Beruflich Dokumente

Kultur Dokumente

NY Property Tax On Gas Wells

Hochgeladen von

James "Chip" NorthrupCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NY Property Tax On Gas Wells

Hochgeladen von

James "Chip" NorthrupCopyright:

Verfügbare Formate

New York Property Tax on Shale Gas Wells Like almost all states with oil and gas

production, New York has a property tax on gas wells. 1 Like other property taxes, the beneficiaries are the counties, townships and school districts where the gas is produced. The appraisal methodology is administered by the Office of Real Property Tax Services (ORPTS), and is similar to that used in Texas. 2 The appraised value is based on the income stream expected from the well in Texas, the discounted cash flow: 3 ORPTS attempts to summarize the value in a Unit Production Value (UPV) as a multiplier of the gas produced. Both methodologies are dependent on valuing the income based on the production history. In a conventional gas well with a relatively flat decline curve, estimating its value can be done more precisely. In a horizontally hydrofracked shale gas well, the rapid decline of the wells production makes valuation problematic. Decline Curves of Major Shale Gas Formations

Ths The first years production can account for up to 75% of the total production of the well. In New York, the gas production is self reported by the producer. It is not clear that the ORPTS or the DEC has the staff necessary to actually verify these numbers in the field. Those production reports are in turn given to the local county and the township assessors who are responsible for doing the appraisals. Any lag - from the self reported numbers

1

http://www.orps.state.ny.us/sas/oil_gas/overview.htm http://www.tad.org/ftp_data/DataFiles/MineralInterestAppraisal.pdf http://en.wikipedia.org/wiki/Discounted_cash_flow

to the report from ORPTS to the local appraisers will delay the appraisal process. The ORPTS has yet to establish a UPV valuation for horizontally hydrofracked shale gas wells. Ironically, this is not how gas producers value their properties. Gas reserves are valued by the companies for their shareholders under Securities and Exchange Commission (SEC) rules. A valuation is made based on proven developed (producing wells), and proven undeveloped reserves meaning the value of the gas in the ground, including gas that has not been drilled for. Banks loan based on similar valuations. Yet the property tax valuation represents a fraction of the total value of the gas, since it is only valuing gas from producing wells. Recommendations Institute a Severance Tax In most oil and gas states, with the notable exceptions of New York and Pennsylvania, the gas produced is taxed at the wellhead via a production or severance tax. Such a tax is paid directly to the state, who may remit a portion to the counties and municipalities impacted by drilling. As a practical matter, a severance tax is the only effective way that the value of a horizontal shale gas well can be fully taxed since the tax calculation starts as soon as the well begins producing and the valuation can be much more straightforward than the UPV multiplier. New York needs to correct that short-coming in its tax code. Consult with Professional Appraisers The ORPTs should establish a valuation method for horizontally shale gas wells based on advice from oil and gas appraisal firms. Such firms are routinely hired by taxing authorities to do complicated appraisals. 4 Streamline and Expedite the Appraisal Process The ORPTS should review its procedures from the way it secures and verifies production data to the time the local appraisal is made and taxes are collected. Impose Impact Fees on the Producers Some wells will not produce. Drilling will negatively impact roads, bridges, water and air quality regardless of the productivity of the well. The state should impose an impact fee to pay for some of these costs.

http://www.pandai.com/home.aspx

Das könnte Ihnen auch gefallen

- Valuing Oil & Gas Properties PDFDokument23 SeitenValuing Oil & Gas Properties PDFPETITNoch keine Bewertungen

- 2014 Property Value StudyDokument8 Seiten2014 Property Value StudyGeorge KubantsevNoch keine Bewertungen

- Chapter 15 - Oil and Gas AccountingDokument33 SeitenChapter 15 - Oil and Gas Accountingcicko45100% (1)

- Open Fiscal LNG ModelDokument166 SeitenOpen Fiscal LNG ModelJSN179Noch keine Bewertungen

