Beruflich Dokumente

Kultur Dokumente

Intellectual capital & ROI: Case study of Iranian Stock Exchange

Hochgeladen von

saliah85Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Intellectual capital & ROI: Case study of Iranian Stock Exchange

Hochgeladen von

saliah85Copyright:

Verfügbare Formate

International Review of Business Research Papers Vol. 7. No. 1. January 2011. Pp.

45 - 59

Intellectual capital & Return on investment: Case study: Iranian Stock Exchange

Dr. Fraydoon Rahnamay Roodposhti , Elahe Rajaei and Somayeh Roshan Jourshari

All organizations are alive in accordance with knowledge in any economies based upon it as well. In such cases, the most successful organizations are able to have better and quicker benefits from knowledge as a real investment. Roos et. al discuss that Intellectual capital from the strategic point of view may be used for creation and application of knowledge in order to increase organization value. Boom & Silverman (2004) considered the relation between IC parts and decisions & financial risks and operation of companies. This article intends to study any relation between Intellectual capitals measured by financial patterns with output rate of investment of accepted companies at Tehran Stock Exchange Organization. The real meaning of Intellectual capital is any intends for effective usage of current knowledge and intangible assets. From the point of view of applicable goal & implementation method, the research system of this study is explanatory-measuring based upon combination of theories test from Test t and for estimation of parameters in which the regression model has been used for minimum squares. Research data are current audited financial statements in Tehran Stock Exchange Archive for 2005-2009 periods. The findings of theories tests through 2004 to 2008 show that there is a meaningful relation between Intellectual capital and investment output rate. This relation is positive in first, second and three methods and negative in fourth one. Furthermore the relation between studying variants are not equal in accordance with measured financial pattern.

Key words: Intellectual capital, Human Capital, Structural Capital, Return of Investment Field of research: Finance & Intellectual capital

1. Introduction

Human being has experienced different periods in the past. The said historical periods had considerable effects on the life style and activity of human being. It is possible to see its effects on the operation of economic agencies. The other effects are IT & appearance of different tools such as internet, intranet and web wide network. The effect of these innovations is a new decade under the title of Age of Knowledge" and to say good bye to industrial age which has been appeared in the past along with information decades which has been introduced in third millennium. In knowledge age, what makes more success in trade and industry is knowledge of human being which was successful in creation of economy based upon knowledge. The knowledge of human being is an intangible asset and recognized as an

Associate Professor and Member of scientific board of Islamic Azad University- Central Tehran Branch (Corresponding Author) rahnama@iau.ir Holder of Master of Science Degree in Executive Management- Islamic Azad University- Central Tehran Branch Holder of Master of Science Degree in MBA- Islamic Azad University- U.A.E Branch

Roodposhti, Rajaei & Jourshari

intellectual capital. Any development of intellectual capital makes a wide field for more wealth and values. In fact, in most countries of the world, any business environment based upon knowledge needs to understand and accept a new paradigm including intangible organizational factors which would be named today as intellectual capital. This may cause to add a new knowledge under the title of intellectual capital with a daily increase of its importance. The present article is in fact a research about any relation between intellectual capital and return of investment in Tehran Stock Exchange Organization. Then after determining its updated scientific bases as the major scientific goals, intends to assist all investors and pioneers of capital market in any further decision making and to answer to this major research question that "What is the relation between intellectual capital and return of investment?" In addition, we have considered the effect of different calculation methods of intellectual capital based upon financial pattern in company's value. This paper design to 4 parts as literature, methodology, discussion of findings & conclusion.

2. Literature Review

2.1 The Meaning of Intellectual Capital Intellectual capital is one of the new subjects in scientific literature. It was presented for the first time in an applicable description format in 1993 by Organization for Economic Cooperation & Development (OECD). It means the economic value of two groups of intangible assets of company including 1-Organizational capital and 2Human being capital including of inter-organizational human resources that means the relevant personnel of the organization and outer-organizational resources that means the customers and suppliers. Various researches revised it for providing a better meaning for intellectual capital including Roos, (1997) who may consider intellectual capital as a collection of knowledge of all members of an organization and its practical application. Bontis (1996, 1999, 1998, 2000, 2004) considered intellectual capital as a search and following up and effective usage of knowledge (made product) in comparison with information (raw material). Mouritsen (1998) explains intellectual capital as a wide organizational knowledge which is exclusive for each company and enables it to comply itself continuously with under change conditions. Gupta et. al (2001) considers intellectual capital as an exclusive set of tangible /intangible resources of company. Swart (2006) introduces the intellectual capital as knowledge for further values. It may change into wealth and values as a knowledge, profession and abilities. Dzinkowski (2000) considers intellectual capital as a total capital and/or ownership right based upon knowledge of company. Khavandkar et. al (2008) provides a complete meaning of intellectual capital. 2.2 Major Elements of Value & Intellectual capital In scientific literature value includes of intellectual capital and financial capital of the organization. This finding is the result of intellectual capital index introduced by Johan Roos et. al in 1997. 46

Roodposhti, Rajaei & Jourshari

This classification is in compliance with different descriptions of intellectual capital based upon customer in any process of organizational value including the provided description by Hananes et. al (1997) as "Intellectual capital is a set of knowledge based assets through increasing the value of key beneficiaries of organization including customers" and Macwatters (2008)who may consider effective factors on creating strategy value for customers including technological changes, globalization and competing and customers' need. Upon considering the researches of this field and for determining of model and measuring methods and evaluation of intellectual capital, Anvari Rostami & Rostami (2003) believe in structural, humanistic and customer dimensions of financial capital. Diagram 1 shows these items.

