Beruflich Dokumente

Kultur Dokumente

Ishan

Hochgeladen von

ten_ishan88Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ishan

Hochgeladen von

ten_ishan88Copyright:

Verfügbare Formate

A Report On Relationship between Indian capital market, crude oil, Gold market & mutual fund & FII

flow

Submitted by: Ishan Patel (108070592010)

Submitted to: Prof. Anshita Shastri

Group Members: 1) 2) 3) 4) 5) 6) Agrawal Nikita Jayant Shubhangi Patel Disha Patel Ishan Patel Nishit Trivedi Manit

SAL INSTITUTE OF MANAGEMENT

1

1) Relationship between Capital Market and FII

A major development in our country post 1991 has been liberalization of the financial sector, especially that of capital markets. Our country today has one of the most prominent and followed stock exchanges in the world. Further, India has also been consistently gaining prominence in various international forums.

Developing countries like India are generally capital scarce. This is because levels of income are lower in comparison to other developed countries, which in turn means savings and investments are also lower.

Developing nations borrow money. Countries can thus invest this borrowed money in various social and physical infrastructures earn a return on them which helps them pay off their debt, and simultaneously propel the country to a higher growth trajectory.

FII is used to denote an investor, who invests money in the financial markets of a country different from the one in which that investor is incorporated. People see headlines such as FIIs remained net buyers. Net buyers implies that foreign investors poured more money into the stock market than they took out, which is generally seen as a positive development as far as our economy is concerned.

FIIs are tracked so closely. It would not be prudent to drive away foreign investors from investing in our country. The importance of foreign capital in the context of a developing economy, and that is precisely why the government has been so keen on liberalizing the external financial sector since 1991. If one foreign investor has had a good experience investing in our country, it builds up our reputation in the international community, and encourages more foreign investors to invest in our economy. However, a crisis of any kind will create panic among foreign investors as well, and regaining their trust and confidence in our economy will entail another mammoth task!

So finally to conclude, we can say that FII invest in Indian capital market, It will lift the market up as they will be investing in large numbers. and when they withdraw their investment Sensex falls. So basically there is a positive relationship between capital market and FII.

2) Relationship between crude oil and Gold Prices

Gold appears to have its own "logic" and mystique. It has traditionally been seen as a very conservative investment due to its relative scarcity, but it tends to be a very accurate reflector of short term fear about the economy in general. When things are "bad" the price of gold rises; when things are "good" it falls.

It tends to be counter-cyclical against the Dow Jones Industrial Average. Gold is not as tightly aligned with Crude Oil except in a general sense. As the price of all commodities rise, then gold tends to rise, too. But the price of Crude Oil right now is being driven largely by the decline in the value of the U.S. Dollar.

As the dollar falls in value, then investors seek Crude Oil rather than dollars as a place to stash cash for the short term. Crude Oil futures are not less liquid than gold (they can be converted into cash quicker in most instances than gold can). Thus crude oil is preferred slightly more than gold in the short run because of the better liquidity. Gold tends to be held longer term, until the "crowd" begins to become bullish, then gold drops quickly. Crude Oil is much more volatile.

3) Relationship between Mutual fund and Indian capital market The cash flows into mutual funds have generally been strongly correlated with market Returns and this relationship reflects the momentum trading or feedback trading Hypothesis (Davidson and Dutia (1989), Delong et al. (1990), Hendricks et al. (1993), Warther (1995), and Zheng (1999)). The hypothesis suggests that a shock to security Returns leads to a change in mutual inflows, which in turn leads to a further change in Security returns. It is often stated that mutual fund flows cause security returns to rise and Fall and one possible reason attributed for this is the price pressure hypothesis (Harris). 1986; Shleifer, 1986). Price pressure theory suggests that increased inflows into equity mutual funds stimulate a greater demand by individuals to hold stock, and this causes share prices to increase while the information revelation hypothesis (Lee et al., (1991) and Warther, (1995)) suggests that if mutual fund investors possess information or if they trade in the same direction as another group of investors who possess information, then their trades will reveal or be associated with new information. Under this scenario, If mutual fund investors are well informed their trades will be a signal to buy stocks and the market in this case will not be responding to fund flows because of price pressure, but rather react efficiently to new information. However, if mutual fund investors are unsophisticated and have a poor track record (noise traders), then the signal would be to Sell stocks. Though, mutual fund flows and stock returns have a high positive correlation as cited in literature, it does not necessarily mean that the former causes the latter and vice versa Potter (1996) in his study used Granger causality tests to examine the leadlag relationship between returns and fund flows for several categories of equity funds. The results show the evidence that security returns are useful to predict flows into aggressive growth funds but not into income funds. Some studies (Warther (1995), Remelona et al. (1997)) have failed to find evidence that mutual fund flows are affected by lagged security prices and security prices in one period are affected by mutual fund flows in previous periods.

