Beruflich Dokumente

Kultur Dokumente

Uranium Reaction: Cameco's Bid For Hathor May Be The Starter's Pistol

Hochgeladen von

flyboy77Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Uranium Reaction: Cameco's Bid For Hathor May Be The Starter's Pistol

Hochgeladen von

flyboy77Copyright:

Verfügbare Formate

September 1, 2011 Industry Update

URANIUM REACTION

Camecos Bid for Hathor May be the Starters Pistol TIMING IS EVERYTHING

Last week we noted that we were at a point of maximum pessimism and that there were no foreseeable negative catalysts in the uranium space. Thanks to Cameco (CCO-TSX), that point may have only lasted a day. As a result of Camecos $520 million dollar hostile bid for Hathor Exploration (HAT-TSXV) the uranium sector appears to have reignited again. Since our first report last week, the average return of the group of equities we highlighted gained 11.8% on average. We continue to believe that there is more potential upside in the uranium sector relative to potential downside.

Exhibit 1. One-Week Performance of Highlighted Uranium Names

Equity Research

Company Name Cameco Uranium One Uranium Participation Fission Energy Kivalliq Energy Energy Fuels Group Average

Source: Versant Partners

Ticker CCO UUU U FIS KIV EFR

24/08/2011 31/08/2011 Return $21.98 $22.73 3.4% $2.77 $2.68 -3.2% $5.84 $6.00 2.7% $0.50 $0.71 42.0% $0.33 $0.41 24.2% $0.31 $0.32 1.6% 11.8%

Since we do not formally cover Hathor Exploration we will refrain from commenting on what a fair value for the company should be. However we would like to highlight that at an enterprise value per in-situ pound of U3O8 (EV/Lb) of $7.75/lb (market capitalization per pound of $9.01/lb), Camecos bid for Hathor is significantly below the EV/Lb values that were north of $12/lb we observed last year and notably below the $9.50/lb takeover valuation for Mantra Resources by ARMZ/Uranium One (UUU-TSX). In a world where grade is king, Mantras global U3O8 grade of 0.042% is significantly less than the 8.628% at Hathor, yet the offer for the latter is at a discount to the takeover value for the former. Not to mention the fact that Hathors Roughrider zone is in an established uranium mining jurisdiction with significant infrastructure already in place.

FISSION ENERGY HATHORS UNDERVALUED NEIGHBOUR

Due to this development between Cameco and Hathor, we highlighted the impact to Fission Energy (FIS-TSXV, Buy (Speculative) Target: $1.50), which has a 60%-interest in Waterbury Lake. The J-East zone at Waterbury is located right at the border between Hathor and Fissions property and is the likely western extension of Roughrider. Thirty-meters to the west of J-East is the J-Zone, which Fission just announced a 56% increase in strike length to 578m. We estimate a resource of 388,416 tonnes grading 2.1% and containing 17.98 MM lbs of U3O8. It is our view that if Cameco is successful in its acquisition of Hathor Explorations Roughrider deposit, the Company will turn its attention towards the acquisition of Fission Energy as its shallower lying J-Zone and J-East zones would be the natural starting point along the path of mining uranium from the deeper Roughrider deposit. Rob Chang

rchang@versantpartners.com (416) 849-5008 (866) 442-4485 Sales/Trading Montreal: (514) 845-8111, (800) 465-5616; Toronto: (416) 363-5757, (866) 442-4485 See disclosure and a description of our recommendation structure at the end of this report.

Uranium Update

September 1, 2011

KIVALLIQ ENERGY IMPRESSIONS OF LAC CINQUNATE

This week we had the pleasure of visiting Kivalliq Energys (KIV-TSXV, BUY (Speculative) Target: $1.00) Angilak Property located in Nunavut, which is home of the highest grade uranium deposit located outside of the Athabasca Basin - the Lac Cinquante deposit (14.15 MM lbs U3O8 at 0.79%). Outside of this zone, we had the opportunity to look at several highly prospective targets including the: Western Extension, Eastern Extension, Blaze Zone, Joule Trend, Forte Zone, PWR Zone, Force Zone, Lucky Break, Bog, VGR, YAT and BIF. As displayed in exhibit 2, Kivalliq has an abundance of high quality targets to explore and we will monitor the results from these targets with great interest.

Exhibit 2. Angilak Property Targets

Source: Kivalliq Energy

GERMANY BRACING FOR BLACKOUTS

Despite importing massive amounts of nuclear energy from France after shutting down eight of 17 nuclear post Fukushima, Germany may deal with blackouts not seen since the end of WWII. German utilities have warned about potential blackouts if Germany experiences a particularly tough winter. Calls have been made to place one of the reactors back online but Matthias Kurth, president of the Federal Network Agency has stated that the nuclear power plants will not be reactivated. The decision to shut down the German nuclear program is more emotional than practical and the idea of simply replacing the source of 25% of Germanys power with renewable energy by 2019 is wildly optimistic.

NEW JAPANESE PRIME MINISTER FAVOURS BETER REGULATION

Yoshihiko Noda has been selected as leader of the ruling Democratic Party of Japan and assumes the role as the prime minister of the country. Unlike his

Rob Chang, (416) 849-5008

2 of 6

Uranium Update

September 1, 2011

predecessor, the former minister of finance favours the 'independence and empowerment' of a new nuclear safety regulator. Unlike outgoing prime minister Naoto Kan, whom envisioned a future Japan that did not use nuclear energy, Noda prefers a new independent institution reporting directly to the cabinet office, with the authority to instigate criminal investigation of any wrongdoing it may find. We view this as a positive development for the nuclear industry as Japan new prime minister will work towards improving nuclear regulation as opposed to the removal of nuclear power from Japan altogether.

