Beruflich Dokumente

Kultur Dokumente

ACC410 Week 1 Assignment

Hochgeladen von

bitofpatienceOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ACC410 Week 1 Assignment

Hochgeladen von

bitofpatienceCopyright:

Verfügbare Formate

Problems LO1,2 232.

John Clinton, owner of Clinton Company, applied for a bank loan and was informed by the banker that audited nancial statements of the business had to be submitted before the bank could consider the loan application. Clinton then retained Arthur Jones, CPA, to perform an audit. Clinton informed Jones that audited nancial statements were required by the bank and that the audit must be completed within three weeks. Clinton also promised to pay Jones a xed fee plus a bonus if the bank approved the loan. Jones agreed and accepted the engagement. The rst step taken by Jones was to hire two accounting students to conduct the audit. He spent several hours telling them exactly what to do. Jones told the students not to spend time reviewing controls but instead to concentrate on proving the mathematical accuracy of the ledger accounts and summarizing the data in the accounting records that support Clinton Companys nancial statements. The students followed Joness instructions and after two weeks gave Jones the nancial statements, which did not include any notes. Jones reviewed the statements and prepared an unqualied audit report. The report, however, did not refer to generally accepted accounting principles. Required: List on the left side of a sheet of paper the generally accepted auditing standards that were violated by Jones, and indicate how the actions of Jones resulted in a failure to comply with each standard. Organize your answer as follows:

Generally Accepted Auditing Standards

Actions by Jones Resulting in Failure to Comply with Generally Accepted Auditing Standards General Standards Jones hired two accounting students and spent several hours telling them what to do. This is a violation because a few hours is not adequate technical training; nor will they be proficient enough, at that time to perform an audit. Employers typically prefer to hire auditors with 2-5 years of experience, not to mention, neither of the students have any certifications, let alone a CPA or CIA credentials. Clinton promises to pay Jones a xed fee plus a bonus if the bank approved

General Standards (1) The auditor must have adequate technical training and prociency to perform the audit. (2) An independent in professional ethical attitude is to be maintained by the auditor or auditors. (3) Professional attention and caution should have been exercised in the planning and performing audits preparation of the report.

the loan, Jones is not working with an independent attitude because he has a financial stake in the outcome of this audit. Jones reviewed the statements and prepared an unqualified audit report. The report, however, did not refer to generally accepted accounting principles. Reviewing work does not qualify professional attention, not adhering to GAAP standards does not exercise caution.

Standards of Field Work Standards of Field Work (1) Auditors should first professional plan the work and must properly supervise. (2) Auditors should attain appropriate understanding of the entity as a while including its internal control, to the assess risk of material misstatement of the financial statements. (3) Auditors must obtain accurate audit findings by performing value audit procedures to afford a reasonable basis for an opinion regarding the financial statements under audit. Jones did not supervise the students and further went to advise them, in his absence, to not review controls; meaning the work wasnt done correctly. Also, he did not put any consideration into hiring qualified staff. Jones only gave instructions to the student to prove the mathematical accuracy of the ledger accounts and summarizing the data in the accounting records that support nancial statements, he did not ask them, nor did he himself, do research to understand the entity, try to assess the risk of material misstatement of the financial statements. He did not perform value audit procedures; he only assessed the mathematical accuracy of the records and summarizing the accounts.

Standards of Reporting Standards of Reporting (1) The report should reflect whether or not the financial statements are in the guidelines according to the generally accepted accounting principles. (2) The report must identify situations in The report does not reference the GAAP. They did not perform an accurate audit; the report should have stated no opinion can be expressed. ---.

which such principles have not been consistently observed previously. (3) Informative disclosures in the financial statements are to be regarded as reasonably adequate unless otherwise stated in the report. (4) The report shall contain an expression of opinion regarding the financial statements, taken as a whole.

The report doesnt contain a single informative disclosure stated in the report. The report cannot contain an expression of opinion regarding the financial statement taken as a whole because, even if he did hire a proper auditing staff, they only checked the mathematical accuracy and did not include any notes. The report should also contain a clear indication of the character in the auditor's work for which the audition is held accountable. Jones report contains an expression of opinion that is not based on the results of a proper audit. He should repudiate the opinion, because he failed to conduct an audit in accordance with GAAP.

