Beruflich Dokumente

Kultur Dokumente

Fine Value Chain

Hochgeladen von

Sushant KapoorOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fine Value Chain

Hochgeladen von

Sushant KapoorCopyright:

Verfügbare Formate

1

Moving a Slow-Clockspeed Business into the Fast Lane: Strategic Sourcing Lessons from Value Chain Redesign in the Automotive Industry

Charles H. Fine (corresponding author) Professor of Management Sloan School of Management, MIT Room E53-390 50 Memorial Drive Cambridge, MA 02142 charley@mit.edu 617-253-3632 Roger Vardan Manager, Strategy Development Group, GM Powertrain Mail Code 483-720-210 777 Joslyn Ave General Motors Corporation Pontiac, MI 48340-2925 roger.vardan@gm.com 248-857-4279 Robert Pethick Director Pittiglio, Rabin, Todd & McGrath, Inc., Detroit, MI bpethick@prtm.com 248-417-9957 Jamal El-Hout Vice President, Planning General Motors of Europe Zurich, Switzerland jamal.el-hout@ch.gm.com

July 2001 Submitted to Sloan Management Review

Moving a Slow-Clockspeed Business into the Fast Lane: Strategic Sourcing Lessons from Value Chain Redesign in the Automotive Industry Charles Fine,1 Roger Vardan2, Robert Pethick,3 Jamal El-Hout,4 Abstract Most companies, whether focused primarily on manufacturing or services, frequently face the need to consider changes in the composition of their supply chains. Few companies, however, undertake with any frequency, the task of comprehensive assessment of the entire value chain that serves the end consumers. This paper presents a strategic sourcing decision model developed in the process of a complete value chain analysis done for the General Motors Powertrain (GMPT) organization. This decision model was been applied across many activities from traditional casting and machining of metal for automotive engines and transmissions to the development of software that encodes the latest algorithms for improved vehicle performance and emissions control. The model has also proved valuable for assessing strategic alliances both with traditional supply chain partners as well as with long-time competitors. As well, it has proved its worth at companies far removed from the relatively slowclockspeed, manufacturing-intensive automotive industry. This paper describes the analysis process, the decision model, and the resulting improved process for value chain strategy at GMPT. The value analysis process emphasizes the need to balance quantitative financial considerations with less-easily quantifiable strategic issues. This model not only provided key decision support for value chain strategy, but also formed the foundation of a fast-response capability to emergent and disruptive strategic challenges. We describe why such a capability is of critical importance not only to companies such as General Motors, buy also to companies in very fast clockspeed industries such as on-line music and entertainment.

Professor of Management, Sloan School of Management, MIT Manager , Strategy Development Group, General Motors Powertrain 3 Director, Pittiglio, Rabin, Todd & McGrath, Inc., 4 Vice President, Planning, General Motors of Europe

1 2

Arvin Mueller, Group Vice-President of GM Powertrain from 1997 through 2001, comments on the Value Chain Strategy and its role in the strategic governance of GMs global powertrain operations: Without a structured process for value chain strategy and formation, dealing with a rapidly changing business model in a huge, complex, and global industry provides only a hit-or-miss destiny. A systems approach to value chain strategy led to a partitioning of Knowledge Assets and Supply Capabilities within the vast business of engineering and manufacturing engines, transmissions, and control systems for the worlds largest automotive company. Application of consistent criteria to each partition enabled a formulation of the ideal value chain configuration a target toward which GMPT can migrate. With this ideal configuration in hand, partnership or supply synergies can now be pursued with value creation as a crafted intentnot a hope. The Value Chain Strategy developed by this team--and the execution thereof--has given us the capability to anticipate and adapt more quickly than our competitors. I thank them for a job well done!

Moving a Slow-Clockspeed Business into the Fast Lane: Strategy Lessons from Value Chain Redesign in the Automotive Industry Charles Fine, Roger Vardan, Robert Pethick, Jamal El-Hout,

Introduction

When one thinks about case studies of innovative value chain management, it is common and useful to look at the exploits fast-clockspeed industries and organizations what are sometimes called the fruit flies of our economy. The dynamic evolution of these organizations, the upstart new ventures or the aggressive electronics giants, can teach a great deal about industry and value chain dynamics.5 With rapidly shifting supply chains and high-clockspeed technologies, these firms often provide useful lessons for responding to cutting-edge strategic challenges. However, these new economy players are not the only ones facing dramatic and sweeping changes throughout their value chains. Stimulated by the creation of a global integrated organization for powertrain (engine, transmission, and controls) engineering and manufacturing at General Motors under the leadership of Arvin Mueller, a team of managers and analysts was created to perform a sweeping analysis of value chain strategy for the General Motors Powertrain organization (GMPT). A key finding: Insights into the nature of value chain design and corporate strategy -- for both fast- and slow- clockspeed firms -- can still arise from the midst of a traditional old economy firm. To present the strategic value chain framework developed and implemented, this paper is organized as follows: Section 1 provides the background for the project and the setting at the General Motors Powertrain organization. Section 2 presents the overall framework of the model developed and applied at GMPT. Section 3 provides details on the components of the strategic value chain analysis model developed and deployed. Section 4 illustrates the application of the strategic value assessment model at GMPT. Section 5 provides a decision framework for applying the model. Section 6 includes concluding remarks on organizational capability and Internet applications.