Exhibit 3. Yoshihiko Noda receives applause from his party and leadership rivals after the announcement of his victory

Source: World Nuclear News

IF CASH IS KING

Uranium equities trading at the lowest multiples relative to their most recently reported balance sheet cash positions are the following:

Exhibit 4. Top 10 Uranium Companies - Price to Balance Sheet Cash

August 31, 2011 Company Name Stage All figures in $CAD Stock Price $0.29 $0.25 $0.19 $0.03 $0.08 $0.32 $0.12 $0.15 $0.20 $0.15 Market Cap (MM) 15.01 14.17 20.02 9.95 5.56 32.86 23.25 12.67 68.23 15.50 Enterprise Value (MM) -5.23 1.42 4.49 2.69 1.95 12.63 9.04 5.04 30.97 17.27 Price/Cash 0.7x 1.1x 1.3x 1.4x 1.5x 1.6x 1.6x 1.7x 1.8x 2.3x Cash (MM) 20.24 12.75 15.53 7.26 3.61 20.23 14.21 7.63 37.26 6.86 Shares O/S 51.75 56.68 105.38 331.71 69.50 102.68 193.73 84.44 341.17 103.30

Continental Precious Minerals, Inc. (TSX:CZQ) Exploration Tigris Uranium Corp. (TSXV:TU) Exploration Macusani Yellowcake, Inc. (TSXV:YEL) Exploration Australian American Mining Corporation Limited (ASX:AIW) Pre-Feasibility Energia Minerals Limited (ASX:EMX) Exploration U308 Corp. (TSXV:UWE) Exploration Tournigan Energy Ltd. (TSXV:TVC) Pre-Feasibility Uranium North Resources Corp. (TSXV:UNR) Exploration Alliance Resources Ltd. (ASX:AGS) Development Powertech Uranium Corp. (TSX:PWE) Pre-Feasibility

Source: Versant Partners and Capital IQ

Rob Chang, (416) 849-5008

3 of 6

Uranium Update

September 1, 2011

IMPLIED EV/LB VALUATION

Applying the concept of mean reversion, a market-implied valuation can be derived by applying the average EV/Lb value to the valuation of each constituent company to determine its value if it reverted to the mean.

Exhibit 5. EV/Lb Averages by Development Stage

Global # of 43-101/JORC Stage Resource Constituents EV/Lb Avg EV/Lb Avg Producer 7 $7.20 $8.46 Developer 4 $3.83 $3.55 Feasibility 7 $0.66 $0.61 Pre-Feasibility 10 $1.38 $1.19 Exploration 32 $1.72 $1.45 60 $1.90 $2.03

*Results higher than three standard deviations are removed from the calculation of averages Source: Versant Partners

