Beruflich Dokumente

Kultur Dokumente

Capital Gains Tax Return

Hochgeladen von

Suzette BalucanagCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Gains Tax Return

Hochgeladen von

Suzette BalucanagCopyright:

Verfügbare Formate

(To be filled up by the BIR)

Repu blika n g P ilipinas Kagawara n n g P anana lapi K awanihan ng Rentas Internas

Capital Gains Tax Return

2 Amended Return? Yes

1707

Code

4 ATC II 030 IC 110

Corporati

BIR Form No .

For Onerous Transfer of Shares of Stock Not T raded Through the Local Stock Exchange

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 Date of Transaction ( MM / DD / YYYY ) Part I 5 TIN Seller 3 No. of Sheets Attached No

July, 1999 ( ENCS )

Individua

Background Information 6 RDO Code 7 TIN Buyer

8 RDO Code Code ode C

Seller's Name

13 Zip Code Yes

10 Buyer's Name 12 Registered Address

11 Registered Address

No Foreclosure Sale If yes, specify Others (specify)

13 Zip Code

15 Are you availing of tax relief under an International Tax Treaty or Special Law? 16 Description of Transaction Cash Sale Installment Sale 17 Details of Installment Sale: 17 A Selling Price/Fair Market Value 17 B 17 C 17 D 17 E 17 Cost and Expenses Mortgage Assumed No. of installments Amount of Installment for this Payment Period

F Date of Collection of Installment for this Payment Period (MM/DD/YYYY) Total Collection (Downpayment and Installments) during the Year of Sale Compu tation of Tax

18 19 20 21

17 G PART II

18 Taxable Base - For Cash Sale/ Foreclosure Sale (Schedule 1) 19 Less: Cost and Other Allowable Expenses (Schedule 2)

20 Net Capital Gain/(Loss) 21 Tax Due on the Entire Transaction (5% on the first 100,000 ; 10% over 100,000)(Cash Sale/Foreclosure Sale); or 22 Tax Due for this Payment Period Computation of the Tax Due (If tax is payable under the installment method of computation) 23 Less: Tax Paid in Return Previously Filed, if this is an Amended Return

22

23 24

24 Tax Payable/(Overpayment)(Item 21 or 22 less Item 23) 25 Add: Penalties Surcharge

25A 25B

Interest

25C

Compromise

25D 26

26 Total Amount Payable/(Overpayment) (Sum of Items 24 & 25D) Schedule 1 Name of Corporate Stock Description of Shares of Stock (attach additional sheets, if necessary) Stock Certificate No. No. of Shares

Taxable Base Selling Price or FMV whichever is higher

27 Total (To Item 18) I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. 28 Part III Taxpayer/Authorized Agent Signature over Printed Name D e t a i l s of P a y m e n t Drawee Bank/ M M D Agency Number Date

D Y Y Y Y

30 31B 32A 33A 33B 31C 32B 33C 31D 32C 33D

29 Title/Position of Signatory Amount

rticulars

30 Cash/Bank Memo 31 Check 32 Tax Debit Memo 33 Others

31A

Stamp of Receivin Office and Date o Receipt

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

apital Gains ax Return

1707

July, 1999 ( ENCS )

Individual Corporation

BIR Form No .

8 RDO Code

Taxable Base

Stamp of Receiving Office and Date of Receipt

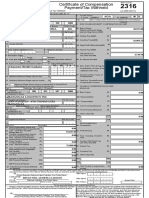

BIR FORM 1707 (ENCS)-PAGE 2 Schedule 2 Schedule of Cost and Other Allowable Expenses Particulars Amount

34

Total (To Item 19) BIR Form 1707 - Capital Gains Tax Return (For Onerous Transfer of Shares of Stock Not Traded Through the Local Stock Exchange) Guidelines and Instructions

Who shall file barter, exc domestic co This return shall b through the juridical person, reside exchange or otherNot ov onero domestic corporation, c On any through the local stock ex Penalties The term Capita

Penalties The term Capita taxpayer (whether or not Ther but does not1. includesurc A sto property of a kindfollow whic inventory of the taxpaye a. year, or property held ordinary course ofb. trad trade or business of allowance for depreciati business. c.

