Beruflich Dokumente

Kultur Dokumente

M07 Handout - Functions of Several Variables

Hochgeladen von

Katherine SauerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

M07 Handout - Functions of Several Variables

Hochgeladen von

Katherine SauerCopyright:

Verfügbare Formate

Economics Dr.

Sauer

Chapter 7 Lecture Handout 7.1 Partial Derivatives (a) z = 2x2 + 3xy + 5 (b) Q = 10L0.7K0.3 (c) U = x2y5

Notice that the mixed second-order partial derivatives are equal. 7.2 Applications 1. Production Functions The Cobb-Douglas production function is widely used in economic analysis. It takes the form: Q = ALK A. Marginal and Average Functions The partial derivatives of the production function are the marginal functions.

Notice that the marginal functions are positive, meaning the production function is increasing as the input is increasing. Notice that the straight second derivative is negative, meaning the law of diminishing returns applies. Ex: Q = 10L0.4K0.6

Average functions for a Cobb-Douglas production function:

In general, firms follow these conditions when deciding how much output to produce: QL = MPL > 0 QLL < 0 MPL < APL

B. Isoquants Productions functions are often represented graphically as isoquants. Various combinations of labor and capital can be used to produce a particular level of output.

The slope of an isoquant is called the Marginal Rate of Technical Substitution.

The slope of an isoquant is the ratio of the marginal products.

Example: Q = 10L0.5K0.5

C. Returns to Scale If you change both inputs by the same proportion, you can determine the proportionate change in output.

Ex: Q = 5L0.2K0.5

______________________________________________________________________ 2. Utility Functions Cobb-Douglas is also widely used for utility functions. Utility functions are often graphically represented as indifference curves.

The slope of an indifference curve is called the Marginal Rate of Substitution.

The slop of an indifference curve is the ratio of the marginal products.

Ex: U = 8x0.3y0.7

3. Partial Elasticities For a general demand function QA = f(PA, Y, PB) we can use partial derivatives to find the price, income, and cross-price elasticities of demand. Ex: QA = 100 2PA + 0.2Y + 0.3PB PA = 6, Y = 500, PB = 10

Similarly, we can find the partial elasticity with respect to Labor or Capital. Ex: Q = 2L0.9K0.1

Optimization 7.3 Unconstrained Optimization Find the 1st and 2nd partial derivatives. Set the 1st derivatives equal to zero and solve for the turning points. Use the 2nd derivative test to determine the nature of the turning points. The point is a maximum if the second derivatives are negative and >0. The point is a minimum if the second derivatives are positive and >0. The point is an inflection point if both second derivatives have the same sign and <0. The point is a saddle point if the second derivatives have different signs and <0. ( )( ) ( )

Example: A monopoly firm produces 2 goods, X and Y. The demand for each is given by: Px = 36 3x Py = 56 - 4y

Example: A competitive firm produces 2 goods, X and Y. The prices are $54 and $52 respectively. The firms total cost function is given by: TC = 3x2 + 3xy + 2y2 100

7.4 Constrained Optimization In the real world, there are limitations on things like our current incomes or the amount of labor a firm can hire. - You want to maximize your utility, subject to your budget constraint. - A firm wants to minimize its costs, subject to producing a given level of output. Example: Your utility function is given by U = 5xy. You have $30 to spend and the prices of goods X and Y are $5 and $1 respectively. Find the quantity of X and Y that will maximize your utility, given your budget.

Example: A firm has the following production function: Q = L0.3K0.7. The firm has to keep its costs at $150 or less. The price of labor is $3 and the price of capital is $15. Find the values of K and L that maximize output, given the firms constraint.

Example: A firm has the following production function: Q = L0.5K0.5. The firm must produce 240 units of output. The wage is $25 per worker and the rental rate of capital is $50 per unit. Find the values of K and L that minimize this firms costs, while producing the target level of output.

Das könnte Ihnen auch gefallen

- MATH2045: Vector Calculus & Complex Variable TheoryDokument50 SeitenMATH2045: Vector Calculus & Complex Variable TheoryAnonymous 8nJXGPKnuW100% (2)

- Function of Several Real VariablesDokument14 SeitenFunction of Several Real VariablesJose Luis CondoriNoch keine Bewertungen

- Stochastic Processes NotesDokument22 SeitenStochastic Processes Notesels_872100% (1)

- Numerical Analysis SolutionDokument19 SeitenNumerical Analysis SolutionPradip AdhikariNoch keine Bewertungen

- Ring Homomorphisms Over Certain RingsDokument122 SeitenRing Homomorphisms Over Certain RingsUnos0% (1)

