Beruflich Dokumente

Kultur Dokumente

Ankit TNG Retail India Pvt. LTD.: Credit Analysis & Research Limited

Hochgeladen von

jshashaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ankit TNG Retail India Pvt. LTD.: Credit Analysis & Research Limited

Hochgeladen von

jshashaCopyright:

Verfügbare Formate

ANKIT TNG RETAIL INDIA PVT. LTD.

Ratings Facilities/Instruments Long-term Bank Facilities Total Facilities Amount (Rs. crore) 45.00 45.00 Ratings1 'CARE B' (Single B) Remarks Assigned The major raw materials for ATNG are fabrics, buttons, zips, packing materials, thread, etc. Fabric is the major contributor of the total raw material costs and is mainly procured from Mumbai, Gujarat, Maharashtra and Rajasthan while Knitwear, T-shirts, Jackets, etc is procured from Ludhiana. The company also purchases imported fabrics through local dealers/distributors. Financial Results (Rs in crore) For the period ended / As at March 31, Rating Rationale The rating factors in ATNG's high financial leverage, declining profitability margins during FY09 and FY10, high working capital intensive nature of operations and its stretched liquidity position and competitive pressures in the garments industry. However, the rating draws comfort from the experience of the promoters and their demonstrated support through equity infusion and established distribution network. Going forward, the ability of ATNG to profitably scale up its operations to generate adequate cash accruals as well as effectively manage its capital structure and working capital requirements shall be the key rating sensitivities. Background Formed as a partnership concern in April 2003 under the name of Ankit Garments Manufacturing Company, ATNG was converted into a private limited company in July 2008. ATNG is engaged in manufacturing and trading of readymade garments for men and women. The company is promoted by Mr. Dwarka Das Agarwal who has been associated with the garment industry for about 25 years. The manufacturing facilities of the company are located in New Delhi with an installed capacity of 6 lakh shirts per annum and 5.4 lakh trousers per annum as on March 31, 2010. The company currently performs only cutting and finishing of products while the remaining work is outsourced to fabricators and job workers. Operations ATNG sells its products under TNG, DASH Casual and DMARS brands. Recently, ATNG launched a fixed-price brand called "Razor Lite". However, the brand - TNG contributed around 88% of gross sales during FY10. ATNG operates under the deep-discount format wherein it offers discounts ranging from 50%-80% along with other promotional schemes to its customers. The discount varies with the product, area, promotional schemes of competitors, season, etc. ATNG had 154 exclusive TNG outlets as on September 30, 2010 across India of which 60 are leased by the company but operated by the franchisee while the remaining are owned/leased and operated by the franchisee. The other brands are sold through dealers and distributors of the company. ATNG has an established presence in North India with 78 stores and contributing 73% of total revenues in FY10.

1

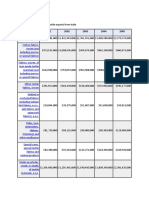

2008 (12m, A) 60.51 60.51 5.08 1.89 0.25 3.01 3.01 3.27 4.50 4.50 25.21

2009 (12m, A)* 100.26 100.26 6.61 2.87 0.56 3.17 1.97 2.50 3.00 4.36 44.94

2010 (12m, A) 138.22 138.22 8.60 4.47 0.95 3.22 2.03 2.92 5.50 8.83 65.91

Net Sales Total Operating Income PBILDT Interest and Finance Charges Depreciation PBT PAT (After Deferred Tax) Gross Cash Accruals Financial Position Equity Share Capital Partner's Capital Networth Total Capital Employed Key Ratios Growth Growth in Total Income (%) Growth in PAT [after Deferred Tax] (%) Profitability PBILDT / Total Operating Income (%) PAT / Total Income (%) ROCE (%) Average Cost of Borrowing (%) Solvency Long Term Debt Equity Ratio (times) Overall Gearing Ratio (times) Interest Coverage (times) Term Debt / Gross Cash Accruals (years) Liquidity Current Ratio (times) Quick Ratio (times) Turnover Average Collection Period (Days) Average Creditors (Days) Average Inventory (Days) Operating Cycle (Days) *

