Beruflich Dokumente

Kultur Dokumente

Brazilian Retail News 403, September, 5th

Hochgeladen von

Gsmd Gouvêa De Souza0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

22 Ansichten3 SeitenThe most important news on the Braziliian retailing. In this issue:

* Carrefour rules out partnership in Brazil;

* H&M postpones arrival in the country;

* Supermarket sales up 6.24% in July;

* British Boots mulls Brazilian venture

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe most important news on the Braziliian retailing. In this issue:

* Carrefour rules out partnership in Brazil;

* H&M postpones arrival in the country;

* Supermarket sales up 6.24% in July;

* British Boots mulls Brazilian venture

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

22 Ansichten3 SeitenBrazilian Retail News 403, September, 5th

Hochgeladen von

Gsmd Gouvêa De SouzaThe most important news on the Braziliian retailing. In this issue:

* Carrefour rules out partnership in Brazil;

* H&M postpones arrival in the country;

* Supermarket sales up 6.24% in July;

* British Boots mulls Brazilian venture

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Brazilian Retail News

Year 11 - Issue # 403 - So Paulo, September, 05

th

, 2011

Phone: (5511) 3405-6666

BRAZILIAN RETAIL NEWS 1

29/08/2011

Brazil Pharma, arm of BTG Pactual private

equity group, is looking for midsize drugstore

chains in the North and Midwest regions, in cities

as Belm, Braslia and Campo Grande. The

company wants to purchase major or minor shares

in these companies, but always maintaining the

owners running the businesses. Market sources

have been speculating on several deals, but Brazil

Pharma has not confrmed any of them.

H&M postpones arrival in Brazil

Swedish apparel retailer H&M has been

studying the Brazilian market in the last months,

even contacting some of the countrys largest mall

owners, as Iguatemi, BR Malls and Aliansce, to

gather more info. According to market sources, it

even asked Iguatemi for more information on the

high-end mall the company is building in So Paulo

(to be opened this November). A deal, however,

was not reached, as H&M is prioritizing its Chinese

operations before going to other countries.

Carrefour rules out partnership in Brazil

French retail group Carrefour said it doesnt need a partner in Brazil. The companys CEO Lars

Olofsson, visiting the country last week, affrmed the Brazilian ops are not for sale and the group is not

studying any partnership or merger in the country. Olofsson said Brazil is a pivotal piece in Carrefours

global strategy and so it will keep developing its position in the South American country.

BR Pharma wants to purchase midsize drugstore chains

Supermarket sales up 6.24% in July

Brazilian supermarket sales had in July a 6.24% growth in real terms over June, according to trade

group Abras. Year-on-year, sales rose 4.32%, also in infation-adjusted terms.

Drogaria So Paulo and Pacheco chains speed up market consolidation

Last month, Drogasil and DrogaRaia merged and created Brazils largest drugstore group. For a

short time. Last week, Pacheco and Drogaria So Paulo stroke back merging their operations and

creating an almost 700 stores, R$ 4.4 billion (US$ 2.59 billion) group that leads the drugstore segment.

Pacheco will own a majority position, but the new company board will be evenly shared. Both brands

will continue to be in the market.

Brazilian Retail News

Year 11 - Issue # 403 - So Paulo, September, 05

th

, 2011

Phone: (5511) 3405-6666

BRAZILIAN RETAIL NEWS 2

29/08/2011

The consolidation in the Brazilian drugstore retailing shall continue in the near future, as British

Boots has shown it intends to invest in the country. Company representatives were in Brazil recently

asking for market information and also evaluating possible partnerships or acquisitions, said Folha

de S.Paulo newspaper.

Warren Buffett to invest in Brazilian retailing

Warren Buffetts Berkshire Hathaway has been purchasing stocks of Brasil Foods in So Paulo and

New York stock exchanges, aiming to, in the hort term, become one of the companys top shareholders.

This is only the tip of a much more ambitious plan, as Berkshire wants to purchase expressive shares

in Brazilian companies, not only in the food industry, but also in retailing, healthcare and IT.

