Beruflich Dokumente

Kultur Dokumente

GSB Sample Investment Banking Private Equity

Hochgeladen von

Ashish SalunkheOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

GSB Sample Investment Banking Private Equity

Hochgeladen von

Ashish SalunkheCopyright:

Verfügbare Formate

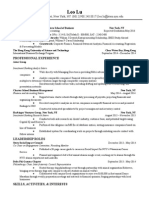

STEPHEN M.

CHANG

901 Riverside Drive Los Gatos, CA 95031 (XXX) XXX-XXXX XXXXX@gsb.stanford.edu

SUMMARY OF QUALIFICATIONS

Senior financial executive with broad expertise in venture capital, investment banking and private equity transactions within the energy and high-technology sectors. Direct and manage all aspects of the investment process, from client management, due diligence, negotiations, strategic market analysis and multimillion dollar financial agreements. Oversaw start-up funding of three green-technology companies, with current rankings on the Fortune 500 list.

CORE EXPERTISE

Investor Relations Business Analysis Private Equity

Valuation Models Due Diligence Risk Management

WORK EXPERIENCE

GREEN TECHNOLOGY VENTURES, Palo Alto, CA Venture capital firm specializing in start-up funding of green technology companies. Vice President 2008-Present

Manage high-profile investor relationships, to raise capital and evaluate offerings. Develop investor pitch-books, including executive and company overviews, valuation research, competitive analysis, niche markets and growth opportunities. Conduct and facilitate investor strategy sessions, including the review of over eight new deals per quarter. Oversee analysis and presentation of client companies. Partner with executive teams to conduct due diligence, prepare financial models and address risk mitigation. Generated over $2B in funding for 17 innovative energy companies. Built relationships with local universities, to market firms offerings and entrepreneurial endeavors, increased inquiries by 30%. THE CAPITAL FUND, Mountain View, CA 2004-2008 Middle market investment bank specializing in private equity for late stage and post IPO companies. Director, Finance Energy Division Consulted with clients and negotiated private equity agreements to fund over $1B in new utility and natural gas ventures. Executed transactions between $1-3M and sourced 14 deals. Grew new market penetration by 25%, through enhanced pricing models. Built business case and portfolio strategies for several international companies, with total private equity transactions of $165M.

Stanford University, Graduate School of Business Resume Sample: Investment Banking/Private Equity

Chang, Page 2, XXXXX@gsb.stanford.edu

WYMAN ASSOCIATES, San Francisco, CA 2001-2004 Boutique investment firm specializing in mergers and acquisitions within the high-technology sector. Senior Investment Manager Oversaw negotiation process and presented proposals to clients and prospects, including valuation, investor profiles, cost management and securities offerings. Led seven companies through mergers/acquisitions representing over $3B in transactions. Generated over $1.3M in repeat business and referrals. NATIONAL BANK, San Francisco, CA Investment bank providing corporate buy-side transactions. Account Manager (1999-2001) Senior Analyst (1997 -1999) 1997-2001

Provided investment banking services to corporate clients. Managed portfolio over $100M. Leveraged client relationships and grew new accounts by 15% within two years. Conducted industry analysis and market analysis, which resulted in 10% growth in new markets.

OTHER PROFESSIONAL EXPERIENCE

PRICE CONSULTING, San Diego, CA Financial services consulting firm. Controller TAYLOR, GIBBS and LIND, Los Angeles, CA Small, private firm of investment advisors. Associate Intern

EDUCATION

MBA, Stanford University, Stanford, CA Venture Capital Club, Vice President BA, Business Economics, UCLA, Los Angeles, CA

PROFESSIONAL CERTIFICATIONS & AFFILIATIONS

Cleantech Venture Network Member (Present) Conference Speaker Greentech Forum (2009) Financial Services Designations Series 6, 26

Stanford University, Graduate School of Business Resume Sample: Investment Banking/Private Equity

