Beruflich Dokumente

Kultur Dokumente

Economic Recession 2008-2009 Impact On Indian Auto Industry's Management Practices

Hochgeladen von

Arjun Pratap SinghOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Economic Recession 2008-2009 Impact On Indian Auto Industry's Management Practices

Hochgeladen von

Arjun Pratap SinghCopyright:

Verfügbare Formate

Title

Economic Recession 2008-2009: Impact on Indian Auto Industrys Management Practices.

Introduction

The National Bureau of Economic Research (NBER) defines recession as a significant decline in economic activity spread across the country, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. (source 1) Global recession has devastated the global auto industry with pinching effects on the Indian auto industry. India is a strong and growing economy but the hit of recession has put red marks on the entire balance sheet of the Indian economy. Among the leading car manufacturers, General Motors and Ford were the first ones to file for bankruptcy. GM is struggling to stay alive and claims that the company has just enough cash to continue its operations. Even the merger talks of GM and Global Recession Hits Indian Auto Industry Chrysler have been officially brought to a halt because of the liquidity crunch. U.S sales have fallen down by 32% which has directly affected the Indian car industry where GM has recorded a fall of 45%, Ford of 30% and Chrysler down by 35%. All the three major car manufacturers have reported declined growth after the hit of recession. (No. 12) This report will aim to answer some vital questions regarding the recession and its impact on the automobile industry with a focus on the Indian automobile industry. Highlights of Indian Automobile Industry

India is the world's largest two wheel manufacturer. India is the world's second largest tractor manufacturer. India has the fourth largest car market in Asia.

India has the world's largest three wheeler market. ( No. 5)

Statement of the problem

According to the Society of Indian Automobile Manufacturers (SIAM), the automobile sale in India has declined substantially. The data provided by the organization points to the fact that Passenger car sales dropped from 1, 15,481 in 2007 to 1, 13, 822 while commercial vehicle sales recorded a growth. Automobile manufacturers like Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra reported a dip in the sales curve as compared to the same month of the previous year. Mr P. Balendran, the Vice-President of General Motors India commented that, This is a sluggish phase for the Indian automobile industry. The passenger car market is not going to improve in the near future. Multiplicity of factors like high finance cost, fuel price and global recession contributed towards the slowdown. In the light of the present scenario, the automobile industry is likely to introduce new incentives to attract potential buyers.

Project Background

Background to the Problem

The sliding economy has bruised the Indian auto industry with sales dipping and many joint ventures being put on hold. "The complete lack of consumer finance and high interest rates are putting off consumers from buying vehicles," says Dilip Chenoy, Executive Director of Society of Indian Automobile Manufacturers (SIAM). In November, the sales of passenger cars plunged from 103,031 to 83,079, while truck sales dropped by half, the worst in 10 years. Infact, Japanese auto firms like Toyota (TM) and Honda (HMC) have cut on their sales projections, which resulted in the former slashing its production by 30 percent since November. The firm's Indian arm which is based in Bangalore has halted production for eight days a month at its plant. At Chennai in southern India, Hyundai Motors has also begun keeping its factory closed for a day every week to rationalize production costs. Moreover, as banks are not in the lending mood, the interest rate on car loans is hovering at around 14 percent to 18 percent, up from 10 percent to 12 percent. So, it takes a huge toll on the buyers capacity, which has been the driving force of the industry. "It is not just the availability, but the better cost of finance which is the main problem," said S.M. Bafna, Head of Bafna Motors, a leading Mumbai auto dealer for Honda, Tata Motors, and Toyota to Business Week. (No. 21) The crippling liquidity and high interest rates have slowed down the vehicle demand. However, the falldown started in July with a decline of 1.9% and thereafter the industry saw a major slowdown in October 2008.

Business Analysts reported that Indian car market had recorded a continuous growth of about 17.2% over the last few years but this year the recession has brought the growth to about 7-8%. Be it Tata Motors or Maruti Suzuki or even Mercedes-Benz, the car market has gone down to a tremendously negative terrain.

Tata has reported that its profit fell from 34.1 percent to 3.47 billion rupees because of the slower growth in the industrial production. Further, the company has also recorded

a 20% decline in the sales as compared to last year. And with its Nano making a big impact before the downturn as such, but after the downturn may hold a bleak future for the world's cheapest car, because the consumer spending has gone very low.

