Beruflich Dokumente

Kultur Dokumente

Report Capital Structure UPHOS Sharad Patel

Hochgeladen von

sharadgpatelOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Report Capital Structure UPHOS Sharad Patel

Hochgeladen von

sharadgpatelCopyright:

Verfügbare Formate

CA.

Sharad Patel, Dayanand House, Group I, MBF

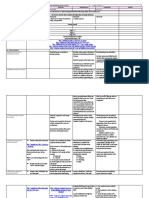

Capital Structure of United Phosphorus Ltd. INDUSTRY STRUCTURE AND DEVELOPMENT :The Company is mainly engaged in the business of agrochemicals, other industrial chemicals and chemical intermediates. It has also got a captive power plant in Jhagadia. The agrochemical industry has several crop protection products which can be broadly divided into herbicides, insecticides, fungicides and others. Herbicides prevent or reduce weeds. They mainly replace or reduce mechanical weeding and thereby help in reducing soil erosion, water loss and providing better targeted nutrition to the plants. Insecticides are used to control insects and pests that reduce crop yields and quality. Fungicides prevent and cure fungal plant diseases which affect crop yields and quality. The agrochemical market is divided into products protected by patents and products which have gone off-patent. Majority of sales of patented as well as off-patent products are dominated by multinational corporations. Over the last few years, there have been many mergers and acquisitions among existing agrochemical companies. The primary reasons for the same are slow pace of new product development, growing generics penetration and increasing cost of regulatory compliance. The industry is regulated by strict and expensive registration processes in various jurisdictions and environmental and safety legislations. There are environmental laws prescribed for production, storage and handling of inputs, intermediates and agrochemicals. As the new products are slow to come in the market, the success of business depends largely on distribution network of the companies. Over the years, the Company has expanded its distribution network in the international market through various subsidiaries. The Company has also acquired new products, businesses and companies to successfully integrate new products to its existing business. Within India, it has got sales depots and distributors across the country to cater to the Indian market. Population has been rising everywhere. This results in higher food consumption. Farmable land is limited and hence, productivity of land has to increase. In India, agrochemical industry is set to progress very fast in the coming years. The second Green Revolution is expected. The government is concerned with the slow growth in agriculture sector. It is providing various incentives and facilities for the growth of this sector. STRENGTH, OPPORTUNITIES AND THREATS:The industry is posing high entry resistance as the industry is capital intensive, long gestation period for the product to come to the market and lengthy regulatory requirement like field trial at different environment zones. More over the company is heaving good product basket. Through acquisitions, strategic alliances and subsidiaries, UPL has built a global network spanning 86 countries. The agrochemical industry in India is poised for good growth. Increase in world population, limited arable land, growing per capita GDP, newer technology such as biotechnology, etc. are the key growth drivers. In India, the use of agrochemicals is much less as compared to most of the developed countries. Increase in population requiring more food production will need more agrochemicals to boost the food production. In India, there are significant cost advantages in production of technical grade materials as well as formulations for agrochemicals. Entry barriers in the form of registrations for the

CA. Sharad Patel, Dayanand House, Group I, MBF

new entrants, strict environment regulations, intellectual property regulations and exorbitant costs of developing any new molecule will all help the established entities to grow their business. Due to its wide spread presence and current situation in Europe and USA, company may look for better acquisition of companies at a very attractive price. For this company may increase its debt which is currently at a comfortable position at Debt Equity ratio of about 1:1. The main threat to the industry is erratic monsoon and frequent changes in government policies which may result in ban of certain agrochemicals. To protect against such ban, higher costs have to be incurred to defend and protect the molecules. Further, unscrupulous formulators are a serious threat for the genuine players in the industry. SEGMENTWISE PERFORMANCE:a) Agrochemicals Agrochemicals accounted for 80% of total sales of the company. Increase in market share of the companys products mainly consists of agrochemicals. b) Industrial chemicals and intermediates this segment accounted for 19% of total sales. c) Power Power plant is for captive. d) Exports Exports accounted for 53% of total sales. BUSINESS OUTLOOK:The world economy is coming out of the downturn. Economies of USA and European countries are picking up again. This will benefit the Company significantly. In last few years, the Companys performance had remained static on account of slackness in demand in these countries. Overall business scenario for the Company is encouraging. A big advantage for the Company is that its cost of manufacture of agrochemicals in India is competitive. Further, it offers the largest range of agrochemicals. With various acquisitions, the Company has gained access to global markets and it is in a position to offer an extensive and balanced product portfolio to its customers worldwide. The Company has also strengthened its distribution reach and access to new markets by various strategic alliances with other agrochemical manufacturers of the world. The Company holds more than 1000 registrations for its products worldwide. The senior management devotes considerable time and resources in research and development for developing new products and improvement in manufacturing processes so as to enhance the quality of its products and make them more affordable. All these factors will help the Company to perform better in coming years