Das könnte Ihnen auch gefallen

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDokument5 SeitenColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNoch keine Bewertungen

- 5 6188442313212035099Dokument19 Seiten5 6188442313212035099JamieNoch keine Bewertungen

- D6Dokument11 SeitenD6lorenceabad07Noch keine Bewertungen

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Dokument1 SeitePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNoch keine Bewertungen

- MA PresentationDokument6 SeitenMA PresentationbarbaroNoch keine Bewertungen

- Chapter15 - Answer PDFDokument14 SeitenChapter15 - Answer PDFAvon Jade RamosNoch keine Bewertungen

- Cases (Cabrera)Dokument5 SeitenCases (Cabrera)Queenie100% (1)

- Chapter 15-Financial Planning: Multiple ChoiceDokument22 SeitenChapter 15-Financial Planning: Multiple ChoiceadssdasdsadNoch keine Bewertungen

- Chapter9Dokument3 SeitenChapter9Keanne ArmstrongNoch keine Bewertungen

- Fedillaga Case13Dokument19 SeitenFedillaga Case13Luke Ysmael FedillagaNoch keine Bewertungen

- Answered - BCD Company Offer Its Investors Option - BartlebyDokument1 SeiteAnswered - BCD Company Offer Its Investors Option - BartlebyTrisha AgraamNoch keine Bewertungen

- Module 1.5 - Corporate Liquidation PDFDokument3 SeitenModule 1.5 - Corporate Liquidation PDFMila MercadoNoch keine Bewertungen

- Pineda, Maricar R. CBET-01-502A: Internal FactorsDokument5 SeitenPineda, Maricar R. CBET-01-502A: Internal FactorsMaricar PinedaNoch keine Bewertungen

- Assets Book Value Estimated Realizable ValuesDokument3 SeitenAssets Book Value Estimated Realizable ValuesEllyza SerranoNoch keine Bewertungen

- SW - NpoDokument1 SeiteSW - NpoGwy HipolitoNoch keine Bewertungen

- DLSA AP Intangibles For DistributionDokument7 SeitenDLSA AP Intangibles For DistributionJan Renee EpinoNoch keine Bewertungen

- ACT631 Assurance Principles, Professional Ethics and Good Governance PDFDokument6 SeitenACT631 Assurance Principles, Professional Ethics and Good Governance PDFMarnelli CatalanNoch keine Bewertungen

- The Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. AuditorDokument2 SeitenThe Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. Auditoraccounts 3 lifeNoch keine Bewertungen

- Acctg 14 - MidtermDokument5 SeitenAcctg 14 - MidtermRannah Raymundo100% (1)

- 02 Fundamentals of Assurance ServicesDokument5 Seiten02 Fundamentals of Assurance ServicesKristine TiuNoch keine Bewertungen

- ASCA301 Module 1 DiscussionDokument22 SeitenASCA301 Module 1 DiscussionKaleu MellaNoch keine Bewertungen

- Chapter 10Dokument6 SeitenChapter 10Melissa Kayla ManiulitNoch keine Bewertungen

- Module 1 - Fundamental Principles of Assurance EngagementsDokument10 SeitenModule 1 - Fundamental Principles of Assurance EngagementsLysss EpssssNoch keine Bewertungen

- FINACC-Homework Exercise 2Dokument3 SeitenFINACC-Homework Exercise 2Jomel BaptistaNoch keine Bewertungen

- Employee Benefits P201Dokument17 SeitenEmployee Benefits P201krisha milloNoch keine Bewertungen

- Recourse Obligation.: RequiredDokument55 SeitenRecourse Obligation.: RequiredJude SantosNoch keine Bewertungen

- ACCTGDokument13 SeitenACCTGCabardo Maria RegilynNoch keine Bewertungen

- Math 006B - Module 4 HypothesisDokument4 SeitenMath 006B - Module 4 Hypothesisaey de guzmanNoch keine Bewertungen

- Mikong Due MARCH 30 Hospital and HmosDokument6 SeitenMikong Due MARCH 30 Hospital and HmosCoke Aidenry SaludoNoch keine Bewertungen

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Dokument16 SeitenACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceNoch keine Bewertungen

- Sample Midterm PDFDokument9 SeitenSample Midterm PDFErrell D. GomezNoch keine Bewertungen

- Chapter 8Dokument7 SeitenChapter 8Yenelyn Apistar CambarijanNoch keine Bewertungen