Magazine Luiza and Renner interested in Leader chain

Relatrio Reservado news bulletin says

Magazine Luiza, Brazils 3rd largest electronics

chain, is a runner up to purchase R$ 1 billion sales

department store chain Leader. The company,

however, is expected to face tough competition,

as Renner department store chain has renewed

interest in Leader, who it almost purchased in

2008, a deal was cancelled in the wake of the

global fnancial crisis.

British Boots mulls Brazilian venture

Dia discount group advancing in master franchising deal

Discount chain Dia, recently spun-off from Carrefour, said a deal with a Brazilian master franchisee

is getting closer and may be reached by the end of the year. Today the chain runs more than 360

stores in So Paulo state and with the franchising deal it plans to grow much faster.

Walmart recycles 20,000 tonnes of waste in Brazil

In the frst half of the year, Walmart, Brazils

number three supermarketer, stopped sending

to landflls 56% of the solid waste generate by its

stores, or more than 20,000 tonnes of recycled

waste. The retailer expects to reduce by 60% the

volume of waste sent to landflls, by increasing the

number of stores with over 90% of waste recycled

(today, there are 15 stores in this condition).

Brazilian Retail News

Year 11 - Issue # 403 - So Paulo, September, 05

th

, 2011

Phone: (5511) 3405-6666

BRAZILIAN RETAIL NEWS 3

29/08/2011

Pets, a rising market

Marcos Gouva de Souza (mgsouza@gsmd.com.br), CEO, GS&MD Gouva de Souza

Momentum

Good not only for dogs, but also for cats, birds, some reptiles, exotic birds and other pets. In Brazil, the pet

market shall end this year with total sales over R$ 11.3 billion (US$ 6.65 billion), in an infation-adjusted growth

of 4.5%, in a conservative forecast. In 2010 this market saw its sales rise by 8.5% over 2009. And it all points to

the fact it will continue to rise above the countrys GDP in the next years.

The main reasons for the growth of this segment, with around 25,000 pet shops in the country, are the countrys

economic growth; the evolution of the families spending patterns; and, mainly, the expansion and professionalism

of the product and service offer, in specialized stores, vet clinics, supermarkets, hypermarkets, cash & carry and

internet.

These were some of the fgures and issues debated during the 1st Pet Brasil Forum, last week in So Paulo.

The seminar presented a deep and broad picture of the segment and was supported by a GS&MD Gouva de

Souza research with all the agents working in this market, debated by retailers and suppliers.

There was some common ground, as the perception of the continuity of the growth of the segment; the evolution

of the digital channels complementing the brick-and-mortar ones; the inevitable consolidation that will occur

alongside the organic expansion; the increasing share of services in the total segment sales; the continuity of

the sectors professionalization and formalization; the ongoing segmentation of brands and products; the growing

presence of large retailers in the segment, with more and more space in stores dedicated to these goods; and

the broader mix offered to customers.

It all following an also common ground perception that the population to be served has been growing, with an

increasing share of cats, although dogs are still majority.

The big store unconsolidation all over the country and the growth reported in the last years point to a natural

consolidation process, once the larger chains own an estimated 4%-6% of the total market, way below other retail

segments. In the next years there shall be an acceleration of the consolidation process, due to organic expansion

of the larger players and also due to the creation of buying groups and franchising chains.

Another relevant aspect is the likely growth of the internet as a shopping alternative, in a move driven by

consumers, specially in the larger cities, as a complement for the brick-and-mortar stores, as detected in the

research that stressed the positive perception consumers have about the internet channel.

In the offer side, its worthy to notice the expansion, diversifcation and segmentation of products offered by

global and national brands, answering to this natural evolution of consumers behavior, looking for goods that ft

better their different realities and shopping moments.

The same way, it stands out the increasing service offer in this segment, in an increasingly sophisticated way:

pet insurances, clinics who differentiate in the services provided; and other options aiming to leverage spending.

This is another segment that has been passing through and will continue experiencing deep structural changes,

due to the upgrade in the populations spending patterns, as a consequence of the changes the market has been

living. The constant monitoring of the segment will make possible to identify shopping patterns that will help in

the development and maturement of the segment.