Das könnte Ihnen auch gefallen

- MRA Project Milestone 2Dokument20 SeitenMRA Project Milestone 2Sandya Vb69% (16)

- Information Memorandum: $1,775m and 250m Senior Secured Credit FacilitiesDokument81 SeitenInformation Memorandum: $1,775m and 250m Senior Secured Credit FacilitiesHilal MilmoNoch keine Bewertungen

- Experienced Investment Banker Resume Template Transaction PageDokument3 SeitenExperienced Investment Banker Resume Template Transaction PageMohamed AbdullaNoch keine Bewertungen

- Spring Week GuideDokument32 SeitenSpring Week Guidevimanyu.tanejaNoch keine Bewertungen

- Investment Banker Finance Resume TemplateDokument2 SeitenInvestment Banker Finance Resume TemplatePho6Noch keine Bewertungen

- Fortress Investment GroupDokument8 SeitenFortress Investment GroupAishwarya Ratna PandeyNoch keine Bewertungen

- Stanford Case Study PDFDokument20 SeitenStanford Case Study PDFWilliam LouchNoch keine Bewertungen

- Technical Interview Questions - IB and S&TDokument5 SeitenTechnical Interview Questions - IB and S&TJack JacintoNoch keine Bewertungen

- Career Guides - Leveraged Finance & Credit Risk Management Free GuideDokument9 SeitenCareer Guides - Leveraged Finance & Credit Risk Management Free GuideRublesNoch keine Bewertungen

- WST Macros Add-In InstructionsDokument3 SeitenWST Macros Add-In InstructionsTrader CatNoch keine Bewertungen

- WSO Resume - DemolishedDokument1 SeiteWSO Resume - DemolishedJack JacintoNoch keine Bewertungen

- Ninepoint Tec Private Credit Fund OmDokument86 SeitenNinepoint Tec Private Credit Fund OmleminhptnkNoch keine Bewertungen

- Private Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsDokument48 SeitenPrivate Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsAljon Del Rosario100% (1)

- KPMGs Guide To Going Public PDFDokument84 SeitenKPMGs Guide To Going Public PDFVenp PeNoch keine Bewertungen

- VP Corporate Development M&A in San Francisco Bay CA Resume Kostas KatsohirakisDokument2 SeitenVP Corporate Development M&A in San Francisco Bay CA Resume Kostas KatsohirakisKostasKatsohirakis100% (1)

- EMPEA Emerging Markets Mezzanine Report May 2014 WEBDokument32 SeitenEMPEA Emerging Markets Mezzanine Report May 2014 WEBJurgenNoch keine Bewertungen

- Fs App BibleDokument28 SeitenFs App Bibleroy064Noch keine Bewertungen

- The Intelligent Investor NotesDokument19 SeitenThe Intelligent Investor NotesJack Jacinto100% (6)

- The Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsVon EverandThe Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsNoch keine Bewertungen

- Dardenresume PEDokument36 SeitenDardenresume PEkk235197Noch keine Bewertungen

- M&A Course SyllabusDokument8 SeitenM&A Course SyllabusMandip LuitelNoch keine Bewertungen

- How To Create Investment Banking Pitch BooksDokument7 SeitenHow To Create Investment Banking Pitch BooksRaviShankarDuggiralaNoch keine Bewertungen

- Lu Leo ResumeDokument2 SeitenLu Leo ResumeLeo LuNoch keine Bewertungen

- Advanced Financial Modeling: Mergers and Acquisitions (M&A)Dokument38 SeitenAdvanced Financial Modeling: Mergers and Acquisitions (M&A)Akshay SharmaNoch keine Bewertungen

- Investment Banking Resume II - AfterDokument1 SeiteInvestment Banking Resume II - AfterbreakintobankingNoch keine Bewertungen

- Ascend Hedge Fund Investment Due Diligence Report 0811redactedDokument17 SeitenAscend Hedge Fund Investment Due Diligence Report 0811redactedJoshua ElkingtonNoch keine Bewertungen