Diagram 1

Human capital

Structural capital

Financial capital

Customer capital

Although there are not equal descriptions and concepts about intellectual capital, but intellectual capital is going towards a way as a witness of combination of meaning. (Nikoo Maram, Yari 2008). 2.3 Measuring of intellectual Capital It is a need to accept measuring principle in financial & accounting literature and in evaluation process of all accidents and phenomena including intellectual capital. This may increase the information effectiveness. Generally there are two major reasons for measuring of intellectual capital in Organization. The first is from financial reporting point of view and for various subjects and the second is ensuring about intellectual capital management for better & effective usage and increasing the competitive advantage of most central organizational competences. Any consideration of scientific literature of subject shows that it is possible to classify most proposed measuring models of intellectual capital into four models such as Direct Intellectual Capital models (DIC), Market Capitalization Models (MCM), Return on Assets Methods (ROA) AND Scorecard Methods (SC). This may cover all models with regard to the real meaning related to intellectual capital.

47

Roodposhti, Rajaei & Jourshari

We have considered Assets output models through the meaning of intellectual capital from the point of view of return of investment that is based upon financial patters. In assets output model we have considered the average income of organization before tax as the base of any calculations. In fact the average of profit before tax in a special period of time will be divided on average of organizational intellectual capital. The obtained result as the output rate of assets would be divided to industry average and in next step it will be multiple in average organizational intellectual capital for further calculation of annual average profit through intellectual capital. The result will be divided on average of capital costs and/or profit rate. The obtained amount would be considered as the value of intellectual capital. Furthermore, the Return of Investment and Return Of Equity (ROE) of introduced models in this classification will be developed in financial literature and based upon this concept. Then it is possible to introduce modern models based upon of value added and creation of similar value of Economic Value Added (EVA) and calculated intangible value model, Knowledge Capital Earning (KCE), Value Added Intellectual Coefficient (VAIC) introduced respectively by Bentnett Stewart (1991), Tomas Stewart (1997), Ante Pulic 2000 and Lev Baruch 2001. Table 1 shows a summary of theoretical studies in relation with subject and according to the researches of Sveiby (1998, 2001).

48

Roodposhti, Rajaei & Jourshari

Pattern Innovation Registration right Table 1: Measuring methods of intellectual capital Researcher Attitude Description of measuring method Bontis DIC Technology factor would be calculated in (1996) accordance with number of made innovations in organization. The intellectual capital operation would be calculated in accordance with any effects of index sets including number and costs of registration the innovations. Mack DIC It may use classification of combined Ferson weighted indexes in which the focus is on (1998) estimated not absolute values. Value= Monetary value added + combined intangible value added Sullivan DIC It is a method for measuring of intellectual (2000) ownership value Nesh (1998) DIC It is a method for reduced monetary currencies. In this method it is assumed the difference between accounting value (for future) at the end and beginning of a value added course. Q Tobin is the rate of value against a registered (book) value of assets. Stewart puts the replacement costs of tangible assets instead of registered value of tangible assets. Any changes in q Tobin may provide an index for measuring of function. It is expected to have this rate in long-term towards 1. Q Tobin=Market value / book value It may consider the intellectual capital in difference between market value and its registered value. Market value= Registered value + intellectual capital It may calculate the effect of non-fixed related costs with human resources on reducing of economic unit profit. It is possible to measure intellectual capital by calculation of the shares of human assets, dividing on investing costs on Human Force (Salary & allowances) It is based upon pricing functions and benefits from real costs accounting convention. It is able to have an integrated evaluating of human capital by traditional accounting patterns. It may estimate the results of knowledge capital as the normalized receipts more than attributable receipts of registered assets. 49

Integrated Evaluation Method

Intellectual assets evaluation Accounting for future

Q Tobin

Stewart (1997) Bontis (1999)

MCM &

Market value Stewart against book (1997) value Looti (1998)

MCM &

Accounting & Johansson pricing of (1996) human resources

ROA

Evaluating of Libowitz human Right capital (1999)

& ROA

Knowledge Capital allowances

Loo (1999)

ROA

Roodposhti, Rajaei & Jourshari

2.4 Background Ross (1997) presented the basic theme of intellectual capital as a framework for further analysis of intangible assets in an organization. Then Chatkel (2001) and Payik et. al (2001) submitted the relevant details of this theory. Bonits (1999), Chen et. al (2000), Stewart (1997), Solivan and Harrison (2000), Bartsh (2005) and Bollen, Vergduwen and Schnieders (2005) continued this research as well. Swedish Association performed the first experimental study for measuring of intellectual capital in middle of 1980s. Riahi Bolkoui (2003) has considered the effect of intellectual capital on operation of multi-national American companies within 1992-96. In their research under the title of "Intellectual capital & Human capital, as the effective factors on risk & financial function in bio-technology industry", Boom & Silverman (2004) considered the relation between intellectual capital parts and decisions of financial risks and operation of companies and the effect of these parts on further functions. According to the results, there is a meaningful effect of intellectual capital on the operation and financial risks of considered companies. Garcia & Matiner (2007) in their theory under the title of "Benefiting from intellectual capital information in investing decision making" will show that all investors benefit from this information. Rodof & Lelyart (2002) confirmed in their article under the title of "Monetary methods for measuring of intellectual capital" that it is possible to qualify intellectual capital in accordance with financial patterns. In their research under the title of "Accounting of Experimental Measuring of intellectual capital with accounting attitude", Mack Pierson & Paik (2001) considered the operation of companies. According to the findings, there is a positive meaningful relation between the operation and intellectual capital. Jafari (2009) has tested and confirmed the effective relation of risk with company's operation level based upon intellectual capital. Anvari Rostami (2005) tests the relation of intellectual capital and market value of shares at Tehran Stock Exchange Organization between years 1997 to 2003 in accordance with financial patterns. Then it was possible to confirm a positive & meaningful relation between both mentioned items. Asghar Nejad Miri (2006) has tested the intellectual capital and its relation with financial output in accordance with Polik method for years 2001 up to 2006. Then it was possible to confirm a positive & meaningful relation between intellectual capital and financial output. Nikoo Maram & Yari (2008) tested the relation between intellectual capital with investment output and economic value added at Tehran Stock Exchange Organization for a financial period of 2002 up to 2006 based upon a special pattern. Then it was possible to confirm a positive relation between intellectual capital and return investment and economic value added.