When and Where to Fil

FORM 1707 (ENCS)-PAGE 2

mount

, exchange or other dispositio stic corporation, classified as ca gh the local stock exchange:

Not over P100,000 On any amount in excess of P10

ties

ties

There shall be imposed and co A surcharge of twenty five per following violations: a. Failure to file any return or installment due on or b b. Unless otherwise authori filing a return with a pe those with whom it is requ c. Failure to pay the full or shown on the return, or for which no return is before the due date;

Das könnte Ihnen auch gefallen

- Bir Form Percentage TaxDokument3 SeitenBir Form Percentage TaxEc MendozaNoch keine Bewertungen

- 1706Dokument2 Seiten1706May Chan Cuyos100% (1)

- 1801 Estate Tax Return FormDokument2 Seiten1801 Estate Tax Return FormMay DinagaNoch keine Bewertungen

- Antichreses - SanchezDokument2 SeitenAntichreses - SanchezJo SanchezNoch keine Bewertungen

- 2018 Form I Individual Income Tax Return 2017Dokument20 Seiten2018 Form I Individual Income Tax Return 2017KSeegurNoch keine Bewertungen

- Capital Gains Tax LAW 101Dokument41 SeitenCapital Gains Tax LAW 101Chit ComisoNoch keine Bewertungen

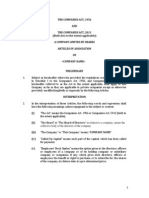

- Articles of Incorporation of A Close CorporationDokument1 SeiteArticles of Incorporation of A Close CorporationparoalonsoNoch keine Bewertungen

- Annual Income Tax Return: (DonotentercentavosDokument2 SeitenAnnual Income Tax Return: (DonotentercentavosKuhramaNoch keine Bewertungen

- BIR Form 1701QDokument2 SeitenBIR Form 1701QfileksNoch keine Bewertungen

- 1701A Annual Income Tax ReturnDokument3 Seiten1701A Annual Income Tax ReturnWa37354Noch keine Bewertungen

- Form No. NTC 1 24 AFFIDAVIT OF OWNERSHIP AND LOSS WITH UNDERTAKING R6Dokument1 SeiteForm No. NTC 1 24 AFFIDAVIT OF OWNERSHIP AND LOSS WITH UNDERTAKING R6Gavino Jr GaboNoch keine Bewertungen

- Tax Form Certificate of CompensationDokument8 SeitenTax Form Certificate of CompensationRafael ZamoraNoch keine Bewertungen

- Bir Forms PDFDokument4 SeitenBir Forms PDFgaryNoch keine Bewertungen

- CONTRACT To SELL - Gomercindo AranasDokument3 SeitenCONTRACT To SELL - Gomercindo AranasrjpogikaayoNoch keine Bewertungen

- Deed of Absolute SaleDokument2 SeitenDeed of Absolute SalegilbertNoch keine Bewertungen

- Metro Board of Directors Agenda, Feb. 2020Dokument15 SeitenMetro Board of Directors Agenda, Feb. 2020Metro Los AngelesNoch keine Bewertungen

- 2016 1040 Individual Tax Return Engagement LetterDokument11 Seiten2016 1040 Individual Tax Return Engagement LettersarahvillalonNoch keine Bewertungen

- Payment Form: Kawanihan NG Rentas InternasDokument3 SeitenPayment Form: Kawanihan NG Rentas InternasglydelNoch keine Bewertungen

- Guidelines and Instruction For BIR Form No 1702 RTDokument2 SeitenGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- 1701A Annual Income Tax ReturnDokument2 Seiten1701A Annual Income Tax ReturnJaneth Tamayo NavalesNoch keine Bewertungen

- 2020 Instructions For Schedule C: Profit or Loss From BusinessDokument19 Seiten2020 Instructions For Schedule C: Profit or Loss From BusinessI'm JuicyNoch keine Bewertungen

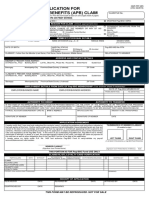

- Pag-IBIG Provident Benefits Claim FormDokument2 SeitenPag-IBIG Provident Benefits Claim FormCarlo Beltran Valerio0% (2)

- Bir 2013Dokument1 SeiteBir 2013karlycoreNoch keine Bewertungen

- Deed of Conditional Sale AgreementDokument3 SeitenDeed of Conditional Sale AgreementJohari ForcadasNoch keine Bewertungen

- 1601EDokument7 Seiten1601EEnrique Membrere SupsupNoch keine Bewertungen

- Contract To Sell Lai CADokument2 SeitenContract To Sell Lai CADM HernandezNoch keine Bewertungen

- SSS R-5 Employer Payment ReturnDokument2 SeitenSSS R-5 Employer Payment ReturnJimzon Kristian JimenezNoch keine Bewertungen

