Beruflich Dokumente

Kultur Dokumente

Cost Accounting 2

Hochgeladen von

Freddy Savio D'souzaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cost Accounting 2

Hochgeladen von

Freddy Savio D'souzaCopyright:

Verfügbare Formate

COST ACCOUNTING

CONTRACT COSTING

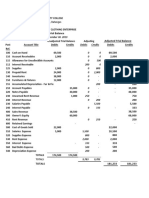

Illustration 1: On 31st October, 2003, A undertook a Contract No.786 for Rs.2,00,000. The following information is available in respect of this contract for the accounting year ended 31.12.2003. Rs. Work Certified Wages paid Materials supplied Other expenses Plant supplied on 1-10-2003 Uncertified work Materials unused lying at site Wages due but not paid Provide 10% depreciation on plant. Prepare Contract Account in the books of A. Illustration 2: M/s. Baiju & Co. undertook a contract for Rs.2,80,000 for constructing a building. The following is the information concerning the contract during the year 2003. Rs. Materials sent on site 84,786 Labour engaged on site 74,152 Plant installed at site at cost 15,000 Direct expenditure 3,201 Other charges 4,878 Materials returned to stores 552 Work certified 1,95,000 Value of plant as on 31st December 2003 11,000 Cost of work not yet certified 4,500 Materials at site 31.12.2003 1,880 Wages accrued 31.12.2003 2,400 Direct expenditure accrued 31.12.2003 240 Cash received from contractee 1,80,000 Prepare contract account in the books of m/s. Baiju & Co. for the year ending 31.12.2003. 40,000 15,000 20,000 3,000 20,000 1,000 800 600

Illustration 3 A railway contractor makes up his accounts to 31st march. Contract No.SER/14 for constructing a culvert between Bhilai and Rajpur commenced on 1st July 2003. The costing records yield the following information at 31.03.2004. Materials charged out to site 31,540 Labour 75,300 Sundry expenses 11,700 A machine costing Rs.25,000 has been on the site for 73 days. Its working life is estimated at 5 years & its final scrap value at Rs.1,000.a supervisor, who is paid Rs. 18,000 per annum, has spent approximately charges amount to Rs. 17,000. Materials in stores at site at the end of the year cost Rs. 2,500. The contract price is Rs. 3,00,000. At the end of the year 2/3rd of the contract was completed, for which the Architects Certificate has been issued & Rs. 1,60,000 have so far been received on account. Prepare Contract Account showing profit or loss to included in respect of this contract in the financial accounts to 31.03.2004 Illustration 4: A firm tendered for a contract putting in a tender price of Rs. 25,00,000. After mutual discussions the price tendered was reduced by 20% & the firm started work on the contract on 1st Jan, 2003. The following information is available for the year ending 31.12.2003. Rs. Material purchased for contract 5,00,000 Stores & spares consumed 45,000 Wages 2,64,000 Plant & Machnery 1,20,000 Overhead expenses 51,000 Stock of materials 31.12.2003 25,000 st The machinery was purchased on 1 April 2003. It has a working life of 5 years & its scrap value has been estimated at Rs. 20,000. By 31.12.2003 the contractor had received Rs. 8,00,000 which represented 80% of the value of work certified on 15th Dec,2003. Expenses incurred after 15.12.2003 upto 31.12.2003 were as follows: 1. Materials Rs. 12,000. 2. Wages Rs. 11,000. 3. Overhead expenses Rs. 7,000. Prepare the Contract Accounting showing the calculation of the profit if any to be taken credit for.