51.12 419.16 8.40 4.97 22.43 10.34 2.44 4.60 2.56 3.36 1.73 1.28 107 34 71 145

65.69 (34.62) 6.59 1.96 17.24 10.07 4.35 9.30 2.11 7.59 1.51 0.55 69 33 133 168

37.86 3.28 6.22 1.47 13.87 9.14 2.17 6.47 1.71 6.55 1.51 0.49 46 31 194 210

Complete definition of the ratings assigned are available at www.careratings.com and in other CARE publications

Audited P& L figures for period ending July 06, 2008 (3months: partnership firm) and March 31, 2009 (9 months: private limited company) have been clubbed while balance sheet figures are as on March 31, 2009

CREDIT ANALYSIS & RESEARCH LIMITED

Financial Analysis The total operating income of ATNG has increased at a Compounded Annual Growth Rate (CAGR) of around 52% over the 3-year period with major growth in FY09 and FY10 contributed by increase in sales volume on the back of increased outlets of the company. However, PBILDT margin was adversely affected during FY09 on account of increased competition and slowdown in the demand leading to pricing pressure. Also, higher incidence of fixed costs and financing charges led to tapering of PBILDT and PAT margins in FY09-10. Lower operating cash accruals led to higher reliance on bank credit as well security deposits from dealers thereby resulting in high financial leveraging. However, in FY10, the promoters and their associates infused equity of Rs.2.5 cr leading to improvement in the overall gearing as on March 31, 2010 but it still stood high at 6.4x as on March 31, 2010. The decline in the collection period and increase in inventory period during FY09 is attributable to the change in accounting treatment of sales and stock wherein during FY09 the company recorded the stock transferred to the franchisees as inventory which was recorded as sales in the previous years. However, with the increase in product lines and the number of stores, the inventory period continued to rise in FY10 resulting in higher requirement for working capital. As per the provisional results for Q1FY11, ATNG has achieved total operating income of Rs.21 cr with PBILDT and PBT margin of 9.12% and 2.31% respectively. Industry The Indian Retail industry is the seventh-largest retail destination

globally. As per the latest Global Retail Development Index (GRDI) Ranking-2009, India stood as the most attractive retail destination globally (ranked no.1 in four of the last five years) followed by Russia and China. The presence of approximately 12 mn retail outlets and the country's huge rural population base driving the consumption represent the industry's characteristics. During H1FY10, the Indian retailers were faced with declining sales and higher operating expenses leading to dent in their profitability margins. To counter the same, the retailers resorted to practices such as re-negotiation of rentals, maintaining better mix of Stock Keeping Units (SKUs) leading to optimum utilisation of inventories, cut-down on power bills etc. This combined with revival in retail sales during H2FY10 has brought about significant improvement in the retailers' profitability margins. With steady revival in the global economy during the latter part of FY10, CARE Research expects the consumer confidence to get restored thereby resulting in higher footfalls as compared to a year ago. CARE Research feels that the sales of lifestyle retailers would pick up more gradually as compared to value retailers and the proportion of private label sales to retailer's total sales would grow to 8-10% by FY11. CARE Research expects the total retail sales at Rs.22,357 bn by FY11. Of the same, the organized retail sales penetration is estimated to be 6.8% valued at Rs.1,520 bn. Prospects With the entry of international brands, the domestic competition in the branded apparel segment has been growing. The prospects for relatively smaller players like ATNG would depend upon their ability to scale up their operations and maintain their profitability margins along with effective working capital management.

November 2010 Disclaimer

CARE's ratings are opinions on credit quality and are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security. CARE has based its ratings on information obtained from sources believed by it to be accurate and reliable. CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bank facilities/instruments.

CAREVIEW

CARE is headquartered in Mumbai, with Offices all over India. The office addresses and contact numbers are given below:

HEAD OFFICE: MUMBAI

Mr. D.R. Dogra Managing Director Cell : +91-98204 16002 E-mail : dr.dogra@careratings.com Mr. P N Sathees Kumar Exective Vice President - Marketing Mobile: +91-9820416004 E-mail : sathees.kumar@careratings.com Mr. Rajesh Mokashi Dy. Managing Director Cell : +91-98204 16001 E-mail: rajesh.mokashi@careratings.com Mr. Ankur Sachdeva Vice President - Marketing (SME) Cell : +91-9819698985 E-mail: ankur.sachdeva@careratings.com

