Beruflich Dokumente

Kultur Dokumente

Ratio Analysis Hyundai

Hochgeladen von

Ankit MistryOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ratio Analysis Hyundai

Hochgeladen von

Ankit MistryCopyright:

Verfügbare Formate

Financial Statement Analysis on JSW STEEL Ltd.

Submitted To: Prof. Dharmesh Shah

Submitted By: Ridham Rawal Roll no. P1038

Batch: Pgdm 10-12

On (Date)

N. R. I NSTITUTE

OF

B USINESS M ANAGEMENT

AHMEDABAD

Liquidity ratio

a) Net working capital:

Meaning: working capital is used to measure firms ability to meet current obligation. A high level of working capital indicates significant liquidity. its also called as a net current ratio. Formula: Total current assets total current liability Table: ( Rs in million) particular 2007-08 2008-09 2009-10

current assets current liabilities cureent ratio 19332774 53426822 34094048 21550793 58366562 36815769 25014175 30041277 5027102

40000000 35000000 30000000 25000000 20000000 15000000 10000000 5000000 0 2007-08 2008-09 2009-10 cureent ratio

Interpretation:

NWC of the company in 2007-08 around 900000 which indicates that net working capital is positive. Than in 2008-09 and in 2009-10 working capital is constantly increase because companys loans. Advances all are increase in comparison of each year.

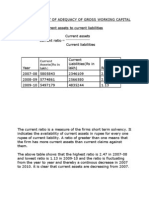

b) current ratio: Meaning: it is a measure of general liquidity and is most widely used to make the

analysis of short term financial position and liquidity of the firm. it is calculated by dividing the total of the current assets by total of the current liability.

Formula:

Current assets/ current liability

Table

particular current assets current liabilities cureent ratio 2007-08 2008-09 2009-10 19332774 21550793 25014175 53426822 58366562 30041277 0.36 0.36 0.83

cureent ratio

0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 2007-08 2008-09 2009-10 0.36 0.36 cureent ratio 0.83

Interpretation:

In 2007-08 companys current ratio is 1.16 times. While in 2008-09 the ability of company to meet short term obligation is 1.2 times more than 2007-08. In 2009-10 companys current ratio is 1.37 which indicates that company has more liquidity in comparison of 2008-09.

c) Quick ratio:

Meaning: An indicator of companys short term liquidity. The quick ratio measures a companys ability to meet its short-term obligation with its most liquid assets. The higher the quick ratio, the better the quick position of the company. Formula: Quick assets / current liabilities Quick assets= current assets-stock-prepaid expenses Table:

particulars quick assets quick liabilities quick ratio 2007-08 9699.9 27438.19 0.35 2008-09 47827.37 27114.83 1.76 2009-10 38178.15 39192.19 0.97

2 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0

quick ratio

quick ratio 2007-08 2008-09 2009-10

Interpretation: Quick ratio of 2007-08 is 1.06. while In 2008-09 it is 1.09 that

indicates slightly increase in the quick ratio. And in comparison of 2007-08 and 2008-09 the quick ratio is increase to 1.37.

Debtors turnover ratio: Debtors turnover ratio indicates the velocity of the debt collection of a firm. In simple terms it

indicates the number of the times average debtor are turnover during year. Formula: Net credit sales / average debtors Table:

particulars net credit sales average debtors debtor turover ratio 2007-08 10468583 679087 15.42 2008-09 10824238 688300 15.72 2009-10 8436974 429078 19.66

debtor turover ratio

20 15 10 5 0 2007-08 2008-09 2009-10 debtor turover ratio

Interpretation:

Cash from operations ratio:

A measure of how well current liabilities are covered by the cash flow generated from a companys operations.

Formula:

Cash flow from operations/current liabilities

Table:

particulars cash flow from operation current liabilities cash flow from operation ratio 2007-08 1342284 5242616 0.26 2008-09 890726 3988694 0.22 2009-10 1177226 3856858 0.31

cash flow from operation ratio

0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 2007-08 2008-09 2009-10 cash flow from operation ratio

Interpretation:

Gross profit ratio

The gross profit margin is a measurement of a companys manufacturing and distribution efficiency during the production process.