- FINA3010 Summary For Lecture 1,2Dokument9 SeitenFINA3010 Summary For Lecture 1,2Koon Sing ChanNoch keine Bewertungen

- Abstract Algebra Assignment SolutionDokument12 SeitenAbstract Algebra Assignment SolutionStudy With MohitNoch keine Bewertungen

- (Lecture Notes) Andrei Jorza-Math 5c - Introduction To Abstract Algebra, Spring 2012-2013 - Solutions To Some Problems in Dummit & Foote (2013)Dokument30 Seiten(Lecture Notes) Andrei Jorza-Math 5c - Introduction To Abstract Algebra, Spring 2012-2013 - Solutions To Some Problems in Dummit & Foote (2013)momNoch keine Bewertungen

- Lecture09 AfterDokument31 SeitenLecture09 AfterLemon SodaNoch keine Bewertungen

- Example of Hessenberg ReductionDokument21 SeitenExample of Hessenberg ReductionMohammad Umar RehmanNoch keine Bewertungen

- Math 196, Section 59 (Vipul Naik)Dokument18 SeitenMath 196, Section 59 (Vipul Naik)Brian HaraNoch keine Bewertungen

- Functions of Several Variables2Dokument5 SeitenFunctions of Several Variables2ngothaiquynhNoch keine Bewertungen

- Monte Carlo Integration LectureDokument8 SeitenMonte Carlo Integration LectureNishant PandaNoch keine Bewertungen

- Complex NumbersDokument12 SeitenComplex Numbersadil4083Noch keine Bewertungen

- Linear Algebra With Probability PDFDokument73 SeitenLinear Algebra With Probability PDFShan De SilvaNoch keine Bewertungen

- Diffie-Hellman Key ExchangeDokument22 SeitenDiffie-Hellman Key ExchangesubburajsNoch keine Bewertungen

- Inequalities for Differential and Integral EquationsVon EverandInequalities for Differential and Integral EquationsNoch keine Bewertungen

- Homework #5: MA 402 Mathematics of Scientific Computing Due: Monday, September 27Dokument6 SeitenHomework #5: MA 402 Mathematics of Scientific Computing Due: Monday, September 27ra100% (1)

- Optimization Class Notes MTH-9842Dokument25 SeitenOptimization Class Notes MTH-9842felix.apfaltrer7766Noch keine Bewertungen

- Unit-2 Shear Force and Bending MomentDokument7 SeitenUnit-2 Shear Force and Bending MomentMouli Sankar100% (1)

- Complex OutlineDokument5 SeitenComplex OutlineZeeshan MazharNoch keine Bewertungen

- Handouts RealAnalysis IIDokument168 SeitenHandouts RealAnalysis IIbareera gulNoch keine Bewertungen

- de Moivres TheoremDokument18 Seitende Moivres TheoremAbdullah SaeedNoch keine Bewertungen

- Boolean Algebra FundamentalsDokument77 SeitenBoolean Algebra FundamentalsjimmyboyjrNoch keine Bewertungen

- Selected Solutions To AxlerDokument5 SeitenSelected Solutions To Axlerprabhamaths0% (1)

- Lecture Notes: Linear AlgebraDokument9 SeitenLecture Notes: Linear Algebrasaqlain abbasNoch keine Bewertungen

- Sylvester Criterion For Positive DefinitenessDokument4 SeitenSylvester Criterion For Positive DefinitenessArlette100% (1)

- Numerical Solutions of Differential EquationsDokument251 SeitenNumerical Solutions of Differential EquationsAmine AbfNoch keine Bewertungen

- Lagrange Interpolation ChapterDokument59 SeitenLagrange Interpolation ChapterSky FireNoch keine Bewertungen

- Lucio Boccardo, Gisella Croce - Elliptic Partial Differential Equations-De Gruyter (2013)Dokument204 SeitenLucio Boccardo, Gisella Croce - Elliptic Partial Differential Equations-De Gruyter (2013)Amanda Clara ArrudaNoch keine Bewertungen

- hw10 (Do Carmo p.260 Q1 - Sol) PDFDokument2 Seitenhw10 (Do Carmo p.260 Q1 - Sol) PDFjulianli0220Noch keine Bewertungen

- Introduction To MATLAB: Engineering Software Lab C S Kumar ME DepartmentDokument36 SeitenIntroduction To MATLAB: Engineering Software Lab C S Kumar ME DepartmentsandeshpetareNoch keine Bewertungen

