Beruflich Dokumente

Kultur Dokumente

Indian Agri Input Companies

Hochgeladen von

pratima_uniyalOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indian Agri Input Companies

Hochgeladen von

pratima_uniyalCopyright:

Verfügbare Formate

Indian agri-input companies thrive, thanks to sustained rural demand------In a global economy battling recessionary pressures, the Indian

economy too witnessed a slowdown in growth in the past year. However, Indias rural economy remained virtually unscathed, in part due to the countrys almost autonomous agricultural sector. With a large rural population base dependent on farming and allied industries, agriculture continues to be the priority area for the Indian government. The past year witnessed reasonably good minimum support prices and open market prices for several crops. All these factors point to reasonably good growth prospects for agriculture and, by logical extension, for the agro-input industry. While companies in industries ranging from telecom to consumer goods benefited from their rural forays, the success of the purely rural companies was more visible. Companies that predominantly cater to the rural marketfertilisers, agrochemicals, producers of farm inputs such as tractors or irrigation systemsmade a strong showing. The domestic demand for fertilisers grew by 11% in FY09, as against a 2.2% decline globally. In spite of the strong demand, the domestic fertiliser production continued to stagnate for reasons such as limited availability of natural gas and plant shutdowns. For example, for two months during the year, Tata Chemicals shut its urea plant at Babrala for debottlenecking and shut its phosphatics plant at Haldia due to uneconomic operations. Several fertiliser companies, including Coromandel Fertilisers, Zuari Industries, Fertiliser and Chemicals Travancore (FACT) and GSFC, more than doubled their reported profit numbers as compared to the previous year. Endorsing the performance of soil nutrients industry, the crop protection and seeds industries too had a reasonably good year in FY09. The global crop protection market is estimated to have grown at 25%, reaching $41 billion with nearly 10% volume growth. In India, however, although the market expanded by over 10%, there was a marginal fall in volumes. Nevertheless, the industry leaders fared well. United Phosphorous reported a strong 61% jump in its net profitsto Rs 147.7 crorefollowing an equally strong 65% growth in net sales to Rs 2327.4 crore. Rallis India, too, expanded its operating profits by 83% to Rs 119.5 crore. M&M, Indias largest tractor manufacturer, which merged with Punjab Tractors in August 2008, reported a 21% jump in its tractor sales during the year. Similarly, Jain Irrigation, Indias largest manufacturer of irrigation systems, had a robust year. However the notional loss of Rs 77.7 crore on forex fluctuations resulted in a stagnant net profit.

The other major PVC pipes manufacturer Finolex Industries reported a 24% volume growth in pipe sales to 94400 tonne, while the polymer sales grew just 2% to 1.92 lakh tonne. Similarly, in value terms, the pipes business grew by 27%, reaching Rs 566.5 crore, as against the 0.6% growth in the polymer business, which reached Rs 862 crore. In view of the strong growth prospects, the company plans to expand its pipes capacity by 40%. The rural-focused companies gained substantially on the list of Indias largest 500 listed companies for FY09. FACT was the biggest gainer, jumping 200 notches to 235th position for FY09, with Bayer Cropscience jumping 82 notches to 309th rank. Coromandel Fertilisers, Mangalore Chemicals, Zuari Industries, Chambal Fertilisers GSFC, Deepak Fertilisers, Tata Chemicals and RCF were the other major gainers. GNFC turned out to be the largest loser, falling 43 places to 183rd position, followed by Escorts, which lost 33 places to be ranked 197th among the companies. The fundamentals of the agriculture sector continue to be robust and will drive growth in the years to come. With the availability of land under agriculture being limited and decreasing in many areas, the need to drive productivity by judicious use of appropriate agri-inputs is imperative. Thus, the long-term growth prospects of companies focused on the rural economy will remain attractive.

Das könnte Ihnen auch gefallen

- Chemical-Market TrendsDokument35 SeitenChemical-Market TrendsNirula SinghNoch keine Bewertungen

- SWOT ANALYSIS of Agro Chemical IndustryDokument4 SeitenSWOT ANALYSIS of Agro Chemical Industryjaya rani dasNoch keine Bewertungen

- Transforming Agriculture Through Mechanisation: A Knowledge Paper On Indian Farm Equipment SectorDokument56 SeitenTransforming Agriculture Through Mechanisation: A Knowledge Paper On Indian Farm Equipment SectorNitin RazdanNoch keine Bewertungen

- A Case Study On Engro FertilizersDokument17 SeitenA Case Study On Engro FertilizersManzoor Ahmed Memon100% (2)

- The Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryDokument6 SeitenThe Petrochemical Industry in India Has Been One of The Fastest Growing Industries in The CountryVishakh KrishnanNoch keine Bewertungen