Even Maruti Suzuki reported a 7% decline in sales due to rising cost of the materials and a falling rupee value. Even Mahindra & Mahindra, the India's largest SUV and tractor manufacturer, is not immunized, showing profit fall of 20.6%.

In the recent months, banks and car financers have disbursed the approved loan because of the cash crunch. Payments from the OEMs (Original Equipment Manufacturer) have also been delayed and in most cases banks have deferred or disbursed the approved loan. OEMs take this loan from banks and financers for establishments, capacity expansions, or even for the requirement of high-end equipments for car designing and production.

In addition, the uncertain exchange rate and a sudden increase in dollar value against Indian Rupee have contributed to the slowdown. Increasing dollar value has raised the landed cost of imported machine tools and even raw materials required for production by about 14%. Alloy and steel prices have also not shown any reduction in their prices and this high price has actually forced the car manufacturers to hike the car prices. To make the matter worse, it is believed that steel manufacturers across the country are looking for re-imposition of custom duty on steel. Increased cost of raw materials directly affects the cost of the car rolled out, eventually tagging a particular car model with a higher price tag.

The conclusion is that the present global recession has hit very hard on the Indian car industry. (No. 13)

Project Aims and Objectives

Research Objectives

1. To evaluate the effects of the recession on the automobile industry. 2. To ascertain how the automobile industry is dealing with the recession. 3. How management philosophies and styles have changed to deal with the recession. 4. Analyze the time the industry will take to emerge from the current downturn. 5. Preventive measures that can be taken in the future to prevent another collapse.

Research Questions

1. What are the causes of the recession? 2. How will the automobile industry recover? 3. What are the effects on the automobile industry? 4. How is management dealing with the recession? 5. What changes are being implemented to alleviate the impact of the recession? 6. What is the government doing to help the automobile industry? 7. What will be the short term effect of the recession? 8. What will be the long term effect of the recession? 9. Could the recession provide an opportunity for some companies? 10. Is it wise to continue production in this environment? Significance of this project

This study is extremely important if the world wants to avoid another a economic recession, therefore if this study can answer some important question pertaining to the causes and effects of recessions then it can be taken to the next level to find out how recessions can be avoided or how a country or industrial sector can insulate itself from the recession. In this case the automobile industry has been taken as the example to explain the causes, effects and solutions for the current recession. This study will help explain the low sales figures of the automobile industry and the how different car companies have been affected by and are dealing with the recession.

Research Programme

Research Design and Justifications/Limitations

PROBABLE STRATEGIES OF THE COMPANIES DURING RECESSION

Companies should bear eight factors in mind when making their marketing plans for 2008 and 2009: 1. Focus of research on the customer. Instead of cutting the market research budget, they need to know more than ever how consumers are redefining value and responding to the recession. Price elasticity curves are changing. Consumers take more time searching for durable goods and negotiate harder at the point of sale. They are more willing to postpone purchases, trade down, or buy less. Must-have features of yesterday are todays can-live-withouts. Trusted brands are especially valued and they can still launch new products successfully but interest in new brands and new categories fades. Conspicuous consumption becomes less prevalent. 2. Focus on family values. When economic hard times arrive, people tend to withdraw themselves. Firms should look for comfortable hearth-and-home family scenes in advertising to replace images of extreme sports, adventure and rugged individualism. Greeting card sales, telephone use and discretionary spending on home furnishings and home entertainment will hold up well, as uncertainty prompts most to stay at home but also stay connected with family and friends. 3. Controlling the expenditure on marketing. This is not the time to cut advertising. It is well documented that brands that increase advertising during a recession, when competitors are cutting back, can improve market share and return on investment at lower cost than during good economic times. Uncertain consumers need the reassurance of known brands--and more consumers at home watching television can deliver higher than expected audiences at lower cost-per-thousand impressions. If companies have to cut marketing spending, they must try to maintain the frequency of advertisements by reducing from 30-to-15 second advertisements, substituting radio

