Beruflich Dokumente

Kultur Dokumente

Cap Rate Survey 04 Q4

Hochgeladen von

Danny J. BrouillardOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cap Rate Survey 04 Q4

Hochgeladen von

Danny J. BrouillardCopyright:

Verfügbare Formate

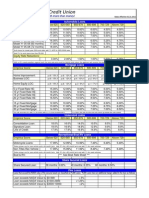

Capitalization Rates Change from Last Quarter Survey Results

Retail

Vancouver Calgary Edmonton Toronto Ottawa Montreal Halifax

Regional

7.25 7.25 7.75 7.00 7.50 7.50 8.00 7.50% 7.75% 8.25% 7.75% 8.00% 8.00% 8.50%

&

7.25 7.75 8.25 7.00 7.50 7.75 8.50 5.00 7.00 7.00 6.50 7.75 7.50 7.75 -

Q4 04 CAP RATE SURVEY

Neighbourhood

7.25 7.75 8.25 7.50 8.75 8.50 8.50 7.75% 8.25% 8.75% 8.50% 9.25% 9.00% 9.25%

Sector/Power

7.75% 8.25% 8.75% 8.50% 8.00% 8.50% 9.50%

Strip

6.75 8.50 9.50 7.25 9.75 8.50 9.50 - 7.75% - 9.00% -10.50% - 9.00% -10.25% - 9.25% -10.50%

Apartment

Vancouver Calgary Edmonton Toronto Ottawa Montreal Halifax

High Rise A

4.50 6.50 6.75 6.25 7.25 7.00 7.25 5.00% 7.00% 7.00% 6.75% 7.75% 7.75% 7.75%

High Rise B

6.00% 7.50% 7.25% 7.00% 8.25% 8.00% 8.25%

Low Rise A

5.00 7.00 7.25 6.25 7.50 8.00 8.00 6.00% 7.50% 7.75% 6.75% 8.25% 8.50% 8.50%

Low Rise B

6.25 7.75 7.75 6.50 7.50 8.50 8.50 6.75% 8.25% 8.00% 7.00% 8.25% 9.00% 9.50%

Downtown Office

Vancouver Calgary Edmonton Toronto Ottawa Montreal Halifax

AA

7.25 8.00 8.00 7.25 7.50 8.25 8.75

A

7.50% 8.50% 8.50% 7.75% 8.25% 8.75% 9.25% 8.00 8.75 9.00 7.75 8.25 8.75 9.25

B

- 8.50% - 9.25% -10.00% - 8.25% - 8.75% - 9.50% - 9.75% Notes on Survey

Capitalization Rate ranges are indicative of properties leased at stabilized occupancy with market rent levels in place. AA" refers to Trophy projects. They are generally less than 15 years old, maintained to a high standard and attract the highest quality lease covenants. The lease profile typically has an average duration of more than ten years. The ownership is typically institutional. "A" Buildings have many of the same characteristics as the "AA"'s. They attract high quality lease covenants, are well maintained and well located. However, they may be somewhat older and the tenant base is less secure (5 to 10 years average lease duration). "B" Buildings are representative of the bulk of properties within each market segment. They attract a mix of national, regional and local lease covenants (generally 3 to 5 year terms). The primary investors are smaller cap, public real estate companies and private investors.

7.00 - 7.50% 7.75 - 8.25% N/A 6.75 - 7.25% 7.00 - 7.50% 7.25 - 7.50% N/A

Suburban Office

Vancouver Calgary Edmonton Toronto Ottawa Montreal Halifax 8.25 8.50 8.75 8.00 8.50 8.75 9.25

A

8.75% 9.00% 9.50% 8.50% 9.25% 9.25% 9.75% 8.25 9.00 9.50 8.50 9.50 9.50 9.75

B

- 8.75% - 9.50% -10.50% - 9.00% -10.50% -10.50% -10.25%

Industrial

Vancouver Calgary Edmonton Toronto Ottawa Montreal Halifax 7.25 8.00 7.50 6.75 7.25 7.75 8.25

A

7.75% 8.50% 8.00% 7.25% 8.00% 8.50% 9.00% 7.50 8.75 8.50 7.25 8.00 8.50 9.50

B

- 8.25% - 9.25% - 9.50% - 8.00% - 9.00% - 9.50% -10.00%

2004 CB Richard Ellis. The information contained herein (the Information) is intended for informational purposes only and should not be relied upon by recipients hereof. Although the Information is believed to be correct, its accuracy, correctness or completeness cannot be guaranteed and has not been verified by either CB Richard Ellis Limited or any of its affiliates (CB Richard Ellis Limited and its affiliates are collectively referred to herein as CB Richard Ellis). CB Richard Ellis neither guarantees, warrants nor assumes any responsibility or liability of any kind with respect to the accuracy, correctness, completeness, or suitability of, or decisions based upon or in connection with, the Information. The recipient of the Information should take such steps as the recipient may deem appropriate with respect to using the Information. The Information may change and any property described herein may be withdrawn from the market at any time without notice or obligation of any kind on the part of CB Richard Ellis. The Information is protected by copyright and shall be fully enforced.

