Beruflich Dokumente

Kultur Dokumente

O.M. Scott & Sons

Hochgeladen von

stig2lufetOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

O.M. Scott & Sons

Hochgeladen von

stig2lufetCopyright:

Verfügbare Formate

A Case Study onO.M.

Scott and Sons Company

CASE CONTEXT The company is facing a good economy as evidenced by the increase in sales. Industry is investing in research and development of products. Competitors are slowly entering the market. O.M. Scott and Sons Company is a business in the lawn care and garden product industry. Currently, the company is reviewing the results of 1961 and preparing plans for the 1962 selling season. Sales were increasing and so is net income except for the year 1960 to 1961. Presently, the company is using a combination of traditional seasonal dating plan and trust receipt plan to encourage and enable as many dealers as possible to be well stocked in advance of seasonal sales peaks. Also, this combination was used to retain security interest in merchandise shipped.

PROBLEM DEFINITION With the current internal complications, what must O.M. Scott and Sons Company do to be able to decrease cost of sales and operating expenses? How will the company keep up with its goal of a 25% annual growth rate in sales and profit considering the current policies? How should the company finance its current policy of combination of seasonal dating and trust receipt plan?

FRAMEWORK FOR ANALYSIS

To assess the current financial position of O.M Scott & Sons Company, key ratios are computed and a Dupont analysis is prepared.

A proforma income statement is prepared to project the companys target sales that will conform to the companys 25% annual growth rate goal.

A further analysis of the financial statements and the notes is made to evaluate the companys condition and the needed financing for the current policies of seasonal dating and trust receipt plan.

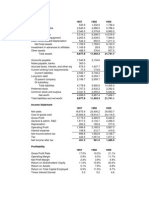

ANALYSIS Financial Ratio Analysis Liquidity

The overall liquidity of the company seems to exhibit an inconsistent trend. The companys liquidity seems to be okay since the recent ratios are not too large from that of the past. Also, the company is a business with relatively predictable cash flow so its current ratio is quite acceptable. With regards to its quick ratio, its inventory is typically sold on credit which means that it becomes an account receivable before being converted into cash so the quick ratio of the company is relatively high.

Activity The companys inventory appears to be in poor shape. Its inventory management seems to have not improved because from 1960 to 1961, its inventory turnover deteriorated. The company may be experiencing some problems with accounts receivable. The average collection period crept up over the past few years. O.M. Scott and Sons Company appear to be slow in paying its bills; it pays nearly 32 days slower compared to that of 1960. Although overall liquidity appears to be okay, the management of receivables and payables should be examined. Total asset turnover reflects a decline in the efficiency of total asset utilization. This means that the companys operation have been financially inefficient.

Debt Indebtedness increased over the 1958-1961 period and this increase in the debt ratio could be cause for alarm. The companys ability to meet interest payment obligations deteriorated from 19581961. The companys indebtedness in these periods apparently caused the deterioration in its ability to pay debt adequately. In summary, it appears that periods 1958-1961 were off years showing that the companys inability to pay debts does not compensate its increased degree of indebtedness.

Profitability O.M. Scott and Sons Companys profitability relative to sales was increasing. Although the gross profit margin was better in recent years than those in the past, higher levels of operating and interest expenses appear to have caused the recent years net profit margin to fall below that of the past. The companys earnings per share deteriorated in 1961 which probably is because of the decrease in net profits. The value of the ROA indicates a poorly managed or ineffective management in generating profits with its available assets. The company appears to have a rapid expansion in its assets during 1958 to 1961 which caused the drop or deterioration in ROA. The low 1961 level of ROE suggests that the company is performing poorly. The return earned on the common stockholders investment in the firm was not better for the owners.

DuPont System of Analysis Doing the DuPont System of Analysis in Exhibit 2, we can trace the possible problem back to its cause: O.M. Scott and Sons Companys ROE is primarily the consequence of slow collections of accounts receivable and poorly managed inventory which resulted in high levels of receivables and inventories and therefore high levels of total assets. The high total assets slowed the companys total asset turnover, driving down its ROA, which then drove down its ROE. By using the DuPont system of analysis to dissect the companys overall returns as measured by its ROE, we found that slow collections of receivable and poor management of inventories caused ROE to drive down. Clearly, the firm needs to better manage its credit and inventory operations. Also, the company is financed primarily through the use of debt as shown by the high value indicated by the leverage ratio.

