Beruflich Dokumente

Kultur Dokumente

Key Answers & Sol-Pa2 1st PB July 2011

Hochgeladen von

maycon925Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Key Answers & Sol-Pa2 1st PB July 2011

Hochgeladen von

maycon925Copyright:

Verfügbare Formate

KEY ANSWERS & SOLUTIONS PRACTICAL ACCOUNTING 2 1ST PB JULY 16, 2011 1. C 2. B 3. A 4. BONUS (556,250; 706,250; 537,500) 5. D 6. B 7. D 8. D 9. A 10.

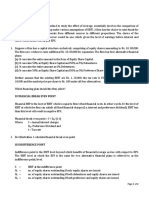

C 11. D 12. A 13. B 14. B 15. C 16. A 17. B 18. D 19. D 20. A 21. B 22. C 23. B 24. B 25. C SOLUTIONS 1. Assets at fair value Joe (80,000 + 400,000) Smith (40,000 + 280,000) Less: Liabilities assumed Capital 2. Capitals before admission Admission of Vince: By purchase By investment Capital balances Goodwill to old partners (330,000 315,000) Bonus to old partners (92,000 70,000) Capital after admission 3. Salary Balance, equally Income for year 2013 only Income for year 2012 (60:40) Reported income for year 2013 Joe 480,000 120,000 360,000 ======== Mitz 95,000 95,000 7,500 11,000 113,500 ======== A 18,000 1,500 19,500 2,400 21,900 ======= 320,000 60,000 260,000 ========= Mart 60,000 60,000 3,000 4,400 67,400 ======== Total 18,000 3,000 21,000 4,000 25,000 ========= Vince 12,000 80,000 92,000 ( 22,000 ) 70,000 ========== Smith 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. C A D C A A D C A B A D B C C B A A B A A A A A B

Marc 80,000 ( 12,000 ) 68,000 4,500 6,600 79,100 ======= D 1,500 1,500 1,600 3,100 =======

4. A Capital balances before admission of D 700,000 Admission of D: By purchase from A (1/2) ( 350,000) By investment Capital balances 350,000 Goodwill to old partners, 3:3:2, P 550,000 206,250 Goodwill to new partner, P 200,000 Capital balances after admission 556,250 ========= Goodwill computation: Total agreed capital of the new partnership Total contributed capital Goodwill To new partner (2,400,000 x 1/4 ) 400,000 To old partners 5. Salaries Interest on average capital Balance, equally A 30,000 2,167 ( 1,483 ) 30,684 ========= B 30,000 800 ( 1,484 ) 29,316 ========

B 500,000

C 400,000

D -

500,000 206,250 706,250 ======== 2,400,000 1,650,000 750,000 200,000 550,000 ========== Total 60,000 2,967 ( 2,967 ) 60,000 =========

350,000 400,000 400,000 750,000 137,500 200,000 537,500 950,000 ========= =========

No bonus since the basis of such computation would be zero. Average capital: A = 325,000/10 mos B = 120,000/10 mos = = 32,500 12,000

6. Whether there is a profit or a loss, F will have a greater advantage. When there is a profit, F will obtain a 20% bonus on profits before the bonus, and also take 40% of the profit after the bonus. I on the other hand, will receive only 60% of the profit after the bonus. 11. Total agreed capital after the admission of David (40,000 x 5) Less: Contribution/investment of David Capital balances of AD before the admission of David Capital contribution (140,000 + 40,000) Reduction of inventory Amount paid (34,000 + 10,000) Less: Book value of interest acquired (180,000 x 1/5) Excess Divided by/Capitalized at Amount of land to be increased Total agreed capital (given) (x) Davids capital interest Agreed capital to be credited to David Contributed/Invested capital of David Bonus to David Cash Allan, capital Dan, capital David, capital 40,000 3,000 1,000 44,000 200,000 40,000 160,000 180,000 20,000 ========= 44,000 36,000 8,000 1/5 40,000 ======== 220,000 1/5 44,000 40,000 4,000 ========

12.

13.

14.

Profit per books, 2008 Unrecorded: Accrued expenses 2008 Accrued income 2008 Prepaid expenses 2007 Unearned income 2007 Corrected profit, 2008 Bs share in the 2008 net profit: 17% x 14,650 =

15,000 ( 1,050 ) 875 ( 1,400 ) 1,225 14,650 ========= 2,490.50 50,000 3,200 46,800 0 46,800 40% 117,000 300,000 183,000 ========= 471,000 231,000 23,500 125,000 70,000 95,000

15.

Quincy capital before liquidation Less: Share in liquidation expenses (8,000 x 40%) Quincy capital before realization of noncash assets Less: Cash received by Quincy (minimum) Share in the loss on realization Divided by: P/L ratio Loss on realization Less: Noncash assets Proceeds from sale Total assets at realizable values Priority claims: Fully secured creditors (220,000 + 11,000) Liabilities with priority (9,500 + 14,000) Partially secured creditors (60,000 + 65,000) Net amount available to unsecured creditors Unsecured creditors: Partially secured creditors (unsecured portion) Accounts payable Estimated deficiency to unsecured creditors

16.

