Beruflich Dokumente

Kultur Dokumente

FCEB

Hochgeladen von

Redefining Success KashishOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FCEB

Hochgeladen von

Redefining Success KashishCopyright:

Verfügbare Formate

Astute Consulting

NEWS FLASH - 28 February 2008

Foreign Currency Exchangeable Bonds Scheme, 2008

The Government of India has recently notified a Scheme vide notification dated 15 February 2008 for Issue of Foreign Currency Exchangeable Bonds, which would allow Indian promoters to unlock part of holding in listed group companies for meeting their financial requirements for various projects from outside India without diluting their stake in Indian listed companies. The key features of the Scheme are as follows:

Foreign Currency Exchangeable Bond (FCEB) is a bond expressed in foreign currency the principal and interest in respect of which is payable in foreign currency, issued by an Issuing Company and subscribed to by a person who is a resident outside India in foreign currency and exchangeable into equity share of another company listed, to be called the Offered Company, in any manner, either wholly, or partly or on the basis of any equity related warrants attached to debt instruments.

Eligibility Conditions and subscription of FCEB

The Issuing Company being an Indian Company shall be part of the promoter group of the Offered Company and shall hold the equity shares being offered at the time of issuance of FCEB. Further, an Indian Company, which is not eligible to raise funds from the Indian securities market, including a company which has been restrained from accessing the securities market by the Securities and Exchange Board of India (SEBI) shall not be eligible to issue Foreign Currency Exchangeable Bond(FCEB) The Offered Company shall be a listed Indian company which is engaged in a sector eligible to receive Foreign Direct Investment (FDI) and eligible to issue or avail of Foreign Currency Convertible Bond (FCCBs) or External Commercial Borrowings (ECBs).

End use requirements

The proceeds of FCEB can be invested by the issuing company in the promoter group companies and shall be used in accordance with end use as prescribed under the External Commercial Borrowings policy. The promoter group company receiving such investments will not be permitted to utilize the proceeds for investments in the capital market or in real estate in India. The proceeds of FCEB can also be invested by the issuing company overseas by way of direct investment including in Joint Ventures or Wholly Owned Subsidiaries subject to the existing guidelines as prescribed.

Partnering

For Your Success Always.

Astute Consulting

The diagrammatic representation of the scheme for issue of FCEB is as under:

Foreign Investor

JV / WOS of Issuing Company Outside India

Issue of FCEB exchangeable into Equity shares of Offered Company Promoter Indian Company (Issuing Company) Existing equity Investment Listed Indian Company (Offered Company)

In India Investment from FCEB proceeds

Promoter Group Companies

Pricing and Maturity

The rate of interest payable on exchangeable bond and the issue expenses would have to be within the all-in cost ceiling as specified by the RBI under the ECB policy. At the time of issuance of Foreign Currency Exchangeable Bond, the exchange price of the offered listed equity shares shall be not be less than the higher of the following two

The average of the weekly high and low of the closing prices of the shares of the offered company quoted on the stock exchange during the six months preceding the date of passing of board resolution for issuance of FCEB, and

Partnering

For Your Success Always.

Astute Consulting

The average of the weekly high and low of the closing prices of the shares of the offered company quoted on the stock exchange during the two weeks preceding the date of passing of board resolution for issuance of FCEB.

The minimum maturity of the Foreign Currency Exchangeable Bond shall be five years for purposes of redemption. The exchange option can be exercised at any time before redemption

Other Relevant Aspects

The Issuing Company shall comply with the requirements of the Companies Act, 1956, SEBI disclosure requirements. Issuing Company shall not transfer, mortgage or offer as collateral or trade in the offered shares from the date of issuance of FCEBs till date of exchange or redemption and is obliged to keep the offered shares from all encumbrances till date of exchange or redemption. Entities prohibited to buy, sell or deal in securities by SEBI, shall not be eligible to subscribe to FCEB. The investment under the scheme shall comply with the FDI policy as well as the ECB Policy requirements. Prior approval of the Reserve Bank of India (RBI) would be required for issuance of FCEB.

Taxation on Exchangeable Bonds

Interest and dividend payments on the bonds, until the exchange option is exercised shall be subject to withholding tax of 10% plus applicable surcharge and education cess as per Section 115AC(1) of the Income Tax Act, 196 l. Exchange of FCEBS into shares shall not give rise to any capital gains. Transfer of FCEBS by non-resident to non-resident shall not give rise to any capital gains in India.

SCOPE AND LIMITATIONS

This above circular is general in nature. In this circular, we have endeavored to prepare a summary of detailed scheme issued by Finance Ministry for issuance of FCEB. It may be noted that nothing contained in this circular should be regarded as our opinion and facts of each case will need to be analyzed to ascertain applicability or otherwise of tax and other laws and professional advice should be sought for applicability of legal provisions based on specific facts. We are not responsible for any liability arising from any statements or error contained in this circular.

