Beruflich Dokumente

Kultur Dokumente

A Dim Link

Hochgeladen von

Mdluli MbondieyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Dim Link

Hochgeladen von

Mdluli MbondieyCopyright:

Verfügbare Formate

McLagan Alert

Redistributed by WorldatWork with permission from McLagan. Copyright 2009. www.mclagan.com

Holistic Risk and Competitive Review of Incentive Plans

By Patrick Connell December 1, 2009

CHICAGO

Aon Center 200 East Randolph Street Tenth Floor Chicago, IL 60601-6421 Tel: 312.381.9700

DUBAI

Dubai International Financial Center Gate Village, 2nd Floor, Unit 9 P.O. Box 506706 Dubai United Arab Emirates Tel: +97 144 255 747

HONG KONG

In McLagans previous Alert, What Do They Mean by Unreasonable Risk?, we considered the challenge of defining unreasonable risk and who should decide that after the fact the risks taken were unreasonable. As a starting point to ensuring that compensation plans are properly constructed to avoid the inducement to take unreasonable risk, while motivating behavior that provides a reasonable return to shareholders, we suggested the following: Define the different forms of risk to be managed Outline the ways a prudent organization can best manage risk Identify observable phenomenon that can indicate a possible disconnect between incentives and prudent risk management Describe the characteristics of compensation plans that optimize the risk/ return relationship

NEXT STEPHOLISTIC FRAMEWORK FOR REVIEWING RISK AND COMPETITIVENESS

Unit 1406, 14/F Low Block Grand Millennium Plaza 181 Queen's Road Central Sheung Wan Hong Kong Tel: 852.2840.0911

LONDON

Lloyds Chambers, 5th Floor 1 Portsoken Street London E1 8BT England Tel: 44.207.680.7400

NEW YORK

199 Water Street 12th Floor New York, NY 10038 Tel: 212.441.2000

SHANGHAI

42nd Floor, Jin Mao Tower 88 Century Boulevard Pudong, Shanghai 200121 P.R.C. Tel: +86 21 3865 8399

STAMFORD (Headquarters)

In this Alert, we provide a framework to take a more holistic view of incentive plan design that moves beyond performance metrics and award opportunities into considering the overall risk and competitiveness of a firms compensation program. We continue to assert that risk comes in many forms and represents both upside and downside opportunity. Since banks are in the business of taking risk, risk minimization should not be the goal, but, rather, profit maximization at an acceptable risk level, defined within the banks stated tolerances. We recognize that communication of this goal does not role off the tongue the way risk minimization does, but it is an important distinction. To help ensure that a firms incentive plans support their business objectives (including risk-taking) while attracting, retaining and motivating employees, we recommend that the risk posed and market competitiveness of incentive plans be thoroughly reviewed.

KEY ELEMENTS AND QUESTIONS REGARDING INCENTIVE PLAN DESIGN

1600 Summer Street Suite 601 Stamford, CT 06905 Tel: 203.359.2878

TOKYO

Akasaka Kato Building 2nd Floor 22-15, Akasaka 2-chome Minato-ku, Tokyo 107-0052 Japan Tel: 813.5549.1850

www.mclagan.com

In this section, each element of incentive plan design is identified and leading questions are asked to explore the current incentive plan structure. In a full review of incentive plan design, a firms structure would be compared versus the external market and best practice, including risk management. Risk within one element of incentive plan design may be offset by another element of plan design. A classic example would be high award opportunities being offset by larger deferrals / long-term awards. Another example would be producer plans that measure performance based on net-interest revenue rather than profitability, but offset by stringent underwriting standards and high collateral requirements. This list is not intended to be exhaustive, but rather a framework for firms to review existing incentive plan design and consider enhancements both from a competitive and risk management perspective.

McLagan Alert

PHILOSOPHY

What is the business mandate and risk appetite? Peer Group Size (Assets, Revenues, and Employees), Geographic Proximity, Business Competitors and Labor market Competitors? Benchmark jobs What jobs are most similar? Realistic employment opportunities?

CHICAGO

Aon Center 200 East Randolph Street Tenth Floor Chicago, IL 60601-6421 Tel: 312.381.9700

DUBAI

Market positioning Follow (25th %tile), Meet (50th %tile) or Lead (75th %tile) Market Compensation?

