Beruflich Dokumente

Kultur Dokumente

Technical Report 5th September 2011

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Technical Report 5th September 2011

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Technical Research | September 05, 2011

Daily Technical Report

Sensex (16821) / Nifty (5040)

Markets opened higher for the Third consecutive session on Fridays session and traded in a narrow range throughout the day to register a weekly close well above 5000 mark. On the sector front, Metal, Consumer Durables and Oil & Gas counters were among the major gainers whereas IT counters ended on a losing side. The advance decline ratio was in favor of advancing counters (A=1660 D=1157). (Source www.bseindia.com)

Exhibit 1: Sensex Daily Chart

Formation

The Weekly chart depicts a positive crossover in RSI momentum oscillator. The 20 EMA on the Daily chart is placed at 16825 /

5052 level.

Trading strategy:

Our benchmark indices opened with a decent upside gap on Mondays session and continued to surge higher to give a close well above 5000 mark. As expected, the RSI Smoothened turned upwards from its oversold territory and gave a positive crossover on Mondays session which led indices to give enormous bounce of 6% in spite of truncated week. We are now observing that indices have closed marginally below 20 EMA on Fridays session which is placed at 16825 / 5052 level. Generally, the 20 EMA is considered as a decent support / resistance. Therefore, going forward, indices may face some resistance near 16825 / 5052 level on a closing basis.

Source: Falcon

On the positive front, the RSI momentum oscillator on the Weekly chart has given a positive crossover which indicates a possibility of a further bounce if indices manage to sustain above Fridays high of 16990 / 5114. In this case, they are likely to rally towards17100 - 17250 / 5150 5200 levels. On the downside, if indices breaks 16688 / 4993 then they are likely to drift towards 16250 - 16550 / 4950 4870 levels. Therefore, we advise our traders to stick to a stock centric approach and avoid heavy trading on a positional basis.

For Private Circulation Only |

Technical Research | September 05, 2011

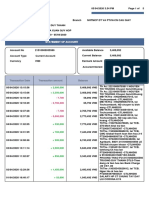

Daily Pivot Levels For Nifty 50 Stocks

SCRIPS SENSEX NIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELCAPITAL RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 16,531 4,929 985 132 1,018 1,564 399 1,651 657 274 270 184 1,461 404 383 634 459 2,007 147 306 864 103 2,217 192 504 58 426 1,570 730 1,056 159 253 884 94 470 77 368 779 428 82 107 1,931 223 844 124 493 36 732 962 450 974 314 S1 16,676 4,984 1,000 134 1,049 1,596 404 1,695 670 279 275 196 1,484 409 390 647 466 2,040 151 313 876 107 2,268 198 515 60 435 1,590 747 1,068 163 259 897 97 475 81 388 792 440 83 108 1,962 228 857 129 499 37 743 991 470 998 324 PIVOT 16,833 5,049 1,017 137 1,079 1,618 411 1,758 679 285 282 203 1,521 417 399 667 475 2,081 154 322 888 112 2,327 202 532 61 447 1,607 759 1,078 169 266 918 101 480 83 401 803 447 85 109 1,992 232 878 133 505 38 753 1,036 481 1,036 339 R1 16,978 5,105 1,032 138 1,111 1,650 416 1,802 691 290 287 215 1,544 422 407 680 482 2,114 158 329 899 116 2,378 208 543 63 455 1,627 776 1,090 172 271 931 103 485 87 420 816 459 86 111 2,023 236 892 138 512 39 765 1,065 502 1,061 349 R2 17,135 5,169 1,049 141 1,141 1,671 424 1,865 700 296 295 222 1,580 430 416 699 491 2,154 161 338 911 122 2,436 212 561 65 467 1,645 788 1,100 178 279 952 108 491 89 433 827 467 88 112 2,052 240 913 142 517 39 775 1,110 513 1,099 363

Technical Research Team

For Private Circulation Only |

Technical Research | September 05, 2011 Technical Report

RESEARCH TEAM

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head - Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to mehul.kothari@angelbroking.com Research Team: 022-3935 7600 Website: www.angelbroking.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Sebi Registration No : INB 010996539

For Private Circulation Only |

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Intro To DTC - Prince Dan - 8888Dokument20 SeitenIntro To DTC - Prince Dan - 8888JOHN MONROYNoch keine Bewertungen

- Fedex vs. UPS The Battle For Value CaseDokument18 SeitenFedex vs. UPS The Battle For Value CaseJose Q. Hdz100% (1)