Partnering

For Your Success Always.

Das könnte Ihnen auch gefallen

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementVon EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNoch keine Bewertungen

- Foreign Currency Exchangeable BondsDokument7 SeitenForeign Currency Exchangeable BondsDheeraj VijayNoch keine Bewertungen

- Foreign Currency Exchangeable BondsDokument2 SeitenForeign Currency Exchangeable BondsGovind RathiNoch keine Bewertungen

- Foreign Currency Convertible Bonds FinalDokument15 SeitenForeign Currency Convertible Bonds FinalGautam JainNoch keine Bewertungen

- Investment Law MarketingDokument6 SeitenInvestment Law MarketingJust RandomNoch keine Bewertungen

- What Is A Foreign Currency Convertible Bond (FCCB) ? A ForeignDokument9 SeitenWhat Is A Foreign Currency Convertible Bond (FCCB) ? A ForeignParas R AsharaNoch keine Bewertungen

- Convertible Notes Open Doors To Foreign Investments For StartupsDokument4 SeitenConvertible Notes Open Doors To Foreign Investments For StartupsFelix AdvisoryNoch keine Bewertungen

- FCCBDokument8 SeitenFCCBRadha RampalliNoch keine Bewertungen

- Powerpoint Presentation On FIIDokument13 SeitenPowerpoint Presentation On FIIManali Rana100% (1)

- Foreign Currency Convertible Bond 100 Marks ProjectDokument47 SeitenForeign Currency Convertible Bond 100 Marks ProjectSalman Corleone100% (1)

- Updates SMAIT June 2016Dokument11 SeitenUpdates SMAIT June 2016Harsh SharmaNoch keine Bewertungen

- Foreign Investment in IndiaDokument13 SeitenForeign Investment in Indiagolu1985Noch keine Bewertungen

- II Regulations in India:: Foreign Institutional Investors (FII's) SebiDokument17 SeitenII Regulations in India:: Foreign Institutional Investors (FII's) SebiKumar DayanidhiNoch keine Bewertungen

- Foreign Collaborations in IndiaDokument17 SeitenForeign Collaborations in IndiacagopalchaturvediNoch keine Bewertungen

- Investment Routes: India's Debt Markets, The Way Forward Available at Last Visited On 8 April, 2019Dokument3 SeitenInvestment Routes: India's Debt Markets, The Way Forward Available at Last Visited On 8 April, 2019Kunwar AbhudayNoch keine Bewertungen

- Debt Funding in India, Nishith Desai Associates, Available At, Last Visited On 8 April, 2019 External Commercial Borrowings & Trade Credits, Available at Last Visited On 9 April 2019Dokument3 SeitenDebt Funding in India, Nishith Desai Associates, Available At, Last Visited On 8 April, 2019 External Commercial Borrowings & Trade Credits, Available at Last Visited On 9 April 2019Kunwar AbhudayNoch keine Bewertungen

- Ecb and Trade CreditsDokument10 SeitenEcb and Trade CreditsVarun JainNoch keine Bewertungen

- FCCBDokument17 SeitenFCCBcoffytoffyNoch keine Bewertungen

- Role of Fii in Share MarketDokument7 SeitenRole of Fii in Share MarketMukesh Kumar MishraNoch keine Bewertungen

- The Role of FIIDokument3 SeitenThe Role of FIIkushalsaxenaNoch keine Bewertungen

- Sources of Foreign Financing or Foreign Currency Finance For Indian CompaniesDokument3 SeitenSources of Foreign Financing or Foreign Currency Finance For Indian Companiesarshad391Noch keine Bewertungen

- Deepanshu'sDokument5 SeitenDeepanshu'sdeepu0787Noch keine Bewertungen

- CA Final May'23 Amendment VfinalDokument18 SeitenCA Final May'23 Amendment VfinalPooja SurveNoch keine Bewertungen

- FCCB 1Dokument6 SeitenFCCB 1krishr25Noch keine Bewertungen

- Foreign Direct InvestmentDokument6 SeitenForeign Direct Investmentrohitalbert5Noch keine Bewertungen

- Indian Investment AbroadDokument17 SeitenIndian Investment Abroadapi-3716588Noch keine Bewertungen

- FCCB in IndiaDokument24 SeitenFCCB in IndiaSana Riyaz KhalifeNoch keine Bewertungen

- Startup Series 7 - Exchange Control Provisions For StartupsDokument12 SeitenStartup Series 7 - Exchange Control Provisions For StartupsRavi PatelNoch keine Bewertungen

