Beruflich Dokumente

Kultur Dokumente

BreakfastBriefingPresentation ThePostRecessionMarketLandscape

Hochgeladen von

K FinkOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BreakfastBriefingPresentation ThePostRecessionMarketLandscape

Hochgeladen von

K FinkCopyright:

Verfügbare Formate

Presentation

North America Wind Power Advisory

The PostPost Recession Wind Market Landscape

IHS Emerging Energy Research, Breakfast Presentation

26 May 2010

Matthew Kaplan Senior Analyst +1 617 551 8583 mkaplan@emerging energy.com mkaplan@emerging-energy com

2010 EMERGING ENERGY RESEARCH, LLC. All rights reserved. Reproduction of this publication in any form without prior written permission is strictly forbidden. The information contained herein is from sources considered reliable but its accuracy and completeness are not warranted, nor are the opinions and analyses which are based upon it.

The Post-Recession Wind Market Landscape

Overview: 2010 Wind Market Landscape

2010 Wind Market Landscape

12,000

ARRA Incentives

10,000

Power Demand/Power Pricing Dearth of PPAs/ No Merchant Wind Build Developer Build Plan Reductions

State St t RPS

US Wind Installatio (MW) ons

8,000

Future Expectations For Growth

6,000

OEM Supply Agreements Slow Component Suppliers/ EPC Business Slowdown

4,000 4 000

2,000

Energy Policy Uncertainty

0 2005

Source: IHS Emerging Energy Research

2006

2007

2008

2009

2010

Despite unprecedented federal wind incentives, reverberations from the financial crisis continue to create a difficult near-term market landscape, especially in light of continued demand uncertainty

North America Wind Power Advisory May 2010 Page 2

The Post-Recession Wind Market Landscape

Electricity and Gas Prices Plummet

Major M j RTO Power Pricing: 20082010 P Pi i 2008 2010

140 Average Monthly Day-Ahead Price PJM 120 SPP MISO ERCOT 100 US$ / MW Wh ISO-NE Henry Hub Gas Prices US / MMBtu S$ 80 8 MW 6,000 10 8,000 12 10,000 10 000 14 12,000

US Wind Project Power j Offtake: 20092010

Non- PPA PPA

60

4,000 40 4 2,000

20

0 2009 2010 (Q1)

Source: IHS Emerging Energy Research

The severe downturn in electricity demand, power and natural gas pricing, along with continued uncertainty over a national RES or carbon legislation, has made utilities hesitant to ink PPAs

North America Wind Power Advisory May 2010 Page 3

The Post-Recession Wind Market Landscape

Wind Developers Adapt to Changing Market Conditions

Leading North American Wind Project Owners

8,000 7,000 6,000 6%

2009 Installed Capacity by Owner (MW)

<1%

YE 2009

YE 2008

14% 41%

International IPP Domestic IPP Domestic Utility Domestic Developer Domestic Other

MW

5,000 4,000 3,000 2,000 1,000 39%

9,789 MW

Changing Build Expectations -150 to 400 MW (2010) -500 MW (2010/2011)

Source: IHS Emerging Energy Research

Despite a large build year in 2009, leading IPPs Horizon and NextEra have slashed build expectations, exemplifying near-term challenges

North America Wind Power Advisory May 2010 Page 4

The Post-Recession Wind Market Landscape

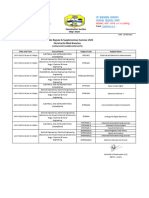

Wind Turbine OEM Domestic Manufacturing Facilities

Major OEM Manufacturing Facilities j g

Company 1 A Power A-Power Acciona Alstom Clipper DeWind 6 7 8 Fuhrlander

Component Assembly Assembly Assembly Assembly Assembly y Tower/Blade Assembly/Bade Assembly 15

Company Nordex

Component Assembly Blades

6 18 7 17 1 13 23 26 24 25 3 21 22 4 20 15 16 27 5 12 # Operating # Planned # Closed 11 2 19

2 3 4 5

16 17 18 19 Siemens 20 21 Suzlon 22 23 24 Vestas 25 26 27 Mitsubishi VienTek (Mitsubishi /TPI) Nordic Samsung

Assembly Tower/Blade Blades Assembly Assembly Blades Blades Assembly Blades Towers Assembly Blades Blades

14 9 8 10

9 10

Gamesa

Blades Blades Assembly Assembly

New Asia Pacific Turbine Supply Entrants

28 29

11 12 GE 13 14

Assembly 28 Gearboxes 29

Source: IHS Emerging Energy Research

More than 15 OEMs serve or look to serve the North American wind market through domestic manufacturing, in addition to several OEMs (mainly from Asia Pacific) inking supply contracts