- Part I. Multiple Choice Questions: Select The Best Statement or Words That Corresponds To The QuestionDokument8 SeitenPart I. Multiple Choice Questions: Select The Best Statement or Words That Corresponds To The QuestionNhel AlvaroNoch keine Bewertungen

- Activity 2Dokument3 SeitenActivity 2LFGS Finals0% (1)

- Problem 17-1, ContinuedDokument6 SeitenProblem 17-1, ContinuedJohn Carlo D MedallaNoch keine Bewertungen

- TB21 PDFDokument33 SeitenTB21 PDFJi WonNoch keine Bewertungen

- Budgeted Cash Disbursements For Merchandise PurchasesDokument27 SeitenBudgeted Cash Disbursements For Merchandise PurchasesMavis LiuNoch keine Bewertungen

- LiabilitiesDokument15 SeitenLiabilitiesegroj arucalamNoch keine Bewertungen

- Auditing Theory Answer Key 6Dokument3 SeitenAuditing Theory Answer Key 6Jasper GicaNoch keine Bewertungen

- Problem 3 5 6 Special TransactionDokument5 SeitenProblem 3 5 6 Special TransactionBabyann BallaNoch keine Bewertungen

- Chapter 8 Data Structures and CAATs For Data Extraction PDFDokument4 SeitenChapter 8 Data Structures and CAATs For Data Extraction PDFJessa Herrera100% (1)

- Auditing JPIADokument18 SeitenAuditing JPIAAken Lieram Ats AnaNoch keine Bewertungen

- Accounting - Inventory Test BankDokument3 SeitenAccounting - Inventory Test BankAyesha RGNoch keine Bewertungen

- T03 - Home Office & BranchDokument3 SeitenT03 - Home Office & BranchChristian YuNoch keine Bewertungen

- 8.0 TVM Financial PlanningDokument2 Seiten8.0 TVM Financial PlanningYashvi MahajanNoch keine Bewertungen

- Confidential: Section A - 20 Marks Scenario A. (3 Questions)Dokument4 SeitenConfidential: Section A - 20 Marks Scenario A. (3 Questions)Otherr HafizNoch keine Bewertungen

- 1617 2ndS FX NBergoniaDokument11 Seiten1617 2ndS FX NBergoniaJames Louis BarcenasNoch keine Bewertungen

- Quiz - M1 M2Dokument12 SeitenQuiz - M1 M2Jenz Crisha PazNoch keine Bewertungen

- Chapter 09 - Answer PDFDokument9 SeitenChapter 09 - Answer PDFjhienellNoch keine Bewertungen

- Audit of Cash Bank ReconDokument8 SeitenAudit of Cash Bank ReconPaul Mc AryNoch keine Bewertungen

- DocxDokument3 SeitenDocxyvonneberdosNoch keine Bewertungen

- QUIZ1PRAC1Dokument23 SeitenQUIZ1PRAC1Marinel Felipe0% (1)

- 1st Mid Term Exam Fall 2014 AuditingDokument6 Seiten1st Mid Term Exam Fall 2014 AuditingSarahZeidat100% (1)

- Semester Assignment # 1: Principles of AuditingDokument4 SeitenSemester Assignment # 1: Principles of AuditingSana LakhaniNoch keine Bewertungen

- 2023 - Communicating Results of An Internal Audit Engagement - Question BankDokument19 Seiten2023 - Communicating Results of An Internal Audit Engagement - Question BankKAGISO BRUCENoch keine Bewertungen

- Class Activity Problem Q Chap 2 and 3 Suggested SolutionsDokument6 SeitenClass Activity Problem Q Chap 2 and 3 Suggested SolutionsHoney ShahNoch keine Bewertungen

- Tutorial 1: Textbook Question 1Dokument33 SeitenTutorial 1: Textbook Question 1Nurfairuz Diyanah RahzaliNoch keine Bewertungen

- Philippine Standards On Auditing (PSA)Dokument19 SeitenPhilippine Standards On Auditing (PSA)Erica DaprosaNoch keine Bewertungen

- Auditing I Ch.2Dokument30 SeitenAuditing I Ch.2Abrha636Noch keine Bewertungen

- LECTURE 1 - Chapter 1 - An Introduction To Assurance and Financial Statement AuditingDokument32 SeitenLECTURE 1 - Chapter 1 - An Introduction To Assurance and Financial Statement AuditingThảo Nhi Đinh TrầnNoch keine Bewertungen

