaj Auto introduced various new and improved models in order to expand its product offerings. For instance, in FY2010, the company launched the new Pulsar 220cc model. During the same period, Bajaj Auto launched 250cc motorcycle Kawasaki Ninja and the Pulsar 135 LS (light sport).

Bajaj Auto Ltd. Datamonitor

Page 22

Bajaj Auto Ltd.

SWOT Analysis

Furthermore, Bajaj Auto introduced the new Platina 125, a heavy duty bike. The company also plans to introduce new models to capture the deluxe commuter segment. In addition, Bajaj Auto is working on the re-designing of the 'Lite' range of its four-wheeler vehicles, both in the passenger and cargo segments. The cargo version is expected to be launched in 2011. Moreover, in May 2010, Bajaj Auto unveiled their new range of 'RE' passenger vehicles. Such product launches would increase the company's reach and the market share which in-turn would boost its revenues and profitability.

Threats

Intense competition in the two wheeler market The two wheeler market in India is highly competitive with fuel efficiency and price being crucial considerations for success. In the Indian two wheeler market, competition is stiff with around 10 players (including Hero Honda) competing for significant market shares. The players include global giants like Suzuki and Yamaha as well as Indian players like Bajaj Auto and TVS Motor. The two wheeler industry is also characterized by frequent new product launches in 2009 and 2010.Yamaha launched the YBR 110 in January 2010. It also plans to relaunch its other 100-cc bikes later this year. During the same period, Honda Motorcycle & Scooter India (MMSI) launched the 110-cc CB Twister, marking its foray into the mass segment.TVS Motors recently launched the 110-cc Jive, an auto-clutch bike aimed at urban commuters who constantly juggle in heavy traffic. Competition is expected to intensify with the focus on technology and price. The extent of pricing reductions varies from year to year, and takes the form of reductions in direct sales prices. Therefore, intense competition and pricing pressure may impact Bajaj Auto's market share and profit margins. Extensive environmental regulations The company is subjected to extensive governmental regulations regarding vehicle emission levels, noise, safety and levels of pollutants generated by its production facilities. These regulations are likely to become more stringent in the near future. The emission norms that are in force for two-wheelers and three-wheelers are more stringent than the Euro II norms. India implemented the Bharat Stage (BS) 2 norms throughout the country in 2005 and BS 3 norms from October 2010, which are more stringent than the previous norms. BS emissions standards regulate the output of air pollutants (such as nitrogen oxides (NOx), carbon monoxide (CO), hydrocarbons (HC), particulate matter (PM), soot, and, sulfur oxides (SOx)) by motor vehicles and other equipment. More stringent vehicle emission regulations in the future may lead to significant compliance costs for Bajaj Auto. Rising raw material prices

Bajaj Auto Ltd. Datamonitor

Page 23

Bajaj Auto Ltd.

SWOT Analysis

Baja Auto manufactures two and three wheeled vehicles which include scooters, motorcycles, passenger carriers and goods carriers. The principal raw materials consumed by Bajaj Auto are steel, ferrous metals, tyres and tubes, and nonferrous materials, which are purchased from several suppliers. Steel prices are significantly rising over the last few years. For instance, the global composite carbon steel price consistently increased from $653 per tonne in January 2010 to $736 per tonne in December 2010. Further, it increased to $813 per tonne in January 2011. Similarly, the global composite stainless steel price increased from $2,912 per tonne in January 2010 to $3,670 per tonne in December 2010, and further increased to $3,749 per tonne in January 2011. The steel prices are forecasted to further increase in 2011. Consistent increase in the raw material price would increase the operating costs of the company which in turn impact its profitability.

Bajaj Auto Ltd. Datamonitor

Page 24

Bajaj Auto Ltd.

Top Competitors

TOP COMPETITORS

The following companies are the major competitors of Bajaj Auto Ltd.

Yamaha Motor Co., Ltd. Hero Honda Motors Limited TVS Motor Company Ltd Mahindra & Mahindra, Ltd. Honda Motorcycle & Scooter India (Private) Ltd. Harley-Davidson, Inc. Piaggio & C. S.p.A.

Bajaj Auto Ltd. Datamonitor

Page 25

Bajaj Auto Ltd.

