Beruflich Dokumente

Kultur Dokumente

Insurance Project

Hochgeladen von

Somil ShahOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Insurance Project

Hochgeladen von

Somil ShahCopyright:

Verfügbare Formate

ULIPs : An Introduction Most importantly, what are ULIPs?

Here, you will find all the information you need to set your mind at ease about how to invest in ULIPs, and which ULIP is right for you. ULIPs are a category of goal-based financial solutions that combine the safety of insurance protection with wealth creation opportunities. In ULIPs, a part of the investment goes towards providing you life cover. The residual portion of the ULIP is invested in a fund which in turn invests in stocks or bonds; the value of investments alters with the performance of the underlying fund opted by you. Simply put, ULIPs are structured in such that the protection element and the savings element are distinguishable, and hence managed according to your specific needs. In this way, the ULIP plan offers unprecedented flexibility and transparency. Working of ULIPs It is critical that you understand how your money gets invested once you purchase a ULIP: When you decide the amount of premium to be paid and the amount of life cover you want from the ULIP, the insurer deducts some portion of the ULIP premium upfront. This portion is known as the Premium Allocation charge, and varies from product to product. The rest of the premium is invested in the fund or mixture of funds chosen by you. Mortality charges and ULIP administration charges are thereafter deducted on a periodic (mostly monthly) basis by cancellation of units, whereas the ULIP fund management charges are adjusted from NAV on a daily basis. Since the fund of your choice has an underlying investment either in equity or debt or a combination of the two your fund value will reflect the performance of the underlying asset classes. At the time of maturity of your plan, you are entitled to receive the fund value as at the time of maturity. The pie-chart below illustrates the split of your ULIP premium:

Types of ULIPs

One of the big advantages that a ULIP offers is that whatever be your specific financial objective, chances are that there is a ULIP which is just right for you. The figure below gives a general guide to the different goals that people have at various age-groups and thus, various life-stages. Depending on your specific life-stage and the corresponding goal, there is a ULIP which can help you plan for it.

ULIPs for retirement planning

Retirement is the end of active employment and brings with it the cessation of regular income. Today an increasing number of people have stated planning for their retirement for below mentioned reasons

Almost 96% of the working population has no formal provisions for retirement With the growing nuclearisation of family structure, traditional support system of the younger earning members is no longer available Developments in the healthcare space has lead to an increase in life expectancy Cost of living is increasing at an alarming rate

Pension plans from insurance companies ensure that regular, disciplined savings in such plans can accumulate over a period of time to provide a steady income post-retirement. Usually all retirement plans have two distinctive phases

The accumulation phase when you are saving and investing during your earning years to build up a retirement corpus and The withdrawal phase when you actually reap the benefits of your investment as your annuity payouts begin

In a typical pension plan you have the flexibility to make a lump sum payment or a regular contribution every year during your earning years. Your money is then invested in funds of your choice. You can opt to receive the annuity at any time after vesting age (age at which you become eligible for pension chosen by you at the inception of the plan). Most of the Unit linked pension plans also come with a wide range of annuity options which gives you choice in structuring the postretirement benefit pay-outs. Also at the time of vesting you can make a lump sum tax-exempted withdrawal of up to 33 per cent of the accumulated corpus.

Get the most out of your ULIP Whether you are in the process of deciding which ULIP to invest in; or whether you already have a Unit linked insurance policy to secure your important financial goals there are some key principles which should govern any decision related to ULIPs. Adhering to these key principles will allow you to make optimum utilization of your ULIP. Appropriate life cover

Choosing an appropriate sum assured Unit Linked Insurance (ULIP) plans are designed to help you meet your financial goals by ensuring you the value of your investments, or your nominee sum assured, which is the life cover of your policy. To make sure that your ULIP is truly working to assure your goal, you should choose a life cover that provides your family with adequate finances and hence security even in your absence, so that important life goals of your family are always secured. Let us take the example of a 35-year-old man with 2 young children. He could begin with a sum assured of Rs 5 lakh. As the children grow and thereby the financial liabilities increase, he might want to increase the level of protection, which can be done by increasing his sum assured.

