Beruflich Dokumente

Kultur Dokumente

Business Communication.

Hochgeladen von

RavRaipurOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Business Communication.

Hochgeladen von

RavRaipurCopyright:

Verfügbare Formate

Live Project Business Communication Topic Share of Life Insurance Products in the personal savings of salaried class in Raipur.

r. Questionnaire 1. Do you have any life insurance policy? -Yes -No If yes of which company? - LIC -Icici Prudential - Bajaj Allianz -Ing Vysya Reliance Life - SBI Life -Max New York - Other ( Mention Name) If no, the reason? 2. Which kind of insurance you have taken? -Term Insurance Policy -Money Back Policy - Whole Life Policy -Annuities & Pension -Endowment -Other (Mention Name) -Hdfc Standard -Aviva -Birla Sun -Sahara Life

-Met Life

3. Why have you adopted for that policy? -Investment -Risk Cover -Tax Planning

4. How many members of your family have got insured? - 1 - 2 - 3 - more than 3

5. May I know which member has got insured? - Mother 6. Whether you are -Self Employed -Salaried - Father - Children - Spouse

7. You come under which income group? Less than 60000 180000-240000 60000-120000 240000-300000 120000-180000 More than 300000

8. What is your monthly savings? Less than 10000 40000-50000 10000-20000 more than 50000 20000-30000 30000-40000

9. Are you availing any insurance from your organization? -Yes -No If yes kindly mention the name of the insurance company. 10. What is the amount insured in your policy/policies? Less than 100000 200000-300000 100000-200000 More than 300000

11. What is the mode of payment of premium? - Yearly - Quarterly - Half-yearly - Monthly

Kindly mention the amount of premium 12. Is your life fully insured? -Yes -No 13. Tick the type of plan. -Protection -Children -Savings & Investment -Others (Mention Name) -Retirement -Dont Know

14. Do you avail any tax benefits under your insurance plan/scheme? -Yes -No - Dont Know

15. Mode of policy purchase -Direct -Insurance Agent

16. Did you undergo any medical test for insurance? -Yes -No

17. Is loan against your policy available? -Yes -No -Dont Know

18. Is your insurance through bancassurance channel? -Yes If yes through which bank? 19. What is the critical illness/ dreaded disease covered under your insurance policy? -Cancer -Paralysis -Kidney Failure -Heart Problem -Other( Mention Name) -No -Dont Know

To From Subject Date

: : : :

The Employees The Manager Customer Plus Campaign September 21, 2008

The banking sector is growing at a scorching pace with a rapid increase in the number of customers. The unprecedented growth calls for enhanced customer services to attract and retain the customers. With the customers demanding reduction in user charges, expecting rapid response to requests it has become imperative to customize and personalize products and services. In this connection the Customer Plus campaign will be conducted commencing from the 1st of September. It focuses on: 1. 2. 3. 4. 5. Improved in-branch customer services. Improved ATM Services Improved Customer tele-helpdesk. Deposit Mobilization Campaign Improved Personal Loan Recovery.

It is expected that the employees actively respond to the consumers needs. The ultimate purpose of the campaign is to build a strong and knitted relationship with the customers through better understanding and management of customer expectations.

Dear Customer, It gives us immense pleasure to inform you that your trusted bank is coming up with yet another initiative called the Customer Plus campaign to serve you in a better way. The month long campaign commences on the 1st of September and will focus on improved in-branch customer services, improved ATM services, improved customer tele-help desk, a deposit mobilization campaign and improved personal loan recovery. If you have any queries about the campaign feel free to contact us. The bank values the strengthening of relationship with the customers and is committed to quality customer service. We seek your continued cooperation and enduring business relationship with the bank.