Illustration 5: The following is the summary of the entries in a Contract Ledger as on 31.12.2003 in respect of Contract No.51: Rs. Materials ( direct ) 60,000 Materials ( from stores) 13,000 Wages 64,600 Direct expenses 13,400 Establishment charges 16,000 Plant 68,400 Sale of scrap 3,640 Sub-contract cost 14,400 You are given the following information: 1. Accruals on 31.12.2003 are: Wages Rs. 1,600 & Direct Expenses Rs. 2,200. 2. Depr. on plant upto 31.12.2003 is Rs. 17,100 3. Included in the above summary of abstract are wages Rs. 2,000 & other expenses Rs. 3,000 since certification. The value of the material used since certification I Rs. 4,160. 4. Materials on site on 31.12.2003 cost Rs. 20,000. 5. Work certified was Rs 1,25,000. Prepare Contract Account No.51 % show that profit or loss should be taken into account for the year ended on 31.12.2003.

Das könnte Ihnen auch gefallen

- Problems On Contract CostingDokument11 SeitenProblems On Contract CostingRoguewolfx VFX50% (2)

- Contarct CostingDokument13 SeitenContarct CostingBuddhadev NathNoch keine Bewertungen

- Contract Costing (Unsolved)Dokument6 SeitenContract Costing (Unsolved)ArnavNoch keine Bewertungen

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDokument13 SeitenGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNoch keine Bewertungen

- Chapter 11 Hire Purchase and Instalment Sale Transactions PDFDokument52 SeitenChapter 11 Hire Purchase and Instalment Sale Transactions PDFEswari GkNoch keine Bewertungen

- Cost Acc Nov06Dokument27 SeitenCost Acc Nov06api-3825774100% (1)

- Chapter 22 Contract Costing - NoRestrictionDokument18 SeitenChapter 22 Contract Costing - NoRestrictionMohammad SaadmanNoch keine Bewertungen

- Branch AccountsDokument12 SeitenBranch AccountsRobert Henson100% (1)

- Royalty AccountsDokument5 SeitenRoyalty AccountsRobert Henson100% (2)

- Hire Purchase Notes 10 YrDokument80 SeitenHire Purchase Notes 10 YrLalitKukreja100% (2)

- Job CostingDokument18 SeitenJob CostingBiswajeet DashNoch keine Bewertungen

- Cost Sheet ProblemsDokument2 SeitenCost Sheet ProblemsPridhvi Raj ReddyNoch keine Bewertungen

- 02 Per. Invest 26-30Dokument5 Seiten02 Per. Invest 26-30Ritu SahaniNoch keine Bewertungen

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDokument11 SeitenSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- Cost Sheet - Pages 16Dokument16 SeitenCost Sheet - Pages 16omikron omNoch keine Bewertungen

- Chapter 8 Operating CostingDokument13 SeitenChapter 8 Operating CostingDerrick LewisNoch keine Bewertungen

- As-2 Inventory Valuation: 1) IntroductionDokument17 SeitenAs-2 Inventory Valuation: 1) IntroductionDipen AdhikariNoch keine Bewertungen

- 7948final Adv Acc Nov05Dokument16 Seiten7948final Adv Acc Nov05Kushan MistryNoch keine Bewertungen

- Study Note 4.3, Page 198-263Dokument66 SeitenStudy Note 4.3, Page 198-263s4sahithNoch keine Bewertungen

- Royalty AccountsDokument11 SeitenRoyalty AccountsVipin Mandyam Kadubi0% (1)

- Chapter 2 Hire Purchase & Installment SystemDokument26 SeitenChapter 2 Hire Purchase & Installment SystemSuku Thomas Samuel100% (1)

- Hire Purchase Short NotesDokument26 SeitenHire Purchase Short NotesULTIMATE FACTS HINDINoch keine Bewertungen

- 5 6084915055709651012Dokument8 Seiten5 6084915055709651012Ajit Yadav100% (1)

- Operating Costing - Pages 32Dokument32 SeitenOperating Costing - Pages 32omikron omNoch keine Bewertungen

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDokument158 SeitenRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.Noch keine Bewertungen

- 13 17227rtp Ipcc Nov09 Paper3aDokument24 Seiten13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNoch keine Bewertungen

- Branch AccountsDokument57 SeitenBranch Accountsasadqhse50% (2)

