Beruflich Dokumente

Kultur Dokumente

2011 03 02 - IronOreMkt

Hochgeladen von

肖申荻Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 03 02 - IronOreMkt

Hochgeladen von

肖申荻Copyright:

Verfügbare Formate

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Iron Ore Market Analysis Report for Northland Resources S. A.

Ocean Equities Limited

2nd March 2011

09/03/2011

1 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

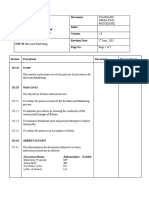

Index

Page 3 Page 3 Page 4 Page 5 Page 6 Page 11 Page 15 Scope of the Report Notes Executive Summary Peer Group Criteria Iron Ore Pricing understanding the New World Order Peer Group Analysis Profitability Analysis Peer Group Analysis Quality Analysis

09/03/2011

2 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Scope of the Report

In January 2011, Ocean Equities Limited (Ocean or we) agreed to provide Northland Resources Inc (Northland or the Company) with a market analysis of its listed peers with a particular emphasis on the costs involved in getting to production (ie a combination of both capital costs and operating costs) and the potential price premium (or discount) that the peers could receive based on the quality of the iron product that they are selling or looking to sell in the future. This report is provided for the sole use of Northland. Except with the permission of Ocean, this report may not be reproduced or redistributed, in whole or in part, to any other person, or published, in whole or in part, for any purpose without the express written consent of Ocean. Northland is free to use the data provided with this report as it sees fit. While such data is based on information that we consider reliable, we do not represent that it is accurate or complete and it should not be relied upon as such.

Notes

All information in this report has been sources from publically available information from (inter alia): tsx.com, asx.com, various company websites, Bloomberg. All market data is sourced from Bloomberg (with some corrections where applicable). FX rates (US$ per currency): o o o C$: $1.03 : $1.63 A$: $1.02

Share prices are at close of business 1st March 2011. All $ in this report are US$ unless otherwise specified. There is an accompanying Excel spreadsheet for this report titled: OEL Market Analysis Report Supporting Data 02-03-11 EDIT 09-03-11.xls

09/03/2011

3 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Executive Summary

In our opinion, too much emphasis is put on the headline operating cost figure by iron ore developers without understanding the full cash requirement to get to production. Also we feel that the relatively new pricing structure for iron ore products that has been in effect for over a year now where producers receive a premium or discount to the benchmark iron ore price depending on the quality of their product has not and is not being fully understood by the market. When these two misconceptions (in our opinion) are combined, it can be understood that certain projects that may have looked more attractive a couple of years ago do now not represent such a compelling investment case and that a deeper understanding of the pricing dynamics of the market are needed to be able to determine this. A term from the gold mining world is grade is king and this is now applicable to the iron ore market as the premium received can be significant: a 70% concentrate can receive a premium of ~$50/t in todays market, which is hugely significant when we consider that it is based on a benchmark price (which could be considered a spot price) of $180/t (for 62% Fe delivered to China) as it represents a 28% uplift. To make an analogy for mining investors, this is like a gold producer suddenly receiving $1,800 per ounce for its gold rather than the current spot price of $1,400. To extend the gold analogy, we feel that a way in which we can attempt to normalise the junior iron ore producers and developers that make up the peer group of this study is to take a lead from the gold industry that takes any extra income that the deposit produces (such a by-product like copper or silver) and rather than using it to inflate the price received, uses it to reduce the cash cost of production. Therefore, we have rebased the peer group in this study to the benchmark 62% level and taken any price premium for higher grade product away from the cost of production. What this shows is that although Northlands Kaunisvaara project does not look compelling purely on the basis of operating costs, when combined with the premium that it should receive for its high grade 69% concentrate and the low capital intensity required to build the mine, Kaunisvaara shows comparable potential profitability to many of its peers and sits squarely in the middle of the peer group. Once we recognise that Kaunisvaara has comparable potential profit margins to its peers, we are then able to turn to the less quantitative factors that affect new iron ore mine in development. These include such factors as availability of capital which Northland scores highly on with its low capital requirement (due mostly to its use of third party rail and port facilities); political risk where Northland possible scores higher than any of the others with its projects in Sweden and Finland; and location advantage where Northland also scores highly as it has the potential to sell some of its product to its European neighbours, thereby saving on shipping costs an option most of the Australian, Canadian and African projects simply do not have.

