Beruflich Dokumente

Kultur Dokumente

Zakat - The "Taxing of Certain Goods, Such As Harvest, With An Eye To Allocating These

Hochgeladen von

WL RazakOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Zakat - The "Taxing of Certain Goods, Such As Harvest, With An Eye To Allocating These

Hochgeladen von

WL RazakCopyright:

Verfügbare Formate

Islamic

economics in

practice,

or economic policies

supported

by

self-identified Islamic groups, has varied throughout its long history. Traditional Islamic concepts having to do with economics included

zakat - the "taxing of certain goods, such as harvest, with an eye to allocating these taxes to expenditures that are also explicitly defined, such as aid to the needy."

Gharar - "the interdiction of chance ... that is, of the presence of any element of uncertainty, in a contract (which excludes not only insurance but also the lending of money without participation in the risks)"

These concepts, like others in Islamic law and jurisprudence, came from the "prescriptions, anecdotes, examples, and words of the Prophet, all gathered together and systematized by commentators according to an inductive, casuistic method." [1] Sometimes other sources such as al-urf, (the custom), al-aql (reason) or al-ijma (consensus of the jurists) were employed.[2] In addition, Islamic law has developed areas of law that correspond to secular laws of contracts and torts.

Islamic economic system is nothing but the economic system cosidered compatible with the Quoran as interpreted and practiced by different Islamic countries. It is based on interpretations given by various Islamic leaders with or without any formal training on Economics as a science but based on their understanding is about the Law in Quoran. It is advisable not to consider all this as pasrt of any scientific scholastic endeavour as Economics is as a scientific discipline. Islamic economics is economics in accordance with Islamic law. Islamic economics can refer to the application of Islamic law to economic activity either where Islamic rule is in force or where it is not; i.e. it can refer to the creation of an Islamic economic system, or to simply following Islamic law in regards to spending, saving, investing, giving, etc. where the state does not follow Islamic law.

The former paradigm, particularly as developed by modern Shia scholars such as Mahmud Taleqani, and Mohammad Baqir al-Sadr, seeks not only to enforce Islamic regulations on issues such as Zakat, Jizya, Nisab, Khums, Riba, insurance and inheritance, but to implement broader economic goals and policies of an Islamic society. It seeks an economic system based on uplifting the deprived masses, a major role for the state in matters such as circulation and equitable distribution of wealth and insuring participants in the marketplace are rewarded by being exposed to risk and/or liability. Islamists movements and authors will generally describe this system as being neither Socialist nor Capitalist, but a third way with none of the drawbacks of the other two systems. [1][2]

The latter paradigm is of necessity more limited, revolving around a few main tenets of Islam: the payment of zakat charity by believers, borrowing and lending without payment of fixed interest (riba), and socially responsible investing. The key difference from a financial

perspective is the no-interest rule since most other religions favor charitable giving and socially responsible investing. The belief that investiment with interest charges is essential for an Islamic society is widespread, though liberal movements within Islam may deny the need for this prohibition, since they see Islam as generally compatible with modern secular institutions and law. Traditional Islamic concepts having to do with economics included zakat - the "taxing of certain goods, such as harvest, with an eye to allocating these taxes to expenditures that are also explicitly defined, such as aid to the needy." Gharar - "the interdiction of chance ... that is, of the presence of any element of uncertainty, in a contract (which excludes not only insurance but also the lending of money without participation in the risks)" Riba - "referred to as usury" [3] These concepts, like others in Islamic law, came from the "prescriptions, anecdotes, examples, and words of the Prophet, all gathered together and systematized by commentators according to an inductive, casuistic method." [4] Sometimes other sources such as al-urf, (the custom), al-aql (reason) or al-ijma (consensus of the jurists) were employed.[5] In addition, Islamic law has developed areas of law that correspond to secular laws of contracts and torts. Reforms under Islam Some argue early Islamic theory and practice formed a "coherent" economic system with "a blueprint for a new order in society, in which all participants would be treated more fairly". Michael Bonner, for example, has written that an "economy of poverty" prevailed in Islam until 13th and 14th century. Under this system God's guidance made sure the flow of money and goods was "purified" by being channeled from those who had much of it to those who had little by encouraging charity zakat and discouraging interest on loans, or usury/riba. Bonner maintains the prophet also helped poor traders by allowing only tents, not permanent buildings in the market of Medina, and not charging fees and rents there.[6] Traditional approach