Unit Linked Insurance Policies (ULIPs) as an investment avenue are closest to mutual funds in terms of their structure and functioning. As is the case with mutual funds, investors in ULIPs are allotted units by the insurance company and a net asset value (NAV) is declared for the same on a daily basis. Similarly ULIP investors have the option of investing across various schemes similar to the ones found in the mutual funds domain, i.e. diversified equity funds, balanced funds and debt funds to name a few. Generally speaking, ULIPs can be termed as mutual fund schemes with an insurance component. However it should not be construed that barring the insurance element there is nothing differentiating mutual funds from ULIPs. Despite the seemingly comparable structures there are various factors wherein the two differ. In this article we evaluate the two avenues on certain common parameters and find out how they measure up. 1. Mode of investment/ investment amounts Mutual fund investors have the option of either making lump sum investments or investing using the systematic investment plan (SIP) route which entails commitments over longer time horizons. The minimum investment amounts are laid out by the fund house. ULIP investors also have the choice of investing in a lump sum (single premium) or using the conventional route, i.e. making premium payments on an annual, half-yearly, quarterly or monthly basis. In ULIPs, determining the premium paid is often the starting point for the investment activity. This is in stark contrast to conventional insurance plans where the sum assured is the starting point and premiums to be paid are determined thereafter. ULIP investors also have the flexibility to alter the premium amounts during the policy's tenure. For example an individual with access to surplus funds can enhance the contribution thereby ensuring that his surplus funds are gainfully invested; conversely an individual faced with a liquidity crunch has the option of paying a lower amount (the difference being adjusted in the accumulated value of his ULIP). The freedom to modify premium payments at one's convenience clearly gives ULIP investors an edge over their mutual fund counterparts. 2. Expenses

In mutual fund investments, expenses charged for various activities like fund management, sales and marketing, administration among others are subject to pre-determined upper limits as prescribed by the Securities and Exchange Board of India [ Images ]. For example equity-oriented funds can charge their investors a maximum of 2.5% per annum on a recurring basis for all their expenses; any expense above the prescribed limit is borne by the fund house and not the investors. Similarly funds also charge their investors entry and exit loads (in most cases, either is applicable). Entry loads are charged at the timing of making an investment while the exit load is charged at the time of sale. Insurance companies have a free hand in levying expenses on their ULIP products with no upper limits being prescribed by the regulator, i.e. the Insurance Regulatory and Development Authority. This explains the complex and at times 'unwieldy' expense structures on ULIP offerings. The only restraint placed is that insurers are required to notify the regulator of all the expenses that will be charged on their ULIP offerings. Expenses can have far-reaching consequences on investors since higher expenses translate into lower amounts being invested and a smaller corpus being accumulated. ULIP-related expenses have been dealt with in detail in the article "Understanding ULIP expenses". 3. Portfolio disclosure Mutual fund houses are required to statutorily declare their portfolios on a quarterly basis, albeit most fund houses do so on a monthly basis. Investors get the opportunity to see where their monies are being invested and how they have been managed by studying the portfolio. There is lack of consensus on whether ULIPs are required to disclose their portfolios. During our interactions with leading insurers we came across divergent views on this issue. While one school of thought believes that disclosing portfolios on a quarterly basis is mandatory, the other believes that there is no legal obligation to do so and that insurers are required to disclose their portfolios only on demand. Some insurance companies do declare their portfolios on a monthly/quarterly basis. However the lack of transparency in ULIP investments could be a cause for concern considering that the amount invested in insurance policies is essentially meant to provide for contingencies and for long-term needs like retirement; regular portfolio disclosures on the other hand can enable investors to make timely investment decisions.

4. Flexibility in altering the asset allocation As was stated earlier, offerings in both the mutual funds segment and ULIPs segment are largely comparable. For example plans that invest their entire corpus in equities (diversified equity funds), a 60:40 allotment in equity and debt instruments (balanced funds) and those investing only in debt instruments (debt funds) can be found in both ULIPs and mutual funds. If a mutual fund investor in a diversified equity fund wishes to shift his corpus into a debt from the same fund house, he could have to bear an exit load and/or entry load. On the other hand most insurance companies permit their ULIP inventors to shift investments across various plans/asset classes either at a nominal or no cost (usually, a couple of switches are allowed free of charge every year and a cost has to be borne for additional switches). Effectively the ULIP investor is given the option to invest across asset classes as per his convenience in a cost-effective manner. This can prove to be very useful for investors, for example in a bull market when the ULIP investor's equity component has appreciated, he can book profits by simply transferring the requisite amount to a debt-oriented plan. 5. Tax benefits ULIP investments qualify for deductions under Section 80C of the Income Tax Act. This holds good, irrespective of the nature of the plan chosen by the investor. On the other hand in the mutual funds domain, only investments in tax-saving funds (also referred to as equitylinked savings schemes) are eligible for Section 80C benefits. Maturity proceeds from ULIPs are tax free. In case of equity-oriented funds (for example diversified equity funds, balanced funds), if the investments are held for a period over 12 months, the gains are tax free; conversely investments sold within a 12-month period attract short-term capital gains tax @ 10%. Similarly, debt-oriented funds attract a long-term capital gains tax @ 10%, while a shortterm capital gain is taxed at the investor's marginal tax rate. Despite the seemingly similar structures evidently both mutual funds and ULIPs have their unique set of advantages to offer. As always, it is vital for investors to be aware of the nuances in both offerings and make informed decisions