Brazilian Retail News (BRN) is a weekly newsletter published by GS&MD - Gouva de Souza with the most important news

on the Brazilian retailing. The content can be freely used, once the source is quoted. If you want any information on BRN or our

services, please send an email to publicacoes@gsmd.com.br or access GS&MD - Gouva de Souza at www.gsmd.com.br.

Gouva de Souza & MD Desenvolvimento Empresarial Ltda.

Av. Paulista, 171 - 10 foor

Paraso So Paulo Brazil Zip Code: 01311-904

Phone: (5511) 3405-6666 Fax: (5511) 3263-0066

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Pre-Feasibility Study of The Guimaras-Iloilo Ferry Terminals System ProjectDokument59 SeitenPre-Feasibility Study of The Guimaras-Iloilo Ferry Terminals System ProjectCarl50% (4)

- Ex 400-1 1ST BLDokument1 SeiteEx 400-1 1ST BLkeralainternationalNoch keine Bewertungen

- Service Operations As A Secret WeaponDokument6 SeitenService Operations As A Secret Weaponclaudio alanizNoch keine Bewertungen

- Case Digest FinalDokument13 SeitenCase Digest FinalAngelo Igharas Infante60% (5)

- Infra Projects Total 148Dokument564 SeitenInfra Projects Total 148chintuuuNoch keine Bewertungen

- Companies List 2014 PDFDokument36 SeitenCompanies List 2014 PDFArnold JohnnyNoch keine Bewertungen

- NBCC Heights - Brochure PDFDokument12 SeitenNBCC Heights - Brochure PDFAr. Yudhveer SinghNoch keine Bewertungen

- Brazilian Retail News 14/09/2012Dokument6 SeitenBrazilian Retail News 14/09/2012Gsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 415, November, 28thDokument2 SeitenBrazilian Retail News 415, November, 28thGsmd Gouvêa De SouzaNoch keine Bewertungen

- The First Global GenerationDokument3 SeitenThe First Global GenerationGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 401, August 22ndDokument3 SeitenBrazilian Retail News 401, August 22ndGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 409, October, 18thDokument2 SeitenBrazilian Retail News 409, October, 18thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 400, August 16thDokument3 SeitenBrazilian Retail News 400, August 16thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 407, October, 4thDokument4 SeitenBrazilian Retail News 407, October, 4thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 412, November, 7thDokument2 SeitenBrazilian Retail News 412, November, 7thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 408, October, 11thDokument3 SeitenBrazilian Retail News 408, October, 11thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 405, September, 19thDokument2 SeitenBrazilian Retail News 405, September, 19thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 402, August 29thDokument2 SeitenBrazilian Retail News 402, August 29thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News, September, 12thDokument2 SeitenBrazilian Retail News, September, 12thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 398, August 2ndDokument3 SeitenBrazilian Retail News 398, August 2ndGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 399, August 9thDokument3 SeitenBrazilian Retail News 399, August 9thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 395, July 11thDokument3 SeitenBrazilian Retail News 395, July 11thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 396, July 18thDokument4 SeitenBrazilian Retail News 396, July 18thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 394, July 4thDokument3 SeitenBrazilian Retail News 394, July 4thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 396, July 25thDokument3 SeitenBrazilian Retail News 396, July 25thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 393, June, 27thDokument3 SeitenBrazilian Retail News 393, June, 27thGsmd Gouvêa De SouzaNoch keine Bewertungen

- A New Retail For A New BrazilDokument3 SeitenA New Retail For A New BrazilGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 389, May, 30thDokument3 SeitenBrazilian Retail News 389, May, 30thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 392, June, 20thDokument3 SeitenBrazilian Retail News 392, June, 20thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 387, May 16thDokument3 SeitenBrazilian Retail News 387, May 16thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 391, June, 13thDokument3 SeitenBrazilian Retail News 391, June, 13thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 388, May, 23rdDokument3 SeitenBrazilian Retail News 388, May, 23rdGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News, May, 2ndDokument3 SeitenBrazilian Retail News, May, 2ndGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 390, June, 6thDokument3 SeitenBrazilian Retail News 390, June, 6thGsmd Gouvêa De SouzaNoch keine Bewertungen