OBJECTIVES

Attract How do you assess, select and on-board the right candidates? Retain How do you keep the right employees? How much turnover is acceptable / encouraged? Motivate What actions / behaviors do you want to encourage or discourage?

ELIGIBILITY (BASED ON)

Dubai International Financial Center Gate Village, 2nd Floor, Unit 9 P.O. Box 506706 Dubai United Arab Emirates Tel: +97 144 255 747

HONG KONG

Unit 1406, 14/F Low Block Grand Millennium Plaza 181 Queen's Road Central Sheung Wan Hong Kong Tel: 852.2840.0911

LONDON

Specific business or functional responsibility? Responsibility for risktaking or management? Level in organization Corporate Title versus Functional; Producer versus Manager? Front-office versus support/infrastructure roles? Time in position, promotion / transfer, minimum individual performance, salary threshold, incentive/commission threshold?

TYPE OF PLAN

Lloyds Chambers, 5th Floor 1 Portsoken Street London E1 8BT England Tel: 44.207.680.7400

NEW YORK

199 Water Street 12th Floor New York, NY 10038 Tel: 212.441.2000

SHANGHAI

Annual Commission, Target-based, Balanced Score-Card, Managed Accrual, Discretionary? Long-term Deferral, Add-On, Retention or Incentive oriented? Vehicle?

PERFORMANCE MEASURES

42nd Floor, Jin Mao Tower 88 Century Boulevard Pudong, Shanghai 200121 P.R.C. Tel: +86 21 3865 8399

STAMFORD (Headquarters)

Measured at Firm, Division, Business, Team and / or individual level? Quantitative / Objective? Qualitative / Subjective? Fully captured risk? Over what time period? Year-over-year? Versus Absolute / Budget? Versus Index / Peers?

FUNDING

1600 Summer Street Suite 601 Stamford, CT 06905 Tel: 203.359.2878

TOKYO

Akasaka Kato Building 2nd Floor 22-15, Akasaka 2-chome Minato-ku, Tokyo 107-0052 Japan Tel: 813.5549.1850

www.mclagan.com

Formula (Top-down) or budgeted (bottom-up)? Variable or fixed percentage? At what level does funding take place (e.g., Division, Product/Team)?

McLagan Alert

AWARD OPPORTUNITIES

Weighting at Firm, Division, Business, Team and/or individual level? For a given level of production at a given level of risk? Competitive with external market? Acceptable from an internal equity point of view?

CHICAGO

Over what time period? Does it align with the business/performance cycle?

MIX OF PAY / FIXED VS. VARIABLE

Aon Center 200 East Randolph Street Tenth Floor Chicago, IL 60601-6421 Tel: 312.381.9700

DUBAI

Salary, annual incentive and long-term incentive as percentage of total compensation? Consistent with risk alignment / realization of profits? Practical management of cash flow, expense and retention of key individuals?

PLAN ADMINISTRATION

Dubai International Financial Center Gate Village, 2nd Floor, Unit 9 P.O. Box 506706 Dubai United Arab Emirates Tel: +97 144 255 747

HONG KONG

Unit 1406, 14/F Low Block Grand Millennium Plaza 181 Queen's Road Central Sheung Wan Hong Kong Tel: 852.2840.0911

LONDON

Who is responsible for overseeing administration of each plan? Are the current tracking systems accurate? Are payments made on a timely basis? Is there an independent audit of all payments? Is communication and disclosure transparent to internal and external stakeholders? Timing/Vesting of awards? Caps on overall incentives, specific transactions or both? On/Off Switches and ability to override division/business plans based on aggregate firm performance? Termination Provisions How are incentives treated under various termination scenarios? Is their coordination of incentive programs with benefit and severance programs?

ROLE OF RISK MANAGEMENT FUNCTION

Lloyds Chambers, 5th Floor 1 Portsoken Street London E1 8BT England Tel: 44.207.680.7400

NEW YORK

199 Water Street 12th Floor New York, NY 10038 Tel: 212.441.2000

SHANGHAI

42nd Floor, Jin Mao Tower 88 Century Boulevard Pudong, Shanghai 200121 P.R.C. Tel: +86 21 3865 8399

STAMFORD (Headquarters)

1600 Summer Street Suite 601 Stamford, CT 06905 Tel: 203.359.2878

TOKYO

Do you have an independent risk function that sets, reviews, monitors and enforces the risks of each plan? To whom does this risk function report? Do risk people rotate to and from business management? Is there regular firm-wide stress testing and scenario analysis to ensure that the plans will be able to pay out under a wide range of potential scenarios? Are risk charges regularly updated? Do risk analyses regularly trigger corrective action?