NATIONAL INVESTMENT TEAM: VANCOUVER CALGARY EDMONTON WINNIPEG TORONTO OTTAWA MONTREAL HALIFAX

Das könnte Ihnen auch gefallen

- Corporate Value Creation: An Operations Framework for Nonfinancial ManagersVon EverandCorporate Value Creation: An Operations Framework for Nonfinancial ManagersBewertung: 4 von 5 Sternen4/5 (4)

- The xVA Challenge: Counterparty Credit Risk, Funding, Collateral and CapitalVon EverandThe xVA Challenge: Counterparty Credit Risk, Funding, Collateral and CapitalNoch keine Bewertungen

- CWSG Capital Markets Update - 10.24.11Dokument1 SeiteCWSG Capital Markets Update - 10.24.11jddishotskyNoch keine Bewertungen

- Net Lease Big Box Report 2016Dokument3 SeitenNet Lease Big Box Report 2016netleaseNoch keine Bewertungen

- Chapter 08Dokument18 SeitenChapter 08Tam NguyenNoch keine Bewertungen

- Patty Kennedy 310.962.3513: Consumer Purpose Sub-Prime Owner OccupiedDokument4 SeitenPatty Kennedy 310.962.3513: Consumer Purpose Sub-Prime Owner OccupiedElizabeth JacksonNoch keine Bewertungen

- Income Balanced Composit 2QTR 2012Dokument2 SeitenIncome Balanced Composit 2QTR 2012jai6480Noch keine Bewertungen

- Income Balanced Composite: Performance SummaryDokument2 SeitenIncome Balanced Composite: Performance Summaryjai6480Noch keine Bewertungen

- Income Balanced Composite - 1QTR 2014Dokument2 SeitenIncome Balanced Composite - 1QTR 2014jai6480Noch keine Bewertungen

- Documentation Full Doc: Amlak Fixed Amlak ProductDokument3 SeitenDocumentation Full Doc: Amlak Fixed Amlak ProductnajeeebinNoch keine Bewertungen

- Summary of Values PPVUL Non-MEC Structure VS. Taxable AccountDokument1 SeiteSummary of Values PPVUL Non-MEC Structure VS. Taxable AccountesuttNoch keine Bewertungen

- Practice Test: 1 Bank Balance Sheet and Ratios Estimation Bank A Bank B Ratios For EstimationDokument11 SeitenPractice Test: 1 Bank Balance Sheet and Ratios Estimation Bank A Bank B Ratios For EstimationassassaNoch keine Bewertungen

- Real Estate Debt Market OverviewDokument9 SeitenReal Estate Debt Market OverviewEddy CoolNoch keine Bewertungen

- SBA Loan ChartDokument2 SeitenSBA Loan ChartsbdcwtNoch keine Bewertungen

- Abdul Qadir Khan (Fixed Income Assignement No.4)Dokument8 SeitenAbdul Qadir Khan (Fixed Income Assignement No.4)muhammadvaqasNoch keine Bewertungen

- 7 Myths of Structured ProductsDokument18 Seiten7 Myths of Structured Productsrohanghalla6052Noch keine Bewertungen

- Net Lease Research Report 2015 Q2Dokument3 SeitenNet Lease Research Report 2015 Q2netleaseNoch keine Bewertungen

- Loan-Level Price Adjustment (LLPA) MatrixDokument8 SeitenLoan-Level Price Adjustment (LLPA) MatrixLashon SpearsNoch keine Bewertungen

- Short Altice Sohn PresentationDokument17 SeitenShort Altice Sohn Presentationmarketfolly.comNoch keine Bewertungen

- Mayfield PlazaDokument9 SeitenMayfield PlazaPuran SarnaNoch keine Bewertungen

- Products and Services: ZTBL Locker FacilityDokument4 SeitenProducts and Services: ZTBL Locker FacilityAzhar MehmoodNoch keine Bewertungen

- Liability Side Risk Management Modelling For Future DC FundsDokument44 SeitenLiability Side Risk Management Modelling For Future DC FundsDumegã KokutseNoch keine Bewertungen

- RE 01 09 Hotel Acquisition Renovation SolutionsDokument7 SeitenRE 01 09 Hotel Acquisition Renovation SolutionsAnonymous bf1cFDuepPNoch keine Bewertungen

- Agro Chem, Inc.Dokument32 SeitenAgro Chem, Inc.Camryn Bintz50% (2)

