Beruflich Dokumente

Kultur Dokumente

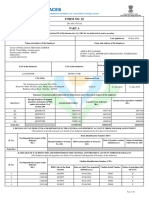

File Format Consolidated Statement Non Salary (26Q, 27Qand27EQ)

Hochgeladen von

Velu KumarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

File Format Consolidated Statement Non Salary (26Q, 27Qand27EQ)

Hochgeladen von

Velu KumarCopyright:

Verfügbare Formate

File format for Quarterly Consolidated for Non-Salary (26Q, 27Q, 27EQ) TDS/TCS statement (V

Note : 1) All amount fields would be padded with zero ,eg., for 0.00 it would be 0000000000000.00. 2) Deleted records will not form part of consolidated file.

TDS Statement for Non Salary category (File Header Record)

Sr. number 1 2 Line number Record Type File Type 3 4 Upload Type File Creation Date 5 File Sequence number 6 Uploader Type 7 TFC ID / Organization ID 8 9 Total number of Batches Count of line in file 10 11 Data as on CHAR INTEGER 10 9 M M M M NA NA NA M NA NA NA CHAR 1 M INTEGER 9 NA CHAR CHAR DATE 3 2 8 M M M Field Name Data Type INTEGER CHAR 9 2 Size M M Mandatory/ Optional

VARCHAR 20 Date INTEGER INTEGER INTEGER INTEGER CHAR INTEGER INTEGER 8 NA NA NA 20 NA NA NA

12 Filler 13 Filler 14 Filler File Hash 15 16 Filler 17 Filler 18 Filler

Batch Header Record

Sr. number 1 Line number 2 Record Type 3 Batch number Field Name Data Type INTEGER CHAR INTEGER Size 9 M 2 M 9 M Mandatory/ Optional

4 Count of Challan/transfer voucher Records

INTEGER

9 M

5 Form number 6 Transaction Type 7 Batch Updation Indicator

CHAR CHAR INTEGER NA NA

4 M NA NA 15 M 15 O NA NA NA NA NA NA 10 M

8 Original RRR number (RRR number of REGULAR File) INTEGER 9 Previous RRR number INTEGER

10 RRR number INTEGER 11 RRR Date DATE Last TAN of Deductor / Employer / Collector ( Used for 12 CHAR Verification) 13 TAN of Deductor / Employer / Collector CHAR

14 Expected challan record number 15 PAN of Deductor / Employer

INTEGER CHAR

9M 10 O

16 Assessment Yr

INTEGER

6 M

17 Financial Yr

INTEGER

6 M

18 Period

CHAR

2 M

19 Name of Deductor / Collector

CHAR

75 M

20 Deductor / Collector Branch/ Division

CHAR

75 O

21 Deductor / Collector Address1

CHAR

25 O

22 Deductor / Collector Address2

CHAR

25 O

23 Deductor / Collector Address3

CHAR

25 O

24 Deductor / Collector Address4

CHAR

25 O

25 Deductor / Collector Address5

CHAR

25 M

26 Deductor / Collector State

INTEGER

2 M

27 Deductor / Collector PIN

INTEGER

6 M

28 Deductor / Collector's Email ID

CHAR

75 O

29 Deductor / Collector's STD

INTEGER

5 O

30 Deductor / Collector's Telephone number 31 Change of Address of Deductor / Collector since last Return

INTEGER CHAR CHAR

10 O 1M 1M

32 Deductor / Collector Type

33 Name of Person responsible for Deduction / Collection CHAR Designation of the Person responsible for paying Deduction / Collection

75 M

34

CHAR

20 M

35 Responsible Person's Address1

CHAR

25 O

36 Responsible Person's Address2

CHAR

25 O

37 Responsible Person's Address3

CHAR

25 O

38 Responsible Person's Address4

CHAR

25 O

39 Responsible Person's Address5

CHAR

25 M

40 Responsible Person's State

INTEGER

2 M

41 Responsible Person's PIN

INTEGER

6 M

42 Responsible Person's Email ID -1

CHAR

75 O

43 Remark 44 Responsible Person's STD CODE

CHAR INTEGER

NA

NA 5 O

45 Responsible Person's Telephone number Change of Address of Responsible person since last Return Batch Total of - Total of Deposit Amount as per 47 Challan 46

INTEGER

10 O

CHAR INTEGER

1M 15 M

48 Mobile no.

INTEGER

10 O

49 Count of Salary Details Records

INTEGER

NA NA

NA NA 1 M 15 O NA 2 O

50 Batch Total of Gross Total Income as per Salary Detail DECIMAL 51 AO Approval 52 AO Approval number 53 Last Deductor/ Collector Type 54 State Name CHAR CHAR CHAR CHAR