Mr. Vivek Palan Manager - Banking & Finance Cell : +91-98206 06406 E-mail: vivek.palan@careratings.com 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai 400 022 Tel.: (022) 67543456 Fax: (022) 67543457 Website: www.careratings.com

OFFICES

Mr. Mehul Pandya Regional Manager 32 TITANIUM, Prahaladnagar Corporate Road, Satellite, Ahmedabad - 380 015. Tel - 079 4026 5656 Mobile - 98242 56265 E-mail: mehul.pandya@careratings.com Mr. Pradeep Kumar Regional Manager Unit No. O-509/C, Spencer Plaza, 5th Floor, No. 769, Anna Salai, Chennai - 600 002. Tel: 044 2849 7812/2849 0811 Mobile - 98407 54521 E-mail: Pradeep.kumar@careratings.com Mr. Sukanta Nag Regional Manager 3rd Floor, Prasad Chambers (Shagun Mall Building), 10A, Shakespeare Sarani, Kolkata - 700 071. Tel - 033 2283 1800/1803 Mobile - 98311 70075 E- mail: sukanta.nag@careratings.com Mr. Sundara Vathanan Regional Manager Unit No. 8, I floor, Commander's Place No. 6, Raja Ram Mohan Roy Road, Richmond Circle, Bangalore - 560 025. Tel - 080 2211 7140 Mobile - 98803 60878 E-mail: sundara.vathanan@careratings.com Mr. Ashwini Jani Regional Manager 401, Ashoka Scintilla, 3-6-520, Himayat Nagar, Hyderabad - 500 029. Tel - 040 40102030 Mobile - 91766 47599 E-mail: ashwini.jani@careratings.com Ms. Swati Agrawal Regional Manager 710 Surya Kiran, 19 K.G. Road, New Delhi - 110 001. Tel - 011 2331 8701/2371 6199 Mobile - 98117 45677 E-mail: swati.agrawal@careratings.com

CREDIT ANALYSIS & RESEARCH LIMITED

Das könnte Ihnen auch gefallen

- FM ProjectDokument13 SeitenFM Projectabhi choudhuryNoch keine Bewertungen

- Smart Gains 42 PDFDokument4 SeitenSmart Gains 42 PDF476Noch keine Bewertungen

- Shriram Transport Finance Company LTD.: Investor PresentationDokument44 SeitenShriram Transport Finance Company LTD.: Investor PresentationAbhishek AgarwalNoch keine Bewertungen

- Tata Consultancy Services LTD: Company ReportDokument10 SeitenTata Consultancy Services LTD: Company Reportcksharma68Noch keine Bewertungen

- Deepesh Agarwal - Financial Statement Analysis of Tata Motors LTDDokument72 SeitenDeepesh Agarwal - Financial Statement Analysis of Tata Motors LTDBhanu PrakashNoch keine Bewertungen

- Working Capital ManagementDokument49 SeitenWorking Capital ManagementAshok Kumar KNoch keine Bewertungen

- An Analysis of Financial and Business Performance of Gul Ahmed Textile Mills Limited Between FY2009 To FY2011Dokument32 SeitenAn Analysis of Financial and Business Performance of Gul Ahmed Textile Mills Limited Between FY2009 To FY2011techyaccountantNoch keine Bewertungen

- Pantaloon Retail Financial AnalysisDokument18 SeitenPantaloon Retail Financial AnalysisSandeep VargheseNoch keine Bewertungen

- Bzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupDokument23 SeitenBzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupMuhammad Ihsan ToorNoch keine Bewertungen

- Infosys Results Q1-2009-10Dokument4 SeitenInfosys Results Q1-2009-10Niranjan PrasadNoch keine Bewertungen

- Finance ColgateDokument104 SeitenFinance ColgatecharvitrivediNoch keine Bewertungen

- A Study On Inventory Management On HeroDokument17 SeitenA Study On Inventory Management On HeroTarun Nani100% (1)

- Accnts Projest - BajajDokument24 SeitenAccnts Projest - BajajAprajita SaxenaNoch keine Bewertungen

