Beruflich Dokumente

Kultur Dokumente

Assignment July 2011 MS 44, MS 45, MS 46

Hochgeladen von

kewlkshitijOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assignment July 2011 MS 44, MS 45, MS 46

Hochgeladen von

kewlkshitijCopyright:

Verfügbare Formate

1 ASSIGNMENT (July-2011 to December 2011) Course Code : MS - 44 Course Title : Security Analysis and Portfolio Management Assignment Code

: MS-44/SEM - II /2011 Coverage : All Blocks Note : Answer all the questions and submit this assignment on or before 31st October 2011, to the coordinator of your study center. 1. risk. What is investment risk? Discuss the various components of investment

2. Define Market Efficiency. Explain the various forms of market efficiency and discuss the tests for various forms of market efficiency. 3. What is fundamental analysis? Explain the utility of Economic Industry Company (EIC) approach to equity investment decisions. 4. Explain and compare CAPM with APT. Which of the two is a better model for pricing risky assets and why? 5. (a) Antique Arts Company would pay Rs. 2.50 as dividend per share for the next year and is expected to grow indefinitely at 12%. What would be the equity value if the investor require 20% return? Analyze the following portfolios performance using Jensen index, Treynor index and Sharpe index versus the market: Observed Beta () Rate of Return 15% 1.5 10% 0.5 Residual Variance 0.02 0.00

(b)

Magic fund Shanti fund

Risk-free rate of interest is 50%, return on the market portfolio is 12% and standard deviation is 0.04.

2 ASSIGNMENT Course Code : MS - 45 Course Title : International Financial Management Assignment Code : MS-45/SEM - II /2011 Coverage : All Blocks Note : Answer all the questions and submit this assignment on or before 31st October 2011, to the coordinator of your study center. 1. 2. 3. Discuss in detail about the international financial architecture and explain the East Asian Crisis of 1997 and the lesson learnt from it. What is Exchange Rate Arrangement? Explain the Present system of Exchange Rate followed by Various Countries. Discuss the concept, application and causes of deviation of the following. (i) (ii) 4. 5. 6. Purchasing Power Parity Relationship Interest Rate Parity Relationship

What do you understand by Exchange Rate Exposure? Explain the techniques used for exchange risk management. How cut off rate for foreign projects are determined? Explain why cost of capital varies across countries? What is international diversification? Discuss about the barriers to international diversification and explain the techniques used to overcome capital flow barriers.

3 ASSIGNMENT Course Code : MS - 46 Course Title : Management of Financial Services Assignment Code : MS-46/SEM - II /2011 Coverage : All Blocks Note : Answer all the questions and submit this assignment on or before 31st October 2011, to the coordinator of your study center. 1. 2. 3. What are financial services? Discuss in detail about the various types of financial services. What do you understand by Government Securities Market and Corporate debt securities market? Compare and Contrast between the two. Explain the meaning, process and mechanism of Securitization? Discuss the role of Special Purpose Vehicle (SPV) in the process of secularization and instruments of securitization. Write short notes on the following: a) Leasing and Hire purchase b) Venture Capital c) Factoring and Forfeiting d) Bill Discounting Discuss in detail about Marine Insurance and bring out the difference between Marine cargo policies and Marine Hull Policies.

4.

5.

Das könnte Ihnen auch gefallen

- Time LineDokument3 SeitenTime LinekewlkshitijNoch keine Bewertungen

- Five Frontier Issues in Indian Banking - Dr. Duvvuri Subba RaoDokument18 SeitenFive Frontier Issues in Indian Banking - Dr. Duvvuri Subba RaotamirisaarNoch keine Bewertungen

- MR - 64 - Kshitij - Pricing Strategy Review in Telecom SectorDokument28 SeitenMR - 64 - Kshitij - Pricing Strategy Review in Telecom SectorkewlkshitijNoch keine Bewertungen

- Case FrameworksDokument14 SeitenCase FrameworkskewlkshitijNoch keine Bewertungen

- 469 Biz QuizDokument73 Seiten469 Biz QuizkewlkshitijNoch keine Bewertungen

- How To Get New Customers in A Matured Telecom MarketDokument23 SeitenHow To Get New Customers in A Matured Telecom MarketkewlkshitijNoch keine Bewertungen

- Dynamic Pricing Strategies For Multiproduct Revenue Management ProblemsDokument13 SeitenDynamic Pricing Strategies For Multiproduct Revenue Management ProblemskewlkshitijNoch keine Bewertungen

- India Unbound ReviewDokument3 SeitenIndia Unbound ReviewkewlkshitijNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Karaf-Usermanual-2 2 2Dokument147 SeitenKaraf-Usermanual-2 2 2aaaeeeiiioooNoch keine Bewertungen