3. Methodology

The current research method is applicable for the aim and explanatory measuring for performance. Data collection is on library basis along with benefiting from Fisher test for measuring the validity of models and T test for examining the meaningful relation between variants (theories test) and R2 Durbin-Watson tests for estimation 50

Roodposhti, Rajaei & Jourshari

of relation of variants in regression model. Research statistical population is all accepted companies at Tehran Stock Exchange Organization selected from different industries with some determined specifications and assumed in better group companies with considered indexes. Study period is 2005-2009. Research Process Design 123456subject define variable Identify & define Hypothesis & problem define Data gathering Hypothesis test Finding model called regression for prediction

Research variables & calculation method such as: 1-Ic1: In this method it is possible to calculate intellectual capital from following relation IC1 = Where: IC: Intellectual capital RC: Company's income in T R1 :Average income of current companies in similar industry through T WACC: Weighted average cost of capital which was about %15.5 in this research and as WACC. 2-Ic2: In this method it is possible to calculate intellectual capital from following relation IC2 = ( IC: Intellectual capital C= the average of return in T 1:The average of return companies in similar industry through T : The average of company's assets through T (Total value of assets) 3-Ic3: In this method it is possible to calculate intellectual capital from following relation

( )1 Q is the return addition of company against the average output of industry through T TA= It is the average of company's assets through T WACC =It is the weighted average cost of capital through T :The average inflation rate through T (Within first to third three years, %14.5 and in fourth & fifth years equal to %16.5 according to the Central Bank of Iran rate. 51

Roodposhti, Rajaei & Jourshari

Ic4: In this method, the value of intellectual capital is as follows:

MV : Company's average market value within T BV : Company's average book value within T : Average inflation rate within T

ROI

netIncome Total investment

4. Discussion

4.1 Hypothesis 1-There is a meaningful relation between intellectual capital & ROI 2-There is a meaningful difference between different calculation methods of intellectual capital based upon financial patterns with ROI. 4.1.1 The Results of 1st Sub Hypothesis: Model Summary (b)

Model R R Square Adjusted R Square Std. Error the of Estimate R Square Change F Change DF1 Df2 Change Statistics Sig.F Change DurbinWatson

.683 (a)

.467

.445

607219.6312

.467

21.016

24

.000

1.648

a predictors: (Constant), Q1 b Dependent Variable: Q5 Coefficients (a)

Model Un-standardized Coefficients B 318455.315 .024 Std. Error 123173.147 .005 Standardized Coefficients Beta .683 T Sig

1 (Constant) Q1

2.585 4.584

.016 .000

a Dependent Variable: Q5

52

Roodposhti, Rajaei & Jourshari

According the results, it was revealed that firstly R2 is equal to 0.467. This may show that about %47 of changes in return of investment would be specified by changes of intellectual capital and in accordance with first pattern. Secondly the sig. results of t test provide proofs that meaningful level is lower than 0.01 and at %99 level, there is a meaningful relation between intellectual capital by 1st method and return of investment rate. Therefore it is possible to confirm first indirect Hypothesis. 4.1.2 The Results of Second Sub Hypothesis Test: Model Summary (b)

Model R R Square Adjusted R Square Std. Error the of Estimate R Square Change F Change DF1 Df2 Change Statistics Sig.F Change DurbinWatson

.723(a)

.523

.504

574107.80976

.523

26.358

24

.000

1.317

a predictors: (Constant), Q2 b Dependent Variable: Q5

Coefficients (a)

Model Un-standardized Coefficients B Std. Error 282704.909 117924.878 .005 .001 Standardized Coefficients Beta .723 T Sig

1 (Constant) Q2

2.397 5.134

.025 .000

a Dependent Variable: Q5 According to the results, it was revealed that firstly R2 is equal to 0.523. This may show that about %52 of changes in return of investment would be specified by changes of intellectual capital and in accordance with second pattern. Secondly the sig. results of t test provide proofs that meaningful level is lower than 0.01 and at %99 level, it is possible to confirm 2nd method for all considered companies. It means that there is a meaningful relation between intellectual capital in 2nd method and return of investment.

53

Roodposhti, Rajaei & Jourshari

4.1.3 The Results of Third Sub Hypothesis Test: Model Summary (b)

Model R R Square Adjusted R Square Std. Error the of Estimate R Square Change F Change DF1 Df2 Change Statistics Sig.F Change DurbinWatson

.723(a)

.523

.503

574378.21521

.523

26.311

24

.000

1.319

a predictors: (Constant), Q3 b Dependent Variable: Q5 Coefficients (a)

Model Un-standardized Coefficients B 282042.318 .013 Std. Error 118023.385 .003 Standardized Coefficients Beta .723 T Sig

1 (Constant) Q3

2.390 5.129

.025 .000

a Dependent Variable: Q5 According to the results, it was revealed that firstly R2 is equal to 0.523. This may show that about %52 of changes in return of investment would be specified by changes of intellectual capital and in accordance with third pattern. Secondly the sig. results of t test provide proofs that meaningful level is lower than 0.01 and at %99 level, the level of meaningful is lower than 0.01. As a result it is possible to apply third indirect theory means there is a meaningful relation in accordance with third pattern with return of investment. 4.1.4 The Results of Fourth Sub Hypothesis Test: Model Summary (b)