CA. Sharad Patel, Dayanand House, Group I, MBF

OBSERVATION & SUGGESTION: As on 31-03-2011, company is due Rs. 709.87 Cr. from its overseas Associate Enterprises on account of Sales and Rs. 1583.82 Cr. on account of Loans and Advances. The company has suffered a loss of Rs. 114.62 Cr. on account of exchange fluctuation during 2010-11 due to revaluation of ECB of Rs. 818.50 Cr. which is falling due in 1 years time. However, there is no visible enough internal accruals from operations to repay the ECB. Therefore, the management is advised not to borrow from Indian market to repay the ECB but to avail factoring facility abroad in its subsidiaries against Rs.709.87 Cr. which can be possible @ Libor + 2% p.a. Thereby, there will be saving of at least 5% p.a. resulting in saving of Rs. 35 Cr. Moreover, the Company should reduce loans given to its subsidiary at least by Rs. 985 Cr. out of total loan of Rs. 1583.82 Cr. to repay the unsecured debentures and reduce the interest burden due to Debentures. This will save another interest amount of appx. Rs. 49.25 Cr. [985 *(11%-6%)].

Dated: 24-08-11.

Das könnte Ihnen auch gefallen

- Emission Control (2uz-Fe)Dokument15 SeitenEmission Control (2uz-Fe)Abbode HoraniNoch keine Bewertungen

- African Traditional Medicine A PrimerDokument5 SeitenAfrican Traditional Medicine A PrimerEditor IJTSRDNoch keine Bewertungen

- The Man S Bible 50 Essential Tips For Success With Your Mind Body and WomenDokument155 SeitenThe Man S Bible 50 Essential Tips For Success With Your Mind Body and WomenDonStemple100% (4)

- ASTM C-1116 - 03 - Standard Specification For Fiber-Reinforced Concrete and ShotcreteDokument8 SeitenASTM C-1116 - 03 - Standard Specification For Fiber-Reinforced Concrete and ShotcretemordeauxNoch keine Bewertungen

- Daily Lesson Log Personal Dev TDokument34 SeitenDaily Lesson Log Personal Dev TRicky Canico ArotNoch keine Bewertungen

- Science Grade 7: Active Reading Note-Taking GuideDokument140 SeitenScience Grade 7: Active Reading Note-Taking Guideurker100% (1)

- Draw-Through or Blow-Through: Components of Air Handling UnitDokument23 SeitenDraw-Through or Blow-Through: Components of Air Handling Unityousuff0% (1)

- Marketing Management Worked Assignment: Model Answer SeriesVon EverandMarketing Management Worked Assignment: Model Answer SeriesNoch keine Bewertungen

- Decommissioning HSE PDFDokument105 SeitenDecommissioning HSE PDFRafael Rocha100% (1)

- Pharma Business Dynamics in ROW MarketsDokument9 SeitenPharma Business Dynamics in ROW Marketskaushal_75Noch keine Bewertungen

- Brooklyn Hops BreweryDokument24 SeitenBrooklyn Hops BrewerynyairsunsetNoch keine Bewertungen

- Swot of ACIDokument3 SeitenSwot of ACItahrimafaruq100% (2)

- AcmeDokument36 SeitenAcmeDhrubo1110% (1)

- Kristen Swanson's Theory of CaringDokument12 SeitenKristen Swanson's Theory of CaringAlexandria David50% (2)

- Financial Analysis of Pharma IndustryDokument82 SeitenFinancial Analysis of Pharma IndustrySudheer Gadey100% (2)