North America Wind Power Advisory May 2010 Page 5

The Post-Recession Wind Market Landscape

Turbine Component Supplier Sourcing Overview

Major Component Manufacturing Facilities

OEM Towers Blades Gearboxes Bearings

Note: Includes operational and proposed manufacturing facilities Source: IHS Emerging Energy Research

The North American supply chain continues to expand domestically, supported by strong prospects for future wind growth

North America Wind Power Advisory May 2010 Page 6

The Post-Recession Wind Market Landscape

US Annual Growth Forecasts: 20102025

20 18 16 14 12 GW W 10 8 6 4 2 0 Base-Case Forecast High-Growth Low-Growth

Source: IHS Emerging Energy Research

Despite near-term uncertainty, EER forecasts 200 GW of wind energy installed by 2025

North America Wind Power Advisory May 2010 Page 7

The Post-Recession Wind Market Landscape

Long-Term Regional Forecast Outlook

Regional Wind Growth Forecasts ( (Onshore and Offshore) g )

P ifi Pacific Northwest New York Rocky Mountains Desert Southwest Great Plains

Pacific Northwest: 12,700 MW New York: 4,425 MW Midwest: 50,613 MW Rocky Mountains: ,600 24,600 MW New England: 3,293 MW

South New England

Midwest

Mid-Atlantic

Mid-Atlantic: 6,905 MW California: 11,300 MW Great Plains: 16,875 MW

California

Desert Southwest: 5,390 MW

South: 615 MW

Incremental 2020 RPS Demand (GWh)

Wind Additions (MW)

20202025

Wind Export

20152019 20102014

Texas: 27,635

Source: IHS Emerging Energy Research

National RES or federal energy policy legislation along with a streamlined transmission siting/cost allocation process will be essential to build a robust future wind market

North America Wind Power Advisory May 2010 Page 8

IHS Emerging Energy Research

IHS Emerging Energy Research provides analyst-directed advisory services on an annual subscription basis, providing market intelligence, competitive analysis and strategy advice in response to the specific needs of our clients. These services provide value-added support of clients competitive and market strategies, and are intended to be interactive, offering clients direct access to EER experts. Advisory service clients receive a stream of market and company briefs, ongoing market data and forecast support, telephone inquiry privileges, and regular analyst briefings. While much of the content is syndicated, clients also receive ongoing individual support of market assessment and strategy development needs. For more information on EERs advisory services, please contact: US Office

700 Technology Square Cambridge, Massachusetts, Cambridge Massachusetts US 02139 Whitney Van Horne Sales Support Manager Email: whitney@emerging-energy.com Phone: +1 617 551 8580 Fax: +1 617 551 8481

Spain Office

Paseo de Gracia 47, Planta 2 Barcelona, Barcelona Spain 08007 Paola Alcala Sales Support Manager Email: paola@emerging-energy.com Phone: +34 932 726 777 Fax: +34 93 467 6754

2010 EMERGING ENERGY RESEARCH, LLC. All rights reserved. Reproduction of this publication in any form without prior written permission is strictly forbidden. The information contained herein is from sources considered reliable but its accuracy and completeness are not warranted, nor are the opinions and analyses which are based upon it.

North America Wind Power Advisory May 2010

Page 9

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 2006 PPAP Manual 4th Edition ManualDokument51 Seiten2006 PPAP Manual 4th Edition ManualK FinkNoch keine Bewertungen

- 2022 Catalog 72Dokument58 Seiten2022 Catalog 72K FinkNoch keine Bewertungen

- Navistar Integrated Supplier Quality RequirementsDokument29 SeitenNavistar Integrated Supplier Quality RequirementsK FinkNoch keine Bewertungen

- CJFS Social Statistics 3710 Study Guide Exam OneDokument12 SeitenCJFS Social Statistics 3710 Study Guide Exam OneK FinkNoch keine Bewertungen

- Us Navy Color SchemesDokument3 SeitenUs Navy Color SchemesK FinkNoch keine Bewertungen

- User's Manual: Digital CameraDokument0 SeitenUser's Manual: Digital CameraMaicol Nicolas Peña FariasNoch keine Bewertungen

- Air Force Handbook 2007Dokument326 SeitenAir Force Handbook 2007joe_hielscher100% (1)

- MFG CSC IA Ver3Dokument1 SeiteMFG CSC IA Ver3K FinkNoch keine Bewertungen

- Bob R Corvette TalkDokument86 SeitenBob R Corvette TalkK FinkNoch keine Bewertungen

- Posing GuideDokument16 SeitenPosing GuideK FinkNoch keine Bewertungen

- Industrial Facilties Question A Ire 2010Dokument5 SeitenIndustrial Facilties Question A Ire 2010K FinkNoch keine Bewertungen

- MFG CompAge Fall FinalDokument4 SeitenMFG CompAge Fall FinalK FinkNoch keine Bewertungen