While most Muslims believe Islamic law is perfect by virtue of its being revealed by God, Islamic law on economic issues was/is not "economics" in the sense of a systematic study of production, distribution, and consumption of goods and services. An example of the traditionalist ulama approach to economic issues is Imam Khomeini's work Tawzih al-masa'il where the term `economy` does not appear and where the chapter on selling and buying (Kharid o forush) comes after the one on pilgrimage. As Olivier Roy puts it, the work "presents economic questions as individual acts open to moral analysis: `To lend [without interest, on a note from the lender] is among the good works that are particularly recommended in the verses of the Quran and the in the Traditions.`" [7] Post-colonial era As the Western ideas, including the study of economics, began to influence the Muslim world, some Muslim writers sought to produce an Islamic discipline of economics. Because Islam is "not merely a spiritual formula but a complete system of life in all its walks", [8] it logically followed that Islam also had its own economic system unique from and superior to non-Islamic systems. [9] To date, however, there have been no agreement as to the methodological definition and scope of Islamic Economics. In the 1960s and 70s Shia Islamic thinkers worked to develop a unique Islamic economic philosophy with "its own answers to contemporary economic problems." Several works were particularly influential, Eslam va Malekiyyat (Islam and Property) by Mahmud Taleqani (1951), Iqtisaduna (Our Economics) by Mohammad Baqir al-Sadr (1961) and Eqtesad-e Towhidi (The Economics of Divine Harmony) by Abolhassan Banisadr (1978) Some Interpretations of Property Rights, Capital and Labor from Islamic Perspective by Habibullah Peyman (1979).[10] [11] Al-Sadr in particular has been described as having "almost single-handedly developed the notion of Islamic economics" [12] In their writings Sadr and the other authors "sought to depict Islam as a religion committed to social justice, the equitable distribution of wealth, and the cause of the deprived classes," with doctrines "acceptable to Islamic jurists", while refuting existing non-Islamic theories of capitalism and Marxism. This version of Islamic economics, which influenced the Iranian

Revolution, called for public ownership of land and of large "industrial enterprises," while private economic activity continued "within reasonable limits." [13] These ideas helped shape the large public sector and public subsidy policies of the Iranian Islamic revolution. In the 1980s and 1990s, as the Islamic revolution failed to reach the per capita income level achieved by the regime it overthrew, and Communist states and socialist parties in the nonMuslim world turned away from socialism, Muslim interest shifted away from government ownership and regulation. In Iran, it is reported that "eqtesad-e Eslami (meaning both Islamic economics and economy) ... once a revolutionary shibboleth, is indubitably absent in all official documents and the media. It disapperared from Iranian political discourse about 15 years ago [1990]." [14] But in other parts of the Muslim world the term lived on, shifting form to the less ambitious goal of interest-free banking. Some Muslim bankers and religious leaders suggested ways to integrate Islamic law on usage of money with modern concepts of ethical investing. In banking this was done through the use of sales transactions (focusing on the fixed rate return modes) to achieve similar results to interest. This has been heavily criticised by many modern writers as a means of covering conventional banking with an Islamic facade. Interest Islamic economic institutions, not just the Islamic bank but all those connected with Islamic banking operates on the basis of "zero interest." Critics of Islamic economics argue, however, that the fundamental characteristic of charging interest (i.e. charging a premium, on the principal amount of a loan, for the time value of the loaned money) is not truly eliminated in Islamic banking, but rather the interest is merely hidden and relabeled.For example, consider the practical reality of purchasing a vehicle from an Islamic bank under an allegedly "zero interest" loan. The procedure, generally, is that the client tells the Islamic bank which vehicle he or she would like to own. The Islamic bank then purchases that vehicle in its name, and sells it to the client at a marked-up price, under an agreement that the new markedup price of the vehicle must be paid in a certain number of installments of a certain time period. Thus a $20,000 car might cost $35,000 if purchased from an Islamic bank at "zero interest," 5 year loan. Of course, the bank charges the extra $15,000 on top of the $20,000 cost of the car because money has a time value (that is to say, a payment of $20,000 5 years from now is worth less than a payment of $20,000 today). This is also why a $20,000 car could cost $35,000 if the purchase were financed by an interest bearing loan issued by a nonIslamic financial institution. This transaction utilises valid sales transactions called murabaha,

but violates Islamic law by the bank usually not taking delivery or connecting two independent contracts or taking of legally enforceable guarantees from the buyer. Usually, time value of money is compensated to the lender by the lender charging the borrower interest on the principal amount of the loan. Islam prohibits time value of money in itself as producing no value - in conjunction with other value driven agreements the idea is entertained. In the case of Islamic banking, the lost time value is compensated by utilising a sales contract, charging a mark-up on the home or vehicle that the client might be seeking to purchase by way of a loan. The vehicle or mortgage usually remains in the name of the bank, until the principal loan including the mark-up has been paid. In the case of a business loan, instead of charging interest over the time that the principal amount is loaned out, an Islamic bank will demand a certain percentage of the borrower's business profits for an indefinite period of time. So it is the principle of sharing and the bank is a partner who obtains losses as profits. This is because of a law in the Islamic financial theory that you are not allowed to enjoy the profits if you did not take its risk based on the famous tradition, al-kharaj bi damaan - return is determined by exposure to risk/liability. Under a conventional interest based loan it is possible to "call" the loan if the interest rate drops and the borrower finds that he can find cheaper financing (i.e. pays off the entire loan before the end of its term, thus paying less interest). However, there is no way to call a loan issued by an Islamic bank. Thus, while the borrower from an Islamic bank is protected against interest rate increases, the borrower cannot benefit from interest rate drops. In theory, Islamic banking should be synonymous with full-reserve banking, with banks achieving a 100% reserve ratio [1]. However in practice this is rarely the case, another point of strong criticism of "Islamic Banking". Debt arrangements Most Islamic economic institutions advise participatory arrangements between capital and labor. The latter rule reflects the Islamic norm that the borrower must not bear all the cost of a failure, as "it is God who determines that failure, and intends that it fall on all those involved." Conventional debt arrangements are thus usually unacceptable - but conventional venture investment structures are applied even on very small scales. However, not every debt arrangement can be seen in terms of venture investment structures. For example, when a