1. Project and Setting Background GM Powertrain (GMPT) is the worlds largest manufacturer of automotive engines and transmissions. Responsible for the design and manufacture of powertrains for General Motors (as well for, among others, BMW, Volvo and Rolls Royce), the 76,000 employees of GM Powertrain produce approximately 7.5 million engines and 6.5 million transmissions annually. As global organization, GMPT has over 35 manufacturing facilities spread across North America, South America, Europe and Asia as well as engineering and administrative centers to govern these activities. In addition to its significant automotive business, GMPT is also the largest supplier of engines to the marine industry, with over 80% market share in the North American marine segments it competes in. If considered as a separate entity, GMPT would itself be a Fortune 100 Company.

5

See, e.g., Clockspeed, by Charles H. Fine, Perseus Books, 1999. 4

The powertrain provides the defining characteristic of a modern vehicle: automatic propulsion. From a cost perspective, the powertrain is the most expensive system in the vehicle and the most asset-intensive in its production. From a technology standpoint, it is the most complex system in the vehicle. From a regulatory standpoint, the powertrain is highly constrained with respect to its fuel economy and tailpipe emissions. Furthermore, the powertrain plays a key role in determining consumer perceptions of vehicle character. Many consumers consider the powertrain to be the heart of the vehicle; its features are of great consequence to vehicle performance and they often play a very significant role in consumers vehicle purchase decisions. Structurally, GMPT is a classic example of the old economy: asset-intensive, highly vertically integrated, and a manufacturer of products that require a large and highly skilled industrial labor force. Yet, the automotive industry and its powertrain segment seem to be undergoing a phase of horizontalization. That is, despite significant industry consolidation at the OEM level, many of the consolidated OEM giants are increasing their outsourcing and reducing their degree of vertical integration. In addition, after nearly 100 years of relative technological stability with the internal combustion engine platform, the auto industry is facing the onset of new and potentially disruptive hybridelectric and fuel cell propulsion technologies. These technological innovations have significant, long-term implications for the GMPT portfolio.6 In short, as the GMPT Value Chain Strategy was undertaken, the organization faced a complex and bewildering array of challenges, changes and uncertainties. The project undertaken, however, boiled these issues down to four key questions that the GMPT leadership wanted the Value Chain Strategy to answer: Where in GMPT is value being created and what activities are not adding to overall enterprise value? What areas of the business should remain in-house versus being outsourced? Where should GMPT be making investments? How can these be leveraged? How can the organization optimize the GMPT Value Chain to govern its destiny through mutual benefit among existing and emerging Alliance partners?

The work described here was motivated by a need to address these questions. 2. The GMPT Value Chain Strategy Framework The overall objective of the Value Chain Strategy project was to examine from scratch the strategy for the GMPT organization. A key sub-objective was to make strategic assessments of important value chain elements. A first step in the analysis was to characterize the GMPT value chain. How should it be represented? What were its constituent parts? As Figure 1 shows, three dimensions were used

See, e.g, Metcalf, Sara Susanne, A System Dynamics Exploration of Future Automotive Propulsion Regimes, MS Thesis, Sloan School of Management, MIT, 2001.

6

to categorize value chain elements: products (e.g., L4, V6, V8), subsystems (e.g., block, valve train, controller), and process elements (e.g., design, assembly, test). As examples, engineering of the block for a certain V8 engine is one process element in the value chain, assembly of the valvetrain for a V6 is another, and test of the electronic controller for an in-line four cylinder engine (I4) is a third. More generally, any cell in the grid portrayed in Figure 1 is a value chain element for which GMPT should develop a strategic posture, i.e., insource, outsource, alliance, etc.

Categorizing Value Chain Elements PROCESS ELEMENTS

ENGINEERING

ASSY

TEST

CONTROLLER VALVETRAIN BLOCK

L4

V6

V8

V8

PRODUCTS

SUBSYSTEMS

Figure 1

The representation in Figure 1 can usefully be called the subsystem value chain because it captures all the subsystems that make up GMPT products. Another approach is to focus primarily on the product value chain and the customers and consumers of powertrains. This paper addresses primarily the work done on the subsystem value chain; work on the product value chain at GMPT is ongoing. To value elements in the chain, one first needs a measure of value. Traditional methods seemed incomplete for the task. For example, Economic Value Added (EVA) analysis provides a quantitative financial value for elements in the value chain. Developing such an analysis and an accompanying financial model requires a significant amount of time and effort. However, there is a well-established body of knowledge to draw upon to complete this analysis.7 Our project objectives required a framework that would extend beyond merely financial assessment. The resulting framework we developed comprises a quantitative, financial component, utilizing traditional EVA analysis, and a qualitative, strategic component, representing the decision model innovations presented here.

See, e.g., EVA: The Real Key to Creating Wealth by Al Ehrbar, Wiley, John & Sons, October 1998, or EVA and Value-Based Management: A Practical Guide to Implementation, S. David Young, Stephen F. O'Byrne, McGraw-Hill Professional Book Group, September 2000.