- E-Business Tax Application SetupDokument25 SeitenE-Business Tax Application Setuprasemahe4100% (1)

- Governance of Regional Transit Systems: Washington, New York, and TorontoDokument34 SeitenGovernance of Regional Transit Systems: Washington, New York, and TorontoThe Wilson CenterNoch keine Bewertungen

- Project Report On AgrochemicalsDokument31 SeitenProject Report On Agrochemicalskamdica78% (18)

- Ch. 13 Leverage and Capital Structure AnswersDokument23 SeitenCh. 13 Leverage and Capital Structure Answersbetl89% (27)

- India's Massive Fertilizer IndustryDokument5 SeitenIndia's Massive Fertilizer IndustrydreamzcastNoch keine Bewertungen

- A Report On Integrated Marketing Communication Plan For Dove Baby Care Products in IndiaDokument14 SeitenA Report On Integrated Marketing Communication Plan For Dove Baby Care Products in IndiaSukanya Bhattacharjee80% (5)

- Deccan Pumps Internship ReportDokument61 SeitenDeccan Pumps Internship ReportAmar Nath54% (13)

- Fra Group 6Dokument42 SeitenFra Group 6aria.joshi30Noch keine Bewertungen

- SWOT ANALYSIS of Agro Chemical IndustryDokument4 SeitenSWOT ANALYSIS of Agro Chemical IndustryVarsha Kasture86% (7)

- FI Alpha-CoromandelInternationalLimitedDokument7 SeitenFI Alpha-CoromandelInternationalLimitedAkshaya SrihariNoch keine Bewertungen

- India's Fertilizer IndustryDokument15 SeitenIndia's Fertilizer Industrydevika20Noch keine Bewertungen

- 02 112201 006 10451176447 07062023 010543amDokument20 Seiten02 112201 006 10451176447 07062023 010543amsara hashimNoch keine Bewertungen

- Basty Sushmitha Shenoy - 4SF18MBA15 - Part B Main ReportDokument77 SeitenBasty Sushmitha Shenoy - 4SF18MBA15 - Part B Main ReportDeepthi NNoch keine Bewertungen

- Fertilizer Industry Report AnalysisDokument39 SeitenFertilizer Industry Report AnalysisSamad Ali QureshiNoch keine Bewertungen

- Chemical Industry - Aarti and AtulDokument24 SeitenChemical Industry - Aarti and AtulDisha Modi100% (1)

- Fauji Fertilizer Profit Up 29Dokument6 SeitenFauji Fertilizer Profit Up 29Sidra NaeemNoch keine Bewertungen

- Fertilizer Industry: Review On Pakistan's Fertilizers IndustryDokument72 SeitenFertilizer Industry: Review On Pakistan's Fertilizers IndustryMuhammad AwaisNoch keine Bewertungen

- Agricultural Inputs Marketing in IndiaDokument34 SeitenAgricultural Inputs Marketing in Indiakiran22vyasNoch keine Bewertungen

- Bsil Diversification: Chemical Plant and Equipment Manufacturing IndustryDokument27 SeitenBsil Diversification: Chemical Plant and Equipment Manufacturing IndustryGauravTaleleNoch keine Bewertungen

- The Thunder PicksDokument7 SeitenThe Thunder PicksManjeet SinghNoch keine Bewertungen

- Fauji Fertilizer Company LimitedDokument4 SeitenFauji Fertilizer Company LimitedKarin PhelpsNoch keine Bewertungen

- Fertilizer Industry AnalysisDokument18 SeitenFertilizer Industry AnalysisZain Bin IshaqNoch keine Bewertungen

- India's cement industry outpaces China's growthDokument92 SeitenIndia's cement industry outpaces China's growthAbdulgafoor NellogiNoch keine Bewertungen

- Executive Summary: Cement IndustryDokument97 SeitenExecutive Summary: Cement Industryst miraNoch keine Bewertungen

- Financial A of NFLDokument66 SeitenFinancial A of NFLybj9899Noch keine Bewertungen

- Executive Summary: Cement IndustryDokument81 SeitenExecutive Summary: Cement IndustrySankaraharan ShanmugamNoch keine Bewertungen

- Strategy AnalysisDokument15 SeitenStrategy Analysispriyankakohli88Noch keine Bewertungen

- Fertilizers Industry OverviewDokument83 SeitenFertilizers Industry Overviewkaushikneha24Noch keine Bewertungen

- The Indian Tractor Industry - Bumpy Road AheadDokument3 SeitenThe Indian Tractor Industry - Bumpy Road AheadSanjana AcharyaNoch keine Bewertungen