- Dianna Montez Vs Chase Home Finance and JPMorgan ChaseDokument262 SeitenDianna Montez Vs Chase Home Finance and JPMorgan ChaseForeclosure Fraud100% (1)

- .Au Forms Change of Ownership FormDokument3 Seiten.Au Forms Change of Ownership FormLucas SchcolnikNoch keine Bewertungen

- Excel PracticeDokument9 SeitenExcel PracticeSheraz AsifNoch keine Bewertungen

- Financial Services Project Manager CVDokument2 SeitenFinancial Services Project Manager CVMike KelleyNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 12 2013Dokument6 SeitenDaily Metals and Energy Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument12 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 13 2013Dokument4 SeitenCurrency Daily Report September 13 2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 12Dokument2 SeitenMetal and Energy Tech Report Sept 12Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 12 2013Dokument2 SeitenDaily Agri Tech Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 12 2013Dokument4 SeitenCurrency Daily Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNoch keine Bewertungen

- A Study of Customer Satisfaction For Services Provided by KCC BankDokument72 SeitenA Study of Customer Satisfaction For Services Provided by KCC BankANKITNoch keine Bewertungen

- Statement of Account: Transaction Amount Balance Transaction Details Transaction DateDokument5 SeitenStatement of Account: Transaction Amount Balance Transaction Details Transaction DatehyhNoch keine Bewertungen

- Latihan Soal Rekonsiliasi BankDokument1 SeiteLatihan Soal Rekonsiliasi BankIchsan WibowoNoch keine Bewertungen

- Notification Syllabus (58, 141) PagemergedDokument78 SeitenNotification Syllabus (58, 141) PagemergedDonal MkNoch keine Bewertungen

- Lucio TanDokument12 SeitenLucio TanNolyne Faith O. VendiolaNoch keine Bewertungen

- Subs Testing Proc AAADokument18 SeitenSubs Testing Proc AAARosario Garcia CatugasNoch keine Bewertungen

- 1mca Education Loan SchemeDokument3 Seiten1mca Education Loan SchemeSurendran NagiahNoch keine Bewertungen

- Order in Respect of IFSL Ltd.Dokument32 SeitenOrder in Respect of IFSL Ltd.Shyam SunderNoch keine Bewertungen

- TARUN Loan Application EnglishDokument4 SeitenTARUN Loan Application EnglishRANA DUTTANoch keine Bewertungen

- Letter of UndertakingDokument5 SeitenLetter of UndertakingAnthlyn PelesminoNoch keine Bewertungen

- Estudio BrandZ 2018Dokument101 SeitenEstudio BrandZ 2018Kit CatNoch keine Bewertungen

- E Banking FDokument21 SeitenE Banking FM Javaid Arif QureshiNoch keine Bewertungen

- FinTree - FRM - HdsOw To StudyDokument5 SeitenFinTree - FRM - HdsOw To StudyRohit TomarNoch keine Bewertungen

- Review of Distress Sy Drome I Igeria Bakswithaviewtoprevetig Recurre CeDokument56 SeitenReview of Distress Sy Drome I Igeria Bakswithaviewtoprevetig Recurre CeHussain AlmahmoodNoch keine Bewertungen

- Extended Stay America St. Petersburg Clearwater Executive DRDokument2 SeitenExtended Stay America St. Petersburg Clearwater Executive DRSiva AllaNoch keine Bewertungen

- Case StudyDokument8 SeitenCase StudyGideon KimariNoch keine Bewertungen

- Fee Structure 2022-2023Dokument2 SeitenFee Structure 2022-2023Ayushmaan RawatNoch keine Bewertungen

- Andre Simatupang - CitiBankDokument22 SeitenAndre Simatupang - CitiBankAndreas SimatupangNoch keine Bewertungen

- Middle East ATE ListDokument10 SeitenMiddle East ATE ListReem JavedNoch keine Bewertungen

- Philippine Health Care Providers Vs CirDokument4 SeitenPhilippine Health Care Providers Vs CirArgel Joseph CosmeNoch keine Bewertungen

- Madoff's American Express Corporate Card StatementDokument30 SeitenMadoff's American Express Corporate Card StatementInvestor Protection100% (3)

- Accounting For Disbursements and Related TransactionsDokument12 SeitenAccounting For Disbursements and Related TransactionsVenn Bacus Rabadon100% (9)

- Front Office AccountingDokument13 SeitenFront Office AccountingpranithNoch keine Bewertungen

- Consumer Financing in Pakistan Issues & Challenges - PROJECTDokument88 SeitenConsumer Financing in Pakistan Issues & Challenges - PROJECTFarman Memon100% (1)