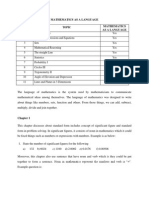

- Mathematics as a Language: Chapters on Standard Form, Quadratic Expressions, Sets, Reasoning and MoreDokument6 SeitenMathematics as a Language: Chapters on Standard Form, Quadratic Expressions, Sets, Reasoning and MoreFarah LiyanaNoch keine Bewertungen

- CompactnessDokument7 SeitenCompactnessvamgaduNoch keine Bewertungen

- Problems of Vector SpacesDokument3 SeitenProblems of Vector SpacesRaulNoch keine Bewertungen

- Infinite Sequences and SeriesDokument105 SeitenInfinite Sequences and Seriesnarukiz100% (1)

- Real Analysis With Real Applications - Kenneth R. Davidson, Allan P. Donsig 2001 Supplementary MaterialDokument78 SeitenReal Analysis With Real Applications - Kenneth R. Davidson, Allan P. Donsig 2001 Supplementary MaterialThanos KalogerakisNoch keine Bewertungen

- Sums of Two Squares: Pete L. ClarkDokument7 SeitenSums of Two Squares: Pete L. Clarkماجد اسماعيل سميرNoch keine Bewertungen

- Complex Analysis 1Dokument8 SeitenComplex Analysis 1xeemac100% (1)

- Functions of Bounded VariationDokument30 SeitenFunctions of Bounded VariationSee Keong Lee100% (1)

- Linear GuestDokument436 SeitenLinear GuestManish kumarNoch keine Bewertungen

- Principles of Least SquaresDokument44 SeitenPrinciples of Least SquaresdrdahmanNoch keine Bewertungen

- Cartesian TensorDokument25 SeitenCartesian Tensorbhbhnjj100% (1)

- Duhamel PrincipleDokument2 SeitenDuhamel PrincipleArshpreet SinghNoch keine Bewertungen

- Ex4 Tutorial - Forward and Back-PropagationDokument20 SeitenEx4 Tutorial - Forward and Back-PropagationAnandNoch keine Bewertungen

- Least Square Equation SolvingDokument22 SeitenLeast Square Equation Solvingnguyen_anh_126Noch keine Bewertungen

- Interpolation and Extrapolation ExplainedDokument16 SeitenInterpolation and Extrapolation Explainedabdul latifNoch keine Bewertungen

- B-Spline - Chapter 4 PDFDokument24 SeitenB-Spline - Chapter 4 PDFMarius DiaconuNoch keine Bewertungen

- Numerical Solutions of Stiff Initial Value Problems Using Modified Extended Backward Differentiation FormulaDokument4 SeitenNumerical Solutions of Stiff Initial Value Problems Using Modified Extended Backward Differentiation FormulaInternational Organization of Scientific Research (IOSR)Noch keine Bewertungen

- Radius of CurvatureDokument15 SeitenRadius of CurvatureLakshayNoch keine Bewertungen

- IIT Kanpur PHD May 2017Dokument5 SeitenIIT Kanpur PHD May 2017Arjun BanerjeeNoch keine Bewertungen

- Mathematics Introduction For MSCDokument52 SeitenMathematics Introduction For MSC34plt34Noch keine Bewertungen

- Real Analysis Lecture Notes PDFDokument124 SeitenReal Analysis Lecture Notes PDFphoeberamos100% (1)

- MA338 Differentiable Manifolds and Lie Groups NotesDokument98 SeitenMA338 Differentiable Manifolds and Lie Groups NotesValdir MendesNoch keine Bewertungen

- Metric SpacesDokument21 SeitenMetric SpacesaaronbjarkeNoch keine Bewertungen

- EC6502-Principal of Digital Signal Processing - 2013 - Regulation PDFDokument13 SeitenEC6502-Principal of Digital Signal Processing - 2013 - Regulation PDFSuba Sara SubaNoch keine Bewertungen

- Lecture Notes PDFDokument143 SeitenLecture Notes PDFPrateeti MukherjeeNoch keine Bewertungen

- Probability and Geometry On Groups Lecture Notes For A Graduate CourseDokument209 SeitenProbability and Geometry On Groups Lecture Notes For A Graduate CourseChristian Bazalar SalasNoch keine Bewertungen

- Integral and Finite Difference Inequalities and ApplicationsVon EverandIntegral and Finite Difference Inequalities and ApplicationsNoch keine Bewertungen

- Financial Wellness Programming: An Administrative PerspectiveDokument16 SeitenFinancial Wellness Programming: An Administrative PerspectiveKatherine SauerNoch keine Bewertungen

- Principles of MIcroeconomics - Notes - Markets/Supply/Demand - Part 2Dokument4 SeitenPrinciples of MIcroeconomics - Notes - Markets/Supply/Demand - Part 2Katherine SauerNoch keine Bewertungen