3

Akasaka Kato Building 2nd Floor 22-15, Akasaka 2-chome Minato-ku, Tokyo 107-0052 Japan Tel: 813.5549.1850

www.mclagan.com

McLagan Alert

Does the risk process include credit, legal, operations, compliance, treasury as well as the business areas?

CONCLUSION

CHICAGO

Aon Center 200 East Randolph Street Tenth Floor Chicago, IL 60601-6421 Tel: 312.381.9700

DUBAI

The regulatory scrutiny on risk management creates either an actual or virtual requirement for firms to review incentive plan design. A narrow view would focus on performance measures and award opportunities. A holistic view would focus on all elements of incentive plan design. Old incentive programs are like old houses; they have details and character that have made them useful/desirable over the years evidenced by the fact that they are still here. However, if a regulatory/housing code change requires you to upgrade the electrical, it will come at significant time and expense. You would be best advised to consider if new plumbing and insulation are in order while the walls are opened and the inner workings are exposed. It will only cost you more if you have to open up those same walls in a year or two.

Dubai International Financial Center Gate Village, 2nd Floor, Unit 9 P.O. Box 506706 Dubai United Arab Emirates Tel: +97 144 255 747

HONG KONG

Patrick Connell is the Head of Corporate and Consumer Banking Consulting at McLagan and the owner of a Victorian built in 1892. He can be reached at (203) 602-1241 or via email at pconnell@mclagan.com.

Unit 1406, 14/F Low Block Grand Millennium Plaza 181 Queen's Road Central Sheung Wan Hong Kong Tel: 852.2840.0911

LONDON

Lloyds Chambers, 5th Floor 1 Portsoken Street London E1 8BT England Tel: 44.207.680.7400

NEW YORK

199 Water Street 12th Floor New York, NY 10038 Tel: 212.441.2000

SHANGHAI

42nd Floor, Jin Mao Tower 88 Century Boulevard Pudong, Shanghai 200121 P.R.C. Tel: +86 21 3865 8399

STAMFORD (Headquarters)

1600 Summer Street Suite 601 Stamford, CT 06905 Tel: 203.359.2878

TOKYO

Akasaka Kato Building 2nd Floor 22-15, Akasaka 2-chome Minato-ku, Tokyo 107-0052 Japan Tel: 813.5549.1850

www.mclagan.com

Das könnte Ihnen auch gefallen

- Solution ManualDokument28 SeitenSolution Manualdavegeek0% (1)

- BMEC103 PrelimDokument2 SeitenBMEC103 PrelimJohn Andrei ValenzuelaNoch keine Bewertungen

- Filedate - 721download Solution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 11Th Edition Hitt Irelandduane Hoskisson 1285425170 9781285425177 Full Chapter PDFDokument29 SeitenFiledate - 721download Solution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 11Th Edition Hitt Irelandduane Hoskisson 1285425170 9781285425177 Full Chapter PDFdavid.dale532100% (11)

- Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt IrelandDuane Hoskisson Solution ManualDokument29 SeitenStrategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt IrelandDuane Hoskisson Solution Manualdavid100% (23)

- Chapter 01 NotesDokument20 SeitenChapter 01 NotesChad FerninNoch keine Bewertungen

- Saudi Electronic University College of Administrative and Financial Sciences E-Commerce DepartmentDokument9 SeitenSaudi Electronic University College of Administrative and Financial Sciences E-Commerce Departmentklm klmNoch keine Bewertungen

- Capital Budgeting Decisions: Fadi Alkaraan and Trevor HopperDokument32 SeitenCapital Budgeting Decisions: Fadi Alkaraan and Trevor Hopperh417d1k4Noch keine Bewertungen

- 316082Dokument28 Seiten316082Lim100% (1)

- Thesis On Investment AppraisalDokument6 SeitenThesis On Investment AppraisalAmanda Summers100% (2)