09/03/2011

4 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Peer Group Criteria

Northland is currently in the process of constructing its first iron ore mine in northern Sweden. The Kaunisvaara project is a magnetite mine that will produce a high quality magnetite concentrate with first production due in 2013. The Company is also developing the Hannukainen project in Finland which is an IOCG (iron-oxide-copper-gold) deposit, for which it has completed a pre-feasibility study (PFS) and is currently completing a bankable feasibility study (BFS) with the intention to produce a magnetite concentrate and a copper-gold concentrate by 2015. With this profile of Northland in mind, our selection of a peer group was to look for companies listed on a well known exchange (ie the LSE, TSX, ASX) that were independent producers (ie not a multi-commodity conglomerate such as Rio Tinto), near producers or developers that have completed a level of technical investigation that provides sufficient amount of data for analysis (quality of the iron ore product, capital and operating costs, etc). We have also included a small number of companies that have not reached this level of technical knowledge if they have advanced other aspects of the project and are well known and regarded purely for information purposes and completeness.

Exhibit 1: Constituents of the study:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Company Northland Resources SA Consolidated Thompson Iron Mines Ltd Grange Resources Ltd Murchison Metals Ltd Northern Iron Ltd African Minerals Ltd Gindalbie Metals Ltd Sundance Resources Ltd/Australia Brockman Resources Ltd London Mining PLC Sphere Minerals Ltd African Aura Mining Inc Australasian Resources Ltd Bellzone Mining PLC Equatorial Resources Ltd Baffinland Iron Mines Corp Labrador Iron Mines Holdings Ltd New Millennium Capital Corp African Iron Limited Advanced Exploration Limited Champion Minerals Macarthur Minerals Venus Metals

Bloomberg Ticker NAU CN CLM CN GRR AU MMX AU NFE AU AMI LN GBG AU SDL AU BRM AU LOND LN SPH AU AAAM LN ARH AU BZM LN EQX AU BIM CN LIM CN NML CN AKI AU AXI CN CHM TO MMS CN VMC AU

09/03/2011

5 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Iron Ore Pricing understanding the New World Order

Towards the end of 2009, the Big 3 iron ore producers (Rio Tinto, BHP Billiton, and Vale) released that although the insatiable demand from China was pushing up the iron ore price rapidly, the traditional annual contract pricing system was restricting them from realising a lot of value from an industry that they dominated. This led to a move to a more dynamic system that used quarterly pricing settled against global indices of spot iron ore trading and this has rapidly become the de facto pricing method for almost all producers and developers (although some have dragged such as Swedish State owned producer LKAB which stuck to a contract price in 2010 as still in discussions with its customers for pricing in 2011 not a surprise that a State run producer is behind the times). Now iron ore is priced according to an index (of which there are a few: Metal Bulletin and Platts both maintain them), the most popular of which is the 62% China CFR (Cost and freight) which is most commonly viewed as the closest to an iron ore spot price. There are 2 other popular indices: the lowergrade 58% index, and the index for higher grade 63.5% Indian fines. Both are quoted in a similar fashion to the 62% index as CFR China. It has always been clear that for a product of variable quality, a variable price will be received, and annual contract negotiations took this into account. What has changed with the move to index-driven prices is the dynamicism of the received price (which now moves daily rather than annually) and the transparency of this mechanism: Whereas previously the contracted prices were well kept secrets, we can now extrapolate a received price for a product in relation to the index if we know the product specifications (or at least make a good estimation). Some examples of the new pricing method have been stated publically over then past 18 months:

As early as in April 2009, when Australasian Resources (ASX:ARH) updated its resource for the Balmoral South project and derived an ore reserve estimate, the independent consultant stated that a premium of 5% for concentrate was applied to the benchmark fines price to acknowledge the quality premium expected. On 1st April 2010 Gindalbie Metals Ltd (ASX:GBG) signed an offtake deal for its magnetite concentrate from the Karara project in Australia that showed a 10% increase above the benchmark price at the time. The offtake was with its joint venture partner in the project AnSteel (Chinas second largest steel producer), and was significant as the 10% gain per iron unit works out to a 21% increase in price per tonne concentrate over and above the 62% benchmark:

Exhibit 2: In April 2010, Gindalbie reported an offtake with Ansteel for its magnetite concentrate that implied a 21% increase above the 2009 benchmark for fines. We see this as a good indication that Northland will be able to negotiate a healthy premium for its concentrate as Kaunisvaaras concentrate will be even higher grade than Karara and with lower impurities.

Revenue $m 2009 benchmark Gindalbie (30 Mar 2010) % inc to 2009 benchmark 580 8.00 Conc prod mtpa Fe grade % Fe 62.0% 68.2% 5.46 Contained Fe mtpa Implied conc price $/t conc sold 60.14 72.50 21% Implied Fe metal price $/t Fe metal sold 97.00 106.30 10%

In October 2010, Grange Resources (ASX:GRR) stated that All sales are being undertaken at index based market prices which resulted in it receiving a price for its pellets of $150/t (well above the benchmark at the time) for the 3 months to the end of September and that the company expects this to continue into the fourth quarter. It also stated that it was continuing discussions with all contracted

09/03/2011

6 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

customers in order to secure agreement to an ongoing sales pricing methodology, based on the iron ore index which is being used by major iron ore suppliers. Grange expected to complete this process by the end of 2010. This followed statements from Grange back in July 2010 that it had finalised negotiations with Shangang (Chinas largest non-State owned steel producer) with the new pricing mechanism and that it had also discussed the new pricing mechanism with another customer BlueScope Steel, that would operate for the remaining two years of its contract.

Most recently on 26th January 2011, London Mining (LSE:LOND) announced that it had signed an offtake with Glencore where the offtake will be priced at around Platts 62% CFR China benchmark, with an upward adjustment for the Fe content of the Companys 65% Fe sinter feed concentrate, and an incentive to place product at locations such as Europe where there is a net pricing benefit through lower shipping costs.

Of course the implication that can be derived form this is that (to borrow phrase form the gold mining industry) grade is king. In 2010, we changed our own pricing mechanism to a method that rewards better-than-index products which we refer to as a price differential premium, but we think that the wider market has not gained a full understanding of the implications of this change in iron ore pricing and the implications that it has for new projects. One may ask why is high grade iron ore important? The primary reason is that by blending higher grade products, steel makers can use more lower grade ore which is more plentiful and a lot cheaper on a periron-unit basis (we examine this relationship in the following pages). Also, higher grade iron ore means lower handling costs for the customers and also less waste to deal with which is another cost saver. Low impurities are also good, but impurities are harder to analyse quantitatively as the demands of levels of impurities varies widely from customer to customer (some furnaces are built with specific ores in mind and so if that particular ore becomes scarce it could become desirable regardless of the impurity). This leaves us with the iron ore grade of a product (be it lump, fines or concentrate) and in this report we have examined how the variance of iron grade can affect the profitability of a variety of projects.

09/03/2011

7 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

The difference between 62% and 58% iron ore The two most commonly used indices are for medium grade 62% iron ore (the closest we have to an iron ore spot price) and low grade 58% iron ore. The indices have been running since 2008 but really took an important role from the end of 2009 when the market started using them as a firm pricing reference.