4) Relationship between Indian capital market and Gold prices

Gold prices have been on an uptick since 2000, while the stock market declined from 2000 to 2003 and then again in 2008 (Fig.3). In 2008 when the market was suffering from bearish phase Worldwide, gold prices spiked as panic spread across global markets. So far since March 2009 in India signs of recovery in the stock markets have emerged.

At the same time gold continues to forge ahead, Gold Price Volatility and Stock Market Returns in India 50 albeit at a slower pace. In 2008, the two assets prices equity and gold, were moving in opposite directions, displaying the ability of the yellow metal to protect one's portfolios at the time of a dip.

Infect, during each of the two prolonged bear phases (lasting at least a year) over the past decade, gold has provided an effective hedge. However, in India stocks do not seem to be perceived as an alternative to gold. The reason for holding gold is, to a large extent, guided by the individual sentiments.

The gold investing habits of Indians strongly ingrained in the Indian Social Psyche. In India gold has been held by individuals for years and have passed hands of many generations. In addition, the equity culture in India is not as developed as in some other parts of the world. Gold has not yet lost its prime importance as a hedge against loss of wealth in times of crises. It is with this backdrop, this paper proceeds to investigate the direction of causality between domestic gold prices and stock market returns in India

Analysis of the relationship between FII,Indian capital Market,Mutual funds, Crude Oil prices and Gold prices

Indian Capital market

Crude Oil Prices

Foreign Institutional Investors

Mutual Funds

Gold Market

The Indian Equity Market is somewhat enhanced by the inflow of foreign institutional investors that, while capitalizing Indian businesses may at the same time be destabilizing to the economy because of the sometimes abrupt inflow and outflow of (mainly) dollars, not to mention the decline in value of the US dollar as a factor in money stability. It would be better if India had substantial investor base of its own.

Suppose because of the increase in the FII, Indian stock market goes up. It will automatically increase the returns on mutual funds there by there is a positive co relationship between FII Indian stock exchange and Mutual funds

The Major reason why FII invest in India is fallen value of dollars. As Indian rupee is appreciated and value of dollar starts declining As weak dollar against rupee helps imports when Industry is going for expansion more Capex Investments. It makes cost of equipments and machinery imported cheaper. Not good for I.T exports.

As the dollar weakens, the gold prices increase. This s because gold is denominated in US Dollars but widely used in global markets and by central banks of foreign countries. Gold has a long history of being used as a currency around the world and is still considered to be a safe heaven for investments whenever there are signs of economic downturn.

Dollar is weak at the moment. A weak Dollar pushes the crude oil prices up because Oil has a Dollar value in the international markets, and a weak Dollar means that more value is attached to other stronger currencies. In other words, a stronger Euro is able to buy more Oil for the same amount of Euros when the Dollar is weakening. This is one important factor that drives up the Oil price.

When dollar is strong, investors tend to trade in dollar in U.S and FII reduces and Capital market in India falls. However, when dollar starts to weaken during times of economic uncertainty, more and more investors shift their investments to gold for safety. This is a kind of wealth protection measure to hedge against currency devaluation, inflation and deflation.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Claris Life SciencesDokument20 SeitenClaris Life Sciencesten_ishan88Noch keine Bewertungen

- GP Final 1Dokument133 SeitenGP Final 1ten_ishan88Noch keine Bewertungen

- OrbitDokument3 SeitenOrbitten_ishan88Noch keine Bewertungen

- Procter and Gamble India LimitedDokument68 SeitenProcter and Gamble India Limitedten_ishan88Noch keine Bewertungen

- Pest AnalysisDokument1 SeitePest Analysisten_ishan88Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 2015.74013.essentials of Spanish With Readings Volume I TextDokument459 Seiten2015.74013.essentials of Spanish With Readings Volume I TextmuytradingsNoch keine Bewertungen

