Beruflich Dokumente

Kultur Dokumente

Statement of Cost Sheet: Output Per Unit

Hochgeladen von

Manish PahujaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Statement of Cost Sheet: Output Per Unit

Hochgeladen von

Manish PahujaCopyright:

Verfügbare Formate

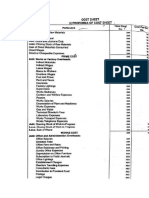

STATEMENT OF COST SHEET

OUTPUT PER UNIT

Particulars Raw Materials consumed: Opening Stock of Raw Material Add: Purchases of Raw materials Add: Carriage on purchases Less: Closing stock of Raw material

Total Cost Rs.

Cost Per unit Rs.

Raw Material Consumed (RMC) Director Labour Chargeable Expenses

PRIME COST Add: Factory overheads Add: Opening work- in -progress Less: Closing work- in- progress

FACTORY COST Add: Office and Administration Overheads

COST OF PRODUCTION Add: Opening stock of finished goods Less: closing stock of finished goods

COST OF GOODS SOLD (COGS) Add: Selling and Distribution Overheads

COST OF SALES PROFIT (BALANCING FIGURE)

REVENUE/SELLING PRICE

Items not included in Cost Sheet: a) Income tax b) Dividends to shareholders c) Commission to managing directors d) Capital losses i.e. loss out of sales e) Interest on loan or debentures or bank interest f) Donations g) Capital expenditure h) Discounts on shares and debentures i) Premium on redemption of shares and debentures j) Underwriting commission

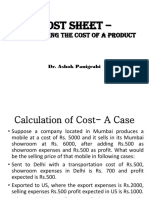

1. Prepare a cost sheet: Raw materials consumed Rs.1,60,000. Direct wages Rs. 80,000. Factory overheads Rs.16,000. Office overheads 10% of factory cost. Selling overheads Rs.12,000. Units produced 4,000. Units sold 3600. Selling price per unit Rs.100.

2. Prepare Cost Sheet:

Direct materials Rs. 200,000. Factory expenses Rs. 120,000. Office expenses Rs.90,000 Total sales Rs.6,50,000. Prime cost Rs. 410,000. 10 % of the output is in stock. 3. The following information is obtained: Stock on Jan 1, 2007 : Raw materials: Rs 40,000 and finished goods Rs. 30, 000. Purchases of Raw materials: Rs 240,000, direct wages Rs. 136,000. Works expenses Rs. 70,400. Dividends paid Rs. 40,000. Office expenses Rs. 24,000. Depreciation on plant Rs. 10,000, Selling and Distribution expenses Rs 32,000. Goodwill written off of Rs. 40,000. Work in progress: 1.1.2007: Rs. 64,000. 31.12.2007: Rs. 72,000.

Stock on31.12.2007: Raw materials Rs. 42,000 Finished goods Rs. 32,000.

4. Prepare a cost sheet in the books of Polly Limited using the following information (14 marks) Raw materials Rs. 33,000, Unproductive wages Rs. 10,500, Factory lighting Rs. 2,200, Motive power Rs.4,400, Directors fees (Works) Rs.1,000, Factory cleaning Rs.500, Factory stationery Rs.750, Loose tools written off Rs.600, Water supply (works) Rs.1,200 and Office insurance Rs. 500. Chargeable (Direct) expenses Rs. 3,000, Depreciation: Plant and machinery Rs. 2,000, Office Building Rs. 1,000 & Delivery vans Rs. 200. Upkeep of Delivery van Rs.700. Commission on sales Rs. 1,500, Productive wages Rs. 35,000. Factory rent and taxes Rs. 7,500, Factory heating Rs. 1,500. Directors fees (office) Rs. 2,000, Sundry office expenses Rs.200, Office stationery Rs.900, Rent and taxes (office) Rs.500, Factory insurance Rs. 1,100, Legal expenses Rs.400, rent of warehouse Rs. 300(selling), Advertising Rs.300, Sales Department salaries Rs. 1,500, Total output is 20,000 tons. Sale of finished goods is Rs. 550,000.