- Brazilian Retail News 386, May, 9thDokument3 SeitenBrazilian Retail News 386, May, 9thGsmd Gouvêa De SouzaNoch keine Bewertungen

- The Store Format EvolutionDokument3 SeitenThe Store Format EvolutionGsmd Gouvêa De SouzaNoch keine Bewertungen

- Chapter 2 Consumer's BehaviourDokument14 SeitenChapter 2 Consumer's BehaviourAdnan KanwalNoch keine Bewertungen

- MEC 1st Year 2020-21 EnglishDokument16 SeitenMEC 1st Year 2020-21 EnglishKumar UditNoch keine Bewertungen

- BCG MatrixDokument5 SeitenBCG MatrixAliza AliNoch keine Bewertungen

- EP-501, Evolution of Indian Economy Midterm: Submitted By: Prashun Pranav (CISLS)Dokument8 SeitenEP-501, Evolution of Indian Economy Midterm: Submitted By: Prashun Pranav (CISLS)rumiNoch keine Bewertungen

- Renewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsDokument1 SeiteRenewal Premium Receipt - NON ULIP: Life Assured: Mr. Vinodkumar Sheth Assignee: N.A. Policy DetailsVinodkumar ShethNoch keine Bewertungen

- EH101 Course InformationDokument1 SeiteEH101 Course InformationCharles Bromley-DavenportNoch keine Bewertungen

- Sipcot 1Dokument1 SeiteSipcot 1sfdsddsNoch keine Bewertungen

- Unit II Competitve AdvantageDokument147 SeitenUnit II Competitve Advantagejul123456Noch keine Bewertungen

- BankingDokument99 SeitenBankingNamrata KulkarniNoch keine Bewertungen

- Urbanized - Gary HustwitDokument3 SeitenUrbanized - Gary HustwitJithin josNoch keine Bewertungen

- Icelandic Line of WorkDokument22 SeitenIcelandic Line of Workfridjon6928Noch keine Bewertungen

- HR McqsDokument12 SeitenHR McqsHammadNoch keine Bewertungen

- CDP VasaivirarDokument194 SeitenCDP VasaivirarKruti ShahNoch keine Bewertungen

- Amb 336 Case Study AnalysisDokument10 SeitenAmb 336 Case Study Analysisapi-336568710Noch keine Bewertungen

- List of Companies: Group - 1 (1-22)Dokument7 SeitenList of Companies: Group - 1 (1-22)Mohammad ShuaibNoch keine Bewertungen

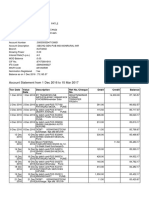

- Account statement showing transactions from Dec 2016 to Feb 2017Dokument4 SeitenAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuNoch keine Bewertungen

- Income from House PropertyDokument5 SeitenIncome from House PropertyKaustubh BasuNoch keine Bewertungen

- Legal NoticeDokument7 SeitenLegal NoticeRishyak BanavaraNoch keine Bewertungen

- ARGA Investment Management L.P.: Valuation-Based Global Equity ManagerDokument1 SeiteARGA Investment Management L.P.: Valuation-Based Global Equity ManagerkunalNoch keine Bewertungen

- IAS 2 InventoriesDokument13 SeitenIAS 2 InventoriesFritz MainarNoch keine Bewertungen

- MK-101 Sec-F Group-4 Executive SummaryDokument16 SeitenMK-101 Sec-F Group-4 Executive SummarySantosh Rajan Iyer0% (1)

- Agricultural Mechanisation Investment Potential in TanzaniaDokument2 SeitenAgricultural Mechanisation Investment Potential in Tanzaniaavinashmunnu100% (3)

- Compressors system and residue box drawingDokument1 SeiteCompressors system and residue box drawingjerson flores rosalesNoch keine Bewertungen