Formula:

Gross profit/sales *100

Table:

Particulars Gross profit sales Gross profit margin 2007-08 2416840 10824238 22.32 2008-09 1318112 8436974 15.62 2009-10 1371058 7517277 18.24

Gross profit margine

25 20 15 10 5 0 2007-08 2008-09 2009-10 Gross profit margine

Interpretation:

Return on Assets:

An indicator of how profitable a company is relative to its total assets.ROA gives an idea as to how efficient management is at using its assets to generate earning.

Formula:

Net profit after tax/average total assets * 100

Table:

Particulars Net profit after tax Average total assets

2007-08 482261 11939482

2008-09 -233709 10239540

2009-10 42390 10214820

ROA

4.04

-2.28

0.41

ROA

5 4 3 2 1 0 -1 -2 -3 2007-08 2008-09 2009-10 ROA

Interpretation:

Operating expenses ratio:

An expense ratio is determined through an annual calculation where a funds operating expenses are divided by the average rupee of its assets under management. Operating expenses are taken out of a funds assets and lower the return of a funds investor.

Formula:

Administrative expenses + selling expenses / net sales * 100

Table:

particulars operating expenses 2007-08 1626010 2008-09 1456033 2009-10 1059449

net sales operating expenses ratio

10824238 15.02

8436974 17.26

7517277 14.09

operating expenses ratio

20 18 16 14 12 10 8 6 4 2 0 2007-08 2008-09 2009-10

operating expenses ratio

Interpretation:

Operating profit ratio:

Formula:

EBIT-other income/ net sales * 100

Table:

particualrs 2007-08 2008-09 2009-10

EBIT-Other income Net sales Operating profit ratio

686131 10824238 6.34%

-180650 8436974 -2.14%

112492 7517277 1.50%

Operating profit ratio

7.00% 6.00% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% -1.00% -2.00% -3.00% 2007-08 2008-09 2009-10 Operating profit ratio

Interpretation:

Pretax profit ratio:

Formula:

EBT/Net sales * 100

Table:

particulars EBT Net sales Pre-tax profit ratio

2007-08 744989 10824238 6.88%

2008-09 -240771 8436974 -2.85%

2009-10 133930 7517277 1.78%

Pre-tax profit ratio

8.00% 6.00% 4.00% 2.00% 0.00% 2007-08 -2.00% -4.00% 2008-09 2009-10 Pre-tax profit ratio

Interpretation:

Das könnte Ihnen auch gefallen

- Thompson, Damon - Create A Servitor - How To Create A Servitor and Use The Power of Thought FormsDokument49 SeitenThompson, Damon - Create A Servitor - How To Create A Servitor and Use The Power of Thought FormsMike Cedersköld100% (5)

- Analysis of Financial StatementsDokument54 SeitenAnalysis of Financial StatementsBabasab Patil (Karrisatte)Noch keine Bewertungen

- Managing Finincial Principles & Techniques Ms - SafinaDokument22 SeitenManaging Finincial Principles & Techniques Ms - SafinajojirajaNoch keine Bewertungen

- Financial Forecasting: SIFE Lakehead 2009Dokument7 SeitenFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNoch keine Bewertungen

- Financial Management Solved ProblemsDokument50 SeitenFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- Statement of Cash Flows: Preparation, Presentation, and UseVon EverandStatement of Cash Flows: Preparation, Presentation, and UseNoch keine Bewertungen

- Programming MillDokument81 SeitenProgramming MillEddy ZalieNoch keine Bewertungen

- Mongodb TutorialDokument106 SeitenMongodb TutorialRahul VashishthaNoch keine Bewertungen

- Assignment of Financial AccountingDokument15 SeitenAssignment of Financial AccountingBhushan WadherNoch keine Bewertungen

- 5G NR Essentials Guide From IntelefyDokument15 Seiten5G NR Essentials Guide From IntelefyUzair KhanNoch keine Bewertungen

- Dashboard - Reveal Math, Grade 4 - McGraw HillDokument1 SeiteDashboard - Reveal Math, Grade 4 - McGraw HillTijjani ShehuNoch keine Bewertungen

- Ratio ANALYSIS OF CEAT TYRESDokument37 SeitenRatio ANALYSIS OF CEAT TYRESS92_neha100% (1)