- Llpa MatrixDokument7 SeitenLlpa MatrixAMIT RAINoch keine Bewertungen

- Century Plus Brochure 2022Dokument14 SeitenCentury Plus Brochure 2022Shirish UmadiNoch keine Bewertungen

- Standard Cds Economics F 102282706Dokument6 SeitenStandard Cds Economics F 102282706Matt WallNoch keine Bewertungen

- Akash 1Dokument13 SeitenAkash 1Akash GulalakaiNoch keine Bewertungen

- Capital BudgetingDokument20 SeitenCapital BudgetingToufiq AitNoch keine Bewertungen

- Off Balance Sheet Financing For UAE Properties: February 2011Dokument14 SeitenOff Balance Sheet Financing For UAE Properties: February 2011Rashdan IbrahimNoch keine Bewertungen

- City DevelopmentsDokument6 SeitenCity DevelopmentsJay NgNoch keine Bewertungen

- Re I Property AnalyzerDokument1 SeiteRe I Property AnalyzerClaudio LaCervaNoch keine Bewertungen

- Core Balanced Composite: Performance SummaryDokument2 SeitenCore Balanced Composite: Performance Summaryjai6480Noch keine Bewertungen

- Bulletin: Most Australians See Mortgage Rates Flat or Higher Over The Next 12mthsDokument4 SeitenBulletin: Most Australians See Mortgage Rates Flat or Higher Over The Next 12mthsLauren FrazierNoch keine Bewertungen

- Earnings Quality Final Project - Leap Wireless International IncDokument10 SeitenEarnings Quality Final Project - Leap Wireless International IncJay HedstromNoch keine Bewertungen

- Core Balanced Composite - 3QTR 2013Dokument2 SeitenCore Balanced Composite - 3QTR 2013jai6480Noch keine Bewertungen

- Case Study 4Dokument4 SeitenCase Study 4Nenad MazicNoch keine Bewertungen

- Angus Cartwright IV Case WriteupDokument11 SeitenAngus Cartwright IV Case Writeupapi-644958016Noch keine Bewertungen

- Loan RatesDokument1 SeiteLoan RatesAndrew ChambersNoch keine Bewertungen

- Core Balanced Composite 2QTR 2013Dokument2 SeitenCore Balanced Composite 2QTR 2013Jason BenteauNoch keine Bewertungen

- Shapiro CHAPTER 6 SolutionsDokument10 SeitenShapiro CHAPTER 6 SolutionsjzdoogNoch keine Bewertungen

- Asset Liabilities ALMDokument39 SeitenAsset Liabilities ALMMoon XinhNoch keine Bewertungen

- Covered Call Strategies P1 PDFDokument10 SeitenCovered Call Strategies P1 PDFThành Tâm DươngNoch keine Bewertungen

- Real Estate Finance & Investments Midterm I Solutions Name: ID#Dokument7 SeitenReal Estate Finance & Investments Midterm I Solutions Name: ID#Jiayu JinNoch keine Bewertungen

- Write Up NBFIsDokument9 SeitenWrite Up NBFIsRakib HossainNoch keine Bewertungen

- AC513 Midterm Review.Dokument14 SeitenAC513 Midterm Review.Lauren ObrienNoch keine Bewertungen

- Problems and KeyDokument1 SeiteProblems and KeydskrishnaNoch keine Bewertungen

- Core Balanced Composite 2QTR 2012Dokument2 SeitenCore Balanced Composite 2QTR 2012jai6480Noch keine Bewertungen

- The Lion FundDokument4 SeitenThe Lion Fundforbesadmin100% (1)

- Chema Lite CaseDokument5 SeitenChema Lite CaseSherin VsNoch keine Bewertungen

- Lessons Learnt Return of Financial EngineeringDokument26 SeitenLessons Learnt Return of Financial Engineeringapi-342216406Noch keine Bewertungen

- Core Balanced Composite - 2QTR 2014Dokument2 SeitenCore Balanced Composite - 2QTR 2014jai6480Noch keine Bewertungen

- Mod 1 - TVM - Intuition Discounting - SlidesDokument39 SeitenMod 1 - TVM - Intuition Discounting - Slidesee1993Noch keine Bewertungen

- Buy-to-Let Index Q1 2014: What A Difference A Year Makes!Dokument4 SeitenBuy-to-Let Index Q1 2014: What A Difference A Year Makes!TheHallPartnershipNoch keine Bewertungen

- Lease Income NarrativeDokument14 SeitenLease Income Narrativegreg_jkNoch keine Bewertungen

- CMBS 101 Slides (All Sessions)Dokument41 SeitenCMBS 101 Slides (All Sessions)Ken KimNoch keine Bewertungen