- TPG PE PresentationDokument37 SeitenTPG PE Presentationnicolee593100% (1)

- TransdigmDokument4 SeitenTransdigmTMFUltimateNoch keine Bewertungen

- Lazard - Analyst Recruitment Process For WebsiteDokument3 SeitenLazard - Analyst Recruitment Process For WebsiteAndor JákobNoch keine Bewertungen

- TBO M&a QuestionsDokument2 SeitenTBO M&a Questionsowen sherryNoch keine Bewertungen

- Cover Letter For Stanford - Mutemi-1Dokument1 SeiteCover Letter For Stanford - Mutemi-1Sitche ZisoNoch keine Bewertungen

- Lecture 5 - A Note On Valuation in Private EquityDokument85 SeitenLecture 5 - A Note On Valuation in Private EquitySinan DenizNoch keine Bewertungen

- Ibig 04 08Dokument45 SeitenIbig 04 08Russell KimNoch keine Bewertungen

- Investment Banking Cover Letter TemplateDokument2 SeitenInvestment Banking Cover Letter TemplateMihnea CraciunescuNoch keine Bewertungen

- Precedent Transaction AnalysisDokument6 SeitenPrecedent Transaction AnalysisJack JacintoNoch keine Bewertungen

- WST University Training MALBODokument5 SeitenWST University Training MALBOJason ToopNoch keine Bewertungen

- How To Prepare For An Asset Management Interview - Online Version2 PDFDokument11 SeitenHow To Prepare For An Asset Management Interview - Online Version2 PDFGuido FranchettiNoch keine Bewertungen

- Investment Banking Generic Cover LetterDokument1 SeiteInvestment Banking Generic Cover LetterbreakintobankingNoch keine Bewertungen

- Framing Global DealsDokument35 SeitenFraming Global DealsLeonel KongaNoch keine Bewertungen

- Annotated Investment Banking Graduate Job Covering LetterDokument1 SeiteAnnotated Investment Banking Graduate Job Covering LetterNuttyahNoch keine Bewertungen

- PitchBook US Institutional Investors 2016 PE VC Allocations ReportDokument14 SeitenPitchBook US Institutional Investors 2016 PE VC Allocations ReportJoJo GunnellNoch keine Bewertungen

- NIBC 2019 2020 Competition Overview2Dokument31 SeitenNIBC 2019 2020 Competition Overview2HarshNoch keine Bewertungen

- #2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?Dokument8 Seiten#2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?helloNoch keine Bewertungen

- A Guide To Venture Capital 3261Dokument64 SeitenA Guide To Venture Capital 3261graylogicNoch keine Bewertungen

- MoelisDokument24 SeitenMoelisBakshi V100% (1)

- Vault Guide PEDokument155 SeitenVault Guide PENéné Oumou BARRYNoch keine Bewertungen

- Princeton-MFIN-Class-of-2023-Resume-Book 2Dokument29 SeitenPrinceton-MFIN-Class-of-2023-Resume-Book 2anish.tionne100% (1)

- Private Eq Interview QsDokument7 SeitenPrivate Eq Interview QsVignesh VoraNoch keine Bewertungen

- JPM-Equity-Research-Report-Hulu You Should Read ItDokument31 SeitenJPM-Equity-Research-Report-Hulu You Should Read ItS MsNoch keine Bewertungen

- Investment Banking Cover Letter TemplateDokument2 SeitenInvestment Banking Cover Letter TemplateBrian OuNoch keine Bewertungen

- PWC Executing Successful IpoDokument13 SeitenPWC Executing Successful Ipolalitkumar_itmbmNoch keine Bewertungen

- WSO Resume 119861Dokument1 SeiteWSO Resume 119861John MathiasNoch keine Bewertungen

- 1 Sequoia Capital Pitch Deck From Info Presented atDokument10 Seiten1 Sequoia Capital Pitch Deck From Info Presented atGaurav PantNoch keine Bewertungen

