Beruflich Dokumente

Kultur Dokumente

Crisil Org

Hochgeladen von

syadav431Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Crisil Org

Hochgeladen von

syadav431Copyright:

Verfügbare Formate

CRISIL CORPORATE GOVERNANCE RATING

To make the analysis of corporate governance complete and more

meaningful, CRISIL has added two aspects which are unique to its criteria

and methodology. The first is an assessment of management quality, an

indicator of value creation potential. The second is the measurement of the

value created for various stakeholders. Thus, in addition to a detailed

analysis and evaluation of corporate governance practices, CRISIL evaluates

the benefits of following good governance: whether it is adding value to the

various stakeholders of a company, and if so to what extent. CRISIL

measures and captures this element in its analysis to make it a genuine 360

degree evaluation rather than an analysis of one aspect alone.

CRISIL's rating criteria:

Equitable treatment of shareholders:

wnership structure is a key factor in assessing the treatment given to

shareholders. While the presence of a large or majority shareholder is not

necessarily a negative governance issue, CRISIL analyses companies with

such concentrated shareholding in detail to ascertain the extent to which the

majority shareholder acts in the interest of minority shareholders and all

other stakeholders. The other aspects that are analyzed here are the extent

of disclosure of shareholding pattern, presence of any disproportionate

control provision, and the systems in place to detect and prevent insider

trading.

nership rights of shareholders

CRISIL examines what a company does in articulating and protecting

shareholder rights: to what extent it is complying with the law, and where

its practices go beyond laws and regulations to address the spirit of

governance. The emphasis is on what a company does, rather than its

compliance with the minimum required by the law. CRISIL analyses the

provisions of the companys charter, viz. memorandum and articles of

association, for voting rights, classes of shares, presence of anti-takeover

provisions, and preferential rights for any section of shareholders. The

analysis also focuses on ease and effectiveness of shareholder participation

at meetings.

%ransparency & Disclosure

Transparency means timely disclosure of adequate information on the

companys operating and financial performance and its corporate

governance practices. This helps stakeholders to monitor the operation and

performance of the management. Good disclosure in a transparent manner

is a reflection of the quality of a companys corporate governance

practices.

CRISIL examines the content of public disclosure for completeness, quality

and clarity of reporting. The degree of disclosure in financial statements, on

related party transactions, on operational performance, and on governance,

is one key aspect that CRISIL looks into. The other aspect of disclosure is

the timing - whether the company communicates material events and

performance in a timely manner to reach the largest possible number of

relevant stakeholders.

CRISIL looks at the independence of the auditor, adequacy of internal audit,

and effectiveness of the audit process. The composition and functioning of

the audit committee, quality and type of issues discussed at the audit

committee, the nature and adequacy of oversight provided with respect to

the companys financial statement, and the internal control and risk

management functions, are some of the aspects examined under this

parameter.

Composition of Board

CRISIL looks at the composition of the Board and its sub-committees.

Boards should be structured in such a way that the interests of all the

shareholders and stakeholders are respected, represented and protected.

CRISIL evaluates whether the Board contains a good balance of independent

and executive directors, and whether the Board has the right mix of various

capabilities required for governing the company, taking into account the

size, industry nature and growth objectives. The analysis also includes

aspects like selection process for Board members, succession policies for

Board members, processes for ensuring availability of relevant competencies

on the Board, and Board compensation.

unctioning of Board

CRISIL examines the functioning of the Board and its sub-committees and

assesses the Boards role in providing independent oversight of

management performance. Effective Boards are active, engaged,

challenging and questioning in attitude, and exhibit true independence in

action. CRISIL assesses Board effectiveness in terms of the role the Board

has played in directing, articulating and implementing the companys

strategy, overseeing the performance of management, and monitoring

operational controls and risk management systems. CRISIL also examines

the role and contribution of independent directors.

anagement assessment

CRISIL looks at the reputation, experience, performance and skills of the

management. These enable the management to create value for

stakeholders. The success of past strategies, proactive nature of

management in identifying threats and opportunities in the operating

environment, integrity of the senior management, and risk appetite of the

management, are some of the key areas CRISIL examines while carrying

out a management assessment.

'alue creation for various stakeholders

The strength of a companys relationship with all its stakeholders (including

shareholders) is an important determinant of its ability to create economic

value on a sustainable basis. CRISIL has devised parameters to quantify the

delivery of value to each stakeholder. The key parameters that CRISIL

considers while analyzing the value delivered to various categories of

stakeholders are given below:

Stakeholder Key parameters

Shareholder Return on invested capital compared to the eighted

average cost of capital, dividend track record, and

payout ratio

Debt holder Debt protection measures, credit ratings

Customer arket share, assessment of customer satisfaction

Employee Absolute salary levels, adjusted groth in average

annual salaries, stock option programmes, attrition

rates, and intangible factors like ork environment

and facilities provided by employer

Supplier Credit terms, support provided, and transparent

dealings

Society Social projects taken up by the company, care for the

environment, taxes paid to Government

Benefits of CRISIL G'C Rating

CRISIL GVC Rating would help a company to:

- Highlight the effectiveness of corporate governance practices to investors

- ssess the existing level of governance practices and benchmark against

peers

- Create visibility across all stakeholders

- Broaden the appeal of the company to investors who are interested in long

term

sustainability

CRISIL Rating Symbols for Governance and 'alue Creation Ratings

CRISIL G'C

Level 1

The capability of firms rated CRISIL GVC Level 1

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is the highest.

CRISIL G'C

Level 2

The capability of firms rated CRISIL GVC Level 2

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is high.