- Estimating IRR With Fake Payback Period-L10Dokument9 SeitenEstimating IRR With Fake Payback Period-L10akshit_vij0% (1)

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsVon EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNoch keine Bewertungen

- The Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsVon EverandThe Mathematics of Financial Models: Solving Real-World Problems with Quantitative MethodsNoch keine Bewertungen

- Attribute Based Perceptual Mapping of Cement Brands: An Empirical StudyDokument8 SeitenAttribute Based Perceptual Mapping of Cement Brands: An Empirical StudyRajesh InsbNoch keine Bewertungen

- Justice Hegde Report On Illegal Mining in KarnatakaDokument466 SeitenJustice Hegde Report On Illegal Mining in KarnatakaNDTVNoch keine Bewertungen

- Teague Vs MartinDokument2 SeitenTeague Vs Martinchisel_159Noch keine Bewertungen

- Men of Muscle Men of The MindDokument7 SeitenMen of Muscle Men of The MindAndrea TavaresNoch keine Bewertungen

- URC Case StudyDokument7 SeitenURC Case StudyJoshua Eric Velasco DandalNoch keine Bewertungen

- BC Ferries Spring - 07 - The WaveDokument20 SeitenBC Ferries Spring - 07 - The WavekstapletNoch keine Bewertungen

- Babst Vs CADokument3 SeitenBabst Vs CAJustin RavagoNoch keine Bewertungen

- Chapter 3Dokument18 SeitenChapter 3Abhirup SenguptaNoch keine Bewertungen

- Corpo Reviewer MidtermsDokument10 SeitenCorpo Reviewer MidtermscrisNoch keine Bewertungen

- CatalogElectrosib2018c A B PDFDokument23 SeitenCatalogElectrosib2018c A B PDFGabi Valadez Garza100% (1)

- Cap Table and Returns TemplateDokument5 SeitenCap Table and Returns TemplatedeepaknadigNoch keine Bewertungen

- SynthesisDokument8 SeitenSynthesisRemy BotardoNoch keine Bewertungen

- Study On Inter-Relationship Between Business Ethics and Corporate GovernanceDokument10 SeitenStudy On Inter-Relationship Between Business Ethics and Corporate GovernanceNandini SinghNoch keine Bewertungen

- 5 - (S2) Aa MP PDFDokument3 Seiten5 - (S2) Aa MP PDFFlow RiyaNoch keine Bewertungen

- CIR vs. Japan AirlinesDokument18 SeitenCIR vs. Japan AirlinesMarianne Therese Malan100% (1)

- Tugas Cost of CapitalDokument16 SeitenTugas Cost of CapitalBudi Arifian HakimNoch keine Bewertungen

- Audit of Cash and Cash EquivalentsDokument6 SeitenAudit of Cash and Cash Equivalentsphoebelyn acdogNoch keine Bewertungen

- Karnataka 17cat 2013Dokument15 SeitenKarnataka 17cat 2013Sumalatha VenkataswamyNoch keine Bewertungen

- Vintage Airplane - Feb 1983Dokument20 SeitenVintage Airplane - Feb 1983Aviation/Space History Library100% (1)

- New Trends in CSI: Presentation To Namibia CSI Conference 18-19 September 2013Dokument19 SeitenNew Trends in CSI: Presentation To Namibia CSI Conference 18-19 September 2013Ismail FaizNoch keine Bewertungen

- Alternative Revenues Raising Mechanism - City of Dasmarinas, CaviteDokument15 SeitenAlternative Revenues Raising Mechanism - City of Dasmarinas, CaviteOman Paul AntiojoNoch keine Bewertungen

- Sample Letter For SponsorshipDokument2 SeitenSample Letter For Sponsorshipejips2100% (1)

- Audit (ISA)Dokument1 SeiteAudit (ISA)Wirdha Annisa HasibuanNoch keine Bewertungen

- Cadbury MarketingDokument3 SeitenCadbury MarketingShaamalR.AvhadNoch keine Bewertungen

- IAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Dokument8 SeitenIAS 20 - Accounting For Government Grants and Disclosure of Government Assistance (Detailed Review)Nico Rivera CallangNoch keine Bewertungen

- CH 3Dokument6 SeitenCH 3usiddiquiNoch keine Bewertungen

- QC-G-7.1-1 Ver 7.0 - 11.08.2017Dokument60 SeitenQC-G-7.1-1 Ver 7.0 - 11.08.2017KISHORENoch keine Bewertungen

- FINMGMT4Dokument6 SeitenFINMGMT4byrnegementizaNoch keine Bewertungen

- Slums of MumbaiDokument4 SeitenSlums of MumbaiNiyati BagweNoch keine Bewertungen

- Fast Moving Consumer GoodsDokument4 SeitenFast Moving Consumer GoodsSatya Prakash ChoudharyNoch keine Bewertungen