Beruflich Dokumente

Kultur Dokumente

Market Outlook 14th September 2011

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Market Outlook 14th September 2011

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Market Outlook

India Research

September 14, 2011

Dealers Diary

The market surged in early trade, tracking higher Asian stocks. The market regained strength after trimming gains from intraday highs in morning trade. The market hit a fresh intraday high in mid-morning trade. The market surged to fresh intraday high in early afternoon trade. The Sensex came sharply off high in afternoon trade as European shares moved off highs after a firm start and as US index futures turned negative from positive. The market reversed its initial rally to hit two-week low in mid-afternoon trade as European shares fell and as US index futures slumped on fears that the Greek government may default on its debts. Volatility in European shares and US index futures triggered high volatility on the domestic bourses in late trade. The Sensex and Nifty ended with losses of 0.2% and 0.1%, respectively. The mid-cap and small-cap indices ended flat. Among the front runners, DLF, Jindal Steel, Bajaj Auto, Wipro and Infosys gained 1-2%, while Tata Motors, SBI, Wipro, Hindustan Unilever, Jaiprakash Asso and Bharti Airtel lost 1-5%. Among mid caps, SpiceJet, Madras Cements, Shree Cement, Aventis Pharma and SKS Microfinance gained 5-6%, while KGN Inds, GTL, Shriram City Uni, Tata Teleservices and GVK Power lost 4-5%.

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

Chg (%) (0.2) (0.1) 0.0 0.0 (0.5) (0.4) (0.4) (0.7) 0.2 0.4 0.9 Chg (%) 0.4 1.5 0.9 1.0 (4.2) (0.5) (1.1)

(Pts) (5.9) 2.0 1.0 (32.0) (26.2) (56.8) 31.4 44.7 (Pts) 37.1 44.6 80.9 (14.2) (26.5)

(Close) 4,941 6,319 7,169 5,925 7,518 8,481 8,510 4,833 (Close) 2,532 5,174 8,617 2,729 2,471

(34.3) 16,467

(47.9) 10,708 23.2 11,911

44.7 11,106

Markets Today

The trend deciding level for the day is 16,536/4,961 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 16,69816,928/5,0105,080 levels. However, if NIFTY trades below 16,536/4,961 levels for the first half-an-hour of trade then it may correct up to 16,30616,145/4,8914,842 levels.

Indices SENSEX NIFTY S2 16,145 4,842 S1 16,306 4,891 R1 16,698 5,010 R2 16,928 5,080

(836.1) 19,031

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank Advances / Declines Advances Declines Unchanged

Chg (%) 1.2 1.1 (0.3) (0.1)

(Pts) 0.6 0.1 (0.1) (0.0) BSE 1,397 1,395 136

(Close) $48.1 $9.3 $36.8 $30.8 NSE 738 732 56

News Analysis

TCS and Felda Prodata sign strategic collaboration DLF to sell NTC land SpiceJet promoter to increase stake at 50% premium

Refer detailed news analysis on the following page

Net Inflows (September 12, 2011) ` cr Purch Sales FII MFs 1,645 344 2,424 438

Net (780) (94)

MTD 1,363 (849)

YTD 555 5,426

Volumes (` cr) BSE NSE 2,276 9,833

FII Derivatives (September 13, 2011) ` cr Index Futures Stock Futures Gainers / Losers Gainers Company Cairn India India Cements IRB Infra. Glaxo. Cons. Patni Computer Price (`) 289 71 162 2,370 283 chg (%) 5.8 4.4 3.7 3.5 3.1 Company Tata Motors Zee Entertainment United Breweries GVK Power Pipavav Shipyard Losers Price (`) 140 114 395 17 88 chg (%) (4.6) (3.9) (3.6) (3.5) (3.3) Sebi Registration No: INB 010996539

