Beruflich Dokumente

Kultur Dokumente

Australian Dollar Outlook 15 August 2011

Hochgeladen von

International Business Times AUCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Australian Dollar Outlook 15 August 2011

Hochgeladen von

International Business Times AUCopyright:

Verfügbare Formate

FX DAILY REPORT

MONDAY 15TH AUGUST 2011

Bell FX Currency Outlook

The AUD is stronger this morning currently trading at USD1.0380 as offshore equity markets finished stronger and markets stabilised after the tumultuous week. Australia: Risk was back on the table as the global markets seemed to gain some stability towards the end of the week; therefore the AUD has risen almost one cent since Friday on the back of renewed demand. The positive news out of Europe, including the approval of Italys austerity budget managed to overshadow the somewhat mixed data out of the US. While US retail sales data was positive; meeting markets expectations of a 0.5% gain, the US consumer sentiment plunged to a 31 year low, leaving investors with little to go on. The Michigan Consumer Confidence fell from 63.7 to 54.9, which was much more severe than the expected drop to 62.The movements in the equity markets in the past week can explain some of the decrease; although should the index not recover next month, then it could leave investors very concerned for the recovery of the US economy. Tonight in the US sees the release of manufacturing data for August. Many will be paying close attention to the result given the recent fluctuating manufacturing results in the region. Locally we have new motor vehicle sales for July released; with the tier two data unlikely to influence the market. However, the Japanese Q2 GDP will be of more interest with markets expecting a 2.5% drop. Majors: Most of the news offshore was in relation to the recent rise of the Swiss Franc. Speculation is rife that Switzerlands central bank will take further measures to weaken the CHF; and this dragged the recent safehaven currency lower. The CHF fell more than 2% during the trading session against both the USD and the EUR. This was surprising as most of the movement out of the currency was purely based on speculation rather than any formal statement by the central bank. Many were going on the behaviour in the last week by the Swiss National Bank as they trimmed rates close to zero and flooded the Swiss money markets with liquidity to make the CHF less attractive to global investors. As mentioned above, the Italian Cabinet approved the austerity budget, which included more than EUR45.5bio in cuts to the balance sheet. A budget of this type is an attempt to show investors that they are undertaking all avenues to avoid any further sovereign debt issues. Other data out of Europe disappointed, with the regions industrial production falling 0.7%.

Australian Dollar / US Dollar

1.20 1.10 1.00 0.90 0.80 0.70 0.60

Oct-05 Oct-06 Oct-07 Oct-08 Oct-09 Oct-10 Oct-11

Todays Forecast Range

USD 1.0275 - 1.0475

Currencies AUD / USD USD / JPY EUR / USD GBP / USD NZD / USD AUD Crosses AUD / JPY AUD / EUR AUD / GBP AUD / NZD AUD / CAD Australian Rates Official Cash 3 Month Bill 10 Year Bond US Rates Fed Funds 3 Month Libor Last 1.0390 76.88 1.4275 1.6291 0.8355 Last 79.92 0.7276 0.6375 1.2439 1.0270 Last 4.75 4.83 4.43 Last 0.25 0.290 2.25 Last 1740.20 85.38 326.53 Last 4173 11269 5320 19620 8964 0.275 2.32 - / + (%) -0.5 -0.4 0.1 - / + (%) 0.8 1.1 3.0 0.1 -0.2 4.88 4.46 Previous High 1.0395 77.02 1.4294 1.6313 0.8358 High 80.11 0.799 0.6382 1.2255 1.0275 Previous Low 1.0171 76.51 1.4104 1.6133 0.8128 Low 78.70 0.7185 0.6325 1.2366 1.0166

Economic Calendar 15 AUG

10 Year Bond AU New Motor Vehicle Sales JUL JN GDP Q2 US Empire Manufacturing AUG US Feds Lockhart Speaks on economy in Alabama Commodities Gold (US$ / oz) Oil (WTI) US$/bbl) CRB Index

