Beruflich Dokumente

Kultur Dokumente

22

Hochgeladen von

Shanay ChodhariOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

22

Hochgeladen von

Shanay ChodhariCopyright:

Verfügbare Formate

2.

Potential main merits of vertical integration are: Improve supply chain More opportunities to differentiate as there is more control over processes Ability to leverage profit margins Can increase entry barriers as a larger organisation can have access to more capital and resources as well Leads to expansion of the core competencies of a firm

Horizontal: when a business tries to become a monopoly by buying other companies that hold similar products, and essentially acquiring the competitors so that they become a monopoly. Vertical: when a company has control of or expands their business into each step of a process, like different points of the same production path. Horizontal Units carrying on the same trade or activity join together Eliminates competition among the units Vertical Units operate at different stages of manufacture of a product Does not eliminate competition among units as they were not competing each other in the first place Cannot lead to a monopoly Combination of successive stages of production. Stoppage at one part affects all the subsequent ones.

Nature

Elimination of competition

Control of market Inter-dependency

May lead to full control of a monopoly Not interdependent as far as raw materials are concerned. Stoppage of one uni doesnt affect others

3. merger = two companies come together "permanently" for mutual gains or to reduce competition acquisition = one company buys another company which may or may not be doing well Mergers are used at a time when companies can see an advantage by coming together, essentially creating a 1 + 1 = 3 situation. This is when both companies collaborate together peacefully and use each other capabilities to leverage as a group. Usually they are used when both companies can see that they can get out something from the collaboration which they do not have and also use it as a tool to continue growth of the company. Acquisitions on the other hand have a negative connotation attached to it. This happens when companies want to take control over other companies and turn it into one big company. It is usually used when a company buys out the other company in order to expand itself. It takes over the resources, capitals and customers among other aspects and then uses them to continue growing. 5. A retrenchment strategy is a corporate-level strategy that seeks to reduce the size or diversity of an organization's operations. This strategy can be useful in many situations. One situation is to slash

expenditures. This can be done by laying off employees, closing offices or branches, reducing benefits, freezing hiring or salaries, or even cutting salaries. There are numerous other ways in which a company can employ retrenchment. These can be non-employee related, such as reducing the quality of the materials used in a product, or moving headquarters to a location where operating costs are lower. The other time when it would be necessary is to downsize in one market that is proving unprofitable and build up the company in a more profitable market. If one market has become obsolete due to modernization or technology, then a company may decide to change with the times to remain profitable.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Kumar-2011-In Vitro Plant Propagation A ReviewDokument13 SeitenKumar-2011-In Vitro Plant Propagation A ReviewJuanmanuelNoch keine Bewertungen

- Pea RubricDokument4 SeitenPea Rubricapi-297637167Noch keine Bewertungen

- English HL P1 Nov 2019Dokument12 SeitenEnglish HL P1 Nov 2019Khathutshelo KharivheNoch keine Bewertungen

- Cover Letter For Lettings Negotiator JobDokument9 SeitenCover Letter For Lettings Negotiator Jobsun1g0gujyp2100% (1)

- DH 0507Dokument12 SeitenDH 0507The Delphos HeraldNoch keine Bewertungen

- 4-Page 7 Ways TM 20Dokument4 Seiten4-Page 7 Ways TM 20Jose EstradaNoch keine Bewertungen

- Amt 3103 - Prelim - Module 1Dokument17 SeitenAmt 3103 - Prelim - Module 1kim shinNoch keine Bewertungen

- Economics and Agricultural EconomicsDokument28 SeitenEconomics and Agricultural EconomicsM Hossain AliNoch keine Bewertungen

- SRL CompressorsDokument20 SeitenSRL Compressorssthe03Noch keine Bewertungen

- Weird Tales v14 n03 1929Dokument148 SeitenWeird Tales v14 n03 1929HenryOlivr50% (2)

- Holophane Denver Elite Bollard - Spec Sheet - AUG2022Dokument3 SeitenHolophane Denver Elite Bollard - Spec Sheet - AUG2022anamarieNoch keine Bewertungen

- Stress Corrosion Cracking Behavior of X80 PipelineDokument13 SeitenStress Corrosion Cracking Behavior of X80 Pipelineaashima sharmaNoch keine Bewertungen

- AITAS 8th Doctor SourcebookDokument192 SeitenAITAS 8th Doctor SourcebookClaudio Caceres100% (13)

- Georgia Jean Weckler 070217Dokument223 SeitenGeorgia Jean Weckler 070217api-290747380Noch keine Bewertungen

- Sheet PilesDokument5 SeitenSheet PilesolcayuzNoch keine Bewertungen

- CPGDokument9 SeitenCPGEra ParkNoch keine Bewertungen

- Bodhisattva and Sunyata - in The Early and Developed Buddhist Traditions - Gioi HuongDokument512 SeitenBodhisattva and Sunyata - in The Early and Developed Buddhist Traditions - Gioi Huong101176100% (1)

- Community Service Learning IdeasDokument4 SeitenCommunity Service Learning IdeasMuneeb ZafarNoch keine Bewertungen

- Living Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Dokument2 SeitenLiving Greyhawk - Greyhawk Grumbler #1 Coldeven 598 n1Magus da RodaNoch keine Bewertungen

- Haloperidol PDFDokument4 SeitenHaloperidol PDFfatimahNoch keine Bewertungen

- (IME) (Starfinder) (Acc) Wildstorm IndustriesDokument51 Seiten(IME) (Starfinder) (Acc) Wildstorm IndustriesFilipe Galiza79% (14)

- MELC5 - First ObservationDokument4 SeitenMELC5 - First ObservationMayca Solomon GatdulaNoch keine Bewertungen

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDokument4 SeitenKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojNoch keine Bewertungen

- Brahm Dutt v. UoiDokument3 SeitenBrahm Dutt v. Uoiswati mohapatraNoch keine Bewertungen

- Ob AssignmntDokument4 SeitenOb AssignmntOwais AliNoch keine Bewertungen

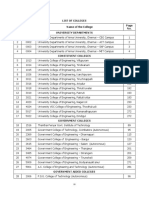

- TNEA Participating College - Cut Out 2017Dokument18 SeitenTNEA Participating College - Cut Out 2017Ajith KumarNoch keine Bewertungen

- 2's Complement Division C++ ProgramDokument11 Seiten2's Complement Division C++ ProgramAjitabh Gupta100% (2)

- (Adolescence and Education) Tim Urdan, Frank Pajares - Academic Motivation of Adolescents-IAP - Information Age Publishing (2004) PDFDokument384 Seiten(Adolescence and Education) Tim Urdan, Frank Pajares - Academic Motivation of Adolescents-IAP - Information Age Publishing (2004) PDFAllenNoch keine Bewertungen

- 44) Year 4 Preposition of TimeDokument1 Seite44) Year 4 Preposition of TimeMUHAMMAD NAIM BIN RAMLI KPM-GuruNoch keine Bewertungen

- Best Interior Architects in Kolkata PDF DownloadDokument1 SeiteBest Interior Architects in Kolkata PDF DownloadArsh KrishNoch keine Bewertungen