- Costing AssignmentDokument15 SeitenCosting AssignmentSumit SumanNoch keine Bewertungen

- Income From House PropertyDokument26 SeitenIncome From House PropertySuyash Patwa100% (1)

- Foreign Currency QuestionsDokument2 SeitenForeign Currency QuestionsAbhijeetNoch keine Bewertungen

- Cost Sheet PDF - 20210623 - 142101Dokument10 SeitenCost Sheet PDF - 20210623 - 142101Raju Lal100% (1)

- Fin Account-Sole Trading AnswersDokument10 SeitenFin Account-Sole Trading AnswersAR Ananth Rohith BhatNoch keine Bewertungen

- Income From Other Sources IllustrationDokument5 SeitenIncome From Other Sources IllustrationSarvar PathanNoch keine Bewertungen

- Study Note 3, Page 114-142Dokument29 SeitenStudy Note 3, Page 114-142s4sahithNoch keine Bewertungen

- Capinew Account June13Dokument7 SeitenCapinew Account June13ashwinNoch keine Bewertungen

- Coc Departmental Accounting Ca/Cma Santosh KumarDokument11 SeitenCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNoch keine Bewertungen

- 5 6168179598107345065Dokument14 Seiten5 6168179598107345065Madhan Aadhvick0% (1)

- 19732ipcc CA Vol2 Cp3Dokument43 Seiten19732ipcc CA Vol2 Cp3PALADUGU MOUNIKANoch keine Bewertungen

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDokument61 SeitenChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNoch keine Bewertungen

- 6 - As-16 Borrowing CostsDokument15 Seiten6 - As-16 Borrowing CostsKrishna JhaNoch keine Bewertungen

- Unit - V Budget and Budgetary Control ProblemsDokument2 SeitenUnit - V Budget and Budgetary Control ProblemsalexanderNoch keine Bewertungen

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentDokument17 Seiten18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiNoch keine Bewertungen

- Chapter 12 Service CostingDokument3 SeitenChapter 12 Service CostingMS Raju100% (1)

- Course Name: 2T7 - Cost AccountingDokument56 SeitenCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- UNIT 3 Income From House PropertyDokument104 SeitenUNIT 3 Income From House Propertydob BoysNoch keine Bewertungen

- Business & Profession Q - A 02.9.2020Dokument42 SeitenBusiness & Profession Q - A 02.9.2020shyamiliNoch keine Bewertungen

- Hire PurchaseDokument6 SeitenHire PurchaseGanesh Bokkisam100% (1)

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Dokument21 Seiten6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNoch keine Bewertungen

- Chapter 7 - Value of Supply - NotesDokument16 SeitenChapter 7 - Value of Supply - NotesPuran GuptaNoch keine Bewertungen

- Problems On Taxable Salary Income Additional PDFDokument24 SeitenProblems On Taxable Salary Income Additional PDFNALIN MEHTA 1713068Noch keine Bewertungen

- 12 Accountancy sp04Dokument45 Seiten12 Accountancy sp04Priyansh AryaNoch keine Bewertungen

- Consignment - SolutionDokument18 SeitenConsignment - Solution203 596 Reuben RoyNoch keine Bewertungen

- Chapter 9 Accounting For Branches Including Foreign Branches PMDokument48 SeitenChapter 9 Accounting For Branches Including Foreign Branches PMviji88mba60% (5)

- 3 Pre - PostDokument7 Seiten3 Pre - PostParul Bhardwaj VaidyaNoch keine Bewertungen

- Cost Sheet Practical ProblemsDokument2 SeitenCost Sheet Practical Problemssameer_kini100% (1)

- Cost Sheet Practical ProblemsDokument2 SeitenCost Sheet Practical Problemssameer_kiniNoch keine Bewertungen

- Capital Gain Sums With SolutionDokument10 SeitenCapital Gain Sums With Solutionkomil bogharaNoch keine Bewertungen