- New SAPM Avi FinalDokument12 SeitenNew SAPM Avi FinalavismlNoch keine Bewertungen

- Executive Summary: Cement IndustryDokument92 SeitenExecutive Summary: Cement Industrypratap_sivasaiNoch keine Bewertungen

- Indian Cement Industry ReportDokument92 SeitenIndian Cement Industry ReportShone ThattilNoch keine Bewertungen

- Indian Cement Industry ReportDokument92 SeitenIndian Cement Industry ReportShone ThattilNoch keine Bewertungen

- Reliance Industries Limted Company AnalysisDokument10 SeitenReliance Industries Limted Company AnalysisDivya Prakash MishraNoch keine Bewertungen

- Business Finance Report - Fatima Fertilizer Group 5Dokument24 SeitenBusiness Finance Report - Fatima Fertilizer Group 5Sarah KhurshidNoch keine Bewertungen

- Tractor Industry ReportDokument12 SeitenTractor Industry ReportIyerNoch keine Bewertungen

- BLK Industries: Industry Analysis:: Understanding The Niche Sector of The CompanyDokument7 SeitenBLK Industries: Industry Analysis:: Understanding The Niche Sector of The Companyneelakanta srikarNoch keine Bewertungen

- Chemicals May 2021Dokument36 SeitenChemicals May 2021Michelle CastelinoNoch keine Bewertungen

- Indian Tractor Industry Continues Strong GrowthDokument47 SeitenIndian Tractor Industry Continues Strong Growthsatishnirwatla100% (1)

- Growth of Ready-to-Eat Foods in IndiaDokument2 SeitenGrowth of Ready-to-Eat Foods in IndiaShantanu BhargavaNoch keine Bewertungen

- 1 Fiev-A T4Dokument27 Seiten1 Fiev-A T4shreya sarkarNoch keine Bewertungen

- Market Share: Mahindra Tractors - It Is The Highest Selling Tractor With The Market Share of 38%. It Is TheDokument3 SeitenMarket Share: Mahindra Tractors - It Is The Highest Selling Tractor With The Market Share of 38%. It Is TheRJ Rishu JalanNoch keine Bewertungen

- Coromandel International LTD Result Update - Q4FY12Dokument4 SeitenCoromandel International LTD Result Update - Q4FY12sneha.j26Noch keine Bewertungen

- Industry Review:: FFC FFBL Engro Dawood Hercules Production Capacity 1,300,000 Tons 975,000 Tons Per AnnumDokument9 SeitenIndustry Review:: FFC FFBL Engro Dawood Hercules Production Capacity 1,300,000 Tons 975,000 Tons Per AnnumDia AslamNoch keine Bewertungen

- Understanding The Niche Sector of The Company:: BLK Industries: Industry AnalysisDokument6 SeitenUnderstanding The Niche Sector of The Company:: BLK Industries: Industry AnalysisJanastus LouieNoch keine Bewertungen

- Organic acid fertilizer business planDokument21 SeitenOrganic acid fertilizer business planPoushali DuttaNoch keine Bewertungen

- FFC Report on Leading Fertilizer Company in PakistanDokument27 SeitenFFC Report on Leading Fertilizer Company in PakistanNabeel AftabNoch keine Bewertungen

- FertilizersDokument31 SeitenFertilizersKhushi Shaharavat222Noch keine Bewertungen

- Bharat Rasayan StockDokument8 SeitenBharat Rasayan StockajaynkotiNoch keine Bewertungen

- Mangalore Chemical and Fertilizers LimitedDokument63 SeitenMangalore Chemical and Fertilizers LimitedRaghavendra0% (1)

- English Assignment 3 (Report)Dokument3 SeitenEnglish Assignment 3 (Report)Danial RashidNoch keine Bewertungen

- Agriculture Sector Another Boom in Indian Stock Market - SharetipsinfoDokument4 SeitenAgriculture Sector Another Boom in Indian Stock Market - SharetipsinfoKaushik Balachandar100% (1)

- Indian Forging Industry OverviewDokument9 SeitenIndian Forging Industry OverviewTalib KhanNoch keine Bewertungen

- RCF - Annual ReportDokument264 SeitenRCF - Annual ReportitrrustNoch keine Bewertungen

- UPL Capital StructureDokument3 SeitenUPL Capital StructuresharadgpatelNoch keine Bewertungen

- Agriculture and Allied Industries October 2019 PDFDokument38 SeitenAgriculture and Allied Industries October 2019 PDFIam ceo100% (1)

- Cambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapVon EverandCambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapNoch keine Bewertungen

- Food Outlook: Biannual Report on Global Food Markets: November 2019Von EverandFood Outlook: Biannual Report on Global Food Markets: November 2019Noch keine Bewertungen