NA

55 PAO Code

CHAR

20 O

56 DDO Code

CHAR

20 O

57 Ministry Name

CHAR

3 O

58 Ministry Name (Other) 59 Registration ID 60 PAO Registration number

CHAR CHAR INTEGER

150 O 12 O 7 O

61 DDO Registration number 62 Record Hash

CHAR INTEGER NA

10 O NA

Challan / Transfer Voucher Detail Record

Sr. number Field Name Data Type Size Mandatory/ Optional

1 2 3 4

Line number Record Type Batch number Challan-Detail Record number

INTEGER CHAR INTEGER INTEGER

9 2 9 9

M M M M

5 6 7 8

Count of Deductee / Party Records

NIL Challan Indicator Challan Updation Indicator

INTEGER CHAR INTEGER INTEGER

9 1 NA 9

M M NA M

Expected Deductee serial number

Challan Matching Indicator

CHAR

10 11 12 13 14 15 16 17 18 19 20 21

Filler Last Bank Challan No ( Used for Verification) Bank Challan No

CHAR INTEGER INTEGER

NA NA 9 NA 9

NA NA O NA O NA O NA M NA NA M

Last Transfer Voucher / DDO serial Number (Used for INTEGER Verification) Transfer Voucher / DDO serial Number INTEGER

Last Bank-Branch Code/ 24G Receipt Number (Used INTEGER NA for Verification) Bank-Branch Code/ 24G Receipt Number INTEGER 7

Last Date of 'Bank Challan No / Transfer Voucher DATE No' ( Used for Verification) Date of 'Bank Challan No / Transfer Voucher No' Filler 5 Filler 6 Section / Collection Code CHAR

DATE

NA 8 NA NA 3

22

'Oltas TDS / TCS -Income Tax '

DECIMAL

15,2

23

'Oltas TDS / TCS -Surcharge '

DECIMAL

15,2

24

'Oltas TDS / TCS - Cess'

DECIMAL

15,2

25

Oltas TDS / TCS - Interest Amount

DECIMAL

15

26

Oltas TDS / TCS - Others (amount)

DECIMAL

15

27

28 29

Total of Deposit Amount as per Challan/Transfer Voucher number ( 'Oltas TDS/ TCS -Income Tax ' + 'Oltas TDS/ TCS -Surcharge ' + 'Oltas TDS/ TCS - DECIMAL Cess' + Oltas TDS/ TCS - Interest Amount + Oltas TDS/ TCS - Others (amount) ) Last Total of Deposit Amount as per Challan ( Used for DECIMAL Verification) Total Tax Deposit Amount as per deductee annexure DECIMAL (Total Sum of 323/425) 'TDS / TCS -Income Tax ' DECIMAL

15

NA 15

NA M

30

15

31

'TDS / TCS -Surcharge '

DECIMAL

15

32

'TDS / TCS - Cess' Sum of 'Total Income Tax Deducted at Source' (TDS/

DECIMAL

15

33

TCS - Income Tax + TDS/ TCS - Surcharge + DECIMAL TDS/TCS - Cess )

15

34

TDS/ TCS - Interest Amount

DECIMAL

15

35

TDS / TCS - Others (amount)

DECIMAL

15

36

Cheque / DD number (if any)

DECIMAL

15

37 38 39

By Book entry / Cash Filler Record Hash

CHAR CHAR INTEGER

1 NA NA

O NA NA

NOTE : All amount values will have leading zeroes Eg. For 8714.00 value would be 0000000008714.00,for 0.00 value wo

TDS Statement for Non Salary category (Deductee Detail Record)

Sr. number Field Data Type Size Mandatory/ Optional

1 2 3 4

Line number Record Type Batch number Challan-Detail Record number

INTEGER CHAR INTEGER INTEGER

9 2 9 9

M M M M

Deductee / Party Detail Record No

INTEGER

6 7 8

Mode Employee Serial No Deductee / Party Code

CHAR INTEGER CHAR

1 NA 1

M NA M

9 10

Last Employee / Party PAN ( Used for Verification) Employee / Party PAN

CHAR CHAR

NA 10

NA M

11 12

Last Employee/Party PAN Ref. number( Used for CHAR Verification) PAN Ref. number CHAR

