Beruflich Dokumente

Kultur Dokumente

Com Nigeria - Mending Project Finance

Hochgeladen von

Macdonald 'Tuneweaver' EzekweOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Com Nigeria - Mending Project Finance

Hochgeladen von

Macdonald 'Tuneweaver' EzekweCopyright:

Verfügbare Formate

allAfrica.

com: Nigeria: Mending Project Finance

http://allafrica.com/stories/printable/201009280976.html

HOME

South Africa Safari Tailormade safaris to South Africa Luxury camps, expert private guides

www.safari.co.uk

Children & Reading The Latest Monitor Report on Children's Media Use & Purchasing

www.childwise.co.uk

Are you a dream teacher? Jamie Oliver and YouTube want to hear from you. Win 10k!

www.youtube.com/dreamteachers

TradeInvest (Nigeria)

Nigeria: Mending Project Finance

Nelly Nyagah

Recommend

ANALYSIS

28 September 2010

Be the first of your friends to recommend this.

Everyone agrees Nigeria is a market that no investor can afford to ignore, yet the federal government is facing a monumental task trying to attract adequate financing that is needed for critical projects particularly in infrastructure. TradeInvestNigeria looks at why most emerging markets investors are reluctant to put their money in Nigeria even though trends show there are considerable potential rewards for investing in the country. Urgent investments in a reliable energy source and infrastructure are the key to unlocking Nigeria's ambitious goal to be among the world's top-20 leading economies by 2020, and to cope with the ever-growing consumer base and unexploited natural resources. This provides profitable opportunities to investors. To meet this goal, Nigeria targets an additional 40 000Mw of electricity, which will require investments in power-generating capacity alone of at least US$3.5-billion per annum for the next 10 years. This is according to the recently launched 'Roadmap for Power Sector Reform'. The paper further states that corresponding large investments will also have to be made in the other parts of the supply chain (the fuel-to-power infrastructure and the power transmission and distribution networks). Launching the power strategy to business leaders and investors in Lagos in August, President Goodluck Jonathan confessed: 'A friend of mine jokingly asked me: Can Nigeria celebrate one day of continuous (uninterrupted) power supply? Then I answered: By God's grace by December 2012, Nigeria will not just celebrate one day, but one week, one month, and even better. It's actually with that vision and mission that we are here today to launch the Roadmap for Power Sector Reform.' This ambitious programme shall require financing. Many foreign investors have shown interest in investing, yet the Nigerian government continues to face an uphill task in trying to draw some of that financing. So why are financiers stuck at 'the mulling stage' despite the considerable potential benefits of investing in the country? 'Inasmuch as Nigeria is replete with investment opportunities, the investment environment needs to be more favourable for potential financiers. Problems associated with infrastructure, power, legal recourse, policy instability, management expertise and integrity all add a considerable risk premium to any potential financier's terms,' says Akinseye Akinola, an analyst with private equity firm Emerging Capital Partners (ECP), a firm that has raised more than $1.8-billion for investment in companies across Africa. There is still a certain level of regulatory and legislative uncertainty in many sectors of the economy. Even the oil and gas industry, which has been the main area of investment, is undergoing a period of uncertainty with the Petroleum Industry Bill in the process of being enacted, and the passage of the Local Content Act. All these issues, in addition to the fact that Nigeria is due to hold a general election next year, worry investors. Should there be change in the political leadership, would the new administration continue with the reforms initiated by the current leadership? The global financial crisis and the crisis in Nigeria's banking industry are also factors that have impacted on the country's undeveloped project finance market. 'One of the effects of the global financial meltdown has been that many financiers are taking a ''wait and see'' stance in relation to projects' financing. The meltdown in the banking and capital- market sectors of the economy has also contributed to the lack of confidence in the market,' says Lawrence Fubara, a managing partner at Nigeria-based law firm Aelex, which has considerable experience in project finance, banking and capital-markets transactions. Periodic sovereign ratings issued by the credit rating agencies are another major influence on the mind of investors. Nigeria was rated a BB- by Fitch and a B+ by Standard and Poor's in April this year. The agencies assess how likely a borrower is able to repay debt and are a reference for investors conducting due diligence on potential projects especially in high risk markets. 'The BB- and B+ ratings fall into the lowest category of sovereign debt ratings and gives Nigeria a ''speculative'' investment grade,' says Fubara. Un-bankable projects Financiers who attended a conference on the continent's power sector in March said red tape and lack of well-structured projects, rather than external funding crimped by the global downturn, are the main hurdles to boosting capacity in Africa's power sector. Like in Nigeria, most of sub-Saharan Africa is battling acute power shortages as governments fail to attract the necessary investment to upgrade grids and build new infrastructure, despite the huge resources of coal, uranium, hydro and other renewable energy sources, which if exploited could see to sustained growth. According to David Donaldson, senior manager for infrastructure at the International Finance Corporation (IFC), the problem isn't and has never been finance. 'If you have a decent, bankable project in the power sector you will be able to get the finance.'