Model R R Square Adjusted R Square Std. Error the of Estimate R Square Change F Change DF1 Df2 Change Statistics Sig.F Change DurbinWatson

.139(a)

.019

-.022 823589.34242

.019

.470

24

.499

1.822

a predictors: (Constant), Q4 b Dependent Variable: Q5

54

Roodposhti, Rajaei & Jourshari

Coefficients (a)

Model Un-standardized Coefficients B Std. Error 495198.420 168322.523 .000 .000 Standardized Coefficients Beta -.139 T Sig

1 (Constant) Q4

2.942 -.686

.007 .499

a Dependent Variable: Q5 According to the results, it was revealed that firstly R2 is equal to 0.019. This may show that about %19 of changes in return of investment would be specified by changes of intellectual capital and in accordance with fourth pattern. The remained are related to other factors which we did not consider anymore. Secondly the sig. results of t test provide proofs at %99level the sig level was more than 0.01. As a result the statistical zero theory is confirmed and fourth indirect theory would be rejected. This means that there is not a meaningful relation between intellectual capital in 4th method and return of investment. Generally it is possible to say that although we can confirm any meaningful relation for first, second and third indirect theories and lack of relation for fourth theory, but the severity of variants are not equal. That means determining of return of investment by intellectual capital is in accordance with financial patterns. While the most specification degree is for intellectual capital in accordance with 2nd and 3rd patterns and the lowest is for 4th one. Also the findings reveal that the validity of mentioned relation among first, second and third patterns is positive and it is negative for 4th pattern. 4.2 Testing of Major Hypothesis 4.2.1 The Results of First Major Theory Test: Following tables show the obtained results of testing the first major Hypothesis: Model Summary (b)

Model R R Square Adjusted R Square Std. Error the of Estimate R Square Change F Change DF1 Df2 Change Statistics Sig.F Change DurbinWatson

.733(a)

.537

.475 5904703193003

.538

8.535

22

.001

1.388

a predictors: (Constant), Q4,Q1,Q3 b Dependent Variable: Q5

55

Roodposhti, Rajaei & Jourshari

Coefficients (a)

Model Un-standardized Coefficients B Std. Error 304936.848 126836.024 .007 .011 .010 .006 .000 .000 Standardized Coefficients Beta .194 .545 -.082 T Sig

1 (Constant) Q1 Q3 Q4

2.404 .616 1.735 -.566

.025 .544 .097 .577

a Dependent Variable: Q5 The results of testing the major first theory show that any intellectual capital variant based upon 2nd pattern is depending upon Partial Correlation test due to the meaningful of Collinerarity statistic and would be extracted from the model and the remained will stay in it. Secondly R2 is equal to 0.538. It means that about %54 of changes are explained in return of investment and by intellectual capital changes. Thirdly the sig. results of t test of indirect theories and the results of t test of major one show that there is a meaningful relation between intellectual capital and return of investment. As a result it is possible for confirm major theory about considered companies. Also the results of this paper is adapt with finding Garcia & matiner (2007), Anvari Rostami (2005) and Nikoomaram & Yari (2008 . 4.2.2 The Results of 2nd Major Hypothesis: Upon consideration of the results of indirect theories, there are different proofs that there is a meaningful relation between the calculated intellectual capital in four-fold pattern with ROI. The results of R2 may confirm this matter. 4.2.3 Main results: The results show that we can use intellectual capital as a proxy ROI for performance assess ment. Because it is elements of value creation in financial capital also measuring financial risks and operation of comparies.

5. Conclusion

Intellectual capital includes in organizational intangible assets in knowledge time. It is a phenomenon based upon decision making, evaluation of function and analysis of investment in an applicable & economic form. All discussed theoretical aspects which have been discussed in the article are necessary & enough proofs for introducing of intellectual capital in knowledge-base economy. All discussed and presented models in measuring of intellectual capital are some important subjects in the field of intellectual capital. Any good understanding of the relation of intellectual capital and its three-fold dimensions and its dealing with financial capital makes a great organizational value for it. Pursuant to the scientific goal of this article for determining of theoretical discussion and further application this article intends to find a relation of intellectual capital based upon financial pattern and return of investment. According to the results, firstly there is a meaningful relation between intellectual capital and return of investment according to the first, second and third 56

Roodposhti, Rajaei & Jourshari

financial pattern. Secondly, the validity results of model for indirect first, second and third theories is positive and for the 4th theory is negative and generally is positive for major theory. Thirdly, the results show that there is a difference between the value of calculated intellectual capital and in accordance with four-fold patterns. Therefore, it is necessary to pay attention to this matter and to use a pattern in all discussion with the most meaningful relation with ROI. This is because of its usefulness in further measuring of function and evaluation of shares. These results show that all active pioneers of capital market and users of financial information may consider intellectual capital as an important variant in any decision making for purchase of shares and evaluation of function. Also the results of research records show that all findings of this research are in compliance with the results of research made by "Tan, Plowman and Hankok" in Singapore and " Boom, Silverman" and the research of Garicia Martines at Spain and the research of Mack Pierson and Paik about function & research by Anvari Rostami and Asghar Nejad and Nikoo Maram and Yari in Iranian Capital market. This is a sign of paying attention to it for any decision making and evaluation of business function. Also we propose to all future researches to test any relation between intellectual capital based upon other measuring models rather than this article with different subjects including economic value added and other indexes based upon the value, type of company either from growth and/or value and type of shares and accounting, financial, economic, human and business points of view.