NA 10

NA O

13

Name of Deductee / Collectee

CHAR

75

14

TDS / TCS -Income Tax for the period

DECIMAL

15

15

TDS / TCS -Surcharge for the period

DECIMAL

15

16

TDS / TCS -Cess

DECIMAL

15

17

18

Total Income Tax Deducted at Source (TDS / TCS DECIMAL Income Tax+ TDS / TCS Surcharge + TDS / TCS Cess) I.e. (319 / 421 / 721 / 672 + 320 / 422 / 722 / 673 + 321 / 423 / 723 / 674 ) Last Total Income Tax Deducted at Source (Income DECIMAL Tax +Surcharge+Cess) ( Used for Verification) Total Tax Deposited DECIMAL

15

NA

NA

19

15

20

Last Total Tax Deposited ( Used for Verification)

DECIMAL

NA

NA

21

Total Value of Purchase

DECIMAL

15

22

Amount of Payment / Credit / Debited ( Rs.)

DECIMAL

15

23

Date on which Amount paid / Credited / Debited

DATE

24

Date on which tax Deducted / Collected

DATE

25

Date of Deposit

DATE

26

Rate at which Tax Deducted / Collected

DECIMAL

27

Grossing up Indicator

CHAR

28

Book Entry / Cash Indicator

CHAR

29 30

Date of furnishing Tax Deduction Certificate Remarks 1 (Reason for non-deduction deduction/ higher deduction/threshold) Remarks 2 Remarks 3 Record Hash

DATE / lower CHAR

NA NA

NA NA

31 32 33

CHAR CHAR INTEGER

NA NA NA

NA NA NA

7EQ) TDS/TCS statement (Version 1.1)

00000000.00.

Header Record)

Description of the field This field will contain running Sequence number for each line in the file. This field will contain "FH" signifying 'File Header' record. This field will contain value as below: For statements submitted in electronic: 26Q & 27Q - value will be "NS1" 27EQ - value will be TC1 This field wil contain value "R". This field will contain date of creation of the consolidated TDS/TCS statement in ddmmyyyy format. Value '1' will be provided in case the uploader type is 'D' else no value will be provided This field will contain value as below: 'T' in case of TIN-FC upload and 'D' in case of online upload. This field will contain value as below: TIN-FC ID in case of TIN-FC upload and Organization ID in case of online upload. This field will contain value as '1'. This field will contain the count of lines in consolidated file requested. This field will contain data as of which date is provided (in ddmmyyyy format). This field will not contain any value. This field will not contain any value. This field will not contain any value. This field will have hash value for complete file This field will not contain any value. This field will not contain any value. This field will not contain any value.

Description of the field This field will contain running Sequence number for each line in the file. This field will contain "BH" signifying 'Batch Header' record. This field will contain value as '1'.

This field will count of total number of challans/transfer vouchers as per the statement details available at TIN central system. This field will contain value '26Q'/ '27Q'/ '27EQ'. This field will not contain any value. This field will not contain any value. Provisional receipt number of Original statement will be provided Provision receipt number of last correction (batch) that has been accepted/partially accepted by TIN. This field will not contain any value. This field will not contain any value. This field will not contain any value. TAN as per the statement details available at TIN central system will be provided. Expected challan detail record number considering the correction statement submitted earlier will be provided. PAN of the deductor as per the statement details available TIN central system. Assessment Year (AY) as per the statement details available TIN central system will be provided. If the AY is 2008-09 then the value provided will be 200809. Financial Year (FY) as per the statement details available TIN central system will be provided. If the FY is 2007-08 then the value provided will be 200708. Quarter as per the statement details available TIN central system will be provided. Name of the employer as per the statement details available TIN central system will be provided. Branch/Division as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided.

Address details as per the statement details available TIN central system will be provided. Address details (State) as per the statement details available TIN central system will be provided. Numeric state code as per Annexure 1 will be provided. PIN code as per the statement details available TIN central system will be provided. E-mail ID as per the statement details available TIN central system will be provided. STD code as per the statement details available TIN central system will be provided. Telephone number as per the statement details available TIN central system will be provided. This field will contain value "N". Deductor/collector type as per the statement details available TIN central system will be provided. Name of the responsible person as per the statement details available TIN central system will be provided. Designation of responsible person as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details as per the statement details available TIN central system will be provided. Address details (State) as per the statement details available TIN central system will be provided. Numeric state code as per Annexure 1 will be provided. PIN code as per the statement details available TIN central system will be provided. E-mail ID of the responsible person as per the statement details available TIN central system will be provided.