7

Combining Strategic & Economic Assessments

Customer Importance Technology Clockspeed Competitive Position Supplier Capability Architecture

Strategic Value Added

Qualitative Model (Strategic)

SVA

Recommendations: Synthesis

Sourcing Investment Architecture Alliance Insights

Costs Assets Quantitative Quantitative Model Revenues Model

Figure 2

Competitive Cost Structure

(Financial)

(Economic)

EVA

Economic Value Added

Figure 2 illustrates the framework that we developed and applied to each value chain element. Each element is passed through a strategic assessment and an economic assessment to produce recommendations regarding Sourcing, Investment, Architecture and Alliance Insights. Before moving into a more detailed discussion of each of the arms of the framework, consider the outputs of the framework in more detail: Sourcing: Identifying elements of the business that either need to be migrated more to the supplier base or, alternately, more insourced within GMPT. Investment: Identifying specific areas and activities of strategic importance where further investment would result in creating or maintaining additional value and/or competitive advantage in the future. Architecture: Identifying potential areas where modularization of previously integral component interfaces would make sense from an overall value chain perspective, often to support ease of outsourcing and development of a competitive supply base. Alternately, identifying modular value chain elements that could productively and profitably be integrated into a single integrated component.

7

Alliance Insights: Identifying areas or activities that benefit from present or future strategic alliances

To do a strategic assessment of value chain elements, we used as a starting point the make/buy decision model presented in Clockspeed, by Charles H. Fine.8 Following this work, the GMPT Value Chain model identifies two broad categories of assets: knowledge assets and supply assets. In the GMPT context, knowledge assets are primarily those related to design and engineering of powertrain products (engines, transmissions, and their subsystems) and process engineering for powertrain manufacturing systems. Supply assets consist primarily of the manufacturing capacity at GM and suppliers to provide the volumes of product required. These two asset domains are not all encompassing. However, conceptually, these two domains broadly represent important asset classes for value chain design consideration. Conceptually, the objective of the project was to define a target value chain configuration based on the strategic and economic analysis. Economic Value Framework As mentioned above, the decision model has two principal components, to assess respectively the economic and strategic aspects of sourcing strategy. As described in the literature, EVA is calculated by combining two distinct financial streams: Income and Capital Costs. The Income stream generates the Net Operating Profit After Taxes (NOPAT) using Revenues, Cost of Goods Sold and Tax charges. Given that GMPT is a cost center and that its automobile engines are consumed internally and not typically sold at market prices an open market, computing the revenue side of EVA proved somewhat challenging. However, the powertrain revenue stream was approximated by examining the differences in manufacturers suggested vehicle sticker prices charged for purchasing different engines in GM vehicles, to estimate the economic value of different engines in various segments. The second component of the EVA equation analyzes the type of return on capital generated in relation to an industry benchmark. Its computation involves identifying the Capital Charge by multiplying net assets by the Weighted Average Cost of Capital (in the case of the Automotive industry this WACC was assumed to be approximately 9.5%). Positive Economic Value is created when NOPAT exceeds the Capital Charge. In a pure application of EVA, this is a fairly straightforward computation. However, to apply the model to understand how EVA for a given element would change as a function of procurement strategy, a EVA approach (which starts with a baseline EVA) was used. Quantities for EVA were calculated as the differences between various value chain options compared with the status quo, using estimates of the cost of procuring products, components and supply chain

8

The starting point for this model was the material in Chapter 9 of Clockspeed, by Charles H. Fine, Perseus Books, 1999. The work there, in turn, builds on an MIT Sloan School Masters thesis, A Strategic Sourcing Model for Concurrent Product, Process, and Supply-Chain Design, by Paul M. Gutwald and the article, "Is the Make-Buy Decision Process a Core Competence?" by Charles Fine and Daniel Whitney, in Moreno Muffatto and Kulwant Pawar (eds.), Logistics in the Information Age, Servizi Grafici Editoriali, Padova, Italy, 1999, pp. 31-63. The latter is also available at http://web.mit.edu/ctpid/www/Whitney/papers.html. 8

activities (such as Machining, Assembly, Product Engineering, etc) from other suppliers/sources. Many sourcing decision approaches simply stop with such a financial analysis. However, a large number of strategic issues are not captured easily or at all with such an approach. Therefore, a complementary qualitative, strategic assessment may significantly improve the overall assessment and decision process. 3. Strategic Value Framework: Assessing Five Dimensions The strategic value assessment tool developed for this project utilizes five criteria (Figure 6) for considering the strategic impact of sourcing alternatives. For each element of the value chain, the model assess five dimensions: (1) Customer Importance (how does the sourcing decision affect customer preferences), (2) Technology Clockspeed (how rapidly is the underlying technology for this value chain element changing), (3) Competitive Position (how does the firm stack up to its competition in achieving cost, quality, technology, etc. on this value chain element), (4) Supply Base Capability (how deep and capable is the outside supply base for outsourcing this value chain element), and (5) Architectural Relationship (how integral or modular is this value chain element to the overall product, service, or system of which it is a component). These five criteria are considered sequentially, as described below. As will be described below, for each element of the value chain to be assessed the model is intended to be used qualitatively and prescriptively to analyze sourcing decisions as follows: (1) The more important the source to the customer, the more important the sourcing decision. (2) The faster the technology clockspeed, the more risky it is to be fully dependent on an outside supplier. (3) The stronger ones own competitive position in designing or making the value chain element, the more desirable it is to insource it. (4) The more capable the supply base (in number of viable suppliers and their technological competency) the safer to outsource. (5) The more integral the value chain element to the overall system, the more risky to be fully dependent on an outside supplier. Before going into the details of the model, we provide two brief illustrations, the first on a famous outsourcing decision: the choice by IBM to outsource to Intel the manufacture of the microprocessor for its first personal computer. Assessment Dimension Customer Importance Technology Clockspeed Competitive Position Supply Base Capability Architectural Relationship Strategic Assessment for PC microprocessor Microprocessor source was irrelevant to the customer (What was relevant (at first) was IBMs name on the computer) Very fast (measured ironically, eventually by Moores law) IBM was the world largest semiconductor manufacturer Intel and AMD were the only qualified suppliers Microprocessor was fairly modular to the rest of the PC (except, famously, to Microsofts DOS; hence the Wintel colossus)