Exhibit 3: Since late 2009, the iron ore price indices for 58% and 62% grade product have risen to the current levels of $156 and $180 respectively

200 190 180 170 160 150 140

62% Fe Index 58% Fe Index

US$/t

130 120 110 100 90 80 70 60 50 Nov 09

Dec 09

Jan 10

Feb 10

Mar 10

Apr 10

May 10

Jun 10

Jul 10

Aug 10

Sep 10

Oct 10

Nov 10

Dec 10

Jan 11

Feb 11

It can be seen in Exhibit 3 that the two indices have drifted apart over time, and this is an indication of the greater desirability of the higher grade ore. This is emphasised in Exhibit 4 which shows the two index prices per iron unit (a dry metric tonne unit (dmtu) equivalent to 1% iron content of a product) and the difference between the two index prices. We can see that the price per dmtu started at a similar level at the end of 2009 but as the index-pricing system took off in 2010 the higher grade ore became more valuable on a per unit basis, but the correlation between the two was quite tight (as indicated by the green line). The downturn in the iron ore price in mid-2010 created uncertainty in the market and the correlation widened drastically until the price began is upward move again in August when the correlation settled down again.

09/03/2011

8 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Exhibit 4: It is clear that higher grade ore is more valuable on a per unit basis and has maintained this for over a year.

3.2 62% index value per mtu (LHS) 3 2.8 2.6 2.4 Value per Fe mtu (US$/t) 2.2 2 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 Nov 09 Dec 09 58% index value per mtu (LHS) Difference between indices (RHS)

100 90 80 70 60 50 40 30 20 10 0 Jan 10 Mar 10 Apr 10 May 10 Jul 10 Aug 10 Sep 10 Nov 10 Dec 10 Jan 11 Difference between index prices (US$/t)

If we take this analysis on step further to look at the dollar value difference between the indices on a per unit basis (Exhibit 5) we can see that an interesting relationship has developed.

09/03/2011

9 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Exhibit 5: The relationship between medium and high grade ore

13 12 11 10 Diff 58-62 per unit (LHS) 62% index (RHS)

250

B 200 180

Price differential per Fe unit (US$)

8 7 C 6 5 4 3 D

150

6.0 100

50 2 1 0

Nov 09 Dec 09 Jan 10 Feb 10 Mar 10 Apr 10 May 10 Jun 10 Jul 10 Aug 10 Sep 10 Oct 10 Nov 10 Dec 10 Jan 11 Feb 11

We can see that from November 2009 to April 2010 when the iron ore price was on a steep upward trajectory, the value differential between 58% and 62% iron ore also rose rapidly (label A). When the price fell between April and August 2010, the uncertainty in the market created a lot of noise and the correlation swung over a wide range (label B). This seemed to calm down again in the latter half of 2010 as the differential seemed to also be on the increase as the iron ore price also increased (albeit with a less steep trajectory). However, there seemed to be a correction just before the end of 2010 and since then the differential has stayed around the $6/t mark (label D) despite the iron ore price continuing its rise. There are a wide variety of reasons for this change in relationship between the price itself and the price differential between medium and high grade iron ore products (stockpile movements at the end of the year; macro economic macro sentiment; etc) but the point that we feel is important to take away from this analysis for the purposes of this report is that even during a falling price environment, the price differential for higher grade iron ore was maintained. The current level of $6.0/t for every dmtu over the 62% is actually close to the 12 month low having peaked at over $12/t in May 2010 and so for the purposes of this report and its analyses, we have used $5/t per dmtu over and above the 62% index.

09/03/2011

10 of 18

Index Price - 62% Fe CFR China

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Peer Group Analysis Profitability Analysis

When attempting to determine the potential profitability of a mine, the first and obvious metric to consider is the operating cost that the project owner is quoting. However, it is our opinion that the market in general places too much importance on this headline number as there are other factors that can affect the economic attractiveness of a project as much if not more than the simple operating cost per tonne. The first consideration is the capital cost that is required to get to production. Iron ore is a bulk commodity and many of the iron ore projects in our peer group are huge undertakings with equally huge capital requirements. The general maxim is that the larger the better as economies of scale can reduce the influence of the fixed cost portion of the project, but is this always true for iron ore projects? It is widely held that bulk commodity projects such as coal and iron ore are often a play on the infrastructure a truism that is played out in the Pilbara every day as junior iron ore developers are held hostage to the rail owned and operated by the larger producers that often have no desire to see their competitors gain access to the international markets. For this reason, we favour projects that have an easier ride to transport infrastructure, and in this respect Northland Kaunisvaara project is one of the best. The availability of a State built and run rail network and access to an existing port reduces Northlands capital requirement for the Kaunisvaara project and this should certainly be taken into consideration when comparing Kaunisvaara as an investment opportunity with other mines in development.