Important Disclaimer This may affect your legal rights: This publication has been issued on the basis that it is only for the information and exclusive use of the particular person to whom it is provided by Bell Potter Securities Limited trading in the foreign exchange markets as Bell Foreign Exchange (ACN 004 845 710). As this publication is a private communication to clients, it is not intended for public circulation or for use by any third party, without the prior approval of Bell Foreign Exchange. The Information contained in this publication has been obtained from sources considered and believed to be both reliable and accurate, and no responsibility is accepted for any error or omission, that may have occurred, or for any opinion expressed. The Information is general in nature, and does not take into account, the particular investment objectives or financial situation of any potential reader. It does not constitute, and should not be relied on, as financial or investment advice, or recommendations (expressed or implied), and is not an invitation to take up securities or other financial products or services. No decision should be made on the basis of the information without seeking expert financial advice. Ranges in this publication are indicative ranges over the past 24 hours. Last is around 9.00am Sydney. Please speak with Bell Foreign Exchange if you require latest pricing and ranges.

Equities ASX 200 Dow Jones FTSE Hang Seng Nikkei

Kimberly Limbert Sally Fisher Nick White Scott Fleming Stephen Blampied

08 8224 2725 08 8224 2771 08 8224 2770 03 9235 1912 03 9235 1960

klimbert@bellfx.com.au sfisher@bellfx.com.au nwhite@bellfx.com.au sfleming@bellfx.com.au sblampied@bellfx.com.au

Bill Giffen Geoff Louw Bronson Livingston Tracey Warren Scott Hill

02 9255 7473 02 8243 3502 02 8243 3503 02 9255 7294 02 8243 3504

TOLL FREE 1800 003 815 INFO@BELLPOTTER.COM.AU WWW.BELLPOTTER.COM.AU

bgiffen@bellfx.com.au glouw@bellfx.com.au blivingston@bellfx.com.au twarren@bellfx.com.au shill@bellfx.com.au

ABN 25 006 390 772 AFS LICENCE NO.243480

BELL POTTER SECURITIES LIMITED

GPO BOX 4718 MELBOURNE VIC 3001 AUSTRALIA

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Australian Dollar Outlook11/30/2011Dokument1 SeiteAustralian Dollar Outlook11/30/2011International Business Times AUNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Australian Dollar Outlook 24 August 2011Dokument1 SeiteAustralian Dollar Outlook 24 August 2011International Business Times AUNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Australian Dollar Outlook 08/29/2011Dokument1 SeiteAustralian Dollar Outlook 08/29/2011International Business Times AUNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Australian Dollar Outlook 22 August 2011Dokument1 SeiteAustralian Dollar Outlook 22 August 2011International Business Times AUNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Australian Dollar Outlook 23 August 2011Dokument1 SeiteAustralian Dollar Outlook 23 August 2011International Business Times AUNoch keine Bewertungen

- Australian Dollar Outlook 17 August 2011Dokument1 SeiteAustralian Dollar Outlook 17 August 2011International Business Times AUNoch keine Bewertungen

- Australian Dollar Report 19 August 2011Dokument1 SeiteAustralian Dollar Report 19 August 2011International Business Times AUNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Forex Market Report 26 July 2011Dokument4 SeitenForex Market Report 26 July 2011International Business Times AUNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Australian Dollar Outlook 03 August 2011Dokument1 SeiteAustralian Dollar Outlook 03 August 2011International Business Times AUNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- NAB's Quarterly SME Business Survey June 2011 (Release Date: 03 August 2011)Dokument11 SeitenNAB's Quarterly SME Business Survey June 2011 (Release Date: 03 August 2011)International Business Times AUNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Forex Market Report 25 July 2011Dokument4 SeitenForex Market Report 25 July 2011International Business Times AUNoch keine Bewertungen

- Australian Dollar Outlook 20 July 2011Dokument1 SeiteAustralian Dollar Outlook 20 July 2011International Business Times AUNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Australian Dollar Outlook 19 July 2011Dokument1 SeiteAustralian Dollar Outlook 19 July 2011International Business Times AUNoch keine Bewertungen

- Communication On The Telephone InfoDokument30 SeitenCommunication On The Telephone Infomelese100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

