Beruflich Dokumente

Kultur Dokumente

209 - Reporte de Inversion en Ingles

Hochgeladen von

Ankush AkkalwarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

209 - Reporte de Inversion en Ingles

Hochgeladen von

Ankush AkkalwarCopyright:

Verfügbare Formate

Report on Foreign Direct Investment in Colombia

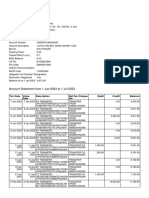

The figures to December 2010 showing details by target sector and country of origin are a source of the Banco de la Republica's Balance of Payments, which includes influxes of currency, profit reinvestment and capital payments other than foreign currencies.

The figures to May 2011 are from the Banco de la Republica's Foreign Currency Balance and exclusively measure influxes of currencies from abroad.

May 2011

OVERVIEW OF FDI BEHAVIOR IN 2010

Following the financial crisis, capital inflows to emerging economies went through a generalized increase as a result of the international liquidity originated by the expense expansion policies of developed countries.

In addition, the increase in the international prices of raw materials has made direct investment more attractive in the countries that produce these commodities, such as the case of Colombia, in which 7% of all the region's capital inflow was concentrated in 2010. Although the FDI in Colombia reached US$6.760 m in 2010 (5% less than in 2009), it was above the historic average of the decade, driven mainly by the high international prices of minerals and petroleum; these two sectors concentrated 67% of the net positive revenue reported by Colombia over the last year. Considering all the other sectors, financial activity received 13% of the total inflows received by the country in 2010, followed by manufacturing activities at 8% and trade with 6% of the total.

FDI INFLOWS INTO COLOMBIA (2002 2010) US$ MILLIONS

12,000

10.252

10,000 8,000 6,000 4,000

10.596 9.049 6.656 7.137 6.760

3.016 2.134 1.720

2,000

-

2002 2003 2004 2005 2006 2007 2008 2009 2010

Between 2009 and 2010, FDI in Colombia dropped 5.3%

Source: Balance of Payments, Banco de la Repblica

FDI INFLOW MAIN SECTORS SHARE % TO 2010*

Ss Comunales, 1% Construction, 4% Com., Rest. and Hoteles; 6% Manufacturing; 8% Financial Establishments; 13% Mines and Quarries, 28% Agricul., Hunting, Forestry and Fishing; 1%

Elect., Nat. Gas and Water; 0%

Petroleum Sector 9%

In 2010, the mining and petroleum sectors accounted for 67% of the total investment, followed by financial establishments with 13% and Manufacturing with 8%.*

*Share of all sectors with positive net investment excluding petroleum and mining: USD $2,432.1 **Share of all sectors with positive net investment USD $8,114.6 Million Source: Balance of Payments, Banco de la Republica. Proexport calculations

FDI INFLOW MAIN SECTORS 2009 2010 USD MILLIONS

Although the sectors with the largest share are Petroleum, Mining and Quarries, the ones with the highest growth were Agriculture and Financial with 86% y 31% respectively.

SectorPetroleum Petrolero Minas y and Quarries Mining Cantanteras

2.055 3.025 945 720 594 621 446 594 262 262 99 88 2010 2009 2.862 2.428

Establecimientos Financieros Financial establishments

Manufacturing Manufactureras Commerce, restaurants y Hoteles Comercio, Restaurantes and hotels

SECTOR Agriculture, Hunting, Forestry and Fishing Financial Establishments Petroleum Public Services Construction Manufacturing Commerce, restaurants and hotels Mining and Quarries Electricity, Natural Gas and Water Transp. Storage and Communications TOTAL

% Var. 2009 - 2010 86.4%

Construccin Construction Servicios Comunales Public Services

Electricity, Water and Gas Electricity, Water and Gas

-977 -589

Agriculture, Hunting, Forestry and Fishing 52 Agricultura, Caza, Silvicultura y Pesca

35

28

Transp., Storage and Commun.

348

NOTE: Sectors arranged by FDI amounts to 2010 Source: Balance of Payments, Banco de la Repblica. Proexport calculations

31.2% 17.9% 12.1% 0.2% -4.4% -25.0% -32.1% -5.3%

MAIN COUNTRIES INVESTING IN COLOMBIA BETWEEN 1994 AND 2010(%) SHARE IN 2010*

Cayman Islands; 2% France; 2% Venezuela, 2% Switzerland; 2% Brazil; 2% Others; 12%

Panama; 28%

Canada; 7% England; 9%

Panama 14.5%

Anguilla, 20%

Although in 2010, approximately 63% of the Investment came from countries like Panama, Anguilla and Bermudas, the main traditional sources of FDI were England and Canada.

Bermudas, 15%

Total FDI 2010: USD $6.760 Million* Transp., Storage and Commun.