Rob Chang, (416) 849-5008

4 of 6

Uranium Update

September 1, 2011

Exhibit 6. Uranium Comparables

August 31, 2011 SYM Exch Company Name Stage All figures in $CAD Stock Price $22.73 $1.60 $4.18 $2.16 $3.43 $2.68 $0.23 $0.20 $0.32 $2.33 $1.23 $0.31 $0.39 $0.39 $0.30 $0.34 $0.61 $0.20 $0.03 $0.30 $0.90 $1.08 $0.06 $0.15 $0.50 $0.09 $0.12 $0.43 $0.05 $0.29 $0.29 $0.65 $0.06 $0.17 $0.08 $0.35 $8.38 $0.71 $0.05 $4.14 $0.12 $0.41 $0.19 $0.03 $1.68 $0.20 $0.23 $0.14 $1.41 $1.98 $0.25 $0.32 $0.87 $0.07 $0.10 $0.15 $1.14 $0.16 $0.22 $0.16 Implied EV/Lb Valuation $19.61 $6.58 $26.05 $4.24 $4.65 $1.39 $0.05 $0.31 $0.60 $1.51 $1.32 $0.60 $0.52 $0.34 $0.58 $0.22 $1.03 $0.21 $0.07 $2.88 $1.58 $1.38 $0.04 $0.30 $0.24 $0.08 $0.51 $0.27 $0.13 $8.36 $35.91 $0.92 $0.14 $0.10 $0.24 $0.30 $3.78 $0.72 $0.04 $1.08 $0.04 $0.36 $0.59 $0.24 $4.51 $0.63 $2.46 $0.24 $0.93 $0.54 $1.20 $1.12 $0.81 $0.31 $0.61 $0.29 $2.09 $0.29 $0.30 $0.60 Upside to Market Implied Value -13.71% 311.41% 523.15% 96.19% 35.52% -48.29% -76.49% 52.72% 88.45% -35.21% 6.98% 92.62% 32.30% -13.74% 94.52% -34.89% 68.24% 3.00% 143.66% 860.06% 75.74% 27.38% -29.23% 101.45% -52.50% -9.94% 324.04% -36.38% 154.77% 2784.41% 12283.07% 40.96% 140.61% -43.91% 195.92% -14.08% -54.90% 1.26% -27.76% -74.00% -68.92% -12.55% 212.66% 705.39% 168.17% 215.94% 968.83% 69.72% -34.26% -72.54% 379.76% 251.00% -6.36% 347.13% 511.57% 92.26% 83.15% 82.15% 35.23% 277.99% Market Cap (MM) 8,971.76 615.46 797.29 1,621.88 247.95 2,565.30 47.35 68.23 39.68 179.29 127.43 61.69 91.43 67.98 16.27 87.41 54.86 25.96 9.95 6.70 72.12 73.29 116.53 15.50 72.47 86.84 23.25 72.87 4.75 38.31 15.01 30.86 6.85 191.51 5.56 47.00 2,038.85 69.27 29.14 449.85 12.74 49.31 20.02 14.96 85.19 26.78 4.74 5.58 153.22 431.60 14.17 32.86 176.67 2.18 13.28 12.67 106.62 25.89 27.41 15.60 Enterprise Value (MM) 8,963.22 482.88 605.78 2,283.53 216.24 2,744.31 50.31 30.97 31.17 136.13 96.05 46.38 82.37 60.54 10.00 56.29 39.65 19.59 2.69 4.98 65.00 69.65 90.63 17.27 78.11 50.86 9.04 67.55 3.99 31.77 -5.23 20.07 6.73 169.98 1.95 35.85 2,002.89 41.98 28.06 432.62 10.38 30.55 4.49 11.36 72.43 22.43 4.00 3.17 100.27 420.04 1.42 12.63 163.17 1.90 7.73 5.04 99.25 18.15 18.49 11.65 Price/Cash 7.4x 4.6x 4.2x 14.3x 7.8x 8.4x 157.8x 1.8x 4.7x 4.1x 4.1x 4.0x 4.9x 9.1x 2.6x 2.8x 2.5x 4.1x 1.4x 3.9x 10.1x 20.1x 4.5x 2.3x 15.4x 2.4x 1.6x 13.7x 5.9x 5.9x 0.7x 2.9x 57.1x 8.9x 1.5x 4.2x 56.7x 2.5x 27.0x 26.1x 5.4x 2.6x 1.3x 2.9x 6.7x 6.2x 6.4x 2.3x 2.9x 37.3x 1.1x 1.6x 13.1x 7.5x 2.4x 1.7x 13.4x 3.3x 2.6x 3.9x Based on 43-101/JORC Resource MKT / LB $9.14 $5.08 $1.20 $3.32 $13.03 $12.27 $3.90 $3.68 $9.41 $4.64 $0.39 $0.54 $0.87 $0.42 $2.22 $0.97 $0.85 $0.81 $0.31 $0.83 $1.18 $3.53 $0.65 $3.58 $2.84 $0.56 $2.45 $0.72 $0.06 $0.01 $1.72 $0.72 $3.84 $0.75 $2.77 $3.97 $2.78 $2.51 $7.76 $3.48 $0.73 $0.22 $5.57 $0.57 $1.36 $5.52 $6.95 $0.44 $1.91 $2.00 $0.30 $1.30 $1.13 $1.62 $0.55 EV / LB $9.13 $3.98 $0.91 $4.68 $11.36 $13.12 $1.77 $2.89 $7.14 $3.50 $0.29 $0.48 $0.78 $0.26 $1.43 $0.70 $0.64 $0.22 $0.23 $0.75 $1.12 $2.75 $0.72 $3.86 $1.66 $0.22 $2.27 $0.61 $0.05 ($0.00) $1.12 $0.71 $3.41 $0.26 $2.11 $3.90 $1.69 $2.42 $7.47 $2.16 $0.16 $0.17 $4.74 $0.48 $0.77 $3.61 $6.76 $0.04 $0.73 $1.85 $0.18 $0.52 $0.79 $1.09 $0.41 Based on Global Resource MKT / LB $8.56 $1.85 $1.20 $3.10 $5.87 $12.27 $24.19 $3.90 $2.29 $9.41 $4.64 $0.39 $0.54 $0.87 $0.42 $2.22 $0.51 $0.84 $0.81 $0.15 $0.83 $1.13 $2.84 $0.65 $2.50 $2.84 $0.38 $2.45 $0.72 $0.06 $0.01 $1.62 $0.72 $3.84 $0.75 $2.77 $3.97 $2.78 $2.51 $7.76 $13.72 $3.48 $0.73 $0.22 $0.68 $0.57 $0.16 $1.36 $5.52 $6.95 $0.44 $0.59 $2.00 $0.40 $0.30 $1.30 $0.98 $1.13 $1.62 $0.49 EV / LB $8.55 $1.45 $0.91 $4.37 $5.12 $13.12 $25.70 $1.77 $1.80 $7.14 $3.50 $0.29 $0.48 $0.78 $0.26 $1.43 $0.37 $0.63 $0.22 $0.11 $0.75 $1.07 $2.21 $0.72 $2.69 $1.66 $0.15 $2.27 $0.61 $0.05 ($0.00) $1.06 $0.71 $3.41 $0.26 $2.11 $3.90 $1.69 $2.42 $7.47 $11.17 $2.16 $0.16 $0.17 $0.58 $0.48 $0.14 $0.77 $3.61 $6.76 $0.04 $0.23 $1.85 $0.35 $0.18 $0.52 $0.91 $0.79 $1.09 $0.36 Avg Grade 9.393% 0.419% 0.308% 0.078% 0.066% 0.072% 0.105% 0.324% 0.206% 0.103% 0.066% 0.015% 0.020% 0.045% 0.127% 0.112% 0.089% 0.113% 0.088% 0.083% 0.024% 0.116% 0.036% 0.138% 0.434% 0.050% 0.302% 0.014% 0.527% 0.016% 0.019% 0.044% 0.043% 0.035% 0.028% 0.091% 0.046% 0.058% 0.030% 8.628% 0.090% 0.790% 0.021% 0.017% 0.031% 0.045% 0.057% 0.230% 0.110% 0.075% 0.105% 0.103% 0.741% 0.063% 0.012% 0.087% 0.168% 0.028% 0.021% 0.076% Resources and Reserves (MM lbs) Total P&P M&I Inferred Historical 484.04 141.65 355.67 67.28 2.87 78.80 39.51 212.15 246.20 272.64 144.74 0.00 159.20 192.06 136.91 34.58 0.00 6.53 12.50 23.24 47.97 59.93 101.25 0.00 0.00 0.00 0.00 1.96 0.00 8.00 9.50 0.00 0.00 6.45 4.35 6.53 0.00 15.72 3.34 0.00 0.00 23.72 3.71 0.00 0.00 50.20 107.60 0.00 0.00 118.96 51.12 0.00 0.00 34.90 43.15 0.00 30.68 6.61 1.39 0.00 0.00 34.56 4.76 0.00 0.00 36.85 19.51 50.50 0.00 30.40 0.00 0.65 0.00 0.00 12.31 0.00 0.00 11.46 10.16 23.73 0.00 77.20 9.50 0.00 0.00 43.26 19.07 2.70 0.00 10.50 22.50 8.00 0.00 17.06 6.85 0.00 0.00 7.46 12.78 8.80 0.00 10.87 19.74 0.00 0.00 28.49 12.66 20.00 0.00 4.35 25.40 0.00 0.00 1.96 4.63 0.00 0.00 0.00 638.00 0.00 0.00 14.41 1,037.96 15.34 0.00 7.40 10.50 1.10 0.00 8.30 1.20 0.00 0.00 30.80 19.09 0.00 0.00 0.00 7.46 0.00 0.00 4.90 12.08 0.00 319.90 38.51 154.80 0.00 0.00 0.00 24.89 0.00 0.00 0.00 11.60 0.00 0.00 17.21 40.73 0.00 0.00 0.00 0.00 0.93 0.00 0.00 14.15 0.00 0.00 10.37 16.97 0.00 0.00 9.60 58.40 0.00 0.00 0.12 15.17 110.00 0.00 15.18 31.44 0.00 0.00 0.00 0.00 29.00 0.00 0.00 4.10 0.00 0.00 6.07 21.68 0.00 0.00 32.70 29.44 0.00 0.00 32.08 0.00 0.00 0.00 12.10 5.14 38.00 0.00 72.77 15.49 0.00 0.00 0.00 0.00 5.49 0.00 0.00 43.95 0.00 0.00 0.00 9.71 0.00 0.00 0.00 0.00 109.15 0.00 0.00 22.90 0.00 0.00 6.24 10.66 0.00 0.00 28.56 0.00 3.40