IBM reasoned correctly that the customers would not care whether the computers brains were made by IBM or not, so on this dimension, outsourcing the microprocessor was a reasonable

9

10

choice to consider, even though as a corporation, IBM had as much capability in semiconductor manufacturing as any firm. However, since semiconductor technology clockspeeds were so fast, a supplier who got a lead proved tough to dislodge. Combine this with the small supply base and the risk goes up. Add in the failure to recognize that the modular architecture combined with an independent Wintel supply base created extremely low barriers to entry for clone makers such and Compaq and Dell, and we gain some insight into one of the most significant sourcing decisions of all time, as measured by its impact on the market values of the firms involved. Our primary intention here is not to second-guess past sourcing decisions however. Rather, we hope to present a model to aid in future strategic sourcing decisions. Even more briefly, consider the following additional example of a consumer products company (say Proctor & Gamble or Unilever) assessing whether it should insource or outsource the manufacture of one of its branded products (say shampoo). With respect to Customer Importance, investment in brand image is quite important, but few, if any, shampoo customers are likely to know or care what company actually mixes the ingredients and bottles the shampoo. Further the Technology Clockspeed on shampoo mixing and bottling is very slow. Third, because the processes are well known, it is unlikely that any firm has a large competitive advantage in, say, the cost of mixing and bottling its shampoo. Fourth, there are quite a few companies that can serve as suppliers for shampoo mixing and bottling. Finally, the production of shampoo is quite modular to its design and to the development of its brand image. We are left to conclude that there is not a strong strategic case to be made for consumer products companies to own and operate their shampoo factories. Nevertheless, one often observes vertical integration in this kind of situation, partly due to history and organizational inertia. For companies that wish to take a fresh look at these kinds of issues, we believe the model described here provides a practical, yet comprehensive approach.

Strategic Sourcing Assessment requires evaluation of five key criteria

Customer Importance:

High Medium Low

High customer importance and fast clockspeed means more strategic

Technology Clockspeed: Fast Medium Slow Competitive Competitive Position: Position:

Competitive position is critical for assessing value of outsourcing

Advantage Advantage Parity Parity Disadvantage Disadvantage

Supply Base Capability must be present for successful outsourcing

Capable Suppliers:

None Few Many

Architecture:

Degree of modularity affects significantly the ease and risk of outsourcing

Integral Modular

Possible Decisions (Knowledge & Supply): Insource Outsource Partner/Acquire Partial Insource Partial Outsource Invest Spin Off Develop Suppliers

Figure 3

10

11

Exercising the Model: Begin with Customer Importance To describe the model in more detail, we relate here the process of its development and use in the General Motors Powertain organization. For engines and transmissions, customer preferences can be estimated in part by observing buying behaviors. That is, one can tabulate how frequently customers choose a gasoline engine over a diesel or a manual transmission over an automatic. However, to uncover subsystem level preferences and biases, surrogate measures are often needed, in part because consumers do not have direct preferences on subsystems such as engine blocks, valve trains, exhaust systems, etc. Instead, one must elicit customers tastes on performance characteristics such as fuel economy, acceleration, emissions, and quietness (noise, vibration, and harshness), and then relate those to powertrain subsystems and value chain process elements. As an example, consider two different customer classes (pickup truck buyers and minivan drivers) and two different engine subsystems (the starter motor and the engine controls logic algorithms). In the pickup truck segment, there are loyal GMC and Chevrolet customers who buy GM products for the superior acceleration and smoothness of their engines. For such buyers, knowing that the control systems are designed by GM engineers, generation after generation, can be important to continued customer loyalty and to the vehicle purchase decision. Such buyers may care little however, about whether GM designs or builds the starter motors, which have little, if any effect, on driving characteristics. Minivan drivers, on the other hand, expect reliability from their engines, but typically pay much more attention to the layout of the vehicles interior space than to any engine characteristics and may not care what parts of the engine are designed by GM. To implement the Customer Importance component of the model, the GMPT value chain team conducted workshops with GMPT Engineering and Manufacturing staffs to relate engine and transmission subsystems to various performance characteristics perceivable by customers. To complement this, GMPT launched the corporations first-ever customer clinics and statistical model aimed solely at capturing customer preferences about powertrains. The resulting model yields significant insights for helping the GMPT designers and managers understand consumer trade-offs and the key drivers of consumer preference in various segments.