family buys a home it is not investing in a business venture - a person's shelter is not a business venture. Similarly, purchasing other commodities for personal use, such as cars, furniture, and so on, cannot realistically be considered as a venture investment in which the Islamic bank shares risks and profits for the profits of the venture. Natural capital Perhaps due to resource scarcity in most Islamic nations, this form of economics also emphasizes limited (and some claim also sustainable) use of natural capital, i.e. producing land. These latter revive traditions of haram and hima that were prevalent in early Muslim civilization. Welfare Social welfare, unemployment, public debt and globalization have been re-examined from the perspective of Islamic norms and values. Islamic banks have grown recently in the Muslim world but are a very small share of the global economy compared to the Western debt banking paradigm. It remains to be seen [vague] if they will find niches - although hybrid approaches, e.g. Grameen Bank which applies classical Islamic values but uses conventional lending practices, are much lauded by some proponents of modern human development theory. Islamic stocks In June 2005 Dow Jones Indexes, New York, and RHB Securities, Kuala Lumpur, teamed up to launch a new "Islamic Malaysia Index" a collection of 45 stocks representing Malaysian companies that comply with a variety of Sharia-based criteria. Three variables (the total debt of an indexed company, its total cash plus interest-bearing securities and its accounts receivables) must each be less than 33% of the trailing 12-month average capitalization, for example. ] Popularity and availability Today there are many financial institutions, even in the Western world, offering financial services and products in accordance with the rules of the Islamic finance. For example, legal changes introduced by Chancellor Gordon Brown in 2003, have enabled British banks and building societies to offer so-called Muslim mortgages for house purchase. In 2004 the UK's first stand alone Sharia'a compliant bank was launched, the Islamic Bank of Britain. They

offer products and services to its UK customers that utilise the Islamic financial principles; such as Mudaraba, Murabaha, Musharaka and Qard. The Islamic finance sector was worth between 300 and 500 billion dollars (237 and 394 billion euros) as of September 2006, compared with 200 billion dollars in 2004. The number of Islamic retail banks and investment funds number in their hundreds and many Western financial institutions offer products that comply with Sharia law, including Citigroup, Deutsche Bank, HSBC, Lloyds TSB and UBS. [2] Business Method Patents With the recent ability to patent new methods of doing business in the United States, a small number of patent applications have been filed on methods for providing Sharia compliant financial services. These pending patent applications include: Criticism Its popularity notwithstanding, critics of Islamic economics have not been sparing. It has been attacked for its alleged "incoherence, incompleteness, impracticality, and irrelevance;" [15] [16] driven by "cultural identity" rather than problem solving.[17] Others have dismissed it as "a hodgepodge of populist and socialist ideas," in theory and "nothing more than inefficient state control of the economy and some almost equally ineffective redistribution policies," in practice. In a political and regional context where Islamist and ulema claim to have an opinion about everything, it is striking how little they have to say about this most central of human activities, beyond repetitious pieties about how their model is neither capitalist nor socialist.[ The main difference between the present economic system and the Islamic economic system is that the later is based on keeping in view certain social objectives for the benefit of human beings and society. Islam, through its various principles, guides human life and ensures free enterprise and trade. That is the reason why the conventional banker does not have to be concerned with the moral implications of the business venture for which money is lent. Socio-economic justice is central to the Islamic way of life. Every religion has the same basic aim. In an Islamic environment, an individual not only lives for himself, but his scope of activities and responsibilities extend beyond himself to the welfare and interests of society at

