Beruflich Dokumente

Kultur Dokumente

Global Sourcing Trends

Hochgeladen von

raghavendra38Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Global Sourcing Trends

Hochgeladen von

raghavendra38Copyright:

Verfügbare Formate

1.

GLOBAL SOURCING TRENDS

Worldwide technology products and related services spend is estimated to cross USD 1.6 trillion in 2008, a growth of 5.6 per cent over 2007.

Worldwide BPO spending in 2008 grew by 12 per cent, which was the highest among all the segments. BPO today is an integral part of the global delivery chainand is increasingly involved in mission critical applications.

Global sourcing market size has increased threefold since 2004, to reach USD 89-93 billion in 2008.

Offshore IT-BPO service providers continued to build their global delivery footprint, expanding service lines and also growing inorganically by acquiring firms in the US and Europe to build skills and nearshore delivery capabilities. Therefore,

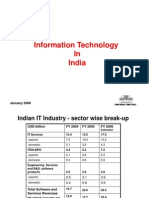

thoughthe established players dominated the market, Indian heritage service providers gained ground and market share. 2. IT-BPO SECTOR-OVERVIEW

Total IT-BPO industry to reach USD 71.7 billion accounting for 5.8% of Indias GDP; software and services revenues aggregated to about USD 60 billion

Software and Services export revenues estimated to grow over 16-17% to reach USD 47 billion

Direct employment expected to reach nearly 2.23 million, an addition of 226,000 employees, while indirect job creation estimated at ~8 million Indias fundamental advantagesabundant talent and costare sustainable overthe long term. With a young demographic profile and over 3.5 million graduates and postgraduates that are added annually to the talent base, no other country offers a similar mix and scale of human resources

Seven Indian cities account for 95 per cent of export revenues, focus on developing 43 new locations to emerge as IT-BPO hubs

Higher growth in European/Asian market

2a. IT SERVICES, ENGINEERING SERVICES, R&D AND SOFTWARE PRODUCTS IT SERVICES IT Services involves a full range of engagement types that include consulting, systems integration, IT outsourcing/managed services/hosting services, training and support/maintenance.

IT services (excluding BPO, Engineering Services, R&D and Software products), contributing to 57 per cent of the total software and services exports,

remains thedominant segment and is estimated at USD 26.9 billion, a growth of nearly 16.5 per cent in FY2009.

Domestic IT services spends grew at over 43 per cent in FY2008, showing strong signs of increasing sophistication as building enterprise IT infrastructures and applications, networking and communication became key priorities for India Inc.

ENGINEERING SERVICES, R&D AND SOFTWARE PRODUCTS

The engineering, R&D, and software products exports segment is expected to grow by 14.4 per cent in the current fiscal, to touch USD 7.3 billion, which highlights thestrong impetus and renewed focus on improving IP driven service capabilities inIndia.

Indian software product companies revenues are expected to account for 21 per cent of total software product revenues in FY2009, up from 20.6 per cent in FY2008. The market is expected to grow exponentially driven by an increasing number of start-up software product businesses as well as a rapid growth of existing businesses.

2b. BPO MARKET

BPO services exports, up 18 per cent, was the fastest growing segment across software and services exports driven by scale as well as scope. BPO serviceportfolio was strengthened by vertical specialization and global delivery capabilities.

Emergence of domestic BPO is the key highlight for FY2009 recording a growth of above 40 per cent in INR terms. The growth is led by the BFSI, Telecom and Airline industries and a greater vendor focus with specific service offering

Horizontal BPO, accounting for more than 80 per cent of Indian BPO exports, represents the larger and relatively more established set of services being delivered from India

Other

aspects

of

Indian

BPO,

besides the growing

breadth

and

depth

of the serviceportfolio, that reflect its increasing maturity include the increasing global delivery footprint and continuous emphasis on enhancing service delivery efficiency and productivity. 2c. HARDWARE MARKET

Despite the declining trends in pricing observed across key categories, increasing volumes have ensured that the domestic hardware revenue aggregate continues to grow. While hardware exports remained steady, domestic hardware segment remains the largest segment to grow at 17 per cent in INR terms during FY 2009.