CCO TSX Cameco Corp. (TSX:CCO) Production DML TSX Denison Mines Corp. (TSX:DML) Production ERA ASX Energy Resources of Australia Ltd. (ASX:ERA) Production PDN TSX Paladin Energy, Ltd. (TSX:PDN) Production UEC AMEX Uranium Energy Corp. (AMEX:UEC) Production UUU TSX Uranium One Inc. (TSX:UUU) Production WU TSXV White Canyon Uranium Ltd. (TSXV:WU) Production AGS ASX Alliance Resources Ltd. (ASX:AGS) Development EFR TSX Energy Fuels Inc. (TSX:EFR) Development URZ amex Uranerz Energy Corp. (AMEX:URZ) Development URE TSX UR-Energy Inc. (TSX:URE) Development ACB ASX A-Cap Resources Ltd. (ASX:ACB) Feasibility BAN TSX Bannerman Resources Limited (TSX:BAN) Feasibility BKY ASX Berkeley Resources Ltd. (ASX:BKY) Feasibility KRI TSX Khan Resources Inc. (TSX:KRI) Feasibility MGA TSX Mega Uranium Ltd. (TSX:MGA) Feasibility STM TSX Strathmore Minerals Corp. (TSX:STM) Feasibility TUE TSXV Titan Uranium Inc. (TSXV:TUE) Feasibility AIW ASX Australian American Mining Corporation Limited (ASX:AIW) Pre-Feasibility BYU TSXV Bayswater Uranium Corp. (TSXV:BYU) Pre-Feasibility FSY TSX Forsys Metals Corp. (TSX:FSY) Pre-Feasibility LAM TSX Laramide Resources Ltd. (TSX:LAM) Pre-Feasibility PEN ASX Peninsula Energy Limited (ASX:PEN) Pre-Feasibility PWE TSX Powertech Uranium Corp. (TSX:PWE) Pre-Feasibility RSC TSX Strateco Resources Inc. (TSX:RSC) Pre-Feasibility TOE ASX Toro Energy Ltd (ASX:TOE) Pre-Feasibility TVC TSXV Tournigan Energy Ltd. (TSXV:TVC) Pre-Feasibility UNX ASX Uranex NL (ASX:UNX) Pre-Feasibility ABE TSXV Abitex Resources Inc. (TSXV:ABE) Exploration AEE ASX Aura Energy Limited (ASX:AEE) Exploration CZQ TSX Continental Precious Minerals, Inc. (TSX:CZQ) Exploration CXZ AMEX Crosshair Exploration & Mining Corp. (AMEX:CXZ) Exploration CUE TSXV Cue Resources Ltd (TSXV:CUE) Exploration DYL ASX Deep Yellow Ltd. (ASX:DYL) Exploration EMX ASX Energia Minerals Limited (ASX:EMX) Exploration EME ASX Energy Metals Limited (ASX:EME) Exploration EXT ASX Extract Resources Ltd. (ASX:EXT) Exploration FIS TSXV Fission Energy Corp. (TSXV:FIS) Exploration FTE ASX Forte Energy NL (ASX:FTE) Exploration HAT TSX Hathor Exploration Ltd. (TSX:HAT) Exploration JNN TSXV JNR Resources Inc. (TSXV:JNN) Exploration KIV TSXV Kivalliq Energy Corp. (TSXV:KIV) Exploration YEL TSXV Macusani Yellowcake, Inc. (TSXV:YEL) Exploration MEY ASX Marenica Energy Ltd (ASX:MEY) Exploration MAW TSX Mawson Resources Ltd. (TSX:MAW) Exploration GEM TSXV Pele Mountain Resources Inc. (TSXV:GEM) Exploration PIT TSXV Pitchblack Resources Ltd. (TSXV:PIT) Exploration PXP TSXV Pitchstone Exploration Ltd. (TSXV:PXP) Exploration RGT TSX Rockgate Capital Corp. (TSX:RGT) Exploration SMM ASX Summit Resources Ltd. (ASX:SMM) Exploration TU TSXV Tigris Uranium Corp. (TSXV:TU) Exploration UWE TSXV U308 Corp. (TSXV:UWE) Exploration UEX TSX UEX Corp. (TSX:UEX) Exploration ULU TSXV Ultra Uranium Corp. (TSXV:ULU) Exploration URC TSXV Uracan Resources, Ltd. (TSXV:URC) Exploration UNR TSXV Uranium North Resources Corp. (TSXV:UNR) Exploration URRE NASDAQ Uranium Resources, Inc. (NasdaqCM:URRE) Exploration USA ASX Uraniumsa Limited (ASX:USA) Exploration VEM TSX Vena Resources Inc. (TSX:VEM) Exploration VAE TSXV Virginia Energy Resources Inc. (TSXV:VAE) Exploration