379,500

165,000 ( 73,500 ) ========== 125,000 38,815 163,815 =========

17.

Estimated amount to be paid to Notes payable plus interest: Partially secured by accounts receivable and inventory Unsecured portion (195,000 125,000) x 55.45%* Total payment * Estimated recovery rate (91,500 / 165,000) 55.45%

18.

Michaels salary is an unsecured with priority, therefore, he receives the full amount. Meldcan 1,050 x (35,000/60,000) = 630 Compboy 5,000 + (6,300 5,000) x 60% = 5,780 Serpor Fully secured creditor, receive 2,650 (2,500 + 150). Estimated losses on realization of assets Less: Estimated gains on realization of assets Additional assets* Estimated net (gain) or loss in assets realization Add: Additional liabilities** Estimated net (gain) or loss Less: Stockholders equity: Capital stock Deficit Estimated amount to be recovered by stockholders Therefore, the prorate payment on the peso is: 2,000,000 1,440,000 1,280,000 ( 2,720,000 720,000 ) 960,000 240,000 800,000 560,000 ========= = .70

19.

2,000,000 1,200,000

560,000/ 800,000

* Additional assets are assets completely written off in the books in the past year but subsequently have a realizable value. * Additional liabilities, are liabilities in addition to the recorded liabilities in the balance sheet. In other words, they are unrecorded liabilities and expenses. Examples are liquidation expenses such as administrative and trustee fees, liability on damage suits, acquired interest on mortgage payable, unbilled creditors fees and the like. 26. Consolidation of parent and subsidiary is achieved by adding together like items, such as the trader receivables in SM (800,000) and SMDC (500,000). Under proportionate consolidation, the investor includes its share of the assets, such as trade receivables, it jointly controls, so one third of P 300,000 = P 100,000 for BDO. 27. Using proportionate consolidation, Ayala should recognize 25% of Greenbelts inventories, under PAS 31. Ayala should only recognize the proportion of the gain it has made on the sale that is attributable to the other venturers. Ayala should recognize P 40,000 (25% of P 160,000) less P 15,000 (25% of the P 60,000 profit it made on the sale to Greenbelt) = P 25,000. 31. Collections during 2008 Gross profit rate: Installment sales: Notes receivable (32,000 + 62,000 + 3,600) Unearned interest income (7,167 + 3,600) Installment sales Cost of installment sales (45,200 2,000) Gross profit GPR Realized gross profit Trade in value Actual value: Estimated sales price Less: Reconditioning cost Gross profit (25,000 x 15%) Overallowance 32,000 97,600 ( 10,767 ) 86,833 43,200 43,633 50.25% 16,080 ======== 30,000 25,000 1,250 3,750 5,000

32.

20,000 10,000 ======== The overallowance is treated as a deduction from the selling price of new equipment. Collections: Downpayment: Cash Actual value of trade in Installment collection (3 mos x 5,000) Total GPR (15,000/75,000) Realized gross profit 37. Construction in Progress: Cost incurred to date, 2007 Gross profit (loss) earned to date, 2007 (3,375,000 3,250,000) Balance as of Dec. 31, 2007 Less: Contract billings, 2007 (3,250,000 x 75%) Current asset

5,000 20,000

25,000 15,000 40,000 20% 8,000 =======

2,625,000 ( 125,000 ) 2,500,000

2,437,500 62,500 ===========

38.

Franchise revenue: Downpayment Note receivable Total Cost of franchise fee Realized gross profit

200,000 1,000,000 1,200,000 900,000 300,000 =========

39.

Since the collectibility of the note is reasonably assured, the accrual basis should be applied. There, full gross profit is recognized in the year of sale. Sales (187,500 x 4.3553) Cost of sales Gross profit (realized) 816,619 637,500 179,119 ========= 179,119 27,221 206,340 ========= 0 78,134 78,134 ========

40.

Gross profit (realized) Interest revenue for 4 mos. (816,619 x 10% x 4/12) Total income for 2011

41.

Gross profit (realized) already recognized in 2011 Interest revenue 8 mos in year 1 (81,662* x 8/12) 54,441 4 mos in year 2 (71,078* x 4/12) 23,693 Total income for 2012

* Schedule of discount amortization/interest income computation: Year 1 2 42. Face amount 1,125,000 937,500 Unamortized discount 308,381 226,719 Net amount 816,619 710,781 Discount amort. 81,662 71,078

Since the collectibility of the note cannot be reasonably assured, the installment sales method should be applied. Also, if there is high degree of uncertainty as to collectibility, the cost recovery method may be used. Installment sale: Gross profit (179,119/816,619) Gross profit earned in 2011 (0* x 22%) * no collection in 2011 22% (rounded) 0

43.