Create PDF files without this message by purchasing novaPDF printer (http://www.novapdf.com) 1 of 3

17/03/2011 23:06

allAfrica.com: Nigeria: Mending Project Finance

http://allafrica.com/stories/printable/201009280976.html

IFC, the World Bank's private sector lending arm, has committed financing to more than 70 projects in Nigeria, amounting to $3-billion from 1964 up until June 2010. Nigeria is the lender's second-largest portfolio in Africa, after South Africa, and its strategy there is to increase investments and advisory services to promote the real sectors of the economy, with a focus on infrastructure, finance and agribusiness. The World Bank's view that the principal problem when it comes to attracting adequate financing for infrastructure and power projects in Africa is the lack of bankable projects with a world-class regulatory and financial framework, rings true for Nigeria. 'Generally, the bankability of projects is negatively affected by the ''speculative'' investment environment of Nigeria. In particular, the failure of project proponents to demonstrate the requisite expertise and experience to execute the projects and the inability to demonstrate efficient risk -mitigation strategies in the event that any problems arise in the course of executing the project, are all factors that slow down the flow of project finance into the country,' says Fubara. 'One must also consider the weakness of Nigerian banks as a contributing factor to the shortage of bankable projects. The process of developing these kind of projects can be very complex, and the skills required to develop such projects remain in short supply,' concurs Julian Jackson, a co-founder of Africa Legal, the specialised legal division of South African law firm Deneys Reitz. Africa Legal provides an extensive range of legal services to investors in Africa. Nigeria received $11-billion in foreign direct investment in 2009. However, most of it was to the oil, gas and telecommunications sectors, which collectively contribute only a fifth of Nigeria's growth domestic product (GDP). 'Capital is dynamic and will flow to where the best risk-adjusted regional opportunities are. If the environment is not favourable, no matter the potential, capital will not be allocated there. Investors want to be sure that contracts will be honoured, regulations will not be ignored, and policies will not be routinely reversed. The issue of bankability of projects I believe is less with the operational performance of the companies, but more so the operating environment within which they operate,' adds Akinola. Current trends The prevalent trends in the project financing market appear to be financing select deals, with equity capital involved, with various guarantees and off-take revenues mitigating the market risks. Although last year's intervention for the banking sector by the Central Bank of Nigeria (CBN) made Nigerian banks quite risk-adverse, they are beginning to look at new deals, especially where proper risk mitigation can be implemented. 'For equity investors, there are a number of good companies trading at distressed or undervalued prices, but I think the key would be to find opportunities with the right management and market-driven sponsors. Also, there is a measure of caution on the investors' side as they wait for the new reformist policies to take effect, and seek clarity on what the political landscape will be like in the coming year,' says Akinola. The trend in the past has been to lend to 'quick win' sectors such as telecommunications and the downstream oil sector because of the shorter gestation period and potential for quick high yields. A typical power plant or road concession project would on the other hand require a longer period to mature. Another reason telecommunications has attracted financing is because of the deliberate effort to liberalise the sector. The result has been a competitive, efficient and lucrative investing space. Says Fubara: 'The lessons of the market meltdown and the not-too-pleasant experience of the financial institutions have contributed to reverse the trend of lending to the "quick win" sectors in Nigeria. For example, Nigerian banks were reported to have suffered great losses from the meltdown with about N6-billion trapped in margin loans and investments in the downstream oil sector.' According to Aelex, Nigeria is beginning to witness significant activity in sectors such as power and infrastructure. Investors generally appear to be waiting to see a clearer regulatory landscape, and local investors are also waiting to see a stable banking sector, which will be more willing to finance projects. 'The bond issue market is also witnessing increased activity with most state governments resorting to this financial instrument to fund their capital infrastructural projects. According to statistics released by the Nigeria Stock Exchange (NSE), about N108-billion has been raised by the states in the last few years,' adds Fubara. Extending measures that have transformed the telecommunications sector to other sectors of the economy will attract potential financiers to competent players. There are signs the federal government wants to move in this direction going by the recent developments in the power sector. The Roadmap for Power Sector Reform is expected to among other things drive the liberalisation and privatisation of state-run distribution companies, concessioning of the transmission grid and creation of a new grid, establishment of a credit-worthy off-taker, adjustment of the pricing regime to accommodate producer costs and guarantee fiscal incentives to Independent Power Producers (IPPs). The existing low tariffs and enforcing Power Purchase Agreements (PPAs) are thorny issues for investors because they undermine appropriate return on investment, including the cost of the necessary maintenance. 'The fundamental issue remains that if, at the end of the chain, users are paying less for electricity than it can conceivably cost to deliver to them, then that's a problem that can't go away,' says Donaldson. CBN governor Lamido Sanusi is among the vocal advocates calling for a hike in the price of electricity to N22 from the current N7 per kilowatt hour, saying the current pricing is unrealistic and discourages investment. 'If you don't have electricity you cannot attract investors and you cannot improve production. We don't have power because the reforms that ought to have been carried out in four years have not been done. We keep talking and talking and we have not yet created the right environment... The reality is that government is not pursuing the right economic policies and nothing in the banking reform will fix the economy unless you fix policy, and I say this as an adviser to the government,' said Sanusi.