Total 1,048.64 333.33 663.59 522.74 42.27 209.14 1.96 17.50 17.32 19.06 27.43 157.80 170.08 78.05 38.69 39.32 106.87 31.05 12.31 45.35 86.70 65.03 41.00 23.91 29.03 30.61 61.15 29.74 6.59 638.00 1,067.71 19.00 9.50 49.89 7.46 16.98 513.21 24.89 11.60 57.94 0.93 14.15 27.34 68.00 125.29 46.63 29.00 4.10 27.75 62.14 32.08 55.24 88.25 5.49 43.95 9.71 109.15 22.90 16.90 31.96

Source: Versant Partners and Capital IQ

Rob Chang, (416) 849-5008

5 of 6

Uranium Update

September 1, 2011

DISCLAIMERS AND DISCLOSURES Disclaimers

The opinions, estimates and projections contained in this report are those of Versant Partners Inc. (Versant) as of the date hereof and are subject to change without notice. Versant makes every effort to ensure that the contents have been compiled or derived from sources believed to be reliable and that contain information and opinions that are accurate and complete; however, Versant makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions which may be contained herein and accepts no liability whatsoever for any loss arising from any use of or reliance on this report or its contents. Information may be available to Versant that is not herein. This report is provided, for informational purposes only, to institutional investor clients of Versant Partners Inc. Canada, and does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction where such offer or solicitation would be prohibited. This report is issued and approved for distribution in Canada, Versant Partners Inc., a member of the Investment Industry Regulatory Organization of Canada ("IIROC"), the Toronto Stock Exchange, the TSX Venture Exchange and the CIPF. This report is has not been reviewed or approved by Versant Partners USA., a member of FINRA. This report is intended for distribution in the United States only to Major Institutional Investors (as such term is defined in SEC 15a-6 and Section 15 of the Securities Exchange Act of 1934, as amended) and is not intended for the use of any person or entity that is not a major institutional investor. Major Institutional Investors receiving this report should effect transactions in securities discussed in the report through Versant Partners USA.

Potential conflicts of interest

The author of this report is compensated based in part on the overall revenues of Versant, a portion of which are generated by investment banking activities. Versant may have had, or seek to have, an investment banking relationship with companies mentioned in this report. Versant and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned herein as principal or agent. Although Versant makes every effort possible to avoid conflicts of interest, readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject companies.

Disclosures as of September 1, 2011

Versant has provided investment banking services or received investment banking related compensation from Kivalliq Energy and Energy Fuels within the past 12 months. Versant has not received investment banking related compensation from Cameco, Fission Energy, Uranium One, Uranium Participation and U3O8 Corp. The analyst responsible for this research report does not have, either directly or indirectly, a long or short position in the shares or options of Kivalliq Energy, Energy Fuels, Cameco, Fission Energy, Uranium One, Uranium Participation and U3O8 Corp. The analyst responsible for this report has visited the material operations of U3O8 Corp, Uranium Energy Corp, Uranerz Energy and Kivalliq Energy. The analyst responsible for this report has not visited the material operations of Cameco, Uranium One, Uranium Participation, and Fission Energy.