Exhibit 6: Ranking iron ore mines in development by operating cost shows that Kaunisvaara is not one of the most attractive (Hannukainen performs better due to its copper-gold output which reduces operating costs)..

Operating cost (US$/t) Sundance (Mbalam Ph 2) Macarthur (Lake Giles DSO) Northland (Kaunisvaara) Australasian (Balmoral South) Champion Minerals (Fermont) Advanced Exp (Roche Bay) Sphere (Askaf) Brockman (Marillana) Gindalbie (Karara) Grange (Southdown) Bellzone (Kalia Phase 1) New Millenium (DSO) Cons Thom (Bloom Lake) Northern Iron (Svardranger) London Mining (Marampa Ph 2) Venus Metals (Yalgoo) Baffinland (Mary River) London Mining (Marampa Ph 1) London Mining (Isua) African Minerals (Tonkolili Ph 1) Labrador (Schefferville DSO) Northland (Hannukainen) Bellzone (Kalia Phase 2) Murchison (Rocklea) New Millenium (Kemag) Sundance (Mbalam) 21.00 21.00 19.65 33.45 32.62 32.56 30.00 29.91 29.78 29.00 29.00 27.50 26.75 26.35 26.13 47.21 45.96 43.95 42.85 42.77 42.50 41.50 52.10 50.07 56.61 10.00 20.00 30.00 40.00 50.00 60.00 70.00 70.00

09/03/2011

11 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Note: If a project intended to produce pellets has given a breakdown of the operating and capital costs for the pelletising process that has enabled us to extract these to normalise to a magnetite concentrate mine, we have done so. If such figures are not given we have not considered the project in the peer group.

The second factor to consider that might not be so obvious is that of the different price that will be received by the different quality of iron ore products that the projects in the peer group will produce. Unlike (for example) gold mines that all produce the same quality gold bar, iron ore mines produce vastly different products that all have their own supply demand dynamics and command their own prices and this makes it difficult to compare apples with apples. As we outlined in the previous section, one factor we can gain some transparency on is that higher grade iron ore attracts an incrementally higher sales price, and this leads us to a methodology whereby we can normalise the mixture of products that the peer group produces. To attempt to normalise the output if the peer group, we have awarded (or deducted) a premium of $5 per Fe unit (or dmtu) above (or below) the 62% benchmark, which we feel is a conservative figure for todays market. For example, Northlands Kaunisvaara is due to produce a 69% Fe concentrate so we have deducted $35/t from the operating cost (69-62 = 7 * $5 = $35/t.) Applying this to the peer group shows that Northlands Kaunisvaara project now sits squarely in the middle of the pack.

Exhibit 7: By reducing the operating costs according to the premium that the mines iron product could receive over and above the 62% benchmark shows that Kaunisvaara now sits squarely in the middle of the pack amongst its peers. A few of the projects (including Hannukainen) now have a net negative cash cost as the premium that the iron product could receive is larger than the per tonne operating cost.