large. The Qur'an is very precise and clear on this issue. There are basically three components of an Islamic economic paradigm: That as viceregent, man should seek the bouties of the land that God has bestowed on humanity. From the wealth thus obtained, he should enjoy his own share. That he should be magnanimous to others and use a part of the wealth so obtained also for the benefit of his fellow-beings. That his actions should not be wilfully damaging to his fellow-beings. Human society in Islam is based upon the validity of law, of life and the validity of mankind. All these are natural corollaries of the faith. Islamic laws promote the welfare of people by safeguarding their faith, life, intellect, property and their posterity. God nurtures, nourishes, sustains, develops and leads humanity towards perfection. Even though an individual may be making a living because of his efforts, he is not the only one contributing towards that living. There are a number of divine inputs into this effort and therefore, the results of such an effort obviously cannot be construed as entirely proprietary. Whereas the Islamic banker has a much greater responsibility. This leads us to a very fundamental concept of the Islamic financial system i.e. the relation of investors to the institution is that of partners whereas that of conventional banking is that of creditor-investor. The Islamic financial system is based on equity whereas the conventional banking system is loan based. Islam is not against the earning of money. In fact, Islam prohibits earning of money through unfair trading practices and other activities that are socially harmful in one way or another. Those who swallow down usury cannot arise except as one whom Shaitan has prostrated by (his) touch does rise. That is because they say, trading is only like usury; and Allah has allowed trading and forbidden usury. To whomsoever then the admonition has come from his Lord, then he desists, he shall have what has already passed, and his affair is in the hands of Allah; and whoever returns (to it) - these are the inmates of the fire; they shall abide in it [Sura 2:275]. Not that there was any ambiguity in the Command of Allah. Far be it from Him to give any order to His Servants, which they can not comprehend. The fact is that those who had surplus money and wanted to earn profit did so either by lending it through riba (usury) or by

investing it in trade and hypocrites were not prepared to forgo the first option. Hence, they argued that since both were means of earning profit, they were alike and the prohibition of riba did not stand to reason. The practice of riba i.e. usury was so deep-rooted in society and continuance of the practice was so undesirable, that Allah warned the believers that if they did not desist, they should be prepared for a war against Allah and His Apostle. This warning was heeded by the Muslim Ummah and for more than a thousand years the economies of Muslim states were free from riba. With the ascendancy of Western influence and its suzerainty over Muslim states, the position changed and an interest-based economy became acceptable. Efforts in Muslim countries to revert to an interest-free economy were hampered by many obstacles. The Role of Money The traditional definition of the time value of money leads one to assume that profit maximisation is the objective of investors irrespective of whether or not the earning of profit has made someone else worse off. Some economists have termed the maximisation of profit as the sole objective of corporations. This view cannot be supported or defended since the profit maximisation process may lead to perverse outcomes. When financial operations are removed of moralistic tone, competitive markets fail to achieve the efficient allocation of a country's resources. In Islam money in itself is not considered, as actual capital only exists when money, along with other resources, is sunk into productive activities. Linking the use of money to productive purposes invariably brings into action the factor of labour, a process from which benefits pass on to society. Types of Islamic Financial Instruments Demand for monetary instruments is influenced by the variation and level in the market rate what is meant as the market rate of return. The demand for household monetary instruments is mainly for the purpose of circulation of income. Banks need these instruments for:transaction purposes; precautionary purposes, in that some unexpected payments have to be made while some expected inflows may not be forthcoming on their due date, and;not only to avoid loss but also to obtain gains in the capital value of financial assets under the expectation that the market rate of return may move in a certain direction.

What differentiates a traditional financial market from others markets is that no tangible good or service is exchanged for any monetary consideration; only a "financial claim" changes hands in the form of a promissory note or a title to any future flow of income adjusted for any capital appreciation. Not all Islamic instruments are purely financial claims. Some of the instruments also represent ownership of the underlying assets together with a claim to underlying cash flows. Basically there are the following four types of Islamic financial instruments: Type "A" is a financial claim of monetary value with recourse to underlying durable assets and related cash flows. This type has a predictable future income stream, is marketable and can be discounted since with the changing of hands, the instrument passes title to the goods and not to the debt. It is basically lease-based. This instrument is partly backed by durable assets and its income is not predictable, but evaluated through an asset valuation process at the end of an agreed and declared duration. The underlying transactions can be a mix of ijara, modaraba, musharaka etc., contracts. This Type may be traded in the secondary market at its fair market price acceptable to the parties involved but not discounted. Type "C" is purely a monetary claim to an expected income stream forthcoming from underlying commercial transactions. Income is evaluated through an asset-valuation process at the end of an agreed and declared period. A transaction of this type may comprise morabaha, istasna etc., contracts which are debt claims against third parties in respect to actual commercial transactions. The Type may be traded at its face value declared at the end of each accounting period but cannot be discounted. The Type "D" is purely a financial claim of monetary value but with recourse to certain precious metals such as gold, silver, platinum, etc., or commodities quoted on exchanges. The instrument entitles the holder to take delivery of the underlying asset but does not carry any attached revenue stream except that its price is pegged to the price of the underlying precious metal or commodity quoted at recognized international exchange rates. It can be traded but not discounted. Risk Mitigating Features The phenomenon of risk plays a pervasive role in economic life. Without it, financial and capital markets would consist of the exchange of a single instrument each period, the