In Exhibit 3, the projected sales for 1962 are based on O.M Scott & Sons Companys goal of up to 25% annual growth rate of sales and profits. Through the years, the company has increased its sales but during the year 1961, profits decreased by 12% even if sales increased at the same rate. It can be observed that even though there is an increase in annual sales and profits, the profit remains to be only 2-5% of sales. This shows that the companys costs and expenses are very large resulting to a small profit. To increase profit, the company could probably cut cost. The projected sales for the next years should be the companys target to keep up with their goal.

Financing Plan Both the seasonal dating plan and trust receipt plan implemented by the company produces high outstanding receivables to finance their dealers in maintaining appropriate levels if inventory. In addition, an increase in expenses and cost of sales is expected in order to sustain the 25% growth in profit and sales and this will also require the company to finance it. The following year of 1962 requires an additional financing of $ 9,976,080 dollars as projected in the proforma income statement. The company is currently financing its long-term debt by subordinated promissory notes which have restrictions attached to it. According to the Financial Statement Analysis, the company is now having a hard time paying its interests. In addition, the company just exchanged the outstanding notes with new ones with same terms to extend the due date of principal payment. They can no longer use this option because of the restriction that limits the allowed subordinated debt by the company.

DECISION AND OPERATIONALIZATION To effectively manage its inventories, the firm must increase its sales of at least $53,925,130 For the year 1962, the company should cut cost of about $657,775 to increase the ratio of profit to sales. Our group suggests that in order to finance the additional needs of the company is to exhaust the other options. Top priority is to ask for additional investment from stockholders for they are the ones who will benefit from the 25% increase in sales and profit. Secondly, the company can offer shares publicly to take advantage of their very competitive market price of shares. These internal financing saves the company from additional interest payments made to creditors. It was also mentioned that the company is able to stretch accounts payable and it will still be useful to ease payments. The remaining financing, if ever still needed, can be obtained from the revolving credit line from the commercial banks but his entails interest payment.

JUSTIFICATION According to the analysis, both the seasonal dating plan and trust receipt plan implemented by the company produces high outstanding receivables to finance their dealers in maintaining appropriate levels if inventory. In addition, an increase in expenses and cost of sales is expected in order to sustain the 25% growth in profit and sales and this will also require the company to finance it.

Based on industry norms, the short-run level of inventories varies inversely with sales. As shown in Exhibit 4, during the year 1959, the companys profit is about 4.86% of net sales. For 5 years, this is the highest ratio of profit and sales. For 1962, projected sales are $5,392,513,000, and net profit after taxes is $1,963,170. The ratio of profit to sales is only 3.6%. To keep up with a good year where the ratio of profit to sales is 4.86%, the company should target a net profit after taxes of at least, $ 2,620,945.10 (a 66.86% increase in profit from the previous year). To do this, the company should cut cost of about $657,775($2,620,945.10-$1,963,170) for the year 1962.

APPENDICES

Exhibit 1 The O.M. Company Scott & Sons Company and Subsidiary Companies Summary of Financial Ratios Year RATIO Liquidity Current Ratio Quick Ratio Activity Inventory Turnover Average Collection Period Average Payment Period Total Asset Turnover Debt Debt Ratio Times Interest Earned Ratio Profitability Gross Profit Margin Operating Profit Margin Net Profit Margin Earnings Per Share (EPS) Return on Total Assets (ROA) Return on Common Equity (ROE) 1957 2.13 1.22 6.62 50.89 51.83 2.1 53.83% 5.48 17.00% 5.86% 2.42% 5.08% 19.27% 1958 2.48 1.58 5.60 72.10 58.04 2.04 50.52% 10.18 19.17% 9.25% 3.85% $0.69 7.84% 27.68% 1959 1.97 1.02 3.45 68.18 88.28 1.41 65.80% 8.69 10.33% 11.67% 4.86% $1.15 6.83% 29.45% 1960 4.30 3.53 7.77 147.67 47.19 1.28 62.75% 5.15 20.78% 11.83% 4.65% $1.21 5.97% 20.30% 1961 3.59 2.88 6.14 179.42 93.46 1.21 67.52% 3.86 20.42% 10.13% 3.64% $0.99 4.39% 16.79% Evaluation Time-series 1957 - 1961 OK OK POOR POOR POOR POOR GOOD POOR OK OK POOR OK POOR POOR

Exhibit 2 DuPont System of Analysis

= 3.64% x 1.21 x 3.82

= 16.8%

Exhibit 3 THE O.M SCOTT AND SONS AND SUBSIDIARY COMPANIES Pro-Forma Income Statements for the Year Ending September 30, 1962-1963 (Dollar amounts in thousands) 1962 Net sales Cost of sales and operating expenses General and administrative, research and development expenses Depreciation and amortization Interest Charges Total Cost of Sales Earnings before taxes on income Federal and state taxes on income Net income after taxes (42,914.69) (4,813.36) (737.16) (1,414.37) (49,879.58) $ 4,045.54 (2,082.37) $ 1,963.17 $53,925.13* (53,643.37) (6,016.70) (921.45) (1,767.97) (62,349.48) $ 5,056.93 (2,602.97) $ 2,453.96 1963 $67,406.41*

* The forecast sales are based on the companys goal of 25% increase in sales every year. The expenses are based on a percent of sales method.