This field will not contain any value. STD code of the responsible person as per the statement details available TIN central system will be provided. Telephone number of the responsible person as per the statement details available TIN central system will be provided. This field will contain value "N". This field will contain challan deposit amount of all challans in the statement. Value will be provided as per the TDS/TCS statement details available at TIN central system. Will be applicable in case of TDS/TCS statement pertaining to FY 2010-11 and onwards. This field will not contain any value. This field will not contain any value. This field will contain value "N". This field will not contain any value. This field will not contain any value. State code will be provided as per the TDS/TCS statement details available at TIN central system. Value will be provided as per the TDS/TCS statement details available at TIN central system. Value will be provided as per the TDS/TCS statement details available at TIN central system. Ministry name code will be provided as per the TDS/TCS statement details available at TIN central system. Value will be provided as per the TDS/TCS statement details available at TIN central system. This field will not contain any value. Value will be provided as per the TDS/TCS statement details available at TIN central system. Value will be provided as per the TDS/TCS statement details available at TIN central system. This field will not contain any value.

Record

Description of the field

This field will contain running Sequence number for each line in the file This field will contain "CD" signifying 'Challan/ Transfer Voucher Detail' record. This field will contain value as '1'. This field will contain running sequence number for 'Challan/ Transfer Voucher Detail' records in a batch. This field will contain count of deductee records present within the Challan/ Transfer Voucher. This field will contain value 'Y' / 'N'. This field will not contain any value. Expected deductee detail record number considering the correction statement submitted earlier will be provided. This field will have value as below: M - In case challan is matched U - In case challan is unmatched P - In case challan is provisionally booked. This field will not contain any value. This field will not contain any value. Challan Serial number as per the statement details available at TIN central system will be provided. This field will not contain any value. Transfer Voucher number as per the statement details available at TIN central system will be provided. This field will not contain any value. BSR code as per the statement details available at TIN central system will be provided. This field will not contain any value. Date of payment of TDS/TCS as per statement details available at TIN central system will be provided. This field will not contain any value. This field will not contain any value. Section code under which Tax has been deducted / collected as per the statement available at TIN central system will be provided. TDS amount as per the statement available at TIN central system will be provided. Surcharge amount as per the statement available at TIN central system will be provided.

Cess amount as per the statement available at TIN central system will be provided. Interest amount as per the statement available at TIN central system will be provided. Others amount as per the statement available at TIN central system will be provided. Total Amount of tax paid as per the statement details available at TIN central system will be provided.

This field will not contain any value. Total tax deposit amount in the deductee annexure as per the statement details will be provided. TDS amount in the deductee annexure as per the statement details will be provided. Surcharge deducted amount in the deductee annexure as per the statement details available at TIN central system will be provided. Cess deducted amount in the deductee annexure as per the statement details available at TIN central system will be provided. Total TDS deducted amount in the deductee annexure as per the statement details available at TIN central sytem will be provided. Interest amount' as per the statement available at TIN central system will be provided. Others amount' as per the statement available at TIN central system will be provided. Cheque number as per the statement details available at TIN central system will be provided. This field will contain Book entry flag for the challan as per the statement details available at TIN central system. This field will not contain any value. This field will not contain any value.

000000008714.00,for 0.00 value would be 000000000000.00

ctee Detail Record)

Description of the field

This field will contain running Sequence number for each line in the file This field will contain "DD" signifying 'Deductee Detail' record. This field will contain value as '1'. This field will contain running sequence number for 'Challan/ Transfer Voucher Detail' records in a batch. This field will contain running sequence number for 'Deductee Detail' records in a batch. This field will contain value as 'O'. This field will not contain any value. This field will contain value deductee/party code as per the statement details available at TIN central system. This field will not contain any value. This field will have PAN of the employee as per the statement details at TIN central system. This field will not contain any value. This field will contain PAN Ref No as per the statement details available at TIN central system This fields will contain Name of Deductee/ Collectee as per the statement details available at TIN central system This field will contain TDS amount as per the statement details available at TIN central system This field will contain Surcharge amount as per the statement details available at TIN central system This field will contain Cess amount as per the statement details available at TIN central system This field will contain Total TDS deducted amount as per the statement details available at TIN central system This field will not contain any value.

This field will contain TDS deposited amount as per the statement details available at TIN central system This field will not contain any value.

This field will contain Total value purchase (in case of Form 27EQ) as per the statement details available at TIN central system else no value will be provided. This field will contain Amount Paid/Credited as per the statement details available at TIN central system. This field will contain Date on which Amount Paid/ Credited /Debited to deductee as per the statement details available at TIN central system. This field will contain Date on which tax was deducted / collected as per the statement details available at TIN central system. This field will contain Date of deposit of tax as per the statement details available at TIN central system. This field will contain rate at which Tax is deducted/ collected (upto 4 decimal places) as per the statement details available at TIN central system. This field will contain Grossing up Indicator (in case of Form 27Q) as per the statement details available at TIN central system else no value will be provided. This field will contain Book entry/Cash Indicator flag as per the statement details available at TIN central system. This field will not contain any value. This field will contain value as per the statement details available at TIN central system. This field will not contain any value. This field will not contain any value. This field will not contain any value.