Adjusted Operating Cost (US$/t) (20.00) (10.00) Murchison (Rocklea) Sundance (Mbalam Ph 2) Brockman (Marillana) African Minerals (Tonkolili Ph 1) Champion Minerals (Fermont) Macarthur (Lake Giles DSO) Sphere (Askaf) Advanced Exp (Roche Bay) Sundance (Mbalam) Northland (Kaunisvaara) Australasian (Balmoral South) London Mining (Marampa Ph 2) New Millenium (DSO) Cons Thom (Bloom Lake) Northern Iron (Svardranger) Gindalbie (Karara) London Mining (Marampa Ph 1) Bellzone (Kalia Phase 1) Baffinland (Mary River) Grange (Southdown) Labrador (Schefferville DSO) (0.09) Venus Metals (Yalgoo) Bellzone (Kalia Phase 2) Northland (Hannukainen) London Mining (Isua) New Millenium (Kemag) 1.85 (5.22) (8.65) (12.00) (14.50) 17.15 17.10 15.07 15.00 13.95 12.62 12.56 11.77 11.00 10.15 9.78 8.50 24.11 21.95 20.96 31.71 50.00 47.85 47.00 10.00 20.00 30.00 40.00 50.00 60.00 56.00 70.00

09/03/2011

12 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

The final step for our analysis is to now also add the capital requirement for the project. We have done this in Exhibit 8 that shows that at the current benchmark price of $180/t for 62% Fe the potential for profit margins are large. We add a proviso that this exercise is strictly for comparative uses and is not a strict guide to cash flows or actual profit margins as while we are using a delivered to China price, we have not considered the transport cost that the projects will have to bear. We discuss this in more detail below. The conclusions that can be drawn from this analysis are that Kaunisvaara is competitively attractive on a purely financial basis, displaying similar profitability potential at London Minings Marampa project in Sierra Leone, Sundance Resources Mbalam project in the Congo/Cameroon, and Baffinlands Mary River project which is currently under offer from ArcelorMittal. However, to make an investment in an iron ore project, we have to consider other factors around the pure financial profitability. One of these factors is the availability of capital which is recent years has been a severely restrictive factor for these capital intensive projects. Exhibit 9 shows that this is one area where both Northlands projects look good the use of already existing rail and port facilities means that both mines have a relatively low capital hurdle to cross to get to production, unlike for example Balmoral South which is a $2.5bn project. The other factor that strikes us in analysis of these results is the location advantage that Northland has in Sweden. Apart from the attraction of being in an area of much lower political risk than a large number of these projects (particularly the African ones), Northland has pretty much the only projects that that are close to potential customers. Whilst we consider that some of Kaunisvaaras product will end up in China, it has the opportunity to improve upon this by selling into Europe and thereby gaining a saving on shipping costs. This is the reason that we have not included shipping costs to China in our analysis as we feel that it would do Northlands projects a disservice.

09/03/2011

13 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Exhibit 9: especially when we consider that the total upfront capital requirement is comparatively low

Exhibit 8: After all expenditure to get to production, Kaunisvaara represents an attractive opportunity price (assuming a price premium of $5 per dmtu over 62%)..

-10 Kemag Kalia Phase 2 Isua Hannukainen Yalgoo Schefferville DSO Southdown Kalia Phase 1 Sydvaranger Bloom Lake DSO Project Karara Mary River Balmoral South Kaunisvaara Marampa phase 1 Marampa phase 2 Mbalam Askaf Lake Giles DSO Fermont Roche Bay Marillana Tonkolili phase 1 Mbalam Stage 2 Rocklea

10

30

50

70

US$ 90

110

130

150

170

Kemag Kalia Phase 2 Isua Hannukainen Yalgoo Schefferville DSO Southdown Kalia Phase 1 Sydvaranger Bloom Lake DSO Project Karara Mary River Balmoral South Kaunisvaara Marampa phase 1 Marampa phase 2 Mbalam Askaf Lake Giles DSO Fermont Roche Bay Marillana Tonkolili phase 1 Mbalam Stage 2 Rocklea

US$m 1,000 2,000 3,000 4,000 5,000

Opex after premium

Capital Intensity

Profit Margin

09/03/2011

14 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Exhibit10:Kaunisvaara still represents an attractive opportunity at $120/t benchmark price (assuming a price premium of $3 per dmtu over 62%)

Exhibit 11: especially when we consider that the total upfront capital requirement is comparatively low