- Contract CostingDokument12 SeitenContract Costingvivek rajakNoch keine Bewertungen

- Contract Costing - Practise ProblemsDokument3 SeitenContract Costing - Practise ProblemsMadhavasadasivan Pothiyil50% (2)

- IFRS 15 Q and ADokument27 SeitenIFRS 15 Q and AaliNoch keine Bewertungen

- New Issues SEBI GuidelineDokument55 SeitenNew Issues SEBI Guidelineapi-3701467100% (1)

- Suitability, BenefitsDokument2 SeitenSuitability, BenefitsFreddy Savio D'souzaNoch keine Bewertungen

- Keyman Insurance New InfoDokument10 SeitenKeyman Insurance New InfoFreddy Savio D'souzaNoch keine Bewertungen

- 3G Technology and INDIADokument21 Seiten3G Technology and INDIAFreddy Savio D'souzaNoch keine Bewertungen

- Maximum Management Review Front PageDokument1 SeiteMaximum Management Review Front PageFreddy Savio D'souzaNoch keine Bewertungen

- Asgnmnt 1 - Q PAPER1Dokument11 SeitenAsgnmnt 1 - Q PAPER1Freddy Savio D'souzaNoch keine Bewertungen

- Reference Books: Introduction To Life Insurance Basics of Life Insurance Principles of Life InsuranceDokument10 SeitenReference Books: Introduction To Life Insurance Basics of Life Insurance Principles of Life InsuranceFreddy Savio D'souzaNoch keine Bewertungen

- Life InsuranceDokument2 SeitenLife InsuranceFreddy Savio D'souzaNoch keine Bewertungen

- BM Asgnmnt Q1Dokument7 SeitenBM Asgnmnt Q1Freddy Savio D'souzaNoch keine Bewertungen

- Final KMI ChaptersDokument57 SeitenFinal KMI ChaptersFreddy Savio D'souzaNoch keine Bewertungen

- Keyman InfoDokument15 SeitenKeyman InfoFreddy Savio D'souzaNoch keine Bewertungen

- Keyman Info 2Dokument17 SeitenKeyman Info 2Freddy Savio D'souzaNoch keine Bewertungen

- Key ManDokument7 SeitenKey ManFreddy Savio D'souzaNoch keine Bewertungen

- "Potential of Life Insurance Industry in Surat Market": Under The Guidance ofDokument51 Seiten"Potential of Life Insurance Industry in Surat Market": Under The Guidance ofFreddy Savio D'souzaNoch keine Bewertungen

- Keyman Insurance New Info2Dokument3 SeitenKeyman Insurance New Info2Freddy Savio D'souzaNoch keine Bewertungen

- Handling The Day-To-Day Operations.: What Can The Money Be Used ForDokument13 SeitenHandling The Day-To-Day Operations.: What Can The Money Be Used ForFreddy Savio D'souzaNoch keine Bewertungen

- Basic Principles of Life InsuranceDokument44 SeitenBasic Principles of Life InsuranceAlanNoch keine Bewertungen

- Case Study-Misrepresentation by Life InsuredDokument3 SeitenCase Study-Misrepresentation by Life InsuredFreddy Savio D'souzaNoch keine Bewertungen

- EIFM Tutorial 3Dokument2 SeitenEIFM Tutorial 3Chi YenNoch keine Bewertungen

- 0504 PDFDokument22 Seiten0504 PDFAnonymous VwHMX3ZNoch keine Bewertungen

- Cost of Equity Risk Free Rate of Return + Beta × (Market Rate of Return - Risk Free Rate of Return)Dokument7 SeitenCost of Equity Risk Free Rate of Return + Beta × (Market Rate of Return - Risk Free Rate of Return)chatterjee rikNoch keine Bewertungen

- Working Capital Estimation ProblemsDokument3 SeitenWorking Capital Estimation ProblemsBunny MathaiNoch keine Bewertungen