CRISIL G'C

Level 3

The capability of firms rated CRISIL GVC Level 3

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is strong.

CRISIL G'C

Level 4

The capability of firms rated CRISIL GVC Level 4

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is moderate.

CRISIL G'C

Level 5

The capability of firms rated CRISIL GVC Level 5

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is adequate.

CRISIL G'C

Level 6

The capability of firms rated CRISIL GVC Level 6

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is inadequate.

CRISIL G'C

Level 7

The capability of firms rated CRISIL GVC Level 7

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is poor.

CRISIL G'C

Level 8

The capability of firms rated CRISIL GVC Level 8

with respect to wealth creation for all their

stakeholders while adopting sound corporate

governance practices is the lowest.

Source: www.crisil.com

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Practice ProblemsDokument11 SeitenPractice ProblemsAlma Jean Monterozo100% (2)

- Balancing SEBI Regulations in Overseas M&ADokument5 SeitenBalancing SEBI Regulations in Overseas M&ASatyakam MishraNoch keine Bewertungen

- Blaine Kitchenware Case QuestionDokument1 SeiteBlaine Kitchenware Case QuestionSimran Malhotra100% (1)

- Tutorial 3 (Q)Dokument4 SeitenTutorial 3 (Q)szh saNoch keine Bewertungen

- WorldcomDokument9 SeitenWorldcomGhazanfarNoch keine Bewertungen

- This Study Resource Was: Business Combinations (Part 2)Dokument6 SeitenThis Study Resource Was: Business Combinations (Part 2)Ahmadnur Jul75% (4)

- Vertical and HorizontalDokument25 SeitenVertical and HorizontalJunaid MalikNoch keine Bewertungen

- Nestle Philippines Inc. v. Court of Appeals PDFDokument8 SeitenNestle Philippines Inc. v. Court of Appeals PDFCJ RomanoNoch keine Bewertungen

- Test Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other LawsDokument8 SeitenTest Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other Lawssunil1287Noch keine Bewertungen

- SY BCOM DIV C 23 24 PPFA Sem IV Internal Project TopicsDokument1 SeiteSY BCOM DIV C 23 24 PPFA Sem IV Internal Project TopicsDarshan BhutaNoch keine Bewertungen

- Wacc Mini CaseDokument12 SeitenWacc Mini CaseKishore NaiduNoch keine Bewertungen

- Acc 501 New Quiz File Before Midterm SpringDokument16 SeitenAcc 501 New Quiz File Before Midterm SpringIshaqZadeNoch keine Bewertungen

- Audit of Shareholder's EquityDokument6 SeitenAudit of Shareholder's EquityRosalie Colarte LangbayNoch keine Bewertungen

- Retail Trade in The PhilippinesDokument4 SeitenRetail Trade in The Philippinesrhea joy tunayNoch keine Bewertungen

- Manajemen Keuangan - Merger and Acquisition PDFDokument36 SeitenManajemen Keuangan - Merger and Acquisition PDFvrieskaNoch keine Bewertungen

- Duterte Is Not Lee Kuan YewDokument4 SeitenDuterte Is Not Lee Kuan YewChristopher EsparagozaNoch keine Bewertungen

- Conceptual Framework and Accounting StandardsDokument5 SeitenConceptual Framework and Accounting StandardspeejayNoch keine Bewertungen

- Financial Statement Analysis of Fauji Fertilizer Company FFC Vs Engro CorporationDokument6 SeitenFinancial Statement Analysis of Fauji Fertilizer Company FFC Vs Engro Corporationqurban balochNoch keine Bewertungen

- SheDokument4 SeitenShecedrick abalosNoch keine Bewertungen

- Shareholders Agreement (Single Shareholder)Dokument2 SeitenShareholders Agreement (Single Shareholder)Legal Forms71% (7)

- FAR 2 Old Final Exam - 2011 - Problem SolvingDokument5 SeitenFAR 2 Old Final Exam - 2011 - Problem SolvingShiela Mae ReyesNoch keine Bewertungen

- L7. IAS 32 - Financial InstrumentsDokument7 SeitenL7. IAS 32 - Financial InstrumentsAhmed HussainNoch keine Bewertungen

- Detackting BreakoutsDokument9 SeitenDetackting BreakoutsJay SagarNoch keine Bewertungen

- Alminas ŽaldokasDokument44 SeitenAlminas ŽaldokasTsui KelvinNoch keine Bewertungen

- Government-Owned And/Or Controlled Corporations: (GOCC)Dokument30 SeitenGovernment-Owned And/Or Controlled Corporations: (GOCC)Angelica HonaNoch keine Bewertungen

- Analisis Laporan Keuangan Gajah TunggalDokument4 SeitenAnalisis Laporan Keuangan Gajah TunggalBramastho PutroNoch keine Bewertungen

- Joint Stock Company: Chapter - 4Dokument12 SeitenJoint Stock Company: Chapter - 4Md. Sojib KhanNoch keine Bewertungen

- Main Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementDokument22 SeitenMain Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementSnehaVohra100% (1)

- Coffin v. Atlantic Power Corp., 2015 ONSC 3686Dokument43 SeitenCoffin v. Atlantic Power Corp., 2015 ONSC 3686Drew HasselbackNoch keine Bewertungen

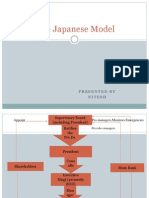

- The Japanese Model: Presented by NiteshDokument11 SeitenThe Japanese Model: Presented by Niteshnarayanyan1436Noch keine Bewertungen