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Dokument9 SeitenMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNoch keine Bewertungen

- Akash 1Dokument13 SeitenAkash 1Akash GulalakaiNoch keine Bewertungen

- Projet PGPM RatioDokument16 SeitenProjet PGPM RatioViren PatelNoch keine Bewertungen

- ANALYSIS of Working Capital With Balance Sheet and Profit and LossDokument33 SeitenANALYSIS of Working Capital With Balance Sheet and Profit and Losssonabeta07Noch keine Bewertungen

- Series 1: 1. Profit Margin RatioDokument10 SeitenSeries 1: 1. Profit Margin RatioPooja WadhwaniNoch keine Bewertungen

- Profitability AnalysisDokument9 SeitenProfitability AnalysisAnkit TyagiNoch keine Bewertungen

- Current Ratio Year LiabilitiesDokument14 SeitenCurrent Ratio Year LiabilitiesVaibhavSonawaneNoch keine Bewertungen

- AXIS Bank AnalysisDokument44 SeitenAXIS Bank AnalysisArup SarkarNoch keine Bewertungen

- (SM) Financial Analysis Malaysia Airline CompanyDokument10 Seiten(SM) Financial Analysis Malaysia Airline Companymad2kNoch keine Bewertungen

- Ratio Analysis - Montex PensDokument28 SeitenRatio Analysis - Montex Penss_sannit2k9Noch keine Bewertungen

- Hindustan Lever Chemicals Balance Sheet - in Rs. Cr.Dokument28 SeitenHindustan Lever Chemicals Balance Sheet - in Rs. Cr.Lochan ReddyNoch keine Bewertungen

- PPTDokument35 SeitenPPTShivam ChauhanNoch keine Bewertungen

- Ratio Analysis (Group 5-Glc - Ib)Dokument53 SeitenRatio Analysis (Group 5-Glc - Ib)Nikam PranitNoch keine Bewertungen

- Overview of The Investing ActivitiesDokument9 SeitenOverview of The Investing ActivitiesTiyani RodrigoNoch keine Bewertungen

- A. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andDokument28 SeitenA. Liquidity Ratio: Current Assets Include Cash and Bank Balances, Marketable Securities, Debtors andYugendra Babu KNoch keine Bewertungen

- Current Assets (Rs in Lakh)Dokument35 SeitenCurrent Assets (Rs in Lakh)Jagadeesh MuthikiNoch keine Bewertungen

- Ratios of Comp.Dokument25 SeitenRatios of Comp.ashish5016Noch keine Bewertungen

- Analysis of Financial StatementsDokument37 SeitenAnalysis of Financial StatementsChajar Matari Fath MalaNoch keine Bewertungen

- Amul DataDokument7 SeitenAmul DataPriyanka KotianNoch keine Bewertungen

- Ratio Analysis of Meezan Bank: Particulars 2009 2008Dokument8 SeitenRatio Analysis of Meezan Bank: Particulars 2009 2008Mostafa KhawarNoch keine Bewertungen

- Chapter 4 - Analysis of Financial StatementsDokument50 SeitenChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- Oil & Natural Gas Corporation LTDDokument19 SeitenOil & Natural Gas Corporation LTDShalini MajethiaNoch keine Bewertungen

- Sandip Voltas ReportDokument43 SeitenSandip Voltas ReportsandipNoch keine Bewertungen

- Data, Analysis and Findings: Tata MotorsDokument24 SeitenData, Analysis and Findings: Tata MotorsAjoy MahajanNoch keine Bewertungen

- Ratio AnalysisDokument50 SeitenRatio AnalysisSweetie Arshad AliNoch keine Bewertungen

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDokument16 SeitenSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991Noch keine Bewertungen

- Ratio Analysis of Sainsbury PLCDokument4 SeitenRatio Analysis of Sainsbury PLCshuvossNoch keine Bewertungen

- Fi 410 Chapter 3Dokument50 SeitenFi 410 Chapter 3Austin Hazelrig100% (1)

- Searle Company Ratio Analysis 2010 2011 2012Dokument63 SeitenSearle Company Ratio Analysis 2010 2011 2012Kaleb VargasNoch keine Bewertungen