1

Purch 2,508 1,685

Sales 2,375 1,396

Net 133 289

Open Interest 17,975 28,430

Please refer to important disclosures at the end of this report

Market Outlook | India Research

TCS and Felda Prodata sign strategic collaboration

TCS and Felda Prodata Systems (Prodata) have signed an agreement to jointly develop and deliver strategic information technology services and solutions to the Malaysian market. Both the organisations will jointly identify opportunities to participate in tenders from government offices. This collaboration is the first between the two organisations to pool their expertise. This is expected to positively impact the IT industry both in the Malaysian and regional markets. Under this agreement, both organisations will jointly take forward their key IT initiatives in a timely, efficient and effective manner to service customers. They will also jointly develop and market IT solutions and services to local companies, Malaysian government-linked companies (GLCs) and global companies within Malaysia. TCS and Prodata will share their technology expertise in areas including open source solutions, SAP-ERP application, application development and maintenance, shared services/business process outsourcing, infrastructure services and business intelligence. We maintain our Buy rating on TCS with a target price of `1,368.

DLF to sell NTC land

DLF, which recently sold 28 acres of land in Gurgaon for `440cr, is further selling its assets to reduce its debt, which stood at `21,524cr at the end of 1QFY2012. The company is expected to sell its 17.5 acres in NTC mill land in central Mumbai, which is estimated to be around `3,000cr`4,000cr and could be one of the biggest land deals in the country. The company is also seeking approval from the Board of Approvals for SEZs to sell the shares of its IT SEZ in Pune. DLF, which has a 70% stake in the SEZ, is in talks with PE players to sell the land, which is estimated to be around `900cr. If these deals go through, the company could significantly reduce its mounting debt, which has been one of the major concerns for the company. We continue to remain Neutral on the stock and will wait for further clarification on the deals.

SpiceJet promoter to increase stake at 50% premium

SpiceJet has decided to issue 35,977,619 equity shares at an average price of `36/share to Mr. Kalanithi Maran on preferential basis. This shows the underlying confidence that the promoter has in the company given the current market scenario. The promoters stake will increase to 43% post dilution. The company will be able to raise nearly `130cr from the equity dilution, which will help it in the current market, where the company is losing money because of artificial low pricing and high fuel cost. The company reported loss of `72cr in 1QFY2012 and is expected to report loss in 2QFY2012E also. We continue to remain Neutral on the stock.

September 14, 2011

Market Outlook | India Research

Economic and Political News

IEA cuts oil demand growth forecasts for 2011 and 2012 Government will meet `40,000cr disinvestment goal: Finance Ministry Competition policy will tame inflation: Corporate Affairs Ministry

Corporate News

BPCL plans to raise US$400mn to fund FY2012 capital expenditure HFCs face tighter regulations as NHB raises provisioning requirements NMDC to submit bid for 50% stake in Australian firm for ~`200cr Bajaj Hindusthan to raise `1,644cr through rights issue

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

September 14, 2011

Market Outlook | India Research

Research Team Tel: 022-3935 7800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

Address: 6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3935 7800

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

September 14, 2011

Das könnte Ihnen auch gefallen

- Market Outlook 28th March 2012Dokument4 SeitenMarket Outlook 28th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 24th August 2011Dokument4 SeitenMarket Outlook 24th August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 29th November 2011Dokument3 SeitenMarket Outlook 29th November 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 11th January 2012Dokument4 SeitenMarket Outlook 11th January 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 25th August 2011Dokument3 SeitenMarket Outlook 25th August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 28th September 2011Dokument3 SeitenMarket Outlook 28th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 7th September 2011Dokument3 SeitenMarket Outlook 7th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 27th September 2011Dokument3 SeitenMarket Outlook 27th September 2011angelbrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument4 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 20th September 2011Dokument4 SeitenMarket Outlook 20th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 6th September 2011Dokument4 SeitenMarket Outlook 6th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 6th March 2012Dokument3 SeitenMarket Outlook 6th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 22nd November 2011Dokument4 SeitenMarket Outlook 22nd November 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 26th August 2011Dokument3 SeitenMarket Outlook 26th August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 5th January 2012Dokument3 SeitenMarket Outlook 5th January 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 8th September 2011Dokument4 SeitenMarket Outlook 8th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 26th September 2011Dokument3 SeitenMarket Outlook 26th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 2nd April 2012Dokument4 SeitenMarket Outlook 2nd April 2012Angel BrokingNoch keine Bewertungen