- Investment Banking Interview Guide: Course OutlineDokument20 SeitenInvestment Banking Interview Guide: Course OutlineTawhid SyedNoch keine Bewertungen

- Private Equity DealDokument39 SeitenPrivate Equity DealZinebCherkaouiNoch keine Bewertungen

- Case Study BriefingDokument5 SeitenCase Study BriefingZohaib AhmedNoch keine Bewertungen

- Strategic Lending Plan: September 2011 Final DocumentDokument11 SeitenStrategic Lending Plan: September 2011 Final DocumentFinley FinnNoch keine Bewertungen

- Mid MarketDokument234 SeitenMid Marketfarafin100% (1)

- WSO FT Banking ResumeDokument1 SeiteWSO FT Banking ResumeJohn MathiasNoch keine Bewertungen

- Vault Career Guide To Investment Management European Edition 2014 FinalDokument127 SeitenVault Career Guide To Investment Management European Edition 2014 FinalJohn Chawner100% (1)

- Private Equity Fund Of Funds A Complete Guide - 2020 EditionVon EverandPrivate Equity Fund Of Funds A Complete Guide - 2020 EditionNoch keine Bewertungen

- Cash Flow Business Case ExampleDokument3 SeitenCash Flow Business Case ExampleSohag HossenNoch keine Bewertungen

- Ifrs16 Analyst Presentation PDFDokument15 SeitenIfrs16 Analyst Presentation PDFAshish SalunkheNoch keine Bewertungen

- Classification of CostsDokument84 SeitenClassification of CostsRoyal ProjectsNoch keine Bewertungen

- DVP DairyFarmProjectReport BuffaloLargescaleDokument2 SeitenDVP DairyFarmProjectReport BuffaloLargescaleRajeev VenegallaNoch keine Bewertungen

- ICST Tallyerp9Dokument141 SeitenICST Tallyerp9Ashish Salunkhe100% (1)

- Financial Statements Presentation Under Comapnies ActDokument196 SeitenFinancial Statements Presentation Under Comapnies ActRajesh SuraseNoch keine Bewertungen

- 38 - Valuation by Prof. GrohDokument51 Seiten38 - Valuation by Prof. GrohAshish SalunkheNoch keine Bewertungen

- Graphical and Analytical Methodology For Cost Benchmarking For New Construction ProjectsDokument11 SeitenGraphical and Analytical Methodology For Cost Benchmarking For New Construction ProjectsAshish SalunkheNoch keine Bewertungen

- Business Plan Marketing Presentation TemplateDokument17 SeitenBusiness Plan Marketing Presentation TemplateAshish SalunkheNoch keine Bewertungen

- Financial Appraisal ReportDokument6 SeitenFinancial Appraisal ReportAshish SalunkheNoch keine Bewertungen

- Real Estate Valuation According To Standardized Methods: An Empirical AnalysisDokument54 SeitenReal Estate Valuation According To Standardized Methods: An Empirical AnalysisAshish SalunkheNoch keine Bewertungen

- Candidate QuestionnaireDokument1 SeiteCandidate QuestionnaireAshish SalunkheNoch keine Bewertungen

- Foreign Policy During Mahathir EraDokument7 SeitenForeign Policy During Mahathir EraMuhamad Efendy Jamhar0% (1)

- Management of Breast CancerDokument53 SeitenManagement of Breast CancerGaoudam NatarajanNoch keine Bewertungen

- Fouts Federal LawsuitDokument28 SeitenFouts Federal LawsuitWXYZ-TV DetroitNoch keine Bewertungen

- La FolianotesDokument4 SeitenLa Folianoteslamond4100% (1)

- Lee. Building Balanced Scorecard With SWOT Analysis, and Implementing "Sun Tzu's The Art of Business Management Strategies" On QFD Methodology PDFDokument13 SeitenLee. Building Balanced Scorecard With SWOT Analysis, and Implementing "Sun Tzu's The Art of Business Management Strategies" On QFD Methodology PDFSekar Ayu ParamitaNoch keine Bewertungen