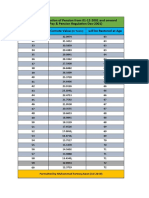

ULIPs Mutual Funds Determined by Minimum the investor investment and can be amounts are Investment modified as determined by amounts well the fund house No upper Upper limits for limits, expenses expenses chargeable to determined by investors have the insurance been set by the Expenses company regulator Quarterly Portfolio Not disclosures are disclosure mandatory* mandatory Generally permitted for Entry/exit loads Modifying free or at a have to be borne asset allocation nominal cost by the investor Section 80C Section 80C benefits are benefits are available only available on all on investments ULIP in tax-saving Tax benefits investments funds

Things

to

know

more

about

ULIPs

Q1. What is a Unit Linked Fund? Unit Linked Fund is a pool of the premiums paid by the policyholders which is invested in a portfolio of assets to achieve the fund(s) objective. The price of each unit in a fund depends on how the investments in the fund would perform. The fund is managed by the insurance companies. Q2. What does a Unit stand for? A Unit stands for a portion or a part of the underlying segregated unit linked Fund. Q3. Whatis Net Asset Net Asset Value (NAV) is the value per unit calculated in rupees. Value?

Q4. What is a Fund Value and how is it calculated? Fund Value is the product of the total number of units under the policy and the NAV. The fund value for the purpose of claims, surrenders or any other clause stated shall be calculated on the basis of NAV. Q5. What do I get at the end of my policy term? The benefit received at the end of policy term is termed as maturity benefit. The policyholder is entitled to receive fund value as maturity benefit. Q6. What should You should verify:

o o o o o o

verify

before

signing

the

proposal?

All the charges deductible under the policy Features and benefits Limitations and exclusions Lapsation and its consequences Other disclosures Illustration projecting benefits payable in two scenarios of 6% and 10% returns as prescribed by the life insurance council.

Q7. What will my family receive if something happens to me? Investment returns from ULIP may not be guaranteed. In unit linked products/policies, the investment risk in investment portfolio is borne by the policy holder. Depending upon the performance of the unit linked fund(s) chosen; the policy holder may achieve gains or losses on his/her investments. It should also be noted that the past returns of a fund are not necessarily indicative of the future performance of the fund.

Q9. Can I change / switch my asset allocation? Yes, you can change the investment pattern by moving from one fund to other fund (s) amongst the funds offered under a particular product. Such a change between funds is termed as a Switch. There will be a flat charge levied for any switch over and above the free switches. Q10. What is Premium Re Direction? Premium Re-Direction is the facility that allows a policyholder to modify the allocation of amount of renewal premium into a different investment pattern from the option (investment pattern) exercised at the inception of the policy. Q11. Can I partially withdraw from my policy? Yes, you can encash / withdraw a part of the fund anytime after completion of three years, subject to surrender charges as applicable to each individual plan. Q12. Can I foreclose my policy? Are there any charges applicable? Yes, you can foreclose your policy by Surrendering the policy. Surrender means terminating the contract once and for all. On surrender, the surrender value is payable to you which is Fund Value less the surrender charge. Surrender Charge means a charge levied on the fund value at the time of surrender of the policy. Q13. What does redemption mean? Redemption means encashing the units at the prevailing NAV offered by the company. This is applicable in case of exercising partial withdrawal, switch, maturity, surrender, settlement option or in the case of payment of death benefit. Q14. What is the Settlement Option? Settlement Option also known as periodical payment, means an option available to the policyholder to receive the maturity benefit as a structured payout over a period of up to 5 years after maturity. Q15. What is the date of commencement? Date of Commencement of Policy as shown in the policy certificate is the date on which the age of the life assured and the term of the policy are calculated and the same are shown on the policy certificate. Q16. What is a Regular Premium Contract? Regular premium contract means a ULIP where the premium payment is in level and paid in regular intervals like yearly, half-yearly or monthly. Q17. What is my monthly due date? Monthly due date means the date in any subsequent calendar month corresponding numerically with the date of the commencement of the policy. In the event that there is no date in any subsequent calendar month corresponding numerically with the

commencement date, then the due date shall be the last date in that subsequent calendar month. Q18. What does Cover Cessation Date mean? Cover Cessation Date (Date of Maturity) as shown in the policy certificate is the date on which the policy contract comes to an end and is the date on which the maturity benefit becomes payable. What are the different kind of charges in a ULIP? Unlike conventional traditional products charges are segregated in ULIP & thus made known to the customer. You can know the charges applicable on your ULIP through:

Sales benefit illustration : A sales benefit illustration illustrates various charges, year by year, for the term of the plan so that you know exactly how much money is deducted as charges & what is invested. Brochure : A brochures informs you about the various charges & their purpose applicable on your policy. Advisor : You should enquire your advisor about all the charge applicable on your policy.