- Overview of Oil Gas AccountingDokument47 SeitenOverview of Oil Gas Accountingtsar_philip2010100% (1)

- Oil & Gas Accounting 2Dokument91 SeitenOil & Gas Accounting 2rajivNoch keine Bewertungen

- Reserves Certification Report For The Rubiales Field, ColombiaDokument124 SeitenReserves Certification Report For The Rubiales Field, Colombiawhales20985Noch keine Bewertungen

- Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 FactsDokument1 SeiteBases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Factsaudrich carlo agustinNoch keine Bewertungen

- (Onassis Series in Hellenic Culture) Lefkowitz, Mary R-Euripides and The Gods-Oxford University Press (2016)Dokument321 Seiten(Onassis Series in Hellenic Culture) Lefkowitz, Mary R-Euripides and The Gods-Oxford University Press (2016)HugoBotello100% (2)

- Iphone 11 Imagine PDFDokument2 SeitenIphone 11 Imagine PDFJonassy SumaïliNoch keine Bewertungen

- Financial Accounting, Reporting and Business Support in The Oil and Gas IndustryDokument112 SeitenFinancial Accounting, Reporting and Business Support in The Oil and Gas IndustryTote FrotyNoch keine Bewertungen

- Vessel Experiance FactorDokument2 SeitenVessel Experiance FactorFarid MuhamadNoch keine Bewertungen

- Other South America Bolivia Chile Paraguay Shale Field To Be ExploredDokument27 SeitenOther South America Bolivia Chile Paraguay Shale Field To Be Exploredmichel louis friedmanNoch keine Bewertungen

- FOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungeVon EverandFOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungeBewertung: 2 von 5 Sternen2/5 (1)

- Oil and Gas Accounting and Performance Measurement: Dr. Batool AlrfoohDokument170 SeitenOil and Gas Accounting and Performance Measurement: Dr. Batool AlrfoohTote FrotyNoch keine Bewertungen

- Oil & Gas Accounting, May 2011Dokument9 SeitenOil & Gas Accounting, May 2011Sunday Oluwole50% (2)

- Coking Coal IndexDokument12 SeitenCoking Coal IndexZaidan EffendieNoch keine Bewertungen

- Facts:: Chevron Philippines, Inc. vs. BCDA, G.R. No. 173863, 15 September 2010 - UsonDokument2 SeitenFacts:: Chevron Philippines, Inc. vs. BCDA, G.R. No. 173863, 15 September 2010 - UsonNichole John UsonNoch keine Bewertungen

- SCCS CO2 EOR JIP Techno Economic EvaluationDokument41 SeitenSCCS CO2 EOR JIP Techno Economic Evaluationskywalk189Noch keine Bewertungen

- Bakken Exit CapacityDokument53 SeitenBakken Exit CapacityaaaabbbbbbbbbcccccNoch keine Bewertungen

- Roanoke Gas Company v. United States, 977 F.2d 131, 4th Cir. (1992)Dokument9 SeitenRoanoke Gas Company v. United States, 977 F.2d 131, 4th Cir. (1992)Scribd Government DocsNoch keine Bewertungen

- Guide To Utility RatemakingDokument7 SeitenGuide To Utility RatemakingMonica RsNoch keine Bewertungen

- Oil Production Final Report, August 2013Dokument15 SeitenOil Production Final Report, August 2013Long Beach PostNoch keine Bewertungen

- Accounting For Differences in Oil and Gas AccountingDokument6 SeitenAccounting For Differences in Oil and Gas Accountingsharanabasappa baliger100% (1)

- Companies InvolvedDokument3 SeitenCompanies InvolvedUBS2015Noch keine Bewertungen

- Complete Uniform Accounting System For Retail Coal MerchantsDokument29 SeitenComplete Uniform Accounting System For Retail Coal Merchantsspamxacc7Noch keine Bewertungen