New Millenium (Kemag) Bellzone (Kalia Phase 2) London Mining (Isua) Northland (Hannukainen) Venus Metals (Yalgoo) Labrador (Schefferville DSO) Grange (Southdown) Bellzone (Kalia Phase 1) Northern Iron (Svardranger) Cons Thom (Bloom Lake) New Millenium (DSO) Gindalbie (Karara) Baffinland (Mary River) Australasian (Balmoral South) Northland (Kaunisvaara) London Mining (Marampa Ph 1) London Mining (Marampa Ph 2) Sundance (Mbalam) Sphere (Askaf) Macarthur (Lake Giles DSO) Champion Minerals (Fermont) Advanced Exp (Roche Bay) Brockman (Marillana) African Minerals (Tonkolili Ph 1) Sundance (Mbalam Ph 2) Murchison (Rocklea)

20.00

40.00

US$ 60.00

80.00

100.00

120.00

Kemag Kalia Phase 2 Isua Hannukainen Yalgoo Schefferville DSO Southdown Kalia Phase 1 Sydvaranger Bloom Lake DSO Project Karara Mary River Balmoral South Kaunisvaara Marampa phase 1 Marampa phase 2 Mbalam Askaf Lake Giles DSO Fermont Roche Bay Marillana Tonkolili phase 1 Mbalam Stage 2 Rocklea

US$m 1,000 2,000 3,000 4,000 5,000

Opex after premium

Capital Intensity

Profit Margin

09/03/2011

15 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Peer Group Analysis Quality Analysis

Although we have stated that there are too many variables to be able to apply quantitative analysis to product quality, we are aware that it plays an important part in determining the desirability of an iron ore product. A case in point of this is Northern Iron that had many problems restarting the Sydvaranger mine in northern Norway with silica levels of over 10% for much of 2010. This meant that its customer Corus, which has signed a 5-year offtake for 1.5mtpa of concentrate, has so refused to take delivery. The first ship of <10% Si left the mine in October and contract deliveries were expected to recommence Q1 2011 (source: Northern Iron October 2010 presentation). We therefore have compared Northlands Kaunisvaara projects intended magnetite concentrate with the products being produced (or intended for production) by the peer group.

Exhibit : Product quality of the European and Canadian products shows that they are mostly of good quality although silica levels are quite high

% Fe

70

65

60

%P 0.04

55

7

%SiO

Northland Resources SA

0.65

Northern Iron Ltd Baffinland Iron Mines Corp Consolidated Thompson Iron Mines Ltd

%Al2SO4

Notes: Northern Iron - intended concentrate specifications Chart axes cross at zero Source: Company Reports; Ocean Equities Research

Labrador Iron Mines Holdings Ltd

09/03/2011

16 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Exhibit : Product quality of the Australian products shows that they are mostly of lower quality than Northlands Kaunisvaara concentrate

% Fe

80

%Fe

75

70 65 60

%P

0.08

0.04

55

%SiO

Northland Resources SA

1.5

Australasian Resources Ltd Brockman Resources Ltd Champion Minerals Gindalbie Metals Ltd

%Al2SO4

Grange Resources Ltd

Notes: Chart axes cross at zero Source: Company Reports; Ocean Equities Research

09/03/2011

17 of 18

Iron Ore Market Analysis Report for Northland Resources S. A.

~ OCEAN EQUITIES

Exhibit : Product quality of the African products shows that they are also mostly of lower quality than Northlands Kaunisvaara concentrate with higher silica levels

% Fe

80 %Fe

75

70 65 60

%P

0.08

0.04

55 7

%SiO

Northland Resources SA

1.5 1.5

African Aura Mining Inc African Minerals Ltd Bellzone Mining PLC London Mining PLC

%Al2SO4

Sundance Resources Ltd/Australia

Notes: Chart axes cross at zero Source: Company Reports; Ocean Equities Research

09/03/2011

18 of 18

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Value Investing and Risk ManagementDokument32 SeitenValue Investing and Risk Managementadib_motiwala0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Understanding Stock OptionsDokument34 SeitenUnderstanding Stock Optionstigertiger70Noch keine Bewertungen