- Form Three Physics Handbook-1Dokument94 SeitenForm Three Physics Handbook-1Kisaka G100% (1)

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADokument10 SeitenResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXNoch keine Bewertungen

- Securitron M38 Data SheetDokument1 SeiteSecuritron M38 Data SheetJMAC SupplyNoch keine Bewertungen

- Ingles Avanzado 1 Trabajo FinalDokument4 SeitenIngles Avanzado 1 Trabajo FinalFrancis GarciaNoch keine Bewertungen

- 06-Apache SparkDokument75 Seiten06-Apache SparkTarike ZewudeNoch keine Bewertungen

- United Nations Economic and Social CouncilDokument3 SeitenUnited Nations Economic and Social CouncilLuke SmithNoch keine Bewertungen

- Gabby Resume1Dokument3 SeitenGabby Resume1Kidradj GeronNoch keine Bewertungen

- Use of EnglishDokument4 SeitenUse of EnglishBelén SalituriNoch keine Bewertungen

- Data Sheet WD Blue PC Hard DrivesDokument2 SeitenData Sheet WD Blue PC Hard DrivesRodrigo TorresNoch keine Bewertungen

- Microwave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDokument28 SeitenMicrowave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDominico Delven YapinskiNoch keine Bewertungen

- Gender Ratio of TeachersDokument80 SeitenGender Ratio of TeachersT SiddharthNoch keine Bewertungen

- The Art of Blues SolosDokument51 SeitenThe Art of Blues SolosEnrique Maldonado100% (8)

- Historical Development of AccountingDokument25 SeitenHistorical Development of AccountingstrifehartNoch keine Bewertungen

- P 1 0000 06 (2000) - EngDokument34 SeitenP 1 0000 06 (2000) - EngTomas CruzNoch keine Bewertungen

- Escario Vs NLRCDokument10 SeitenEscario Vs NLRCnat_wmsu2010Noch keine Bewertungen

- What Caused The Slave Trade Ruth LingardDokument17 SeitenWhat Caused The Slave Trade Ruth LingardmahaNoch keine Bewertungen

- The Rise of Populism and The Crisis of Globalization: Brexit, Trump and BeyondDokument11 SeitenThe Rise of Populism and The Crisis of Globalization: Brexit, Trump and Beyondalpha fiveNoch keine Bewertungen

- Bajaj Allianz InsuranceDokument93 SeitenBajaj Allianz InsuranceswatiNoch keine Bewertungen

- Photon Trading - Market Structure BasicsDokument11 SeitenPhoton Trading - Market Structure Basicstula amar100% (2)

- BSCSE at UIUDokument110 SeitenBSCSE at UIUshamir mahmudNoch keine Bewertungen

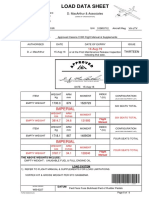

- Load Data Sheet: ImperialDokument3 SeitenLoad Data Sheet: ImperialLaurean Cub BlankNoch keine Bewertungen

- State Immunity Cases With Case DigestsDokument37 SeitenState Immunity Cases With Case DigestsStephanie Dawn Sibi Gok-ong100% (4)

- Seminar On Despute Resolution & IPR Protection in PRCDokument4 SeitenSeminar On Despute Resolution & IPR Protection in PRCrishi000071985100% (2)

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDokument2 SeitenEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaNoch keine Bewertungen

- Government of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Dokument2 SeitenGovernment of West Bengal Finance (Audit) Department: NABANNA', HOWRAH-711102 No. Dated, The 13 May, 2020Satyaki Prasad MaitiNoch keine Bewertungen

- General Financial RulesDokument9 SeitenGeneral Financial RulesmskNoch keine Bewertungen

- Sample Annual BudgetDokument4 SeitenSample Annual BudgetMary Ann B. GabucanNoch keine Bewertungen

- Building and Other Construction Workers Act 1996Dokument151 SeitenBuilding and Other Construction Workers Act 1996Rajesh KodavatiNoch keine Bewertungen

- ST JohnDokument20 SeitenST JohnNa PeaceNoch keine Bewertungen

- A Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Dokument73 SeitenA Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Os MNoch keine Bewertungen