References

Anvari Rostami, A, Seraji, A & Seraji, H 2005, Evaluation of Intellectual Capital and surveying relation between intellectual capital and market value of stocks in Tehran Stock Exchange, Accounting and Auditing Surveys Journal no.39.[Persian-Language] Anvari Rostami, A, Rostami, A & Rostami, M 2003, Valuation of models and evaluation and valuation methods of companies' intellectual capital, Accounting and Auditing Surveys Journal, no.34. [Persian-Language] Asgharnejad, M 2006, Evaluation of intellectual capital and survey of relation between that and financial turnover Thesis, Master of business Management in Finance. [Persian-Language] Bollen, L, Vergauwen, P and Schnieders, S 2005, Linking Intellectual Capital and Intellectual Property to Company Performance, Management Decision Journal, vol.43, no.9, pp.1161-1185. Bonits, N 1998, intellectual capital: an exploratory study that develops measure and models Management Decision, vol.36, no.2, pp. 63-76. Bonit, N 2004, National intellectual capital index: A united Nation initiative for the Arab Region, Journal of intellectual capital, vol.5 no.1. Bontis, N, Keow, WCC and Richardso , S 2000, Intellectual Capital and Business Performance in Malaysian Industries, Journal of Intellectual Capital, vol.1, no.1, pp.85-92. Bontis, N, 1996, There's a price on your head: managing intellectual capital strategically, Business Quarterly, no. summer, pp. 40-47. Bontis, N, 1999, Managing organizational knowledge by diagnosing intellectual capital: framing and advancing the state of the field, International Journal of Technology Management, vol.18, No. 5/6/7/8, pp.433-462. 57

Roodposhti, Rajaei & Jourshari

Chen, MC, Cheng, SJ, Hwang, C and Hwang, Y 2005, An Empirical Investigation of the Relationship between Intellectual Capital and Firms' Market Value and Financial Performance, Journal of Intellectual Capital, vol. 6, no.2, pp.159176. Chen, J, xie, Y 2004, measuring intellectual capital a new model and empirialstudy Journal of Intellectual Capital, vol.5 no.1. Dzinkowski, R 2000, The Measurement and Management of Intellectual Capital: an Introduction, Management Accounting Journal, vol.78, no.2, pp.32-36. Hansen, GS, Wernerfelt, B 1989, Determinants of Firm Performance: The Relative Importance of Economic and Organization Factors, Strategic Management Journal, vol. 10, pp.399-411. Hunter, L, Webster, E, and Wyatt, A 2005, Measuring Intangible Capital: A Review of Current Practice Australian Accounting Review, vol.15, no.2, pp.4-21. Jafari, M 2009, relation of Effective Management of Risk and Operation Level of Company, Master Thesis, Islamic Azad University, Iran, [Persian-Language] Khavandkar, J, Khavandkar, E & Motaghi, A 2008, Intellectual Capital, first publish, Tehran Industrial and Researches Center, Tehran. [Persian-Language]. McWatters, CS. Morse, DC & Zimmerman, JL 2004, Management Acc.: Analysis and Interpretation, McGraw-Hill, New York. Nikoomaram, H, Yari, H 2008, Relation Between Intellectual Capital and Turnover of Investment and Economic Additional Value in Tehran Stock Exchange, Financial Studies Journal pre. no.3. [Persian-Language] Pulic, A 2000, VALCTM- an Accounting Toll for IC Management International Journal of Technology Management, vol.20, no.5-8, pp.702-714. Pulic, A 2004, Intellectual Capital- Does it Create or Destroy alue? Measuring Business Excellence, vol.8, no.1, pp.62-68. Pulic, A 2005, Intellectual Capital for Communities-Nations, Regions, Cities and other Communities, first edition, Elsevier Butterworth Heinemann, Boston. Pulic, A 1998, Measuring the performance of intellectual potential in knowledge economy', < http://www.measuring-ip.at/papers/Vaictxt/vaictxt.html>. Pulic, A 2000, An accounting tool for IC management, <http://www.measuingip.at/papers/ham99txt.html>. Rahnamay Roodposhti, F, Nikoomaram, H and Shahverdiani, Shadi 2006, Strategic Financial Management, Tehran Kasa Kavosh Press, Tehran. [PersianLanguage]. Riahi Belkaoui, A 2003, Intellectual Capital Firm Performance of US Multinational Firms, Journal of Intellectual Capital, vol.4, no.2, pp.215-226. Roos, J, Roos, G, Dragoneti, N and Edvinsoon, L 1997, Intellectual Capital: Navigating in the New Business Landscape, Macmillan Business, London. Roos, G and Roos, J 1997, Measuring your company's intellectual performance, International Journal of strategic Management, vol.30, no.3, pp.413-426. Stewart, T 1997, Intellectual Capital: The New Wealth of Nations, Doubleday Dell Publishing Group, New York. Sveiby, KE 1998, Measuring intangibles and intellectual capital an emerging first standard, <www.seiby.com/articles/EmergingStandard.html>. Sveiby, KE 2001, The new organizational wealth: managing and measuring knowledge based assets, <www.seiby.com/articles/EmergingStandard.html> Swart, J 2006, Intellectual Capital: Disentangible an Enigmatic Concept, Journal of Intellectual Capital, vol. 7, no.2. Tan, H, Plowman, D and Hancock, P 2007, Intellectual Capital and Financial Returns of Companies, Journal of Intellectual Capital, vol.8, no.1, pp.76-95. 58

Roodposhti, Rajaei & Jourshari

Zhang, JJ, Zhu, NP and Kong, YS 2006, Study on Intellectual Capital and Enterprise's Performance-Empirical Evidence from the Chinese Securities Market, Journal of Modern Accounting and Auditing, vol.2, no.10, pp.35-39.