Gross profit earned in 2011 Interest revenue Total income for 2011 Collections in 2012 Less: Interest revenue from Sept. 01, 2011 to Aug. 31, 2012 Collection as to principal (x) GPR Gross profit realized in 2012 Add: interest revenue for 2012 Total income for 2012

0 27,221 27,221 ======== 187,500 81,662 105,838 22% 23,284 78,134 101,418 =========

44.

48. 49. 50.

All of the others are actually insurance contracts and (a) is an investment contract. 2008: 50,000 30,000 10,000 + 2,000 2009: 50,000 30,000 10,000 + 4,000 = = 12,000 14,000

In 2011, the initial franchise fee of P 1,000,000 is recognized as revenue. Therefore, in 2012, the only amount of revenue to be recognized is the P 50,000, the continuing franchisee fee.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- ChatGPT 18Dokument2 SeitenChatGPT 18ashaykosare.007Noch keine Bewertungen

- CFD Forex Broker Report - 7th EditionDokument75 SeitenCFD Forex Broker Report - 7th EditiongghghgfhfghNoch keine Bewertungen

- A Guide To The Stock Exchange For Beginners - Part 2 PDFDokument5 SeitenA Guide To The Stock Exchange For Beginners - Part 2 PDFAnil Yadavrao GaikwadNoch keine Bewertungen

- IC38 Janamghutti v1 10052019 PDFDokument67 SeitenIC38 Janamghutti v1 10052019 PDFMahesh S Gour75% (4)

- Preface Mutual FundDokument38 SeitenPreface Mutual Fundjkbs_omNoch keine Bewertungen

- Topic 3 Bonds VolatilityDokument68 SeitenTopic 3 Bonds Volatilityjason leeNoch keine Bewertungen

- Work PaystubDokument1 SeiteWork Paystubjoelryan2019Noch keine Bewertungen

- PT Nagai Plastic Indonesia Feb 2015 - 06072015 Draft6jul15Dokument41 SeitenPT Nagai Plastic Indonesia Feb 2015 - 06072015 Draft6jul15nogoenogoe yahoo.co.idNoch keine Bewertungen

- Fundamentals Dec 2014Dokument40 SeitenFundamentals Dec 2014Yew Toh TatNoch keine Bewertungen

- Arvog Finance Corporate Presentation 2022Dokument9 SeitenArvog Finance Corporate Presentation 2022Dinesh KandpalNoch keine Bewertungen

- 14 Reinsurance PDFDokument28 Seiten14 Reinsurance PDFHalfani MoshiNoch keine Bewertungen

- Automatic PaymentsDokument12 SeitenAutomatic PaymentsfinerpmanyamNoch keine Bewertungen

- Foreign Exchange Rate Sheet: Bulletin November 29, 2021Dokument1 SeiteForeign Exchange Rate Sheet: Bulletin November 29, 2021Zeeshan AtharNoch keine Bewertungen

- JAIIB Paper 4 Module A Retail Banking PDFDokument21 SeitenJAIIB Paper 4 Module A Retail Banking PDFAssr Murty100% (1)

- Capital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Dokument2 SeitenCapital Structure Policy I Ebit-Eps Analysis: Page 1 of 2Danzo ShahNoch keine Bewertungen

- Notes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The NotesDokument5 SeitenNotes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The Notesjake doinogNoch keine Bewertungen

- NTRP - Track Transaction HistoryDokument2 SeitenNTRP - Track Transaction HistorySathish KumarNoch keine Bewertungen

- I2BE-Morning Evening PDFDokument10 SeitenI2BE-Morning Evening PDFusama sajawalNoch keine Bewertungen

- Bansi Khakhkhar PDFDokument74 SeitenBansi Khakhkhar PDFVishu MakwanaNoch keine Bewertungen

- P2 07Dokument3 SeitenP2 07rietzhel22Noch keine Bewertungen

- IAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDokument3 SeitenIAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsMarc Eric RedondoNoch keine Bewertungen

- Financial Planning and ForecastingDokument20 SeitenFinancial Planning and ForecastingSyedMaazNoch keine Bewertungen

- EXERCISESDokument25 SeitenEXERCISESGandaNoch keine Bewertungen

- BSP M-2020-016 PDFDokument9 SeitenBSP M-2020-016 PDFRaine Buenaventura-EleazarNoch keine Bewertungen

- Cost and Benefit Analysis BookDokument361 SeitenCost and Benefit Analysis Book9315875729100% (7)

- COGS and DCOGS WorkflowDokument48 SeitenCOGS and DCOGS Workflowptameb10% (1)

- Topic 7 - Forecasting Financial Statements (Updated)Dokument64 SeitenTopic 7 - Forecasting Financial Statements (Updated)Jasmine JacksonNoch keine Bewertungen

- TestDokument14 SeitenTesthonest0988Noch keine Bewertungen

- Divine Word College of BanguedDokument3 SeitenDivine Word College of BanguedAeRis Blancaflor BalsitaNoch keine Bewertungen

- Ias 36 ImpairementDokument24 SeitenIas 36 Impairementesulawyer2001Noch keine Bewertungen