for television advertising, or increasing the use of direct marketing, which gives more immediate sales impact. 4. Reviewing the product-mix strategies. Marketers must reforecast demand for each item in their product lines as consumers trade down to models that stress good value, such as cars with fewer options. During this time, people prefer multi-purpose goods over specialized products and weaker items in product lines should be pruned. In grocery-products categories, good-quality own-brands gain at the expense of national brands. Industrial customers prefer to see products and services unbundled and priced separately. New products, especially those that address the new consumer reality and thereby put pressure on competitors, should still be introduced but advertising should stress superior price performance, not corporate image. 5. Extending the help to distributors. In uncertain times, no one wants to tie up working capital in excess of inventories. Marketers can follow some policies such as early-buy allowances, extended financing and generous return policies to motivate distributors to stock your full product line. This is particularly true with unproven new products. Care should be taken while expanding distribution to lower-priced channels; doing so can jeopardize existing relationships and the brand image. However, this may be the time to drop weaker distributors. 6. Reviewing the pricing strategies. Customers will be shopping around for the best deals. It may not necessarily mean to cut list prices but may need to offer more temporary price promotions, reduce thresholds for quantity discounts, extend credit to long-standing customers and price smaller pack sizes more aggressively. In tough times, price cuts attract more consumer support than promotions such as sweepstakes and mail-in offers. 7. Focus on the market share. Knowing cost structure can ensure that any cuts or consolidation initiatives will save the most money with minimum customer impact. Companies such as Wal-Mart and Southwest Airlines, with strong positions and the most productive cost structures in their industries, can expect to gain market share. Other companies with healthy balance sheets can do so by acquiring weak competitors.

8. Emphasizing the core values. Although most companies are making employees redundant, chief executives can strengthen the loyalty of those who remain by assuring employees that the company has survived difficult times before, maintaining quality rather than cutting corners and servicing existing customers rather than trying to be all things to all people. CEOs must spend more time with customers and employees. Economic recession can elevate the importance of the finance directors balance sheet over the marketing managers income statement. Managing working capital may tend to dominate managing customer relationships. CEOs must counter this. Successful companies do not abandon their marketing strategies in a recession; they adapt them.

Deliverables-Expected Results

How would India auto industry fare in 2009? In 2009 estimated rate of growth of India auto industry is going to be 9 percent. Auto industry in India has been hit hard by ongoing global financial recession. Sales figures of India automobile industry for December 2008 have shown devastating after effects of global financial slowdown. However, there is still hope for automobile industry of India in 2009 as there are certain factors working in its favor. India is blessed with a middle class, which is getting economically stronger with every passing day. This class is being touted as potential consumers for India auto industry in years to come.

Indian economy has been, more or less, able to withstand tremors of global financial meltdown. Even though its rate of growth has slowed down considerably, there are hopes of an economic revival. Work force of auto industry of India is relatively well trained. All these factors indicate that there could be a decent future for India auto industry in days to come.

India automobile market India automobile market is likely to be in good shape in 2009. Much of this optimism results from renewed interest being shown in India auto industry by reputed overseas car makers. Nissan Motors, which is a well known Japanese car making company, regards India automobile market as a global car manufacturing hub for future.

Hyundai, a major automobile establishment of South Korea, has put in large sums of money in India automobile market. As per its estimates, India auto industry could become a major center for small car manufacturing organizations in future.

There are some other automobile companies of world who have shown interest in India auto market. Major names among these are General Motors, Skoda Auto and Mercedes-Benz. These companies have major plans lined up for India auto industry and are likely to invest a huge amount of money in India automobile market.

India domestic auto industry India domestic auto industry has been passing through a tough phase in 2008 and such a trend is supposed to continue in 2009 as well. Leading members of India auto industry have forecast a difficult path in 2009. Shinzo Nakanishi, managing director of Maruti Suzuki, has said that 2009 would present them with a number of challenges. fitted greatly from China auto insurance policies. One example is Huatai Insurance Co, which generates 70 percent of its income from these policies.

Resources

References

This is a list of all works cited in the proposal and should be written according to the recognised format and must be consistent throughout the chapter. The referencing must follow the Harvard system of referencing. You may visit http://www.education.ex.ac.uk/dll/studyskills/harvard_referencing website for details.