- Tax and Royalty Burdens On Oil and Gas Investments: Taxing Canada'S Cash CowDokument19 SeitenTax and Royalty Burdens On Oil and Gas Investments: Taxing Canada'S Cash CowSchoolofPublicPolicyNoch keine Bewertungen

- 2012 12 Emission Monitoring BriefingDokument4 Seiten2012 12 Emission Monitoring BriefingTermiteEnkayNoch keine Bewertungen

- Taxation and Depletion: 2.4.2 Federal Income Taxation 2.4.2.1 Exploration ExpendituresDokument7 SeitenTaxation and Depletion: 2.4.2 Federal Income Taxation 2.4.2.1 Exploration ExpendituresBrunno AndradeNoch keine Bewertungen

- Citywide Fuel Expenditures: Consolidation of Fuel OperationsDokument4 SeitenCitywide Fuel Expenditures: Consolidation of Fuel OperationsLong Beach PostNoch keine Bewertungen

- Measuring Effective Tax Rates For Oil and Gas in Canada: SPP Technical PapersDokument20 SeitenMeasuring Effective Tax Rates For Oil and Gas in Canada: SPP Technical PapersSchoolofPublicPolicyNoch keine Bewertungen

- United States Court of Appeals, First CircuitDokument11 SeitenUnited States Court of Appeals, First CircuitScribd Government DocsNoch keine Bewertungen

- Jacobs Consultancy Lca Report Exec SummaryDokument17 SeitenJacobs Consultancy Lca Report Exec SummaryCyril BorleNoch keine Bewertungen

- Argentina 2013Dokument37 SeitenArgentina 2013Martin BertagnonNoch keine Bewertungen

- DEC Martens LetterDokument5 SeitenDEC Martens LetterJon CampbellNoch keine Bewertungen

- National Thermal Power Corporation Limited: Manual On Sales AccountingDokument48 SeitenNational Thermal Power Corporation Limited: Manual On Sales AccountingSamNoch keine Bewertungen

- Measuring CO2 - The Technology Is Out ThereDokument2 SeitenMeasuring CO2 - The Technology Is Out Therekittiwake10Noch keine Bewertungen

- Current Methodologies and Best Practices For Preparing Port Emission InventoriesDokument20 SeitenCurrent Methodologies and Best Practices For Preparing Port Emission InventoriesMohamed Esha FayasNoch keine Bewertungen

- Mineral Appraisal HandoutDokument16 SeitenMineral Appraisal HandoutHarry100% (1)

- Open Fiscal LNG Model v2Dokument264 SeitenOpen Fiscal LNG Model v2Almamy TouréNoch keine Bewertungen

- Organic Theory: Full Cost Accounting MethodDokument7 SeitenOrganic Theory: Full Cost Accounting MethodOyeleye TofunmiNoch keine Bewertungen

- 2005-001-02 GAS QUALITY HarmonisationDokument7 Seiten2005-001-02 GAS QUALITY HarmonisationVivi GouriotiNoch keine Bewertungen

- Discount Rate Range For Oil and Gas PropertiesDokument8 SeitenDiscount Rate Range For Oil and Gas PropertiesBerby BerlianiNoch keine Bewertungen

- Smart Money: Efficient Investments During Geopolitical VolatilityDokument3 SeitenSmart Money: Efficient Investments During Geopolitical VolatilitySaf MassNoch keine Bewertungen

- Overview of Oil & Gas AccountingDokument43 SeitenOverview of Oil & Gas AccountingViral ShahNoch keine Bewertungen

- 2022 Schedule of Values - FINAL - 202111161458309303Dokument153 Seiten2022 Schedule of Values - FINAL - 202111161458309303OUSMAN SEIDNoch keine Bewertungen

- Acific EporterDokument30 SeitenAcific EporterScribd Government DocsNoch keine Bewertungen

- Regulatory Assets and LiabilitiesDokument5 SeitenRegulatory Assets and LiabilitiesMatthew Dickerson100% (1)