- SWOT ANALYSIS - Docx Sime DarbyDokument9 SeitenSWOT ANALYSIS - Docx Sime Darbynur azfarinie ruzliNoch keine Bewertungen

- Financial Analysis of Chlor-Alkali IndustryDokument33 SeitenFinancial Analysis of Chlor-Alkali IndustryAakash Sharma100% (1)

- Bar Exam Questions Week 1Dokument30 SeitenBar Exam Questions Week 1Mark Bantigue100% (1)

- How to Apply Marketing Theories for "The Marketing Audit": 27 Theories Practical Example insideVon EverandHow to Apply Marketing Theories for "The Marketing Audit": 27 Theories Practical Example insideNoch keine Bewertungen

- Building Manufacturing Competitiveness: The TOC WayVon EverandBuilding Manufacturing Competitiveness: The TOC WayBewertung: 3 von 5 Sternen3/5 (1)

- Risk Management Policy StatementDokument13 SeitenRisk Management Policy StatementRatnakumar ManivannanNoch keine Bewertungen

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportVon EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNoch keine Bewertungen

- Dhanuka AgritechDokument10 SeitenDhanuka AgritechAshok JainNoch keine Bewertungen

- Environmental Analysis: GDP, Fii, Fdis, Govt. Expenditures, Rate of Interest and InflationDokument6 SeitenEnvironmental Analysis: GDP, Fii, Fdis, Govt. Expenditures, Rate of Interest and InflationaamritaaNoch keine Bewertungen

- Pesticide CompaniesDokument4 SeitenPesticide CompaniesAshish PandeyNoch keine Bewertungen

- PI Industries Ltd. - Initiating CoverageDokument19 SeitenPI Industries Ltd. - Initiating Coverageequityanalystinvestor100% (1)

- Selwin George Roll - No - 32: SWOT Analysis of Godrej Consumer Products LimitedDokument6 SeitenSelwin George Roll - No - 32: SWOT Analysis of Godrej Consumer Products LimitedSelwin GeorgeNoch keine Bewertungen

- India PHARMA Report-Mid Year 03Dokument44 SeitenIndia PHARMA Report-Mid Year 03Sylvia GraceNoch keine Bewertungen

- Short Note On Meghmani Organics LimitedDokument12 SeitenShort Note On Meghmani Organics LimiteddikshaNoch keine Bewertungen

- Internship Report On Malladi PharmaceuticalsDokument57 SeitenInternship Report On Malladi PharmaceuticalsRaju Veluru100% (2)

- Stock AnalysisDokument6 SeitenStock AnalysisJulia KujurNoch keine Bewertungen

- BASF India Ltd. Equity Research Report: Company InformationDokument19 SeitenBASF India Ltd. Equity Research Report: Company InformationYashvi ShahNoch keine Bewertungen

- KLJ Group - BBA Summer ReportDokument54 SeitenKLJ Group - BBA Summer ReportHardik SNoch keine Bewertungen

- N 112621 Godrej AgroDokument31 SeitenN 112621 Godrej AgroPIYUSH GOPALNoch keine Bewertungen

- BCG Matrix + Porters Five Force Model - Anuj Gandhi: Presentation TranscriptDokument4 SeitenBCG Matrix + Porters Five Force Model - Anuj Gandhi: Presentation TranscriptpjsudhanNoch keine Bewertungen

- BCG Matrix & Poter'S Five Force Model: Anuj Gandhi 3907, PGDPM (09-11)Dokument23 SeitenBCG Matrix & Poter'S Five Force Model: Anuj Gandhi 3907, PGDPM (09-11)adijain2205Noch keine Bewertungen

- P&G SwotDokument4 SeitenP&G SwotSania WaheedNoch keine Bewertungen

- Chemical Industry - Aarti and AtulDokument24 SeitenChemical Industry - Aarti and AtulDisha Modi100% (1)

- FMCG Sector AnalysisDokument5 SeitenFMCG Sector Analysislisa moh100% (2)

- Part 3Dokument41 SeitenPart 3Yashvi ShahNoch keine Bewertungen

- Term Paper On Acme LabsDokument37 SeitenTerm Paper On Acme LabsSyed Shahnawaz MohsinNoch keine Bewertungen