Appendices

Theories about the causes of economic recessions In fact the general consensus is that a recession is primarily caused by the actions taken to control the money supply in the economy. So in the United States many economists believe that it is because of the Federal Reserve that we go into a recession. The reason for this is that in the United States it is the Federal Reserves responsibility to maintain an ideal balance between money supply, interest rates and inflation. And if the Federal Reserve loses balance in this equation the ending result is that the economy spirals out of control. In fact we have actually seen this happen recently. In 2007 the Federal Reserve monetary policy of injecting huge amounts of money supply into the money market kept the interest rates down but inflation actually continued to rise. And it was this combined with how easy it was to borrow money that caused our economy to spiral out of control to where we now sit in 2008. Most economists believe that we are currently heading towards a recession, not to mention that quite a few tend to think we are already there. But something else that you want to keep in mind when it comes to the Federal Reserve Board causing a recession because of their responsibility with the money in the United States, it is also because of the actions of the Federal Reserve Board that we come out of or recover from a recession. Many people tend to blame the current President of the United States for any recession that our nation faces, and they also tend to give the current President the credit for getting us out of the recession. But what these people do not realize is that the President actually has hardly any control or influence over the economy for the short term. What they do has a gradual and long term effect on our current economy.

Another theory about what causes an economic recession is that they are caused by events that hurt particular firms or industries rather than events that impact the entire economy. The reason that some economists support this theory is because of how a recession seems to affect some industries badly, while other industries seem to thrive during these hard times. The economists believe that this happens because either a

major innovation or a change in the price of a key item can adversely affect some firms. And when they are adversely affected they tend to lay off workers and reduce their production, which slows down that industry even further because they demand is greatly reduced. But at the same time there are other industries that are going through a major hiring phase and are actively looking to hire new workers, so it seems they are being helped by the recession activity. But what happens is that the people who were laid off can't find work right away because sometimes it takes time to find new employment so while they are waiting for that new job to come in there is a period of reallocation, moving workers from one job to another, which can cause a recession until everything is figured out.

Recession stops now. The economic recession started in 2008 has put numerous countries' economy into the stage of mess or collapsing. The most influenced business are online business, foreign trade, real estate, and banks. Now, the crisis seems to be over and the world economy seems to be recovering slowly. According to Reuter report, GDP in China increases 7.9% in the second quarter of 2009, that number extends the previous expectations from outside. In Shenzhen in this country, the prices of house increase stably in recent two months, compared to the early of 2009. The number of employees demand rises, job seekers now have 2 or more job options, according to local news. In accordance to cnfol.com, the economic recession of developed countries, including America, Japan, Europe, ect., has alleviated from the second quarter of 2009, because of their previous effective measures. In the second half of 2009, Economic crisis in American stops declining. And even a small increase has been achieved. Some of the world-famous electronics brands also have increase in their income. According to a piece of BBC news on 30 July, 2009: Apple iPhone Shipments totaled 5.2 million units between April and June, a six-fold increase on a year earlier; shipments at Samsung were up 14% from a year earlier to 52.3 million units; LG

shipments rose 8% to 29.8 million; and Motorola made a net profit of $26m, up from $4m a year earlier. Some people hold positive attitude about the economy development in the late of 2009, some still have worries, especially about China economy. China economic grows too fast. Chinese government chose to focus more on quantity instead of quality when they made macro strategies.

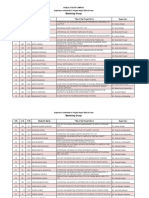

Das könnte Ihnen auch gefallen

- CSR of Exim Bank of BanhladeshDokument10 SeitenCSR of Exim Bank of BanhladeshZahid HasanNoch keine Bewertungen

- Internship Report On Loan & Deposit Policy of HBLDokument52 SeitenInternship Report On Loan & Deposit Policy of HBLLochan Khanal100% (3)

- A Thesis Proposal On Risk and Return Analysis of Commercial Banks in NepalDokument9 SeitenA Thesis Proposal On Risk and Return Analysis of Commercial Banks in NepalselNoch keine Bewertungen

- Dividend Policy of Himalayan Bank LimitedDokument41 SeitenDividend Policy of Himalayan Bank Limitedsandip neupaneNoch keine Bewertungen

- Deposit of Nabil Bank LTD Front PartDokument8 SeitenDeposit of Nabil Bank LTD Front Partanupa bhattaraiNoch keine Bewertungen

- A Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDDokument16 SeitenA Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDram binod yadavNoch keine Bewertungen

- Project Report of Bank of KathmanduDokument30 SeitenProject Report of Bank of KathmanduShree Shrestha100% (1)

- A Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDDokument16 SeitenA Case Study of Profitability Analysis of Standard Chartered Bank Nepal LTDDiwesh Tamrakar100% (1)

- Kumari Bank Limited: Damauli BranchDokument28 SeitenKumari Bank Limited: Damauli BranchBijaya DhakalNoch keine Bewertungen