PC adoption is growing at more than 30 per cent incase of SMBs

3. INDIANS IT-BPO VALUE PROPOSITION Strong fundamentals, a robust enabling environment, and enhanced value delivery capability are the hallmarks of the Indian IT-BPO industry.

India enjoys a cost advantage of around 60-70 per cent as compared to source markets. Additional productivity improvements and the development of tier 2/3 cities as future delivery centres, is expected to enhance Indias cost competitiveness.

Timely government policies and increased public-private participation have played a key role in developing an enabling business environment for the Indian IT-BPO industry. The Governments focus on education has helped create the large talent base from where the industry draws its workforce. The Governments proactive approach towards the IT-BPO industry was further highlighted in 2008 through actions such as the IT Act Amendment, extension of tax incentives by a year, removal of the SEZ Act

anomalies and the introduction of progressive telecom policies that focus on work from home.

Indian companies are now trying to adopt a culture that encourages innovation, embrace new trends such as Green IT, and deliver solutions that are focused on re-engineering and transformation. India is emerging as a leading Innovation hub with increasing number of patents being filed and granted from India

The silver lining of the economic downturn is the opportunity for the industry to enhance its overall efficiency. Companies are increasingly looking inwards and focusing on process benchmarking, enhanced utilization of infrastructure and talent, increasing productivity and greater customer engagement

4. FUTURE OUTLOOK

Despite the unprecedented economic downturn the industry will witness sustainable growth

The global technology related spending is expected to grow from 2010 onwards led by growth in outsourcing adoption.

Greater focus on cost and operational efficiencies in the recessionary environment is expected to enhance global sourcing

India Inc would remain focused on tactical measures to achieve cost savings and greater productivity

Services and software segments are estimated to cross USD 1.2 trillion by 2012. This is more than the 5.2 per cent growth expected in the total IT spending

The huge potential for global sourcing is further highlighted by an addressable market size of USD 500 billion in 2008, which is more than five times bigger thanthe current market

The industry will continue to diversify in terms of geographies, verticals and servicelines SMBs are expected to emerge as a significant opportunity due to lower IT adoption currently

Lack of working age population in the developed economies and a significant long term cost arbitrage indicates Indias sustained cost competitiveness

Service providers are expected to enhance focus to domestic market to de-risk business and tap into the local growth opportunities

Das könnte Ihnen auch gefallen

- Indian BPO IndustryDokument4 SeitenIndian BPO Industrysanjanasingh29Noch keine Bewertungen

- Executive Summary of NascomDokument6 SeitenExecutive Summary of Nascomgsatch4uNoch keine Bewertungen

- Industry OutlookDokument7 SeitenIndustry OutlookRahul KumarNoch keine Bewertungen

- Studiu de Caz IndiaDokument17 SeitenStudiu de Caz IndiaAngela IriciucNoch keine Bewertungen

- Chapter 2 & 3: "Industry Overview, Literature Review & Research Methodology"Dokument18 SeitenChapter 2 & 3: "Industry Overview, Literature Review & Research Methodology"A KNoch keine Bewertungen

- A Snap Shot of Indian IT IndustryDokument10 SeitenA Snap Shot of Indian IT IndustryGanesh JanakiramanNoch keine Bewertungen

- Financial Analysis On TcsDokument28 SeitenFinancial Analysis On TcsBidushi Patro20% (5)

- Summer Project - HarshitaDokument19 SeitenSummer Project - Harshitasailesh60Noch keine Bewertungen

- FM AssignmentDokument30 SeitenFM AssignmentHemendra GuptaNoch keine Bewertungen

- Assignment On Strategic Management: Topic: Company Analysis of InfosysDokument8 SeitenAssignment On Strategic Management: Topic: Company Analysis of InfosysPrithvi RajNoch keine Bewertungen

- SM IT Industryanalysis - Report - Rungthip and AkhilDokument35 SeitenSM IT Industryanalysis - Report - Rungthip and AkhilAkhil AgarwalNoch keine Bewertungen