- Market Outlook: India Research Dealer's DiaryDokument3 SeitenMarket Outlook: India Research Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 24th November 2011Dokument3 SeitenMarket Outlook 24th November 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 18th August 2011Dokument3 SeitenMarket Outlook 18th August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 4th August 2011Dokument4 SeitenMarket Outlook 4th August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook: India Research Dealer's DiaryDokument4 SeitenMarket Outlook: India Research Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 23rd August 2011Dokument3 SeitenMarket Outlook 23rd August 2011angelbrokingNoch keine Bewertungen

- Market Outlook 19th August 2011Dokument3 SeitenMarket Outlook 19th August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 2nd September 2011Dokument4 SeitenMarket Outlook 2nd September 2011anon_8523690Noch keine Bewertungen

- Market Outlook 9th April 2012Dokument3 SeitenMarket Outlook 9th April 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 17.11.11Dokument3 SeitenMarket Outlook 17.11.11Angel BrokingNoch keine Bewertungen

- Market Outlook 12th October 2011Dokument4 SeitenMarket Outlook 12th October 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 14th March 2012Dokument3 SeitenMarket Outlook 14th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument4 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 4th January 2012Dokument3 SeitenMarket Outlook 4th January 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 9th January 2012Dokument3 SeitenMarket Outlook 9th January 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 10th April 2012Dokument3 SeitenMarket Outlook 10th April 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 5th August 2011Dokument4 SeitenMarket Outlook 5th August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 29th March 2012Dokument3 SeitenMarket Outlook 29th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 22nd August 2011Dokument4 SeitenMarket Outlook 22nd August 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 21st March 2012Dokument3 SeitenMarket Outlook 21st March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 23rd December 2011Dokument4 SeitenMarket Outlook 23rd December 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 13th March 2012Dokument4 SeitenMarket Outlook 13th March 2012Angel BrokingNoch keine Bewertungen

- Marudyog 20110607Dokument3 SeitenMarudyog 20110607hemen_parekhNoch keine Bewertungen

- Market Outlook 26th March 2012Dokument4 SeitenMarket Outlook 26th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 23rd September 2011Dokument4 SeitenMarket Outlook 23rd September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 23rd February 2012Dokument4 SeitenMarket Outlook 23rd February 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 1st March 2012Dokument4 SeitenMarket Outlook 1st March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 24th February 2012Dokument4 SeitenMarket Outlook 24th February 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 30th March 2012Dokument3 SeitenMarket Outlook 30th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 2nd January 2012Dokument3 SeitenMarket Outlook 2nd January 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 5th September 2011Dokument4 SeitenMarket Outlook 5th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 29th September 2011Dokument3 SeitenMarket Outlook 29th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 30th Decmber 2011Dokument3 SeitenMarket Outlook 30th Decmber 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 28th December 2011Dokument4 SeitenMarket Outlook 28th December 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 20th March 2012Dokument3 SeitenMarket Outlook 20th March 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 4th October 2011Dokument3 SeitenMarket Outlook 4th October 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 10th January 2012Dokument4 SeitenMarket Outlook 10th January 2012Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument5 SeitenMarket Outlook: Dealer's DiaryVaibhav BhadangeNoch keine Bewertungen

- Market Outlook 21st December 2011Dokument5 SeitenMarket Outlook 21st December 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 20th December 2011Dokument4 SeitenMarket Outlook 20th December 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 30th September 2011Dokument3 SeitenMarket Outlook 30th September 2011Angel BrokingNoch keine Bewertungen

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingVon EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Wayfair Research PaperDokument22 SeitenWayfair Research PaperYasuo GodNoch keine Bewertungen

- Bonds and Stocks (Math of Investment)Dokument2 SeitenBonds and Stocks (Math of Investment)RCNoch keine Bewertungen

- 14.Kx For Surveillance AlertsDokument31 Seiten14.Kx For Surveillance AlertsManojNoch keine Bewertungen

- CFADokument79 SeitenCFATuan TrinhNoch keine Bewertungen

- Transition From LIBOR To SOFR - Primer For IFC ClientsDokument4 SeitenTransition From LIBOR To SOFR - Primer For IFC ClientsOUSSAMA NASRNoch keine Bewertungen