- Capital Market Regulatory Insight - P.S.rao & AssociatesDokument43 SeitenCapital Market Regulatory Insight - P.S.rao & AssociatesSharath Srinivas Budugunte100% (1)

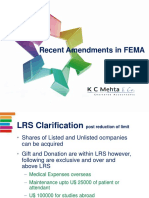

- Recent Amendments in FemaDokument14 SeitenRecent Amendments in FemaSarath Kumar Vijaya KumarNoch keine Bewertungen

- MM M M MMDokument17 SeitenMM M M MMDhiraj K DalalNoch keine Bewertungen

- FII Investment in IndiaDokument38 SeitenFII Investment in IndiaKhushbu GosherNoch keine Bewertungen

- Investment by The Foreign Institutional Investors: DR Sanjeev KumarDokument4 SeitenInvestment by The Foreign Institutional Investors: DR Sanjeev KumarDr. Mohammad Noor AlamNoch keine Bewertungen

- Join Caiib With Ashok On Youtube & App: BFM Module - ADokument34 SeitenJoin Caiib With Ashok On Youtube & App: BFM Module - ASamir BuddheNoch keine Bewertungen

- Foreign Currency Exchangeable BondsDokument5 SeitenForeign Currency Exchangeable BondsMitesh LadNoch keine Bewertungen

- QIPsDokument19 SeitenQIPsJyothsna RanganathNoch keine Bewertungen

- Overseas Direct InvestmentDokument61 SeitenOverseas Direct InvestmentSutonu BasuNoch keine Bewertungen

- International Business: Key Compliances in Investing AbroadDokument73 SeitenInternational Business: Key Compliances in Investing AbroadSunny KumarNoch keine Bewertungen

- 220ecb and Trade Credits1Dokument10 Seiten220ecb and Trade Credits1Mohd ParvezNoch keine Bewertungen

- Regulatory Provisions Under EcbDokument6 SeitenRegulatory Provisions Under EcbAllwyn FlowNoch keine Bewertungen

- Q&a FemaDokument7 SeitenQ&a FemaVijay MakhijaniNoch keine Bewertungen

- Foreign Instituitional InvestorsDokument8 SeitenForeign Instituitional InvestorsJayneel JadejaNoch keine Bewertungen

- External Commercial BorrowingDokument14 SeitenExternal Commercial BorrowingKK SinghNoch keine Bewertungen

- Fema Rbi Org inDokument11 SeitenFema Rbi Org inamishtheanalystNoch keine Bewertungen

- Mahindra & Mahindra Financial Services Limited Dividend Distribution PolicyDokument6 SeitenMahindra & Mahindra Financial Services Limited Dividend Distribution PolicyJuan Carlos CalderonNoch keine Bewertungen

- Private Equity StructureDokument14 SeitenPrivate Equity Structurewww.pubg3.co.inNoch keine Bewertungen

- Refresh Changing Regulatory Landscape July August 2014Dokument30 SeitenRefresh Changing Regulatory Landscape July August 2014Aayushi AroraNoch keine Bewertungen

- Public Issue and Listing of Non-Convertible Debt SecuritiesDokument1 SeitePublic Issue and Listing of Non-Convertible Debt SecuritiesKhushiNoch keine Bewertungen

- RBI FAQ of FDI in IndiaDokument53 SeitenRBI FAQ of FDI in Indiaaironderon1Noch keine Bewertungen

- Qualified Institutional Placement: Presented by - Sandeep Singh 09-II-247 Shyamu Pandey 09-II-250Dokument11 SeitenQualified Institutional Placement: Presented by - Sandeep Singh 09-II-247 Shyamu Pandey 09-II-250sandeep-bhatia-911Noch keine Bewertungen

- Non-Banking Financial Companies (NBFCS) FinalDokument29 SeitenNon-Banking Financial Companies (NBFCS) FinalAnsumanNathNoch keine Bewertungen

- Commercial PaperDokument15 SeitenCommercial PaperKrishna Chandran Pallippuram100% (1)

- By Geet Arora Bba 3 Year Roll No - 4204Dokument15 SeitenBy Geet Arora Bba 3 Year Roll No - 4204geet882004Noch keine Bewertungen

- 52MCC160107IDokument7 Seiten52MCC160107IPrasad NayakNoch keine Bewertungen

- External Commercial Borrowings (Ecbs)Dokument5 SeitenExternal Commercial Borrowings (Ecbs)Prateek MallNoch keine Bewertungen

- Ecb and Trade CreditDokument8 SeitenEcb and Trade CreditSatyanag VenishettyNoch keine Bewertungen

- Global Depository ReceiptsDokument4 SeitenGlobal Depository ReceiptsSaiyam ChaturvediNoch keine Bewertungen