- Semi-Detailed Lesson Plan in Tle (Cookery) Mhaylani O. Otanes-Flores 1 February 16, 2022 (Wednesday) 7 TLE-Cookery 1 10Dokument4 SeitenSemi-Detailed Lesson Plan in Tle (Cookery) Mhaylani O. Otanes-Flores 1 February 16, 2022 (Wednesday) 7 TLE-Cookery 1 10Mhaylani Otanes100% (1)

- High Court Judgment On Ex Party DecreeDokument2 SeitenHigh Court Judgment On Ex Party Decreeprashant pathakNoch keine Bewertungen

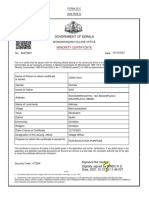

- Government of Kerala: Minority CertificateDokument1 SeiteGovernment of Kerala: Minority CertificateBI185824125 Personal AccountingNoch keine Bewertungen

- Dances in LuzonDokument13 SeitenDances in LuzonDenise Michelle AntivoNoch keine Bewertungen

- Investigative Project Group 8Dokument7 SeitenInvestigative Project Group 8Riordan MoraldeNoch keine Bewertungen

- A Palace in TimeDokument6 SeitenA Palace in TimeSonkheNoch keine Bewertungen

- Privileged Communications Between Husband and Wife - Extension of PDFDokument7 SeitenPrivileged Communications Between Husband and Wife - Extension of PDFKitingPadayhagNoch keine Bewertungen

- A Re Ection On The Dominant Learning Theories: Behaviourism, Cognitivism and ConstructivismDokument13 SeitenA Re Ection On The Dominant Learning Theories: Behaviourism, Cognitivism and Constructivismchill protocolNoch keine Bewertungen

- Corporation Essay ChecklistDokument5 SeitenCorporation Essay ChecklistCamille2221Noch keine Bewertungen

- SOCI 223 Traditional Ghanaian Social Institutions: Session 1 - Overview of The CourseDokument11 SeitenSOCI 223 Traditional Ghanaian Social Institutions: Session 1 - Overview of The CourseMonicaNoch keine Bewertungen

- Case Digest Labor DisputeDokument5 SeitenCase Digest Labor DisputeMysh PDNoch keine Bewertungen

- Review of Related LiteratureDokument5 SeitenReview of Related LiteratureRJ PareniaNoch keine Bewertungen

- A Terence McKenna Audio Archive - Part 1Dokument203 SeitenA Terence McKenna Audio Archive - Part 1BabaYagaNoch keine Bewertungen

- Eyewitness Bloody Sunday PDFDokument2 SeitenEyewitness Bloody Sunday PDFKatie0% (1)

- 1Dokument13 Seiten1Victor AntoNoch keine Bewertungen

- NKU Athletic Director Ken Bothof DepositionDokument76 SeitenNKU Athletic Director Ken Bothof DepositionJames PilcherNoch keine Bewertungen

- Coaching Skills For Optimal PerformanceDokument58 SeitenCoaching Skills For Optimal PerformanceYodhia Antariksa100% (3)

- DonatelloDokument12 SeitenDonatelloGiorgia Ronfo SP GironeNoch keine Bewertungen

- Anesthesia Considerations in Microlaryngoscopy or Direct LaryngosDokument6 SeitenAnesthesia Considerations in Microlaryngoscopy or Direct LaryngosRubén Darío HerediaNoch keine Bewertungen

- SSP ReviwerDokument40 SeitenSSP ReviwerRick MabutiNoch keine Bewertungen

- Sepulveda v. de Las CasasDokument2 SeitenSepulveda v. de Las CasasNova GaveNoch keine Bewertungen

- Security and Azure SQL Database White PaperDokument15 SeitenSecurity and Azure SQL Database White PaperSteve SmithNoch keine Bewertungen

- 2.2 Push and Pull Sources of InnovationDokument16 Seiten2.2 Push and Pull Sources of Innovationbclarke113Noch keine Bewertungen

- Chap 9 Special Rules of Court On ADR Ver 1 PDFDokument8 SeitenChap 9 Special Rules of Court On ADR Ver 1 PDFambahomoNoch keine Bewertungen

- Ingles Semana 11. P6. 2Q. 4egb. A y BDokument2 SeitenIngles Semana 11. P6. 2Q. 4egb. A y BWendisilla BelenchisNoch keine Bewertungen

- Malaria SymptomsDokument3 SeitenMalaria SymptomsShaula de OcampoNoch keine Bewertungen

- Africanas Journal Volume 3 No. 2Dokument102 SeitenAfricanas Journal Volume 3 No. 2Gordon-Conwell Theological Seminary100% (2)

- Message To St. MatthewDokument3 SeitenMessage To St. MatthewAlvin MotillaNoch keine Bewertungen

- Fdar For UtiDokument2 SeitenFdar For UtiCARL ANGEL JAOCHICONoch keine Bewertungen