11

12

In the words of one GMPT executive: I care about this variable because I want to know what investments I will get paid for. That is, the data from the Customer Importance variable aids in understanding what product characteristics the customer will pay a premium for. For an organization whose annual investments in products, processes, capacity, and technology are typically measured in the billions of dollars, the model provides a critical new source of data to help direct these investments and related sourcing decisions. Technology Clockspeed The second criterion in our Strategic Assessment Framework is Technology Clockspeed.9 The clockspeed construct assesses the rate at which underlying technologies of a product or system are changing. This criterion is important because value chain elements with fast clockspeeds are more prone to experience rapid innovations and are more likely to require ongoing knowledge investments to maintain technological competency. As an illustration, consider the Cylinder Block, which has relatively stable underlying process technologies (e.g., aluminum casting), compared with the Controller, which is the computerized brain of the engine, and has underlying technologies (e.g., semiconductors, algorithms) that change quite rapidly. Elements with fast Technology Clockspeeds typically require higher levels of investment to maintain technical competency. In contrast, even though the Cylinder Block is a crucial element of the Engine, the relatively slow pace of underlying technological change makes the core knowledge more common and less likely to be subject to innovations that could result in loss of competitive advantage if it were to be outsourced. Furthermore, once dependent on a supplier for a fast clockspeed technology, it can be very difficult and/or costly to regain capability in the technology should that become desirable or necessary. Competitive Position A companys relative competitive position for developing and/or producing some element of the value chain is another important factor to consider in formulating sourcing strategy. The reason for this is straightforward: areas of relative competitive advantage are potential sources of strategic advantage, especially when they are in areas of high customer importance and with relatively fast technology clockspeeds. By contrast, areas of relative competitive weakness could be candidates for outsourcing, since the weakness may not be able to be overcome without significant investment, if at all. Of course, the data collected for this dimension of the project is highly confidential, so we use a hypothetical example to illustrate further. Consider, for example, how this factor might be assessed differentially by General Motors and Toyota. Imagine for some component, that GM assessed that its competitive position in manufacturing cost were average. That is, benchmarking studies showed that total manufacturing cost at GM was about equal to the industry average for that component. In such a case, GM might assess that such a component might benefit from outsourcing if a lower cost could be obtained from an outside supplier. GM would therefore consider this component as a candidate for outsourcing based on this criterion. Suppose for example, in contrast, that for the same component, Toyota were to assess that its internal manufacturing costs were the lowest in the industry. In this case, even though GM and

9

See C. H. Fine, Clockspeed, Perseus Books, 1999. 12

13

Toyota might assess Customer Importance and Technology Clockspeed identically, they might come to different conclusions on outsourcing based on Competitive Position. In particular, GM might reasonably choose to search for a lower cost external supplier whereas Toyota would not.

Capable Suppliers The relative strength of the supply base for any given value chain element is also an important factor in our Strategic Value framework. The strength and size of the supply base provides perspective on the relative leverage that the supply base might have if a given value chain element is outsourced. For example, if some value chain element were outsourced where only one supplier existed, the supplier might have considerable leverage versus the OEM. On the other hand, where an extensive supply base exists, the key capabilities are more likely to be judged as commodities and not necessarily a source of strategic value. As an example, consider the sourcing strategy that GMPT might consider for the casting of engine blocks. As mentioned, the engine block casting process is not a value chain component that is high in the customers consciousness. As well the clockspeed is relatively slow, so we might consider this process as not particularly strategic. Yet, GM, as well as most of the worlds large automotive OEMs are largely vertically integrated in engine block casting. One reason for this is a dearth of suppliers able to take on the volume of casting GM might like to outsource. That is the supply base capability is low. More specifically, GM casts many million engine blocks each year, as does each of Ford, Toyota, DaimlerChrysler, Volkswagen, and Renault/Nissan. With all the major manufacturers vertically integrated to a significant degree, no large capable suppliers have arisen, so the supply base capability, for the volumes needed by the large OEMs, is low. If any one of these firms chose to spin off its casting plants as an independent entity, that would create a large independent supplier, but only one such supplier might leave the OEM in the type of situation IBM found itself in with Intel: dependent on a single supplier with little leverage on price. As a result, developing a capable supply base where there is none can be a difficult task. Architectural Relationship The Architectural Relationship between the value chain element in question and the product, service, or system in which it is embedded represents the fifth and final dimension of our Strategic Value Framework. Following Ulrich,10 we think of product architecture as the scheme by which the function of a product is allocated to its constituent components. Ulrich distinguishes between integral and modular product architectures, where integral architectures exhibit close coupling among the elements of the product. In contrast, a modular architecture features separation among a systems constituent parts, where standard interfaces make the exchange of parts relatively simple. We find it useful to make this assessment along a continuum from highly integral to highly modular. To a significant degree, an automobile engine is a fairly integral system. One certainly cannot build one from off-the shelf parts as can be done with a stereo system or a bicycle, for example. On the other hand, although the design of the many subsystems is fairly integrated, once the

10

Karl Ulrich, The Role of Product Architecture in the Manufacturing Firm, Research Policy 24 (1995): 419-40. 13

14

design is complete, the manufacture of many subsystems is modular from the manufacture of others. As a result, following Fine and Whitney,11 we found it useful to assess separately the knowledge elements (e,.g., design and engineering) of the value chain and the capacity or supply elements (e.g., the manufacture) of the value chain.