*Total investment of countries with positive net investment excluding reinvested profits and petroleum sector investment (figures excluded from the country's investment total and broken down individually). Value 2010: USD $2,235.8 Million NOTE: The order of the countries has been established according to the largest shares in 2010 of the main countries investing in Colombia as accumulated from 1994 to 2010. Source: Balance of Payments, Banco de la Repblica

FDI INFLOW BY COUNTRIES 2009 2010 USD MILLIONS

Canada, Denmark, Ecuador and Ireland reported a growth of more than 100% between 2009 and 2010 as issuers of FDI to Colombia

Panam Panama

Anguilla Anguilla Bermuda Bermudas England Inglaterra Canada Canad Brazil Brasil Switzerland Suiza

-18 -327 -241 78 54 47 48 65 191 46 328 287 620 337 455

Country Anguilla Canada Panama Bermuda Brazil Switzerland England United States Mexico Spain TOTAL

1.234

386

163 2010 2009

Spain

% Var. 2009 - 2010 899.2% 107.9% 84.0% 14.2% 12.9% -27.3% -50.4% -5.3%

United States

-623

Mexico

203

* The order of the countries has been established according to the highest investment flows in 2010 of the main countries investing in Colombia as accumulated from 1994 to 2010. Countries like the United States, Spain and Mexico have been included in the Graph because, although they had negative flows in 2010, they are traditionally important investors to Colombia. Source: Balance of Payments, Banco de la Repblica

ANNUAL AVERAGE FDI OF COUNTRIES WITH SALES OFFICES (USD MILLION)

Countries like Canada and the United Kingdom have shown a significant upward trend in their investments in Colombia over the last 5 years

COUNTRY Brazil Venezuela France Peru Costa Rica Ecuador China India Chile Mexico United Kingdom Germany United States Spain Canada

AVERAGE AVERAGE INVESTMENT INVESTMENT 2000-2010 2005-2010 4.9 7,7 4,0 (3.7) 3.1 5,0 1,1 0,7 0.7 1,5 0.5 0,2 0,2 0,8 0,0 0,0 (1.0) (0.1) (2.3) (2.7) (2.3) 58,3 (8.2) (0.4) (12.0) (145.7) (47.9) (22.6) (50.1) 25,9

DIFFERENCE 2,8 (7.7) 1,9 (0.3) 0,9 (0.3) 0,7 (0.0) 0,9 (0.4) 60,6 7,7 (133.7) 25,3 76,0

Source: Balance of Payments, Banco de la Repblica, Proexport Calculations

FOREIGN DIRECT INVESTMENT MEASURED BY THE DOMESTIC FOREIGN CURRENCY BALANCE* ACCUMULATED JANUARY JUN 04, 2010-2011 USD MILLIONS

Total FDI: 5,752

6000 5000 4000 3000 2000 1000

Total FDI: 3,684

5,117

88%

3,364

10% 86%

87%

12%

2010-2011 GROWTH 56%

Total FDI

88%

88%

Petroleum

866

52%

88%

Others

461

12%

14%

0 2010 Otros Sectores Other Sectors 2011 Petrleo yand Mining Petroleum Minera

Source: Foreign Currency Balance. Banco de la Repblica. *The Domestic Foreign Currency Balance for FDI measures currency movements from abroad, whereas the Balance of Payments does not include other forms of FDI such as reinvested profits and non-currency foreign capital contributions.

MAIN CASES OF INVESTMENT 2010: Communications and Information Technology Services

In 2010, thirteen cases of investment, four greenfield and seven reinvestments were detected Number of projects Subsectors - 2010

2

(BPO&O)

The South Korean airport operator Korea Airports Corporation invested USD $60.9 million in the operation and administration of five airport terminals in Colombia. (La Repblica, November 04, 2010).

Chilean communications company DeVeTel came to Colombia to offer its services in the country's mobile telephony sector. (La Repblica, December 02, 2010).

(Communications)

2 1 1 1

Q1 1T

1 2 1

Q2T 2 Q3T 3 Q4 4T

The Canadian company of services and products for oil and mining development Estrella International Services acquired Colombian firm STS Andes, specialized in cargo transport in the hydrocarbon sector for USD $20 million. (Portafolio, November 04, 2010)

(Engineering, Mining and Petroleum Services)

BPO Engineering BPO RRHH

HR Comunicaciones Communications Ingenieria The US multinational company that manufactures and sells IT products, IBM invested USD $8 million in the construction of a new data center in Colombia. (Portafolio, August 12, 2010).