communications industry would cease to exist in so far as this market is concerned and the profession of investment banking would be reduced to that of accounting. Risk is further segregated from uncertainty. A situation is said to involve risk if the randomness facing an economic agent can be expressed in terms of specific numerical probabilities (these probabilities may either be objectively specified, as with lottery tickets or else reflect the individual's own subjective beliefs). Situations where the agent cannot (or does not) assign actual probabilities to alternative possible occurrences are said to involve uncertainty. While it is not always true that a riskier asset will pay a higher average rate of return, it is usually return. Risk is an opportunity in financial markets and also a problem. Risk-averse investors require additional return to be at additional risk and, in effect, in a competitive market higher return is accompanied by higher risk. An investor evaluates an asset in terms of its marginal contribution to his/her portfolio. The fundamental principal of valuation is that the value of any financial asset is the present value of the cash expected. The process requires two steps: estimating the cash flow, and;determining the appropriate interest rate that should be used to calculate the present value.The following are the Shari'ah compliant risk mitigating features: By prior arrangements in the instrument, the investing company, through its banker, would have a priori right in profit sharing up to an agreed upon ratio. The profit will be paid on account on a monthly basis to the investing company as provided in the projected accounts. The final accounting and settlement is accomplished at the end of the term of the instrument when the profit and loss accounts are finalised. In order to mitigate the risk and as per the terms of the instrument, a Takaful fund is established for the term of the instrument. In this Takaful fund where the investee company earmarks a part of their reserves for the Takaful fund.The investing company will contribute 1% of the invested amount. This 1% contribution is made through an advance by the investee company on account of future profits.

In case of any loss during the tenancy of the instrument, it will be adjusted against the Takaful fund. The balance will be distributed between investor and the at the end of the term of instrument. Through a valuation, value of the investment would be established for the purpose of exercising the put option. The investing company shall have the option to exercise its put option at the value price and the company shall buy this instrument. Islamic Leasing But before describing leasing, as aforesaid, let me very briefly touch upon two of the basic or fundamental principles of Islamic finance in order to develop a premise for meaningful discussions on leasing. It has to be asset-based financing: The first fundamental principle of Shari'ah is that as opposed to conventional monetary dealing, profit is generated when something having intrinsic utility is sold or offered for use. Money has no intrinsic value. As such dealing in money (same currency) cannot generate profit but a Riba unless converted into real assets to deal with. There has to be an element of risk:The second basic element of Shari'ah is that one cannot claim a profit or fee for a property/transaction, the risk of which was never borne by him. Based on the above fundamental principles, the most ideal mode or instrument of financing in Shari'ah are Musharaka and Modarabah followed by Salam and Istinsa.

Advantages

but

not

limited

to:

Islamic economy considers the lender (provider) as a participant who shares the losses and the gains

Islamic economy does not exploit the need of the poor by taking interests which eventually makes the wealth concentrates in the hands of the rich capitalists

Islamic economy make the people feel united and taking care of each other like one body without the exploitation of one another

Islam encourages charity and it promises rewards on it in this life and in the hereafter

There are no disadvantages as the Islamic teachings are from God and He knows the best that befits the human nature

Das könnte Ihnen auch gefallen

- Islam and Mammon: The Economic Predicaments of IslamismVon EverandIslam and Mammon: The Economic Predicaments of IslamismBewertung: 2.5 von 5 Sternen2.5/5 (4)

- Muslim and Debt: 5 Practical Steps to Freedom from DebtVon EverandMuslim and Debt: 5 Practical Steps to Freedom from DebtNoch keine Bewertungen

- Reply To Show Cause Letter For MisconductDokument1 SeiteReply To Show Cause Letter For MisconductWL RazakNoch keine Bewertungen

- Metric Hex Nuts, Style 2: ASME B18.2.4.2M-2005Dokument14 SeitenMetric Hex Nuts, Style 2: ASME B18.2.4.2M-2005vijay pawarNoch keine Bewertungen

- Social Implications in The Hound of The BaskervillesDokument8 SeitenSocial Implications in The Hound of The BaskervillesDaffodilNoch keine Bewertungen

- Letter of Intent for Exclusive DistributionDokument2 SeitenLetter of Intent for Exclusive Distributionfaith liboon60% (5)

- Assignment On Features of Islamic Economic SystemDokument15 SeitenAssignment On Features of Islamic Economic SystemKh Fahad Koushik50% (6)

- Absolut Bazaar X Gaya Raya - Exhibitor Manual - LatestDokument29 SeitenAbsolut Bazaar X Gaya Raya - Exhibitor Manual - LatestWL RazakNoch keine Bewertungen

- The Dev of Islamic Fin SystemDokument13 SeitenThe Dev of Islamic Fin SystemNadiah GhazaliNoch keine Bewertungen

- Islamic Economics and The Islamic Sub EconomyDokument18 SeitenIslamic Economics and The Islamic Sub EconomyNoerma Madjid Riyadi100% (1)

- Theoretical Studies in Islamic Banking and FinanceVon EverandTheoretical Studies in Islamic Banking and FinanceBewertung: 5 von 5 Sternen5/5 (1)