It gives us immense pleasure to You are cordially invited to the inauguration function of Customer Plus Campaign on the 1st of September 2008. The campaign is

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Banking Procedures and Control of CashDokument27 SeitenBanking Procedures and Control of CashMohamedNoch keine Bewertungen

- EOI On Excess Bank ChargesDokument22 SeitenEOI On Excess Bank ChargesOlufemi Moyegun100% (4)

- Press ReleaseDokument3 SeitenPress ReleaseFuaad DodooNoch keine Bewertungen

- CH 12Dokument32 SeitenCH 12Abood AlissaNoch keine Bewertungen

- ANZ Commodity Daily 703 120912Dokument5 SeitenANZ Commodity Daily 703 120912ftforfree9766Noch keine Bewertungen

- Negotin Bar Exam QuestionsDokument13 SeitenNegotin Bar Exam QuestionsVenz LacreNoch keine Bewertungen

- 114 008 1 ct5Dokument8 Seiten114 008 1 ct5Wei SeongNoch keine Bewertungen

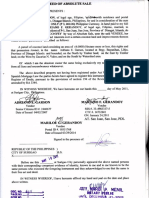

- Deed of Absolute SaleDokument1 SeiteDeed of Absolute SaleMariano GerandoyNoch keine Bewertungen

- Avoidance of Certain Terms and Rights of Recovery"Dokument1 SeiteAvoidance of Certain Terms and Rights of Recovery"Ramgilas MeenaNoch keine Bewertungen

- BlackDokument2 SeitenBlacksaxvdx100% (1)

- Soriano V Bautista Sales Case DigestDokument2 SeitenSoriano V Bautista Sales Case DigestattycertfiedpublicaccountantNoch keine Bewertungen

- Advanced Auditing ProblemsDokument4 SeitenAdvanced Auditing Problemsshani shanNoch keine Bewertungen

- MODAUD1 UNIT 3 - Audit of ReceivablesDokument11 SeitenMODAUD1 UNIT 3 - Audit of ReceivablesJake BundokNoch keine Bewertungen

- Enrollment List - For Website UploadDokument1.473 SeitenEnrollment List - For Website UploadShailesh TrivediNoch keine Bewertungen

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 409Dokument22 SeitenDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 409Justia.comNoch keine Bewertungen

- Bharat BankDokument62 SeitenBharat BankMaria NunesNoch keine Bewertungen

- Credit Union ResumeDokument2 SeitenCredit Union Resumeapi-459901054Noch keine Bewertungen

- Trust Accounting HandbookDokument95 SeitenTrust Accounting HandbookLuis RiquelmeNoch keine Bewertungen

- Majority of The Respondents Are FemaleDokument4 SeitenMajority of The Respondents Are Femalenataraj008Noch keine Bewertungen

- PEC's Standard Form of Document For Engineering Consultancy Projects (Small Projects) Lump Sum AssignmentsDokument45 SeitenPEC's Standard Form of Document For Engineering Consultancy Projects (Small Projects) Lump Sum AssignmentsFahad Masood100% (1)

- CAS 560 Subsequent EventsDokument11 SeitenCAS 560 Subsequent EventszelcomeiaukNoch keine Bewertungen

- Urs For Export DocumentationDokument14 SeitenUrs For Export DocumentationSubhash ReddyNoch keine Bewertungen

- Bank of Maharashtra History INFORMATIONDokument3 SeitenBank of Maharashtra History INFORMATIONbharatNoch keine Bewertungen

- Cebu Pacific RyanDokument5 SeitenCebu Pacific RyanBryan DimayugaNoch keine Bewertungen

- M3M Corner Walk BrochureDokument14 SeitenM3M Corner Walk BrochureharshNoch keine Bewertungen

- Multiple Deposit CreationDokument10 SeitenMultiple Deposit CreationAsif NawazNoch keine Bewertungen

- Research Proposal On Corporate GovernanceDokument12 SeitenResearch Proposal On Corporate GovernanceOlabanjo Shefiu Olamiji60% (5)

- Appraisal of Term LoanDokument13 SeitenAppraisal of Term LoanAabhash ShrivastavNoch keine Bewertungen

- Financial Inclusion in IndiaDokument2 SeitenFinancial Inclusion in IndiaashishNoch keine Bewertungen

- Principle of Utmost Good FaithDokument7 SeitenPrinciple of Utmost Good FaithMina GagaoinNoch keine Bewertungen