(Software)

Source: Cases collected from stories published in major national and international media sources

MAIN CASES OF INVESTMENT 2010: Financial Services

In 2010, four cases of investment were detected, two of which were acquisitions, one greenfield and one reinvestment. Number of projects Subsectors - 2010

(Other financial

US asset management and AVL solutions company, Lender Systems, invested US $0.03 million in the creation of the firm Intellitech, which will specialize in loan portfolio management in Colombia. (La Repblica, April 12, 2010).

services)

(Banking system)

US conglomerate of financial services Citigroup opened a new service center in the city of Bogot D.C. (Portafolio, August 06, 2010).

1

1T Q1 Q2T 2

1

3T Q3

1

4T 4 Q

(Investment

Banking)

US conglomerate of financial services Citigroup acquired 31.9% of Colombian company Transportadora de Gas Internacional for USD $400 million through its subsidiary, Citi Venture Capital. (Portafolio, December 20, 2010)

Oder financial services Otros servicios bancarios

Sistema bancario Banking system

Investmentinversin Banca de banking

Source: Cases collected from stories published in major national and international media sources

MAIN CASES OF INVESTMENT 2010: Cosmetics and Hygiene Products

During the period from April to September 2010 four cases of investment were detected in Cosmetics and Hygiene Products, which were all reinvestments

(Absorbents)

Chilean absorbent paper manufacturer CMPC invested US $74 million in opening a plant in Gachancip, Cundinamarca. (Portafolio, July 09, 2010).

Number of projects Subsectors - 2010

(Cosmetics)

US cosmetics and perfume company Avon invested USD $50 million in a distribution center in the town of Guame, Antioquia. (Dinero, June 03, 2010).

(Cosmetics)

1

1T Q1 Q2T 2

1

3T Q3 Q 4T 4

Peruvian cosmetics and perfume company Yanbal invested USD $25 million in a distribution center in the town of Tenjo, Cundinamarca. (La Repblica, July 29, 2010).

Personal hygiene Aseo Personal

(Personal hygiene)

US multinational personal hygiene product manufacturer Proctor&Gamble invested USD $25 million in the construction of a distribution center in Rionegro, Antioquia. (La Repblica, May 27, 2010).

Cosmticos Cosmetics Absorbentes Absorbents

Source: Cases collected from stories published in major national and international media sources

MAIN CASES OF INVESTMENT 2010: Tourism

(Tourism Infrastructure)

US hotel chain Marriott International opened a new hotel in the financial district of Bogot D.C. under its brand JW Marriott. (La Repblica, June 23, 2010).

In 2010, there was a rise in the investment in hotel infrastructure. The first nine months of the year showed increases. Almost all these cases are Greenfield. Number of projects Subsectors - 2010

(Tourism Infrastructure)

US hotel chain Starwood Hotels and Resorts invested about USD $62.5 million on opening new hotels in Colombia. (La Repblica, June 23, 2010).

2

1T

(Tourism Infrastructure)

French hotel and travel agencies group Accor invested approximately USD $62.5 in positioning its brands in Latin America, among which Colombia was one of the top countries. (FDI Markets, March 2010).

2T

3T

4T

Tourism Infrastructure Infraestructura de Turismo

Source: Cases collected from stories published in major national and international media sources

MAIN CASES OF INVESTMENT 2010: Agro-industry/Automotive

(Processed Foods)

AGRO-INDUSTRY

During the first half of 2010, two cases of investment were observed in the agroindustry sector, specifically in Processed Foods

Spanish pizzeria chain Telepizza acquired 80% of the Colombian company Jeno's Pizza. (Portafolio, June 01, 2010).

(Processed Foods)

Italian dairy product manufacturer Parmalat invested USD $3.2 million in adapting its plant in Chia, Cundinamarca. (Portafolio, March 07, 2011).

AUTOMOTIVE

During Q2 2010 two cases of reinvestment were detected in the automotive sector, specifically in the sale of vehicles in the Colombian capital

(Sales)

Italian car manufacturer Fiat invested USD $15 million on opening a new point of sale in the city of Bogot D.C. (Portafolio, April 09, 2010).

(Sales)

Swedish car manufacturer Volvo opened a new showcase in the city of Bogot D.C. (Portafolio, March 07, 2010).

Source: Cases collected from stories published in major national and international media sources

CONCLUSIONS

Although the Petroleum and Mining sectors still have the highest share in FDI, the Agricultural and Financial sectors showed relevant increases.

The United Kingdom and Canada are listed as the main sources of investment in Colombia in the year 2010, as well as those with the highest growth rate over the last 5 years. The ICT sector went on from two investment projects in Q1 of the year to six in the last quarter, for a total of 15 for the entire year.

There were nine cases of investment during the year 2010 in the Hotel sector.