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitVon EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNoch keine Bewertungen

- How To Attack The Leader - FinalDokument14 SeitenHow To Attack The Leader - Finalbalakk06Noch keine Bewertungen

- SAP Project Systems OverviewDokument6 SeitenSAP Project Systems OverviewkhanmdNoch keine Bewertungen

- Keegan gm7 STPPT 01Dokument20 SeitenKeegan gm7 STPPT 01Dirco JulioNoch keine Bewertungen

- India Is The Second Largest Employment Generator After AgricultureDokument2 SeitenIndia Is The Second Largest Employment Generator After AgriculturevikashprabhuNoch keine Bewertungen

- LC Financial Report & Google Drive Link: Aiesec Delhi IitDokument6 SeitenLC Financial Report & Google Drive Link: Aiesec Delhi IitCIM_DelhiIITNoch keine Bewertungen

- BDW94CDokument7 SeitenBDW94CWalter FabianNoch keine Bewertungen

- Finals Quiz #2 Soce, Soci, Ahfs and Do Multiple Choice: Account Title AmountDokument3 SeitenFinals Quiz #2 Soce, Soci, Ahfs and Do Multiple Choice: Account Title AmountNew TonNoch keine Bewertungen

- European Culinary Management & Western Gastronomic CookeryDokument6 SeitenEuropean Culinary Management & Western Gastronomic CookeryJennifer MuliadyNoch keine Bewertungen

- Environmental Assessment Template Group MembersDokument4 SeitenEnvironmental Assessment Template Group MembersPaula NguyenNoch keine Bewertungen

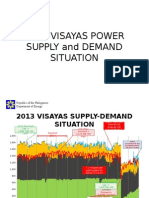

- 2013 Visayas Power Supply and Demand Situation: Republic of The Philippines Department of EnergyDokument10 Seiten2013 Visayas Power Supply and Demand Situation: Republic of The Philippines Department of EnergyJannet MalezaNoch keine Bewertungen

- Idea Bridge - 100 Success Plan For Crisis Recovery & New CeoDokument6 SeitenIdea Bridge - 100 Success Plan For Crisis Recovery & New CeoJairo H Pinzón CastroNoch keine Bewertungen

- Bill of Lading: Cable: CSHKAC Telex: 87986 CSHKAHX Port-to-Port or Combined TransportDokument1 SeiteBill of Lading: Cable: CSHKAC Telex: 87986 CSHKAHX Port-to-Port or Combined TransportMoineeNoch keine Bewertungen

- Presented By: Sainbu Dutt Gupta Mukul Mansharamani Nikhil BhatiaDokument16 SeitenPresented By: Sainbu Dutt Gupta Mukul Mansharamani Nikhil BhatiaSirohi JatNoch keine Bewertungen

- Cash Inflow and OutflowDokument6 SeitenCash Inflow and OutflowMubeenNoch keine Bewertungen

- Main Theories of FDIDokument22 SeitenMain Theories of FDIThu TrangNoch keine Bewertungen

- Cash Forecasting For ClassDokument24 SeitenCash Forecasting For ClassShaikh Saifullah KhalidNoch keine Bewertungen

- PWC NPL June18Dokument64 SeitenPWC NPL June18Murdoc Alphonce NicallsNoch keine Bewertungen

- Long-Term Contracts Loss AdjustmentDokument30 SeitenLong-Term Contracts Loss AdjustmentDina Adel DawoodNoch keine Bewertungen

- Lecture7 - Equipment and Material HandlingDokument52 SeitenLecture7 - Equipment and Material HandlingAkimBiNoch keine Bewertungen

- Term Paper-IMCDokument9 SeitenTerm Paper-IMCMazharul Islam AnikNoch keine Bewertungen

- The Investment Function in Banking and Financial-Services ManagementDokument18 SeitenThe Investment Function in Banking and Financial-Services ManagementHaris FadžanNoch keine Bewertungen

- The Russian Oil Refining FactoriesDokument17 SeitenThe Russian Oil Refining Factoriestomica06031969Noch keine Bewertungen

- Hygeia International: I. Title of The CaseDokument7 SeitenHygeia International: I. Title of The CaseDan GabonNoch keine Bewertungen

- Hygienic Chappathi Business Loan ReportDokument13 SeitenHygienic Chappathi Business Loan ReportJose PiusNoch keine Bewertungen

- Chapter 4 Transportation and Assignment ModelsDokument88 SeitenChapter 4 Transportation and Assignment ModelsSyaz Amri100% (1)

- Business Model Canvas Template For Social Enterprise: PurposeDokument1 SeiteBusiness Model Canvas Template For Social Enterprise: PurposeadinaNoch keine Bewertungen