Exhibit 4 1957 Net sales Net income after taxes % of profit over sales 2.42 3.85 4.86 4.65 3.64 18675.9 451.3 1958 23400.2 901.1 1959 30563.7 1485.5 1960 38396.4 1785 1961 43140.1 1570.7

Das könnte Ihnen auch gefallen

- Scott & Sons Company Case Solution From Syndicate 3Dokument3 SeitenScott & Sons Company Case Solution From Syndicate 3Murni Fitri FatimahNoch keine Bewertungen

- The O. M. Scott & Sons CompanyDokument4 SeitenThe O. M. Scott & Sons Companycarolina120209100% (1)

- SCOTTDokument20 SeitenSCOTTOliviaNoch keine Bewertungen

- OM Scott FinancialsDokument4 SeitenOM Scott FinancialsClarisse MendozaNoch keine Bewertungen

- Caso Star Appliance CompanyDokument10 SeitenCaso Star Appliance CompanyJuan0% (1)

- MGT431 - AppleDokument13 SeitenMGT431 - AppleMokshNoch keine Bewertungen

- DynashearsDokument2 SeitenDynashearsIlia Imerlishvili75% (4)

- Dynashears Inc CaseDokument4 SeitenDynashears Inc Casepratik_gaur1908Noch keine Bewertungen

- Toy World - Group 14Dokument3 SeitenToy World - Group 14Gowthami Shaik0% (1)

- Dynashears StudyDokument2 SeitenDynashears Studylika rukhadze100% (1)

- Ssustainability Scorecard 56743Dokument4 SeitenSsustainability Scorecard 56743killer dramaNoch keine Bewertungen

- APPLE Case SolutionDokument11 SeitenAPPLE Case SolutionsamgoshNoch keine Bewertungen

- New BalanceDokument11 SeitenNew BalanceKen ComeiroNoch keine Bewertungen

- Bausch N LombDokument3 SeitenBausch N LombRahul SharanNoch keine Bewertungen

- Dell Working CapitalDokument7 SeitenDell Working CapitalARJUN M KNoch keine Bewertungen

- Coke Vs Pepsi, 2001Dokument5 SeitenCoke Vs Pepsi, 2001Bibhu Prasad BiswalNoch keine Bewertungen

- OM Scott Case AnalysisDokument20 SeitenOM Scott Case AnalysissushilkhannaNoch keine Bewertungen

- Dynatronics MSB Part 1Dokument10 SeitenDynatronics MSB Part 1Atef ZouariNoch keine Bewertungen

- Docslide - Us Jet Blue Airways Managing Growth Case SolutionDokument12 SeitenDocslide - Us Jet Blue Airways Managing Growth Case SolutionarnabnitwNoch keine Bewertungen

- SpyderDokument3 SeitenSpyderHello100% (1)

- Group 1 - New BalanceDokument16 SeitenGroup 1 - New BalanceAninda DuttaNoch keine Bewertungen

- New Balance Athletic ShoesDokument31 SeitenNew Balance Athletic ShoesArnold Clifton50% (2)

- Deutsche Brauerei CaseDokument2 SeitenDeutsche Brauerei CaseIrma Martinez100% (1)

- Assignment #2 Workgroup E IttnerDokument8 SeitenAssignment #2 Workgroup E IttnerAziz Abi AadNoch keine Bewertungen

- Toy World Inc.Dokument11 SeitenToy World Inc.Ivaner CentenoNoch keine Bewertungen

- Friendly CS SolutionDokument8 SeitenFriendly CS SolutionEfendiNoch keine Bewertungen

- Team 14 - Boeing 7E7Dokument10 SeitenTeam 14 - Boeing 7E7Tommy Suryo100% (1)

- Markstrat Report Round 0-3 Rubicon BravoDokument4 SeitenMarkstrat Report Round 0-3 Rubicon BravoDebadatta RathaNoch keine Bewertungen

- Case Bausch & LombDokument4 SeitenCase Bausch & LombMohan BishtNoch keine Bewertungen