Analyst certification

The research analyst whose name appears on this report hereby certifies that the opinions and recommendations expressed herein accurately reflect his personal views about the securities, issuers or industries discussed herein.

Definitions of recommendations

BUY: The stock is attractively priced relative to the companys fundamentals and we expect it to appreciate significantly from the current price over the next 6 to 12 months.

BUY (Speculative): The stock is attractively priced relative to the companys fundamentals, however investment in the security carries a higher degree of risk. NEUTRAL: The stock is fairly valued, lacks a near term catalyst, or its execution risk is such that we expect it to trade within a narrow range of the current price in the next 6 to 12 months. The longer term fundamental value of the company may be materially higher, but certain milestones/catalysts have yet to be fully realized. SELL: The stock is overpriced relative to the companys fundamentals, and we expect it to decline from the current price over the next 6 to 12 months. TENDER: We believe the offer price by the acquirer is fair and thus recommend investors tender their shares to the offer. UNDER REVIEW: We are temporarily placing our recommendation under review until further information is disclosed.

Member-Canadian Investor Protection Fund. Customers' accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of coverage is available upon request.

Rob Chang, (416) 849-5008

6 of 6

Das könnte Ihnen auch gefallen

- Uranium Reaction: Switzerland's Anti-Nuclear Stance Softening?Dokument6 SeitenUranium Reaction: Switzerland's Anti-Nuclear Stance Softening?Roman SuprunNoch keine Bewertungen

- The Delicate Supply Balance and Growing The Delicate Supply Balance and Growing Demand For Rare EarthsDokument55 SeitenThe Delicate Supply Balance and Growing The Delicate Supply Balance and Growing Demand For Rare Earthsguarulhos125Noch keine Bewertungen

- Australian Uranium Market OutlookDokument24 SeitenAustralian Uranium Market OutlooksegurarodrigoNoch keine Bewertungen

- Discovery Follow-Up Hit Bonanza 1.3M at 2658G/T Ageq in New Blind LodeDokument4 SeitenDiscovery Follow-Up Hit Bonanza 1.3M at 2658G/T Ageq in New Blind LodetomNoch keine Bewertungen

- U.S. Uranium Reserves Estimates: GlossaryDokument4 SeitenU.S. Uranium Reserves Estimates: GlossaryrendytalionNoch keine Bewertungen

- Daily Report 20140915Dokument3 SeitenDaily Report 20140915Joseph DavidsonNoch keine Bewertungen

- Northern Star Resources LTD: More +KG/T Intercepts Into Voyager Lodes, PaulsensDokument6 SeitenNorthern Star Resources LTD: More +KG/T Intercepts Into Voyager Lodes, Paulsenschrisb700Noch keine Bewertungen

- UraniumDokument11 SeitenUraniumSoren K. GroupNoch keine Bewertungen

- DEFCON 2: TRR Moves Closer To A "War Footing" On Iran Concerns - Buying OilsDokument34 SeitenDEFCON 2: TRR Moves Closer To A "War Footing" On Iran Concerns - Buying OilsNathan MartinNoch keine Bewertungen

- GLOBALATOMIC SPU Oct2019Dokument8 SeitenGLOBALATOMIC SPU Oct2019mushava nyokaNoch keine Bewertungen

- Due Diligence ReportDokument139 SeitenDue Diligence Reportkamara100% (1)

- Heron Resources Limited 2015Dokument34 SeitenHeron Resources Limited 2015Yojan Ccoa CcopaNoch keine Bewertungen

- October 2011: Corporate PresentationDokument23 SeitenOctober 2011: Corporate PresentationarzoorathiNoch keine Bewertungen

- Earth Wars: The Battle for Global ResourcesVon EverandEarth Wars: The Battle for Global ResourcesBewertung: 4 von 5 Sternen4/5 (2)

- UPMDokument6 SeitenUPMHarold Kent HerediaNoch keine Bewertungen

- Lincoln Crowne Copper Gold Report 20131125Dokument4 SeitenLincoln Crowne Copper Gold Report 20131125Lincoln Crowne & CompanyNoch keine Bewertungen

- Nuclear Glossary DictionaryDokument74 SeitenNuclear Glossary DictionaryAriful Islam PrantoNoch keine Bewertungen

- Cannacord - RKHDokument17 SeitenCannacord - RKHShane ChambersNoch keine Bewertungen

- TAG Initiating Coverage - 20111003 CasimirDokument17 SeitenTAG Initiating Coverage - 20111003 CasimirmpgervetNoch keine Bewertungen

- The Big Uranium Short (Age) : The Best Entry Point of The CycleDokument8 SeitenThe Big Uranium Short (Age) : The Best Entry Point of The CycleLong HuynhNoch keine Bewertungen

- YNG Hall Gar Ten and Company Oct11Dokument24 SeitenYNG Hall Gar Ten and Company Oct11Mariusz SkoniecznyNoch keine Bewertungen

- Industry Thrown Into Turmoil: Oil & GasDokument4 SeitenIndustry Thrown Into Turmoil: Oil & GasAnkit GuptaNoch keine Bewertungen