- Missioner of Internal Revenue vs. Court of Appeals, 242 SCRA 289, March 10, 1995Dokument30 SeitenMissioner of Internal Revenue vs. Court of Appeals, 242 SCRA 289, March 10, 1995specialsection100% (1)

- The Qatar Kuwait Pipeline Project - Economic ModelDokument7 SeitenThe Qatar Kuwait Pipeline Project - Economic Modeladeel499Noch keine Bewertungen

- B 11Dokument176 SeitenB 11Nathan JonesNoch keine Bewertungen

- Taxicab Industry: An Update On Rates of Fare, Gate Fees and The IndustryDokument24 SeitenTaxicab Industry: An Update On Rates of Fare, Gate Fees and The Industrysrinath.rajaramNoch keine Bewertungen

- Issue71 Cash FlowsDokument4 SeitenIssue71 Cash FlowsZulmy Ikhsan WNoch keine Bewertungen

- Concurrent Production Application Guideline June Release 2013Dokument2 SeitenConcurrent Production Application Guideline June Release 2013Eyoma EtimNoch keine Bewertungen

- Global 091616Dokument5 SeitenGlobal 091616rkarlinNoch keine Bewertungen

- C-2016.06.16-Project Contingencies, Quality Control, W.C. Agency ChargesDokument6 SeitenC-2016.06.16-Project Contingencies, Quality Control, W.C. Agency ChargesromorthraipurNoch keine Bewertungen

- Touchstone Announces Third Test Results at Royston-1 and Extended Production TestDokument3 SeitenTouchstone Announces Third Test Results at Royston-1 and Extended Production Testdaam naamNoch keine Bewertungen

- Marathon Fact SheetDokument11 SeitenMarathon Fact SheetJessica StrachanNoch keine Bewertungen

- PW Department CodesDokument20 SeitenPW Department Codessrikanth2vangaraNoch keine Bewertungen

- Mpa EmtagasDokument23 SeitenMpa EmtagasRina Fabiola Rueda RuedaNoch keine Bewertungen

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransVon EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNoch keine Bewertungen

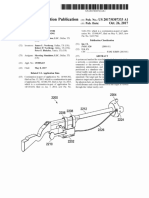

- Drone Zones: Virtual Geo-Enclosures For Air SpacesDokument30 SeitenDrone Zones: Virtual Geo-Enclosures For Air SpacesJames "Chip" NorthrupNoch keine Bewertungen

- Autonomous Vehicle ZonesDokument31 SeitenAutonomous Vehicle ZonesJames "Chip" NorthrupNoch keine Bewertungen

- Toll Zones - Zonal Toll Roads and Paid ParkingDokument25 SeitenToll Zones - Zonal Toll Roads and Paid ParkingJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Toll RoadsDokument25 SeitenZonal Toll RoadsJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Places - Mobile App Geo-EnclosuresDokument31 SeitenZonal Places - Mobile App Geo-EnclosuresJames "Chip" NorthrupNoch keine Bewertungen

- Virtual Reality Gun Controller For TrainingDokument53 SeitenVirtual Reality Gun Controller For TrainingJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Systems Patent Application 5th For Security Zones, Parking Zones, RoboZonesDokument153 SeitenZonal Systems Patent Application 5th For Security Zones, Parking Zones, RoboZonesJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Control For Autonomous VehiclesDokument31 SeitenZonal Control For Autonomous VehiclesJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Systems Control of Remote ActivitiesDokument30 SeitenZonal Systems Control of Remote ActivitiesJames "Chip" NorthrupNoch keine Bewertungen

- Patent For Virtual, Augmented and Mixed Reality Shooting SimulatorDokument34 SeitenPatent For Virtual, Augmented and Mixed Reality Shooting SimulatorJames "Chip" NorthrupNoch keine Bewertungen