- 2316Dokument13 Seiten2316Ariel BarkerNoch keine Bewertungen

- Schedule of Taxes - 2020-2021 South MCD (Commisioner Proposal)Dokument10 SeitenSchedule of Taxes - 2020-2021 South MCD (Commisioner Proposal)Cool-tigerNoch keine Bewertungen

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDokument42 Seiten2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Trade LicenceDokument1 SeiteTrade Licencekellymtuku25Noch keine Bewertungen

- Bir Ruling No. 108-93Dokument2 SeitenBir Ruling No. 108-93saintkarriNoch keine Bewertungen

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Dokument42 Seiten2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- 1701A Annual Income Tax ReturnDokument1 Seite1701A Annual Income Tax ReturnmoemoechanNoch keine Bewertungen

- Aoa Sample CommentedDokument12 SeitenAoa Sample CommentedxYrIsNoch keine Bewertungen

- Tax Return Receipt ConfirmationDokument1 SeiteTax Return Receipt ConfirmationKisu Shute60% (5)

- Pdic Certification-FinalDokument1 SeitePdic Certification-FinalmutedchildNoch keine Bewertungen

- Income Tax Return FormDokument3 SeitenIncome Tax Return FormTru TaxNoch keine Bewertungen

- Tax Cases - Atty CatagueDokument264 SeitenTax Cases - Atty CatagueJo-Al GealonNoch keine Bewertungen

- 2022 Individual Tax Organizer FillableDokument6 Seiten2022 Individual Tax Organizer FillableTham DangNoch keine Bewertungen

- Affidavit of AcquisitionDokument2 SeitenAffidavit of AcquisitionMarvidelio D PalomarNoch keine Bewertungen

- Individual Taxpayers Tax Filing ExercisesDokument3 SeitenIndividual Taxpayers Tax Filing ExercisesKIM RAGANoch keine Bewertungen

- Annual Income Tax Return: BrianDokument4 SeitenAnnual Income Tax Return: BrianChristine ViernesNoch keine Bewertungen

- Contract of LeaseDokument3 SeitenContract of LeaseAstralDropNoch keine Bewertungen

- Republic of The Philippines) ) S.S.Dokument4 SeitenRepublic of The Philippines) ) S.S.Noan SimanNoch keine Bewertungen

- Vendor Supplier Registration Information SheetDokument3 SeitenVendor Supplier Registration Information SheetEnzo MarquezNoch keine Bewertungen

- NBR Tin Certificate 180261996183 PDFDokument1 SeiteNBR Tin Certificate 180261996183 PDFNewaz KabirNoch keine Bewertungen

- Cancellation of Rem-Kumala MendozaDokument2 SeitenCancellation of Rem-Kumala MendozaNicolo Jay PajaritoNoch keine Bewertungen

- Sana MabagoDokument1 SeiteSana MabagojoystambaNoch keine Bewertungen

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Dokument1 SeiteW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNoch keine Bewertungen

- PHILIPPINE BUREAU OF INTERNAL REVENUE RULING ON USING FOREIGN CURRENCY IN FINANCIAL STATEMENTSDokument2 SeitenPHILIPPINE BUREAU OF INTERNAL REVENUE RULING ON USING FOREIGN CURRENCY IN FINANCIAL STATEMENTSOrlando O. CalundanNoch keine Bewertungen

- Annex C.2: Sworn Application For Tax ClearanceDokument1 SeiteAnnex C.2: Sworn Application For Tax ClearanceIan Bernales OrigNoch keine Bewertungen

- Electronic Official Receipt: City Government of Manila City Treasurer'S OfficeDokument2 SeitenElectronic Official Receipt: City Government of Manila City Treasurer'S OfficeBarangay 708 Zone 78 District VNoch keine Bewertungen

- PhilGEPS Sworn StatementDokument2 SeitenPhilGEPS Sworn StatementArchie PadillaNoch keine Bewertungen

- Individuals Tax Return - US 2016Dokument2 SeitenIndividuals Tax Return - US 2016Yousef M. AqelNoch keine Bewertungen

- Business Personal Financial Statement FormDokument2 SeitenBusiness Personal Financial Statement FormMantasha Financial services100% (1)

- Gadiano 2316Dokument2 SeitenGadiano 2316Jypy Torrejos100% (1)

- MorrisBreann Fall 2020 MGMT 343 Exam #1Dokument4 SeitenMorrisBreann Fall 2020 MGMT 343 Exam #1Breann MorrisNoch keine Bewertungen