Company View

COMPANY VIEW

A statement by Rahul Bajaj, Chairman at Bajaj Auto Ltd. is given below. The statement has been taken from the companys annual report for FY2010. Dear Shareholder, When I wrote to you last year, we were amidst the worst global economic and financial crisis since the Great Depression of the 1930s. India, too, was affected. Quite frankly, at the time I wasnt sure when we might come out of the lower growth phase; and when we could expect better fortunes for the Countrys automotive industry. I have been surprised at the speed of the turnaround. It looks as if India will achieve somewhere between 7.2% and 7.5% GDP growth for 2009-10. It is, of course, lower than the 9% plus growth that we were getting accustomed to for three consecutive years up to 2007-08. Yet, it is the second highest growth rate among all major countries in the world. Even more impressive, is the significant uptick in demand for two-wheelers, three-wheelers as well as passenger vehicles. We have witnessed excellent growth in the two-wheeler market, which increased in volume by 24% in 2009-10. Your Company did better. It sold over 2.5 million motorcycles, and grew by more than 31%. Bajaj Autos superior performance suggests that it has been more than just leveraging market growth. What was it? For the last few years, your Company has been working at developing a brand-centered strategy especially of its two key brands, the Discover and the Pulsar. I believe that 2009-10 saw a near perfect alignment between the power of the brands the front-end and production efficiency, quality, costs and logistics, or the back-end. I agree with the managing director and his team that it is this alignment which has resulted in your Company growing faster than the market and earning the highest profit rate in the industry. 2009-10 has been a record year for Bajaj Auto in terms of highest ever sales, exports, profits and margins. Most of the financial details are in the chapter on Management Discussion and Analysis. Even so, here are a few key numbers: - Net sales and other operating income grew by 35% to over Rs.119 billion. - Your Companys operating EBITDA grew by 116% to almost Rs.26 billion. Operating earnings before interest, taxes, depreciation and amortization (EBITDA) was 21.7% of net sales and other operating income.

Bajaj Auto Ltd. Datamonitor

Page 26

Bajaj Auto Ltd.

Company View

- Operating profit before tax (PBT) grew by 170% to almost Rs.23 billion, and was over 19% of net sales and other operating income. - Profit after tax (PAT) grew by 160% to Rs.17 billion. I am delighted with the performance. And I would like you to join me and the rest of your Board of Directors to congratulate your Companys managing director, Rajiv Bajaj, and his team for delivering such excellent results. What pleases me is that Bajaj Auto is leveraging its key brands to maximize profits. Your Companys performance has not been about buying market share through various pricing deals. Instead, it is about gaining share through better quality and branding thus having the customer willing to pay higher prices for better value. Your Managing Director often says that while products may generate market share, brands provide pricing power and create higher profits. I am increasingly tending to agree with him. While writing this letter, I went back to the one written in Bajaj Autos annual report of 2005-06. It was also an excellent year: sales were up by almost 31% to a high of Rs.85 billion; EBITDA had increased by 47% to Rs.13.7 billion; the operating EBITDA margin was at 17.9%; and PAT had grown by 44% to cross Rs.11 billion. In that letter, I had exhorted your Company to mobilize India and sell 4 million motorcycles by 2010. We are clearly getting there. 2009-10 saw Bajaj Auto sell over 2.5 million motorcycles. Since Im known for speaking my mind, I am asking the management to make the vision of selling 4 million motorcycles come good by 31 March 2011. I had also asked your Company to globalize India by rapidly enhancing Bajaj Autos international footprint. It has. Exports has again done well this year, as it had in the last. 2009-10 saw Bajaj Auto export over 725,000 motorcycles and almost 165,000 three-wheelers. I expect 2010-11 will see us exporting over 1 million two- and three-wheelers. As India regains its growth momentum in 2010-11 and generates something in the neighborhood of 8.5% GDP growth, I believe that we should see yet another excellent year for Bajaj Auto: greater sales, pervasive brand loyalty and pull, more R&D successes, and higher profits and return on both capital employed and shareholder wealth. My thanks to all employees of Bajaj Auto for their unstinting support, especially in hard times. And to you for being our support through thick as well as thin. May India prosper. And with it, may Bajaj Auto.

Bajaj Auto Ltd. Datamonitor

Page 27

Bajaj Auto Ltd.

Locations and Subsidiaries

LOCATIONS AND SUBSIDIARIES

Head Office

Bajaj Auto Ltd. Akurdi Pune 411 035 IND P:91 20 2747 2851 http://www.bajajauto.com

Other Locations and Subsidiaries

Bajaj Auto - Pantnagar plant Plot No 2 Sectoe 10 Phase II E Pantnagar, Sidcul Rudrapur District Udhamsingh Nagar Uttranchal IND Bajaj Auto - Waluj plant Bajaj Nagar Waluj Aurangabad 431 136 Maharashtra IND Bajaj Auto - Chakan Plant MIDC Plot No A1 Mahalunge Village Chakan 410 501 Pune Maharashtra IND Bajaj Auto International Holdings BV NLD

Bajaj Auto Ltd. Datamonitor

Page 28

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- AEDK0627 CAT Truck Body Operation and Maitenance Guide PDFDokument9 SeitenAEDK0627 CAT Truck Body Operation and Maitenance Guide PDFCarlos Lobo100% (2)