The Financial and Cosmetics sectors each presented 4 investment projects throughout 2010. The Agro-industry and Automotive sectors each presented two cases of investment throughout 2010.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Modes of Entry Into An International BusinessDokument6 SeitenModes of Entry Into An International Businessrabinosss95% (22)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- CRM MGR Case StudiesDokument3 SeitenCRM MGR Case StudiesAnkush AkkalwarNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Sales Management - PPT NewDokument14 SeitenSales Management - PPT NewAnkush AkkalwarNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- International MarketingDokument8 SeitenInternational MarketingAnkush AkkalwarNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Case Study ObDokument454 SeitenCase Study ObAnkush AkkalwarNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- MERS As Nominee For MFC - Mary Kist and Donald ClarkDokument2 SeitenMERS As Nominee For MFC - Mary Kist and Donald ClarkLoanClosingAuditorsNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Espiritu V LandritoDokument7 SeitenEspiritu V LandritoMichael John CaloNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- RCBC Senate TestimonyDokument10 SeitenRCBC Senate TestimonyMa FajardoNoch keine Bewertungen

- money: Revealed: Gupta's Circular Money TrailDokument14 Seitenmoney: Revealed: Gupta's Circular Money TrailAna LourençoNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Foss V HarbottleDokument20 SeitenFoss V HarbottlefrancinederbyNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- TTQTDokument24 SeitenTTQTXu XuNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- MOFS PresentationDokument11 SeitenMOFS PresentationAdarsh Singh RathoreNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Revised Amlc TrancodesDokument25 SeitenRevised Amlc TrancodesGuevarraWellrhoNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- JR 4 Axs BLBQVHH GL VDokument4 SeitenJR 4 Axs BLBQVHH GL Vgaurav sehrawatNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- MBA INTERNATIONAL BUSINESS PROJECT REPORT SAMPLE - Project Helpline PDFDokument81 SeitenMBA INTERNATIONAL BUSINESS PROJECT REPORT SAMPLE - Project Helpline PDFAniket MankarNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Investment Banking Firms (Handouts)Dokument2 SeitenInvestment Banking Firms (Handouts)Joyce Ann SosaNoch keine Bewertungen

- Agency Enrollment FormDokument4 SeitenAgency Enrollment FormprasannzaNoch keine Bewertungen

- ISO20022 MDRPart1 PaymentsInitiation 2016 2017 v2Dokument88 SeitenISO20022 MDRPart1 PaymentsInitiation 2016 2017 v2arunsdharanNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Sps Reyes vs. BPI No. 21Dokument1 SeiteSps Reyes vs. BPI No. 21Ryan SabunganNoch keine Bewertungen

- Full Text CaseDokument10 SeitenFull Text CaseAron MenguitoNoch keine Bewertungen

- Challan Form-02 For Clerk-Cum-CashierDokument1 SeiteChallan Form-02 For Clerk-Cum-CashierjatinorbitNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- 2016 Us Kit Catalog - NolinksDokument1.108 Seiten2016 Us Kit Catalog - NolinksJorge Silva100% (1)

- Correct Answer: D (Shiv Kapur) ExplanationDokument18 SeitenCorrect Answer: D (Shiv Kapur) ExplanationSourabh NegiNoch keine Bewertungen

- Chase E-Statement FebruaryDokument4 SeitenChase E-Statement February76xzv4kk5vNoch keine Bewertungen

- Diploma in Investment AnalysisDokument4 SeitenDiploma in Investment AnalysisyanauitmNoch keine Bewertungen

- Monetary Policy of BangladeshDokument11 SeitenMonetary Policy of BangladeshGobinda sahaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Water and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriaDokument4 SeitenWater and Sanitation Services Company - WSSC D.I. Khan: Eligibility CriteriakabirNoch keine Bewertungen

- WWW TSPSC Gov inDokument22 SeitenWWW TSPSC Gov inrameshNoch keine Bewertungen

- PSU184581461 Auth LetterDokument3 SeitenPSU184581461 Auth Letterzihang yanNoch keine Bewertungen

- Jean Keating's Prison TreatiseDokument41 SeitenJean Keating's Prison Treatise:Lawiy-Zodok:Shamu:-ElNoch keine Bewertungen

- Annual Report Summit Bank Pakistan 2015Dokument239 SeitenAnnual Report Summit Bank Pakistan 2015HammadNoch keine Bewertungen

- My Logo Art 20181203121246Dokument1 SeiteMy Logo Art 20181203121246shameer vcNoch keine Bewertungen

- Aided SFS 1Dokument95 SeitenAided SFS 1Shankari.kNoch keine Bewertungen

- Q SBI DataLake RFP v1.0 25Dec2016-Mod V2Dokument220 SeitenQ SBI DataLake RFP v1.0 25Dec2016-Mod V2VadlamaniKalyanNoch keine Bewertungen

- Smart Card Security SystemDokument29 SeitenSmart Card Security SystemRohan Kawediya0% (3)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)