- Complete Analysis of Bandhan BankDokument18 SeitenComplete Analysis of Bandhan BankAkashNoch keine Bewertungen

- Sunrise Bank LTDDokument43 SeitenSunrise Bank LTDsaurabchirania100% (3)

- Himalayan Bank ReportDokument5 SeitenHimalayan Bank ReportShiva DhakalNoch keine Bewertungen

- Askari Bank Ratio AnalysisDokument32 SeitenAskari Bank Ratio Analysis✬ SHANZA MALIK ✬Noch keine Bewertungen

- Financial Ananlysis of Siddhartha Bank Limited: A Project Work Report ProposalDokument8 SeitenFinancial Ananlysis of Siddhartha Bank Limited: A Project Work Report ProposalNiva ShresthaNoch keine Bewertungen

- Bajaj Finserv Consumer Loan StudyDokument48 SeitenBajaj Finserv Consumer Loan StudyDashing HemantNoch keine Bewertungen

- Mehak Mahajan... Project Report On J & K Bank... Word 2007Dokument107 SeitenMehak Mahajan... Project Report On J & K Bank... Word 2007Mayank Mahajan0% (1)

- PMC Bank Summer Internship ReportDokument78 SeitenPMC Bank Summer Internship ReportManpreet Singh Sasan0% (4)

- Deposit Analysis of Kumari Bank Limited A Project Work Report - PDF - ConvertDokument13 SeitenDeposit Analysis of Kumari Bank Limited A Project Work Report - PDF - ConvertReshma ParweenNoch keine Bewertungen

- Chapter 1Dokument24 SeitenChapter 1Nayan Kc100% (1)

- Proposal of SCBNLDokument7 SeitenProposal of SCBNLRam khadkaNoch keine Bewertungen

- Financial Statement Analysis Southeast Bank LimitedDokument8 SeitenFinancial Statement Analysis Southeast Bank LimitedSharifMahmud50% (4)

- Final Project of Reliance InfraDokument57 SeitenFinal Project of Reliance InfraChaitali SarmalkarNoch keine Bewertungen

- Determinants of Capital Adequacy Ratio of Commercial Banks in NepalDokument48 SeitenDeterminants of Capital Adequacy Ratio of Commercial Banks in NepalSabinaNoch keine Bewertungen

- Reserch Report (Liquidity Analysis of SRDB)Dokument21 SeitenReserch Report (Liquidity Analysis of SRDB)Amrit PoudelNoch keine Bewertungen

- Nlic Project Work Report From Eashwari Bhandari (ABIMS)Dokument91 SeitenNlic Project Work Report From Eashwari Bhandari (ABIMS)eashwaribhandariNoch keine Bewertungen

- Chapter IIDokument30 SeitenChapter IIBayalkotee ReshamNoch keine Bewertungen

- Working Capital & Inventory Analysis of OPGC LimitedDokument51 SeitenWorking Capital & Inventory Analysis of OPGC LimitedSubhendu Ghosh100% (1)

- Ration Analysis of 3 Commercial Banks in PakistanDokument30 SeitenRation Analysis of 3 Commercial Banks in PakistanMubarak HussainNoch keine Bewertungen

- Supervisors Allotment BBS 4th Year 2070 Batch - Marketing Group PDFDokument10 SeitenSupervisors Allotment BBS 4th Year 2070 Batch - Marketing Group PDFShreety razbncNoch keine Bewertungen

- Financial Performance of Nepal TelecomDokument15 SeitenFinancial Performance of Nepal TelecomAnita TamangNoch keine Bewertungen

- Report On Performance Analysis of SEBLDokument53 SeitenReport On Performance Analysis of SEBLShanu Uddin Rubel80% (10)

- 1.1 Background of The StudyDokument5 Seiten1.1 Background of The StudyBayalkotee Resham100% (1)

- Raj Bank Ratio Analysis PDFDokument72 SeitenRaj Bank Ratio Analysis PDFRonak VaishnavNoch keine Bewertungen

- Working Capital Management of Commercial Banks in Nepal-LibreDokument119 SeitenWorking Capital Management of Commercial Banks in Nepal-LibreVivrant100% (2)

- Comparative Liquidity Analysis of NepalDokument53 SeitenComparative Liquidity Analysis of NepalBadri mauryaNoch keine Bewertungen