- ME 428 Nuclear Reactor Engineering Term Project Mechanical Engineering Department MetuDokument11 SeitenME 428 Nuclear Reactor Engineering Term Project Mechanical Engineering Department Metuqyilmazoglu100% (1)

- Daily Report 20141104Dokument3 SeitenDaily Report 20141104Joseph DavidsonNoch keine Bewertungen

- GEO ExPro V8i5 Full PDFDokument88 SeitenGEO ExPro V8i5 Full PDFAl MartinNoch keine Bewertungen

- 4aaca066 Af7Dokument11 Seiten4aaca066 Af7freNoch keine Bewertungen

- Energy Services - Off Shore Oil & Gas Drilling: Henry Fund ResearchDokument10 SeitenEnergy Services - Off Shore Oil & Gas Drilling: Henry Fund ResearchPraveen KumarNoch keine Bewertungen

- OpecDokument26 SeitenOpecapi-287148829Noch keine Bewertungen

- 18 Share Tips - 22 November 2021Dokument32 Seiten18 Share Tips - 22 November 2021FrankNoch keine Bewertungen

- Ambrian Gold Book - 2011Dokument56 SeitenAmbrian Gold Book - 2011gpperkNoch keine Bewertungen

- Dacha Strategiv Metals Aug 2011 PresentationDokument26 SeitenDacha Strategiv Metals Aug 2011 PresentationOld School ValueNoch keine Bewertungen

- An Original Research Paper To Be SubmittDokument21 SeitenAn Original Research Paper To Be Submittshifara TesfayeNoch keine Bewertungen

- AVALON Corporate PresentationDokument16 SeitenAVALON Corporate PresentationJupiter ZaoltNoch keine Bewertungen

- LynasDokument37 SeitenLynasAkmal AminovNoch keine Bewertungen

- 2011 AQP Annual Report v2Dokument127 Seiten2011 AQP Annual Report v2djokosNoch keine Bewertungen

- GEO ExPro V12i5 PDFDokument104 SeitenGEO ExPro V12i5 PDFMark MaoNoch keine Bewertungen

- Copper Market PrimerDokument206 SeitenCopper Market Primeruser1218210% (1)

- Japan's Current Nuclear Energy PolicyDokument35 SeitenJapan's Current Nuclear Energy PolicyJoe BacchusNoch keine Bewertungen

- WLC Presentation - Oct 28 WebsiteDokument19 SeitenWLC Presentation - Oct 28 WebsitehengkimyongNoch keine Bewertungen

- Global Coal Risk AssessmentDokument76 SeitenGlobal Coal Risk AssessmentEnergiemediaNoch keine Bewertungen

- Natural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightDokument10 SeitenNatural Gas/ Power News: Africa's East Coast in Natural-Gas SpotlightchoiceenergyNoch keine Bewertungen

- Energy Resources of PakistanDokument13 SeitenEnergy Resources of Pakistanjawad009100% (2)

- Nuclear Energy Policy: Mark HoltDokument37 SeitenNuclear Energy Policy: Mark Holtep2175Noch keine Bewertungen

- Sub258 - Simon Holmes A CourtDokument6 SeitenSub258 - Simon Holmes A Courtsimon100% (1)

- Calytrix Consulting Pty LTD - Uranium Exploration - Safety, Environmental, Social and Regulatory ConsiderationsDokument78 SeitenCalytrix Consulting Pty LTD - Uranium Exploration - Safety, Environmental, Social and Regulatory Considerationsj李枂洙Noch keine Bewertungen

- Natural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberDokument9 SeitenNatural Gas/ Power News: Spot Natural Gas Prices Dipped To Two-Year Low in NovemberchoiceenergyNoch keine Bewertungen

- Scotia CapitalDokument86 SeitenScotia CapitalBiswa1983100% (1)

- ERGI Toolkit Executive ReportDokument32 SeitenERGI Toolkit Executive ReportEnith SifuentesNoch keine Bewertungen

- Ol18-1 Opgw Layout Drawing and Specifications: Total E&P Yemen Kharir Power Plant ProjectDokument32 SeitenOl18-1 Opgw Layout Drawing and Specifications: Total E&P Yemen Kharir Power Plant ProjectSaber AbdelaalNoch keine Bewertungen

- Advanced Uranium Explorer in The Athabasca Basin, Canada: Investment RationaleDokument34 SeitenAdvanced Uranium Explorer in The Athabasca Basin, Canada: Investment RationalekaiselkNoch keine Bewertungen

- Battery Test Centre: Report 4Dokument23 SeitenBattery Test Centre: Report 4Muhammad HazihNoch keine Bewertungen

- 2012 & Beyond:State-of-the-Art Radiation Monitoring Systems For Nuclear Power Plants and Accelerators - White PaperDokument14 Seiten2012 & Beyond:State-of-the-Art Radiation Monitoring Systems For Nuclear Power Plants and Accelerators - White PaperPennyNoch keine Bewertungen

- Listado de M&ADokument16 SeitenListado de M&Ajulioramos1Noch keine Bewertungen

- Energy: A Global Outlook: The Case for Effective International Co-operationVon EverandEnergy: A Global Outlook: The Case for Effective International Co-operationNoch keine Bewertungen

- Energy And Environmental Hedge Funds: The New Investment ParadigmVon EverandEnergy And Environmental Hedge Funds: The New Investment ParadigmBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Europe's Nuclear Power Experiment: History of the OECD Dragon ProjectVon EverandEurope's Nuclear Power Experiment: History of the OECD Dragon ProjectNoch keine Bewertungen