- Case Analysis NATODokument5 SeitenCase Analysis NATOTalha SiddiquiNoch keine Bewertungen

- USTDokument4 SeitenUSTJames JeffersonNoch keine Bewertungen

- O.M. Scott - Sons CompanyDokument31 SeitenO.M. Scott - Sons Companysultan altamashNoch keine Bewertungen

- Case Questions - Bang & OlufsenDokument1 SeiteCase Questions - Bang & OlufsenRahul SatijaNoch keine Bewertungen

- Spyder Case Intro: See Templates On Blackboard For WACC and DCF OutputDokument11 SeitenSpyder Case Intro: See Templates On Blackboard For WACC and DCF Outputrock sinhaNoch keine Bewertungen

- Instruction For Nantucket NectarsDokument4 SeitenInstruction For Nantucket NectarsTanaporn SuwanchaiyongNoch keine Bewertungen

- New Balance Case StudyDokument4 SeitenNew Balance Case StudyTejashviNoch keine Bewertungen

- Group 6 ECCO A S Global Value Chain Management Case PDFDokument16 SeitenGroup 6 ECCO A S Global Value Chain Management Case PDFIndoxfeeds Gram100% (1)

- Nbas Group 8Dokument20 SeitenNbas Group 8shishirNoch keine Bewertungen

- Coursehero 40252829Dokument2 SeitenCoursehero 40252829Janice JingNoch keine Bewertungen

- CASO Worldwide Paper CompanyDokument10 SeitenCASO Worldwide Paper CompanyJennyfer Andrea Izaziga ParadaNoch keine Bewertungen

- Jackson Automotive Systems ExcelDokument5 SeitenJackson Automotive Systems Excelonyechi2004Noch keine Bewertungen

- DynatronicsDokument24 SeitenDynatronicsFezi Afesina Haidir90% (10)

- NYT - Paywall - For StudentsDokument69 SeitenNYT - Paywall - For StudentsSakshi Shah100% (1)

- Halloran MetalsDokument3 SeitenHalloran MetalsDibyanshu KumarNoch keine Bewertungen

- Harvard CaseDokument9 SeitenHarvard CaseGemar Singian0% (2)

- AB Thorsten Case StudyDokument6 SeitenAB Thorsten Case StudyRahul PambharNoch keine Bewertungen

- Chema LiteDokument8 SeitenChema LiteHàMềmNoch keine Bewertungen

- The US Current Account DeficitDokument5 SeitenThe US Current Account DeficitturbolunaticsNoch keine Bewertungen

- Part 1Dokument2 SeitenPart 1Jia LeNoch keine Bewertungen

- PGP Heritage Doll ExcelDokument5 SeitenPGP Heritage Doll ExcelPGP37 392 Abhishek SinghNoch keine Bewertungen

- LSCM Group 2 Scientific Glass Case AnalysisDokument10 SeitenLSCM Group 2 Scientific Glass Case AnalysisArshpreet SinghNoch keine Bewertungen

- Apple Inc. Swot Analysis 2020Dokument13 SeitenApple Inc. Swot Analysis 2020Bhawana SharmaNoch keine Bewertungen

- Predicting Consumer With Big Data at GAPDokument10 SeitenPredicting Consumer With Big Data at GAPNhư NgọcNoch keine Bewertungen

- Srikant BluntlyMediaDokument3 SeitenSrikant BluntlyMediaSrikant SharmaNoch keine Bewertungen

- LSCM Group 2 Scientific Glass Case AnalysisDokument10 SeitenLSCM Group 2 Scientific Glass Case AnalysisCesar CuchoNoch keine Bewertungen

- Hill Country Snack Foods Co - UDokument4 SeitenHill Country Snack Foods Co - Unipun9143Noch keine Bewertungen

- Bausch & Lomb RevisedDokument2 SeitenBausch & Lomb Revisedkimphan04Noch keine Bewertungen

- Kota FibresDokument4 SeitenKota FibresZhijian HuangNoch keine Bewertungen

- Ratio Analysis: Mari Perolum Company LimitiedDokument5 SeitenRatio Analysis: Mari Perolum Company LimitiedNuman AhmedNoch keine Bewertungen

- 8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresDokument28 Seiten8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresNeeraj BhartiNoch keine Bewertungen

- Types of Shops Shopping: 1. Chemist's 2. Grocer's 3. Butcher's 4. Baker'sDokument1 SeiteTypes of Shops Shopping: 1. Chemist's 2. Grocer's 3. Butcher's 4. Baker'sMonik IonelaNoch keine Bewertungen