- IT and ITeS Industry in India PDFDokument7 SeitenIT and ITeS Industry in India PDFMujahid RezaNoch keine Bewertungen

- Wipro Technologies LTD.: Sapm Project Submission Submitted byDokument18 SeitenWipro Technologies LTD.: Sapm Project Submission Submitted byManoj ThadaniNoch keine Bewertungen

- Software Sector Analysis ReportDokument8 SeitenSoftware Sector Analysis ReportpintuNoch keine Bewertungen

- It Sector: BY Harmeet SehgalDokument9 SeitenIt Sector: BY Harmeet SehgalMonisha MalhotraNoch keine Bewertungen

- Report On Indian IT IndustryDokument7 SeitenReport On Indian IT IndustryMandar KulkarniNoch keine Bewertungen

- Submitted in Partial Fulfillment of The Requirements For The Award of DegreeDokument46 SeitenSubmitted in Partial Fulfillment of The Requirements For The Award of DegreeShilpa SharmaNoch keine Bewertungen

- Financial Meltdown: Threats & Opportunities For Indian I T SectorDokument2 SeitenFinancial Meltdown: Threats & Opportunities For Indian I T SectorNitesh NigamNoch keine Bewertungen

- Industry & Services Information Technology and Information Technology Enabled Services (Ites)Dokument9 SeitenIndustry & Services Information Technology and Information Technology Enabled Services (Ites)rohityadavalldNoch keine Bewertungen

- SWOT Analysis of Infosys: Submitted by Sharwan Kumar Mahala JKBS - 090450Dokument20 SeitenSWOT Analysis of Infosys: Submitted by Sharwan Kumar Mahala JKBS - 090450Ashutosh Kumar Dubey100% (1)

- Strategic Review 2011Dokument1 SeiteStrategic Review 2011Rucha_123Noch keine Bewertungen

- Snehal KambleDokument63 SeitenSnehal KambleSheeba MaheshwariNoch keine Bewertungen

- MMMMDokument28 SeitenMMMMJayanth KumarNoch keine Bewertungen

- Full Project Ashok ADokument73 SeitenFull Project Ashok AKhan SultanNoch keine Bewertungen

- Information Technology in India: January 2006Dokument18 SeitenInformation Technology in India: January 2006richdev009_106456088100% (1)

- Information Technology OutsourcingDokument7 SeitenInformation Technology OutsourcingPradeep ChintadaNoch keine Bewertungen

- Name: Chintada - Pradeep 1226113112 Information Technology Outsourcing SummaryDokument7 SeitenName: Chintada - Pradeep 1226113112 Information Technology Outsourcing SummaryPradeep ChintadaNoch keine Bewertungen

- Chapter - V Summary, Conclusion & Suggestions Summary:: Page - 144Dokument11 SeitenChapter - V Summary, Conclusion & Suggestions Summary:: Page - 144vSravanakumarNoch keine Bewertungen

- IT Industry in IndiaDokument22 SeitenIT Industry in IndiakrisNoch keine Bewertungen

- It in IndiaDokument27 SeitenIt in Indiashashank0803Noch keine Bewertungen

- Information Technology: Review of The Ninth PlanDokument16 SeitenInformation Technology: Review of The Ninth PlanAyush TripathiNoch keine Bewertungen

- Information Technology Sector of IndiaDokument20 SeitenInformation Technology Sector of IndiaFaizan MukaddamNoch keine Bewertungen

- Industry Analysis of ItDokument6 SeitenIndustry Analysis of ItDurgesh KumarNoch keine Bewertungen

- PESTEL Framework For IT Sector: 1. Political FactorsDokument14 SeitenPESTEL Framework For IT Sector: 1. Political FactorsJevian FernandezNoch keine Bewertungen

- Yy Yy Yy Yy Yy Yy: C C Y Yyyy Yy Yyyyy YDokument5 SeitenYy Yy Yy Yy Yy Yy: C C Y Yyyy Yy Yyyyy Ysajna25Noch keine Bewertungen