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- ItlpDokument14 SeitenItlpA_saravanavelNoch keine Bewertungen

- Accountancy and Auditing 2-2011Dokument7 SeitenAccountancy and Auditing 2-2011Muhammad BilalNoch keine Bewertungen

- 504A Direct TaxDokument38 Seiten504A Direct TaxOwais ZamanNoch keine Bewertungen

- LNT Bond FormDokument8 SeitenLNT Bond FormsunajbaniNoch keine Bewertungen

- Vivad Se Vishwas PPT File - PPTX 1Dokument11 SeitenVivad Se Vishwas PPT File - PPTX 1Piyush MundadaNoch keine Bewertungen

- Section 80uDokument3 SeitenSection 80uSukhada SontakkeNoch keine Bewertungen

- Wealth Tax Authorities NotesDokument3 SeitenWealth Tax Authorities NotesSanjana PSNoch keine Bewertungen

- Assessment Under The It ActDokument34 SeitenAssessment Under The It ActbhanumaaaNoch keine Bewertungen

- PNB Savings Account FeaturesDokument28 SeitenPNB Savings Account Featuresgauravdhawan1991Noch keine Bewertungen

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Dokument1 SeiteItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)deepakNoch keine Bewertungen

- Form No 15GDokument4 SeitenForm No 15Graghu_kiranNoch keine Bewertungen

- Section 80C To 80U 1Dokument41 SeitenSection 80C To 80U 1karanmasharNoch keine Bewertungen

- Heads of IncomeDokument26 SeitenHeads of IncomeShardulWaikar100% (2)

- CS Professional Programme Tax NotesDokument47 SeitenCS Professional Programme Tax NotesridhiworkingNoch keine Bewertungen

- Project On Home LoanDokument64 SeitenProject On Home LoanAjay Singhal100% (6)

- Facilities For Senior Citizens in IndiaDokument30 SeitenFacilities For Senior Citizens in IndiaArushi MishraNoch keine Bewertungen

- Indian Income Tax Return Verification FormDokument1 SeiteIndian Income Tax Return Verification FormramanNoch keine Bewertungen

- Agricultural IncomeDokument15 SeitenAgricultural Incomerups05Noch keine Bewertungen

- Basic Concepts of Income TaxDokument4 SeitenBasic Concepts of Income Taxkyunki143Noch keine Bewertungen

- Business Taxation Module 1&2Dokument13 SeitenBusiness Taxation Module 1&2Khushboo Parikh100% (1)

- Chapter 1 - Basic Concepts of Income Tax - AY - 20-21 PDFDokument16 SeitenChapter 1 - Basic Concepts of Income Tax - AY - 20-21 PDFAbhishek VermaNoch keine Bewertungen

- International TaxationDokument46 SeitenInternational TaxationsridhartksNoch keine Bewertungen

- Concept of Salary Under Income Tax ActDokument30 SeitenConcept of Salary Under Income Tax ActChirag Madan100% (8)

- Tax Planning For SalaryDokument31 SeitenTax Planning For SalaryAjit SwainNoch keine Bewertungen

- Compliance Audit of RUSA Scheme FundsDokument16 SeitenCompliance Audit of RUSA Scheme Fundspawan kumar100% (1)

- 21 Useful Charts For Tax ComplianceDokument24 Seiten21 Useful Charts For Tax Compliancevrj1091Noch keine Bewertungen

- FORM 16 DETAILSDokument2 SeitenFORM 16 DETAILSKushal MalhotraNoch keine Bewertungen

- Vivad Se Vishwas Scheme - Handbook - CA Vaishali Kharde - CA Pritam Mahure and AssociatesDokument172 SeitenVivad Se Vishwas Scheme - Handbook - CA Vaishali Kharde - CA Pritam Mahure and AssociatesCA Vaishali KhardeNoch keine Bewertungen

- Supply Spare Parts CT & D50A15Dokument26 SeitenSupply Spare Parts CT & D50A15LokeshRathorNoch keine Bewertungen

- .Paper - V - Sec.I - Direct Taxes PDFDokument238 Seiten.Paper - V - Sec.I - Direct Taxes PDFMichelle MarkNoch keine Bewertungen