- Research Paper On Investment AppraisalDokument4 SeitenResearch Paper On Investment Appraisalfysygx5k100% (1)

- Post - Covid - TG - On - BCP - Detailed NoteDokument9 SeitenPost - Covid - TG - On - BCP - Detailed NoteManoj Kumar KoyalkarNoch keine Bewertungen

- Project On Private Label of "Shopper Stop Limited": ContentDokument11 SeitenProject On Private Label of "Shopper Stop Limited": ContentRakesh SamariyaNoch keine Bewertungen

- Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Solutions ManualDokument30 SeitenStrategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt Solutions Manualnicholasfarleyeokpsrbwzn100% (12)

- Answers Strategic Management Assignment Dec 2022Dokument9 SeitenAnswers Strategic Management Assignment Dec 2022Ankita SinghNoch keine Bewertungen

- 2 - Long-Term Objectives - PDFDokument13 Seiten2 - Long-Term Objectives - PDFKate NuevaNoch keine Bewertungen

- CH 2Dokument10 SeitenCH 2Miftahudin Miftahudin100% (1)

- Real Options: We Will Maintain Our Highly Disciplined Approach To CapitalDokument32 SeitenReal Options: We Will Maintain Our Highly Disciplined Approach To CapitalAbhishek PuriNoch keine Bewertungen

- SPM AssignmentDokument8 SeitenSPM AssignmentKelvin MasekoNoch keine Bewertungen

- Strategic Management Concepts Competitiveness and Globalization Hitt 11th Edition Solutions ManualDokument29 SeitenStrategic Management Concepts Competitiveness and Globalization Hitt 11th Edition Solutions ManualJohnny Adams100% (27)

- Strategic Marketing PlanningDokument10 SeitenStrategic Marketing PlanningFaizan Ahmad100% (1)

- Operational StrategyDokument2 SeitenOperational Strategyusme314Noch keine Bewertungen

- Module 1 (Strategic Management)Dokument51 SeitenModule 1 (Strategic Management)The Brain Dump PHNoch keine Bewertungen

- REENA SINGH 1062230450 5TH Div (I)Dokument13 SeitenREENA SINGH 1062230450 5TH Div (I)Darshil RajNoch keine Bewertungen

- Mark Parte 1-1Dokument9 SeitenMark Parte 1-1AlexandraNoch keine Bewertungen

- Group 3-Case Study in OdDokument3 SeitenGroup 3-Case Study in OdNoemie DelgadoNoch keine Bewertungen

- Test Bank CH 02 Ed 5Dokument12 SeitenTest Bank CH 02 Ed 5Joshua TengNoch keine Bewertungen

- Infosys Annual Report 2005Dokument208 SeitenInfosys Annual Report 2005Niranjan PrasadNoch keine Bewertungen

- Videcon FinalDokument26 SeitenVidecon FinalvahidNoch keine Bewertungen

- First Six Pages - SAMPLE - HSC Business Studies Syallabus Revision GuideDokument6 SeitenFirst Six Pages - SAMPLE - HSC Business Studies Syallabus Revision GuideJessica SamNoch keine Bewertungen

- Strategic ManagementDokument10 SeitenStrategic ManagementkanchanNoch keine Bewertungen

- Accenture Operational ExcellenceDokument12 SeitenAccenture Operational ExcellenceIndermohan Bains100% (1)

- 2013IJBValuationmethodP590 2correctedDokument9 Seiten2013IJBValuationmethodP590 2correctedHana SupportNoch keine Bewertungen

- Functions of ManagementDokument13 SeitenFunctions of ManagementLemi Chala Beyene100% (1)

- Solution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 13th Edition Michael A Hitt R Duane Ireland Robert e Hoskisson 13 978Dokument37 SeitenSolution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 13th Edition Michael A Hitt R Duane Ireland Robert e Hoskisson 13 978bowerybismarea2blrr100% (11)

- Chapter 1 To 4 Business StrategyDokument15 SeitenChapter 1 To 4 Business StrategySufian TanNoch keine Bewertungen

- Capital Budgeting 2Dokument26 SeitenCapital Budgeting 2shubhamNoch keine Bewertungen

- BBA4600 Test 2 2022Dokument9 SeitenBBA4600 Test 2 2022GIVEN N SIPANJENoch keine Bewertungen