Create PDF files without this message by purchasing novaPDF printer (http://www.novapdf.com) 2 of 3

17/03/2011 23:06

allAfrica.com: Nigeria: Mending Project Finance

http://allafrica.com/stories/printable/201009280976.html

The power sector has been without a regulator for two years following the suspension of the Nigerian Electricity Regulatory Agency (NERC). 'The absence of a properly constituted regulator is a real problem. The board of the NERC is in the process of being re-constituted and once this process has been completed, it may help eliminate one major source of uncertainty,' says Jackson. While development institutions have their role to play in Nigeria's infrastructure development landscape, they cannot fill the funding gap and in any case such finance does not bring with it the financial discipline to project implementers that private sector capital does. Private investment also ensures complete projects are maintained. Private sector participation The federal government has been very welcoming to the private sector with the aim of building a strong relationship that can anchor the development of among other drivers, a solid public - private partnership (PPP) market. The opportunities for PPPs are enormous and span every sector of the Nigerian economy. The states have employed private finance initiatives in infrastructure development even more than the federal government. 'The Nigerian PPP market could be very attractive and what matters right now is that projects are made attractive to international investors, lenders and construction companies. These international PPP players should be encouraged to regard Nigerian projects as being relatively more attractive than other projects elsewhere in the world,' says Anthony Sykes, a director at the International Project Finance Association (IPFA), in an interview with Nigeria-based Vanguard newspaper. IPFA promotes and represents the interests of private-sector companies involved in project finance and PPPs throughout the world. 'Nigeria faces a big challenge to compete with the rest of the world, to attract the attention of investors, sponsors and lenders and that's where the IPFA is trying to help. We are able to help Nigeria to make its projects more bankable, more suitable and attractive to international investors,' says Sykes.

Recommend Be the first of your friends to recommend this.

Copyright 2010 TradeInvest. All rights reserved. Distributed by AllAfrica Global Media (allAfrica.com). AllAfrica - All the Time

Create PDF files without this message by purchasing novaPDF printer (http://www.novapdf.com) 3 of 3

17/03/2011 23:06

Das könnte Ihnen auch gefallen

- Private Equity Case Study Presentation TemplateDokument20 SeitenPrivate Equity Case Study Presentation TemplateMacdonald 'Tuneweaver' EzekweNoch keine Bewertungen

- Wall Street Ledger Guyduport InterviewDokument4 SeitenWall Street Ledger Guyduport InterviewMacdonald 'Tuneweaver' EzekweNoch keine Bewertungen

- Danske Daily: Key NewsDokument5 SeitenDanske Daily: Key NewsMacdonald 'Tuneweaver' EzekweNoch keine Bewertungen

- Danske Daily: Key NewsDokument5 SeitenDanske Daily: Key NewsMacdonald 'Tuneweaver' EzekweNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Sports TourismDokument14 SeitenSports TourismJaipurnetNoch keine Bewertungen