Although ULIPs offered by different insurers have varying charge structures broadly, important charges that you should know are:

Policy administration charges These charges are deducted on a monthly basis to recover the expenses incurred by the insurer on servicing and maintaining the life insurance policy like paperwork , work force etc. Premium allocation charges These charges are deducted upfront from the premium paid by the client. These charges account for the initial expenses incurred by the company in issuing the policyeg. Cost of underwriting, medicals & expenses related to distributor fees. After these charges are deducted the money gets invested in the chosen fund. Mortality charges Mortality expenses are charged by life insurance companies for providing a life cover to the individual. The expenses vary with the age and either the sum assured or the sum-at-risk which is the difference between sum assured and fund value of the insurance policy of an individual. Mortality charges are deducted on a monthly basis. Fund management charges A portion of the ULIP premium, depending on the fund chosen, is invested either in equities, bonds, g-secs or money market instruments. Sometimes it is a combination of these. Managing these investments incurs a fund management charge (FMC).

The FMC varies from fund to fund even within the same insurance company depending on the underlying assets in the fund. Usually a fund with higher equity component will have a higher FMC

The important thing to note about ULIPs is that the overall charge structure for the plan comes down substantially over a long term. However it may be noted that insurers have the right to revise fees and charges over a period of time. The above can be very simply broken down into:

What a ULIP is A plan which gives complete clarity about the various charges deducted and why its being deducted and so how your fund will grow over time. What a ULIP is not A plan in which you dont know where your money is going or what is happening to it. When ULIPs work best?

Get the most out of your ULIP Whether you are in the process of deciding which ULIP to invest in; or whether you already have a Unit linked insurance policy to secure your important financial goals there are some key principles which should govern any decision related to ULIPs. Adhering to these key principles will allow you to make optimum utilization of your ULIP.

ULIP ban on 14 private life insurance companies TNN Apr 10, 2010, 03.29am IST MUMBAI: In a significant order late on Friday, market regulator Sebi banned issuance of Unit-Linked Insurance Plans, popularly known as ULIPs, by life insurance companies. Sebi has asked 14 private insurance companies, including market leaders like SBI Life, ICICI Prudential Life and Reliance Life Insurance, not to issue any more ULIP products.

The Sebi order does not cover state-owned insurance major LIC. There is no immediate clarity on the fate of existing products. At present, over 70% of the new business premium for most insurance companies come from ULIPs, running into thousands, if not lakhs of customers. The genesis of the Sebi order goes back to the feud between MFs and insurance companies. when the latter started issuing ULIPs about 5-6 years ago, offered huge commissions to insurance agents and flooded the market with these products which nearly mirrored mutual fund (MF) products. ULIPs are products that combine insurance and investment for the insured and are mostly market-linked. Between 2005 and 2008, when the stock market was on a bull run, MFs lost business but insurance companies mopped up large sums of money through ULIPs. In December 2009 and January 2010, Sebi had issued show cause notices to 14 insurance companies asking them why action should not be initiated against them for issuing investment products without Sebi's permission. On Friday, Sebi wholetime member Prashant Saran passed the order putting a ban on ULIP products by these 14 insurers. One of the main contentions for Sebi was that although a ULIP is an insurance product which comes under IRDA, part of it is also an investment product which should ideally be regulated by Sebi.