- Bacc20-A2 Seow-Yee-Juh B200042a SM ExamDokument7 SeitenBacc20-A2 Seow-Yee-Juh B200042a SM ExamBBMK21-A2 You SengNoch keine Bewertungen

- Neim 3Dokument31 SeitenNeim 32206172000823Noch keine Bewertungen

- Outsourcing MantrasDokument22 SeitenOutsourcing MantrasMichael ManNoch keine Bewertungen

- Entrepreneurship DA 1Dokument13 SeitenEntrepreneurship DA 1Pushpa MahatNoch keine Bewertungen

- Calculating ROI For Technology InvestmentsDokument12 SeitenCalculating ROI For Technology Investmentsrefvi.hidayat100% (1)

- Test Bank For Entrepreneurial Finance 5th Edition Leach, MelicherDokument12 SeitenTest Bank For Entrepreneurial Finance 5th Edition Leach, Melichera790327112Noch keine Bewertungen

- Key Performance Indicators Drive Best Practices For General ContractorsDokument9 SeitenKey Performance Indicators Drive Best Practices For General ContractorsMarcus Skookumchuck VanniniNoch keine Bewertungen

- Commercial Excellence: Slide 1 - Title SlideDokument8 SeitenCommercial Excellence: Slide 1 - Title SlideMridul DekaNoch keine Bewertungen

- Blocher - 9e - SM - Ch02-Final - StudentDokument32 SeitenBlocher - 9e - SM - Ch02-Final - Studentadamagha703Noch keine Bewertungen

- Better Off Than Its Competitors As A Result of Being First To Market in A New Product CategoryDokument6 SeitenBetter Off Than Its Competitors As A Result of Being First To Market in A New Product Categoryvijayadarshini vNoch keine Bewertungen

- Portfolio Aya Azif 18Dokument6 SeitenPortfolio Aya Azif 18Aya AzifNoch keine Bewertungen

- Chapter 1 - Strategic Management and Strategic CompetitivenessDokument24 SeitenChapter 1 - Strategic Management and Strategic CompetitivenessMara Shaira SiegaNoch keine Bewertungen

- Business Notes Plus Button Battery SpeechDokument14 SeitenBusiness Notes Plus Button Battery Speechhussainshakeel.mzNoch keine Bewertungen

- Strategic Management and Strategic Competitiveness: Chapter OverviewDokument15 SeitenStrategic Management and Strategic Competitiveness: Chapter OverviewAizen SosukeNoch keine Bewertungen

- All PDFDokument14 SeitenAll PDFkarthiarmy98Noch keine Bewertungen

- Retrenchment StrategyDokument46 SeitenRetrenchment StrategyAnonymous TxGjonjHGNoch keine Bewertungen

- HSC Business Studies Syllabus Revision GuideDokument96 SeitenHSC Business Studies Syllabus Revision GuideEdward Pym100% (3)

- Assignment No.1 ED Shubham Jagtap MIS: 732391012Dokument7 SeitenAssignment No.1 ED Shubham Jagtap MIS: 732391012shubhamshubhshubh20Noch keine Bewertungen

- Industrial Megaprojects: Concepts, Strategies, and Practices for SuccessVon EverandIndustrial Megaprojects: Concepts, Strategies, and Practices for SuccessBewertung: 3 von 5 Sternen3/5 (3)

- Business Plan Checklist: Plan your way to business successVon EverandBusiness Plan Checklist: Plan your way to business successBewertung: 5 von 5 Sternen5/5 (1)

- Serrano Vs NLRCDokument6 SeitenSerrano Vs NLRCRobert Ross DulayNoch keine Bewertungen

- Activity Sheet # 8 - Concept and Nature of StaffingDokument2 SeitenActivity Sheet # 8 - Concept and Nature of StaffingChristine RamirezNoch keine Bewertungen

- CSR of Exim Bank of BanhladeshDokument10 SeitenCSR of Exim Bank of BanhladeshZahid HasanNoch keine Bewertungen

- Envoy Filing H1B Onboarding GuideDokument11 SeitenEnvoy Filing H1B Onboarding GuideRamesh Babu PindigantiNoch keine Bewertungen

- Royal Plant Workers V Coca Cola BottlersDokument4 SeitenRoyal Plant Workers V Coca Cola BottlersinvictusincNoch keine Bewertungen