- BE Sols - FM14 - IM - Ch3Dokument25 SeitenBE Sols - FM14 - IM - Ch3ashibhallauNoch keine Bewertungen

- SOA 30 Sample Problems On Derivatives MarketsDokument24 SeitenSOA 30 Sample Problems On Derivatives MarketsSilvioMassaro100% (1)

- CDS Presentation With References PDFDokument42 SeitenCDS Presentation With References PDF2401824Noch keine Bewertungen

- MCQ Part 1Dokument41 SeitenMCQ Part 1Santosh Shrestha100% (1)

- Sealed Air CorporationDokument7 SeitenSealed Air CorporationMeenal MalhotraNoch keine Bewertungen

- Sop 28 - Sales and MarketingDokument8 SeitenSop 28 - Sales and Marketingnice guy100% (3)

- 100 To 1 in The Stock Market - Seeking WisdomDokument29 Seiten100 To 1 in The Stock Market - Seeking Wisdomkrb2709100% (2)

- FinQuiz Level2Mock2016Version6JunePMSolutionsDokument57 SeitenFinQuiz Level2Mock2016Version6JunePMSolutionsAjoy RamananNoch keine Bewertungen

- Customer's Perception Towards The Loan Product of State Bank of IndiaDokument60 SeitenCustomer's Perception Towards The Loan Product of State Bank of IndiaSubodh Sonawane33% (3)

- Education Loan ProjectDokument45 SeitenEducation Loan ProjectyogeshgharpureNoch keine Bewertungen

- Comparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDDokument27 SeitenComparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDMD. SAMIUL HASAN ARICNoch keine Bewertungen

- WORKING CAPITAL MANAGEMENT of Axis Bank Finance Research 2014Dokument112 SeitenWORKING CAPITAL MANAGEMENT of Axis Bank Finance Research 2014Indu Gupta82% (11)

- Marico Final ProjectDokument49 SeitenMarico Final ProjectRAHUL DAMNoch keine Bewertungen

- Bank of China PDFDokument394 SeitenBank of China PDFImran Abdul AzizNoch keine Bewertungen

- Course - 307, LINDEBD VALUATION REPORT PDFDokument26 SeitenCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNoch keine Bewertungen

- (FINA1303) (2014) (F) Midterm Yq5j8 42714Dokument19 Seiten(FINA1303) (2014) (F) Midterm Yq5j8 42714sarah shanNoch keine Bewertungen

- Fundamental Analysis - Agriculture UniverseDokument99 SeitenFundamental Analysis - Agriculture UniverseQ.M.S Advisors LLCNoch keine Bewertungen

- Fin Statement AnalysisDokument22 SeitenFin Statement AnalysisJon MickNoch keine Bewertungen

- Report On FciDokument93 SeitenReport On FciAlok VermaNoch keine Bewertungen

- Loan Policy of Uco Bank For Retail SectorDokument22 SeitenLoan Policy of Uco Bank For Retail SectorAnurag BohraNoch keine Bewertungen

- Question Paper Introduction To Security Analysis (MB3G1F) : October 2008Dokument17 SeitenQuestion Paper Introduction To Security Analysis (MB3G1F) : October 2008Jatin GoyalNoch keine Bewertungen

- Načrt PrestrukturiranjaDokument57 SeitenNačrt PrestrukturiranjaKatjaCimermančičNoch keine Bewertungen

- Liquidity Analysis RatiosDokument5 SeitenLiquidity Analysis Ratiosyuvraj gosainNoch keine Bewertungen

- Schwab One Account AgreementDokument112 SeitenSchwab One Account AgreementcadeadmanNoch keine Bewertungen

- Analysis of AmazonDokument7 SeitenAnalysis of Amazonapi-272956173Noch keine Bewertungen

- Derivative Short Notes Final PDFDokument122 SeitenDerivative Short Notes Final PDFVidhi GoyalNoch keine Bewertungen

- DerivativesDokument8 SeitenDerivativesNg PhuonggNoch keine Bewertungen

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDokument3 SeitenRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNoch keine Bewertungen