- Internship Report by Tanzina Ahmed ChoudhuryDokument56 SeitenInternship Report by Tanzina Ahmed ChoudhuryTanzina Ahmed Choudhury100% (1)

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofDokument9 SeitenSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofMOHAMMED KHAYYUMNoch keine Bewertungen

- Internship Report On Credit Adminitraation of Mutual Trust BankDokument140 SeitenInternship Report On Credit Adminitraation of Mutual Trust BankNazmul Amin AqibNoch keine Bewertungen

- Credit Risk Management of Nepalese BanksDokument121 SeitenCredit Risk Management of Nepalese BanksPrem YadavNoch keine Bewertungen

- HCL Tech Ratio Analysis ReportDokument11 SeitenHCL Tech Ratio Analysis ReportVasudha NagpalNoch keine Bewertungen

- NIC Asia Bank Balance SheetDokument11 SeitenNIC Asia Bank Balance SheetKrishna DHAKALNoch keine Bewertungen

- A Case Study of Financial Analysis of Nepal SDokument22 SeitenA Case Study of Financial Analysis of Nepal SDiwesh Tamrakar100% (1)

- Working Capital ManagementDokument72 SeitenWorking Capital ManagementShilpi AggarwalNoch keine Bewertungen

- A Comparative Study On Investment Pattern...Dokument9 SeitenA Comparative Study On Investment Pattern...cpmrNoch keine Bewertungen

- Summer Training Project ReportDokument110 SeitenSummer Training Project ReportmeetrinkuNoch keine Bewertungen

- Mba Project ReportDokument15 SeitenMba Project ReportPreet GillNoch keine Bewertungen

- Pest Analysis of Indusind BankDokument3 SeitenPest Analysis of Indusind BankViola33% (3)

- ProposalDokument12 SeitenProposalapil subediNoch keine Bewertungen

- Profitability Ratio Fieldwork Report Preparation For Bank.Dokument27 SeitenProfitability Ratio Fieldwork Report Preparation For Bank.Arpan GhimireNoch keine Bewertungen

- Gangadhar Meher University: A Study On Non Performing Asset of Scheduled Commercial Banks of India"Dokument42 SeitenGangadhar Meher University: A Study On Non Performing Asset of Scheduled Commercial Banks of India"Sushmita BarlaNoch keine Bewertungen

- Summer Training Report200Dokument25 SeitenSummer Training Report200amarsinghchawlaNoch keine Bewertungen

- Marketing in Recession:Maruti SuzukiDokument23 SeitenMarketing in Recession:Maruti Suzukigaurav@nm100% (1)

- Sindhudurg District Central Co-operative Bank Introduction (38 charactersDokument29 SeitenSindhudurg District Central Co-operative Bank Introduction (38 charactersSupriya MestryNoch keine Bewertungen

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceVon EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNoch keine Bewertungen

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexVon EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNoch keine Bewertungen

- The Four Walls: Live Like the Wind, Free, Without HindrancesVon EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesBewertung: 5 von 5 Sternen5/5 (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementVon EverandRegional Rural Banks of India: Evolution, Performance and ManagementNoch keine Bewertungen

- Porter's Five Forces Model On Automobile IndustryDokument6 SeitenPorter's Five Forces Model On Automobile IndustryBhavinShankhalparaNoch keine Bewertungen

- Financial Analysis of Maruti Suzuki, Tata Motors and Mahindra and MahindraDokument7 SeitenFinancial Analysis of Maruti Suzuki, Tata Motors and Mahindra and MahindraGarry JosanNoch keine Bewertungen

- Indian Aviation Industry - Indigo AirlinesDokument13 SeitenIndian Aviation Industry - Indigo AirlinesArjun Pratap SinghNoch keine Bewertungen

- Engineer in Society - BEM Code of Professional Conduct & Ethical TheoriesDokument38 SeitenEngineer in Society - BEM Code of Professional Conduct & Ethical TheoriesArjun Pratap Singh90% (30)

- Macro Economics - Tackling High Food Inflation & GST IndiaDokument8 SeitenMacro Economics - Tackling High Food Inflation & GST IndiaArjun Pratap SinghNoch keine Bewertungen

- Corruption & Cronyism in IndiaDokument15 SeitenCorruption & Cronyism in IndiaArjun Pratap SinghNoch keine Bewertungen