5. The following data relates to the manufacture of a standard product during the month of April,2009 Raw Materials: Rs. 180,000 Direct Wages: Rs. 90,000 Machine hours worked (hours): 10,000 Machine Hour Rate (per hour): Rs. 8 Administration overheads 10% of work cost Selling overheads Rs 5 per unit Units produced: 4000 Units Sold: 3,600 You are required to prepare a cost sheet in respect of the above 6. The following information has been obtained from the records of ABC corporation for the period from June 1 to June 30, 2009 On June 1 On June 30 Cost of raw materials 60,000 50,000 Cost of work-in-progress 12,000 15,000 Cost of stock of finished goods 90,000 110,000

Purchase of Raw material during June 2009: Rs. 480,000 Wages Paid Rs. 240,000 Factory Overheads Rs. 100,000 Administration Overheads Rs. 50,000 Selling & Distribution Overheads Rs. 25,000 Sales Rs 1,000,000 Prepare a statement giving the following information (a) Raw Material consumed (b) Prime Cost (c) Factory cost (d) Cost of goods sold; and (e) Net Profit

Das könnte Ihnen auch gefallen

- Cost ProblemsDokument7 SeitenCost ProblemsMadanNoch keine Bewertungen

- Neca Labor Factor Score SheetDokument1 SeiteNeca Labor Factor Score SheetEng Waseem SamsodienNoch keine Bewertungen

- Cost Sheet for Company BooksDokument16 SeitenCost Sheet for Company BooksJayaKhemani82% (11)

- Cost Sheet ProblemsDokument7 SeitenCost Sheet ProblemsApparao ChNoch keine Bewertungen

- IGBC Certified BldgsDokument26 SeitenIGBC Certified BldgsNidhi Chadda MalikNoch keine Bewertungen

- Costing Sheet - Easiest WayDokument11 SeitenCosting Sheet - Easiest Waypankajkuma981100% (1)

- Cost Accounting 2013Dokument3 SeitenCost Accounting 2013GuruKPO0% (1)

- Sample Paper Cost & Management Accounting Question BankDokument17 SeitenSample Paper Cost & Management Accounting Question BankAnsh Sharma100% (1)

- COST SHEET TITLEDokument6 SeitenCOST SHEET TITLEmeenagoyal995650% (2)

- Level 3 Repair: 8-1. Components LayoutDokument50 SeitenLevel 3 Repair: 8-1. Components LayoutManuel BonillaNoch keine Bewertungen

- Notes On Cash BudgetDokument26 SeitenNotes On Cash BudgetJoshua P.Noch keine Bewertungen

- Iphone 14 Plus InvoiceDokument2 SeitenIphone 14 Plus Invoicesubhashgidwani0099100% (1)

- Cost Sheet FormatDokument5 SeitenCost Sheet FormatJatin Gadhiya83% (6)

- Field Experience B Principal Interview DardenDokument3 SeitenField Experience B Principal Interview Dardenapi-515615857Noch keine Bewertungen

- Business Finance Week 2 2Dokument14 SeitenBusiness Finance Week 2 2Phoebe Rafunsel Sumbongan Juyad100% (1)

- Cost Sheet Practical ProblemsDokument2 SeitenCost Sheet Practical Problemssameer_kiniNoch keine Bewertungen

- Costing AssignmentDokument15 SeitenCosting AssignmentSumit SumanNoch keine Bewertungen

- COSTINGDokument182 SeitenCOSTINGjahazi2100% (1)

- Cost SheetDokument5 SeitenCost Sheetpooja45650% (2)

- Cost SheetDokument3 SeitenCost SheetAnkit Yadav100% (1)

- Cec Case Study of 20 MarksDokument32 SeitenCec Case Study of 20 MarksAjay GohilNoch keine Bewertungen

- Important Theorertical QuestionsDokument3 SeitenImportant Theorertical QuestionsKuldeep Singh Gusain100% (1)

- Questions of CGSDokument4 SeitenQuestions of CGSaneel72Noch keine Bewertungen

- HW 1 MGT202Dokument4 SeitenHW 1 MGT202Rajnish Pandey0% (1)

- Question PaperDokument2 SeitenQuestion Papertitu mamaNoch keine Bewertungen

- Cost Accounting: Time Allowed: 3 Hours Marks: 100Dokument3 SeitenCost Accounting: Time Allowed: 3 Hours Marks: 100muhammad sami ullah khanNoch keine Bewertungen

- Cost Accounting MCQs and ProblemsDokument5 SeitenCost Accounting MCQs and ProblemsEnbathamizhanNoch keine Bewertungen