4. Model Illustration and Implementation As we developed our framework, we continually tried to collect data to quantify the concepts. As mentioned, a major customer preference assessment project was launched to collect data for the Customer Importance component of the model. For data on Technology Clockspeed and Architectural Relationship, dozens of engineers were interviewed and their assessments tabulated. For the Supply Base Capability and Competitive Position components, we interviewed experts in procurement, financial analysis, benchmarking, etc. In total, over 100 executives, product engineers, manufacturing engineers, financial analysts, planners, and purchasing agents contributed their knowledge. The project team systematically documented this large knowledge base. In the first use of the model we developed a database of each of the five criteria (and the underlying rationale behind each rating) for over 20 Engine Subsystems, 20 Transmission Subsystems, as well as various supply chain elements for both Engineering and Manufacturing.

11

"Is the Make-Buy Decision Process a Core Competence?" by Charles Fine and Daniel Whitney, in Moreno Muffatto and Kulwant Pawar (eds.), Logistics in the Information Age, Servizi Grafici Editoriali, Padova, Italy, 1999, pp. 31-63. The paper is also available at http://web.mit.edu/ctpid/www/Whitney/papers.html. 14

15

Table 1: Case Example: Exhaust System Engineering As an example of the approach, consider the analysis for the Powertrain Exhaust subsystem (Also, see Figure 4 below).

Subsystem Powertrain Exhaust Components Catalytic converter, Air Injection Reaction system, O2 sensors, etc. Customer Importance High. The performance of this subsystem impacts the emissions of the vehicle, which is important to many customers. The Exhaust system also has a high impact on acceleration due to the converters key role in regulating exhaust back-pressure. Technology clockspeed Fast. Key driver is the sensor technology, which is evolving rapidly. Stringent government regulations and use of precious metals requires GMPT to maintain a continual focus on improving the performance of this subsystem. Competitive position Parity. The OEMs have different strategies for the cost and performance of this subsystem, but overall all OEMs have similar capability. Supplier Capability None. Although there are suppliers capable of component design, there are currently no suppliers that are capable of developing the entire subsystem. Architecture Modular. The powertrain exhaust system is somewhat modular because the same converter can be used in multiple vehicle applications. The packaging constraints may drive changes in the design of the down pipes and bolting schemes from vehicle to vehicle. Strategic Value Chain Assessment High Strategic Value; Likely Insourcing Candidate

Table 1 provides some of the details on the strategic value analysis performed for the Exhaust System Engineering sourcing decision. The economic data is proprietary and not included. At a broader level, some of the highlights of the strategic Value Chain analysis for the entire organization included: Enhance / Maintain capability to determine the Architecture of the Engine, Transmission and Controls as this is a highly strategic activity. Maintain Process Expertise for Product / Process Development & Supplier Management. Maintain Final Assembly & Test of Engines and Transmissions within GMPT as it is a highly strategic activity.

15

16

Increase Reliance on Suppliers for design of lower strategic importance subsystems & components Develop a capable supply base for lower strategic subsystems and components.

The performance of the Exhaust subsystem impacts the emissions of the vehicle, which is important to the customers. This system also has a high impact on acceleration due to the converters key role in regulating exhaust backpressure Key driver is the sensor technology, which is relatively fast changing. Stringent government regulations and use of precious metals requires GMPT to maintain a continual focus on improving the performance of this subsystem. The OEMs have different strategies for the cost and performance of this subsystem, but overall all OEMs have similar capability.

Customer Importance

High

Technology Clockspeed

Fast

Competitive Position: Competitive Advantage Position

Parity Parity Disadvantage

Although there are suppliers capable of component design, there are currently no suppliers that are capable of developing the entire subsystem. The powertrain exhaust system is somewhat modular because the same converter can be used in multiple vehicle applications. The packaging constraints may drive changes in the design of the down pipes and bolting schemes from vehicle to vehicle.

Capable Suppliers

None

Architecture

Modular

Value Chain Strategy Outcome Insource All

Figure 4

5. Decision Framework: Analysis, Options, Assessment, Decision The Strategic Value Framework described above should be considered as an analysis tool. It does not actually recommend a course of action. Thus the value framework has to be embedded in a decision framework which includes (1) value analysis (economic and strategic), (2) development of strategic options, (3) assessment of the generated options, and then (4) the making of a decision. The implementation of the remaining steps in this process for specific subsystems is proprietary to General Motors and therefore not appropriate for this article. However, some broad comments about the process follow. The economic and strategic value analysis enabled us to classify key elements of the value chain in a matrix shown in Figure 4. This classification scheme categorized value chain elements as having (1) both high economic and strategic value (likely insourcing candidates), (2) both bow economic and strategic value (likely outsourcing candidates), (3) high economic, but low strategic value (internal cash cow or spinoff candidate), and (4) high strategic, but low

16

17

economic value (strategic investment or financial problem). Once categorized, we compared the existing sourcing posture for each element with the desired position. In many cases, those elements that our value analysis recommended outsourcing were already outsourced and conversely. However, we did find some elements that were not aligned. These were the ones that received additional attention to generate alternatives to the existing posture. These alternatives were then assessed, followed by decisions and actions. These alternatives broadly fall into the following categories:

Insource Invest Partner/Acquire Partial Outsource Partial Insource Spin Off Outsource to existing suppliers Develop Suppliers and Outsource

Synthesizing Strategic & Economic Elements

Leverage

Strategic - High Economic - Low

Consider alliances Use for higher price vehicle segments

Invest

Strategic - High Economic - High

Strategic Value

Low

6. Organizational Capability and Internet Applications

Medium

High

Outsource

Figure 5

Strategic - Low Economic - Low

Harvest

Low (negative) Medium (break even) Economic Value Added High (positive)