- Ronnie Contract To SellDokument3 SeitenRonnie Contract To Sellcris jaluageNoch keine Bewertungen

- Bir Forms 1706 (99) Capital Gains Tax ReturnDokument5 SeitenBir Forms 1706 (99) Capital Gains Tax ReturnArnel Melgar100% (2)

- Ra 7875Dokument27 SeitenRa 7875Sj EclipseNoch keine Bewertungen

- General IEC 01162015Dokument36 SeitenGeneral IEC 01162015Suzette BalucanagNoch keine Bewertungen

- FemaleBenefitForm Aug2009Dokument6 SeitenFemaleBenefitForm Aug2009Suzette BalucanagNoch keine Bewertungen

- Motion To Reduce BailDokument2 SeitenMotion To Reduce BailSuzette Balucanag87% (15)

- RA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesDokument12 SeitenRA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesCrislene Cruz83% (12)

- Philhealth November UpdatesDokument25 SeitenPhilhealth November UpdatesSuzette BalucanagNoch keine Bewertungen

- Personal Data SheetDokument4 SeitenPersonal Data SheetLeonil Estaño100% (7)

- Affidavit of No IncomeDokument1 SeiteAffidavit of No IncomeSuzette Balucanag88% (32)

- 1702 NewDokument11 Seiten1702 NewDIVINE WAGTINGANNoch keine Bewertungen

- Professional Code of Ethics For Teachers of PhilippinesDokument6 SeitenProfessional Code of Ethics For Teachers of PhilippinesMichael Pagaduan97% (35)

- NPO Acct ManualDokument26 SeitenNPO Acct ManualdavidkongNoch keine Bewertungen

- Documentary Stamp Tax ReturnDokument6 SeitenDocumentary Stamp Tax ReturnSuzette BalucanagNoch keine Bewertungen

- Drilon Vs ErmitaDokument36 SeitenDrilon Vs ErmitaSuzette Balucanag100% (2)

- SEC FormsDokument6 SeitenSEC FormsSuzette Balucanag40% (10)

- 2007 Procedure ManualDokument91 Seiten2007 Procedure ManualSuzette BalucanagNoch keine Bewertungen

- Omnibus Rules Book 5Dokument17 SeitenOmnibus Rules Book 5Suzette BalucanagNoch keine Bewertungen

- Evidence2008 4thsetDokument74 SeitenEvidence2008 4thsetSuzette BalucanagNoch keine Bewertungen

- Evidence2008 3rdsetDokument46 SeitenEvidence2008 3rdsetSuzette BalucanagNoch keine Bewertungen

- Prelims. CasesDokument25 SeitenPrelims. CasesSuzette BalucanagNoch keine Bewertungen

- Evidence2008 7thsetDokument14 SeitenEvidence2008 7thsetSuzette BalucanagNoch keine Bewertungen

- Provrem UneditedDokument28 SeitenProvrem UneditedSuzette BalucanagNoch keine Bewertungen

- Business OrgDokument19 SeitenBusiness OrgSuzette BalucanagNoch keine Bewertungen

- Evidence2008 6thsetDokument24 SeitenEvidence2008 6thsetSuzette BalucanagNoch keine Bewertungen

- Taxation CasesDokument120 SeitenTaxation CasesSuzette Balucanag100% (5)

- Taxation Real Property CasesDokument38 SeitenTaxation Real Property CasesSuzette BalucanagNoch keine Bewertungen

- Evidence2008 5thsetDokument22 SeitenEvidence2008 5thsetSuzette Balucanag100% (1)

- Evidence 2008Dokument98 SeitenEvidence 2008Suzette Balucanag100% (1)

- Evidence2008 2ndsetDokument38 SeitenEvidence2008 2ndsetSuzette BalucanagNoch keine Bewertungen

- TAX1 FinalsDokument22 SeitenTAX1 FinalsSuzette BalucanagNoch keine Bewertungen

- CFTC Case Study: Prioritizing Business Lines & Controlling Workforce IssuesDokument7 SeitenCFTC Case Study: Prioritizing Business Lines & Controlling Workforce IssuesViancx PallarcoNoch keine Bewertungen

- Creating Value in Service EconomyDokument34 SeitenCreating Value in Service EconomyAzeem100% (1)

- Seed Working Paper No. 28: Series On Innovation and Sustainability in Business Support Services (FIT)Dokument61 SeitenSeed Working Paper No. 28: Series On Innovation and Sustainability in Business Support Services (FIT)helalhNoch keine Bewertungen