- I.B. PRSNTNDokument29 SeitenI.B. PRSNTNmnmmhmNoch keine Bewertungen

- FI Alpha-CoromandelInternationalLimitedDokument7 SeitenFI Alpha-CoromandelInternationalLimitedAkshaya SrihariNoch keine Bewertungen

- Advanced Enzymes Technologies Limited: First Indian Enzyme CompanyDokument15 SeitenAdvanced Enzymes Technologies Limited: First Indian Enzyme CompanyAmeya WartyNoch keine Bewertungen

- Rallis IndiaDokument19 SeitenRallis IndiaShaifali BhatnagarNoch keine Bewertungen

- Equity Master Report 2015-16Dokument3 SeitenEquity Master Report 2015-16Aalokek KumarNoch keine Bewertungen

- AFC Agro BiotechDokument8 SeitenAFC Agro BiotechIstiak MahmudNoch keine Bewertungen

- Granules India PDFDokument29 SeitenGranules India PDFP VinayakamNoch keine Bewertungen

- Fine Organic Industries LTD IPO Snapshot-201806191533423490461Dokument3 SeitenFine Organic Industries LTD IPO Snapshot-201806191533423490461HDFC SecuritiesNoch keine Bewertungen

- Pidilite Industries Limited FinalDokument28 SeitenPidilite Industries Limited FinalrgogariNoch keine Bewertungen

- The Indian Pharmaceutical Industry - An Overview On Cost Efficiency Using DEADokument23 SeitenThe Indian Pharmaceutical Industry - An Overview On Cost Efficiency Using DEASaurabh SharmaNoch keine Bewertungen

- Soumya Agrawal BV1Dokument19 SeitenSoumya Agrawal BV1Soumya AgrawalNoch keine Bewertungen

- FMCG Sector AnalysisDokument7 SeitenFMCG Sector AnalysisKrutika AbitkarNoch keine Bewertungen

- Topic: Investing in FMCG Sector Company Analysis: ITC: Subm Itted By: Ankit Saxena Devendra BhatiaDokument8 SeitenTopic: Investing in FMCG Sector Company Analysis: ITC: Subm Itted By: Ankit Saxena Devendra BhatiaPrateek JainNoch keine Bewertungen

- Management Theory and PracticeDokument10 SeitenManagement Theory and PracticeVidhath C GowdaNoch keine Bewertungen

- P I Industries - A Niche Agri CSM Company - Initiating CoverageDokument11 SeitenP I Industries - A Niche Agri CSM Company - Initiating CoverageshahavNoch keine Bewertungen

- Soumya Agrawal PRN No: 20020942063 Business Valuation AssignmentDokument19 SeitenSoumya Agrawal PRN No: 20020942063 Business Valuation AssignmentSoumya AgrawalNoch keine Bewertungen

- BIOcon SWOTDokument2 SeitenBIOcon SWOTShankar NarayanNoch keine Bewertungen

- Introduction To The IndustryDokument21 SeitenIntroduction To The IndustrySmeet JasoliyaNoch keine Bewertungen

- Business Communication: Individual Case Assignment - 1 Written Analysis OnDokument10 SeitenBusiness Communication: Individual Case Assignment - 1 Written Analysis OnParidhi JainNoch keine Bewertungen

- WackhardDokument72 SeitenWackhardAbuzar AhmadNoch keine Bewertungen

- Indoco RemediesDokument29 SeitenIndoco RemediesArti IyerNoch keine Bewertungen

- Swot Analysis On Hydroponics Farming CompanyDokument4 SeitenSwot Analysis On Hydroponics Farming CompanyAkshay KumarNoch keine Bewertungen

- Pharmaceutical Sector: India: Group: 6 Agya Pal Singh Bharathwaj S Gurudas KR Indu Bagchandani Parnika ChaurasiaDokument9 SeitenPharmaceutical Sector: India: Group: 6 Agya Pal Singh Bharathwaj S Gurudas KR Indu Bagchandani Parnika ChaurasiaGurudas RaghuramNoch keine Bewertungen

- An Organizational Study atDokument20 SeitenAn Organizational Study atHitha MathaiNoch keine Bewertungen