- PPCE Que BankDokument2 SeitenPPCE Que BanktsrNoch keine Bewertungen

- Job and Batch CostingDokument7 SeitenJob and Batch CostingDeepak R GoradNoch keine Bewertungen

- Management Accounting AssignmentDokument8 SeitenManagement Accounting AssignmentAjay VatsavaiNoch keine Bewertungen

- List of Problems@mac2Dokument6 SeitenList of Problems@mac2rahulchohan21080% (1)

- Management Accounting 21.1.11 QuestionsDokument5 SeitenManagement Accounting 21.1.11 QuestionsAmeya TalankiNoch keine Bewertungen

- UNIT 3 & 5 - Cost classification & Cost sheetDokument14 SeitenUNIT 3 & 5 - Cost classification & Cost sheetkevin75108Noch keine Bewertungen

- Manufacturing Cost Sheet Group 1Dokument7 SeitenManufacturing Cost Sheet Group 1Anantha KrishnaNoch keine Bewertungen

- Tugas Akuntansi Keuangan InggrisDokument2 SeitenTugas Akuntansi Keuangan InggrisHernandez TVNoch keine Bewertungen

- 68957Dokument9 Seiten68957Mehar WaliaNoch keine Bewertungen

- Cost Sheet QuestionsDokument5 SeitenCost Sheet QuestionsDrimit GhosalNoch keine Bewertungen

- Eiii - Ii.1.cost Acctg (Ccafat)Dokument11 SeitenEiii - Ii.1.cost Acctg (Ccafat)shreekumar_scdlNoch keine Bewertungen

- The Account of Chintu ManufacturingDokument3 SeitenThe Account of Chintu ManufacturingSafiqur RahmanNoch keine Bewertungen

- CMA Online Final Assessment Spring 2020Dokument4 SeitenCMA Online Final Assessment Spring 2020Waqar AhmadNoch keine Bewertungen

- Important Theorertical QuestionsDokument3 SeitenImportant Theorertical QuestionsKuldeep Singh GusainNoch keine Bewertungen

- Important Theorertical QuestionsDokument3 SeitenImportant Theorertical QuestionsKuldeep Singh GusainNoch keine Bewertungen

- Cost Sheet ProblemsDokument22 SeitenCost Sheet ProblemsAvinash Tanawade100% (4)

- 4 FM AssignmentDokument3 Seiten4 FM AssignmentGorav BhallaNoch keine Bewertungen

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDokument11 SeitenSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- Marginal CostingDokument9 SeitenMarginal CostingSharika EpNoch keine Bewertungen

- Mms AssignDokument3 SeitenMms AssigndarekarroshanNoch keine Bewertungen

- Cost AccountingDokument43 SeitenCost AccountingAmina QamarNoch keine Bewertungen

- Cost SheetDokument3 SeitenCost Sheetruchi_rohilla9603Noch keine Bewertungen

- Test Cost SheetDokument3 SeitenTest Cost SheetIt's MeNoch keine Bewertungen

- ALl Questions According To TopicsDokument11 SeitenALl Questions According To TopicsHassan KhanNoch keine Bewertungen

- Paper - 5: Advanced Management Accounting Questions Marginal Costing vs. Absorption CostingDokument66 SeitenPaper - 5: Advanced Management Accounting Questions Marginal Costing vs. Absorption CostingNagabhushanaNoch keine Bewertungen

- Cost Sheet-3Dokument77 SeitenCost Sheet-3nahi batanaNoch keine Bewertungen

- Accounting For Raw Material and LaborDokument24 SeitenAccounting For Raw Material and LaborAntony HermawanNoch keine Bewertungen

- Assignment One and TwoDokument5 SeitenAssignment One and Twowalelign yigezawNoch keine Bewertungen

- Cost Sheet 23 ProblemsDokument3 SeitenCost Sheet 23 ProblemsTanmay DattNoch keine Bewertungen

- Cost Sheet PDFDokument73 SeitenCost Sheet PDFsaloniNoch keine Bewertungen

- Cost Sheet and TenderDokument8 SeitenCost Sheet and Tenderanupsuchak50% (2)

- Unit Costing IllustrationsDokument14 SeitenUnit Costing IllustrationskeyurNoch keine Bewertungen

- Calculate Working Capital Requirements from Financial Data ProblemsDokument3 SeitenCalculate Working Capital Requirements from Financial Data ProblemsPriyanka RajendraNoch keine Bewertungen