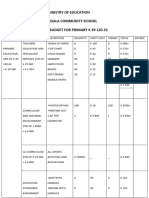

- Ministry of Education Musala SCHDokument5 SeitenMinistry of Education Musala SCHlaonimosesNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- COGELSA Food Industry Catalogue LDDokument9 SeitenCOGELSA Food Industry Catalogue LDandriyanto.wisnuNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Introduction To AirtelDokument6 SeitenIntroduction To AirtelPriya Gupta100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Drill String DesignDokument118 SeitenDrill String DesignMohamed Ahmed AlyNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Risk Analysis and Management - MCQs1Dokument7 SeitenRisk Analysis and Management - MCQs1Ravi SatyapalNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- MLT Torque Ring Field Make-Up HandbookDokument44 SeitenMLT Torque Ring Field Make-Up HandbookKolawole Adisa100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- NX CAD CAM AutomationDokument12 SeitenNX CAD CAM AutomationfalexgcNoch keine Bewertungen

- Exoskeleton ArmDokument5 SeitenExoskeleton Armc214ocNoch keine Bewertungen

- Aluminium Extrusion Industry in IndiaDokument3 SeitenAluminium Extrusion Industry in Indiakalan45Noch keine Bewertungen

- Time-Dependent Deformation of Shaly Rocks in Southern Ontario 1978Dokument11 SeitenTime-Dependent Deformation of Shaly Rocks in Southern Ontario 1978myplaxisNoch keine Bewertungen

- Intro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Dokument5 SeitenIntro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Thăng Nguyễn BáNoch keine Bewertungen

- Tindara Addabbo, Edoardo Ales, Ylenia Curzi, Tommaso Fabbri, Olga Rymkevich, Iacopo Senatori - Performance Appraisal in Modern Employment Relations_ An Interdisciplinary Approach-Springer Internationa.pdfDokument278 SeitenTindara Addabbo, Edoardo Ales, Ylenia Curzi, Tommaso Fabbri, Olga Rymkevich, Iacopo Senatori - Performance Appraisal in Modern Employment Relations_ An Interdisciplinary Approach-Springer Internationa.pdfMario ChristopherNoch keine Bewertungen

- A Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseDokument6 SeitenA Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseSpend ThriftNoch keine Bewertungen

- 87 - Case Study On Multicomponent Distillation and Distillation Column SequencingDokument15 Seiten87 - Case Study On Multicomponent Distillation and Distillation Column SequencingFranklin Santiago Suclla Podesta50% (2)

- Circuitos Digitales III: #IncludeDokument2 SeitenCircuitos Digitales III: #IncludeCristiamNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Ticket Udupi To MumbaiDokument2 SeitenTicket Udupi To MumbaikittushuklaNoch keine Bewertungen

- BSBOPS601 Develop Implement Business Plans - SDokument91 SeitenBSBOPS601 Develop Implement Business Plans - SSudha BarahiNoch keine Bewertungen

- White Button Mushroom Cultivation ManualDokument8 SeitenWhite Button Mushroom Cultivation ManualKhurram Ismail100% (4)

- Data Mining - Exercise 2Dokument30 SeitenData Mining - Exercise 2Kiều Trần Nguyễn DiễmNoch keine Bewertungen

- BACE Marketing Presentation FINALDokument14 SeitenBACE Marketing Presentation FINALcarlosfelix810% (1)

- Lemon AidDokument17 SeitenLemon AidJade Anne Mercado BalmesNoch keine Bewertungen

- BMT6138 Advanced Selling and Negotiation Skills: Digital Assignment-1Dokument9 SeitenBMT6138 Advanced Selling and Negotiation Skills: Digital Assignment-1Siva MohanNoch keine Bewertungen

- An Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)Dokument18 SeitenAn Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)gurumurthy38Noch keine Bewertungen

- Preventing OOS DeficienciesDokument65 SeitenPreventing OOS Deficienciesnsk79in@gmail.comNoch keine Bewertungen

- Revit 2019 Collaboration ToolsDokument80 SeitenRevit 2019 Collaboration ToolsNoureddineNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Te 1569 Web PDFDokument272 SeitenTe 1569 Web PDFdavid19890109Noch keine Bewertungen

- SPC Abc Security Agrmnt PDFDokument6 SeitenSPC Abc Security Agrmnt PDFChristian Comunity100% (3)

- Writing Task The Strategy of Regional Economic DevelopementDokument4 SeitenWriting Task The Strategy of Regional Economic DevelopementyosiNoch keine Bewertungen

- Digital Documentation Class 10 NotesDokument8 SeitenDigital Documentation Class 10 NotesRuby Khatoon86% (7)