- MFG Tray Presentation Mar 2010Dokument16 SeitenMFG Tray Presentation Mar 2010K FinkNoch keine Bewertungen

- 9 Compelling Reasons To Specify CompositesDokument1 Seite9 Compelling Reasons To Specify CompositesK FinkNoch keine Bewertungen

- FRP Design Guide 06Dokument28 SeitenFRP Design Guide 06K Fink100% (5)

- Mass Reduction With Value-Engineered Composites: ProcessDokument4 SeitenMass Reduction With Value-Engineered Composites: ProcessK FinkNoch keine Bewertungen

- A Fundamental and Technical Review of RadomesDokument2 SeitenA Fundamental and Technical Review of RadomesK FinkNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 06-Apache SparkDokument75 Seiten06-Apache SparkTarike ZewudeNoch keine Bewertungen

- Online EarningsDokument3 SeitenOnline EarningsafzalalibahttiNoch keine Bewertungen

- T1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurningDokument16 SeitenT1500Z / T2500Z: Coated Cermet Grades With Brilliant Coat For Steel TurninghosseinNoch keine Bewertungen

- SAS SamplingDokument24 SeitenSAS SamplingVaibhav NataNoch keine Bewertungen

- Module 5 Data Collection Presentation and AnalysisDokument63 SeitenModule 5 Data Collection Presentation and AnalysisAngel Vera CastardoNoch keine Bewertungen

- BS 8541-1-2012Dokument70 SeitenBS 8541-1-2012Johnny MongesNoch keine Bewertungen

- Saet Work AnsDokument5 SeitenSaet Work AnsSeanLejeeBajan89% (27)

- 18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFDokument1 Seite18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFSantiago GarciaNoch keine Bewertungen

- Oem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Dokument43 SeitenOem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Farhad FarajyanNoch keine Bewertungen

- Dike Calculation Sheet eDokument2 SeitenDike Calculation Sheet eSaravanan Ganesan100% (1)

- Unit 1Dokument3 SeitenUnit 1beharenbNoch keine Bewertungen

- Year 9 - Justrice System Civil LawDokument12 SeitenYear 9 - Justrice System Civil Lawapi-301001591Noch keine Bewertungen

- Asphalt Plant Technical SpecificationsDokument5 SeitenAsphalt Plant Technical SpecificationsEljoy AgsamosamNoch keine Bewertungen

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDokument2 SeitenEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaNoch keine Bewertungen

- Sophia Program For Sustainable FuturesDokument128 SeitenSophia Program For Sustainable FuturesfraspaNoch keine Bewertungen

- Peoria County Jail Booking Sheet For Oct. 7, 2016Dokument6 SeitenPeoria County Jail Booking Sheet For Oct. 7, 2016Journal Star police documents50% (2)

- Basic Vibration Analysis Training-1Dokument193 SeitenBasic Vibration Analysis Training-1Sanjeevi Kumar SpNoch keine Bewertungen

- Termination LetterDokument2 SeitenTermination Letterultakam100% (1)

- Photon Trading - Market Structure BasicsDokument11 SeitenPhoton Trading - Market Structure Basicstula amar100% (2)

- Javascript Applications Nodejs React MongodbDokument452 SeitenJavascript Applications Nodejs React MongodbFrancisco Miguel Estrada PastorNoch keine Bewertungen

- Privacy: Based On Slides Prepared by Cyndi Chie, Sarah Frye and Sharon Gray. Fifth Edition Updated by Timothy HenryDokument50 SeitenPrivacy: Based On Slides Prepared by Cyndi Chie, Sarah Frye and Sharon Gray. Fifth Edition Updated by Timothy HenryAbid KhanNoch keine Bewertungen

- Heavy LiftDokument4 SeitenHeavy Liftmaersk01Noch keine Bewertungen

- 5 Deming Principles That Help Healthcare Process ImprovementDokument8 Seiten5 Deming Principles That Help Healthcare Process Improvementdewi estariNoch keine Bewertungen

- Extent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home EconomicsDokument47 SeitenExtent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home Economicschukwu solomon75% (4)

- 4th Sem Electrical AliiedDokument1 Seite4th Sem Electrical AliiedSam ChavanNoch keine Bewertungen

- CIR Vs PAL - ConstructionDokument8 SeitenCIR Vs PAL - ConstructionEvan NervezaNoch keine Bewertungen

- Water Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Dokument160 SeitenWater Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Aldrian PradanaNoch keine Bewertungen

- Bajaj Allianz InsuranceDokument93 SeitenBajaj Allianz InsuranceswatiNoch keine Bewertungen

- Information Security Chapter 1Dokument44 SeitenInformation Security Chapter 1bscitsemvNoch keine Bewertungen

- Shubham Tonk - ResumeDokument2 SeitenShubham Tonk - ResumerajivNoch keine Bewertungen