- Jom 05 03 006Dokument9 SeitenJom 05 03 006kureshia249Noch keine Bewertungen

- IT Industry in India: Indian Education SystemDokument9 SeitenIT Industry in India: Indian Education SystemPradeep BommitiNoch keine Bewertungen

- Internship ReportDokument39 SeitenInternship ReportAnkith BhansaliNoch keine Bewertungen

- Relative Valuation RepoDokument4 SeitenRelative Valuation RepoPrasanth TalluriNoch keine Bewertungen

- Nasscom - The IT-BPO Sector N IndiaDokument8 SeitenNasscom - The IT-BPO Sector N IndiaKarthik RajaramNoch keine Bewertungen

- IT IndustryDokument16 SeitenIT IndustrySneha DeoreNoch keine Bewertungen

- Role of Bpo and Its Impact On Indian EconomyDokument11 SeitenRole of Bpo and Its Impact On Indian EconomyYash PatniNoch keine Bewertungen

- Panaroma - ICT - 2014Dokument4 SeitenPanaroma - ICT - 2014Shubham AroraNoch keine Bewertungen

- Scenerio of IT Industry in IndiaDokument9 SeitenScenerio of IT Industry in IndiaDeepjyoti ChoudhuryNoch keine Bewertungen

- Industry Report On IT SectorDokument16 SeitenIndustry Report On IT SectorSailesh Kumar Patel100% (2)

- IT & ITeS - 2020Dokument27 SeitenIT & ITeS - 2020Ashutosh PatidarNoch keine Bewertungen

- Marketing Plan For Office Ethics SoftwareDokument41 SeitenMarketing Plan For Office Ethics SoftwarehafizNoch keine Bewertungen

- Indian Information Technology Industry: Presented By: Govind Singh KushwahaDokument14 SeitenIndian Information Technology Industry: Presented By: Govind Singh KushwahadrgovindsinghNoch keine Bewertungen

- IT Industry. AnalysisDokument20 SeitenIT Industry. AnalysisVaibhav MoreNoch keine Bewertungen

- PANKAJDokument54 SeitenPANKAJPankaj RaiNoch keine Bewertungen

- Annualreport2009 10Dokument132 SeitenAnnualreport2009 10Abhishek KumarNoch keine Bewertungen

- Key Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityDokument6 SeitenKey Highlights of The NASSCOM - IDC Study On The Domestic Services (IT - ITES) Market OpportunityshashankrandevNoch keine Bewertungen

- IT and BPM November 2020Dokument33 SeitenIT and BPM November 2020minaf47Noch keine Bewertungen

- Presentation For IT in INDIA by SABITAVO DASDokument30 SeitenPresentation For IT in INDIA by SABITAVO DASSabitavo DasNoch keine Bewertungen

- IT Sector: in IndiaDokument36 SeitenIT Sector: in IndiaSophia JamesNoch keine Bewertungen

- It Sector in India PDFDokument77 SeitenIt Sector in India PDFAnish NairNoch keine Bewertungen

- Moving up the Value Chain: The Road Ahead for Indian It ExportersVon EverandMoving up the Value Chain: The Road Ahead for Indian It ExportersNoch keine Bewertungen

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportVon EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNoch keine Bewertungen

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItVon EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNoch keine Bewertungen

- Gypsum Plasterboard: National Standard of The People'S Republic of ChinaDokument15 SeitenGypsum Plasterboard: National Standard of The People'S Republic of ChinaGarry100% (2)

- Fines Reduction Project at Wendling Bowser QuarryDokument2 SeitenFines Reduction Project at Wendling Bowser QuarryMarcos Antonio ParoliniNoch keine Bewertungen

- Emw 2007 FP 02093Dokument390 SeitenEmw 2007 FP 02093boj87Noch keine Bewertungen

- Tuberculosis PowerpointDokument69 SeitenTuberculosis PowerpointCeline Villo100% (1)

- Curing Obesity, WorldwideDokument6 SeitenCuring Obesity, WorldwideHernán SanabriaNoch keine Bewertungen