- Case Analysis: Rohan.J.PatelDokument4 SeitenCase Analysis: Rohan.J.PatelhardikgosaiNoch keine Bewertungen

- Table of Content 1.0 Introduction of StudyDokument26 SeitenTable of Content 1.0 Introduction of StudyDee JoeNoch keine Bewertungen

- Anamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaDokument24 SeitenAnamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaAnamika ChakrabartyNoch keine Bewertungen

- Sbi General Set PPT 2012Dokument20 SeitenSbi General Set PPT 2012Kaif KidwaiNoch keine Bewertungen

- Mandhana IndustMandhana Industries Limited - Q1FY14-1.pdfries Limited - Q1FY14-1Dokument23 SeitenMandhana IndustMandhana Industries Limited - Q1FY14-1.pdfries Limited - Q1FY14-1mdd25Noch keine Bewertungen

- Pitti Laminations Annual Report 2011-2012Dokument68 SeitenPitti Laminations Annual Report 2011-2012SwamiNoch keine Bewertungen

- TCS Financial Results: Quarter I FY 2014 - 15Dokument28 SeitenTCS Financial Results: Quarter I FY 2014 - 15Bethany CaseyNoch keine Bewertungen

- Tata Motors Ratio AnalysisDokument12 SeitenTata Motors Ratio AnalysisVasu AgarwalNoch keine Bewertungen

- DLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverDokument15 SeitenDLF Limited, Is India's Largest Real Estate Company in Terms of Revenues, Earnings, Market Capitalisation and Developable Area. It Has OverShashi ShekharNoch keine Bewertungen

- Li - Ningco.ltd ReportDokument6 SeitenLi - Ningco.ltd ReportzeebugNoch keine Bewertungen

- Tata Consultancy Services: Financial Statements AnalysisDokument13 SeitenTata Consultancy Services: Financial Statements AnalysisChhaya ThakorNoch keine Bewertungen

- Corporates: 2011 Outlook: Indian Retail SectorDokument8 SeitenCorporates: 2011 Outlook: Indian Retail SectorPankaj KishnaniNoch keine Bewertungen

- Abhishek Industries Annual Report 2009-2010Dokument63 SeitenAbhishek Industries Annual Report 2009-2010raovarun8Noch keine Bewertungen

- Report For The Second Quarter Ended September 30, 2011: Letter To The ShareholderDokument4 SeitenReport For The Second Quarter Ended September 30, 2011: Letter To The ShareholderNiranjan PrasadNoch keine Bewertungen

- Reliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee SuganyaDokument8 SeitenReliance Industries Limited: Team Members Ragavi Priyanka Kirthika Suhitaa Rajee Suganyachitu1992Noch keine Bewertungen

- Live Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Dokument15 SeitenLive Project: Financial Planning For Hawkers GROUP 4 (PG SEC-B 2011-2012)Shakthi ShankaranNoch keine Bewertungen

- CMA Project Shivam GroudDokument18 SeitenCMA Project Shivam GrouddiveshNoch keine Bewertungen

- Share Khan Report Max IndiaDokument15 SeitenShare Khan Report Max IndiaKarlosNoch keine Bewertungen

- Rambling Souls - Axis Bank - Equity ReportDokument11 SeitenRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNoch keine Bewertungen

- T-Shirts PLCDokument13 SeitenT-Shirts PLCCosmin IonițăNoch keine Bewertungen

- Report For The Second Quarter Ended September 30, 2009: Letter To The ShareholderDokument4 SeitenReport For The Second Quarter Ended September 30, 2009: Letter To The ShareholderAshutosh KumarNoch keine Bewertungen

- Group7 FA Assignment Auto Ancillary Exide v3. 0Dokument11 SeitenGroup7 FA Assignment Auto Ancillary Exide v3. 0Anupriya SenNoch keine Bewertungen

- RETAILDokument11 SeitenRETAILMewa SinghNoch keine Bewertungen

- Investor Presentation May 2016 (Company Update)Dokument29 SeitenInvestor Presentation May 2016 (Company Update)Shyam SunderNoch keine Bewertungen

- Shoppers StopDokument8 SeitenShoppers StopRavish SrivastavaNoch keine Bewertungen