- AE 25 Module 1 Lesson 1Dokument99 SeitenAE 25 Module 1 Lesson 1Queeny Mae Cantre ReutaNoch keine Bewertungen

- Contract of LeaseDokument2 SeitenContract of LeaseElain OrtizNoch keine Bewertungen

- eDocumentFile 2Dokument2 SeiteneDocumentFile 29z8925bxm8Noch keine Bewertungen

- FNCE3000-Group Assignment-WilliamWhiteford, NivPatel PDFDokument20 SeitenFNCE3000-Group Assignment-WilliamWhiteford, NivPatel PDFNiv PatelNoch keine Bewertungen

- Chapter 17Dokument3 SeitenChapter 17Juan Rafael FernandezNoch keine Bewertungen

- Vardhan Consulting Finance Internship Task 1Dokument6 SeitenVardhan Consulting Finance Internship Task 1Ravi KapoorNoch keine Bewertungen

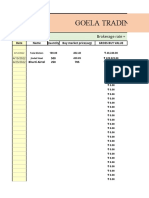

- Goela Trading JournalDokument621 SeitenGoela Trading JournalrohankananiNoch keine Bewertungen

- Basel III and Its Implications On Banking SectorDokument56 SeitenBasel III and Its Implications On Banking Sectoradityavikram009Noch keine Bewertungen

- Ias 16 Property Plant and Equipment SummaryDokument8 SeitenIas 16 Property Plant and Equipment SummaryFelice FeliceNoch keine Bewertungen

- Market Analysis - CourseworkThe Competitive Advantage of FinlandDokument10 SeitenMarket Analysis - CourseworkThe Competitive Advantage of FinlandscrimaniaNoch keine Bewertungen

- BEGP2 OutDokument28 SeitenBEGP2 OutSainadha Reddy PonnapureddyNoch keine Bewertungen

- List of Preference Shares 27.11.20Dokument360 SeitenList of Preference Shares 27.11.20kishoreNoch keine Bewertungen

- Banking On Big Data - A Case Study PDFDokument4 SeitenBanking On Big Data - A Case Study PDFMuthiani MuokaNoch keine Bewertungen

- 8th ATMA by Dalta Rsi - AnalysisDokument44 Seiten8th ATMA by Dalta Rsi - Analysissuresh100% (2)

- Inventory Cost Flow Biological AssetsDokument7 SeitenInventory Cost Flow Biological Assetsemman neriNoch keine Bewertungen

- Major Assignment - FM303 PDFDokument5 SeitenMajor Assignment - FM303 PDFfrancisNoch keine Bewertungen

- Castillo V PascoDokument2 SeitenCastillo V PascoSui50% (2)

- Case Study Finding WACC For A Project BoltaDokument1 SeiteCase Study Finding WACC For A Project BoltaebeNoch keine Bewertungen

- Form 3Dokument6 SeitenForm 3ShyamgNoch keine Bewertungen

- Horizontal Balance Sheet: Total Equity&LiabilitiesDokument7 SeitenHorizontal Balance Sheet: Total Equity&LiabilitiesM.TalhaNoch keine Bewertungen

- Public Procurement Rules 2004Dokument19 SeitenPublic Procurement Rules 2004Hafiz MehmoodNoch keine Bewertungen

- Ch14 - Audit ReportsDokument25 SeitenCh14 - Audit ReportsShinny Lee G. UlaNoch keine Bewertungen

- RAYMONDSDokument1 SeiteRAYMONDSsalman KhanNoch keine Bewertungen

- Banking Notes BBA PDFDokument19 SeitenBanking Notes BBA PDFSekar Murugan50% (2)

- The Nigerian Tourism Sector and The Impact of Fiscal PolicyDokument73 SeitenThe Nigerian Tourism Sector and The Impact of Fiscal PolicyAttah Andung PeterNoch keine Bewertungen

- Ia MidtermDokument5 SeitenIa MidtermCindy CrausNoch keine Bewertungen