- Ma Notes PDFDokument17 SeitenMa Notes PDFrupaliNoch keine Bewertungen

- Mohd Arbaaz Khan Digital Marketing UAEDokument2 SeitenMohd Arbaaz Khan Digital Marketing UAEArbaaz KhanNoch keine Bewertungen

- Xacc280 Chapter 2Dokument46 SeitenXacc280 Chapter 2jdcirbo100% (1)

- Affordable Lawn Care Financial StatementsDokument8 SeitenAffordable Lawn Care Financial StatementsTabish TabishNoch keine Bewertungen

- Banking Reforms in IndiaDokument6 SeitenBanking Reforms in IndiaChaitanya Athyala0% (1)

- Customs Unions and Free Trade AreasDokument6 SeitenCustoms Unions and Free Trade AreasÖzer AksoyNoch keine Bewertungen

- Hidden Costof Quality AReviewDokument21 SeitenHidden Costof Quality AReviewmghili2002Noch keine Bewertungen

- 9708 w14 Ms 21 PDFDokument7 Seiten9708 w14 Ms 21 PDFTan Chen Wui0% (1)

- Mps international Class 11 business studies CASE STUDIESDokument7 SeitenMps international Class 11 business studies CASE STUDIESRaghav Kanoongo100% (1)

- SIBL FinalDokument24 SeitenSIBL FinalAsiburRahmanNoch keine Bewertungen

- Mgnm581:Organizational Behaviour and Human Resource Dynamics-IDokument2 SeitenMgnm581:Organizational Behaviour and Human Resource Dynamics-IsudhaNoch keine Bewertungen

- Lion Dates PDFDokument20 SeitenLion Dates PDFIKRAMULLAHNoch keine Bewertungen

- Gmail - Exciting Roles Available at One Finserv Careers!Dokument8 SeitenGmail - Exciting Roles Available at One Finserv Careers!Arif KhanNoch keine Bewertungen

- Chapter 6 B629Dokument60 SeitenChapter 6 B629Ahmed DahiNoch keine Bewertungen

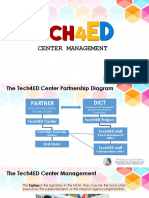

- BCMT Module 3 - Tech4ED Center ManagementDokument46 SeitenBCMT Module 3 - Tech4ED Center ManagementCabaluay NHSNoch keine Bewertungen

- Kool King DivisionDokument6 SeitenKool King DivisionAkhil GoyalNoch keine Bewertungen

- Group 8 Risk ManagementDokument22 SeitenGroup 8 Risk ManagementStephen OlufekoNoch keine Bewertungen

- 18MEC207T - Unit 5 - Rev - W13Dokument52 Seiten18MEC207T - Unit 5 - Rev - W13Asvath GuruNoch keine Bewertungen

- Module 5Dokument28 SeitenModule 5nucleya nxsNoch keine Bewertungen

- Enterprise Structure OverviewDokument5 SeitenEnterprise Structure OverviewAnonymous 7CVuZbInUNoch keine Bewertungen

- Unit 3-Strategy Formulation and Strategic Choices: Group MemberDokument12 SeitenUnit 3-Strategy Formulation and Strategic Choices: Group MemberBaken D DhungyelNoch keine Bewertungen

- Syllabus PGDERPDokument6 SeitenSyllabus PGDERPAsif Ali H100% (1)

- Agency and Mortgage Lecture NotesDokument13 SeitenAgency and Mortgage Lecture NotesNA Nanorac JDNoch keine Bewertungen

- The Digital Project Manager Communication Plan ExampleDokument2 SeitenThe Digital Project Manager Communication Plan ExampleHoney Oliveros100% (1)

- Commercial Excellence Your Path To GrowthDokument6 SeitenCommercial Excellence Your Path To GrowthBiswajeet PattnaikNoch keine Bewertungen

- Aastha Sharma CVDokument1 SeiteAastha Sharma CVaasthaNoch keine Bewertungen

- Factors Influencing Market and Entry Mode Selection PDFDokument11 SeitenFactors Influencing Market and Entry Mode Selection PDFPaula ManiosNoch keine Bewertungen

- Strategic Leadership - CinnamonDokument24 SeitenStrategic Leadership - Cinnamonaseni herathNoch keine Bewertungen

- ADAPTING HAIER'S PERFORMANCE MANAGEMENTDokument9 SeitenADAPTING HAIER'S PERFORMANCE MANAGEMENTsanthosh_annamNoch keine Bewertungen