- Foreign Investment Regime in IndiaDokument4 SeitenForeign Investment Regime in IndiaKriti KaushikNoch keine Bewertungen

- Private Equity 2015Dokument47 SeitenPrivate Equity 2015Apurva SoodNoch keine Bewertungen

- Summary (SDL: Continuing The Evolution)Dokument2 SeitenSummary (SDL: Continuing The Evolution)ahsanlone100% (2)

- The Consequences of Using Incorrect TerminologyDokument6 SeitenThe Consequences of Using Incorrect TerminologyPastor DavidNoch keine Bewertungen

- MA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCDokument105 SeitenMA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCPrisca RaniNoch keine Bewertungen

- Scraper SiteDokument3 SeitenScraper Sitelinda976Noch keine Bewertungen

- English (202) Tutor Marked Assignment: NoteDokument3 SeitenEnglish (202) Tutor Marked Assignment: NoteLubabath IsmailNoch keine Bewertungen

- PrecedentialDokument41 SeitenPrecedentialScribd Government DocsNoch keine Bewertungen

- Gladys Ruiz, ResumeDokument2 SeitenGladys Ruiz, Resumeapi-284904141Noch keine Bewertungen

- IBA High Frequency Words PDFDokument18 SeitenIBA High Frequency Words PDFReduanul Chowdhury NitulNoch keine Bewertungen

- SAHANA Disaster Management System and Tracking Disaster VictimsDokument30 SeitenSAHANA Disaster Management System and Tracking Disaster VictimsAmalkrishnaNoch keine Bewertungen

- Module 2Dokument6 SeitenModule 2MonicaMartirosyanNoch keine Bewertungen

- Chapter 6-Contracting PartiesDokument49 SeitenChapter 6-Contracting PartiesNUR AISYAH NABILA RASHIMYNoch keine Bewertungen

- Glossary of Fashion Terms: Powered by Mambo Generated: 7 October, 2009, 00:47Dokument4 SeitenGlossary of Fashion Terms: Powered by Mambo Generated: 7 October, 2009, 00:47Chetna Shetty DikkarNoch keine Bewertungen

- Bhagwanti's Resume (1) - 2Dokument1 SeiteBhagwanti's Resume (1) - 2muski rajputNoch keine Bewertungen

- Case Studies in Entrepreneurship-3MDokument3 SeitenCase Studies in Entrepreneurship-3MAshish ThakurNoch keine Bewertungen

- Philips AZ 100 B Service ManualDokument8 SeitenPhilips AZ 100 B Service ManualВладислав ПаршутінNoch keine Bewertungen

- Nittscher vs. NittscherDokument4 SeitenNittscher vs. NittscherKeej DalonosNoch keine Bewertungen

- Case Study No. 8-Managing Floods in Metro ManilaDokument22 SeitenCase Study No. 8-Managing Floods in Metro ManilapicefeatiNoch keine Bewertungen

- 6 Habits of True Strategic ThinkersDokument64 Seiten6 Habits of True Strategic ThinkersPraveen Kumar JhaNoch keine Bewertungen

- Carbon Pricing: State and Trends ofDokument74 SeitenCarbon Pricing: State and Trends ofdcc ccNoch keine Bewertungen

- Postgame Notes 0901 PDFDokument1 SeitePostgame Notes 0901 PDFRyan DivishNoch keine Bewertungen

- Ch02 Choice in World of ScarcityDokument14 SeitenCh02 Choice in World of ScarcitydankNoch keine Bewertungen

- Commercial Law 11 DR Caroline Mwaura NotesDokument16 SeitenCommercial Law 11 DR Caroline Mwaura NotesNaomi CampbellNoch keine Bewertungen

- AICPADokument5 SeitenAICPAMikaela SalvadorNoch keine Bewertungen

- Chapter 12 - Bank ReconciliationDokument29 SeitenChapter 12 - Bank Reconciliationshemida100% (7)

- Heat Resisting Steels and Nickel Alloys: British Standard Bs en 10095:1999Dokument30 SeitenHeat Resisting Steels and Nickel Alloys: British Standard Bs en 10095:1999amanduhqsmNoch keine Bewertungen

- Qualitative KPIDokument7 SeitenQualitative KPIMas AgusNoch keine Bewertungen

- Little White Book of Hilmy Cader's Wisdom Strategic Reflections at One's Fingertip!Dokument8 SeitenLittle White Book of Hilmy Cader's Wisdom Strategic Reflections at One's Fingertip!Thavam RatnaNoch keine Bewertungen

- Front Cover NME Music MagazineDokument5 SeitenFront Cover NME Music Magazineasmediae12Noch keine Bewertungen

- Retrato Alvin YapanDokument8 SeitenRetrato Alvin YapanAngel Jan AgpalzaNoch keine Bewertungen