- Islamic Banking - Principles and PracticesDokument28 SeitenIslamic Banking - Principles and Practicesbashir_abdi100% (2)

- Amit Vadhadiya Saving Ac PDFDokument11 SeitenAmit Vadhadiya Saving Ac PDFKotadiya ChiragNoch keine Bewertungen

- Mike Bobo Employment ContractDokument15 SeitenMike Bobo Employment ContractHKMNoch keine Bewertungen

- Italian WarsDokument14 SeitenItalian WarsLaura MayoNoch keine Bewertungen

- Carpio vs. DorojaDokument2 SeitenCarpio vs. DorojaAimee Dela Cruz100% (1)

- Islamic Financial SystemDokument24 SeitenIslamic Financial System✬ SHANZA MALIK ✬Noch keine Bewertungen

- Understanding Islamic EconomicsDokument30 SeitenUnderstanding Islamic Economicsmsa11pkNoch keine Bewertungen

- Islamic Banking DefinitionsDokument7 SeitenIslamic Banking Definitionsjuni26287Noch keine Bewertungen

- Introduction to Islamic Banking PrinciplesDokument53 SeitenIntroduction to Islamic Banking PrinciplesVarun JainNoch keine Bewertungen

- Islamic Economy in EnglishDokument45 SeitenIslamic Economy in EnglishDwi rezky YuliantyNoch keine Bewertungen

- Islamic Banking ExplainedDokument8 SeitenIslamic Banking ExplainedlitufernsNoch keine Bewertungen

- Islamic Finance Final ProjectDokument83 SeitenIslamic Finance Final ProjectMohammed YunusNoch keine Bewertungen

- A Brief Look Into The Concept of Islamic Banking and FinanceDokument12 SeitenA Brief Look Into The Concept of Islamic Banking and Financeصفوان عارفNoch keine Bewertungen

- Comparative Analysis of Capitalism and Islamic Economic SystemsDokument15 SeitenComparative Analysis of Capitalism and Islamic Economic SystemsAbdul Salam NMNoch keine Bewertungen

- The Basic Principles of Islamic Economy and Their Effects On Accounting StandardsDokument11 SeitenThe Basic Principles of Islamic Economy and Their Effects On Accounting StandardsawaisdotcomNoch keine Bewertungen

- ISLAMIC ECONOMICS, What Went Wrong?: Historical BackgroundDokument10 SeitenISLAMIC ECONOMICS, What Went Wrong?: Historical BackgroundArdi PrawiroNoch keine Bewertungen

- MPRA Paper 42046Dokument26 SeitenMPRA Paper 42046Martini Dwi Pusparini S.H.I., M.S.I.Noch keine Bewertungen

- Islamic Banking DissertationDokument47 SeitenIslamic Banking Dissertationafshanwani07100% (4)

- Ibadat (Worship) Mu 'AmalatDokument4 SeitenIbadat (Worship) Mu 'AmalatHoài Sơn VũNoch keine Bewertungen

- SOCIO ReportDokument17 SeitenSOCIO ReportAli NaqiNoch keine Bewertungen

- Making Markets MuslimDokument7 SeitenMaking Markets MuslimAzhar GhaniNoch keine Bewertungen

- Accountancy Article PDFDokument7 SeitenAccountancy Article PDFAmer RasticNoch keine Bewertungen

- Shariah Economics and The Progress of Islamic Finance The Role of Shariah ExpertsDokument5 SeitenShariah Economics and The Progress of Islamic Finance The Role of Shariah ExpertsmohamedNoch keine Bewertungen

- Islam and Mammon: The Economic Predicaments of Islamism. Timur Kuran, 2004Dokument8 SeitenIslam and Mammon: The Economic Predicaments of Islamism. Timur Kuran, 2004Moeez MobinNoch keine Bewertungen

- Fundamentals of An Islamic Economic System Compared To The Social Market EconomyDokument22 SeitenFundamentals of An Islamic Economic System Compared To The Social Market EconomySyed MehboobNoch keine Bewertungen

- Self-Interest, Homo Islamicus and Behavioral AssumptionsDokument15 SeitenSelf-Interest, Homo Islamicus and Behavioral AssumptionsJobaiyerNoch keine Bewertungen

- Islamic Economics SystemDokument2 SeitenIslamic Economics SystemAqsa RiazNoch keine Bewertungen

- Islamic Public Finance: 13 WeekDokument6 SeitenIslamic Public Finance: 13 Weekhaiqa malikNoch keine Bewertungen

- The Role of Islamic Finance in The Economy of UzbekistanDokument4 SeitenThe Role of Islamic Finance in The Economy of UzbekistanAcademic JournalNoch keine Bewertungen

- MRP Interim Ankush 09bs0000323Dokument15 SeitenMRP Interim Ankush 09bs0000323sonu1aNoch keine Bewertungen