- Watts in the Desert: Pioneering Solar Farming in Australia's OutbackVon EverandWatts in the Desert: Pioneering Solar Farming in Australia's OutbackNoch keine Bewertungen

- Nuclear or Not?: Choices for Our Energy FutureVon EverandNuclear or Not?: Choices for Our Energy FutureGerald FoleyNoch keine Bewertungen

- Solartech Solar Pumping System BrochureDokument32 SeitenSolartech Solar Pumping System BrochureShelly SantiagoNoch keine Bewertungen

- Excitation Systems: Expert Course Faculty LeaderDokument5 SeitenExcitation Systems: Expert Course Faculty Leaderevonik1234560% (1)

- Advance Power SystemsDokument88 SeitenAdvance Power SystemsRachit KhannaNoch keine Bewertungen

- 5 4 General Sco Rotterdam Port Azerbaijan Origin Wtig OriginalDokument3 Seiten5 4 General Sco Rotterdam Port Azerbaijan Origin Wtig OriginalHongdangNoch keine Bewertungen

- Osage1 Project Prospectus LowResDokument36 SeitenOsage1 Project Prospectus LowReshung_hathe100% (1)

- Recruitment and Selection ProcessDokument119 SeitenRecruitment and Selection ProcessAlin Iustinian Toderita100% (1)

- EU CodeDokument34 SeitenEU CodeVan CaoNoch keine Bewertungen

- Bgrim Oppday 2q2021Dokument77 SeitenBgrim Oppday 2q2021faroukaliasNoch keine Bewertungen

- 32-4-3 - Social ScienceDokument19 Seiten32-4-3 - Social Sciencestudygirl03Noch keine Bewertungen

- Teoria ACVDokument11 SeitenTeoria ACVMarcelo Weihmayr da SilvaNoch keine Bewertungen

- Princeton - 0311 PDFDokument20 SeitenPrinceton - 0311 PDFelauwitNoch keine Bewertungen

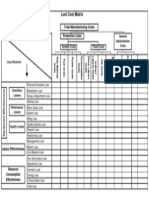

- Lost Cost Matrix: Total Manufacturing CostsDokument1 SeiteLost Cost Matrix: Total Manufacturing CostsMadhan KumarNoch keine Bewertungen

- Annual Report11 12Dokument160 SeitenAnnual Report11 12Jenifer KaraiNoch keine Bewertungen

- Case Analysis ON: Initial Public Offering OF BGR Energy SystemsDokument16 SeitenCase Analysis ON: Initial Public Offering OF BGR Energy SystemsmanojpuruNoch keine Bewertungen

- M&a ReportDokument10 SeitenM&a ReportTiffany SandjongNoch keine Bewertungen

- Segmenting The Energy Market: Problems and SuccessesDokument13 SeitenSegmenting The Energy Market: Problems and SuccessesNaveen AmarasingheNoch keine Bewertungen

- Features: High Burden Hand / Electrical Reset Trip & Lockout RelayDokument4 SeitenFeatures: High Burden Hand / Electrical Reset Trip & Lockout RelayDon on ScribeNoch keine Bewertungen

- Grove GMK 4075 BrochureDokument22 SeitenGrove GMK 4075 Brochurejpablop12100% (2)

- EC HARRIS OIL, GAS & CHEMICALS WORK ACTIVITY NORMS HANBOOK Versión 1 (ARCADIS)Dokument34 SeitenEC HARRIS OIL, GAS & CHEMICALS WORK ACTIVITY NORMS HANBOOK Versión 1 (ARCADIS)laumartinez894069Noch keine Bewertungen

- Generator VibrationDokument4 SeitenGenerator VibrationsatyandaruNoch keine Bewertungen

- Competitive Performance Summary: Emissions Capable Tolerance of Associated Gas Warranty Global Product SupportDokument5 SeitenCompetitive Performance Summary: Emissions Capable Tolerance of Associated Gas Warranty Global Product SupportالمهندسوليدالطويلNoch keine Bewertungen

- Generation Subsystem Transmission Subsystem Distribution SubsystemDokument14 SeitenGeneration Subsystem Transmission Subsystem Distribution SubsystemMohammed Hammad RizviNoch keine Bewertungen

- Monthly CFC HSE Committee Meeting (April)Dokument3 SeitenMonthly CFC HSE Committee Meeting (April)Htoo Htoo KyawNoch keine Bewertungen

- Vahterus Esite enDokument8 SeitenVahterus Esite enJohan ConradieNoch keine Bewertungen

- Bee Sme SchemeDokument9 SeitenBee Sme SchemeFaris Khairul ArifinNoch keine Bewertungen

- Automation of Petrol StationsDokument27 SeitenAutomation of Petrol StationsTechnotrade100% (2)

- Offshore Wind Ports StatementDokument14 SeitenOffshore Wind Ports StatementSara Brito100% (2)

- Electricity Distribution - An Industry AnalysisDokument13 SeitenElectricity Distribution - An Industry AnalysisSagnik SharangiNoch keine Bewertungen

- EY Natural Gas Pricing in IndiaDokument12 SeitenEY Natural Gas Pricing in IndianessfernNoch keine Bewertungen

- Physics Exercise 5Dokument26 SeitenPhysics Exercise 5Law Jing SeeNoch keine Bewertungen