- AWAMI LEAGUE ELECTION MANIFESTODokument1 SeiteAWAMI LEAGUE ELECTION MANIFESTOSadik Irfan Shaikat100% (1)

- Setting The Right Price at The Right TimeDokument5 SeitenSetting The Right Price at The Right TimeTung NgoNoch keine Bewertungen

- CONWORLDDokument3 SeitenCONWORLDCollege DumpfilesNoch keine Bewertungen

- ECON2113 Microeconomics Final Exam QuestionsDokument2 SeitenECON2113 Microeconomics Final Exam QuestionsNamanNoch keine Bewertungen

- A Study of Training Program Characteristics and Training Effectiveness Among Organizations Receiving Services From External Training ProvidersDokument193 SeitenA Study of Training Program Characteristics and Training Effectiveness Among Organizations Receiving Services From External Training ProvidersbhuvaneshkmrsNoch keine Bewertungen

- Changhong Zhu’s PARS IV fund earned 61 percent for Bill Gross’s PimcoDokument11 SeitenChanghong Zhu’s PARS IV fund earned 61 percent for Bill Gross’s PimcoMichael BenzingerNoch keine Bewertungen

- KijamiiDokument16 SeitenKijamiiRawan AshrafNoch keine Bewertungen

- TNB Handbook: Prepared By: COE Investor RelationsDokument35 SeitenTNB Handbook: Prepared By: COE Investor Relationsmuhd faizNoch keine Bewertungen

- Analysis of Financial Statements Project: GUL AHMAD Textile MillsDokument32 SeitenAnalysis of Financial Statements Project: GUL AHMAD Textile MillsHanzala AsifNoch keine Bewertungen

- FMCG Sales Territory ReportDokument21 SeitenFMCG Sales Territory ReportSyed Rehan Ahmed100% (3)

- NikeDokument33 SeitenNikeRocking Heartbroker DebNoch keine Bewertungen

- (Marketing Management ENEMBA-KESDM) Finaltest - MUHAMAD FUDOLAHDokument6 Seiten(Marketing Management ENEMBA-KESDM) Finaltest - MUHAMAD FUDOLAHMuhamad FudolahNoch keine Bewertungen

- 11 - PSS (SBL Specimen 1 Sept 3023 Preseen) - Answer by Sir Hasan Dossani (Full Drafting)Dokument12 Seiten11 - PSS (SBL Specimen 1 Sept 3023 Preseen) - Answer by Sir Hasan Dossani (Full Drafting)abdullahdap9691Noch keine Bewertungen

- Isuzu sr2021Dokument115 SeitenIsuzu sr2021Karthik MadhuNoch keine Bewertungen

- Rethinking Single-Use Plastic Products in Travel & TourismDokument48 SeitenRethinking Single-Use Plastic Products in Travel & TourismComunicarSe-ArchivoNoch keine Bewertungen

- CG Question 567Dokument1 SeiteCG Question 567Maryam MalikNoch keine Bewertungen

- Consumer Rights and ProtectionsDokument46 SeitenConsumer Rights and ProtectionsSagar Kapoor100% (3)

- Management Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressDokument136 SeitenManagement Discussion & Analysis highlights key developments in Indian economy, housing finance industry and company's progressVritika JainNoch keine Bewertungen

- Information Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsDokument4 SeitenInformation Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsPeter BensonNoch keine Bewertungen

- A Dilg Joincircular 2015212 - cf2966c253Dokument12 SeitenA Dilg Joincircular 2015212 - cf2966c253Erin CruzNoch keine Bewertungen

- Downsizing Best PracticesDokument26 SeitenDownsizing Best PracticescorfrancescaNoch keine Bewertungen

- Worksheet - Rectification of ErrorsDokument3 SeitenWorksheet - Rectification of ErrorsRajni Sinha VermaNoch keine Bewertungen

- Business Plan Step by StepDokument147 SeitenBusiness Plan Step by StepJason MartinNoch keine Bewertungen

- Itc PPT 1Dokument10 SeitenItc PPT 1nikhil18202125Noch keine Bewertungen

- Short Iron Condor Spread - FidelityDokument8 SeitenShort Iron Condor Spread - FidelityanalystbankNoch keine Bewertungen

- BCG Matrix ModelDokument10 SeitenBCG Matrix ModelGiftNoch keine Bewertungen

- LECTURE-03c Source of CapitalsDokument55 SeitenLECTURE-03c Source of CapitalsNurhayati Faiszah IsmailNoch keine Bewertungen