- Is Riba AnwarDokument16 SeitenIs Riba AnwarDr. Muhammad Mazhar IqbalNoch keine Bewertungen

- The Islamic Economic SystemDokument15 SeitenThe Islamic Economic SystemMaryam NoorNoch keine Bewertungen

- Islam and Mammon - ReviewDokument4 SeitenIslam and Mammon - ReviewIbrahim KnNoch keine Bewertungen

- Iktin Z and Islamic Monetary: PolicyDokument15 SeitenIktin Z and Islamic Monetary: PolicyShaz MaNoch keine Bewertungen

- What Is Islamic Finance?: Faleel JamaldeenDokument9 SeitenWhat Is Islamic Finance?: Faleel JamaldeenanggiNoch keine Bewertungen

- What Is Islamic Finance?: Faleel JamaldeenDokument9 SeitenWhat Is Islamic Finance?: Faleel JamaldeenanggiNoch keine Bewertungen

- Business Communication 5001 Assignment No 1 Autumn 2020Dokument21 SeitenBusiness Communication 5001 Assignment No 1 Autumn 2020Mujtaba AhmedNoch keine Bewertungen

- What Is Wrong With Islamic EconomicDokument6 SeitenWhat Is Wrong With Islamic EconomicadsolahNoch keine Bewertungen

- Al-Ghazālī and The Intellectual History of Islamic EconomicsDokument21 SeitenAl-Ghazālī and The Intellectual History of Islamic EconomicsBeBent100% (1)

- Dr. Mehmet AsutayDokument17 SeitenDr. Mehmet AsutayHasanovMirasovičNoch keine Bewertungen

- One Study: Islamic Economics: What Does It Mean?Dokument3 SeitenOne Study: Islamic Economics: What Does It Mean?Damara Euy RachmadNoch keine Bewertungen

- MNC and IslamDokument12 SeitenMNC and IslamasepsetiaNoch keine Bewertungen

- Islamic Economic SystemDokument5 SeitenIslamic Economic SystemMukhlis NasriNoch keine Bewertungen

- Concept of Islamic Banks System: Islamic banking (or participant banking) (Arabic: ةيملسسسلا ةيفرسسصملاDokument16 SeitenConcept of Islamic Banks System: Islamic banking (or participant banking) (Arabic: ةيملسسسلا ةيفرسسصملاJane AlamNoch keine Bewertungen

- ISLAMIC LAW OF CONTRACTDokument49 SeitenISLAMIC LAW OF CONTRACTwandanbera01Noch keine Bewertungen

- What is Islamic BankingDokument3 SeitenWhat is Islamic BankingAnjum TaNoch keine Bewertungen

- Islamic Economics (: Fiqh Al-Mu'āmalātDokument1 SeiteIslamic Economics (: Fiqh Al-Mu'āmalātchris williamsNoch keine Bewertungen

- Lecture 2 - An Brief Introduction To Money and Islamic BankingDokument28 SeitenLecture 2 - An Brief Introduction To Money and Islamic BankingborhansetiNoch keine Bewertungen

- Islamic Econ Journal Article ReviewedDokument7 SeitenIslamic Econ Journal Article ReviewedDiaz HasvinNoch keine Bewertungen

- iSLAMIC BANKINGDokument101 SeiteniSLAMIC BANKINGZuher ShaikhNoch keine Bewertungen

- Islamic FinanceDokument18 SeitenIslamic FinanceJOHN KAMANDANoch keine Bewertungen

- "Interest" and The Paradox of Contemporary Islamic Law and FinanceDokument33 Seiten"Interest" and The Paradox of Contemporary Islamic Law and FinanceIcas PhilsNoch keine Bewertungen

- Islamic Economics: Still in Search of An Identity: Abdulkader Cassim MahomedyDokument14 SeitenIslamic Economics: Still in Search of An Identity: Abdulkader Cassim MahomedySon Go HanNoch keine Bewertungen

- Abdul RazzaqueDokument4 SeitenAbdul RazzaqueAbdul Razzaque BozdarNoch keine Bewertungen

- Topic 5: Islamic Economics As Plea For Liberal Capitalism: Wrong Answer To The Wrong QuestionDokument20 SeitenTopic 5: Islamic Economics As Plea For Liberal Capitalism: Wrong Answer To The Wrong QuestionUmer SaeedNoch keine Bewertungen

- Islamic FinanceDokument3 SeitenIslamic FinancejanshalNoch keine Bewertungen

- Comparison of Islamic Economy and Conventional Economy To People'S Income Growth in Reducing Poverty and UnemploymentDokument16 SeitenComparison of Islamic Economy and Conventional Economy To People'S Income Growth in Reducing Poverty and UnemploymentSaif AfridiNoch keine Bewertungen

- The Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceVon EverandThe Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceNoch keine Bewertungen

- Sop Shipping 2022Dokument1 SeiteSop Shipping 2022WL RazakNoch keine Bewertungen