- Cost accounting cycle stepsDokument2 SeitenCost accounting cycle stepsChris Aruh BorsalinaNoch keine Bewertungen

- Soal Asistensi Akuntansi Manajemen 1-6Dokument26 SeitenSoal Asistensi Akuntansi Manajemen 1-6Lilik Adik KurniawanNoch keine Bewertungen

- Marginal AbsorptionDokument4 SeitenMarginal Absorptionbalachmalik100% (1)

- Job & Batch Costing-IllustrationsDokument14 SeitenJob & Batch Costing-IllustrationskeyurNoch keine Bewertungen

- Cost Accounting CycleDokument2 SeitenCost Accounting CycleJessica AningatNoch keine Bewertungen

- Ac Solve PaperDokument59 SeitenAc Solve PaperHaseeb ShadNoch keine Bewertungen

- New Position Performance Evaluation FormDokument4 SeitenNew Position Performance Evaluation FormRomero SanvisionairNoch keine Bewertungen

- CFPA E Guideline No 32 2014 F1Dokument38 SeitenCFPA E Guideline No 32 2014 F1akramNoch keine Bewertungen

- Chap 01-Introduction To AccountingDokument56 SeitenChap 01-Introduction To AccountingJean CoulNoch keine Bewertungen

- Swelab User ManualDokument2 SeitenSwelab User Manualhayder FadelNoch keine Bewertungen

- Oscilloscope TutorialDokument32 SeitenOscilloscope TutorialEnrique Esteban PaillavilNoch keine Bewertungen

- HostsDokument4 SeitenHostsakoe.hendryanaNoch keine Bewertungen

- Journal of Cleaner Production: Peide Liu, Baoying Zhu, Mingyan Yang, Xu ChuDokument12 SeitenJournal of Cleaner Production: Peide Liu, Baoying Zhu, Mingyan Yang, Xu ChuccNoch keine Bewertungen

- DocumentDokument11 SeitenDocumentKHIEZZIER GHEN LLANTADANoch keine Bewertungen

- Ad Notam Manual DSTB-T S2Dokument28 SeitenAd Notam Manual DSTB-T S2okejekNoch keine Bewertungen

- 1979 IC MasterDokument2.398 Seiten1979 IC MasterIliuta JohnNoch keine Bewertungen

- E-Government in Developing Countries: Experiences From Sub-Saharan AfricaDokument11 SeitenE-Government in Developing Countries: Experiences From Sub-Saharan AfricaMashael AzizNoch keine Bewertungen

- SEZOnline SOFTEX Form XML Upload Interface V1 2Dokument19 SeitenSEZOnline SOFTEX Form XML Upload Interface V1 2శ్రీనివాసకిరణ్కుమార్చతుర్వేదులNoch keine Bewertungen

- MEC-004 TMA: Harrod-Domar Model and Golden Age EquilibriumDokument11 SeitenMEC-004 TMA: Harrod-Domar Model and Golden Age EquilibriumnitikanehiNoch keine Bewertungen

- Jess 303Dokument22 SeitenJess 303Santanu Saha100% (1)

- UntitledDokument1 SeiteUntitledGetu NigussieNoch keine Bewertungen

- How To Add Message Queuing Feature - Dell IndiaDokument2 SeitenHow To Add Message Queuing Feature - Dell Indiayuva razNoch keine Bewertungen

- ACCT 433 - Role-Playing Assessment RubricDokument5 SeitenACCT 433 - Role-Playing Assessment Rubricwafa aljuaidNoch keine Bewertungen

- Swat Modflow TutorialDokument56 SeitenSwat Modflow TutorialfrenkiNoch keine Bewertungen

- United International University: Post Graduate Diploma in Human Resource Management Course TitleDokument20 SeitenUnited International University: Post Graduate Diploma in Human Resource Management Course TitleArpon Kumer DasNoch keine Bewertungen

- Customer Guide Electrical Service Information FormDokument2 SeitenCustomer Guide Electrical Service Information FormRyder BergerudNoch keine Bewertungen

- GEC 6 Lesson 12Dokument19 SeitenGEC 6 Lesson 12Annie CabugNoch keine Bewertungen

- Supply Chain Analysis of PRAN GroupDokument34 SeitenSupply Chain Analysis of PRAN GroupAtiqEyashirKanakNoch keine Bewertungen

- Tut 1Dokument5 SeitenTut 1foranangelqwertyNoch keine Bewertungen