- Corp Fin AssignDokument9 SeitenCorp Fin AssignTwafik MoNoch keine Bewertungen

- Chap-6 Financial AnalysisDokument15 SeitenChap-6 Financial Analysis✬ SHANZA MALIK ✬Noch keine Bewertungen

- Walmart ValuationDokument24 SeitenWalmart ValuationnessawhoNoch keine Bewertungen

- Financial Management AssignmentDokument16 SeitenFinancial Management AssignmentNishant goyalNoch keine Bewertungen

- OR Test of Solvency: (A) Liquidity RatiosDokument24 SeitenOR Test of Solvency: (A) Liquidity RatiosshivaniNoch keine Bewertungen

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Dokument40 SeitenStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamNoch keine Bewertungen

- Ratio AnalysisDokument36 SeitenRatio AnalysisAditya SawantNoch keine Bewertungen

- Longenecker-Materi KomplemenDokument13 SeitenLongenecker-Materi KomplemenAtyaFitriaRiefantsyahNoch keine Bewertungen

- Ratio AnalysisDokument17 SeitenRatio AnalysisPGNoch keine Bewertungen

- B&I DBBL PRSNDokument42 SeitenB&I DBBL PRSNMahirNoch keine Bewertungen

- Asyad Financial AnalysisDokument9 SeitenAsyad Financial AnalysisshawktNoch keine Bewertungen

- Study ON Working Capital Management: Conducted at HMT Limited, Tractor Bussiness Group, PinjoreDokument37 SeitenStudy ON Working Capital Management: Conducted at HMT Limited, Tractor Bussiness Group, PinjoreShruti LatherNoch keine Bewertungen

- Corporate Finance:: School of Economics and ManagementDokument13 SeitenCorporate Finance:: School of Economics and ManagementNgouem LudovicNoch keine Bewertungen

- Profitability Analysis of Tata Motors: AbhinavDokument8 SeitenProfitability Analysis of Tata Motors: AbhinavAman KhanNoch keine Bewertungen

- Ratio Analysis ITCDokument15 SeitenRatio Analysis ITCVivek MaheshwaryNoch keine Bewertungen

- VebitdaDokument24 SeitenVebitdaAndr EiNoch keine Bewertungen

- Tata Steel ReportDokument4 SeitenTata Steel ReportHARJEET KAURNoch keine Bewertungen

- Tata Steel ReportDokument4 SeitenTata Steel ReportHARJEET KAURNoch keine Bewertungen

- Financial Highlights: 1. SalesDokument6 SeitenFinancial Highlights: 1. SalesAkshay BhonagiriNoch keine Bewertungen

- ProjectDokument34 SeitenProjectAkhil NairNoch keine Bewertungen

- Anamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaDokument24 SeitenAnamika Chakrabarty Anika Thakur Avpsa Dash Babli Kumari Gala MonikaAnamika ChakrabartyNoch keine Bewertungen

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Dokument6 SeitenQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607Noch keine Bewertungen

- Which Type of Account Do You Have?Dokument5 SeitenWhich Type of Account Do You Have?Ankit MistryNoch keine Bewertungen

- CalenderDokument1 SeiteCalenderAnkit MistryNoch keine Bewertungen

- PrefaceDokument21 SeitenPrefaceAnkit MistryNoch keine Bewertungen

- Business Level StrategyDokument41 SeitenBusiness Level StrategyAtima Hooda100% (1)

- Adani Prots Ltd.Dokument75 SeitenAdani Prots Ltd.Divyesh MungaraNoch keine Bewertungen

- Ankit MistryDokument2 SeitenAnkit MistryAnkit MistryNoch keine Bewertungen

- DXFtoGerberConversionGuide Rev2!12!10 13Dokument8 SeitenDXFtoGerberConversionGuide Rev2!12!10 13Tomasz BarwińskiNoch keine Bewertungen

- 5000-5020 en PDFDokument10 Seiten5000-5020 en PDFRodrigo SandovalNoch keine Bewertungen

- (Kazantzakis Nikos) Freedom or DeathDokument195 Seiten(Kazantzakis Nikos) Freedom or DeathTarlan FisherNoch keine Bewertungen