- Invitation DetailsDokument1 SeiteInvitation DetailsWL RazakNoch keine Bewertungen

- Professional Resignation Letter UpdatedDokument1 SeiteProfessional Resignation Letter UpdatedWL RazakNoch keine Bewertungen

- Brochure JazzDokument16 SeitenBrochure JazzHilmi Ahmad AIJ170010 STUDENTNoch keine Bewertungen

- Crash Log 2Dokument1 SeiteCrash Log 2WL RazakNoch keine Bewertungen

- Review and Its Grounds Under CPC PDFDokument11 SeitenReview and Its Grounds Under CPC PDFshivam mauryaNoch keine Bewertungen

- Tally TestDokument6 SeitenTally TestRia MakkarNoch keine Bewertungen

- Kenneth E. Wilson v. State of New Hampshire, 18 F.3d 40, 1st Cir. (1994)Dokument2 SeitenKenneth E. Wilson v. State of New Hampshire, 18 F.3d 40, 1st Cir. (1994)Scribd Government DocsNoch keine Bewertungen

- 2D07 4644 Motion For Rehearing/ClarificationsDokument10 Seiten2D07 4644 Motion For Rehearing/ClarificationsTheresa MartinNoch keine Bewertungen

- Principles of Cost Accounting 16th Edition Vanderbeck Solution ManualDokument47 SeitenPrinciples of Cost Accounting 16th Edition Vanderbeck Solution Manualcorey100% (30)

- Despieve A4VG045Dokument50 SeitenDespieve A4VG045Zamuel Torres GarcíaNoch keine Bewertungen

- Davao City Water District vs. CSCDokument15 SeitenDavao City Water District vs. CSCJudy Ann BilangelNoch keine Bewertungen

- Working at Heights ChecklistDokument3 SeitenWorking at Heights ChecklistCristiane RibeiroNoch keine Bewertungen

- Cambridge IGCSE: 0450/22 Business StudiesDokument4 SeitenCambridge IGCSE: 0450/22 Business StudiesJuan GonzalezNoch keine Bewertungen

- RemLaw Transcript - Justice Laguilles Pt. 2Dokument25 SeitenRemLaw Transcript - Justice Laguilles Pt. 2Mark MagnoNoch keine Bewertungen

- Application Form Registration of Job, Service Contractor, Sub ContractorDokument1 SeiteApplication Form Registration of Job, Service Contractor, Sub ContractorJane PerezNoch keine Bewertungen

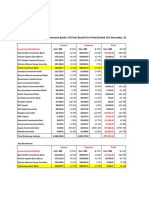

- Kenyan Brokerage & Investment Banking Financial Results 2009Dokument83 SeitenKenyan Brokerage & Investment Banking Financial Results 2009moneyedkenyaNoch keine Bewertungen

- Juan Luna Massacres Wife and Mother-in-Law in 1892Dokument1 SeiteJuan Luna Massacres Wife and Mother-in-Law in 1892Khimmy Magpantay FloresNoch keine Bewertungen

- Umesh Narain Vs Tobacco Institute of IndiaDokument73 SeitenUmesh Narain Vs Tobacco Institute of IndiaThe Quint100% (2)

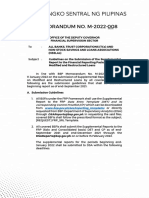

- Guidelines on Submission of Supplemental Report to FRP on Modified LoansDokument3 SeitenGuidelines on Submission of Supplemental Report to FRP on Modified Loanswilma balandoNoch keine Bewertungen

- BITH 211 Study Sheet 1Dokument5 SeitenBITH 211 Study Sheet 1Yi Yan HengNoch keine Bewertungen

- KadapaDokument1 SeiteKadapaAparna DeviNoch keine Bewertungen

- Rules and Regulations On The Implementation of Batas Pambansa Blg. 33Dokument9 SeitenRules and Regulations On The Implementation of Batas Pambansa Blg. 33Martin Thomas Berse LaguraNoch keine Bewertungen

- Audit 2Dokument6 SeitenAudit 2Frances Mikayla EnriquezNoch keine Bewertungen

- Mendota MS-13 Investigative Doc5 229Dokument54 SeitenMendota MS-13 Investigative Doc5 229Dave MinskyNoch keine Bewertungen

- E-TICKET DETAILSDokument3 SeitenE-TICKET DETAILSKrishna TelgaveNoch keine Bewertungen

- International Standard: Destructive Tests On Welds in Metallic Materials - Fracture TestDokument8 SeitenInternational Standard: Destructive Tests On Welds in Metallic Materials - Fracture TestVengat EshNoch keine Bewertungen

- Download free font with copyright infoDokument2 SeitenDownload free font with copyright infoMaria CazacuNoch keine Bewertungen

- Laws and Found: Phil Refining V, NG Sam DigestDokument3 SeitenLaws and Found: Phil Refining V, NG Sam DigestSilver Anthony Juarez PatocNoch keine Bewertungen