59

Das könnte Ihnen auch gefallen

- SSRN Id2251620Dokument15 SeitenSSRN Id2251620mohammad.mamdooh9472Noch keine Bewertungen

- Ic & EvaDokument26 SeitenIc & EvaRatIeh DewNoch keine Bewertungen

- 3 1 311 587Dokument4 Seiten3 1 311 587JOSHUANoch keine Bewertungen

- Intellectual Capital, Firm Value, and Financial Performance: Aida Irsyahma, NikmahDokument15 SeitenIntellectual Capital, Firm Value, and Financial Performance: Aida Irsyahma, NikmahnandaNoch keine Bewertungen

- The Relation Between Network of CollaborDokument8 SeitenThe Relation Between Network of CollaborAna Paula SantosNoch keine Bewertungen

- Institutional Ownership, Intellectual Capital, and Firm Size Impact on Company ValueDokument11 SeitenInstitutional Ownership, Intellectual Capital, and Firm Size Impact on Company ValueB2MSudarman IfolalaNoch keine Bewertungen

- The Impact of Intellectual Capital On Innovation: A Literature StudyDokument13 SeitenThe Impact of Intellectual Capital On Innovation: A Literature StudyA.s.qudah QudahNoch keine Bewertungen

- The Impact of Intellectual Capital On Organizational PerformanceDokument9 SeitenThe Impact of Intellectual Capital On Organizational PerformanceAqsaNoch keine Bewertungen

- Performance Impact of Intellectual Capital: A Study of Indian IT SectorDokument9 SeitenPerformance Impact of Intellectual Capital: A Study of Indian IT SectorShazia HassanNoch keine Bewertungen

- Intellectual Capital Impact On Investment Recommendations Evidence From IndonesiaDokument11 SeitenIntellectual Capital Impact On Investment Recommendations Evidence From IndonesiaAlexander DeckerNoch keine Bewertungen

- The EffectendDokument15 SeitenThe EffectendCorolla SedanNoch keine Bewertungen

- Analyzing The Relationship BetweenDokument14 SeitenAnalyzing The Relationship BetweenHusnul HotimahNoch keine Bewertungen

- Intellectual Capital Measurement MethodsDokument9 SeitenIntellectual Capital Measurement MethodsLuciana Nagel-PiciorusNoch keine Bewertungen

- Human Capital Accounting and The Comparability of Financial Statements in NigeriaDokument12 SeitenHuman Capital Accounting and The Comparability of Financial Statements in Nigeriarabbits bdNoch keine Bewertungen

- Intellectual Capital PDFDokument18 SeitenIntellectual Capital PDFA.s.qudah QudahNoch keine Bewertungen

- Influence: SciencedirectDokument7 SeitenInfluence: Sciencedirectshanane loteriaNoch keine Bewertungen

- A Study On The Effect of Intellectual Capital ...Dokument17 SeitenA Study On The Effect of Intellectual Capital ...Breeze MaringkaNoch keine Bewertungen

- Kardigap PDFDokument16 SeitenKardigap PDFasad ullahNoch keine Bewertungen

- IJMRES 3 Paper Vol 6 No1 2016Dokument20 SeitenIJMRES 3 Paper Vol 6 No1 2016International Journal of Management Research and Emerging SciencesNoch keine Bewertungen

- AbstractDokument35 SeitenAbstracthuzaifa anwarNoch keine Bewertungen

- Earning Quality ICDokument6 SeitenEarning Quality ICnovitaanggrainiNoch keine Bewertungen

- (Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesDokument20 Seiten(Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesishelNoch keine Bewertungen

- The Significance of Intellectual Capital in Strategies of Transnational CorporationsDokument16 SeitenThe Significance of Intellectual Capital in Strategies of Transnational Corporations20212111047 TEUKU MAULANA ARDIANSYAHNoch keine Bewertungen

- Intellectual Capital and Value Creation-Is Innovation Capital A Missing Link?Dokument10 SeitenIntellectual Capital and Value Creation-Is Innovation Capital A Missing Link?ratiehayoeNoch keine Bewertungen

- The Influence of Intellectual Capital On Firm Value Towards Manufacturing Performance in IndonesiaDokument8 SeitenThe Influence of Intellectual Capital On Firm Value Towards Manufacturing Performance in IndonesiaDaby Hari RobbyNoch keine Bewertungen

- Ijm 11 07 146Dokument16 SeitenIjm 11 07 146mkashif041Noch keine Bewertungen

- Relationship Between Intellectual Capital and Organizational Agility With Mediatory Role of Employee Empowering in Service Sector (Case Study: Karafarin Insurance Company)Dokument5 SeitenRelationship Between Intellectual Capital and Organizational Agility With Mediatory Role of Employee Empowering in Service Sector (Case Study: Karafarin Insurance Company)TI Journals PublishingNoch keine Bewertungen

- Intellectual CapitalDokument16 SeitenIntellectual CapitalDr-Sobia AmirNoch keine Bewertungen

- 05-INT-The Link Between Intellectual Capital and Business Performance A Mediation Chain ApproachDokument21 Seiten05-INT-The Link Between Intellectual Capital and Business Performance A Mediation Chain ApproachSulaiman HanifNoch keine Bewertungen

- Intellectual Capital and BusinDokument16 SeitenIntellectual Capital and BusinEkta MehtaNoch keine Bewertungen

- The Impact of Intellectual Capital On Business OrganizationDokument17 SeitenThe Impact of Intellectual Capital On Business OrganizationB2MSudarman IfolalaNoch keine Bewertungen

- Determinants of Capital Structure in SpainDokument26 SeitenDeterminants of Capital Structure in Spainaakanksha_rinniNoch keine Bewertungen

- Pengaruh Intellectual Capital Terhadap Kinerja Keuangan Dan Nilai Pasar Perusahaan Perbankan Dengan Metode Value Added Intellectual CoefficientDokument0 SeitenPengaruh Intellectual Capital Terhadap Kinerja Keuangan Dan Nilai Pasar Perusahaan Perbankan Dengan Metode Value Added Intellectual CoefficientAhmad HakemNoch keine Bewertungen