SEBI and IRDA to meet again soon

The Finance Ministry has asked Sebi and the IRDA to meet again for the second attempt to get them to settle their differences regarding ULIP regulation. Sebi took the case to the Supreme Court and the rivalry between the companies has led the Ministry to believe that the companies have drifted from the original reason and have both taken different stances. "We just want to take stock of the progress achieved so far on the agreement reached between the two regulators," A spokesperson for the ministry said. The IRDA and the SEBI agreed to work on terms decided by the ministry in an agreement but are now claiming their own charges. The IRDA and SEBI have been receiving legal counseling and will soon meet to resolve their issues. SEBI has asked for all the public interest litigations be bundled and the IRDA has refused to accept those terms. The apex court will decide on the bundling. A spokesperson for the Finance Ministry said "They will approach a high court under Section 90 of the Civil Procedure Code (CPC), 1908 to resolve the dispute on the oversight of ULIPs." The two companies agreed to the ministry agreement and are noe claiming different charges. Experts say IRDA is trying to make ULIPs more user-friendly just to spite SEBI. "Most of these measures, including the recent one on disclosing commission, were taken only to make sure that IRDA is on a strong wicket. However, the frontloading of commission, rampant mis-selling on claims of past performance or not having to pay premium after three years are yet to be addressed." The President promulgated an ordinance late last evening amending the RBI Act 1934, Insurance Act 1938, SEBI Act 1992 and Securities Contract Regulations Act 1956, thereby clarifying by way of an explanation that Life Insurance business shall include any Unit Linked Insurance Policy (ULIPs) or scrips or any such instruments.

This would set at rest all the issues regarding ULIPs between two financial regulators, the Securities Exchange Board of India (SEBI) and the Insurance Regulatory Development Authority (IRDA), an official press release said here today.Further, for sorting out all issues of jurisdiction regarding hybrid products, a high-level Committee under Chairmanship of Union Finance Minister has been constituted, the release saidThe Finance Secretary, the Secretary, Department of Financial Services and the Chiefs of four Financial Regulators the Reserve Bank of India (RBI), IRDA, SEBI and the Pension Fund Regulatory Development Authority (PFRDA) will be the members of the committee, the release added.

Implications of the SEBI & IRDA issue for Financial Planning

In my opinion we are going to see far-reaching long-term consequences once the SEBIIRDA issue gets resolved for Financial Planning profession. I base my fact & assumptions that SEBI is on a strong wicket rather than IRDA. However we need to go to the origin of this situation. In this article we will see what exactly is happening at this moment between SEBI and IRDA over ULIP ban and whats its implication on financial planning . Also Read : A short guide to Hire a Good Financial Planner in India What is SEBI & IRDA issue all about? How it actually originated? The IRDA was formed before SEBI and with the help of IRDA insurance companies came out with a Jugaadu product called ULIP which is just identical to MF with one minor difference that apx.2-5% of a clients investment goes to provide a life cover and rest is invested in either market, Govt. Securities, corporate debt or Equity, depending on the mandate of that fund. Now the second part is nothing but just like a mutual fund scheme. Where is the problem now? There is no problem with it as 90% of insurance premium world over goes to market or securities. However, in India the ULIP products become terrible investment products because if one invests Rs.100 in a ULIP then 20% of your money goes into commissions and approx. 2% into insurance, only 78% of ones money is invested in market or securities. So to get back to 98 ( 100 2 ) it would take in normal market conditions at least 2 years in Equity oriented funds and 4 years in debt oriented funds. So all you are doing is just recovering your principal in next 2 to 4 years. Now, the miss-selling by an insurance agent gets hidden in the bull run and because of rampant financial illiteracy even among so called highly qualified professionals & corporate executives leave alone the advisor selling the ULIP, the investor is fooled into putting more money in these bull runs saying that your money will double in x years and in the bear runs when the ULIP loose even their principal, the advisor gives them a either long term talk or plays on the investor fear and switches them to another products. Hence, an advisor in India is the a true definition of an opportunist. In the bull run he plays on the greed of the investor and in the bear run he plays on the fear of the investor. What the above does is that apart from loss to investors it gives an unfair advantage to insurance companies compared to mutual fund houses where commissions are in fraction of your investments. What is the incentive for an advisor or even big distributors like banks & distribution companies to sell MF schemes when they have the option of selling a similar scheme where they gets heavy commissions as an agent what would you do go for Rs.20/commission on ULIP or Rs.1 on Mutual Fund Scheme on an investors investment of Rs.100/-.

Now, taking stock of the above problem SEBI has gone for an eagle eyes view of the whole problem and to create a level playing field among all market participants.After a lot of cajoling & convincing IRDA which failed to budge, SEBI issued the harsh step of issuing an quasi-judicial order restraining Insurance companies from offering ULIP without proper registration with SEBI. What will happen now? Though there is likely to be a stay on the SEBI order given the large number of clients who hold ULIP products by the high court. This can be a short-term breather to insurance companies but it is not a long-term solution. Who is on strong wicket when the issue goes to Court SEBI or IRDA? Mr. Bave is a master strategist, he knew that the lobby of insures is very strong and united and it will take him years to bring them to negotiating table. With the powers conferred to him by parliament, he issued a quasi judicial order. Now, quasi judicial order is such that even Mr.Bave cannot revoke it. The IRDA may win a temporary relief in this war, but SEBI stands on a strong footings as in the court of law the court will go where investor interests remains. Insurance companies must see the larger picture and rather than worrying about loosing valuations post an unfavorable order, they must prepare them self to change with the times. What are the implications of the SEBI & IRDA issue for Financial Planning profession? So lets come back to the question whats in it for Financial Planning profession ? In my opinion, realizing the investors interest the court will rule in favor of SEBI, post which Insurance companies will have to bring down the commissions to Mutual Fund level on ULIPs.