- Industrial Artificial Intelligence For Industry 4.0-Based Manufacturing SystemsDokument5 SeitenIndustrial Artificial Intelligence For Industry 4.0-Based Manufacturing SystemsMuhammad HaziqNoch keine Bewertungen

- Catalogo Aesculap PDFDokument16 SeitenCatalogo Aesculap PDFHansNoch keine Bewertungen

- MarbiehistoryDokument6 SeitenMarbiehistoryMarbie DalanginNoch keine Bewertungen

- Semi Finals in Tle 2015Dokument3 SeitenSemi Finals in Tle 2015LoraineTenorioNoch keine Bewertungen

- The Acceptability of Rubber Tree Sap (A As An Alternative Roof SealantDokument7 SeitenThe Acceptability of Rubber Tree Sap (A As An Alternative Roof SealantHannilyn Caldeo100% (2)

- Improve On-Time DeliveriesDokument24 SeitenImprove On-Time DeliveriesUdayNoch keine Bewertungen

- Flow Chart - QCDokument2 SeitenFlow Chart - QCKarthikeyan Shanmugavel100% (1)

- Determination of Drop-Impact Resistance of Plastic BottlesDokument11 SeitenDetermination of Drop-Impact Resistance of Plastic BottlesAndres BrañaNoch keine Bewertungen

- Purpose in LifeDokument1 SeitePurpose in Lifeaashish95100% (1)

- S TR GEN ID (Component Marking) (Rev 3 2009) - AN Marked UpDokument6 SeitenS TR GEN ID (Component Marking) (Rev 3 2009) - AN Marked UpsnclgsraoNoch keine Bewertungen

- Lab Report Marketing Mansi 4Dokument39 SeitenLab Report Marketing Mansi 4Mansi SharmaNoch keine Bewertungen

- Ali Erdemir: Professional ExperienceDokument3 SeitenAli Erdemir: Professional ExperienceDunkMeNoch keine Bewertungen

- 41z S4hana2021 Set-Up en XXDokument46 Seiten41z S4hana2021 Set-Up en XXHussain MulthazimNoch keine Bewertungen

- G.S 5Dokument2 SeitenG.S 5Jamsher BalochNoch keine Bewertungen

- Cathodic Protection Catalog - New 8Dokument1 SeiteCathodic Protection Catalog - New 8dhineshNoch keine Bewertungen

- Dual Op Amp and Voltage Reference Ap4310/ADokument12 SeitenDual Op Amp and Voltage Reference Ap4310/AМихаил ЯненкоNoch keine Bewertungen

- From Input To Affordance: Social-Interactive Learning From An Ecological Perspective Leo Van Lier Monterey Institute Oflntemational StudiesDokument15 SeitenFrom Input To Affordance: Social-Interactive Learning From An Ecological Perspective Leo Van Lier Monterey Institute Oflntemational StudiesKayra MoslemNoch keine Bewertungen

- Lesson Plan in Science 9: I. ObjectivesDokument8 SeitenLesson Plan in Science 9: I. ObjectivesmarichuNoch keine Bewertungen

- PIX4D Simply PowerfulDokument43 SeitenPIX4D Simply PowerfulJUAN BAQUERONoch keine Bewertungen

- Oil Whirl and Whip Instabilities - Within Journal BearingsDokument27 SeitenOil Whirl and Whip Instabilities - Within Journal BearingsTalha AamirNoch keine Bewertungen

- RACI Matrix Design For Managing Stakeholders in PRDokument12 SeitenRACI Matrix Design For Managing Stakeholders in PRRheza Nugraha Prabareswara100% (1)

- Esteem 1999 2000 1.3L 1.6LDokument45 SeitenEsteem 1999 2000 1.3L 1.6LArnold Hernández CarvajalNoch keine Bewertungen

- VBAC MCQsDokument3 SeitenVBAC MCQsHanaNoch keine Bewertungen

- NF en Iso 5167-6-2019Dokument22 SeitenNF en Iso 5167-6-2019Rem FgtNoch keine Bewertungen

- World's Standard Model G6A!: Low Signal RelayDokument9 SeitenWorld's Standard Model G6A!: Low Signal RelayEgiNoch keine Bewertungen