- Intellectual Capital and Firm Performance: Mu Shun WangDokument26 SeitenIntellectual Capital and Firm Performance: Mu Shun WangNadia FelisyaNoch keine Bewertungen

- The Influence of Intellectual Capital To Financial Performance atDokument7 SeitenThe Influence of Intellectual Capital To Financial Performance atRahayu SusantiNoch keine Bewertungen

- Intellectual CapitalDokument23 SeitenIntellectual CapitalchoirunnissaNoch keine Bewertungen

- Research Paper On Factoring in IndiaDokument5 SeitenResearch Paper On Factoring in Indiacarkdfp5100% (1)

- The Impact of Intellectual Capital On Business OrganizationDokument8 SeitenThe Impact of Intellectual Capital On Business OrganizationSAMEENA NAWAZNoch keine Bewertungen

- The Effect of Firm Characteristic On Intellectual Capital Disclosure in Islamic Banking: Evidence From AsiaDokument20 SeitenThe Effect of Firm Characteristic On Intellectual Capital Disclosure in Islamic Banking: Evidence From AsiaRyan NababanNoch keine Bewertungen

- 5500 24013 2 PB PDFDokument12 Seiten5500 24013 2 PB PDFhokipiggyNoch keine Bewertungen

- Fundamental Analysis and Stock Returns: An Indian Evidence: Full Length Research PaperDokument7 SeitenFundamental Analysis and Stock Returns: An Indian Evidence: Full Length Research PaperMohana SundaramNoch keine Bewertungen

- Intellectual CapitalDokument16 SeitenIntellectual CapitalArslan AyubNoch keine Bewertungen

- Intellectual Capital Measurement The Yes and NoDokument6 SeitenIntellectual Capital Measurement The Yes and NoarcherselevatorsNoch keine Bewertungen

- How Intellectual Capital Effects Firm's Financial PerformanceDokument8 SeitenHow Intellectual Capital Effects Firm's Financial PerformanceHendra GunawanNoch keine Bewertungen

- 76-Article Text-76-1-10-20170315Dokument16 Seiten76-Article Text-76-1-10-20170315Pedro GonçalvesNoch keine Bewertungen

- Fundamental Analysis and Stock Returns in PakistanDokument13 SeitenFundamental Analysis and Stock Returns in PakistanCristina CiobanuNoch keine Bewertungen

- Intellectual Capital Effect On Financial Performance and Company Value (Empirical Study On Financial Sector Companies Listed On The Indonesia Stock Exchange in 2020)Dokument11 SeitenIntellectual Capital Effect On Financial Performance and Company Value (Empirical Study On Financial Sector Companies Listed On The Indonesia Stock Exchange in 2020)International Journal of Business Marketing and ManagementNoch keine Bewertungen

- Intellectual Capital and Its Major ComponentsDokument7 SeitenIntellectual Capital and Its Major Componentsmyie83Noch keine Bewertungen

- SSRN Id3834213Dokument14 SeitenSSRN Id3834213Ranveer kumarNoch keine Bewertungen

- Role of Venture Capital Financing in Emerging EconomiesDokument5 SeitenRole of Venture Capital Financing in Emerging EconomiesAasheesh BeniwalNoch keine Bewertungen

- Intellectual Capital EfficiencyDokument7 SeitenIntellectual Capital EfficiencyAnonymous 4gOYyVfdfNoch keine Bewertungen

- Effect of Intellectual Capital On The Profitability of Nigerian Deposit Money BanksDokument13 SeitenEffect of Intellectual Capital On The Profitability of Nigerian Deposit Money BanksEditor IJTSRDNoch keine Bewertungen

- Measurement of Intellectual Capital in A Company: Artur PaździorDokument7 SeitenMeasurement of Intellectual Capital in A Company: Artur PaździorDima AbdulhayNoch keine Bewertungen

- Human Capital Management Boosts Research Center InnovationDokument17 SeitenHuman Capital Management Boosts Research Center InnovationAndi Nurlelasari AsNoch keine Bewertungen

- The Nexus of Intellectual CapiDokument21 SeitenThe Nexus of Intellectual CapiEkta MehtaNoch keine Bewertungen

- Intangible Assets, Intellectual Capital and Balanced ScorecardDokument5 SeitenIntangible Assets, Intellectual Capital and Balanced Scorecardouciefnadia1973Noch keine Bewertungen

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveVon EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNoch keine Bewertungen

- Artificial Intelligence in Financial Markets: Cutting Edge Applications for Risk Management, Portfolio Optimization and EconomicsVon EverandArtificial Intelligence in Financial Markets: Cutting Edge Applications for Risk Management, Portfolio Optimization and EconomicsChristian L. DunisNoch keine Bewertungen

- Analyzing the Fair Market Value of Assets and the Stakeholders' Investment DecisionsVon EverandAnalyzing the Fair Market Value of Assets and the Stakeholders' Investment DecisionsNoch keine Bewertungen

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationVon EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNoch keine Bewertungen

- v2Dokument15 Seitenv2saliah85Noch keine Bewertungen

- Practical Fuzzy "Nite Element Analysis of Structures: U.O. Akpan, T.S. Koko, I.R. Orisamolu, B.K. GallantDokument19 SeitenPractical Fuzzy "Nite Element Analysis of Structures: U.O. Akpan, T.S. Koko, I.R. Orisamolu, B.K. Gallantsaliah85Noch keine Bewertungen

- Ajsr 34 05Dokument8 SeitenAjsr 34 05saliah85100% (1)

- Cancer Res 2009 Nasarre 1324 33Dokument11 SeitenCancer Res 2009 Nasarre 1324 33saliah85Noch keine Bewertungen