Is this is a good news for Financial planners? Yes, but how many of us are changing as fast as the opportunity provided by structural changes effected by such orders? Time & again it has been proved that great opportunity lies when you have big structural changes in an economy. Every century gives some opportunity during financial turmoil and this time we are in the midst of such an opportunity.

Das könnte Ihnen auch gefallen

- Ulips U: How Ulips Can Make You Rich!Dokument7 SeitenUlips U: How Ulips Can Make You Rich!Anu BumraNoch keine Bewertungen

- "ULIP As An Investment AvenueDokument60 Seiten"ULIP As An Investment AvenueMahesh ThallapelliNoch keine Bewertungen

- Ulips-Systematic Insurance Cum Investment Plan: TransparencyDokument5 SeitenUlips-Systematic Insurance Cum Investment Plan: Transparencymiina91Noch keine Bewertungen

- Chapter IDokument80 SeitenChapter IKamal SajeevanNoch keine Bewertungen

- ULIP's SATHYADokument9 SeitenULIP's SATHYAsantoduNoch keine Bewertungen

- Ulip ProjectDokument31 SeitenUlip Projecttilak kumar vadapalliNoch keine Bewertungen

- Conceptual Framework: ULIP Is A Market Linked Investment Where The Premium Paid Is Invested in FundsDokument7 SeitenConceptual Framework: ULIP Is A Market Linked Investment Where The Premium Paid Is Invested in Fundsreliable panditNoch keine Bewertungen

- Pre-Reading On ULIPs Session On 15th January, 2019 - SCMHRDDokument8 SeitenPre-Reading On ULIPs Session On 15th January, 2019 - SCMHRDSuman SinhaNoch keine Bewertungen

- ULIPs Vs Mutual FundsDokument3 SeitenULIPs Vs Mutual FundsIftekhar AhmedNoch keine Bewertungen

- Ulips Give You Stay Invested and Enjoy Their PowerDokument23 SeitenUlips Give You Stay Invested and Enjoy Their Powersumit_pNoch keine Bewertungen

- Provides Flexibility in InvestmentsDokument6 SeitenProvides Flexibility in InvestmentsVisha BalajiNoch keine Bewertungen

- Introduction To ULIP: Unit Link Insurance Plan ULIPDokument31 SeitenIntroduction To ULIP: Unit Link Insurance Plan ULIPcreators_5Noch keine Bewertungen

- Benefits of ULIPsDokument5 SeitenBenefits of ULIPsanand98809880Noch keine Bewertungen

- The Beginner's Handbook to Retirement Funds: Investing for a Secure FutureVon EverandThe Beginner's Handbook to Retirement Funds: Investing for a Secure FutureNoch keine Bewertungen

- Mutual Funds Vs Ulips: How Mfs Are Better Than Ulips ?Dokument7 SeitenMutual Funds Vs Ulips: How Mfs Are Better Than Ulips ?Richa ChandraNoch keine Bewertungen

- UlipDokument43 SeitenUlipPriyanka PadhiNoch keine Bewertungen

- Ulip Unit Linked Insurance PlanDokument8 SeitenUlip Unit Linked Insurance PlanSoni SagarNoch keine Bewertungen

- Introduction To ULIPDokument24 SeitenIntroduction To ULIPPriyanka KumariNoch keine Bewertungen

- 4.1 Introduction To ULIP:: HDFC Standard Life Insurance, BangaloreDokument36 Seiten4.1 Introduction To ULIP:: HDFC Standard Life Insurance, BangaloreLavanya RajuNoch keine Bewertungen

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Von EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Noch keine Bewertungen

- Mutual Funds for Beginners Learning Mutual Funds BasicsVon EverandMutual Funds for Beginners Learning Mutual Funds BasicsNoch keine Bewertungen

- Bi Assignment Group 1Dokument8 SeitenBi Assignment Group 1Kanika DubeyNoch keine Bewertungen

- What Is An InvestmentDokument20 SeitenWhat Is An InvestmentSebin SebastianNoch keine Bewertungen