- LGGM Magallanes Floor PlanDokument1 SeiteLGGM Magallanes Floor PlanSheena Mae FullerosNoch keine Bewertungen

- Socialology L1Dokument32 SeitenSocialology L1Muhammad Waseem YaseenNoch keine Bewertungen

- Tulip ManiaDokument37 SeitenTulip Maniasmile010Noch keine Bewertungen

- Manufacturing ConsentDokument3 SeitenManufacturing ConsentSaif Khalid100% (1)

- Ltma Lu DissertationDokument5 SeitenLtma Lu DissertationPayToWriteMyPaperUK100% (1)

- KTP Leng: Rawngbawl Leh A That Dan BerDokument4 SeitenKTP Leng: Rawngbawl Leh A That Dan Berlaltea2677Noch keine Bewertungen

- Department of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzDokument8 SeitenDepartment of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzNiño Esco DizorNoch keine Bewertungen

- Philips AZ 100 B Service ManualDokument8 SeitenPhilips AZ 100 B Service ManualВладислав ПаршутінNoch keine Bewertungen

- Why Have You Chosen MeDokument1 SeiteWhy Have You Chosen MeRmb MandaueNoch keine Bewertungen

- Cover LetterDokument2 SeitenCover LetterAditya Singh0% (1)

- May Galak Still This Is MyDokument26 SeitenMay Galak Still This Is MySamanthafeye Gwyneth ErmitaNoch keine Bewertungen

- 165 1 COST EST COMPLI Proposal1Dokument17 Seiten165 1 COST EST COMPLI Proposal1Sofiane SetifienNoch keine Bewertungen

- Senior Residents & Senior Demonstrators - Annexure 1 & IIDokument3 SeitenSenior Residents & Senior Demonstrators - Annexure 1 & IIsarath6872Noch keine Bewertungen

- Research Paper On RapunzelDokument8 SeitenResearch Paper On RapunzelfvgcaatdNoch keine Bewertungen

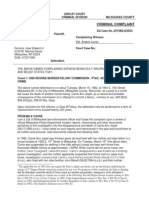

- Jose Ferreira Criminal ComplaintDokument4 SeitenJose Ferreira Criminal ComplaintDavid Lohr100% (1)

- China: Xi: Nation Cannot Afford ComplacencyDokument20 SeitenChina: Xi: Nation Cannot Afford ComplacencyLuis LozanoNoch keine Bewertungen

- Wa0256.Dokument3 SeitenWa0256.Daniela Daza HernándezNoch keine Bewertungen

- The A To Z Guide To Afghanistan Assistance 2012Dokument365 SeitenThe A To Z Guide To Afghanistan Assistance 2012Khan MohammadNoch keine Bewertungen

- 5.2 - PSC - Indonesain CaseDokument23 Seiten5.2 - PSC - Indonesain CaseShaun EdNoch keine Bewertungen

- Quizlet - SOM 122 Chapter 5 - ManagementDokument3 SeitenQuizlet - SOM 122 Chapter 5 - ManagementBob KaneNoch keine Bewertungen

- 30 Iconic Filipino SongsDokument9 Seiten30 Iconic Filipino SongsAlwynBaloCruzNoch keine Bewertungen

- CRM AssignmentDokument43 SeitenCRM Assignmentharshdeep mehta100% (2)

- Principles of ManagementDokument107 SeitenPrinciples of ManagementalchemistNoch keine Bewertungen

- Electric Vehicles Charging Optimization To Minimize Marginal Greenhouse Gas Emission From Power GenerationDokument10 SeitenElectric Vehicles Charging Optimization To Minimize Marginal Greenhouse Gas Emission From Power GenerationPradeep RavichandranNoch keine Bewertungen

- RanbaxyDokument2 SeitenRanbaxyAmit BorseNoch keine Bewertungen

- What Is Supply Chain ManagementDokument3 SeitenWhat Is Supply Chain ManagementozkanyilmazNoch keine Bewertungen

- Chapter 6-Contracting PartiesDokument49 SeitenChapter 6-Contracting PartiesNUR AISYAH NABILA RASHIMYNoch keine Bewertungen

- HANA Presented SlidesDokument102 SeitenHANA Presented SlidesRao VedulaNoch keine Bewertungen

- Crossen For Sale On Market - 05.23.2019Dokument26 SeitenCrossen For Sale On Market - 05.23.2019Article LinksNoch keine Bewertungen