- Developing Mental Health-Care Quality Indicators: Toward A Common FrameworkDokument6 SeitenDeveloping Mental Health-Care Quality Indicators: Toward A Common FrameworkCarl FisherNoch keine Bewertungen

- Kematian Di ICUDokument24 SeitenKematian Di ICURahmida RahmyNoch keine Bewertungen

- The Great Muslim Scientist and Philosopher Imam Jafar Ibn Muhammad Al Sadiq A S PDFDokument38 SeitenThe Great Muslim Scientist and Philosopher Imam Jafar Ibn Muhammad Al Sadiq A S PDFS.SadiqNoch keine Bewertungen

- Urban Design ToolsDokument24 SeitenUrban Design Toolstanie75% (8)

- Direct RetainerDokument186 SeitenDirect RetainerAngkita KalitaNoch keine Bewertungen

- Kravitz Et Al (2010)Dokument5 SeitenKravitz Et Al (2010)hsayNoch keine Bewertungen

- Pemahaman Sastra Mahasiswa Bahasa Dan Sastra Arab UIN Imam Bonjol Padang: Perspektif Ilmu SastraDokument31 SeitenPemahaman Sastra Mahasiswa Bahasa Dan Sastra Arab UIN Imam Bonjol Padang: Perspektif Ilmu Sastrailham nashrullahNoch keine Bewertungen

- Pressure Sound MeasurementDokument47 SeitenPressure Sound MeasurementSaleem HaddadNoch keine Bewertungen

- Quality of Life After Functional Endoscopic Sinus Surgery in Patients With Chronic RhinosinusitisDokument15 SeitenQuality of Life After Functional Endoscopic Sinus Surgery in Patients With Chronic RhinosinusitisNarendraNoch keine Bewertungen

- Ponty Maurice (1942,1968) Structure of BehaviorDokument131 SeitenPonty Maurice (1942,1968) Structure of BehaviorSnorkel7Noch keine Bewertungen

- Creating The HardboiledDokument20 SeitenCreating The HardboiledBen NallNoch keine Bewertungen

- The 5 Basic Sentence PatternsDokument6 SeitenThe 5 Basic Sentence PatternsShuoNoch keine Bewertungen

- Stability Result 15275 MT - Initial StowageDokument1 SeiteStability Result 15275 MT - Initial StowageLife with Our planetNoch keine Bewertungen

- Hussain Kapadawala 1Dokument56 SeitenHussain Kapadawala 1hussainkapda7276Noch keine Bewertungen

- Current MBA GradesDokument2 SeitenCurrent MBA GradesDiptarghya KunduNoch keine Bewertungen

- P.E and Health: First Quarter - Week 1 Health-Related Fitness ComponentsDokument19 SeitenP.E and Health: First Quarter - Week 1 Health-Related Fitness ComponentsNeil John ArmstrongNoch keine Bewertungen

- Press ReleaseDokument1 SeitePress Releaseapi-303080489Noch keine Bewertungen

- مذكرة التأسيس الرائعة لغة انجليزية للمبتدئين?Dokument21 Seitenمذكرة التأسيس الرائعة لغة انجليزية للمبتدئين?Manar SwaidanNoch keine Bewertungen

- Chapter 8 Review QuestionsDokument2 SeitenChapter 8 Review QuestionsSouthernGurl99Noch keine Bewertungen

- DR LukeDokument126 SeitenDR Lukegabryelbarretto7Noch keine Bewertungen

- Essay On Earth QuakeDokument7 SeitenEssay On Earth Quakexlgnhkaeg100% (2)

- Mamaoui PassagesDokument21 SeitenMamaoui PassagesSennahNoch keine Bewertungen

- 50 Life Secrets and Tips - High ExistenceDokument12 Seiten50 Life Secrets and Tips - High Existencesoapyfish100% (1)