- Wealth Management - PPTX 06-11-2019Dokument14 SeitenWealth Management - PPTX 06-11-2019Sree LakshmyNoch keine Bewertungen

- Study Into Ulip Plans Reliance CapitalDokument84 SeitenStudy Into Ulip Plans Reliance CapitalshashankNoch keine Bewertungen

- Project On ULIPDokument22 SeitenProject On ULIPDhaval Lagwankar88% (17)

- Ulips and MFDokument3 SeitenUlips and MFbhaveshmore13Noch keine Bewertungen

- Literature Review On UlipsDokument8 SeitenLiterature Review On Ulipsyelbsyvkg100% (1)

- Variable Universal Life - ExplanationDokument5 SeitenVariable Universal Life - ExplanationGerald MesinaNoch keine Bewertungen

- Ulips DejargonedDokument19 SeitenUlips Dejargoned07anshumanNoch keine Bewertungen

- Your Guide To: Investment-Linked Insurance PlansDokument23 SeitenYour Guide To: Investment-Linked Insurance PlansVincent engNoch keine Bewertungen

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingVon EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNoch keine Bewertungen

- 1.1 Background of The Study:: Chapter - 1Dokument45 Seiten1.1 Background of The Study:: Chapter - 1Vinutha EllurNoch keine Bewertungen

- Intro: Expenses Charged in A ULIP Premium Allocation ChargeDokument18 SeitenIntro: Expenses Charged in A ULIP Premium Allocation ChargejayeshgoradiaNoch keine Bewertungen

- Profile ChangeDokument5 SeitenProfile ChangeAbhishekNoch keine Bewertungen

- 4 Reasons Why Ulips Make Sense: Insurance Cover Plus SavingsDokument39 Seiten4 Reasons Why Ulips Make Sense: Insurance Cover Plus SavingsSuparna TandonNoch keine Bewertungen

- Unit-Linked Insurance Plans (ULIP) Unit-Linked Insurance PlansDokument12 SeitenUnit-Linked Insurance Plans (ULIP) Unit-Linked Insurance Planssonambawa7491719Noch keine Bewertungen

- Unit Linked Insurance PlanDokument5 SeitenUnit Linked Insurance Planagarwal13Noch keine Bewertungen

- Life Insuranc (Sem - LLL)Dokument20 SeitenLife Insuranc (Sem - LLL)Milton Rosario MoraesNoch keine Bewertungen

- What Is Investment Definition?Dokument6 SeitenWhat Is Investment Definition?Simohamed BennaniNoch keine Bewertungen

- Vignana Jyothi Institute of Management Operations and Management OF Banks and Insurance Companies AssignmentDokument5 SeitenVignana Jyothi Institute of Management Operations and Management OF Banks and Insurance Companies Assignmentsri kavyaNoch keine Bewertungen

- Should Immediate Annuities Be a Tool in Your Retirement Planning Toolbox?Von EverandShould Immediate Annuities Be a Tool in Your Retirement Planning Toolbox?Noch keine Bewertungen

- Synopsis: Comparative Analysis of Mutual Funds and UlipsDokument13 SeitenSynopsis: Comparative Analysis of Mutual Funds and Ulipssumitsonkar007Noch keine Bewertungen

- Canadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersVon EverandCanadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersNoch keine Bewertungen

- Report of CPDokument15 SeitenReport of CPVishal ShahNoch keine Bewertungen

- Research Paper On UlipsDokument7 SeitenResearch Paper On Ulipsafeawobfi100% (1)

- By Chandan Chandwani Hemal Mehta Rakesh Rajput Prinal Kapadia Dhaval Pandya Mentor Anand Panchal Prof. Ganatra Kashyap ADokument15 SeitenBy Chandan Chandwani Hemal Mehta Rakesh Rajput Prinal Kapadia Dhaval Pandya Mentor Anand Panchal Prof. Ganatra Kashyap AHemal MehtaNoch keine Bewertungen

- Chapter 24 Professional and Institutional Money ManagementDokument24 SeitenChapter 24 Professional and Institutional Money Managementsharktale2828100% (1)

- ULIPs Vs Mutual FundsDokument6 SeitenULIPs Vs Mutual FundsArun ThakurNoch keine Bewertungen

- IapmDokument8 SeitenIapmjohn doeNoch keine Bewertungen

- UntitledDokument26 SeitenUntitledKrishna YadavNoch keine Bewertungen

- Life Insurance Linked With InvestmentDokument14 SeitenLife Insurance Linked With InvestmentWyatt HurleyNoch keine Bewertungen