- Zonal RetailDokument30 SeitenZonal RetailJames "Chip" NorthrupNoch keine Bewertungen

- Patent For Virtual, Augmented and Mixed Reality Shooting Simulator Using A Real GunDokument34 SeitenPatent For Virtual, Augmented and Mixed Reality Shooting Simulator Using A Real GunJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Systems OverviewDokument17 SeitenZonal Systems OverviewJames "Chip" NorthrupNoch keine Bewertungen

- Virtual Reality Shotgun Shooting SimulatorDokument35 SeitenVirtual Reality Shotgun Shooting SimulatorJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Systems Geo-Enclosure Patent For Control of MachinesDokument127 SeitenZonal Systems Geo-Enclosure Patent For Control of MachinesJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Control: Automated Control of Geo-ZonesDokument33 SeitenZonal Control: Automated Control of Geo-ZonesJames "Chip" NorthrupNoch keine Bewertungen

- Rockefeller Climate Change LetterDokument4 SeitenRockefeller Climate Change LetterJames "Chip" NorthrupNoch keine Bewertungen

- Radioactive Frack Waste in PennsylvaniaDokument25 SeitenRadioactive Frack Waste in PennsylvaniaJames "Chip" NorthrupNoch keine Bewertungen

- Virtual Reality Shooting Game PatentDokument47 SeitenVirtual Reality Shooting Game PatentJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Control US Patent 9319834Dokument30 SeitenZonal Control US Patent 9319834James "Chip" NorthrupNoch keine Bewertungen

- LeadTech Virtual Reality Shotgun Shooting PatentDokument26 SeitenLeadTech Virtual Reality Shotgun Shooting PatentJames "Chip" NorthrupNoch keine Bewertungen

- Zonal Systems US Patent 9317996Dokument44 SeitenZonal Systems US Patent 9317996James "Chip" NorthrupNoch keine Bewertungen

- Radioactive Frack Waste in PennsylvaniaDokument25 SeitenRadioactive Frack Waste in PennsylvaniaJames "Chip" NorthrupNoch keine Bewertungen

- Texas Municipal Frack Reparations House Bill 539Dokument4 SeitenTexas Municipal Frack Reparations House Bill 539James "Chip" NorthrupNoch keine Bewertungen

- Unlawful Gas Lease ExtensionDokument14 SeitenUnlawful Gas Lease ExtensionJames "Chip" NorthrupNoch keine Bewertungen

- Texas Frack Anywhere Bill HB 40Dokument2 SeitenTexas Frack Anywhere Bill HB 40James "Chip" NorthrupNoch keine Bewertungen

- Texas Frack Anywhere Commercially Reasonable Test FailDokument1 SeiteTexas Frack Anywhere Commercially Reasonable Test FailJames "Chip" NorthrupNoch keine Bewertungen

- Texas HB 40 Frack Anywhere CommmentsDokument2 SeitenTexas HB 40 Frack Anywhere CommmentsJames "Chip" NorthrupNoch keine Bewertungen

- Gas Pipeline RIght of Way CondemnationDokument56 SeitenGas Pipeline RIght of Way CondemnationJames "Chip" NorthrupNoch keine Bewertungen

- Program Evaluation RecommendationDokument3 SeitenProgram Evaluation Recommendationkatia balbaNoch keine Bewertungen

- Apostrophes QuizDokument5 SeitenApostrophes QuizLee Ja NelNoch keine Bewertungen

- MorningOPDRoster PDFDokument3 SeitenMorningOPDRoster PDFMahesh ThapaliyaNoch keine Bewertungen

- OB Escription: Job Title: Delivery DriverDokument2 SeitenOB Escription: Job Title: Delivery DriverMarisa Arizky PutriNoch keine Bewertungen

- Winning The LotteryDokument3 SeitenWinning The Lotterysantosh mizarNoch keine Bewertungen

- Wohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Dokument30 SeitenWohnt Der Teufel in Haus 2 ? Amigo Affäre V Sicherheeeit ! Der Mecksit Vor Gericht Und Auf Hoher See..Simon Graf von BrühlNoch keine Bewertungen

- Week 4 & 5 DDG (Designing Channel Networks)Dokument32 SeitenWeek 4 & 5 DDG (Designing Channel Networks)Aqib LatifNoch keine Bewertungen

- Glassix Walkthrough v0.15.1Dokument5 SeitenGlassix Walkthrough v0.15.1JesusJorgeRosas50% (2)

- SAA Committee GlossaryDokument29 SeitenSAA Committee GlossarysanjicamackicaNoch keine Bewertungen

- India's Foreign PolicyDokument21 SeitenIndia's Foreign PolicyManjari DwivediNoch keine Bewertungen

- Endole - Globe Services LTD - Comprehensive ReportDokument20 SeitenEndole - Globe Services LTD - Comprehensive ReportMoamed EliasNoch keine Bewertungen

- Ac3 Permanent File ChecklistDokument4 SeitenAc3 Permanent File ChecklistAndrew PanganibanNoch keine Bewertungen

- Bangalore & Karnataka Zones Teachers' Summer Vacation & Workshop Schedule 2022Dokument1 SeiteBangalore & Karnataka Zones Teachers' Summer Vacation & Workshop Schedule 2022EshwarNoch keine Bewertungen

- Reviewer For Fundamentals of Accounting and Business ManagementDokument4 SeitenReviewer For Fundamentals of Accounting and Business ManagementAngelo PeraltaNoch keine Bewertungen

- The Role of A Citizen in Upholding Sovereignty, UnityDokument2 SeitenThe Role of A Citizen in Upholding Sovereignty, Unityaditya .dNoch keine Bewertungen

- Link Between Competitive Advantage and CSRDokument14 SeitenLink Between Competitive Advantage and CSRManish DhamankarNoch keine Bewertungen

- Minimum Support Prices (MSP) : FOR Nabard Grade A & B ExamsDokument8 SeitenMinimum Support Prices (MSP) : FOR Nabard Grade A & B ExamsvidhuNoch keine Bewertungen

- Tin Industry in MalayaDokument27 SeitenTin Industry in MalayaHijrah Hassan100% (1)

- Common List 2nd Yr UG Boys & Girls (Batch 2020) Shifting From LBS & NVH HallDokument57 SeitenCommon List 2nd Yr UG Boys & Girls (Batch 2020) Shifting From LBS & NVH Hallkaran vaishnavNoch keine Bewertungen

- Big Data Report 2012Dokument103 SeitenBig Data Report 2012bileshNoch keine Bewertungen

- "Mero Share" Application Form: Æd) /F) Z) O/æ SF) ) JF LNGSF) Nflu LGJ) BG KMF/FDDokument2 Seiten"Mero Share" Application Form: Æd) /F) Z) O/æ SF) ) JF LNGSF) Nflu LGJ) BG KMF/FDANKITNoch keine Bewertungen

- Internet Marketing Ch.3Dokument20 SeitenInternet Marketing Ch.3Hafiz RashidNoch keine Bewertungen

- DowryDokument34 SeitenDowryRashid ZubairNoch keine Bewertungen

- Cheat Sheet - Logistics Term & Salary DetailsDokument4 SeitenCheat Sheet - Logistics Term & Salary Detailstaseenzaheer33Noch keine Bewertungen

- Maptek FlexNet Server Quick Start Guide 4.0Dokument28 SeitenMaptek FlexNet Server Quick Start Guide 4.0arthur jhonatan barzola mayorgaNoch keine Bewertungen

- Pointers For FinalsDokument28 SeitenPointers For FinalsReyan RohNoch keine Bewertungen

- English SpeachDokument3 SeitenEnglish Speachppdb mtsdalwaNoch keine Bewertungen