Strategic - Low Economic - High

17

18

We have presented a model for strategic value chain analysis based on work at the General Motors Powertrain organization. However, during the course of this work, we became aware of how such a project can create an organizational capability for fast response to industry value chain dynamics. Specifically, when the first phase of our project was almost complete, General Motors announced a major alliance with Fiat, Italys leading vehicle manufacturer. At the time of the first announcement, not all of the details of the relationship had been settled and Arvin Mueller, GMs Group Vice President and General Manager of GMPT was asked to make recommendations on how to structure the powertrain portion of the GM/Fiat alliance. Building on the value chain analyses that our project team had developed, we were able to make specific recommendations that influenced the alliance structure in the powertrain domain. A year later, the powertrain portion of the alliance was being viewed by the automotive press as successful and particularly savvy.12 Of course, in a relatively slow-clockspeed environment like automotive powertrains, the need for rapid response value chain analysis arises relatively rarely. However, in a very fast clockspeed environment, the need for what we call a Value Chain SWAT Capability is arguably much greater.13 To illustrate this, consider the gyrations in the music industry since the explosion of MP3 file sharing built on the peer-to-peer sharing software distributed widely by Napster. Napster displaced the distribution segment of the music industrys value chain, which happens to be the stage in the chain where most of the revenue is traditionally collected, only after significant investment has been sunk by large music companies in upstream value stages. Although Napster was started by a 19-year-old hobbyist, its control was bought by capitalists once the subscriber count exceeded ten million or so. The Recording Industry Association of America (RIAA), which represents large music companies (the property rights holders of a large fraction of commercially recorded music), quickly deemed Napster as Public Enemy Number One, and successfully applied a legal strategy to have the courts shut Napster down. At best the RIAA might be judged as having displayed brilliant legal tactics, but extremely myopic strategic vision. As widely predicted, Napsters demise has lead to a multitude of websites devoted to free music file sharing.14 There are now even websites devoted solely to keeping track of the many music file sharing sites in existence.15 Many of these sites are undoubtably run by capitalists, who might respond predictably to legal or financial incentives. However, some of these sites seem to be run by music lovers (or freedom lovers) who might be more aptly described as anarchists. Some of these website operators seem to be more interested in seeing music widely available for free than they are in financial remuneration. As a result, the upcoming war between the RIAA and the anarchists is likely to be very different from the one with Napster. Anarchists are hard to find and harder to hit. By destroying Napster rather than finding a way to coopt or control it, the RIAA has made its value chain infinitely more difficult to control. Had the RIAA done a deeper (and timely) value chain analysis, they may have concluded that a partnership with Napster (who had a huge following and huge market share for music file sharing) represented their best chance to preserve any degree of control over the

12

Looking More Savvy than Sentimental: A Year after Rejecting Merger, Fiats Silencing Critics, Jeff Israely, The Boston Globe 06/23/2001 Page: C1 Section: Business 13 In police work, SWAT stands for Special Weapons and Tactics. SWAT teams are rapid response teams that are trained to react to difficult and unanticipated urgent matters. We think the analogy fits well here. 14 Revenge of the file-sharing masses! http://www.salon.com, July 20, 2001, by Scott Rosenberg. 15 See, e.g., http://www.zeropaid.com. 18

19

future of on-line music-distribution. The window of opportunity for creating such a deal was very short, however. The anarchists were already hard at work refining their user interfaces to the point where generations X, Y, and Z would forever abandon the concept of paying for music. More than ever, companies in fast-clockspeed environments need a strong capability for continuous assessment of their entire end-to-end (E2E) supply and distribution chains. When disruptions occur, value chain SWAT teams must rapidly assess which parts of the chain are vulnerable, which parts are defensible, which alliances are palatable, and which threats are deadly. Such skills were clearly lacking at the RIAA and at Napster. The RIAA chose to shoot its potential partners, while giving valuable development time to its truly deadly foes. Napster, however, was also at a loss to define a viable business model, although its large collection of eyeballs (or ear drums) would surely have fetched a decent price when its peak matched the internet markets peak. One Napster executive allegedly suggested to an already-agitated RIAA official that the only profit model available to the RIAA might be selling Tshirts on the Napster website, further inflaming the passions against Napster arrogance. But Napster, too, had a limited opportunity window to cut a deal with the RIAA before losing its ear drums to the anarchists or losing its business license in the courts. Whether the music distribution industry will save itself from the anarchists (or even profitably postpone its demise) continues to be a fascinating case study in internet-driven disruption. But the deeper lesson is learning what capabilities are required by companies to survive such now-commonplace cosmic disruptions driven by the internet. No one can predict what industry will next be disrupted by what teenage hobbyist. And strikingly, the capabilities of teenagers to disrupt industries is probably only growing with each passing year of Internet experience. Our conclusion: In any business where digital content is of any importance, managers ought not sleep well until the value chain SWAT team is armed and ready.

Acknowledgments The authors would like to thank Mr. Arvin Mueller for conceiving the GMPT Value Chain project and, more importantly, for leading it with his active involvement and his strategic insights. The authors also acknowledge the valuable contributions of Mr. Cuneyt Oge of PRTM, Messrs. Gary Blair and Alan Kennedy of GMPT, as well as the members of the GMPT Strategy Development Group and the PRTM team.