- 27 Things You Must Know About VulDokument9 Seiten27 Things You Must Know About VulTina LlorcaNoch keine Bewertungen

- The Road to Financial Freedom: A Guide to Investing WiselyVon EverandThe Road to Financial Freedom: A Guide to Investing WiselyNoch keine Bewertungen

- 21day Studyplan For LLQP ExamDokument9 Seiten21day Studyplan For LLQP ExamMatthew ChambersNoch keine Bewertungen

- 2015 Client Checklist - IndividualDokument9 Seiten2015 Client Checklist - IndividualMichael JordanNoch keine Bewertungen

- Ortiz V ComelecDokument2 SeitenOrtiz V ComelecLuz Celine CabadingNoch keine Bewertungen

- Kotak Lifetime Income V13Dokument11 SeitenKotak Lifetime Income V13skverma3108Noch keine Bewertungen

- Supporting Documents: Please Attach Certified Copies of The Following DocumentsDokument1 SeiteSupporting Documents: Please Attach Certified Copies of The Following DocumentskfctcoNoch keine Bewertungen

- Welfare Scheme ConcessionsDokument6 SeitenWelfare Scheme Concessionskapil11211Noch keine Bewertungen

- Go.151 Leave Travel Concession-Ltc-RulesDokument3 SeitenGo.151 Leave Travel Concession-Ltc-RulesVanagantinaveen Kumar100% (1)

- The Daily Union. February 27, 2014Dokument16 SeitenThe Daily Union. February 27, 2014DUNewsNoch keine Bewertungen

- Civil Service Regulations PDFDokument66 SeitenCivil Service Regulations PDFget thosebooksNoch keine Bewertungen

- Insurance Interview Questions and Answers Guide.: Global GuidelineDokument11 SeitenInsurance Interview Questions and Answers Guide.: Global Guidelinegaurav SinghNoch keine Bewertungen

- Neston Local Mar 2011Dokument32 SeitenNeston Local Mar 2011Talkabout PublishingNoch keine Bewertungen

- Bipartite Settlement 7Dokument24 SeitenBipartite Settlement 7Nadeem MalekNoch keine Bewertungen

- Pay Slip: For The Month of September 2019Dokument1 SeitePay Slip: For The Month of September 2019mustafaNoch keine Bewertungen

- Annual Report 2011 - EnglishDokument86 SeitenAnnual Report 2011 - EnglishkhankhanmNoch keine Bewertungen

- AssignmentDokument5 SeitenAssignmentSuyash PrakashNoch keine Bewertungen

- EpayslipDokument1 SeiteEpayslipconstantin radu lunguNoch keine Bewertungen

- PCE ENG - Set 6Dokument17 SeitenPCE ENG - Set 6Elansegaran Thangamani100% (2)

- Salary - Practice QuestionsDokument8 SeitenSalary - Practice Questionssyedameerhamza762Noch keine Bewertungen

- Pay SlipDokument1 SeitePay SlipSaiful IslamNoch keine Bewertungen

- Office Memorandum: Subject:-The Assured Career Progression Scheme For The Central GovernmentDokument37 SeitenOffice Memorandum: Subject:-The Assured Career Progression Scheme For The Central GovernmentThilakarajan ANoch keine Bewertungen

- Government of KeralaDokument5 SeitenGovernment of KeralabharathydglNoch keine Bewertungen

- ACC WagesDokument4 SeitenACC WagesAshish NandaNoch keine Bewertungen

- OB AND HRM Unit 2 Part 2Dokument2 SeitenOB AND HRM Unit 2 Part 2Swati AnandNoch keine Bewertungen

- Restoration TableDokument2 SeitenRestoration TableMuhammad Farooq AwanNoch keine Bewertungen

- Oracle HRMS Setup For SingaporeDokument33 SeitenOracle HRMS Setup For SingaporeShmagsi11Noch keine Bewertungen

- Taxation I Syllabus PDFDokument4 SeitenTaxation I Syllabus PDFzeigfred badanaNoch keine Bewertungen

- Unger V Sanchez (2009) VSC 541 (1 December 2009)Dokument19 SeitenUnger V Sanchez (2009) VSC 541 (1 December 2009)James JohnsonNoch keine Bewertungen

- ICGP Sign Posts To SuccessDokument139 SeitenICGP Sign Posts To SuccessJonathanGrahamNoch keine Bewertungen

- FreedomFiler Getting Started v3.1Dokument16 SeitenFreedomFiler Getting Started v3.1pr1asd67% (3)

- Deed of AdherenceDokument4 SeitenDeed of AdherencexeniaNoch keine Bewertungen