- Assignment - MuncheeDokument8 SeitenAssignment - MuncheeA M N A R I Z W A NNoch keine Bewertungen

- Chemicals 2.0 - Consolidated - VF PDFDokument31 SeitenChemicals 2.0 - Consolidated - VF PDFbullet rajaNoch keine Bewertungen

- Economic Analysis of CiplaDokument24 SeitenEconomic Analysis of Ciplapramod23sept100% (2)

- Medicine Box NotesDokument7 SeitenMedicine Box NotesNiruNoch keine Bewertungen

- Abbott Piramal DealDokument2 SeitenAbbott Piramal DealAbhishek Kumar100% (1)

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitVon EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNoch keine Bewertungen

- Model Answer: E-Commerce store launch by Unilever in Sri LankaVon EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNoch keine Bewertungen

- Yumiko@Dokument2 SeitenYumiko@api-25886263Noch keine Bewertungen

- Biecco Lawrie Ece Gec Reyrolle Burn Jyoti SwitchgearDokument18 SeitenBiecco Lawrie Ece Gec Reyrolle Burn Jyoti SwitchgearSharafat AliNoch keine Bewertungen

- Burns Plastic Reconstructive Surgery MSCDokument4 SeitenBurns Plastic Reconstructive Surgery MSCCareer VoyageNoch keine Bewertungen

- Jepretan Layar 2022-11-30 Pada 11.29.09Dokument1 SeiteJepretan Layar 2022-11-30 Pada 11.29.09Muhamad yasinNoch keine Bewertungen

- Arcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 PartsDokument5 SeitenArcelor Mittal Operations: Operational Area Is Sub-Divided Into 4 Partsarpit agrawalNoch keine Bewertungen

- This Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsDokument2 SeitenThis Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsKim TanNoch keine Bewertungen

- Plumbing Design Calculation - North - Molino - PH1 - 5jun2017Dokument5 SeitenPlumbing Design Calculation - North - Molino - PH1 - 5jun2017Jazent Anthony RamosNoch keine Bewertungen

- @9negros Occidental Vs BezoreDokument3 Seiten@9negros Occidental Vs BezoreSimeon SuanNoch keine Bewertungen

- National Federation OF Sugar Workers (NFSW), Petitioner, vs. ETHELWOLDO R. OVEJERA Et. Al., RespondentsDokument32 SeitenNational Federation OF Sugar Workers (NFSW), Petitioner, vs. ETHELWOLDO R. OVEJERA Et. Al., RespondentsRon GawatNoch keine Bewertungen

- (R#1) XQ-450 - 600-800VDokument121 Seiten(R#1) XQ-450 - 600-800VFrancisco PestañoNoch keine Bewertungen

- Yam FlourDokument5 SeitenYam Flouramdbilal123Noch keine Bewertungen

- Measurement and Correlates of Family Caregiver Self-Efficacy For Managing DementiaDokument9 SeitenMeasurement and Correlates of Family Caregiver Self-Efficacy For Managing DementiariskhawatiNoch keine Bewertungen

- The Daily Star On 19.05.2021Dokument12 SeitenThe Daily Star On 19.05.2021nira miraNoch keine Bewertungen

- A-Level: Psychology 7182/1Dokument20 SeitenA-Level: Psychology 7182/1Queen Bee (Tt)Noch keine Bewertungen

- Disease PreventionDokument14 SeitenDisease PreventionJoan InsonNoch keine Bewertungen

- The Bevel Grooves Welds Are Missing in The Track Frames On Certain 325 and 330 Undercarriages Supplied by Caterpillar Industrial Products Inc.Dokument18 SeitenThe Bevel Grooves Welds Are Missing in The Track Frames On Certain 325 and 330 Undercarriages Supplied by Caterpillar Industrial Products Inc.alan gonzalezNoch keine Bewertungen

- Refuse Chute PPT 01Dokument11 SeitenRefuse Chute PPT 01sanika shindeNoch keine Bewertungen

- Amsoil Synthetic CVT Fluid (CVT)Dokument2 SeitenAmsoil Synthetic CVT Fluid (CVT)amsoildealerNoch keine Bewertungen