- Work Study 1Dokument47 SeitenWork Study 1Anonymous phDoExVlNoch keine Bewertungen

- MG8591-Principles of ManagementDokument13 SeitenMG8591-Principles of ManagementBasidh JrNoch keine Bewertungen

- Terms and Conditions For Advertisement and ProformaDokument3 SeitenTerms and Conditions For Advertisement and ProformaMallikarjunayya HiremathNoch keine Bewertungen

- Job Satisfaction Among Long Term Care Staff Bureaucracy Isn T Always BadDokument11 SeitenJob Satisfaction Among Long Term Care Staff Bureaucracy Isn T Always BadKat NavarroNoch keine Bewertungen

- Gainesville Health & Fitness: Journey!Dokument24 SeitenGainesville Health & Fitness: Journey!mindy_miller5630Noch keine Bewertungen

- CCCFDC Audit Work SummaryDokument4 SeitenCCCFDC Audit Work SummaryWKYC.comNoch keine Bewertungen

- Old NLRC Rules of ProcedureDokument12 SeitenOld NLRC Rules of ProcedureMara Corteza San PedroNoch keine Bewertungen

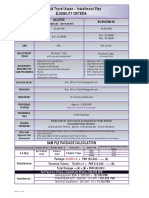

- Labbaik Travel Asaan - Installment Plan Eligibility CriteriaDokument1 SeiteLabbaik Travel Asaan - Installment Plan Eligibility CriteriamuhammadTzNoch keine Bewertungen

- NFR3 PayrollDokument69 SeitenNFR3 PayrollAnandNoch keine Bewertungen

- Module 1 - Foundation of Indian BusinessDokument25 SeitenModule 1 - Foundation of Indian BusinessChaithanyaNoch keine Bewertungen

- Sponsored by Ccps Supporters: Messages For Manufacturing PersonnelDokument1 SeiteSponsored by Ccps Supporters: Messages For Manufacturing PersonnelTriod jacksonNoch keine Bewertungen

- Knowledge Management in Agile OrganizationsDokument8 SeitenKnowledge Management in Agile OrganizationsSunway UniversityNoch keine Bewertungen

- PEACE CORP AGENCY ANALYSIS - EditedDokument8 SeitenPEACE CORP AGENCY ANALYSIS - EditedJames KimaniNoch keine Bewertungen

- HR Activity in Nissan CompanyDokument6 SeitenHR Activity in Nissan CompanyAnnapurna VinjamuriNoch keine Bewertungen

- VETASSESS Statement of Service TemplateDokument1 SeiteVETASSESS Statement of Service TemplateShen Ogoc100% (2)

- Management: Delegation and Stages of Team DevelopmentDokument76 SeitenManagement: Delegation and Stages of Team DevelopmentAlvin OroscoNoch keine Bewertungen

- Eligibility For Internships & PlacementsDokument2 SeitenEligibility For Internships & PlacementsraadNoch keine Bewertungen

- Resume Writing PDFDokument72 SeitenResume Writing PDFNandan KumarNoch keine Bewertungen

- Collective Bargaining Agreement: Examples and DiscussionsDokument12 SeitenCollective Bargaining Agreement: Examples and DiscussionsCarmela GuiboneNoch keine Bewertungen

- Contract Evaluation ChecklistDokument2 SeitenContract Evaluation ChecklistDawit Solomon100% (1)

- Ojt Narrative Report Group 5Dokument64 SeitenOjt Narrative Report Group 5Jeffrey RegondolaNoch keine Bewertungen

- PDF de Poche Vocabulaire Anglais AssurancesDokument6 SeitenPDF de Poche Vocabulaire Anglais AssurancesMatcheha aimé HervéNoch keine Bewertungen

- 3-Stakeholders in Supply Chain ManagementDokument8 Seiten3-Stakeholders in Supply Chain ManagementHenry dragoNoch keine Bewertungen

- Vishwa Bharati Public School: Grams: VishwabhartiDokument4 SeitenVishwa Bharati Public School: Grams: Vishwabhartimittal_y2kNoch keine Bewertungen

- First Aid ChecklistDokument5 SeitenFirst Aid ChecklistBobby CastleNoch keine Bewertungen