- Development of Electric Drives in Light Rail Transit (LRT) SystemDokument31 SeitenDevelopment of Electric Drives in Light Rail Transit (LRT) SystemArjun Pratap Singh100% (1)

- Bharat Petroleum (BPCL) Refinery 2009 - 2010 PresentationDokument40 SeitenBharat Petroleum (BPCL) Refinery 2009 - 2010 PresentationArjun Pratap SinghNoch keine Bewertungen

- Telecom Industry & Reasons For Switching Operators in The IndustryDokument21 SeitenTelecom Industry & Reasons For Switching Operators in The IndustryArjun Pratap Singh100% (1)

- Corruption & Cronyism in IndiaDokument15 SeitenCorruption & Cronyism in IndiaArjun Pratap SinghNoch keine Bewertungen

- Indian Aviation Industry - Indigo AirlinesDokument13 SeitenIndian Aviation Industry - Indigo AirlinesArjun Pratap SinghNoch keine Bewertungen

- A Positive Attitude EbookDokument19 SeitenA Positive Attitude Ebookhuy22983Noch keine Bewertungen

- AbdominalsDokument13 SeitenAbdominalsBeniamin CociorvanNoch keine Bewertungen

- PLC & Pneumatic SystemDokument38 SeitenPLC & Pneumatic SystemArjun Pratap Singh88% (8)

- How Can HUL Expand Its Reach To Rural Markets in India (Ideation)Dokument3 SeitenHow Can HUL Expand Its Reach To Rural Markets in India (Ideation)Arjun Pratap SinghNoch keine Bewertungen

- Natural Gas CompressionDokument49 SeitenNatural Gas CompressionArjun Pratap SinghNoch keine Bewertungen

- Major Oil and Gas Related CompaniesDokument4 SeitenMajor Oil and Gas Related CompaniesArjun Pratap SinghNoch keine Bewertungen

- DC - Coupled, Selectable-Gain Headphone Amplifier CircuitDokument30 SeitenDC - Coupled, Selectable-Gain Headphone Amplifier CircuitArjun Pratap SinghNoch keine Bewertungen

- Ultrasonic or MFL InspectionDokument4 SeitenUltrasonic or MFL InspectionArjun Pratap Singh100% (3)

- Windows XP Hidden ApplicationsDokument3 SeitenWindows XP Hidden ApplicationsArjun Pratap SinghNoch keine Bewertungen

- 10 Things They Never Tell You When You Start Work and WhyDokument24 Seiten10 Things They Never Tell You When You Start Work and WhyArjun Pratap SinghNoch keine Bewertungen

- Value Co-Creation of Social NetworkingDokument18 SeitenValue Co-Creation of Social NetworkingArjun Pratap SinghNoch keine Bewertungen

- Solar Energy - Photo Voltaic CellDokument22 SeitenSolar Energy - Photo Voltaic CellArjun Pratap Singh100% (1)

- Alternative English Dictionary Comprehensive, Vulgar Slang and Sex Related)Dokument38 SeitenAlternative English Dictionary Comprehensive, Vulgar Slang and Sex Related)pasooriNoch keine Bewertungen

- Impacts of Globalization On E-Commerce Adoption and Firm PerformanceDokument8 SeitenImpacts of Globalization On E-Commerce Adoption and Firm PerformanceArjun Pratap SinghNoch keine Bewertungen

- College Students and Personal Finance EducationDokument6 SeitenCollege Students and Personal Finance EducationArjun Pratap SinghNoch keine Bewertungen

- Challenges That Might Be Faced by Maersk & Damco MergersDokument4 SeitenChallenges That Might Be Faced by Maersk & Damco MergersArjun Pratap SinghNoch keine Bewertungen

- L Light A Amplification S Stimulated E Emission R RadiationDokument8 SeitenL Light A Amplification S Stimulated E Emission R RadiationArjun Pratap SinghNoch keine Bewertungen

- Autonomous Underwater Vehicle (AUV)Dokument44 SeitenAutonomous Underwater Vehicle (AUV)Arjun Pratap Singh100% (1)

- Engineering Project Management Hypothetical)Dokument96 SeitenEngineering Project Management Hypothetical)Arjun Pratap Singh100% (1)

- IMS Market Segmentation, Targeting and PositioningDokument35 SeitenIMS Market Segmentation, Targeting and PositioningBabul Jha100% (1)