19

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- G DHS 1Dokument22 SeitenG DHS 1Sergio Boillos100% (1)

- Lista 1 - Mayor y Gran Mayor Mastro (May-31-2023)Dokument160 SeitenLista 1 - Mayor y Gran Mayor Mastro (May-31-2023)JoséNoch keine Bewertungen

- GMW14278Dokument15 SeitenGMW14278Ivan Dario Oyola RaveloNoch keine Bewertungen

- Ford vs Toyota competitive strategiesDokument4 SeitenFord vs Toyota competitive strategiesamitiiit31Noch keine Bewertungen

- 2007 GM Car and Truck GuideDokument121 Seiten2007 GM Car and Truck GuideNorm Sai100% (1)

- Fit for SUZUKI /スズキ enginesDokument3 SeitenFit for SUZUKI /スズキ enginesEdixo ReyesNoch keine Bewertungen

- CadillacDokument9 SeitenCadillacapi-281175594Noch keine Bewertungen

- GM Performance Parts Catalog 2007Dokument383 SeitenGM Performance Parts Catalog 2007dingypilotNoch keine Bewertungen

- C CMM M MMMMMMMM M ? MMM M!M!! MM"M#$MMM M M$$M: ®M ®M ®M ®M ®MDokument39 SeitenC CMM M MMMMMMMM M ? MMM M!M!! MM"M#$MMM M M$$M: ®M ®M ®M ®M ®MSon TranNoch keine Bewertungen

- 2021 CATÁLOGO DE FILTROS LÍNEA LIVIANA 40-characterDokument48 Seiten2021 CATÁLOGO DE FILTROS LÍNEA LIVIANA 40-characterJordyPonceNoch keine Bewertungen

- Zedbull ApplicationDokument4 SeitenZedbull ApplicationFernando OliveiraNoch keine Bewertungen

- Aftermarket Warranty Quick Reference ChartDokument2 SeitenAftermarket Warranty Quick Reference Chartjorge alonsoNoch keine Bewertungen

- Special Tools BulletinDokument5 SeitenSpecial Tools BulletinoscarNoch keine Bewertungen

- Automobile IndustryDokument25 SeitenAutomobile IndustryAneeka Niaz0% (1)

- Technical Appraisal: Unit 5Dokument16 SeitenTechnical Appraisal: Unit 5DIPAKNoch keine Bewertungen

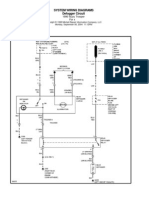

- Saturn - Alarm & Remote Start Wiring - Copyright © 2004-2006 - 12 Volt Resource LLCDokument20 SeitenSaturn - Alarm & Remote Start Wiring - Copyright © 2004-2006 - 12 Volt Resource LLCneaalecu4Noch keine Bewertungen

- Lockdecoders 2018 Catalogue Featuring Key Cutting & CNC MachinesDokument27 SeitenLockdecoders 2018 Catalogue Featuring Key Cutting & CNC MachinesMick BurnsNoch keine Bewertungen

- Tesla's Entry Into The U.S. Auto Industry: Donald Sull and Cate ReavisDokument27 SeitenTesla's Entry Into The U.S. Auto Industry: Donald Sull and Cate ReavisHiểu TâmNoch keine Bewertungen

- Installation Kit for GM and Suzuki VehiclesDokument42 SeitenInstallation Kit for GM and Suzuki VehiclesWayne LundNoch keine Bewertungen

- Case Analysis Ford Motor CompanyDokument8 SeitenCase Analysis Ford Motor CompanyBegna AbeNoch keine Bewertungen

- How To Lose 8 Kgs Weight in 7 Days - My Health Tips - My Health TipsDokument14 SeitenHow To Lose 8 Kgs Weight in 7 Days - My Health Tips - My Health TipskrishnakumariramNoch keine Bewertungen

- September 19, 2014 Strathmore TimesDokument24 SeitenSeptember 19, 2014 Strathmore TimesStrathmore TimesNoch keine Bewertungen

- Cross Over Reference Chart for Automotive FiltersDokument380 SeitenCross Over Reference Chart for Automotive FiltersdanielNoch keine Bewertungen

- General Motors Clips and FastenersDokument153 SeitenGeneral Motors Clips and Fastenersahappyuser100% (2)

- Thai Autobook 2013 - PreviewDokument38 SeitenThai Autobook 2013 - PreviewUlrich KaiserNoch keine Bewertungen

- Letter From Mary Barra To Environmental Leaders 11.23.20Dokument1 SeiteLetter From Mary Barra To Environmental Leaders 11.23.20Fred LamertNoch keine Bewertungen

- General Motors Company: Form 10 KDokument234 SeitenGeneral Motors Company: Form 10 Kalphawasbeta3104Noch keine Bewertungen

- Research Paper PaezDokument7 SeitenResearch Paper Paeztrishiaannpaez7Noch keine Bewertungen

- Isuzu Trooper 1990Dokument20 SeitenIsuzu Trooper 1990toktor toktor100% (5)

- GM 5.0 & 5.7L ManualDokument78 SeitenGM 5.0 & 5.7L ManualChris MaytumNoch keine Bewertungen