- Schermer 1984Dokument25 SeitenSchermer 1984Pedro VeraNoch keine Bewertungen

- Jar Doc 06 Jjarus Sora Executive SummaryDokument3 SeitenJar Doc 06 Jjarus Sora Executive Summaryprasenjitdey786Noch keine Bewertungen

- HC+ Shoring System ScaffoldDokument31 SeitenHC+ Shoring System ScaffoldShafiqNoch keine Bewertungen

- Studies - Number and Algebra P1Dokument45 SeitenStudies - Number and Algebra P1nathan.kimNoch keine Bewertungen

- White Cataract What To AssesDokument2 SeitenWhite Cataract What To Assesalif andraNoch keine Bewertungen

- Chapter 2Dokument69 SeitenChapter 2Lizi CasperNoch keine Bewertungen

- Crusader Castle Al-Karak Jordan Levant Pagan Fulk, King of Jerusalem MoabDokument3 SeitenCrusader Castle Al-Karak Jordan Levant Pagan Fulk, King of Jerusalem MoabErika CalistroNoch keine Bewertungen

- Piping Class Spec. - 1C22 (Lurgi)Dokument9 SeitenPiping Class Spec. - 1C22 (Lurgi)otezgidenNoch keine Bewertungen

- Visual Inspection ReportDokument45 SeitenVisual Inspection ReportKhoirul AnamNoch keine Bewertungen

- You're reading a free preview. Pages 4 to 68 are not shown in this preview. Leer la versión completa You're Reading a Free Preview Page 4 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 5 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 6 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 7 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 8 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 9 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 10 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 11 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 12 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 13 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 14 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 15 is notDokument9 SeitenYou're reading a free preview. Pages 4 to 68 are not shown in this preview. Leer la versión completa You're Reading a Free Preview Page 4 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 5 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 6 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 7 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 8 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 9 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 10 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 11 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 12 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 13 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 14 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 15 is notFernando ToretoNoch keine Bewertungen

- Aashirwaad Notes For CA IPCC Auditing & Assurance by Neeraj AroraDokument291 SeitenAashirwaad Notes For CA IPCC Auditing & Assurance by Neeraj AroraMohammed NasserNoch keine Bewertungen

- DILG Opinion-Sanggunian Employees Disbursements, Sign Checks & Travel OrderDokument2 SeitenDILG Opinion-Sanggunian Employees Disbursements, Sign Checks & Travel OrderCrizalde de DiosNoch keine Bewertungen

- 50 Law-Firms Details by Vaibhav SharmaDokument17 Seiten50 Law-Firms Details by Vaibhav SharmaApoorva NandiniNoch keine Bewertungen

- 6 RVFS - SWBL Ojt Evaluation FormDokument3 Seiten6 RVFS - SWBL Ojt Evaluation FormRoy SumugatNoch keine Bewertungen

- Engine Stalls at Low RPM: Diagnostic CodesDokument3 SeitenEngine Stalls at Low RPM: Diagnostic CodesAmir Bambang YudhoyonoNoch keine Bewertungen

- Small Data, Big Decisions: Model Selection in The Small-Data RegimeDokument10 SeitenSmall Data, Big Decisions: Model Selection in The Small-Data Regimejuan carlos monasterio saezNoch keine Bewertungen

- Translations Telugu To English A ClassifDokument111 SeitenTranslations Telugu To English A ClassifGummadi Vijaya KumarNoch keine Bewertungen

- Southern California International Gateway Final Environmental Impact ReportDokument40 SeitenSouthern California International Gateway Final Environmental Impact ReportLong Beach PostNoch keine Bewertungen

- Chandigarh Distilers N BotlersDokument3 SeitenChandigarh Distilers N BotlersNipun GargNoch keine Bewertungen

- Syllabus DU NewDokument48 SeitenSyllabus DU NewANKIT CHAKRABORTYNoch keine Bewertungen

- Xii Mathematics CH 01 Question BankDokument10 SeitenXii Mathematics CH 01 Question BankBUNNY GOUDNoch keine Bewertungen

- Poka-Yoke or Mistake Proofing: Historical Evolution.Dokument5 SeitenPoka-Yoke or Mistake Proofing: Historical Evolution.Harris ChackoNoch keine Bewertungen