- Financial Highlights Q1 (3M) 2011-12Dokument24 SeitenFinancial Highlights Q1 (3M) 2011-12Dilip KumarNoch keine Bewertungen

- Report Cpall Rc2012Dokument38 SeitenReport Cpall Rc2012dumacatyNoch keine Bewertungen

- Mid-Cap Marvels: RCM ResearchDokument20 SeitenMid-Cap Marvels: RCM ResearchmannimanojNoch keine Bewertungen

- Gillette Pakistan Limited: Analysis of Financial StatementDokument19 SeitenGillette Pakistan Limited: Analysis of Financial StatementElhemJavedNoch keine Bewertungen

- Ratio Analysis of HDFC FINALDokument10 SeitenRatio Analysis of HDFC FINALJAYKISHAN JOSHI100% (2)

- A C Choksi: Marico LimitedDokument0 SeitenA C Choksi: Marico LimitedvvkguptavoonnaNoch keine Bewertungen

- Report For The Third Quarter Ended December 31, 2011: Letter To The ShareholderDokument4 SeitenReport For The Third Quarter Ended December 31, 2011: Letter To The ShareholderfunaltymNoch keine Bewertungen

- Dabur Vs ITC FinancialsDokument6 SeitenDabur Vs ITC Financialssarthak.ladNoch keine Bewertungen

- IJCRT22A6682Dokument7 SeitenIJCRT22A6682shashikumarb2277Noch keine Bewertungen

- CMT Ar 2015Dokument212 SeitenCMT Ar 2015Sassy TanNoch keine Bewertungen

- Financial Analysis Research Paper SampleDokument7 SeitenFinancial Analysis Research Paper Sampleafeaudffu100% (1)

- CRISIL Research Ier Report Sterlite Technologies 2012Dokument28 SeitenCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNoch keine Bewertungen

- Professional & Management Development Training Revenues World Summary: Market Values & Financials by CountryVon EverandProfessional & Management Development Training Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- India Consumer - Enjoying A Slice of Luxury.248.175.146Dokument60 SeitenIndia Consumer - Enjoying A Slice of Luxury.248.175.146Harinig05Noch keine Bewertungen

- Bharti Airtel Annual Report 2012 PDFDokument240 SeitenBharti Airtel Annual Report 2012 PDFnikhilcsitmNoch keine Bewertungen

- Bata - MoSTDokument59 SeitenBata - MoSTcanaryhillNoch keine Bewertungen

- Mastering Operational Performance : The Ultimate KPI HandbookVon EverandMastering Operational Performance : The Ultimate KPI HandbookNoch keine Bewertungen

- Management Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099Dokument15 SeitenManagement Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099prithvi17Noch keine Bewertungen

- TridentDokument65 SeitenTridentEr Puneet GoyalNoch keine Bewertungen

- Sintex Industries: Topline Beats, Margins in Line - BuyDokument6 SeitenSintex Industries: Topline Beats, Margins in Line - Buyred cornerNoch keine Bewertungen

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- MFM Ii SgpaDokument10 SeitenMFM Ii SgpajshashaNoch keine Bewertungen

- Affordable Case StudyDokument3 SeitenAffordable Case StudyjshashaNoch keine Bewertungen

- MFM Ii SgpaDokument10 SeitenMFM Ii SgpajshashaNoch keine Bewertungen

- Literature ListDokument2 SeitenLiterature ListjshashaNoch keine Bewertungen

- Fast FashionDokument2 SeitenFast FashionjshashaNoch keine Bewertungen

- Environmental ManagementDokument2 SeitenEnvironmental ManagementjshashaNoch keine Bewertungen

- Product 2001 2002 2003 2004 2005Dokument4 SeitenProduct 2001 2002 2003 2004 2005jshashaNoch keine Bewertungen

- Buyback Letter of OfferDokument3 SeitenBuyback Letter of OfferNarNoch keine Bewertungen

- Finance and Accounts - Business Management IBDokument6 SeitenFinance and Accounts - Business Management IBJUNIORNoch keine Bewertungen

- Solution Manual For Multinational Business Finance 15th by EitemanDokument36 SeitenSolution Manual For Multinational Business Finance 15th by Eitemanpicheywitlingaip34100% (47)