- Booster Pump CalculationDokument3 SeitenBooster Pump CalculationYe Myat Thu93% (14)

- Handling & Shipping ProcedureDokument4 SeitenHandling & Shipping ProcedureRidoNoch keine Bewertungen

- Crew Tasks on WatchDokument10 SeitenCrew Tasks on WatchmytnameNoch keine Bewertungen

- InteroperabilityDokument330 SeitenInteroperabilityEmirson Obando100% (1)

- JSA For Cathodic Protection Installation For PipelineDokument15 SeitenJSA For Cathodic Protection Installation For PipelineAmeerHamzaWarraichNoch keine Bewertungen

- Rack Server Teech Sheet ManualDokument20 SeitenRack Server Teech Sheet ManualTim WiseNoch keine Bewertungen

- EP HSE SG 06 14 - EP HSE Technical Standard For Quantitative Risk Assessment (QRA) Rev 0Dokument88 SeitenEP HSE SG 06 14 - EP HSE Technical Standard For Quantitative Risk Assessment (QRA) Rev 0Kais Messaoudi100% (1)

- Etom Level 2 PDFDokument2 SeitenEtom Level 2 PDFNicoleNoch keine Bewertungen

- Nasm1312-13 Double Shear Test PDFDokument7 SeitenNasm1312-13 Double Shear Test PDFMichelle Camacho Heredia100% (1)

- Ceridust® 6721: Polypropylene Wax / Amide WaxDokument2 SeitenCeridust® 6721: Polypropylene Wax / Amide Waxمحمد عزتNoch keine Bewertungen

- Allan D. Cruzat: Position Applied: Pipe Fitter Educational AttainmentDokument15 SeitenAllan D. Cruzat: Position Applied: Pipe Fitter Educational AttainmentRaymond Manalo PanganibanNoch keine Bewertungen

- ROTORCOMP Company ProfileDokument26 SeitenROTORCOMP Company ProfileJose Santos0% (1)

- Supply Chain Evolution - Theory, Concepts and ScienceDokument25 SeitenSupply Chain Evolution - Theory, Concepts and ScienceAhmed AmrNoch keine Bewertungen

- Google Ad Manager Getting Started GuideDokument16 SeitenGoogle Ad Manager Getting Started GuideStathis MichailNoch keine Bewertungen

- GE 8077 - TQM Principles and ToolsDokument36 SeitenGE 8077 - TQM Principles and ToolsmenakadevieceNoch keine Bewertungen

- Hybrid IDEF0 IDEF03 HoustonDokument3 SeitenHybrid IDEF0 IDEF03 HoustonHouston Mandar TrivediNoch keine Bewertungen

- Crew Habitability Offshore HAB Guide E-Mar13Dokument87 SeitenCrew Habitability Offshore HAB Guide E-Mar13CrowthorneNoch keine Bewertungen

- Aptitude Test For FreshersDokument16 SeitenAptitude Test For FreshersnovateurNoch keine Bewertungen

- Panwater Proposal 11309Q3Dokument4 SeitenPanwater Proposal 11309Q3WahidCesarR100% (1)

- Experienced NDT engineer CVDokument6 SeitenExperienced NDT engineer CVTrung Tinh HoNoch keine Bewertungen

- Network - Shortest RouteDokument22 SeitenNetwork - Shortest RouteNoor AsikinNoch keine Bewertungen

- ARC Tech Talk Vol 5 Why Rack Flue Spaces Are Important enDokument3 SeitenARC Tech Talk Vol 5 Why Rack Flue Spaces Are Important enBaoDuongTranNoch keine Bewertungen

- TnaDokument7 SeitenTnaHRBP DEPARTMENT WPBNoch keine Bewertungen

- Icr July 2013 Bridge Gap Successful Kiln Shell Replacement ProjectDokument3 SeitenIcr July 2013 Bridge Gap Successful Kiln Shell Replacement ProjectSiddharth DeshmukhNoch keine Bewertungen

- Ampco-Fristam-Replacement-Parts-GuideDokument2 SeitenAmpco-Fristam-Replacement-Parts-GuideИбрагим НурмамедовNoch keine Bewertungen

- Terms & Conditions - Aluminium Window Work 13.02Dokument3 SeitenTerms & Conditions - Aluminium Window Work 13.02Boring GamerNoch keine Bewertungen

- Weight Calculations for Metal Fabrication ProjectDokument4 SeitenWeight Calculations for Metal Fabrication ProjectjmondroNoch keine Bewertungen

- Performance Tuning Document Um ApplicationsDokument11 SeitenPerformance Tuning Document Um Applicationsschnoodle3Noch keine Bewertungen

- Wheel Model 6 CatalogDokument40 SeitenWheel Model 6 CatalogHernan LopezNoch keine Bewertungen