- Stability Regions in Quadrupole Ion Trap: Adv. Studies Theor. Phys., Vol. 6, 2012, No. 5, 225 - 232Dokument8 SeitenStability Regions in Quadrupole Ion Trap: Adv. Studies Theor. Phys., Vol. 6, 2012, No. 5, 225 - 232saliah85Noch keine Bewertungen

- Finite Elemente Method For Flow ProblemDokument9 SeitenFinite Elemente Method For Flow Problemsaliah85Noch keine Bewertungen

- Grid Adaptation Via Node MovementDokument20 SeitenGrid Adaptation Via Node Movementsaliah85Noch keine Bewertungen

- Hypothesis Testing and Inferential StatisticsDokument19 SeitenHypothesis Testing and Inferential StatisticsnityaNoch keine Bewertungen

- MAE 108 Final Exam Probability and Statistical Methods GuideDokument8 SeitenMAE 108 Final Exam Probability and Statistical Methods Guidejj012586Noch keine Bewertungen

- E 7 Bda 3 CaDokument15 SeitenE 7 Bda 3 CaKaranNoch keine Bewertungen

- Inferential StatsDokument11 SeitenInferential Statsvisu009Noch keine Bewertungen

- A Course in Mathematical Statistics George G. Roussas p593 TDokument593 SeitenA Course in Mathematical Statistics George G. Roussas p593 TGooreshNoch keine Bewertungen

- Studying The Impact of Spiritual Intelligence On Job EngagementDokument5 SeitenStudying The Impact of Spiritual Intelligence On Job EngagementTI Journals PublishingNoch keine Bewertungen

- A Review On Concept DriftDokument7 SeitenA Review On Concept DriftInternational Organization of Scientific Research (IOSR)Noch keine Bewertungen

- DrAshrafElsafty ResearchMehods ESLSCA July12Dokument297 SeitenDrAshrafElsafty ResearchMehods ESLSCA July12mezo_noniNoch keine Bewertungen

- ANOVA detergent brands whiteness ratingsDokument2 SeitenANOVA detergent brands whiteness ratingsAlicia GuyNoch keine Bewertungen

- Statisticsprobability11 q4 Week6 v4Dokument9 SeitenStatisticsprobability11 q4 Week6 v4Sheryn CredoNoch keine Bewertungen

- Asset-liability gap analysis of Indian banksDokument8 SeitenAsset-liability gap analysis of Indian banksTelika RamuNoch keine Bewertungen

- Business AnalyticsDokument8 SeitenBusiness Analyticsssssstt62201450% (2)

- Tests of SignificanceDokument40 SeitenTests of SignificanceRahul Goel100% (1)

- The Nine Nations of North America v2Dokument13 SeitenThe Nine Nations of North America v2Vinay Xavier100% (1)

- Math 1040 Skittles Term ProjectDokument8 SeitenMath 1040 Skittles Term Projectapi-272870073Noch keine Bewertungen

- T Distribution TableDokument1 SeiteT Distribution TableEesha MusicNoch keine Bewertungen

- A Brief Overview of The Classical Linear Regression Model: Introductory Econometrics For Finance' © Chris Brooks 2013 1Dokument80 SeitenA Brief Overview of The Classical Linear Regression Model: Introductory Econometrics For Finance' © Chris Brooks 2013 1sdfasdgNoch keine Bewertungen

- QB BCom BBA Business Research MethodsDokument22 SeitenQB BCom BBA Business Research MethodsMaheswar KondreddyNoch keine Bewertungen

- ANOVA of Unequal Sample Sizes - AssessmentDokument2 SeitenANOVA of Unequal Sample Sizes - Assessmentyzabelle marie mendozaNoch keine Bewertungen

- Pengaruh Media Promosi Gizi Terhadap Peningkatan PDokument10 SeitenPengaruh Media Promosi Gizi Terhadap Peningkatan PDwi KarismaNoch keine Bewertungen

- Pre-Test & Post Test Analysis Sample ComputationsDokument8 SeitenPre-Test & Post Test Analysis Sample ComputationsJai AidamusNoch keine Bewertungen

- Statistic and PRO. B. E. (Civil IV - Computer - E&C VI)Dokument0 SeitenStatistic and PRO. B. E. (Civil IV - Computer - E&C VI)www.bhawesh.com.npNoch keine Bewertungen

- IB Biology Internal Assessment Rubric (38Dokument3 SeitenIB Biology Internal Assessment Rubric (38Natsuki YoshiokaNoch keine Bewertungen

- Paper 2 Revision Pack (198 Marks)Dokument27 SeitenPaper 2 Revision Pack (198 Marks)Cora OliveraNoch keine Bewertungen

- MATH11002 PRAC Modules RecoDokument131 SeitenMATH11002 PRAC Modules RecoYosef BayuNoch keine Bewertungen

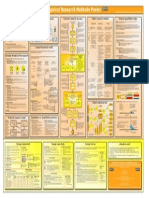

- ResearchMethods Poster A4 en Ver 1.0Dokument1 SeiteResearchMethods Poster A4 en Ver 1.0Gitarja SandiNoch keine Bewertungen

- STATSDokument2 SeitenSTATSPrincess Jovie BitangaNoch keine Bewertungen

- "The Truth Wears Off: Is There Something Wrong With The Scientific Method?" (By Jonah Lehrer, The New Yorker)Dokument6 Seiten"The Truth Wears Off: Is There Something Wrong With The Scientific Method?" (By Jonah Lehrer, The New Yorker)Sandy CohenNoch keine Bewertungen

- Point Estimation and Interval Estimation: Learning ObjectivesDokument58 SeitenPoint Estimation and Interval Estimation: Learning ObjectivesVasily PupkinNoch keine Bewertungen

- Kruskal Wallis TestDokument12 SeitenKruskal Wallis TestRonald DarwinNoch keine Bewertungen