- CLSA India Strategy (Taking Stock June 2023) 06072023Dokument19 SeitenCLSA India Strategy (Taking Stock June 2023) 06072023botoy26Noch keine Bewertungen

- 20189616154angel Broking DRHPDokument349 Seiten20189616154angel Broking DRHPravi.youNoch keine Bewertungen

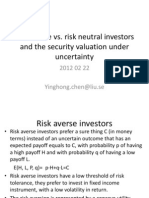

- Risk Averse Vs Risk Neutral InvestorsDokument9 SeitenRisk Averse Vs Risk Neutral InvestorsYinghong chenNoch keine Bewertungen

- MKTG 116 Quiz 1Dokument3 SeitenMKTG 116 Quiz 1Olive BobadillaNoch keine Bewertungen

- SM Chap 9Dokument41 SeitenSM Chap 9Debora BongNoch keine Bewertungen

- CEEMEA Strategy Türkiye Strategy - Post-Election Scenarios 74Dokument21 SeitenCEEMEA Strategy Türkiye Strategy - Post-Election Scenarios 74Ceren Dogu KaraatmacaNoch keine Bewertungen

- Infox TechnologiesDokument7 SeitenInfox Technologiesparvathy prakashNoch keine Bewertungen

- Quantitative Methods in Finance Msc. in Finance Fall 2020: InstructionsDokument2 SeitenQuantitative Methods in Finance Msc. in Finance Fall 2020: InstructionsAlvaro Ramos RiosNoch keine Bewertungen

- Factors That Necessitate The Shift of The Security Market Line To A New Security LineDokument2 SeitenFactors That Necessitate The Shift of The Security Market Line To A New Security LineBarno NicholusNoch keine Bewertungen

- WhitepaperDokument33 SeitenWhitepaperniteshmchopraNoch keine Bewertungen

- A Fuller OFC: K-REIT AsiaDokument5 SeitenA Fuller OFC: K-REIT Asiacentaurus553587Noch keine Bewertungen

- NISM Series VII: Securities Operations and Risk Management Certification ExaminationDokument99 SeitenNISM Series VII: Securities Operations and Risk Management Certification ExaminationSaied MastanNoch keine Bewertungen

- MKTG Atlantic Computer Case Study AssignmentDokument5 SeitenMKTG Atlantic Computer Case Study Assignmentvarshavarala61198Noch keine Bewertungen

- Rose Hudgins Bank Management and FinanciDokument42 SeitenRose Hudgins Bank Management and FinancisaadNoch keine Bewertungen

- AP.2906 InvestmentsDokument6 SeitenAP.2906 InvestmentsmoNoch keine Bewertungen

- The Rise and Fall of The Shadow Banking System, Zoltan PozsarDokument14 SeitenThe Rise and Fall of The Shadow Banking System, Zoltan Pozsared_nyc100% (1)

- 6 5.1-Elss PDFDokument12 Seiten6 5.1-Elss PDFKshitiz RastogiNoch keine Bewertungen

- TWSGuide PDFDokument1.742 SeitenTWSGuide PDFeplan drawingsNoch keine Bewertungen

- SREI Infrastructure Bond Application FormDokument8 SeitenSREI Infrastructure Bond Application FormPrajna CapitalNoch keine Bewertungen

- Philippine Monetary SystemDokument6 SeitenPhilippine Monetary SystemMikk Mae GaldonesNoch keine Bewertungen

- Capital Asset Pricing ModelDokument4 SeitenCapital Asset Pricing ModelGeorge Ayesa Sembereka Jr.Noch keine Bewertungen

- Karen The SupertraderDokument2 SeitenKaren The SupertraderHemant Chaudhari100% (1)

- Chapter 15 WileyDokument5 SeitenChapter 15 WileyTati Ana0% (1)

- The Trading Bible: Supply/Demand & Liquidity ConceptsDokument46 SeitenThe Trading Bible: Supply/Demand & Liquidity ConceptsLuiz Fernando Teixeira94% (16)

- Break Even PointDokument2 SeitenBreak Even PointIan VinoyaNoch keine Bewertungen