- Principles of MIcroeconomics - Lecture - Markets/Supply/Demand - Part 2Dokument17 SeitenPrinciples of MIcroeconomics - Lecture - Markets/Supply/Demand - Part 2Katherine Sauer100% (1)

- IntMicro ReadingOutline Ch02 S D and EquilibriumDokument7 SeitenIntMicro ReadingOutline Ch02 S D and EquilibriumKatherine SauerNoch keine Bewertungen

- ReadingNotes Chapter08 StatsDokument2 SeitenReadingNotes Chapter08 StatsKatherine SauerNoch keine Bewertungen

- Principles of MIcroeconomics - Worksheet - IntroductionDokument2 SeitenPrinciples of MIcroeconomics - Worksheet - IntroductionKatherine SauerNoch keine Bewertungen

- Principles of MIcroeconomics - Reading Outline - IntroductionDokument3 SeitenPrinciples of MIcroeconomics - Reading Outline - IntroductionKatherine SauerNoch keine Bewertungen

- IntMicro ReadingOutline Ch03 PreferencesDokument8 SeitenIntMicro ReadingOutline Ch03 PreferencesKatherine SauerNoch keine Bewertungen

- Intermediate Microeconomic Theory Katherine M. Sauer, Ph.D. ECO 3010 AD 530-R 303-556-3037 Fall 2012 Ksauer5@msudenver - EduDokument5 SeitenIntermediate Microeconomic Theory Katherine M. Sauer, Ph.D. ECO 3010 AD 530-R 303-556-3037 Fall 2012 Ksauer5@msudenver - EduKatherine SauerNoch keine Bewertungen

- Model Summary TemplateDokument1 SeiteModel Summary TemplateKatherine SauerNoch keine Bewertungen

- Chapter 1: Analyzing Economic Problems 1.1 Why Study Microeconomics?Dokument4 SeitenChapter 1: Analyzing Economic Problems 1.1 Why Study Microeconomics?Katherine SauerNoch keine Bewertungen

- IntMicro ReadingOutline Ch04 Consumer ChoiceDokument7 SeitenIntMicro ReadingOutline Ch04 Consumer ChoiceKatherine SauerNoch keine Bewertungen

- ReadingNotes Chapter08 MathDokument2 SeitenReadingNotes Chapter08 MathKatherine SauerNoch keine Bewertungen

- Reading Notes Economics - Dr. SauerDokument6 SeitenReading Notes Economics - Dr. SauerKatherine SauerNoch keine Bewertungen

- ReadingNotes Chapter09 StatsDokument2 SeitenReadingNotes Chapter09 StatsKatherine SauerNoch keine Bewertungen

- Lecture Notes - Big Mac IndexDokument2 SeitenLecture Notes - Big Mac IndexKatherine SauerNoch keine Bewertungen

- ReadingNotes Chapter07 StatsDokument3 SeitenReadingNotes Chapter07 StatsKatherine SauerNoch keine Bewertungen

- ReadingNotes Chapter06 StatsDokument2 SeitenReadingNotes Chapter06 StatsKatherine SauerNoch keine Bewertungen

- PM Guilds QuestionsDokument2 SeitenPM Guilds QuestionsKatherine SauerNoch keine Bewertungen

- ReadingNotes Chapter01 StatsDokument5 SeitenReadingNotes Chapter01 StatsKatherine Sauer100% (1)

- This Chapter Is Kind of Intense. I Don't Recommend Trying To Read Through The Whole Thing in One SittingDokument5 SeitenThis Chapter Is Kind of Intense. I Don't Recommend Trying To Read Through The Whole Thing in One SittingKatherine SauerNoch keine Bewertungen

- ReadingNotes Chapter02 StatsDokument2 SeitenReadingNotes Chapter02 StatsKatherine SauerNoch keine Bewertungen

- Chapter 4: Non-Linear Functions 4.1 Quadratic, Cubic and Other Polynomial FunctionsDokument4 SeitenChapter 4: Non-Linear Functions 4.1 Quadratic, Cubic and Other Polynomial FunctionsKatherine SauerNoch keine Bewertungen

- Lecture Notes - TaxesDokument3 SeitenLecture Notes - TaxesKatherine SauerNoch keine Bewertungen

- PM Income Tax History QuestionsDokument2 SeitenPM Income Tax History QuestionsKatherine SauerNoch keine Bewertungen

- Lecture - Big Mac IndexDokument11 SeitenLecture - Big Mac IndexKatherine SauerNoch keine Bewertungen

- PM Iceland Krona QuestionsDokument2 SeitenPM Iceland Krona QuestionsKatherine SauerNoch keine Bewertungen