- Test Unit 2 Urbanisation L P 12Dokument9 SeitenTest Unit 2 Urbanisation L P 12Xuân NguyenNoch keine Bewertungen

- Future Proofing Cities Toolkit by Craig Applegath 2012-03-01sm PDFDokument20 SeitenFuture Proofing Cities Toolkit by Craig Applegath 2012-03-01sm PDFJorge Fernández BaluarteNoch keine Bewertungen

- Paracetamol DegradationDokument9 SeitenParacetamol DegradationTruyền Phạm MinhNoch keine Bewertungen

- Electrical Rooms Fire FightingDokument2 SeitenElectrical Rooms Fire Fightingashraf saidNoch keine Bewertungen

- Corp Given To HemaDokument132 SeitenCorp Given To HemaPaceNoch keine Bewertungen

- Normal Microflora of Human BodyDokument14 SeitenNormal Microflora of Human BodySarah PavuNoch keine Bewertungen

- Atomic Structure Worksheet: Name PeriodDokument4 SeitenAtomic Structure Worksheet: Name Periodapi-496534295100% (1)

- Physical Fitness TestDokument1 SeitePhysical Fitness TestGiessen Fran RamosNoch keine Bewertungen

- Unit 8 Ethics and Fair Treatment in Human Resources ManagementDokument56 SeitenUnit 8 Ethics and Fair Treatment in Human Resources Managementginish12Noch keine Bewertungen

- 2021 Physician Compensation Report - Updated 0821Dokument24 Seiten2021 Physician Compensation Report - Updated 0821Michael Knapp100% (3)

- Separating Mixtures: Techniques and Applications: Evaporation, Distillation and FiltrationDokument4 SeitenSeparating Mixtures: Techniques and Applications: Evaporation, Distillation and FiltrationAndrea SobredillaNoch keine Bewertungen

- ControllingDokument3 SeitenControllingGenesis_Y_Gall_6808Noch keine Bewertungen

- 2mw Biomass Gasification Gas Power Plant ProposalDokument9 Seiten2mw Biomass Gasification Gas Power Plant ProposalsabrahimaNoch keine Bewertungen

- DiffusionDokument25 SeitenDiffusionbonginkosi mathunjwa0% (1)

- Commented (JPF1) : - The Latter Accused That Rizal HasDokument3 SeitenCommented (JPF1) : - The Latter Accused That Rizal HasLor100% (1)

- Pia AlgebraDokument12 SeitenPia AlgebraCarvajal EdithNoch keine Bewertungen

- Transaction AnalysisDokument34 SeitenTransaction AnalysisSunil Ramchandani100% (1)

- QM SyllabusDokument2 SeitenQM SyllabusSanthosh Chandran RNoch keine Bewertungen

- (Complete) BLC 201 Assignment Intro Logistics SCM Sep 2021 - McdonaldDokument12 Seiten(Complete) BLC 201 Assignment Intro Logistics SCM Sep 2021 - McdonaldHf CreationNoch keine Bewertungen

- Nuclear Over Hauser Enhancement (NOE)Dokument18 SeitenNuclear Over Hauser Enhancement (NOE)Fatima AhmedNoch keine Bewertungen

- Steen Kamp 2021Dokument16 SeitenSteen Kamp 2021LARANSA SOLUNA GOGO SIMATUPANGNoch keine Bewertungen

- Oxigen Gen Container CMM 35-21-14Dokument151 SeitenOxigen Gen Container CMM 35-21-14herrisutrisna100% (2)

- Seed PrimingDokument4 SeitenSeed PrimingbigbangNoch keine Bewertungen

- Handover Paper Final 22 3 16 BJNDokument13 SeitenHandover Paper Final 22 3 16 BJNsisaraaah12Noch keine Bewertungen

- The 3 Basic Listening Models and How To Effectively Use ThemDokument6 SeitenThe 3 Basic Listening Models and How To Effectively Use ThemTzuyu TchaikovskyNoch keine Bewertungen

- Bad Effects of Festivals On The EnvironmentDokument10 SeitenBad Effects of Festivals On The EnvironmentSahil Bohra85% (52)

- Chapter 2Dokument5 SeitenChapter 2ERICKA MAE NATONoch keine Bewertungen

- Consumer ReportsDokument64 SeitenConsumer ReportsMadalina Pilipoutanu100% (1)

- Dental Hygienist Learning Outcomes Form v1.2Dokument32 SeitenDental Hygienist Learning Outcomes Form v1.2Karman Deep Singh100% (1)