- Aspires Aggressive Market Share: UnratedDokument10 SeitenAspires Aggressive Market Share: Unratedmbts.14014cm020Noch keine Bewertungen

- Batas Pambansa BLG 232Dokument14 SeitenBatas Pambansa BLG 232xerxeschuaNoch keine Bewertungen

- 9 Advanced and Profitable Trading StrategiesDokument44 Seiten9 Advanced and Profitable Trading StrategiesKrish RajNoch keine Bewertungen

- Informal Economy of Pakistans Land MarketDokument24 SeitenInformal Economy of Pakistans Land MarketJehangir IftikharNoch keine Bewertungen

- Inancial Arkets: Learning ObjectivesDokument24 SeitenInancial Arkets: Learning Objectivessourav goyalNoch keine Bewertungen

- Searching For A Strategy To Teach Strategy (Larry E. Greiner)Dokument20 SeitenSearching For A Strategy To Teach Strategy (Larry E. Greiner)dasboot69Noch keine Bewertungen

- FNB SG Retail 2017-03Dokument23 SeitenFNB SG Retail 2017-03Arravind UdayakumarNoch keine Bewertungen

- Major Transaction Used in TRMDokument9 SeitenMajor Transaction Used in TRMAbhishek SarawagiNoch keine Bewertungen

- Financial and Managerial Accounting 8Th Edition Wild Test Bank Full Chapter PDFDokument67 SeitenFinancial and Managerial Accounting 8Th Edition Wild Test Bank Full Chapter PDFClaudiaAdamsfowp100% (9)

- Family Id FormDokument2 SeitenFamily Id FormkiranNoch keine Bewertungen

- Midterm Quiz in ACCTG2215Dokument17 SeitenMidterm Quiz in ACCTG2215guess who100% (1)

- Chapter 2Dokument22 SeitenChapter 2Tiến ĐứcNoch keine Bewertungen

- Buyback: What Is A Buyback?Dokument3 SeitenBuyback: What Is A Buyback?Niño Rey LopezNoch keine Bewertungen

- Govacctg New PDFDokument190 SeitenGovacctg New PDFJasmine Lim100% (1)

- Campus 22 - Finance JDDokument2 SeitenCampus 22 - Finance JDAryan MaheshwariNoch keine Bewertungen

- BCom TableDokument10 SeitenBCom TablesimsonNoch keine Bewertungen

- Atrill Capital Structure SlidesDokument8 SeitenAtrill Capital Structure SlidesEYmran RExa XaYdiNoch keine Bewertungen

- Fractional Share FormulaDokument1 SeiteFractional Share FormulainboxnewsNoch keine Bewertungen

- Singapore Institute of Management: University of London Preliminary Exam 2020Dokument20 SeitenSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəNoch keine Bewertungen

- ProblemSet Cash Flow EstimationQA 160611 021520 PDFDokument25 SeitenProblemSet Cash Flow EstimationQA 160611 021520 PDFCucumber IsHealthy96Noch keine Bewertungen

- Delgado - Forex: How To Build Your Trading Watch List.Dokument13 SeitenDelgado - Forex: How To Build Your Trading Watch List.Franklin Delgado VerasNoch keine Bewertungen

- Royal Sundaram General Insurance Co. Limited: Hi, Passenger Carrying Vehicle (Upto 6 Passengers) QuoteDokument1 SeiteRoyal Sundaram General Insurance Co. Limited: Hi, Passenger Carrying Vehicle (Upto 6 Passengers) QuoteGadde Maha lakshmiNoch keine Bewertungen

- Laundry QuestionnaireDokument3 SeitenLaundry QuestionnaireRIGENE MAGNAYENoch keine Bewertungen

- Money Banking and Financial Markets 4th Edition Cecchetti Solutions ManualDokument15 SeitenMoney Banking and Financial Markets 4th Edition Cecchetti Solutions Manualsamsondorothyuu2100% (26)

- Lyft CaseDokument5 SeitenLyft CaseMyDude IsHungryNoch keine Bewertungen

- QutotionDokument1 SeiteQutotionmanishsngh24Noch keine Bewertungen

- GTB Statement For The Month of May 2013Dokument3 SeitenGTB Statement For The Month of May 2013shomama100% (2)