- Exam 2 Information SheetDokument3 SeitenExam 2 Information SheetKatherine SauerNoch keine Bewertungen

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerDokument21 SeitenTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerNoch keine Bewertungen

- Exam 3 Information SheetDokument1 SeiteExam 3 Information SheetKatherine SauerNoch keine Bewertungen

- IBDP Economics P3 - Revision WorksheetDokument4 SeitenIBDP Economics P3 - Revision WorksheetSahana Rao100% (1)

- Ba-Computer Applications Course StructureDokument2 SeitenBa-Computer Applications Course StructureNaveen SanghviNoch keine Bewertungen

- Miroslav - Volf - Work in The Spirit Toward A Theology of Work PDFDokument266 SeitenMiroslav - Volf - Work in The Spirit Toward A Theology of Work PDFloreulici9973100% (1)

- JP Morgan - Global ReportDokument88 SeitenJP Morgan - Global Reporttrinidad01Noch keine Bewertungen

- Bruce Trigger - Archaeology and EcologyDokument17 SeitenBruce Trigger - Archaeology and EcologyArmanNoch keine Bewertungen

- Hedging Strategies Using Futures and OptionsDokument5 SeitenHedging Strategies Using Futures and Optionsniravthegreate999Noch keine Bewertungen

- Influence of Network Economy on Modern Enterprises and Chinese TacticsDokument8 SeitenInfluence of Network Economy on Modern Enterprises and Chinese TacticstujthevuxNoch keine Bewertungen

- HW5 SolnDokument7 SeitenHW5 SolnZhaohui Chen100% (1)

- Recycling of Demolition Waste and StrategiesDokument61 SeitenRecycling of Demolition Waste and StrategiesSham Candy100% (2)

- Who Is An EntrepreneurDokument29 SeitenWho Is An EntrepreneurmeliasuzzielNoch keine Bewertungen

- ECON 365 NotesDokument82 SeitenECON 365 Notesrushikesh KanireNoch keine Bewertungen

- Introduction To Feasibility Studies 97Dokument32 SeitenIntroduction To Feasibility Studies 97Tanzeel LiaqatNoch keine Bewertungen

- Emba55a s9 Problem1&15Dokument5 SeitenEmba55a s9 Problem1&15Senna El0% (1)

- VR - Cost of CapitalDokument36 SeitenVR - Cost of CapitalkjohnabrahamNoch keine Bewertungen

- Adda247 Publications For Any Detail, Mail Us atDokument15 SeitenAdda247 Publications For Any Detail, Mail Us atbhuviNoch keine Bewertungen

- Chapter 7 Dornbusch ModelDokument25 SeitenChapter 7 Dornbusch ModelDương Quốc TuấnNoch keine Bewertungen

- Market Value BasisDokument11 SeitenMarket Value BasisAtnapaz JodNoch keine Bewertungen

- Wage Payment SystemsDokument2 SeitenWage Payment SystemsShekhar J DekaNoch keine Bewertungen

- Ba (H) 20-Sem.i-Iii-V PDFDokument14 SeitenBa (H) 20-Sem.i-Iii-V PDFapoorvaNoch keine Bewertungen

- Vgalan DMDokument2 SeitenVgalan DMvinnygoldNoch keine Bewertungen

- WCM QuestionsDokument13 SeitenWCM QuestionsjeevikaNoch keine Bewertungen

- Causation and Effectuation - SarasvathyDokument22 SeitenCausation and Effectuation - SarasvathyRolf Dyhrberg Jensen100% (1)

- BD Pharma IndustryDokument3 SeitenBD Pharma IndustryS M Nabil AfrojNoch keine Bewertungen

- Chapter 12Dokument100 SeitenChapter 12cutiee cookieyNoch keine Bewertungen

- Managerial Economics Class 6: The University of British ColumbiaDokument25 SeitenManagerial Economics Class 6: The University of British ColumbiaManan ShahNoch keine Bewertungen

- Volum 2012 P 2 V 2Dokument1.430 SeitenVolum 2012 P 2 V 2Simina Măntescu100% (1)

- Eco-10 em PDFDokument11 SeitenEco-10 em PDFAnilLalvaniNoch keine Bewertungen

- Lecture 1 Market AnalysisDokument22 SeitenLecture 1 Market Analysisks9455Noch keine Bewertungen

- Cover Letter Ministry of Foreign AffairDokument2 SeitenCover Letter Ministry of Foreign AffairVINNY D.MELLINYNoch keine Bewertungen

- Law of Variable ProportionsDokument5 SeitenLaw of Variable ProportionsVinod Gandhi100% (1)