- Fyp Manufacturing Design Insulation SystemDokument105 SeitenFyp Manufacturing Design Insulation SystemMuhammad AsifNoch keine Bewertungen

- Company Analysis - CastrolDokument12 SeitenCompany Analysis - CastrolSamirNoch keine Bewertungen

- Door Trim Panel Front Removal and Installation PDFDokument3 SeitenDoor Trim Panel Front Removal and Installation PDFMichael HernandezNoch keine Bewertungen

- Atlas Group of CompaniesDokument31 SeitenAtlas Group of CompaniesmuhammadtaimoorkhanNoch keine Bewertungen

- Autoweek - October 27, 2014Dokument72 SeitenAutoweek - October 27, 2014Cristian MineaNoch keine Bewertungen

- Ketki ZaveriDokument2 SeitenKetki Zaveriapi-15368277100% (2)

- Get Surrounded With Bright Minds: Entourage © 2011Dokument40 SeitenGet Surrounded With Bright Minds: Entourage © 2011Samantha HettiarachchiNoch keine Bewertungen

- 6bta59 G5Dokument2 Seiten6bta59 G5LibRo Vels100% (1)

- List of German CompaniesDokument637 SeitenList of German CompaniesmanishaNoch keine Bewertungen

- Package Policy Details for Maruti AltoDokument4 SeitenPackage Policy Details for Maruti AltoJeyam SpNoch keine Bewertungen

- Automotive Design and Production - May 2016 PDFDokument60 SeitenAutomotive Design and Production - May 2016 PDFzawmintun1Noch keine Bewertungen

- Schema Cutie de Viteza AD4Dokument4 SeitenSchema Cutie de Viteza AD4istanmoniNoch keine Bewertungen

- ENG7cranesgen Volvo Body Builder Cat Crane MountingDokument13 SeitenENG7cranesgen Volvo Body Builder Cat Crane MountingL.kolekar0% (1)

- IIIE Feb 16 FormDokument6 SeitenIIIE Feb 16 FormAnand SutarNoch keine Bewertungen

- Ignition Model #35496: Installation InstructionsDokument8 SeitenIgnition Model #35496: Installation InstructionsAlfonso JaureguiNoch keine Bewertungen

- Hero Honda Motors LTDDokument12 SeitenHero Honda Motors LTDAashir AgrawalNoch keine Bewertungen

- Revised Fines for Land Transport ViolationsDokument8 SeitenRevised Fines for Land Transport ViolationsJvlNoch keine Bewertungen

- Final Omkar Mahadane SIP ReportDokument49 SeitenFinal Omkar Mahadane SIP ReportAdesh MahadaneNoch keine Bewertungen

- D 1882 - 96 Rde4oditotyDokument2 SeitenD 1882 - 96 Rde4oditotyFrancisco GuerraNoch keine Bewertungen

- Plagiarism Checker Report Shows 10% SimilarityDokument31 SeitenPlagiarism Checker Report Shows 10% SimilaritykhayyumNoch keine Bewertungen

- Lincoln Vantage 575Dokument4 SeitenLincoln Vantage 575baoyingNoch keine Bewertungen

- Fuse Application Chart For PEUGEOT 306 From DAM 7147 TO 7447Dokument3 SeitenFuse Application Chart For PEUGEOT 306 From DAM 7147 TO 7447dedi kurniawanNoch keine Bewertungen

- Classification of Roads TypesDokument4 SeitenClassification of Roads TypesSubbaReddyNoch keine Bewertungen

- Comperative Study of Marketing Strategies in Luxury Car of Ford & HondaDokument88 SeitenComperative Study of Marketing Strategies in Luxury Car of Ford & Hondabond99999Noch keine Bewertungen

- Fix A FlatDokument1 SeiteFix A FlatKz SjjNoch keine Bewertungen

- Members: Cristopher Peña Mario RojasDokument23 SeitenMembers: Cristopher Peña Mario RojasAnonymous GB2pLzNoch keine Bewertungen

- Chapter 1Dokument14 SeitenChapter 1sathishprabu89Noch keine Bewertungen

- Case Study On TataDokument53 SeitenCase Study On Tatabunty.0991100% (1)

- 1103D-33 Engine PN1896Dokument2 Seiten1103D-33 Engine PN1896Paulo AzañeroNoch keine Bewertungen